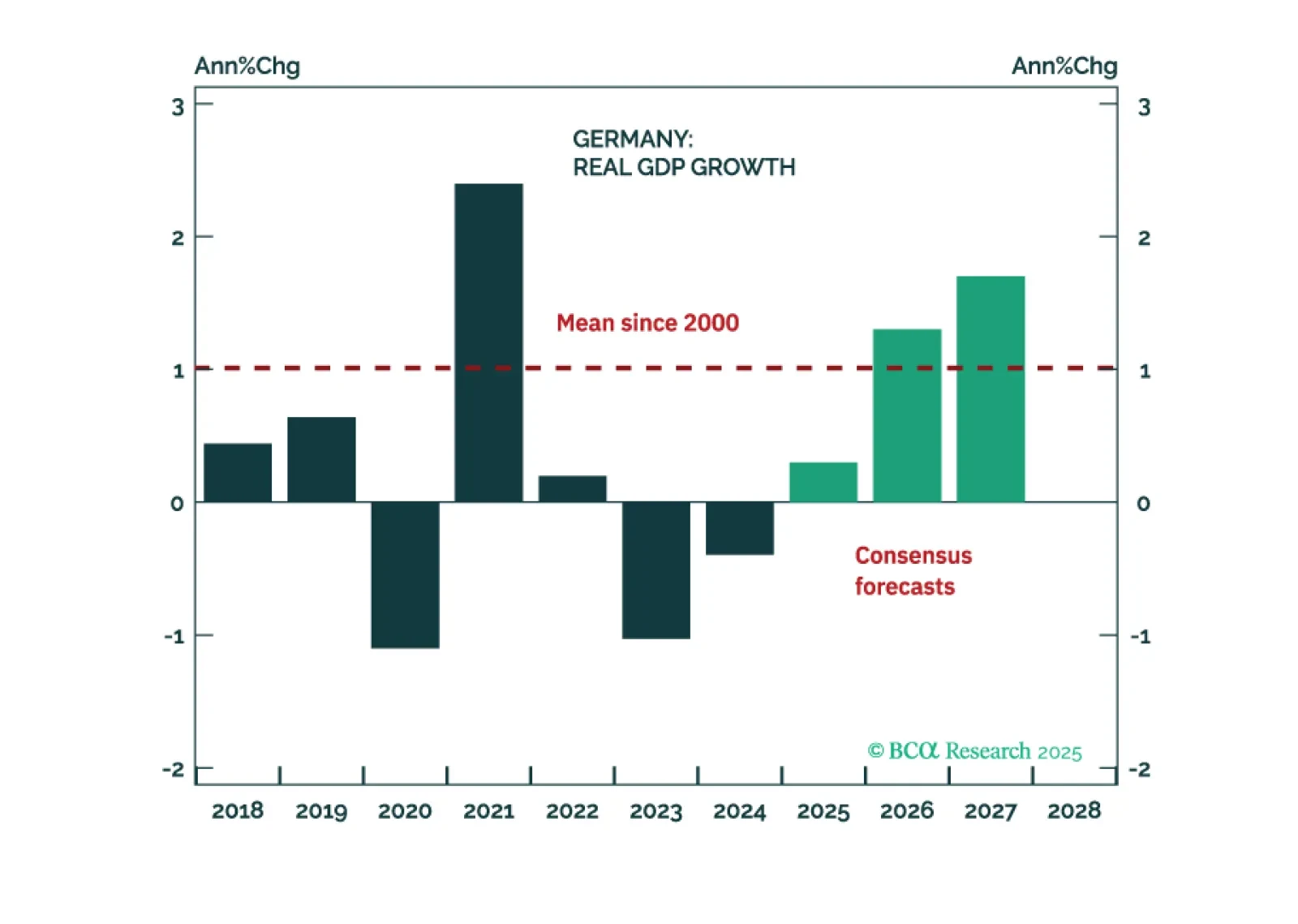

Recent economic data have been reasonably firm. We will cut our 12-month US recession probability to 40% from 50% if the Supreme Court strikes down President Trump’s tariffs. This would take our scenario-weighted year-end 2026…

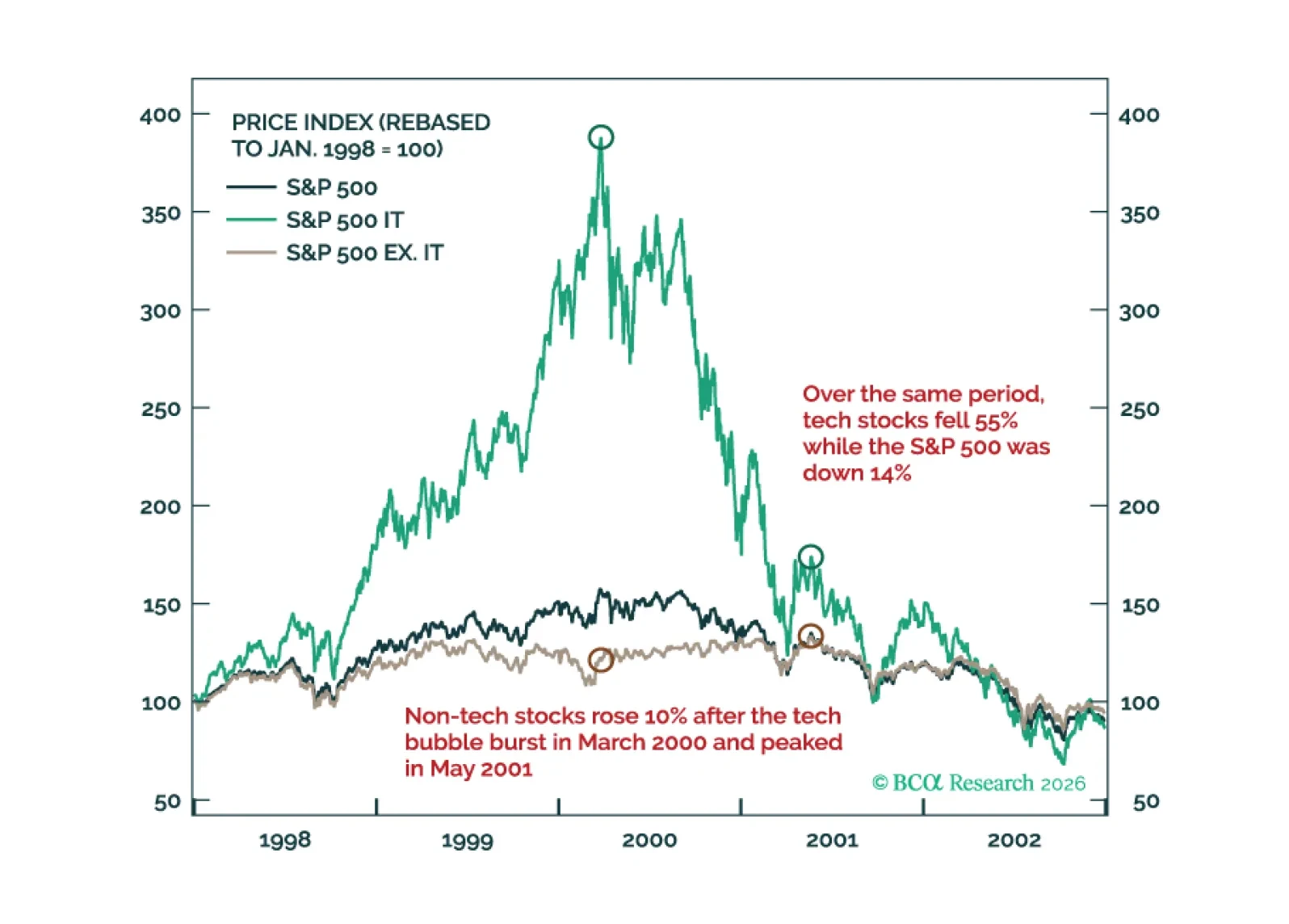

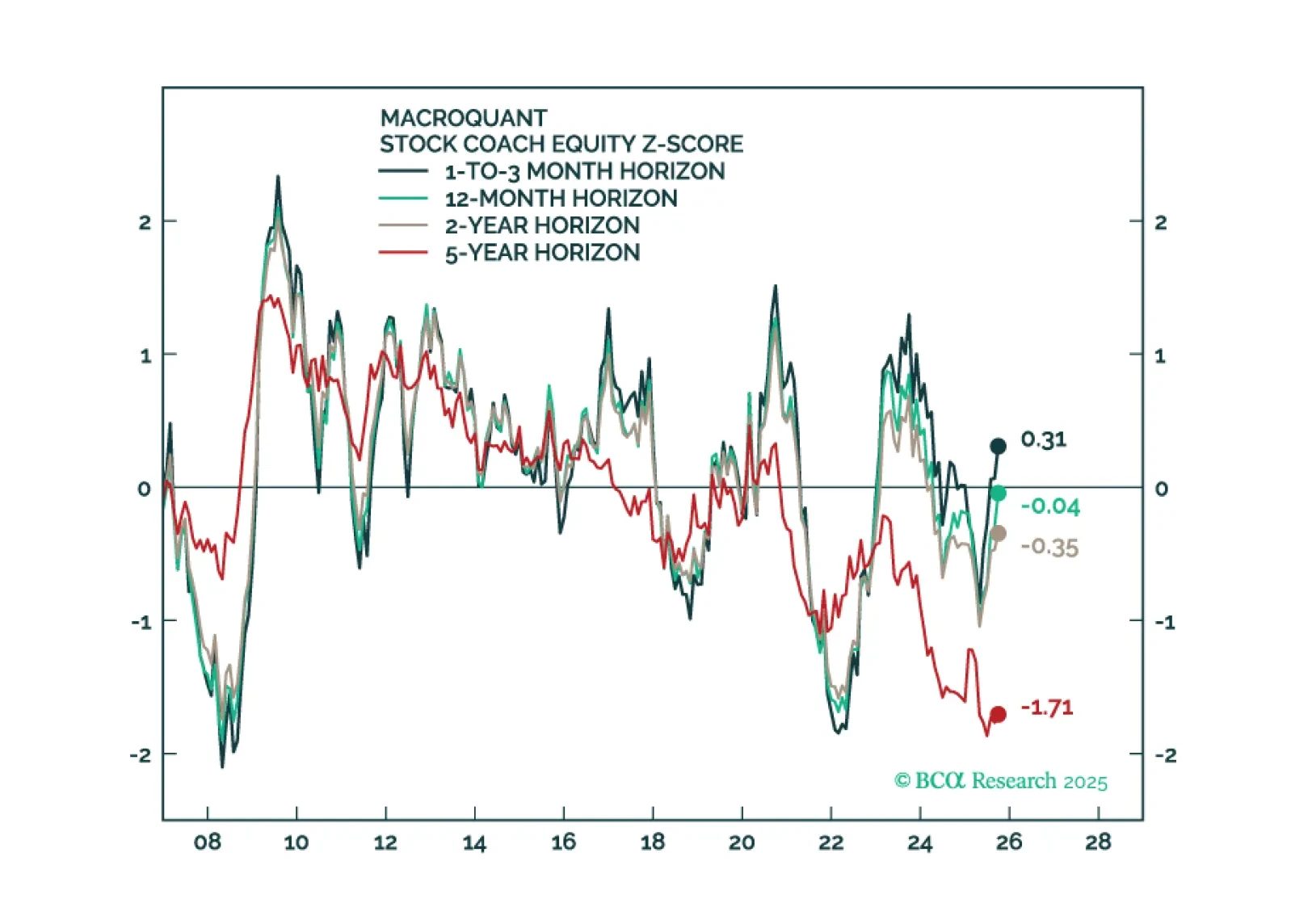

Much like the 2000 episode, we expect this year to unfold in two stages: A “Great Rotation” from tech stocks to non-tech names in the first half of 2026 followed by a broad-based selloff in stocks in the second half on the back of a…

This year, we once again present our 2026 outlook as a retrospective from the future – a future in which the AI boom turned to bust.Next week, please join me for a Webcast on Wednesday, December 17 at 10:30 AM EST (3:30 PM GMT, 4:30…

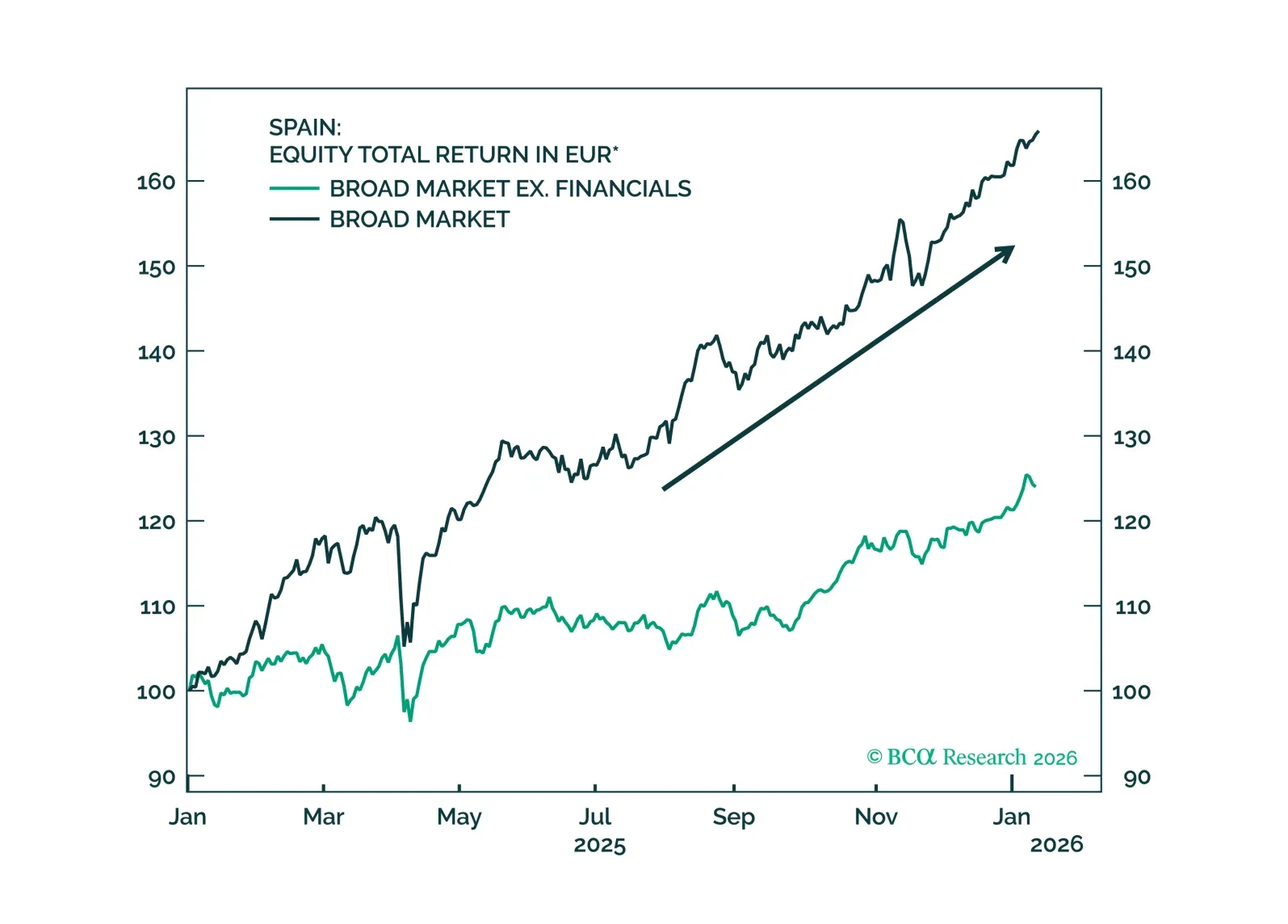

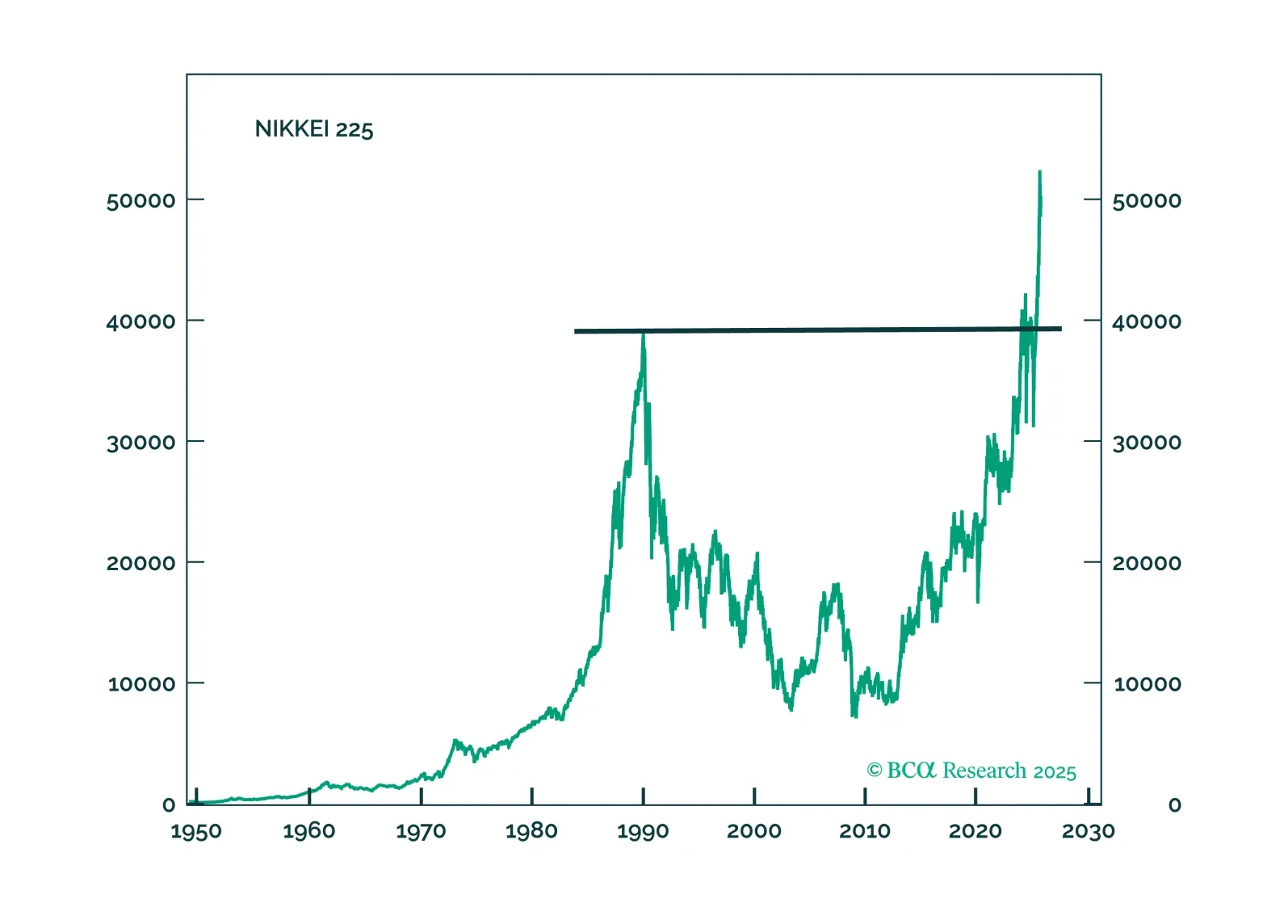

Japanese financial assets will finally have unfettered access to outsized returns. This performance will come in fits and starts, but we are comfortable laying our cards down on buying the yen, and Japanese industrial stocks.

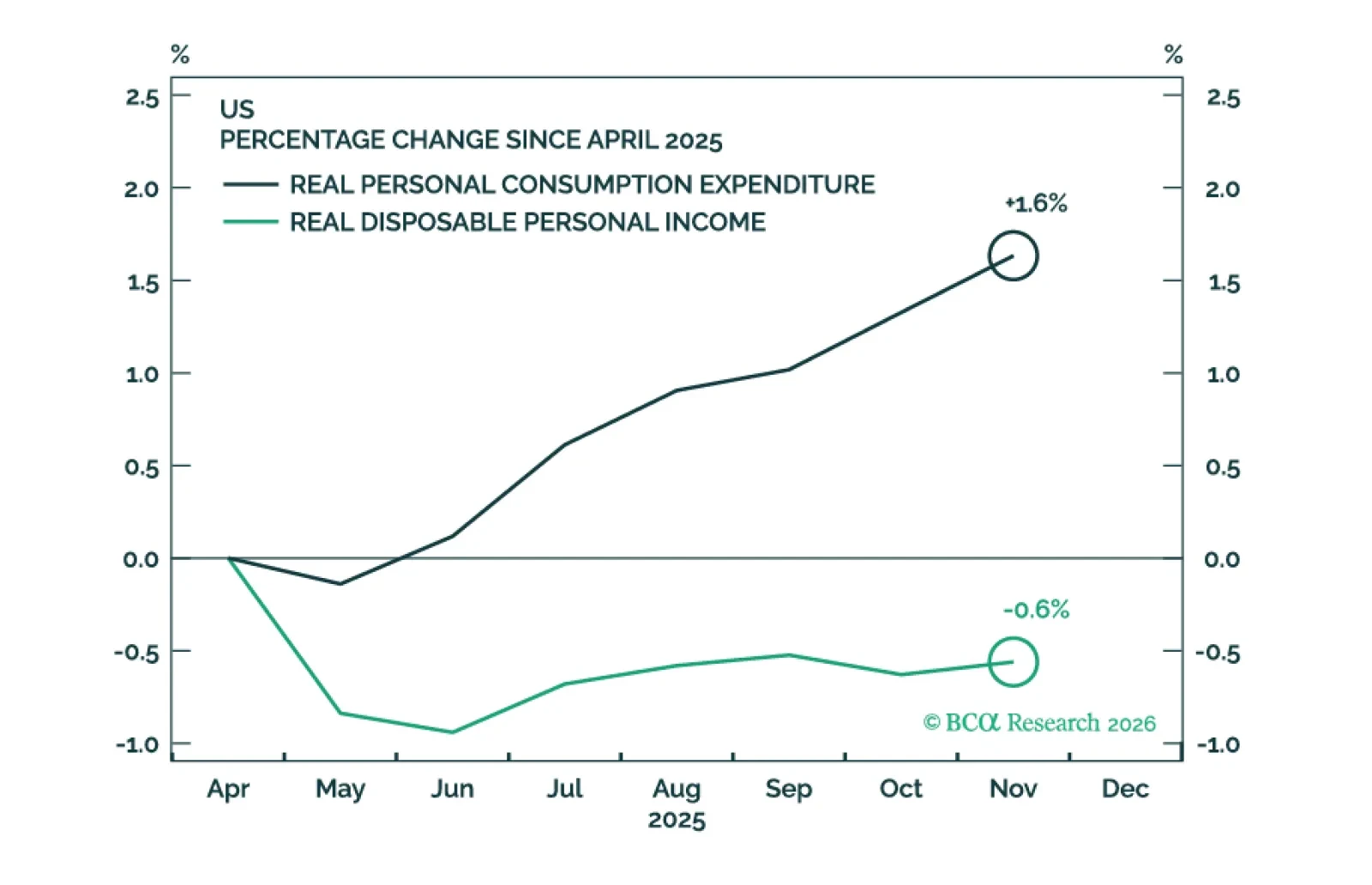

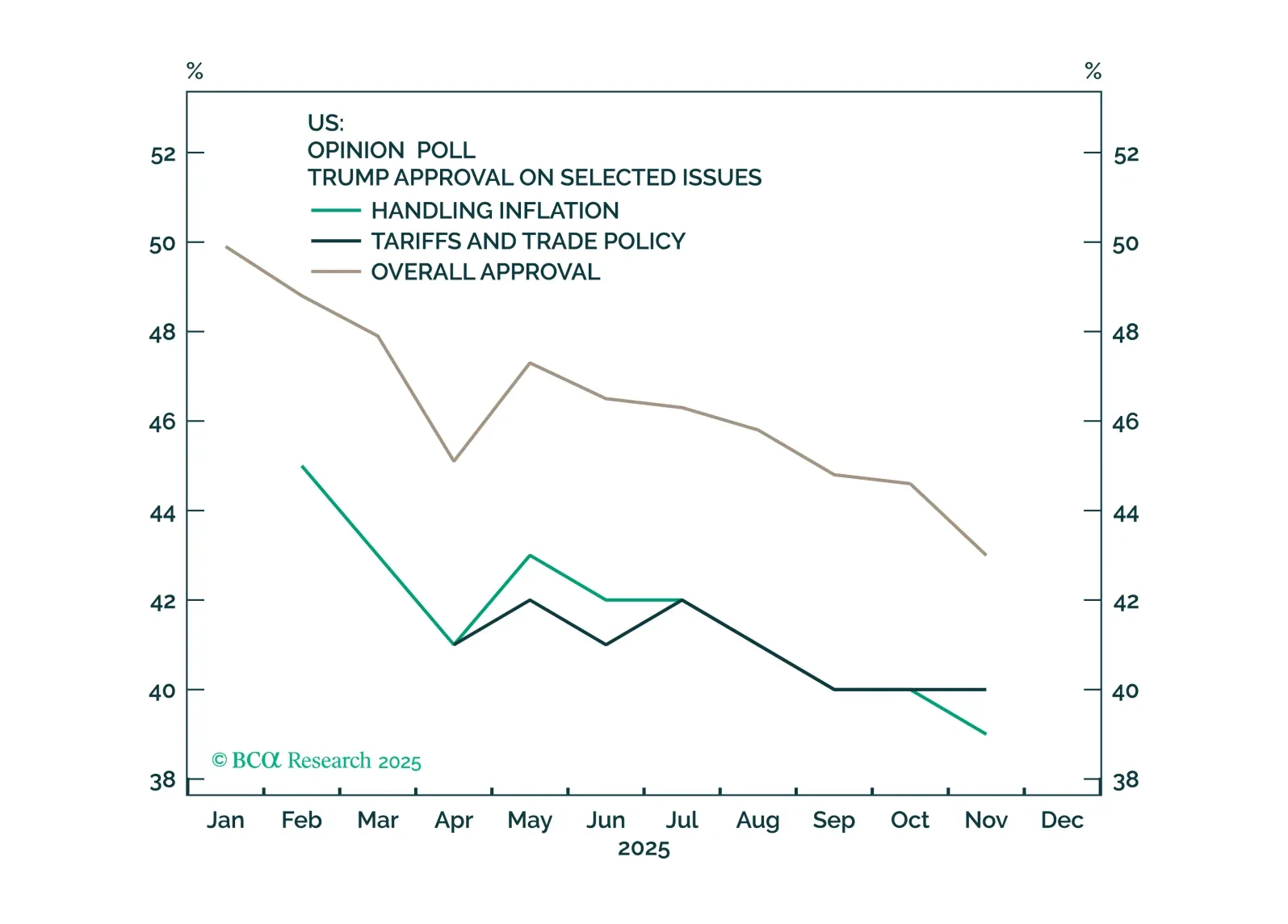

On purely macroeconomic terms, the US economy appears to be heading towards a recession. But the whole point of our framework – GeoMacro – is to forecast the interplay between politics, geopolitics, and macro. The White House is…

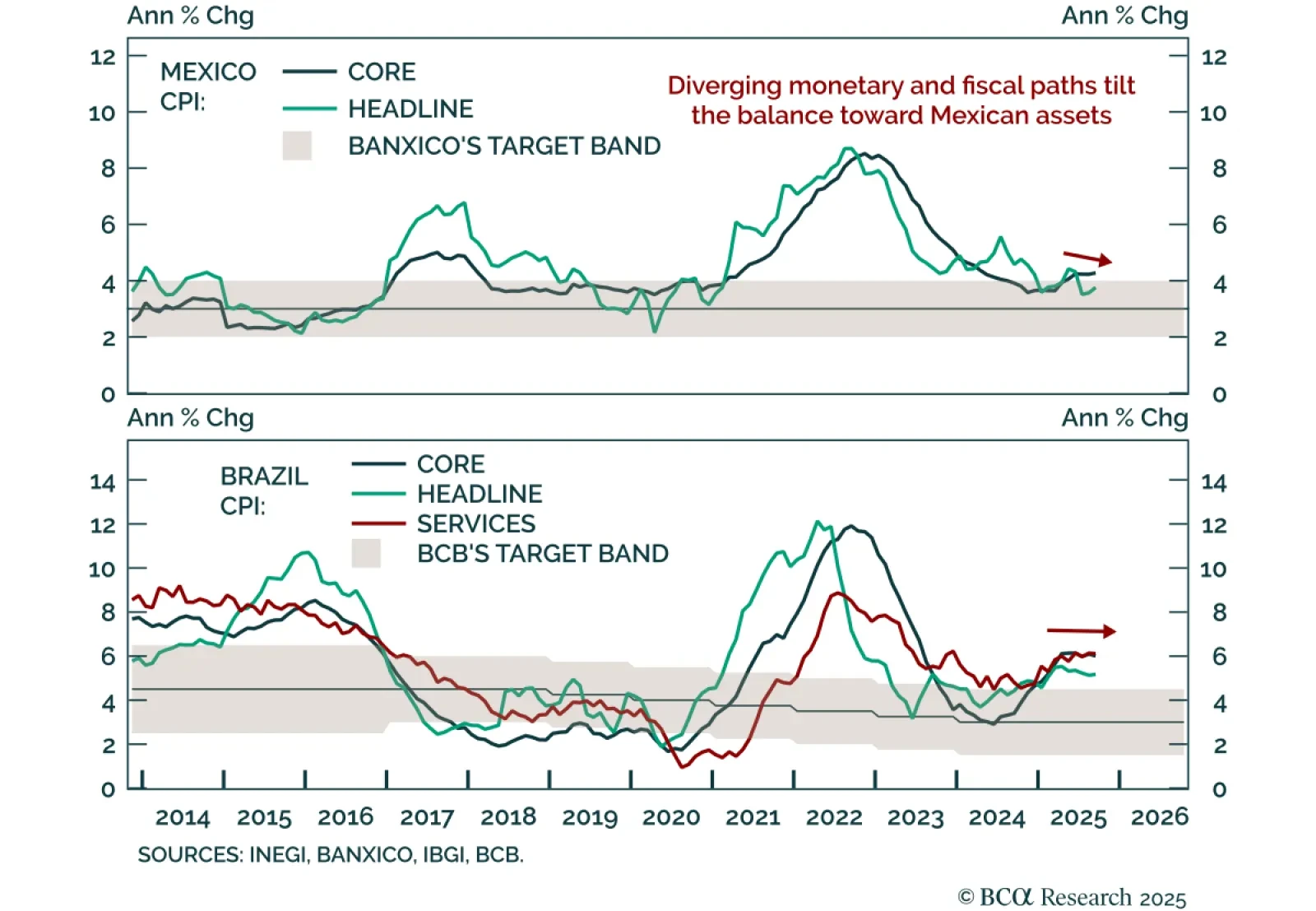

September CPI releases in Brazil and Mexico reinforce a divergent inflation and policy outlook that supports an overweight stance in Mexican local bonds and currency relative to Brazilian assets. Brazil’s headline CPI at 5.2% was…

In this Q4 Strategy Outlook, we discuss where we stand on our recession call, the outlook for stocks and bonds in various scenarios, why investors are misunderstanding the impact of AI on corporate profits, whether the US dollar has…

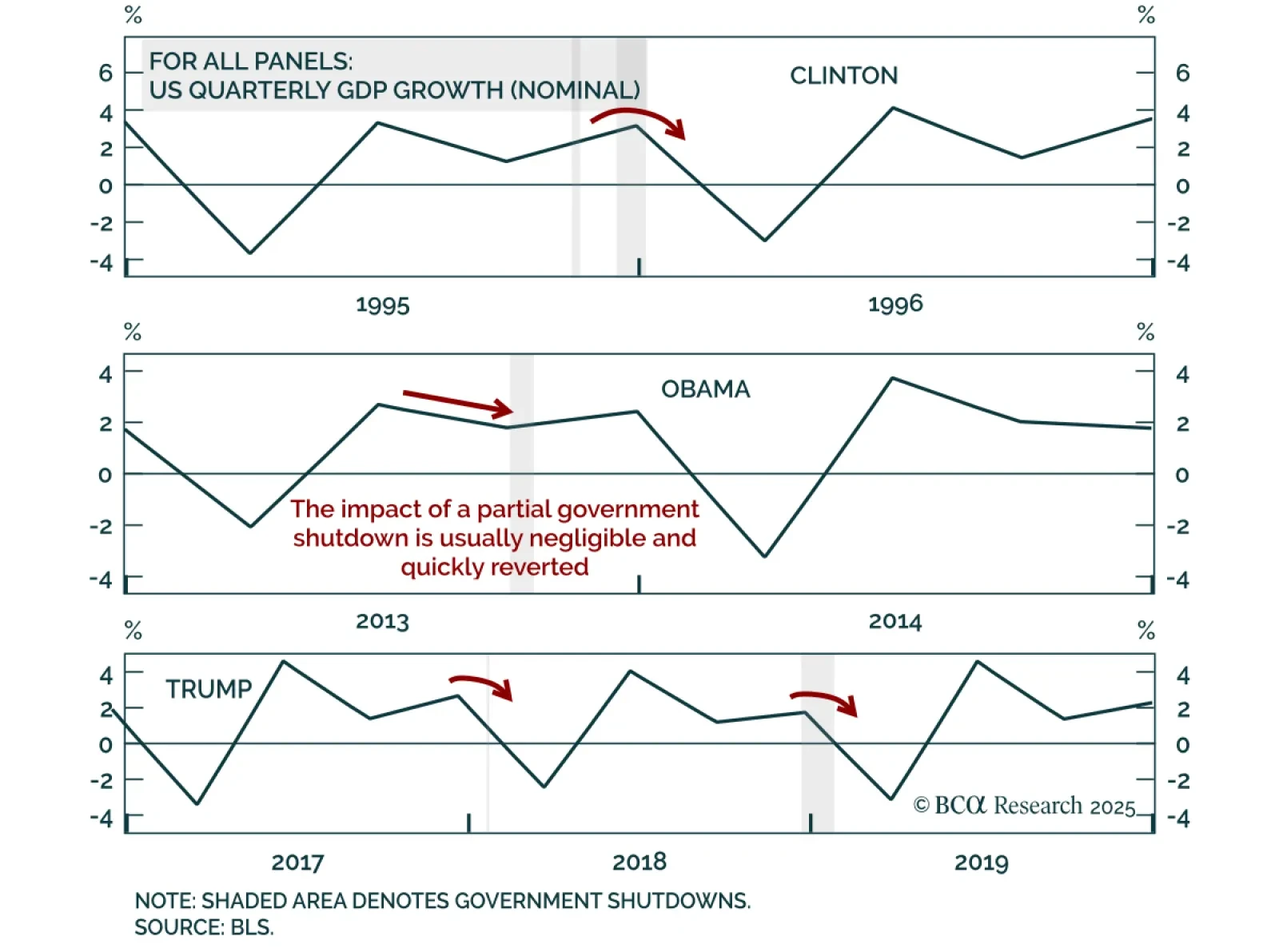

The October 1 partial US government shutdown risks denting near-term GDP and sentiment but should present a buying opportunity if it triggers equity weakness. The US federal government partly shutdown on October 1 after the…