Highlights Equities hit an air pocket last week after making another recovery high: Investors seemed to reassess the economy’s direction following official forecasts that ranged from sober to grim. “Whatever we can, and…

In a webcast this Friday I will be joined by our Chief US Equity Strategist, Anastasios Avgeriou to debate ‘Sectors To Own, And Sectors To Avoid In The Post-Covid World’. Today’s report preludes five of the points…

Highlights If policymakers can neutralize default pressures arising from the lockdowns, the lasting impacts of this recession may not be so bad: As Jay Powell put it on 60 Minutes several weeks ago, policymakers just have to keep…

Highlights The good stock market = ‘growth defensives’ like technology that benefit from lower bond yields. The bad stock market = ‘value cyclicals’ like banks that suffer from lower bond yields. Structurally…

Highlights Investment Grade Sector Valuation: Our investment grade corporate bond sector valuation models for the US, euro area, UK, Canada and Australia show some common messages, as markets have adjusted to a virus-stricken world.…

Highlights The global economy will contract at its fastest pace since the early 1930s, but will not slump into a depression. Easy monetary conditions, an extremely expansive fiscal policy, and solid bank and household balance sheets…

Highlights The six-month increase in European bank credit flows amounts to an underwhelming $70 billion, compared to a record high $660 billion in the US and $550 billion in China. Underweight European domestic cyclicals versus their…

Highlights Real Yield Curve: Last week’s negative oil print could signal the peak in deflationary sentiment for this cycle. It’s a good time for bond investors to enter real yield curve steepeners. Buy a short-maturity real…

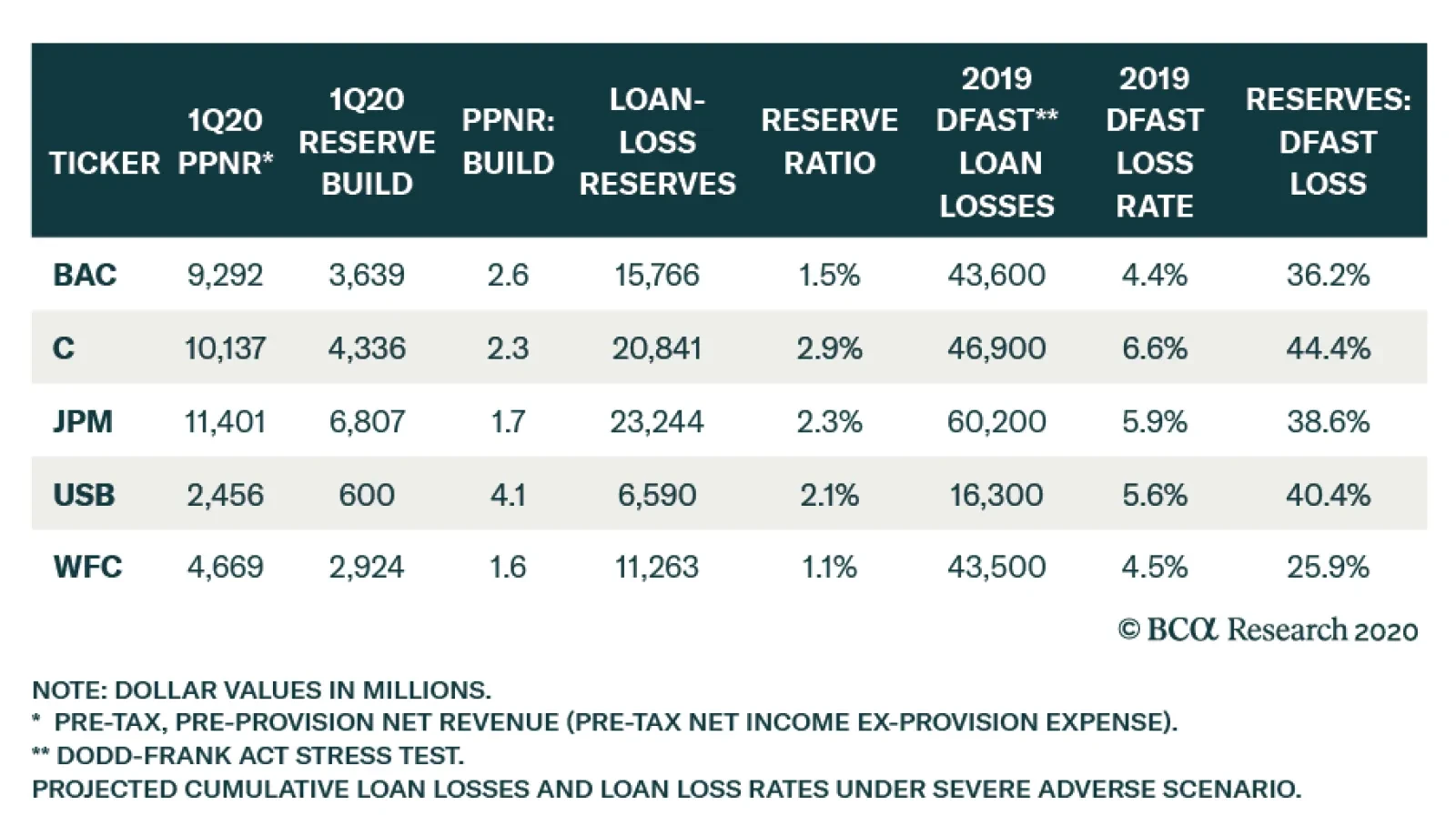

Yesterday, BCA Research's US Investment Strategy service recommended that investors go overweight the largest banks in the US; BAC, C, JPM, USB and WFC. The uncertainty around loan losses remains extremely high. No one knows…