Positive economic surprises have delayed the onset of recession in the United States. But tighter monetary and fiscal policy, slowing global growth, and a looming rebound in policy uncertainty and geopolitical risk suggest that…

In June, the rally gained momentum and broadened due to positive economic data, particularly in the housing market. We expect cheaper cyclical sectors and styles to mark a change in leadership as the rally broadens, helped on by…

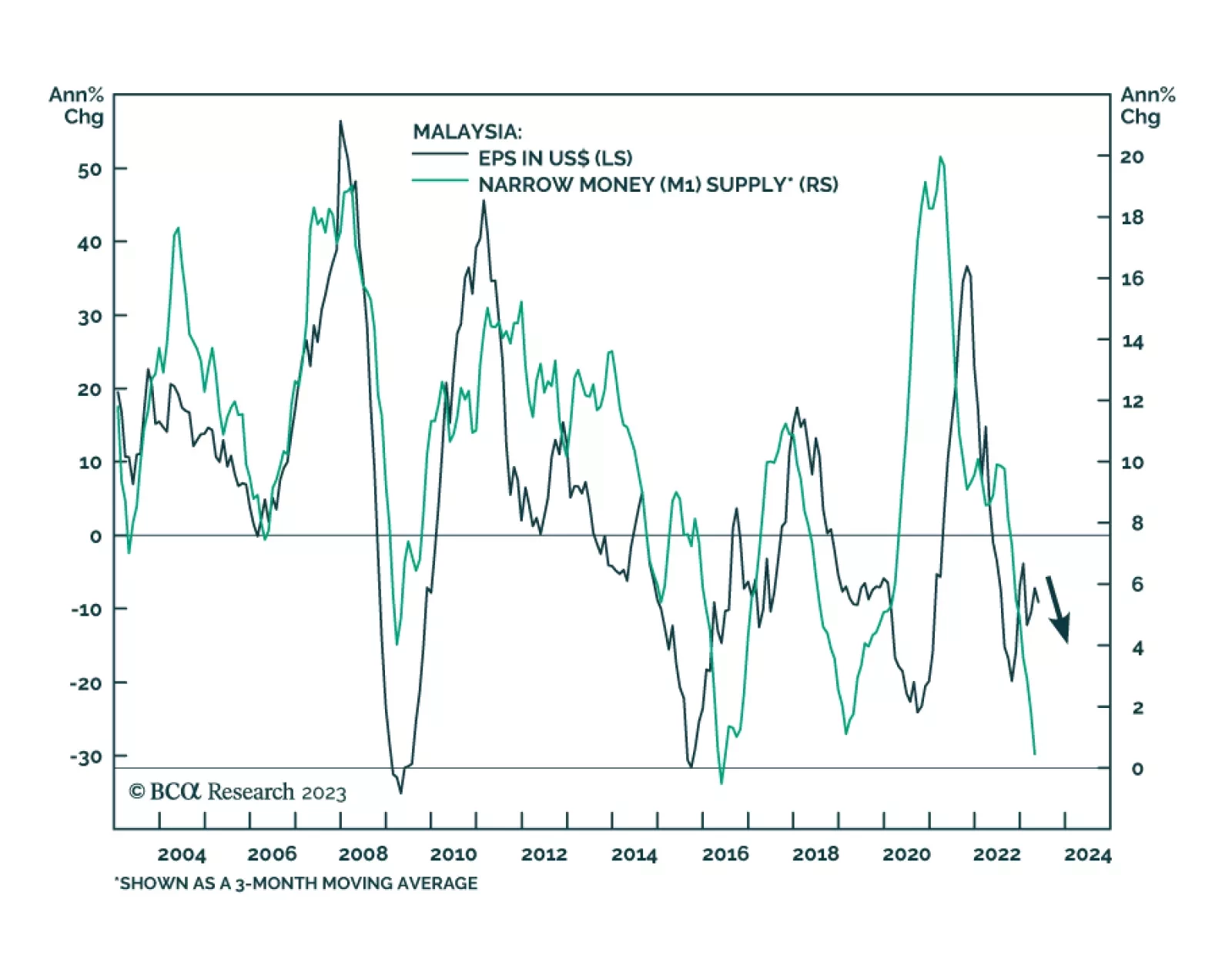

In a recent report, our Emerging Markets Strategy team posited that the bear market in Malaysian stocks will be prolonged. Disinflationary forces have taken hold of the Malaysian economy: money supply has plunged, bond yields…

Investors are still cautious and have significant cash that needs to be put to work. Trickle-down of it into the US equity market may extend the rally. Overly bearish futures positioning is also a strong contrarian indicator.…

As the major central banks once again mull their policy options, they face a daunting task. They must phase-transition inflation back to imperceptible, without phase-transitioning unemployment to perceptible. This report explains why…

In response to client questions, we offer our view on the purported link between tech stocks and interest rates, the similarities between the S&L Crisis and the current banking turmoil and the near-term outlook for consensus…

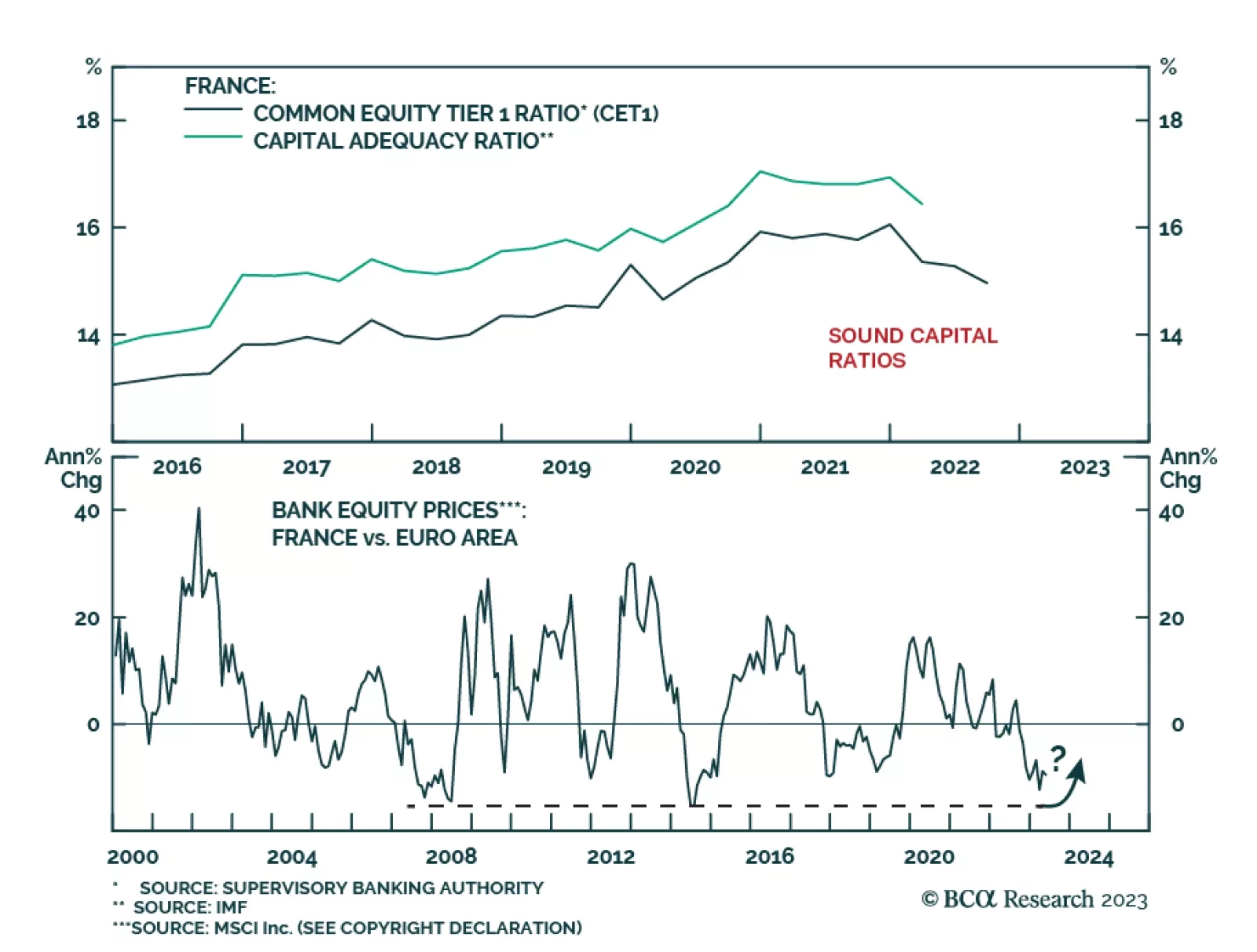

According to BCA Research’s European Investment Strategy service French banks are better positioned to weather current headwinds than their European peers. The team sees limited risks to the French banking sector from…

In this US Bond Strategy Insight we discuss the outlook for bank bonds.

According to BCA Research’s US Equity Strategy service, investors should stay underweight banks on a tactical investment horizon as the banking turmoil is far from over, and the industry’s profitability will be under…

We Introduce our new macro models for the Eurozone’s equity earnings, which include sectoral forecasts. Find out what they predict for the next six-to-nine months.