Investors should prepare for an equity market pullback this fall, prefer Treasuries over stocks, and US defensives over cyclicals. A pullback could also morph into another bear market given that monetary policy is tight, policy…

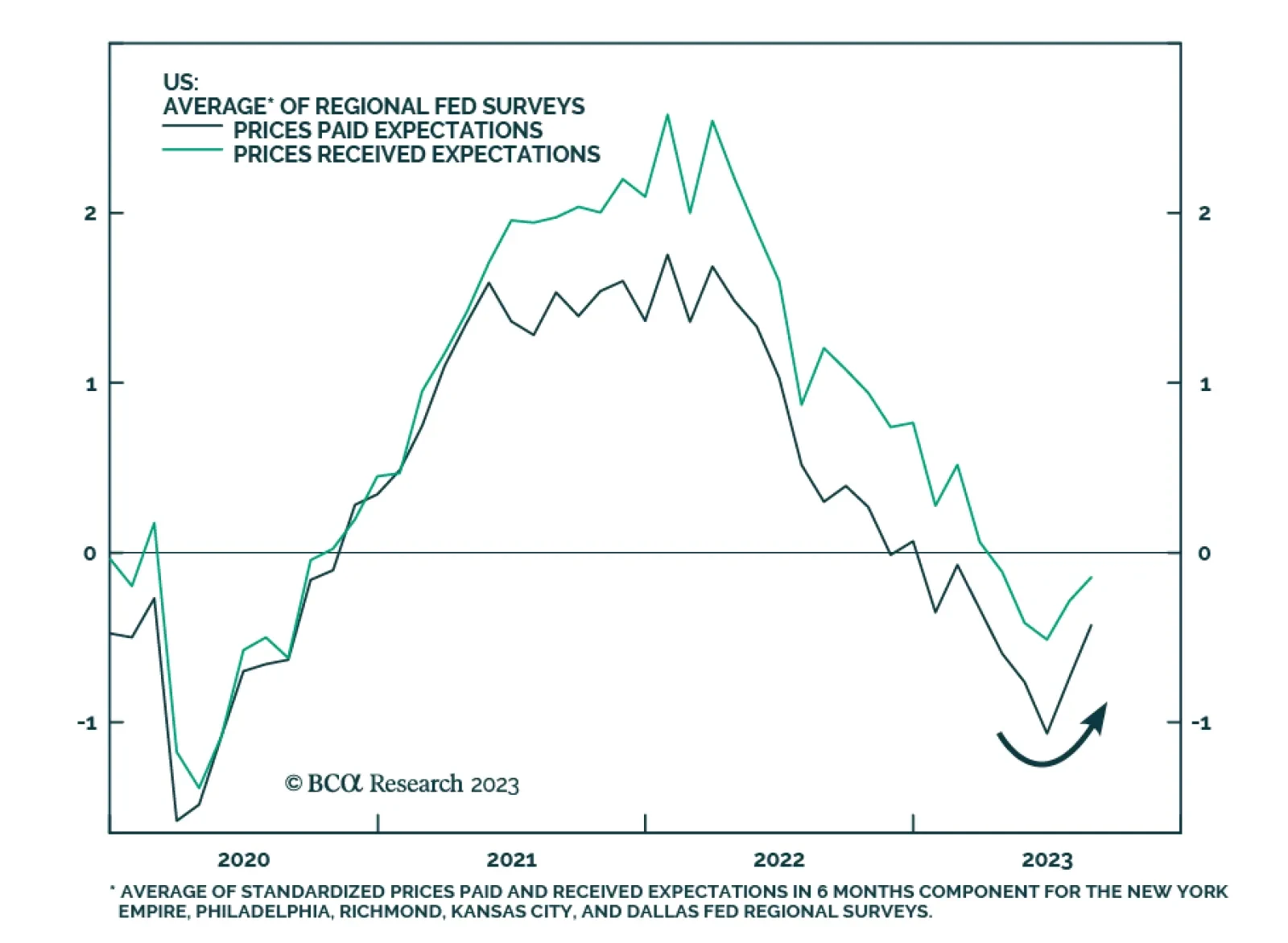

In an Insight last month, we noted that the Global Investment Strategy service increased its subjective odds for the resurgence of US inflation later this year or early next year from 20% to 30%. Here are some of the data points…

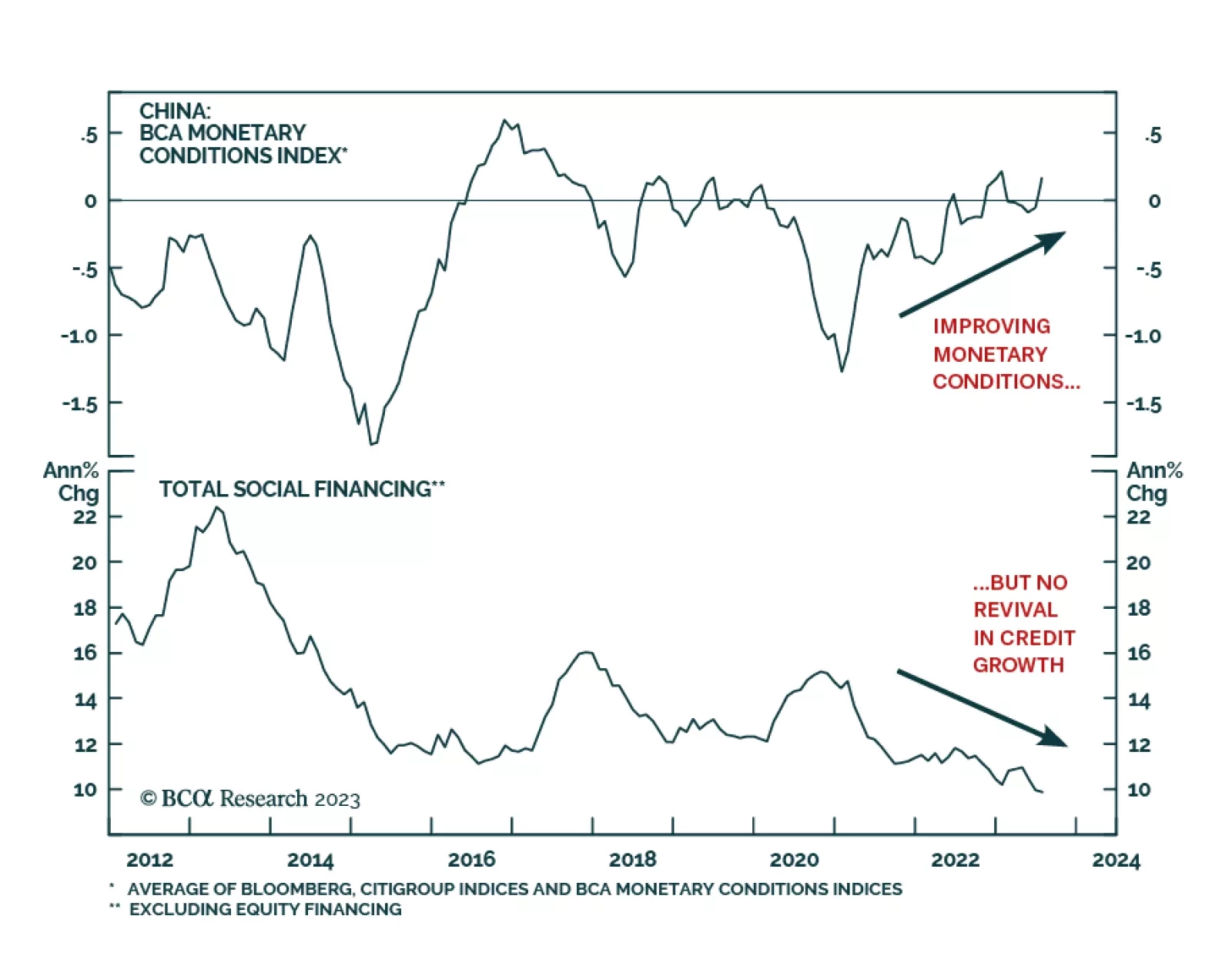

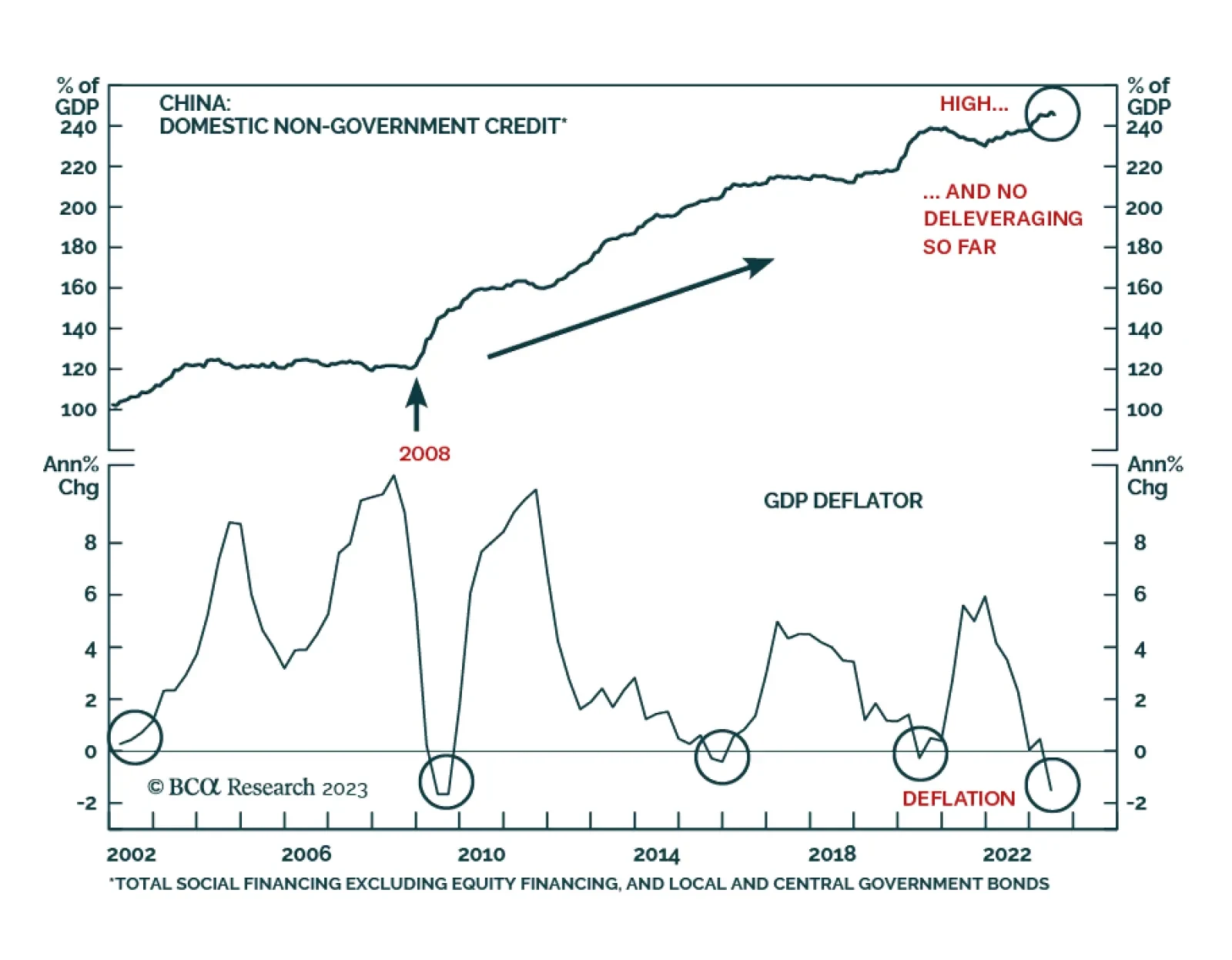

Despite the underwhelming economic recovery, Chinese authorities remain reluctant to open wide stimulus taps as much as they have in past economic downturns. This is corroborated by the PBoC’s marginal interest rate cut…

Before doctors prescribe treatments to a patient, they first make a diagnosis. The success of the treatment is contingent upon the accuracy of the diagnosis. The same is true for a country’s economy. Many commentators…

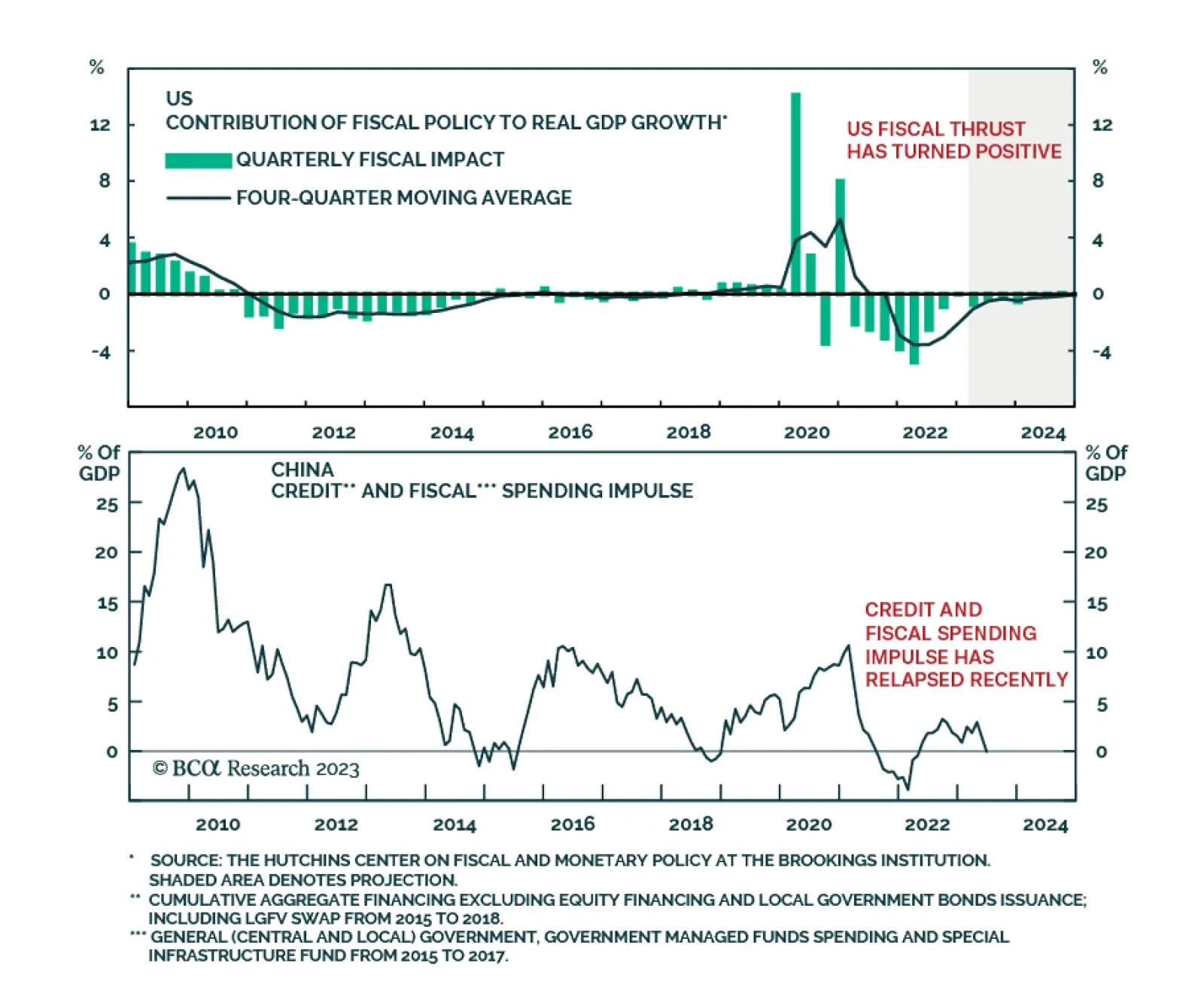

The fiscal impulse philosophies of the two largest economies of the world are set to pull in opposite directions in 2023. After the massive fiscal stimulus of 2020, the US had been cutting back on its deficit. But US fiscal…

The global economy will not enjoy an “immaculate disinflation” but will suffer a very maculate one due to China’s growth slowdown and restrictive monetary policy in the developed world. Investors should stay overweight low-beta…