Overweight (Downgrade Alert) Banks got earnings season off to a great start with heavyweight JPM (and the majority of the rest of the industry) reporting solid earnings. One of the key risks to our overweight banks call that…

Highlights New structural recommendation: long GBP/USD. The substantial Brexit discount in the pound makes it a long-term buy for investors who can tolerate near-term volatility. The most powerful equity play on a fading Brexit…

Highlights The Chinese economy is still slowing, and there is not yet enough evidence from forward-looking economic data to suggest a turnaround is imminent. Deflation has returned to China’s industrial sector. Even though…

Highlights MARKET FORECASTS Investment Strategy: Markets have entered a “show me” phase. Better economic data and meaningful progress on the trade negotiations will be necessary for stocks to move sustainably…

Highlights The global manufacturing cycle is likely to bottom soon, and consumption and services remain robust. The risk of recession over the next 12 months is low. This suggests that equities will continue to outperform bonds. But…

Energy Stocks Are Heading North Banks Clamoring For Higher Rates And A More Hawkish Fed Homebuilding Stocks Are Catching Up To Housing Starts Will Global Trade Get “Fed-Exed”? Do Not Try To Bottom Fish……

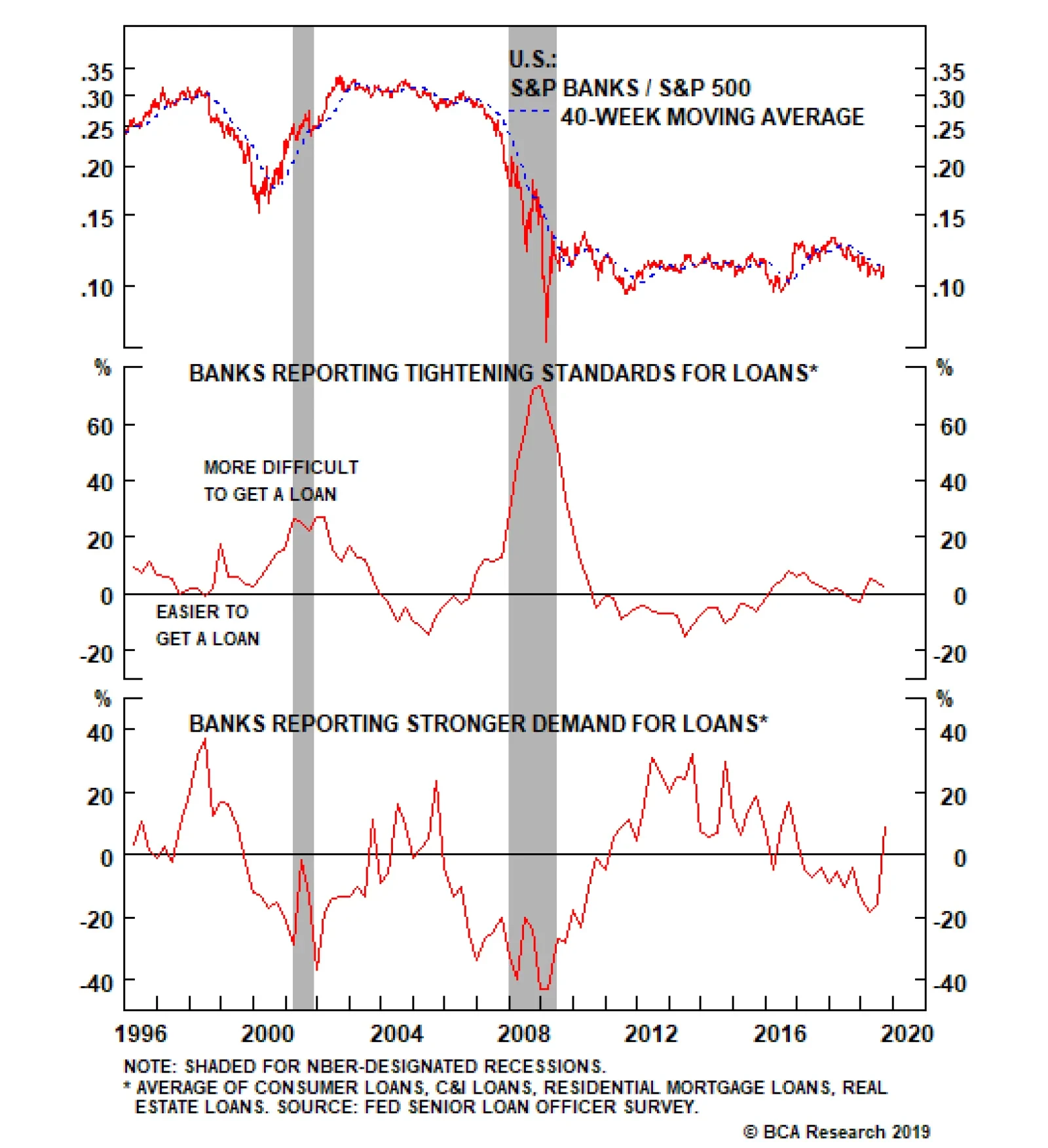

Overweight – Downgrade Alert Banks stocks troughed in mid-August, sniffing out a sell-off in the bond market, and we continue to recommend an above benchmark allocation in the S&P banks index. This is a global…

Overweight The rise in the 10-year U.S. Treasury (UST) yield over the past two weeks has breathed life back into the S&P financials sector, and for the time being we are sticking with an overweight recommendation. While…

Banks stocks troughed in mid-August, sniffing out a sell-off in the bond market. While the broad financials index is levered to interest rate movements, banks are hyper-sensitive to changes in the risk-free asset. Thus, the…