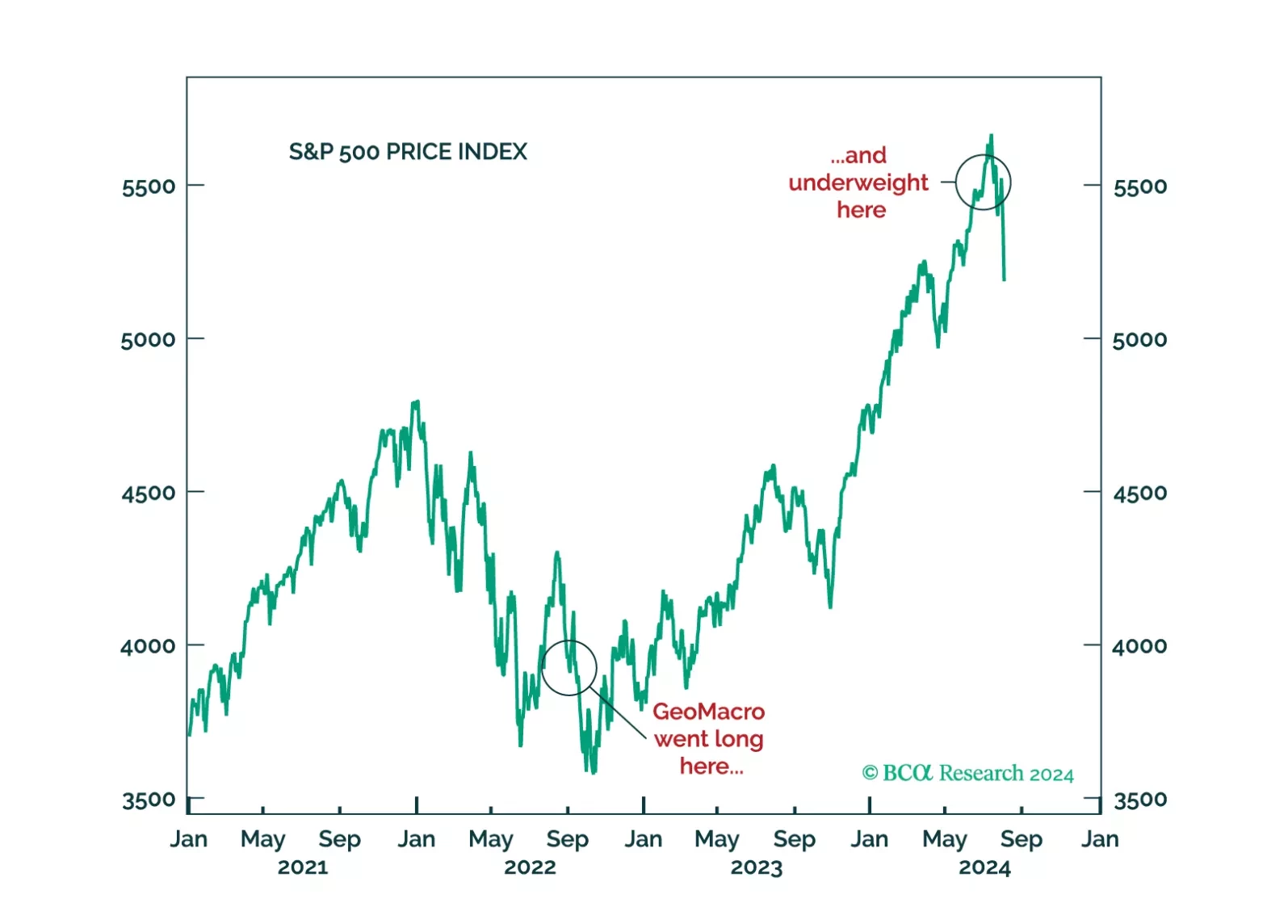

The decision by GeoMacro team on July 2 to short USDJPY and underweight equities has proven to be prescient. We still do not like the market setup from here on out. A recession would, obviously, be negative for risk assets. But even…

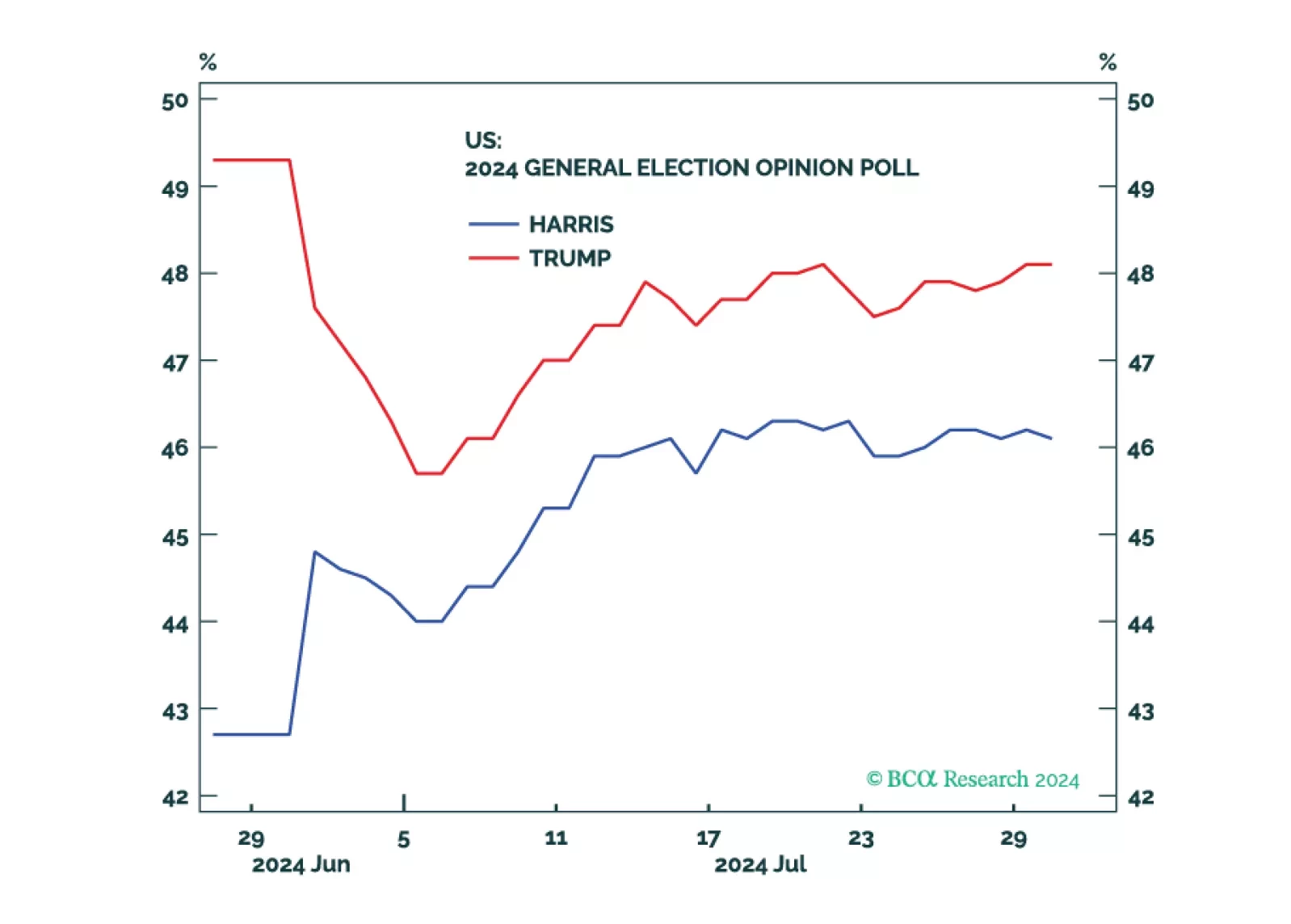

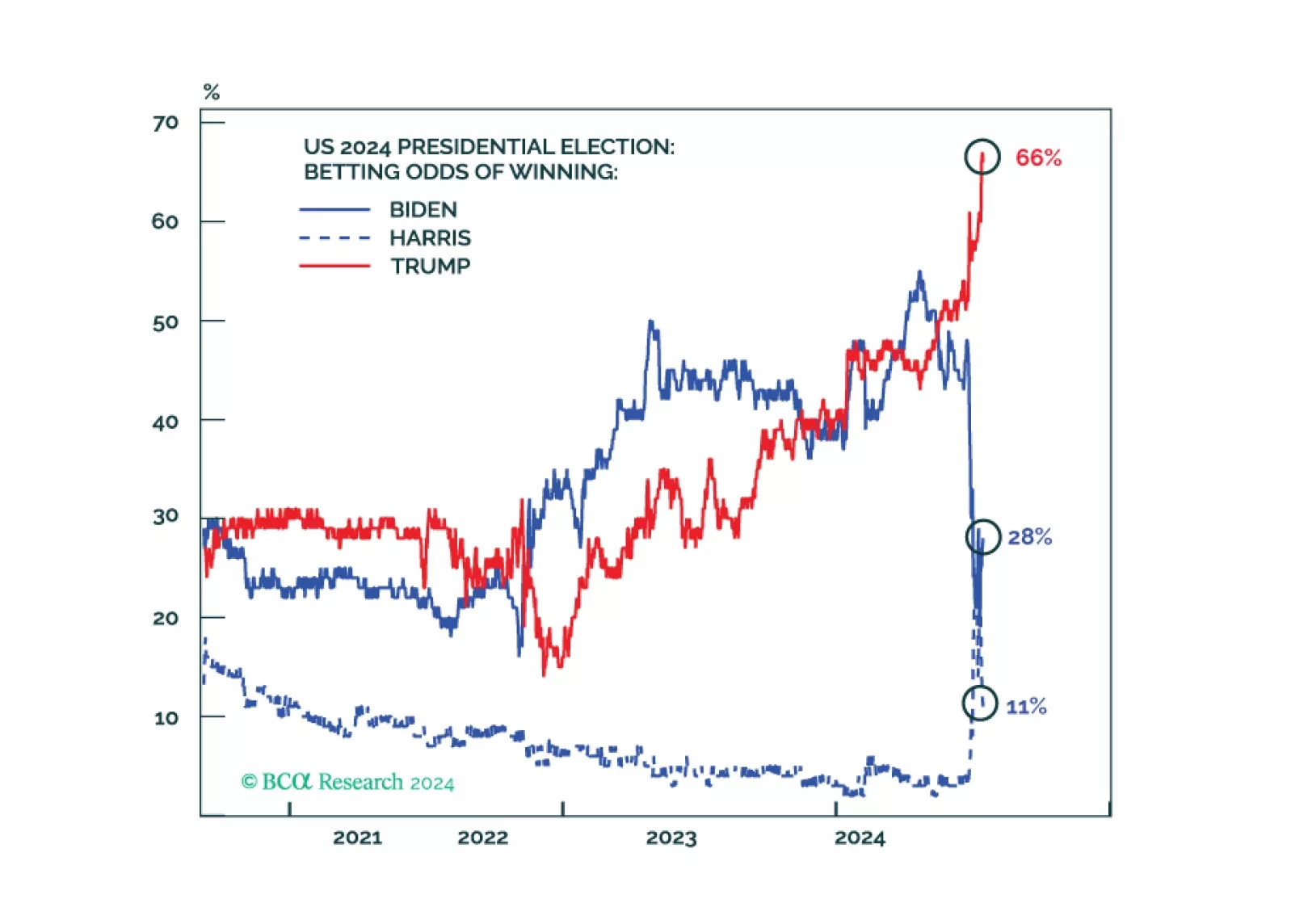

Republicans are favored but the election is still competitive. Equities, corporate credit, and cyclical sectors will fall until policy uncertainty is reduced.

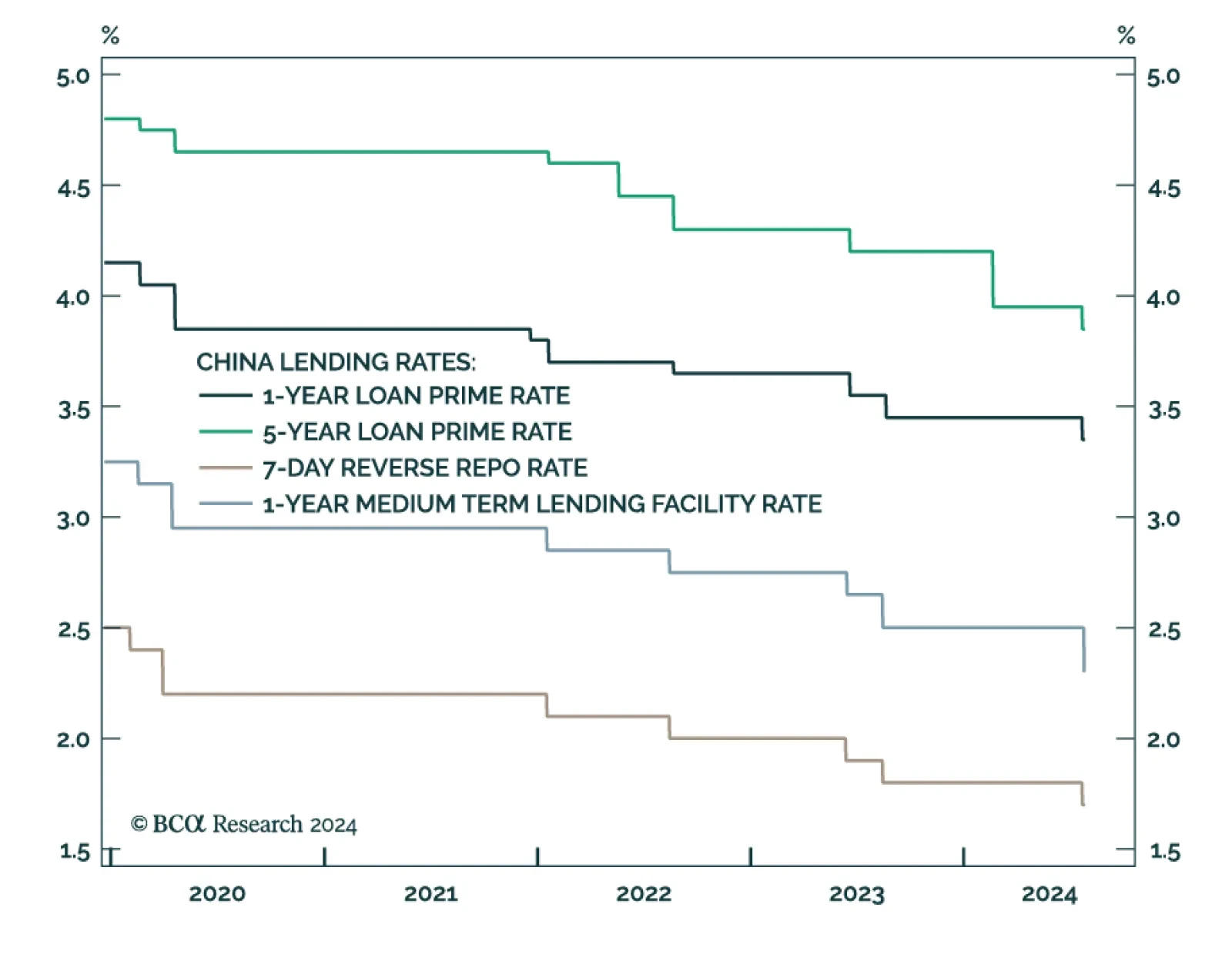

Just a few days after unexpectedly lowering three key borrowing rates by 10 basis points (bps), the PBoC cut the 1-year medium-term lending facility rate by 20 bps, from 2.50% to 2.30%. While the earlier cut lowered the…

Investors should overweight US assets and de-risk their portfolios in anticipation of a major increase in policy uncertainty and geopolitical risk surrounding the US election and its global ramifications.

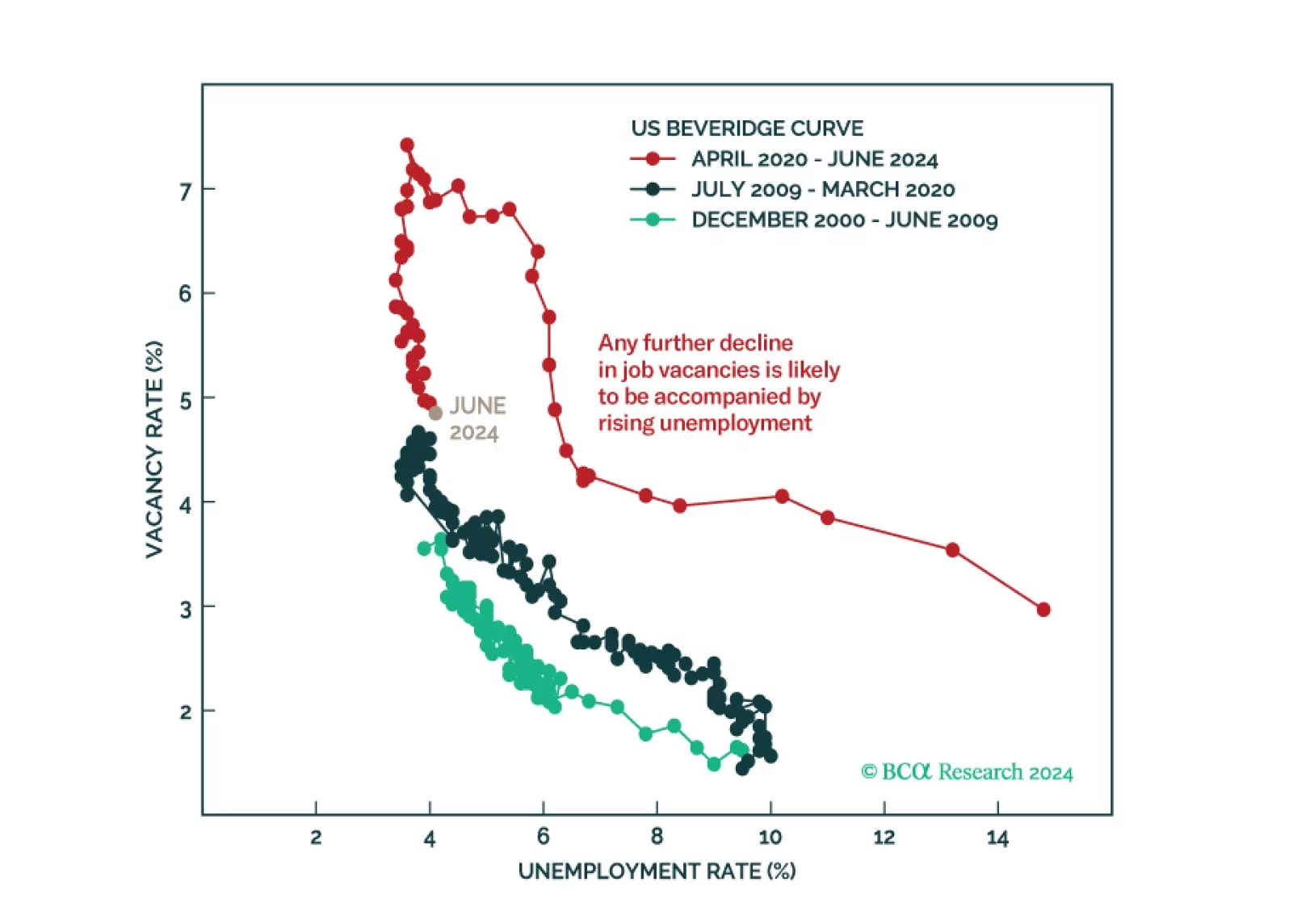

Don't buy the dip. The equity bull market is over. The US will enter a recession in late 2024 or in early 2025.

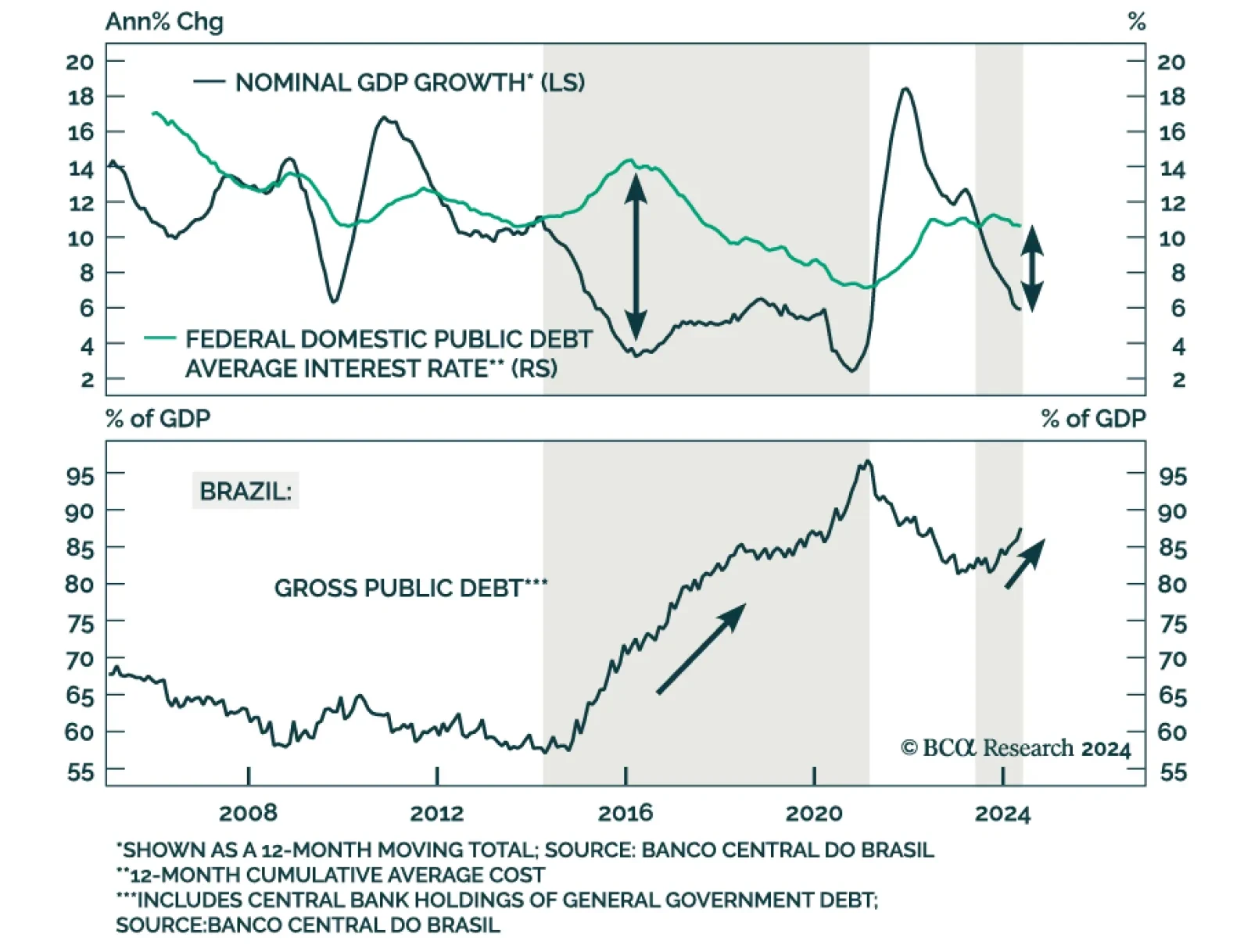

Two of Brazil’s ever-recurring demons have come back to haunt investors: public debt sustainability and persistent inflation. According to the latest report from our Emerging Markets Strategy (EMS) team, these troubles are…

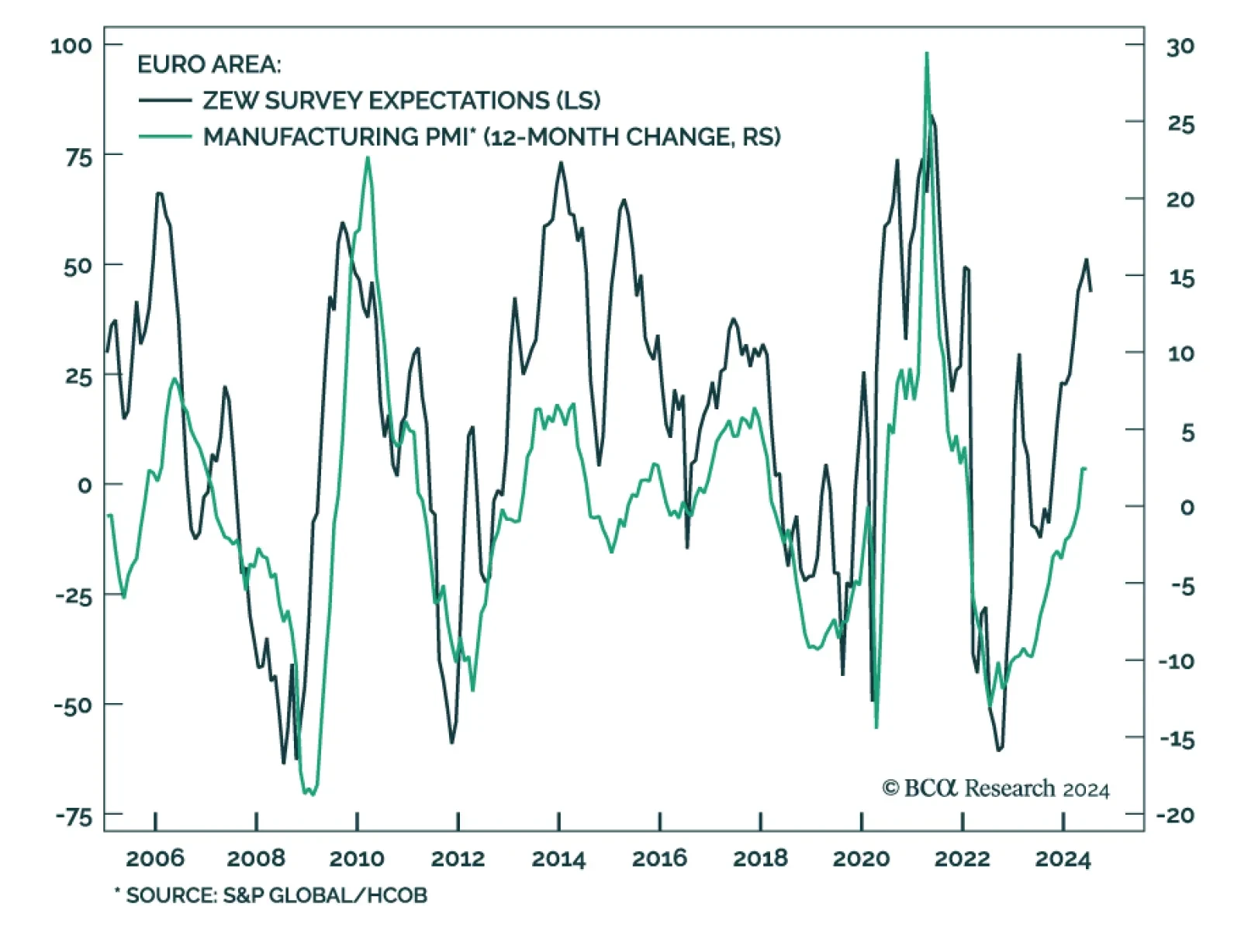

The Euro Area economy broadly surprised to the upside in the first half of 2024. Cooling inflation lifted real wages and the global late cycle amelioration benefitted the pro-cyclical Euro Area economy, but these tailwinds are…

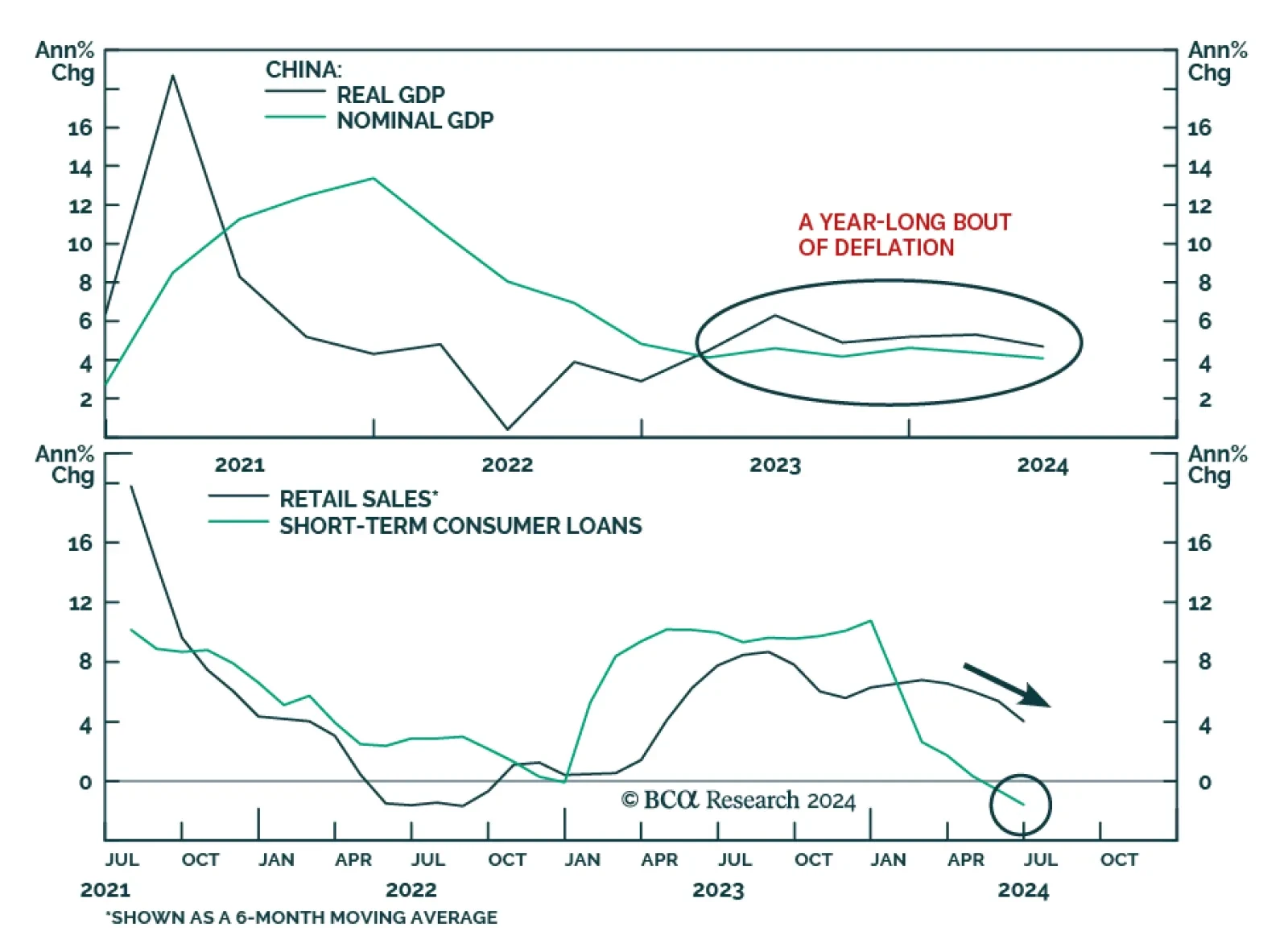

China's real GDP growth decelerated to 4.7% y/y in Q2, down from 5.3% in Q1 and below the consensus forecast of 5.1%. Domestic demand weakened, with retail sales growth sliding to 2% y/y in June, down from 3.7% in the…

The real threat to European equities is growth, not political risk. How low will Eurozone earnings fall during the coming recession and how much will equities decline in response?

The cyclical economy is slowing today. Republicans are now more likely to win a full sweep, crack down on immigration and trade, and at least modestly stimulate the economy. Uncertainty and volatility will rise.