Highlights Banks have an unmatched perspective on the entire economy, … : BCA began by tracking money flows through the banking system to gain advance notice of the direction of markets and the economy. … so we review…

Highlights Stay tactically neutral to equities. The market may meet some short-term resistance, especially as a slew of poor earnings are released in the coming weeks. The long-term threat to equities comes from the pandemic’s…

Highlights US Corporates: The Fed continues to expand the reach of its extraordinary monetary policies designed to combat the COVID-19 recession, now giving itself the ability to hold BB-rated US high-yield bonds within its corporate…

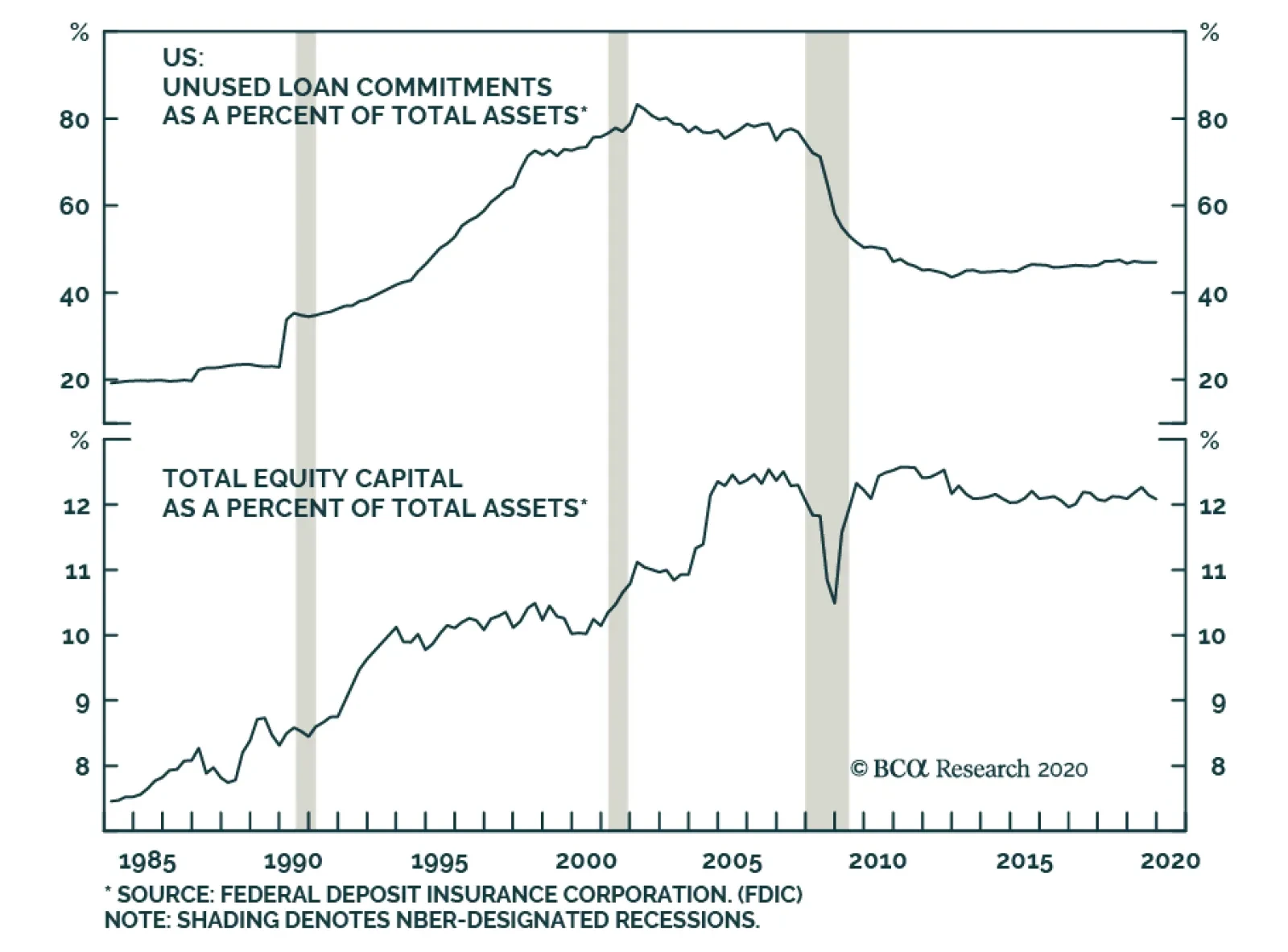

Yesterday, BCA Research's US Investment Strategy service continued its series of reports on How Vulnerable Are US Banks? Unused loan commitments have provoked much agitation among investors in recent weeks. A floundering company,…

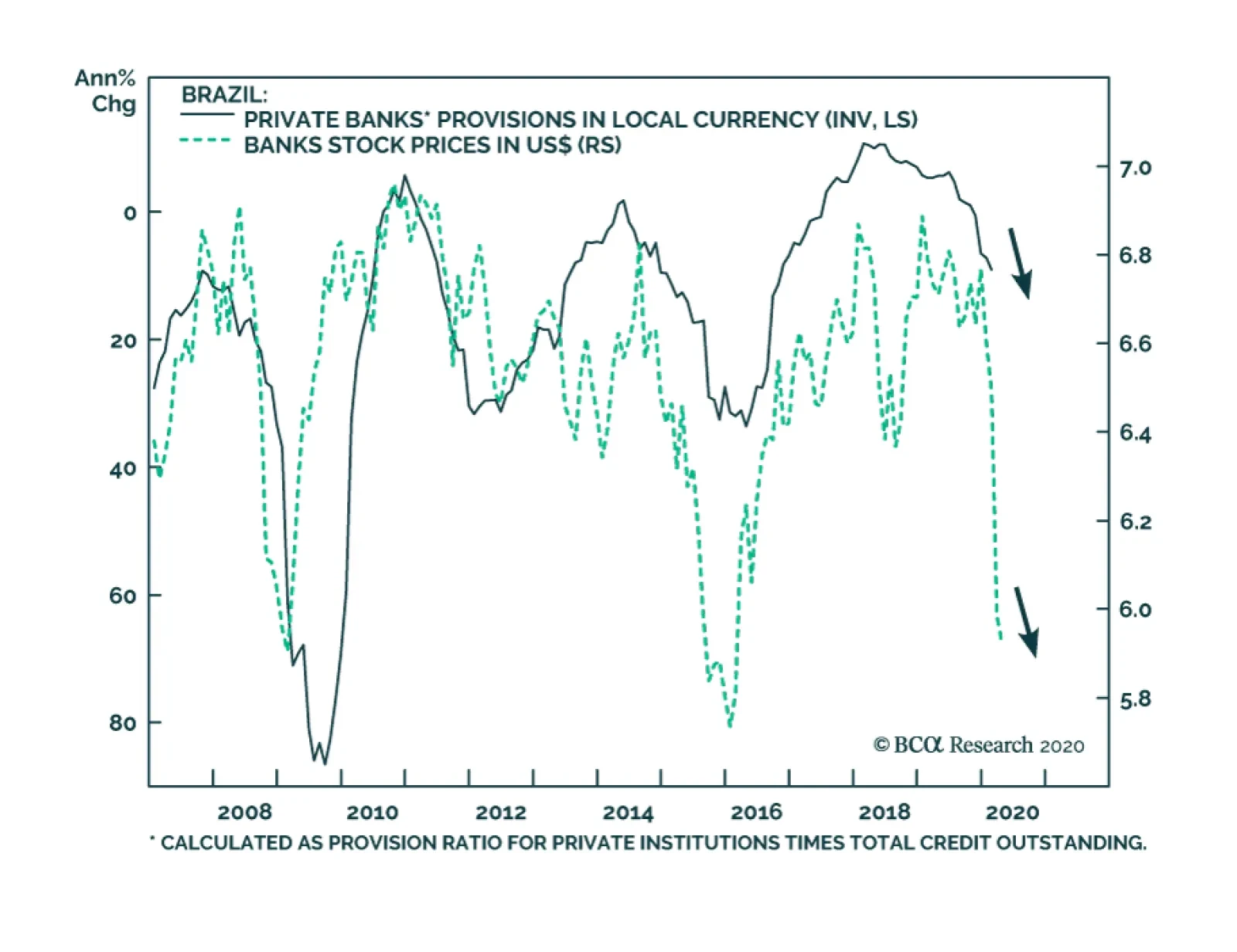

On Tuesday, BCA Research's Emerging Markets Strategy service concluded that the cyclical outlook for Brazilian bank stocks has worsened further due to the COVID-19 pandemic, despite the fact that valuations have improved. Brazilian…

Highlights Recommended Allocation The outlook for markets over the next few months is highly uncertain. On the optimistic side, new COVID-19 cases are probably close to peaking (for now), and so equities could continue to…

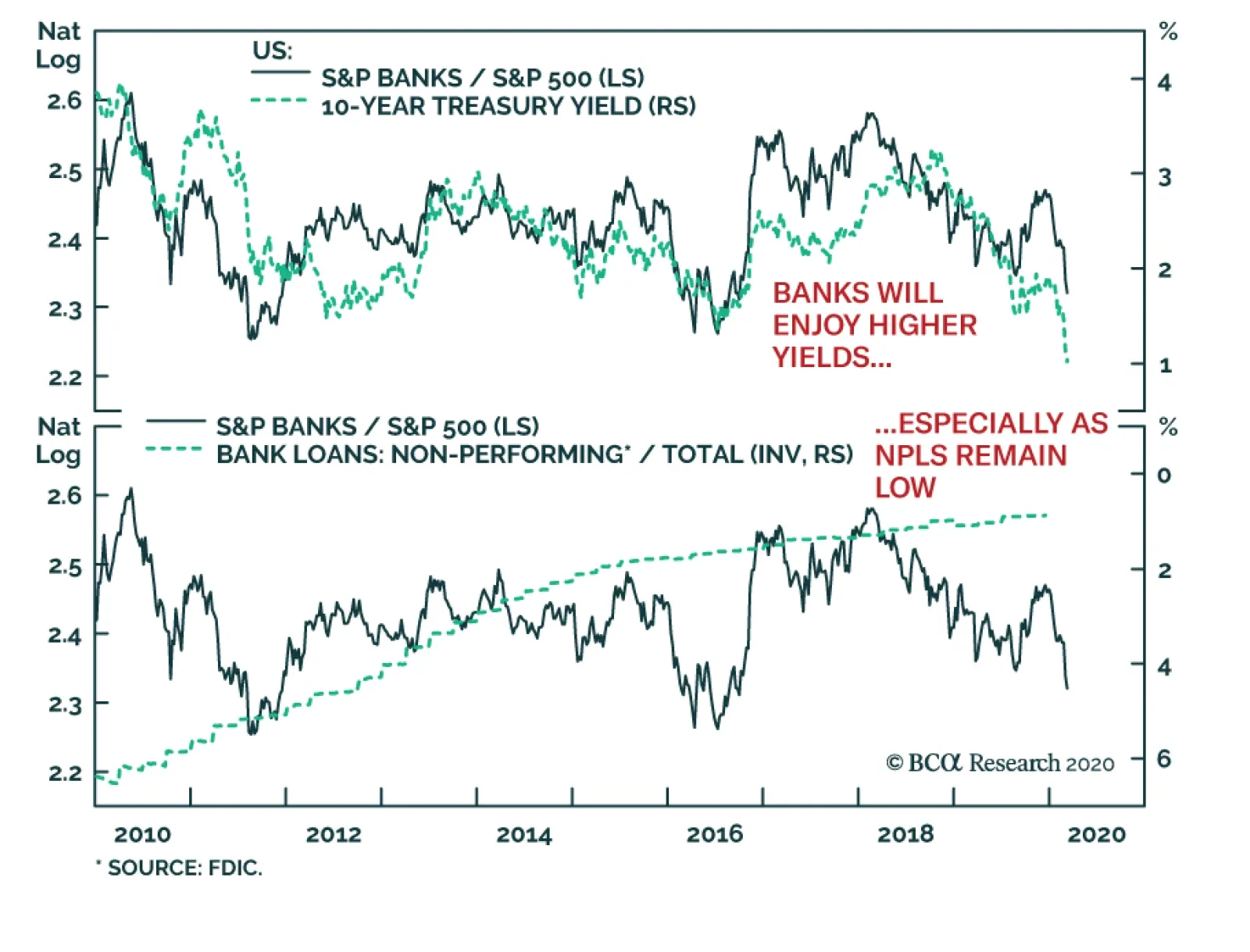

Year to date, financials have been the second worst-performing sector in the S&P 500, after energy. Within that group, banks fell nearly 20%, thanks to the collapse in yields caused by the COVID-19 outbreak. If our…