Overweight The S&P consumer finance index, much like their larger financials peers in the S&P banks index, have mostly not participated in the rise in Treasury yields, a relationship that has heretofore been relatively tight (…

Overweight The recent global move away from risk assets has been a headwind for the high-beta S&P investment bank and brokers index that thrives when risk appetites are healthy. Still, the return of volatility should be a boon to…

Highlights Five risks to our bullish dollar stance need to be monitored: further weakness in the S&P 500; rebounding gold prices; stabilizing EM exchange rates and bond prices; Spanish bank stocks at multi-decade lows; and large,…

Highlights The long term direction for the pound is higher... ...but as the EU withdrawal bill passes through the U.K. parliament, expect a very hairy ride. The stock markets in Norway, Sweden and Denmark are driven by energy,…

Overweight - Downgrade Alert Between Friday of this week and Monday of next, roughly 75% of the S&P banks index, representing the nation's largest lenders, will be reporting their Q3 earnings results. Our loan growth and…

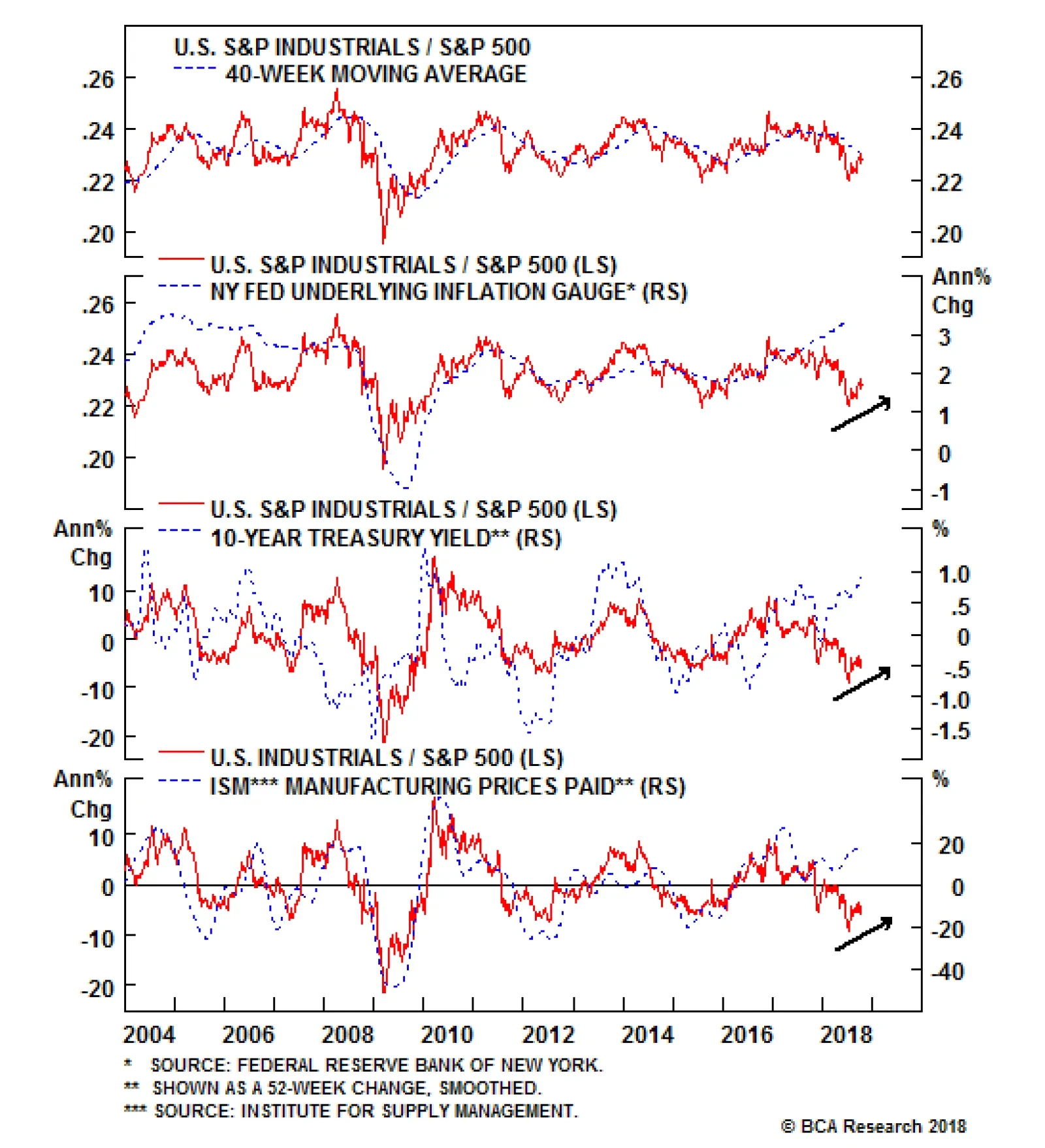

Against such a backdrop, the coming quarters should see sectors that benefit from rising interest rates and that also serve as inflation hedges outperform. This means we favor "FIT" stocks, which refers to financials,…

Highlights Portfolio Strategy A playable sector rotation opportunity has emerged, as we first argued at the recent BCA investment conference: Financials, industrials and select tech subgroups will lead the next phase of the market…

Highlights Set your overall investment strategy with two 'rules of 4' based on 10-year bond yields: If either the Italian BTP or the sum of the U.S. T-bond, German bund and JGB stays above 4 percent, then sell equities and buy…

Highlights Macro outlook: Global growth will continue to decelerate into early next year on the back of brewing EM stresses and an underwhelming policy response from China. Equities: Stay neutral for now, while underweighting EM…