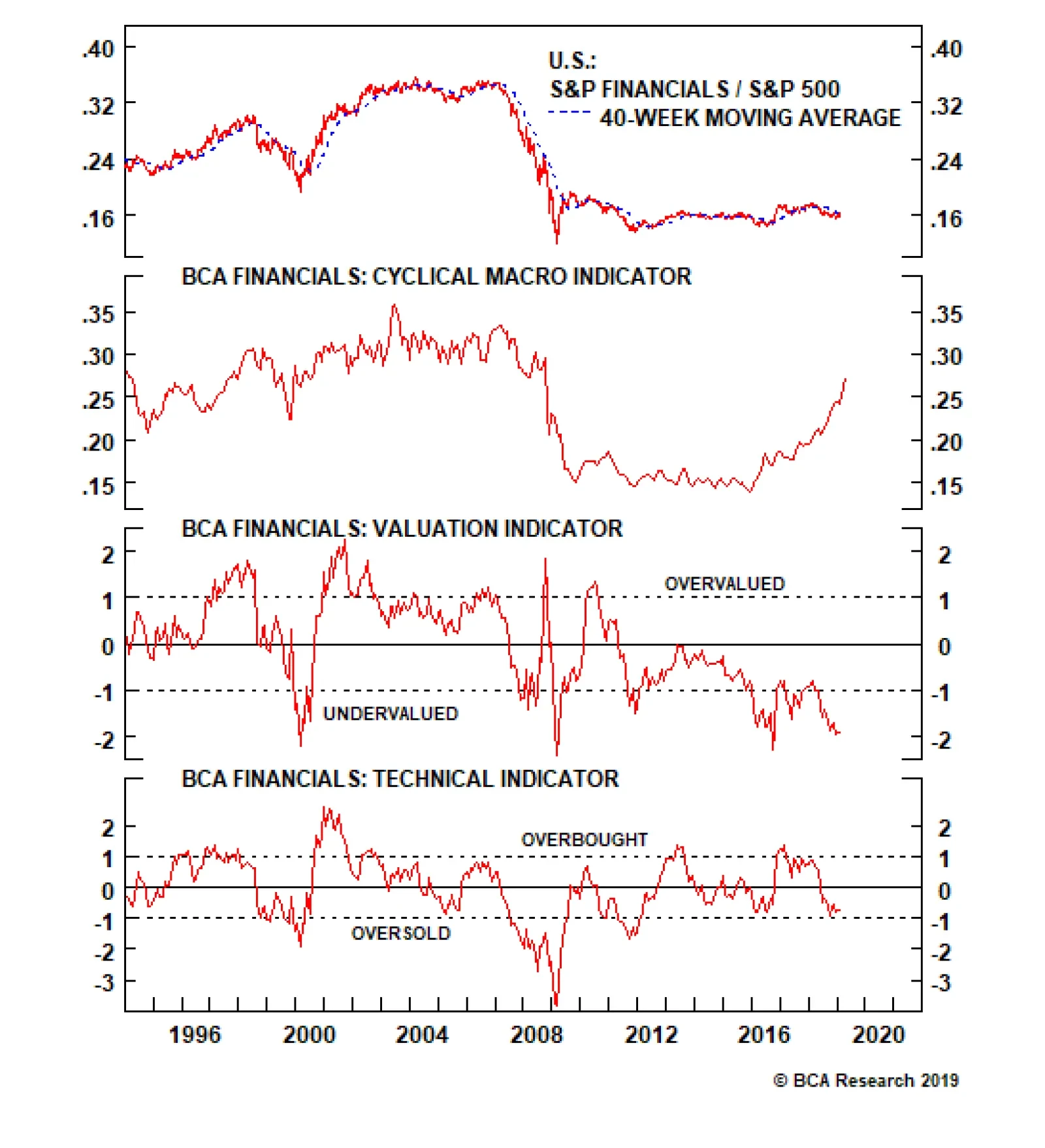

For S&P financials, the divergence between the upward thrust of our CMI and the depressed level of our valuation indicator (VI) has reached stunning levels, the former accelerating into pre-GFC territory and the latter…

Overweight In Monday’s Cyclical Indicator Update, we highlight our cyclical portfolio bent, driven by three core catalysts that we think will take U.S. equities higher. These are: a definitively more dovish Fed,…

Key Portfolio Highlights The S&P 500 has started 2019 with a bang as dovish cooing from the Fed has proven a tonic for equities. While we have not entirely retraced the path to the early-autumn highs, our strategy of staying…

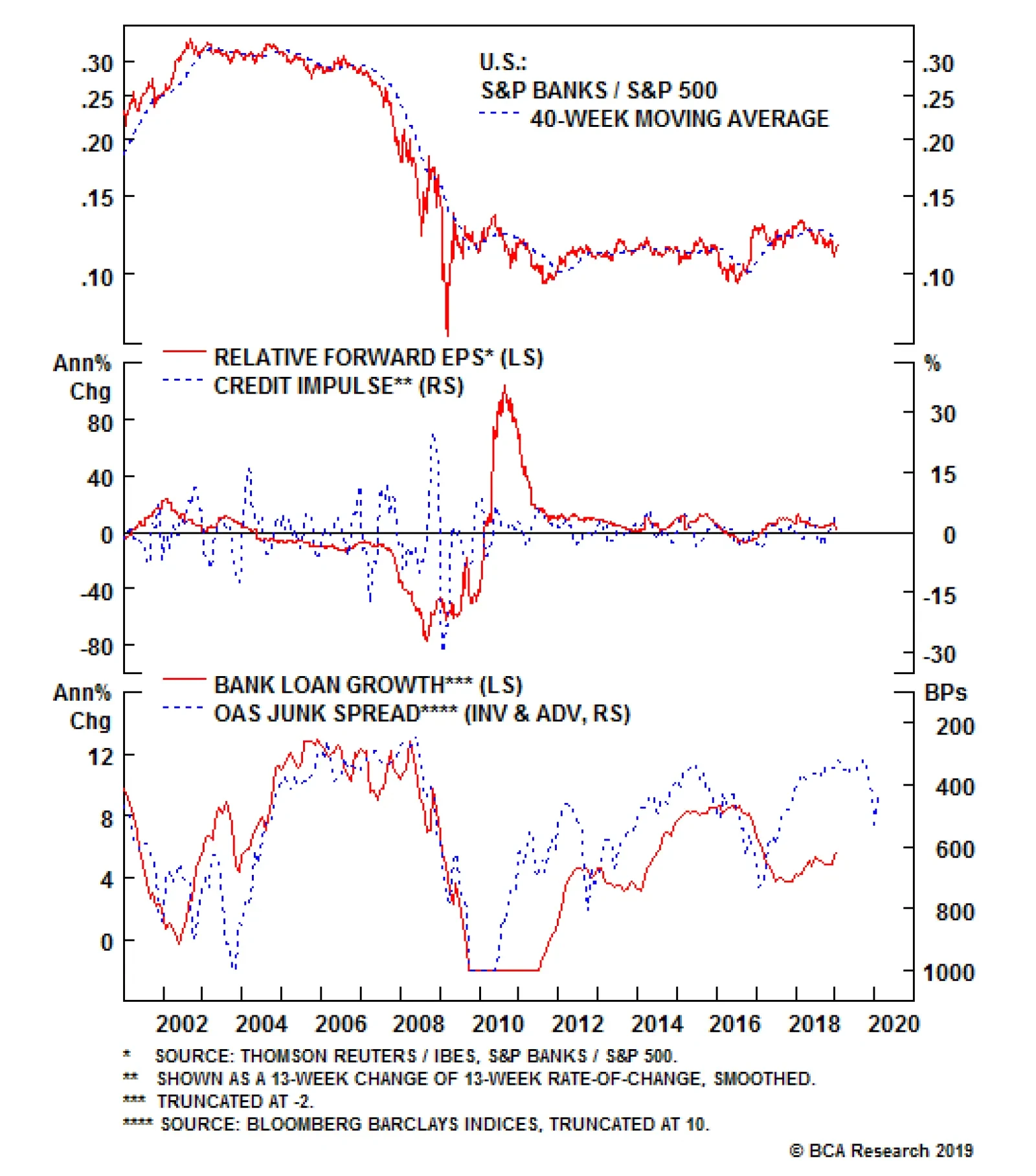

Overweight In a recent Weekly Report,1 we highlighted four reasons to stay overweight banks that more than counter the risk of a 10/2 yield curve inversion. These are: vibrant and broad-based bank credit growth, pristine credit…

Underweight A seldom considered victim from the slowdown in both the housing and auto markets is the top lines of property & casualty insurers. Relative growth of insurers and home & auto sales have typically shown a…

Highlights Portfolio Strategy Vibrant and broad-based bank credit growth, pristine credit quality, pent up bank buyback demand and a V-shaped recovery in bank ROE more than offset the risk of 10/2 yield curve inversion, and suggest…

On the loan growth front, our credit impulse diffusion index is reaccelerating and the overall credit impulse is expanding. Our total loans & leases growth model and the BCA’s C&I loan growth model both corroborate…

Highlights All of our recent investment recommendations have performed very strongly but have further to go: 1. Own a combination of European banks plus U.S. T-bonds. 2. Overweight EM versus DM. 3. …