Highlights Increasing consumption should be a lot easier than increasing savings. After all, most people like to spend! It is getting them to work that should be challenging. Yet, the conventional wisdom is that deflation is a much…

Highlights Inflation in the US and many other countries is likely to follow a “two steps up, one step down” trajectory of higher highs and higher lows over the remainder of the decade. Goods inflation will ease in 2022,…

Highlights Gold prices will continue to be challenged by conflicting information flows regarding US monetary policy; higher inflationary impulses from commodity prices and supply-chain bottlenecks; global economic policy uncertainty,…

Highlights Equity valuations are extremely stretched versus bonds, so there is little wiggle room for bonds to sell off before pulling down large tracts of the stock market. We estimate that bond yields can rise by no more than 30 bps…

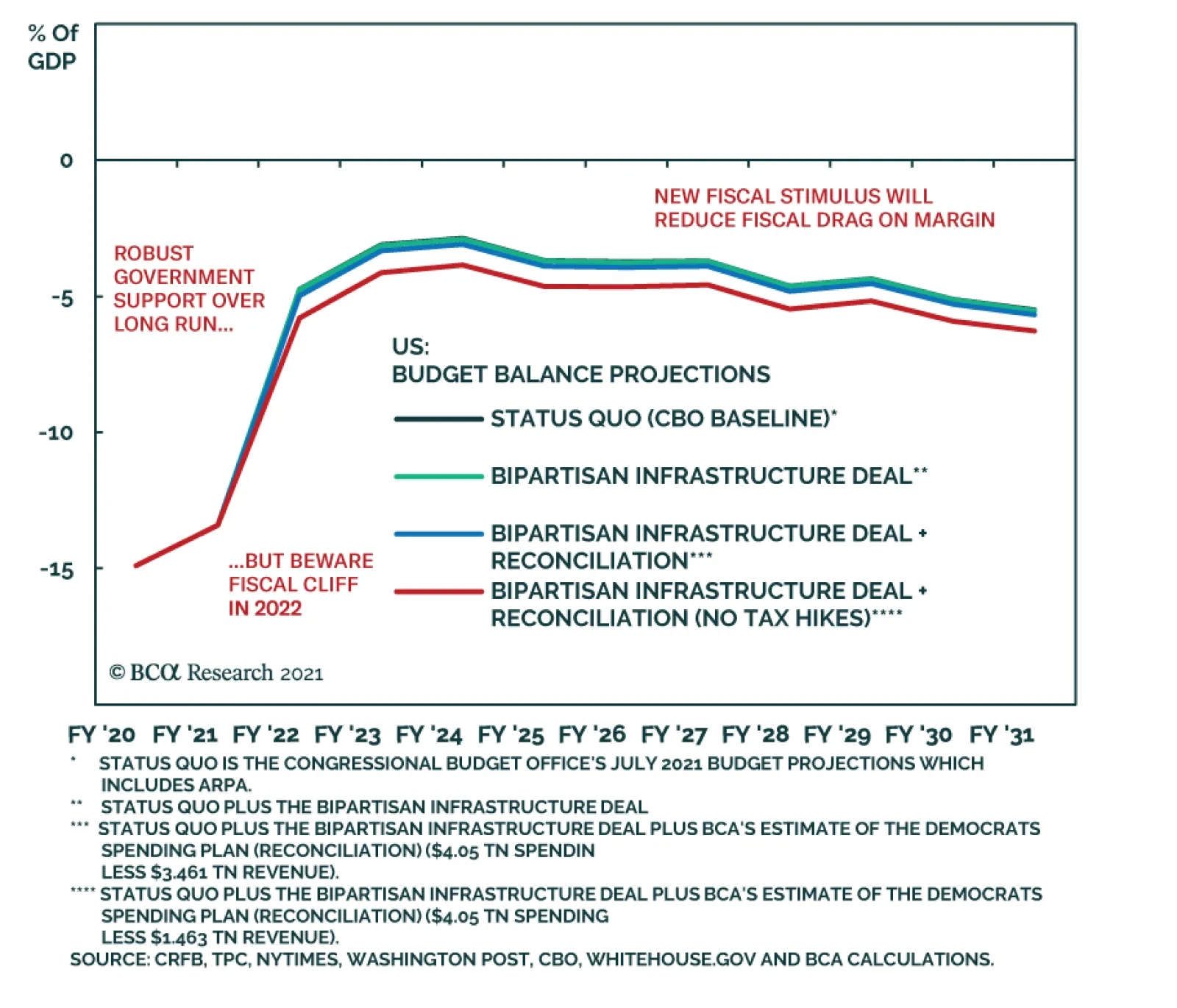

According to BCA Research’s Geopolitical Strategy service fiscal drag is probably overstated as governments are likely to increase deficit spending on the margin. US Congress is likely to pass Biden’s $550 billion bipartisan…

Dear Client, We are sending you our Strategy Outlook today, where we outline our thoughts on the macro landscape and the direction of financial markets for the rest of 2021 and beyond. Next week, please join me for a webcast on…

Highlights The fourth quarter will be volatile as China still poses a risk of overtightening policy and undermining the global recovery. US political risks are also elevated. A debt default is likely to be averted in the end. Fiscal…

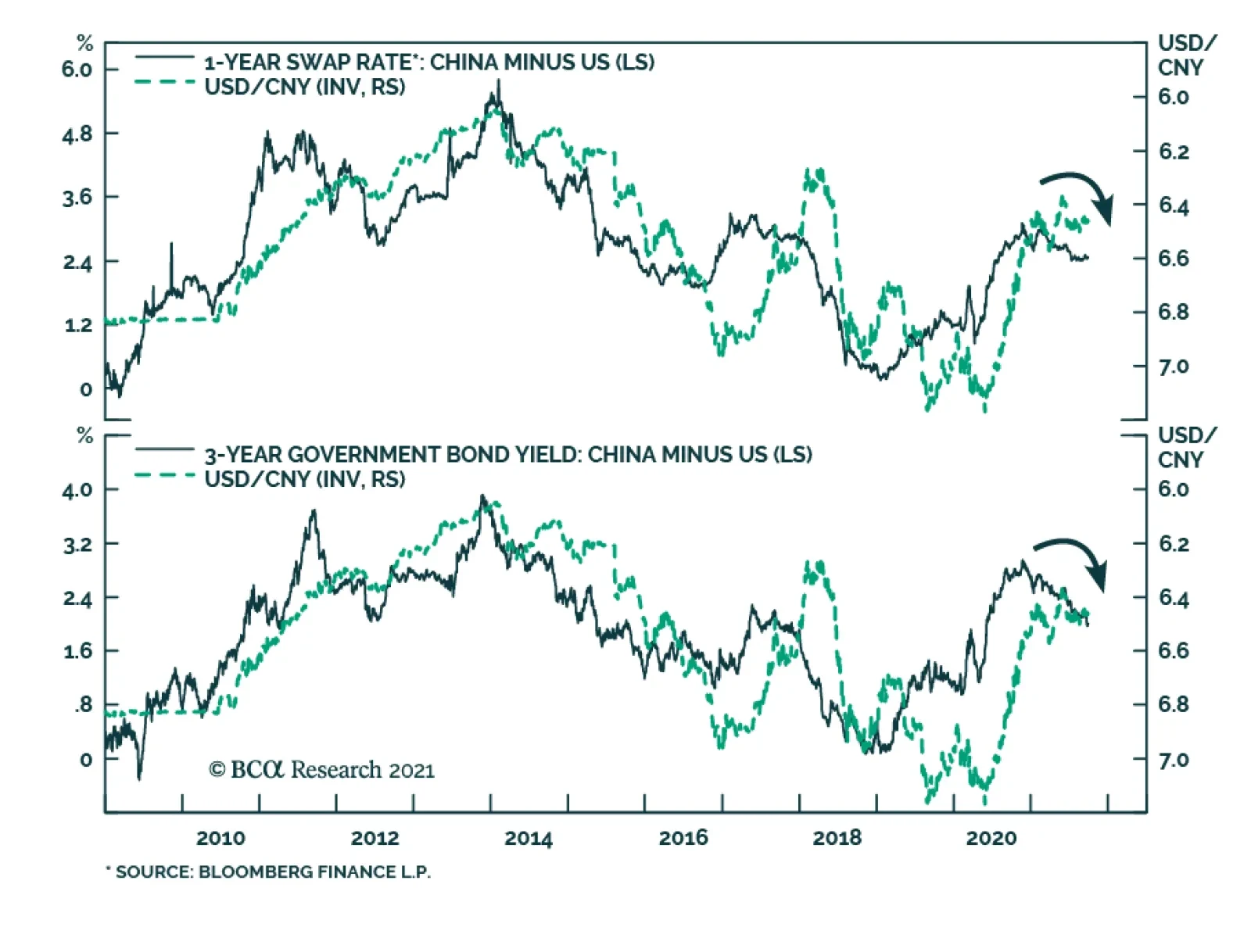

The performance of USD/CNY can often be explained by relative rates. The widening of the China-US yield differential in the second half of last year coincided with a sharp appreciation in the CNY vis-à-vis the USD. However, this…