In a recent daily report, we analyzed relative performance of the S&P 500 sectors and styles under different US 10-year Treasury yield (UST10Y) regimes. Today we expand our analysis and map relative performance of the S…

Highlights Economy – Everyone from banks to households to businesses is swimming in cash: The Fed’s asset purchases will continue until the middle of next year, but banks, households and businesses already have more cash…

Dear Client, There will be no weekly report next week. Instead, we will host our quarterly webcast on Tuesday, October 26 for the US and EMEA regions and Wednesday, October 27 for the Asia Pacific region. We will resume our regular…

Foreword Today we are publishing a charts-only report focused on the S&P 500, and GICS 1 sectors. Many of the charts are self-explanatory; to some, we have added a short commentary. The charts cover macro, valuations,…

Chart 1Cyclicals Styels and Sectors Outperform In The Rising Rates Environment In a recent daily report, we analyzed performance of the S&P 500 sectors before and after the 2013 tapering announcement. Today we expand our…

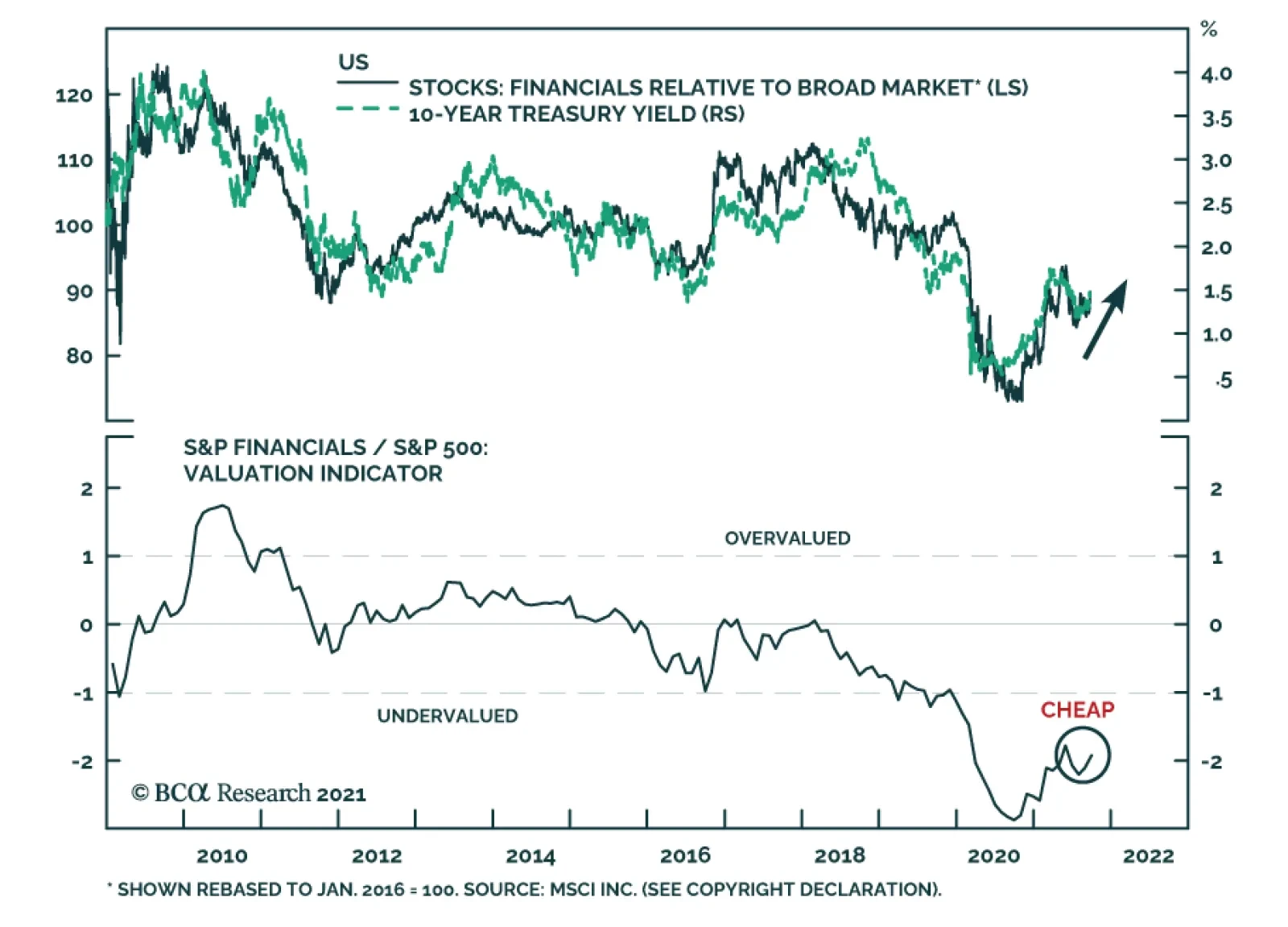

US Financials is among the best performing US equity sectors over the past three months. We expect these positive relative gains to continue. Financials will benefit from rising US bond yields over the coming year. Not only…

August PPI reading came in at 8.3%. Naturally, many investors are wondering whether the companies will be able to pass their soaring input costs to the customers. An in-depth analysis of margins and pricing power requires a significant…

Highlights The Evergrande crisis is not China’s Lehman moment. Nonetheless, Chinese construction activity will decelerate further in response to this shock. Global equities are frothy enough that a weaker-than-expected Chinese…

Today we take a close look at the historical GICS1 level performance following the taper event in 2013. Chart 1 provides an overview of a price action of the 10-year US Treasury yield, the US dollar, and gold to provide context,…

Highlights We are reviewing our recommendations. We are also introducing recommendation tables to monitor these positions. Overall, our main recommendations have generated alpha and have a positive batting average. Feature The end…