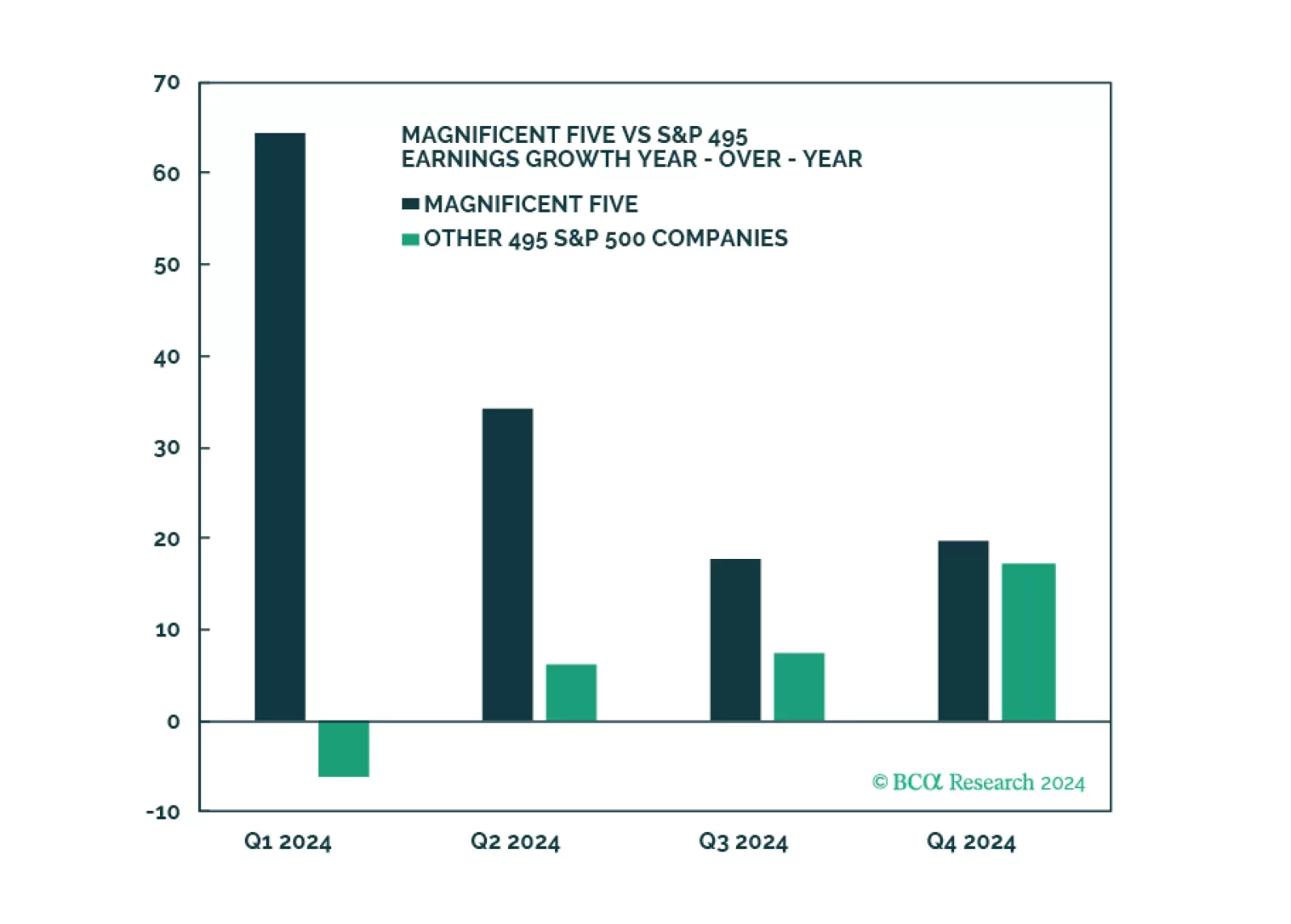

Q1 Earnings and sales growth were strong, but the devil is in the details: Without the Magnificent Five, earnings growth for the index would have been negative. On a positive note, margins have stabilized, and earnings growth is…

The broad market took a significant step backward in April, as market jitters gripped investors, stoking fears of higher for longer monetary policy. However, our roundtable investor poll has demonstrated that the majority remain…

The latest edition of our Big Bank Beige Book suggests the expansion remains intact, though weakness in C’s private-label credit card portfolio could be a harbinger of distress among lower-income consumers. We remain tactically…

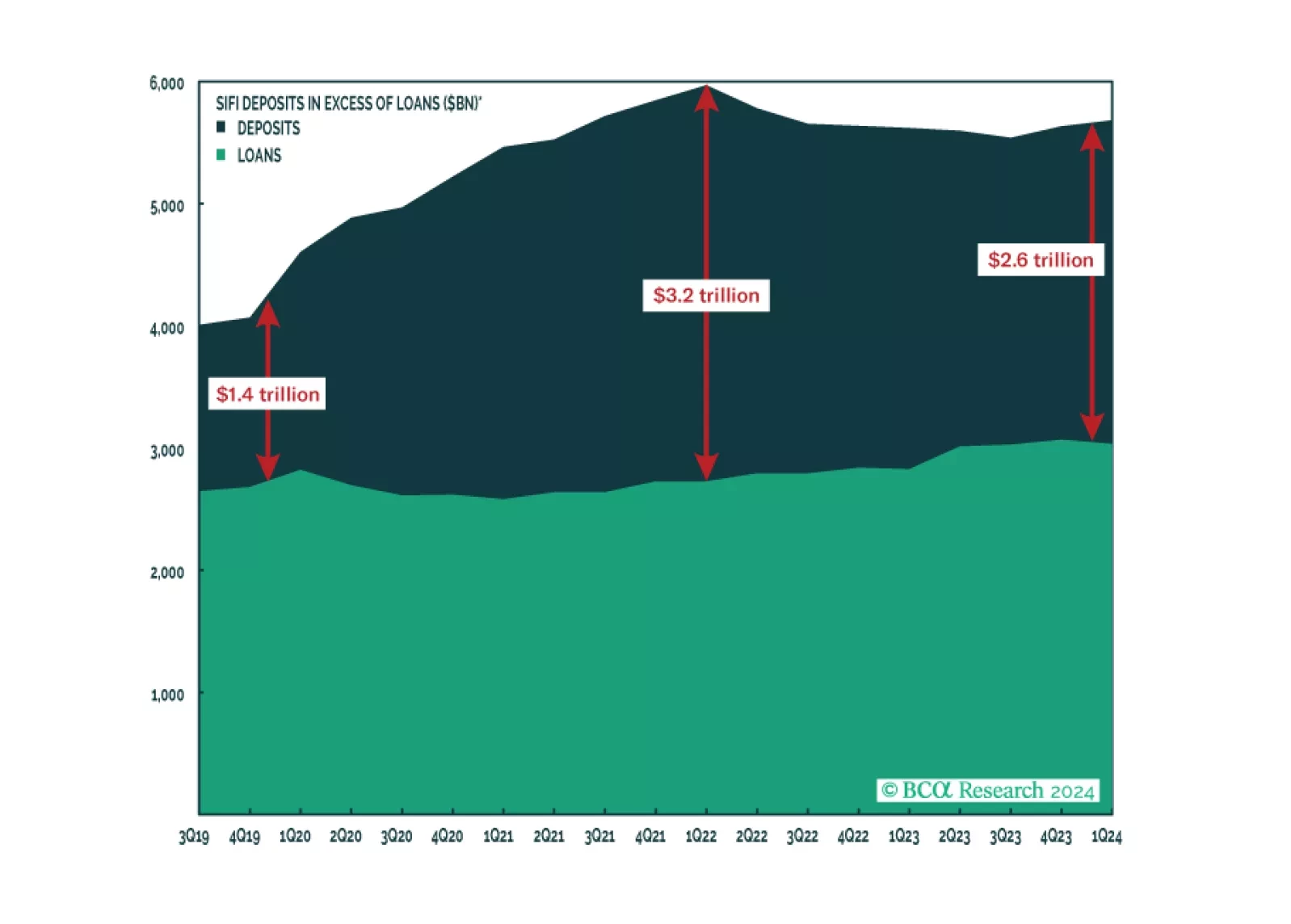

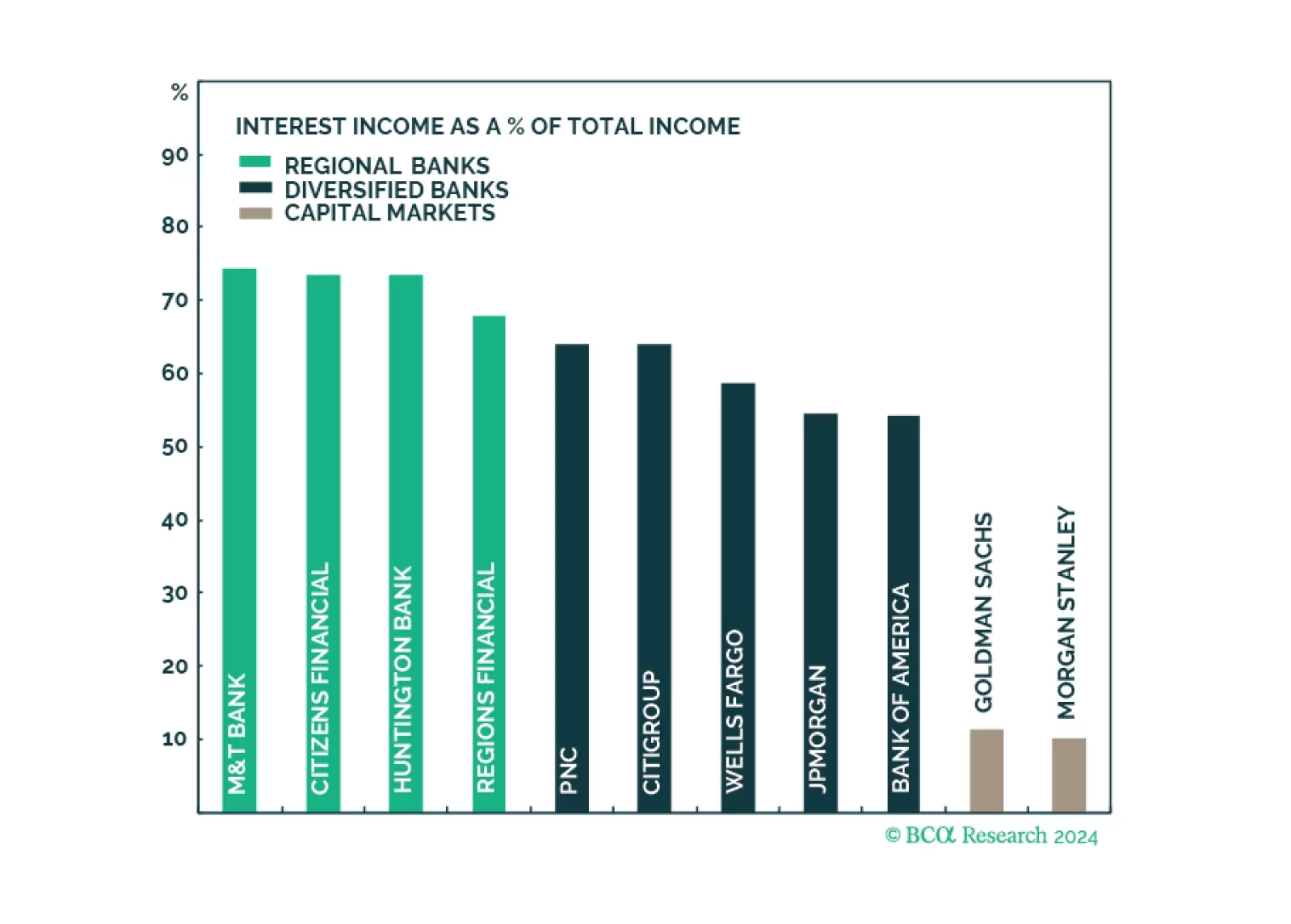

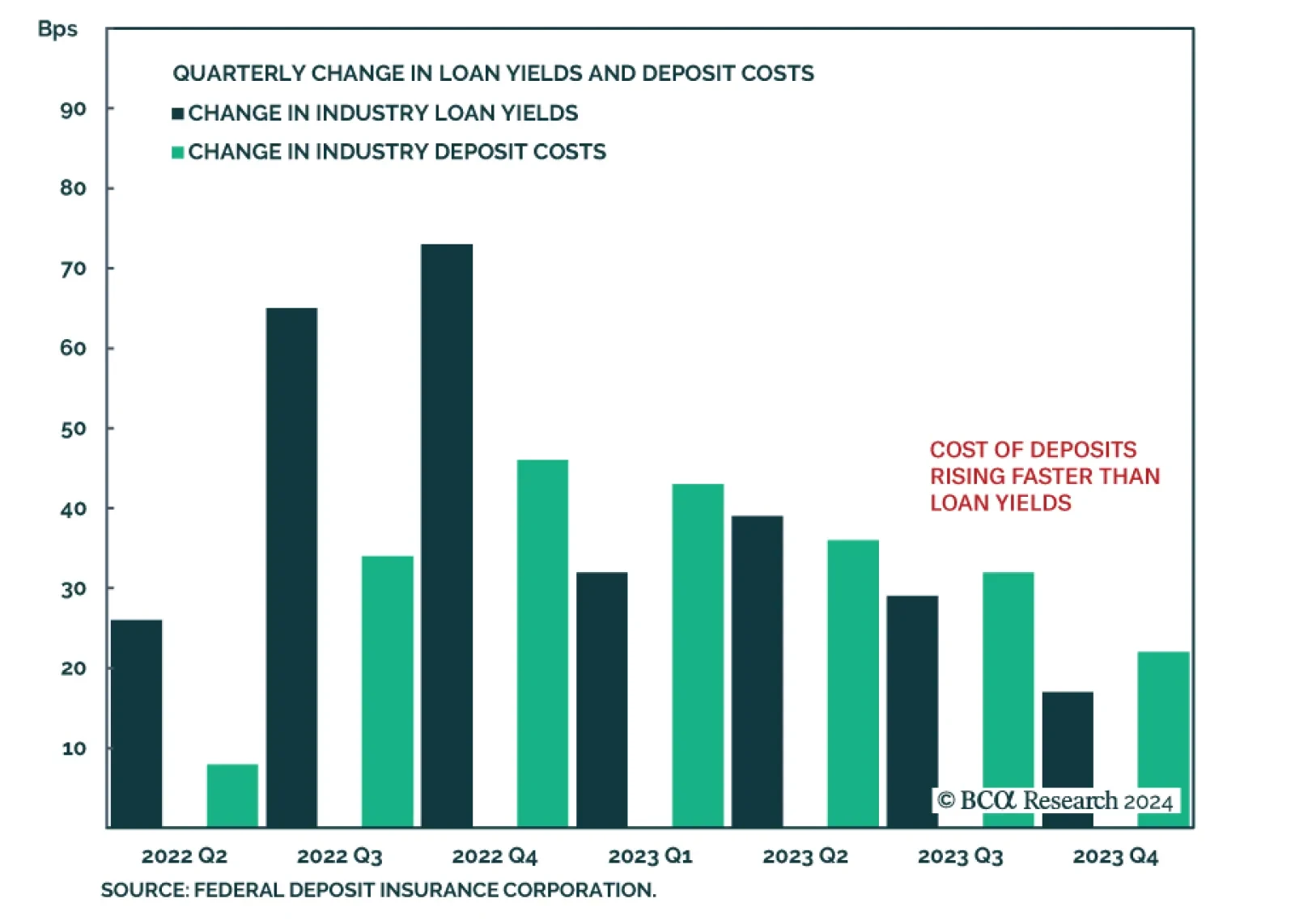

According to BCA Research’s US Equity Strategy service, Q1 earnings results signaled that net interest income (NII) growth is set to decline in US banks. For nearly two years, America’s largest banks enjoyed a…

Q1 earnings results of the largest US banks have demonstrated that the engine of recent growth in profitability, NII, has faltered as funding costs are rising fast. However, the resurgence in non-NII thanks to a revival in corporate…

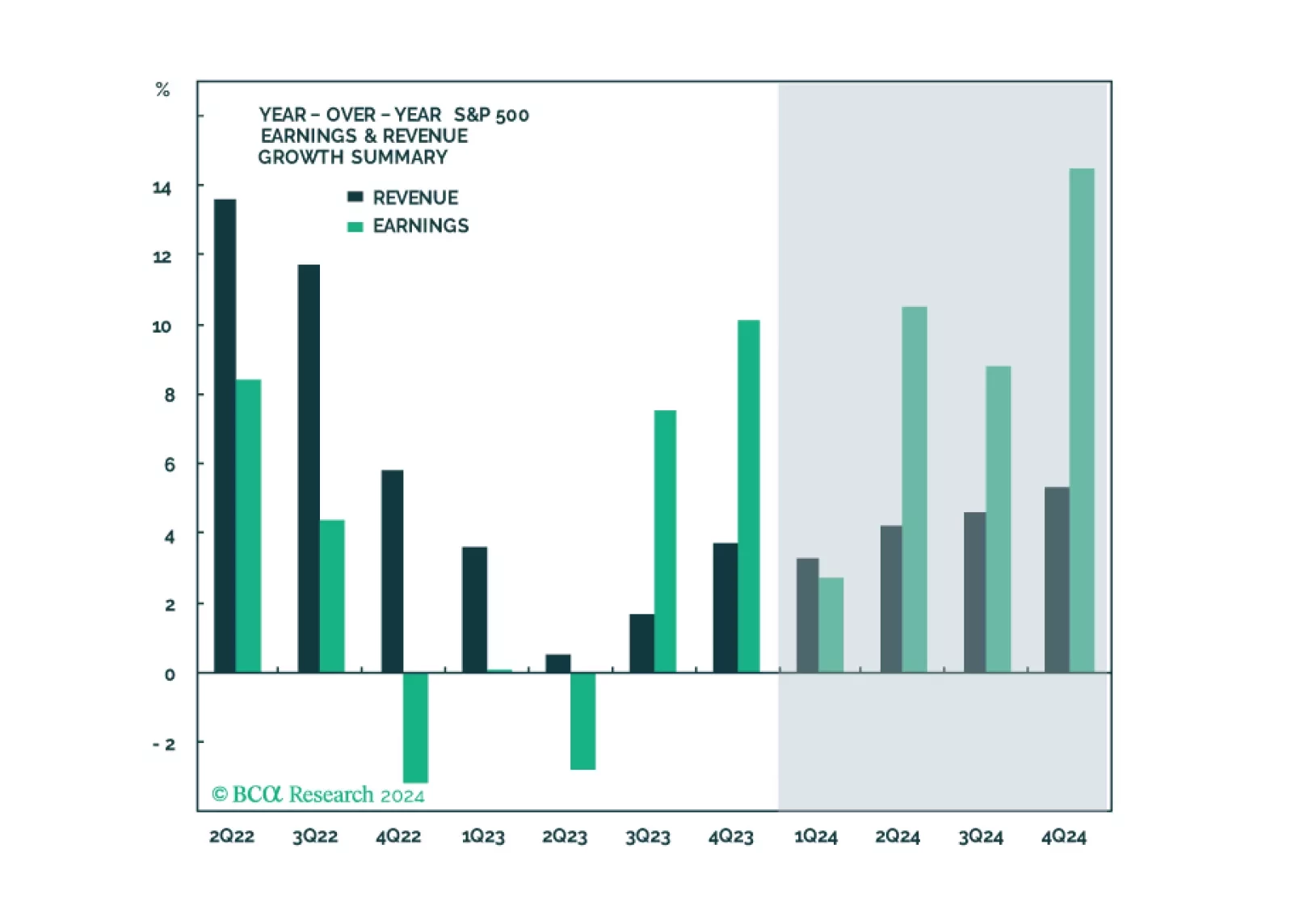

In this note, we preview the Q1-2024 earnings season, give our take on expectations and share what we will be watching.

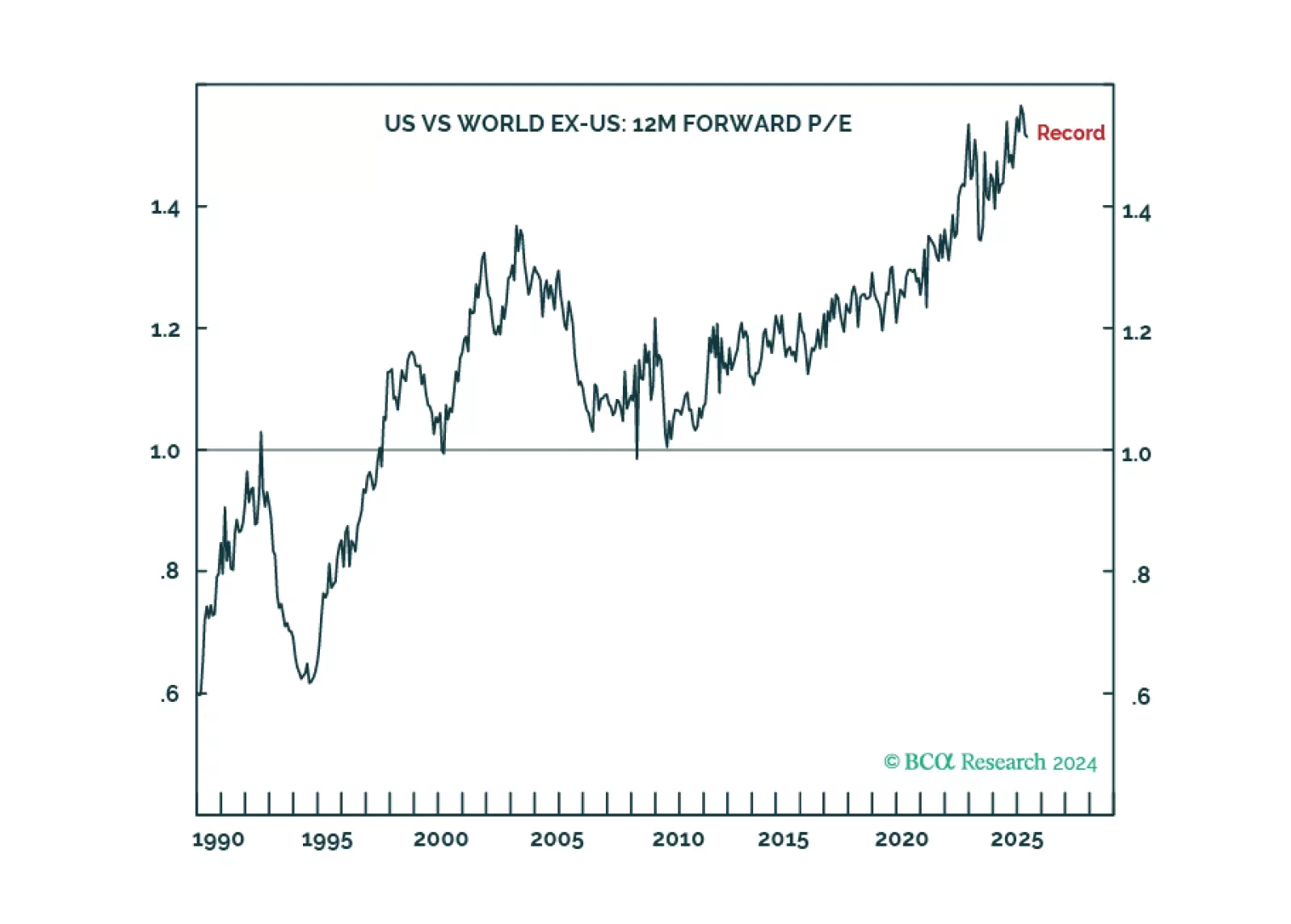

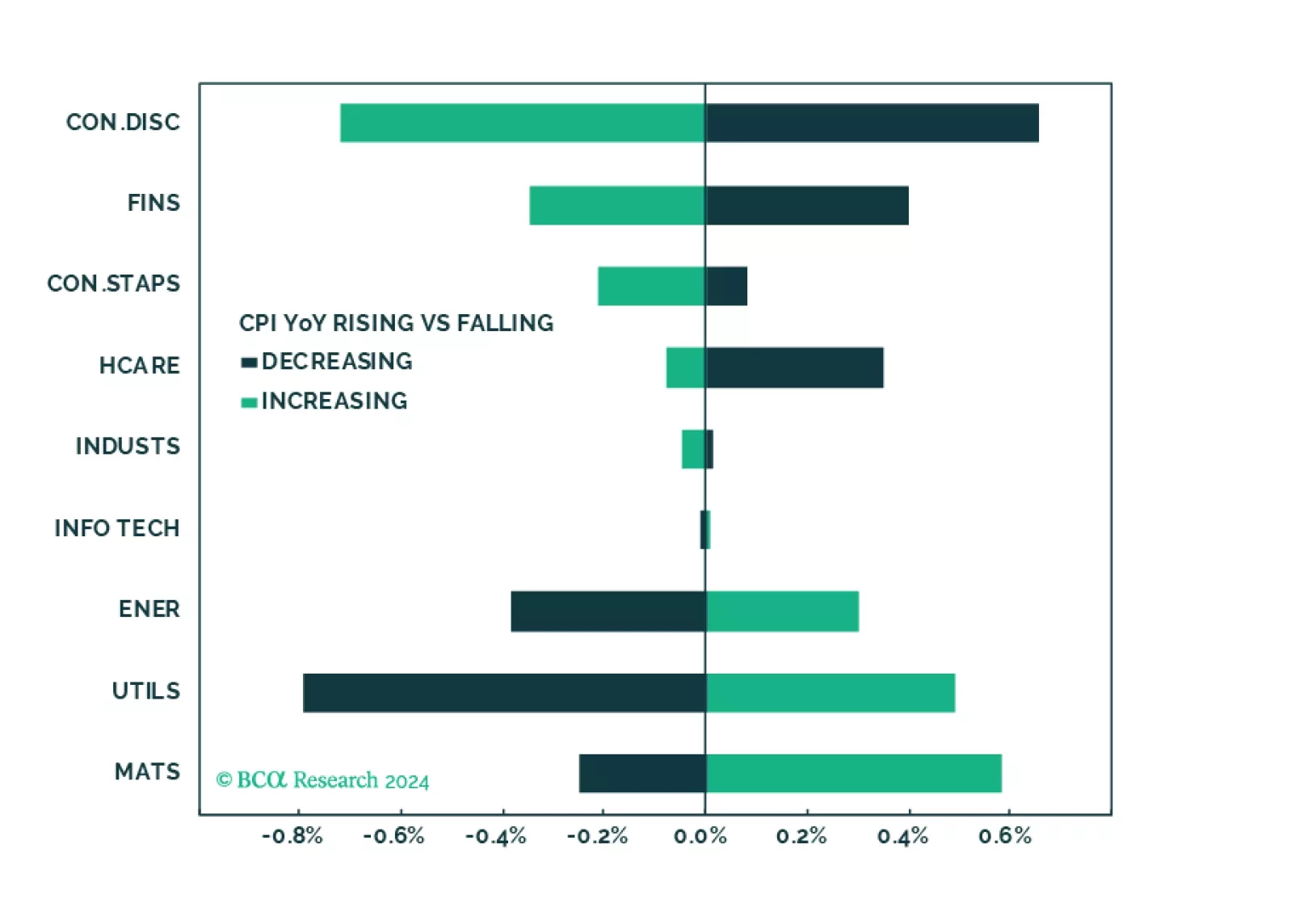

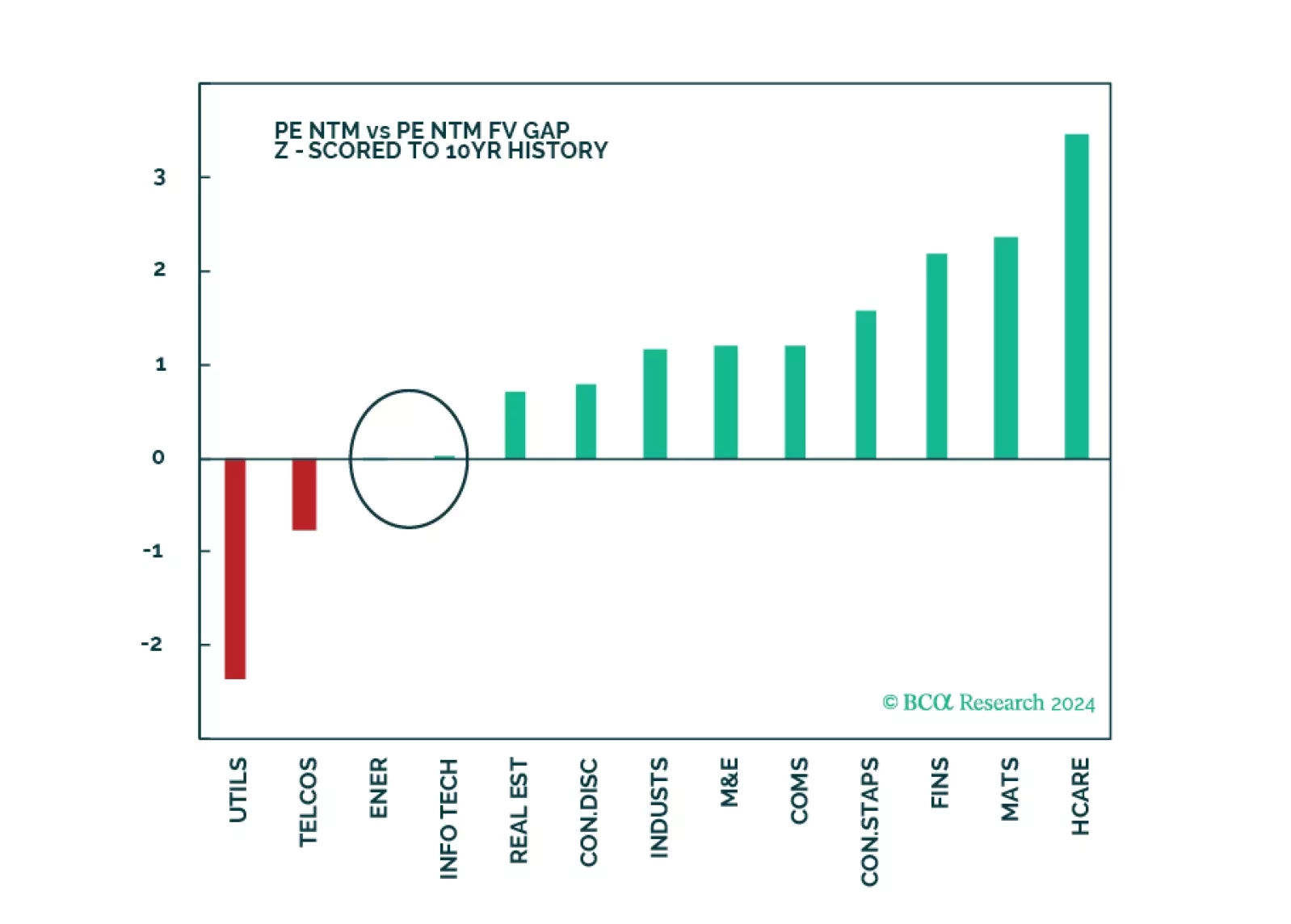

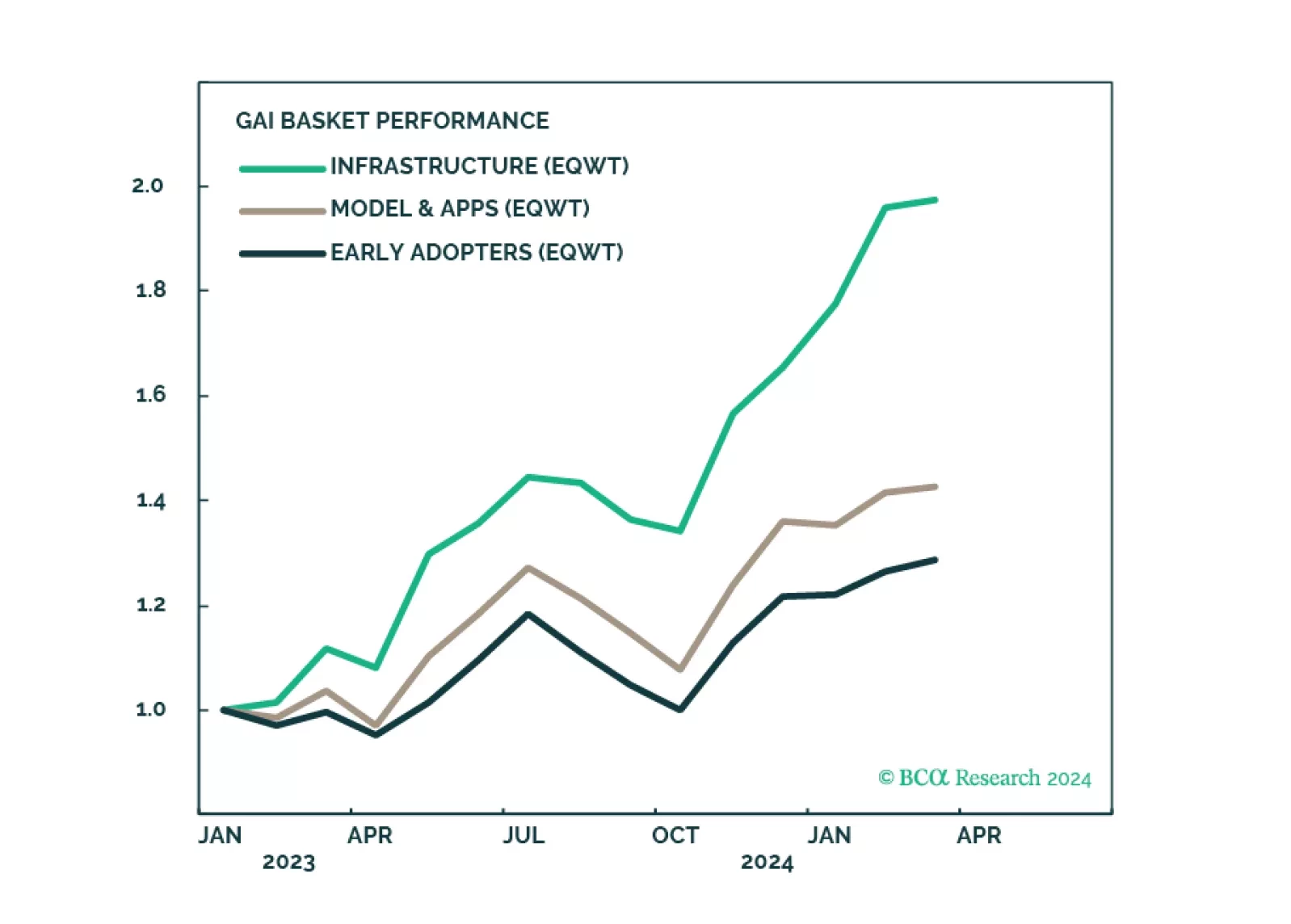

Fears of a hard landing are abating as growth has been surprising to the upside. New worries are emerging, such as the trajectory of disinflation, and the pace and timing of rate cuts. In this environment, it is important to build a…

The equity rally extended into March as hard landing outcome was priced out. It has broadened, as money flowed into less over-loved pockets of the market. Our models signal that margins are about to stabilize, and earnings growth…