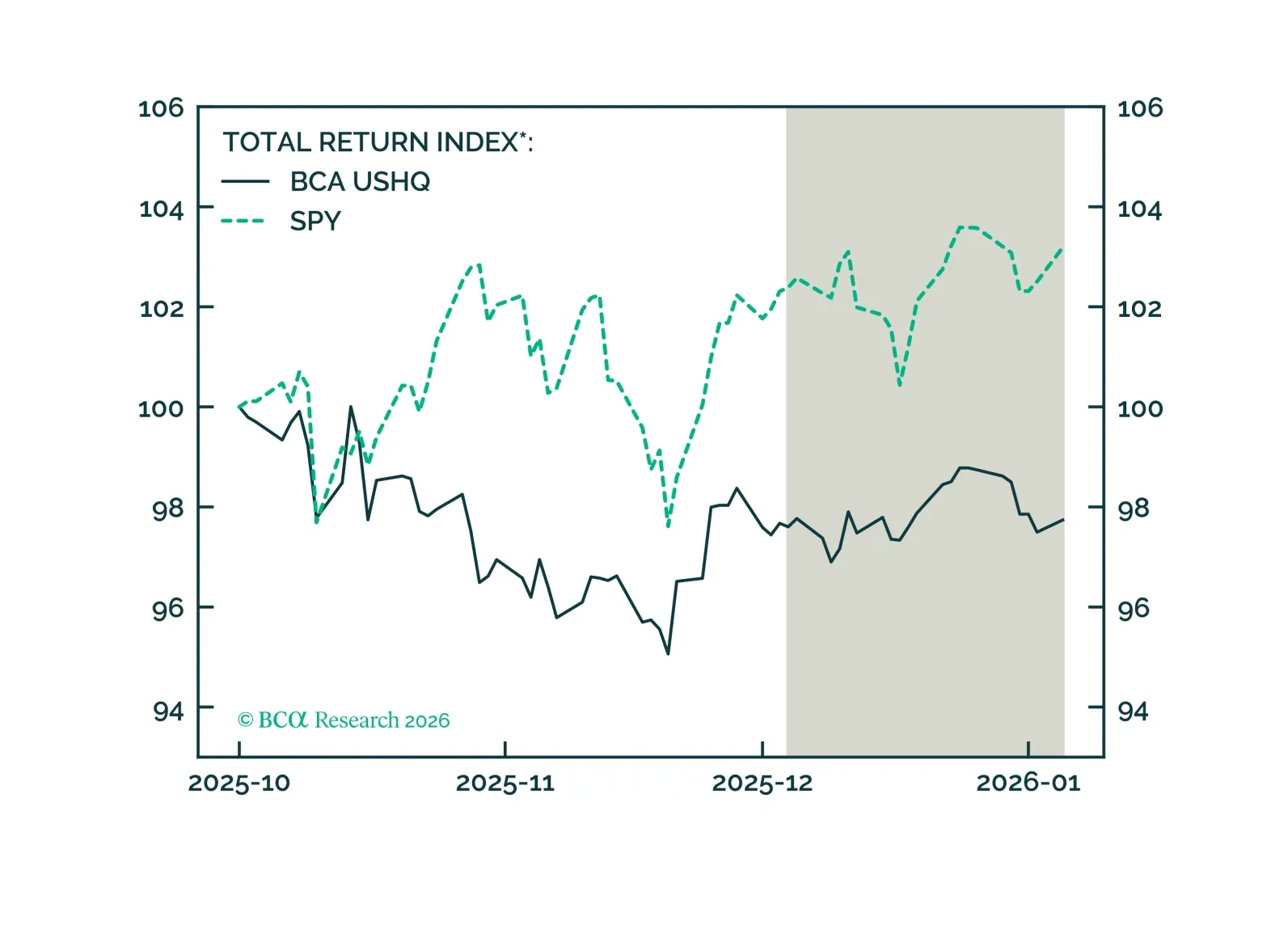

The US High Quality portfolio underperformed its benchmark through December, returning 0.14%, while its SPY benchmark returned 0.78%. On a trailing three-month basis, the USHQ portfolio’s performance was weaker than the benchmark,…

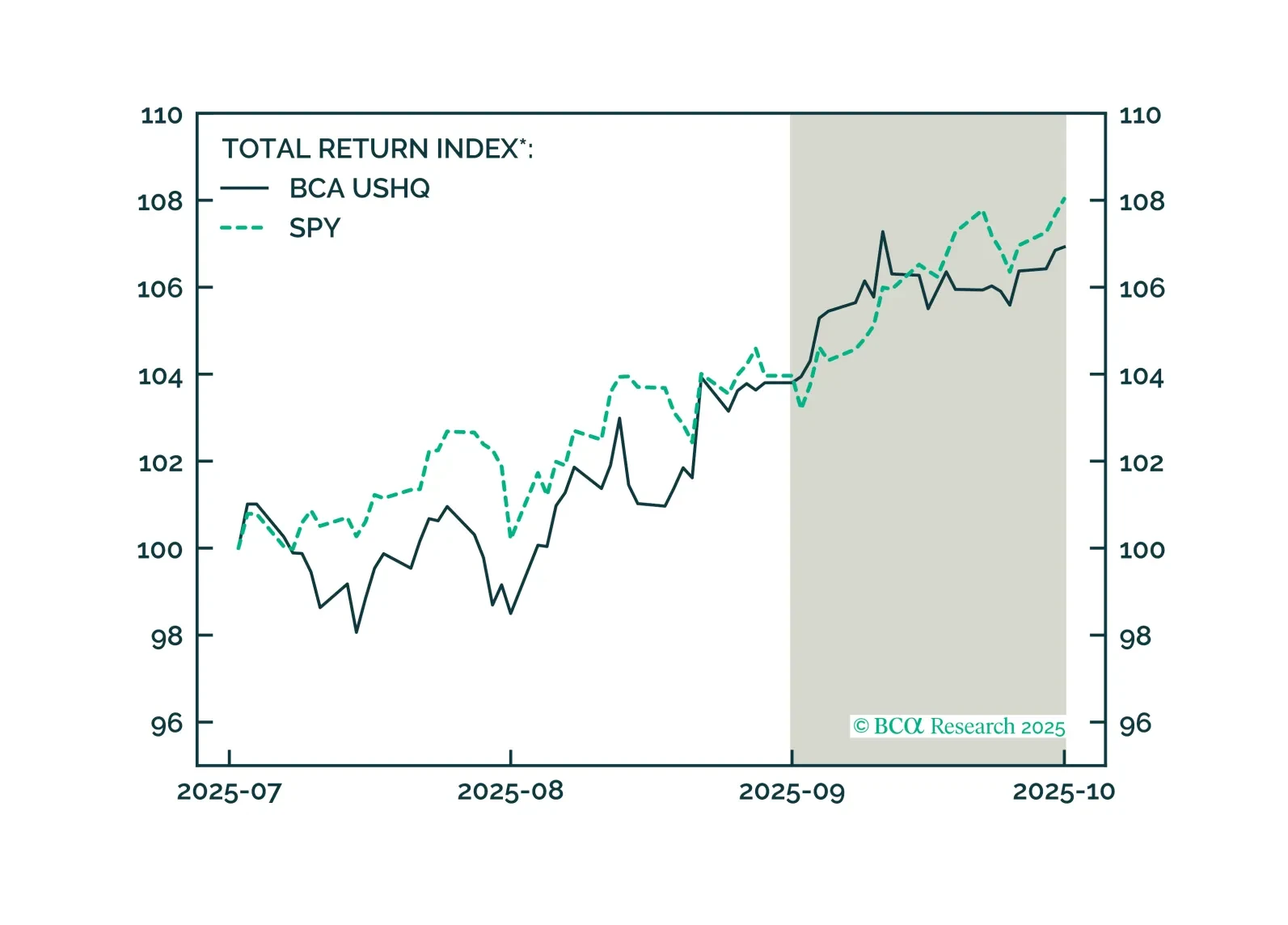

The US High Quality (USHQ) portfolio underperformed its benchmark through September, returning 3.01%, whilst its SPY benchmark returned 3.91%. However, our US High Quality SMID (USHQ SMID) portfolio continues to show strength, with…

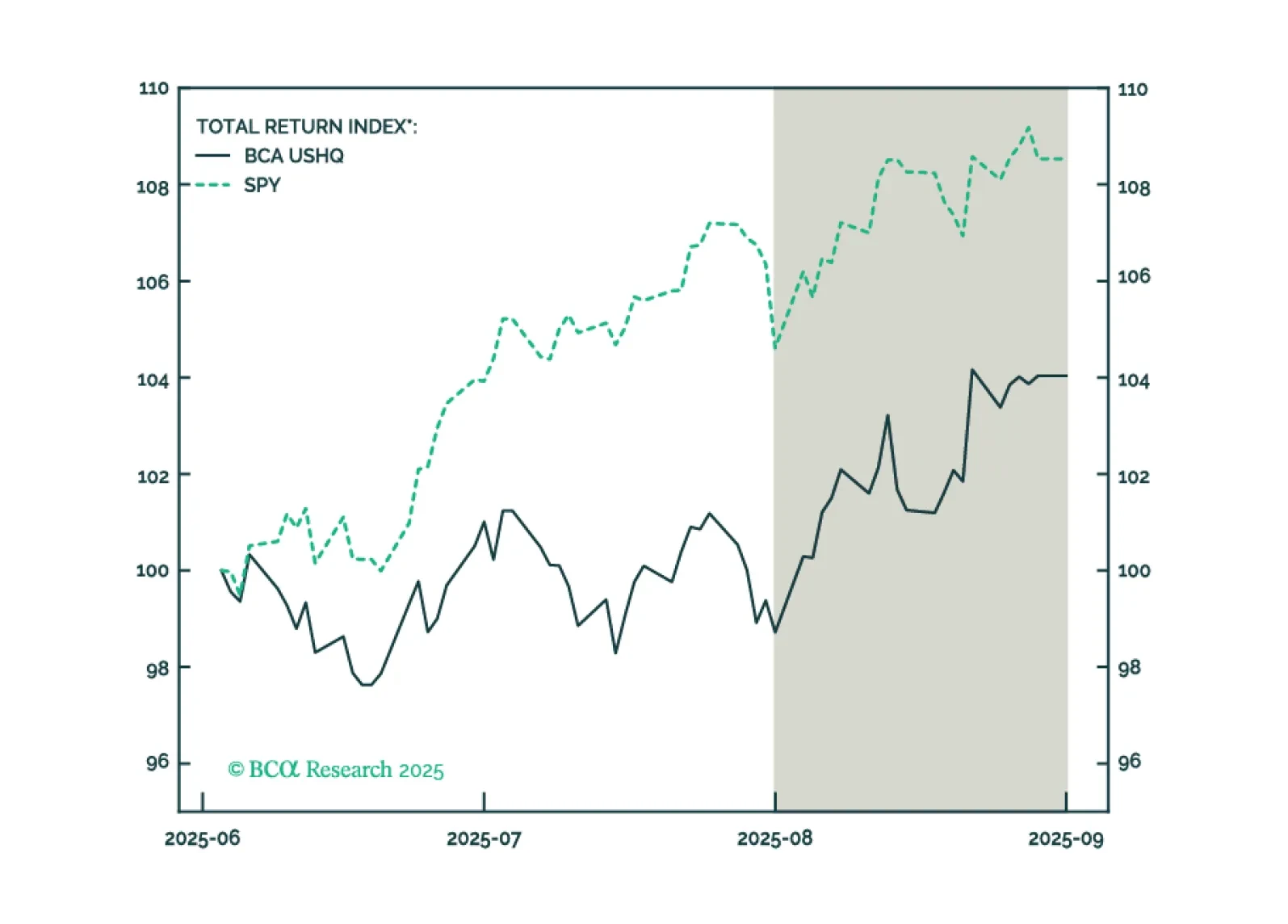

The US High Quality (USHQ) portfolio outperformed its benchmark through August, returning 5.39%, whilst its SPY benchmark returned 3.75%. On a trailing three-month basis, the USHQ portfolio’s performance was weaker than the benchmark…

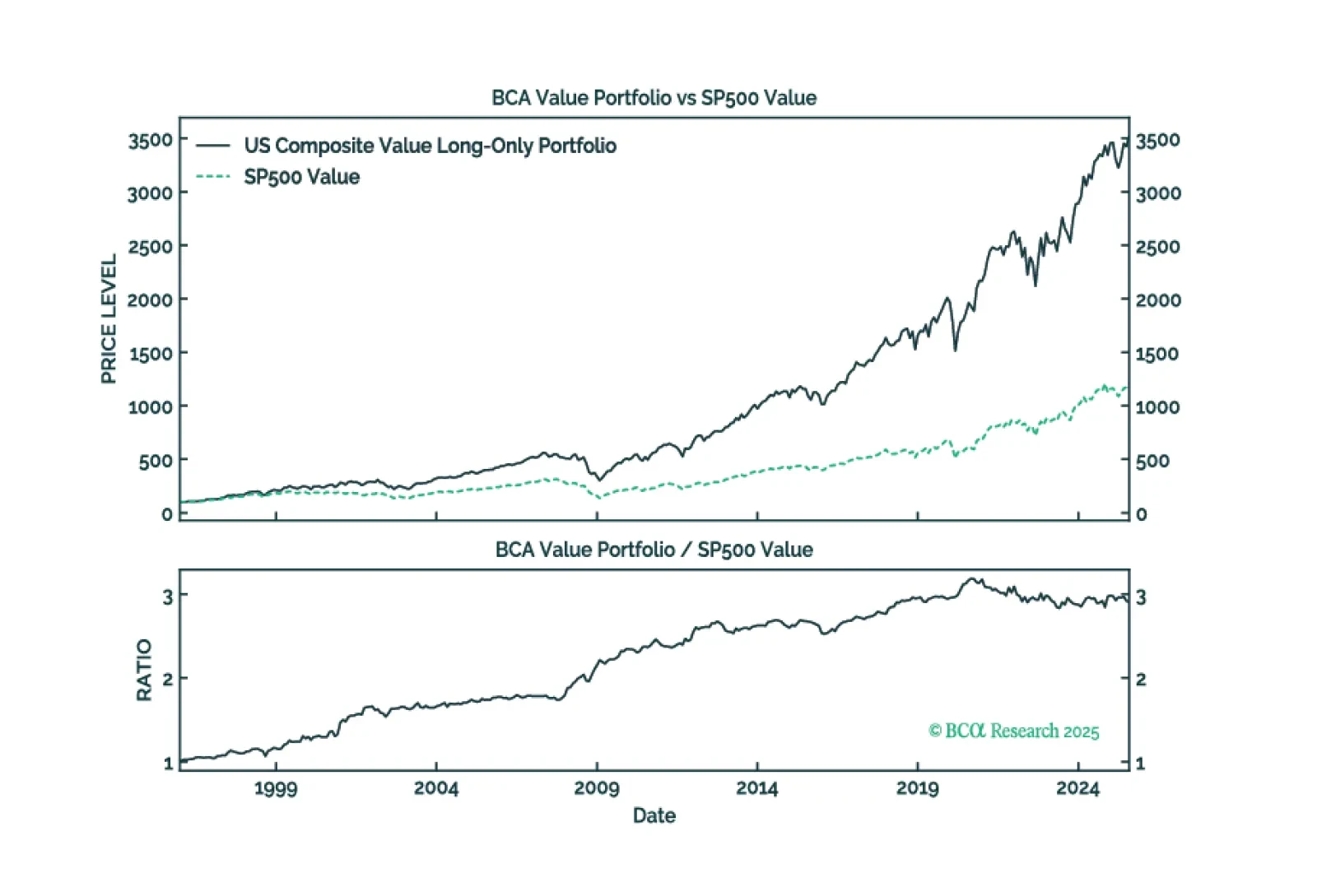

Commercial indices’ limitations have made Value a fertile ground for stock pickers. Our Composite Value model has shown promise in circumventing these flaws and capturing alpha.

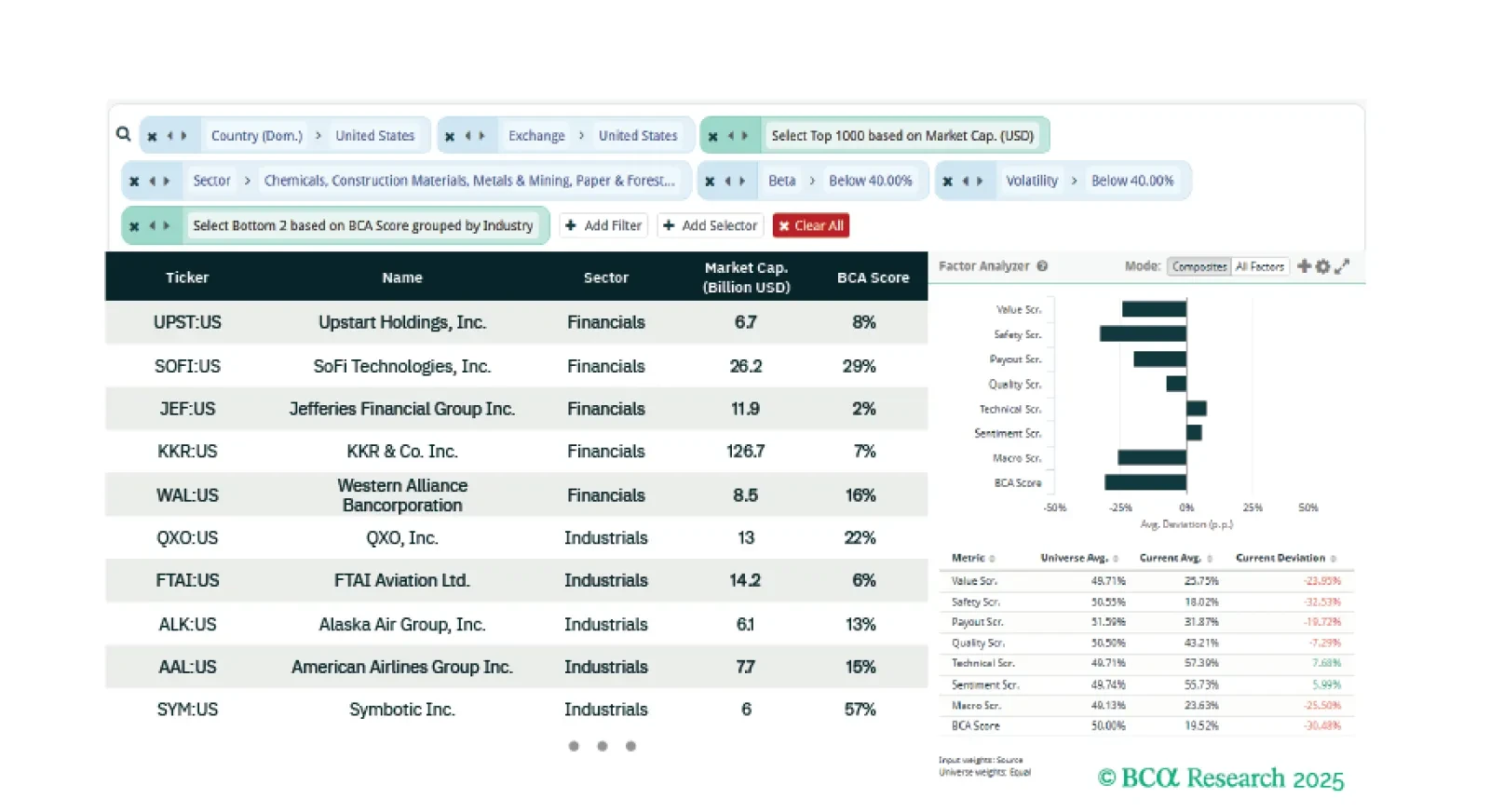

This week we develop two ideas with three screeners. The first identifies deep cyclical sectors that continue to outperform post Liberation Day in the US. We provide two screens to identify equity opportunities for this. Our…

The US High Quality (USHQ) portfolio underperformed its benchmark through July, returning -1.5%, whilst its SPY benchmark returned 0.2%. On a trailing three-month basis, performance was notably weak vs. benchmark, with USHQ…

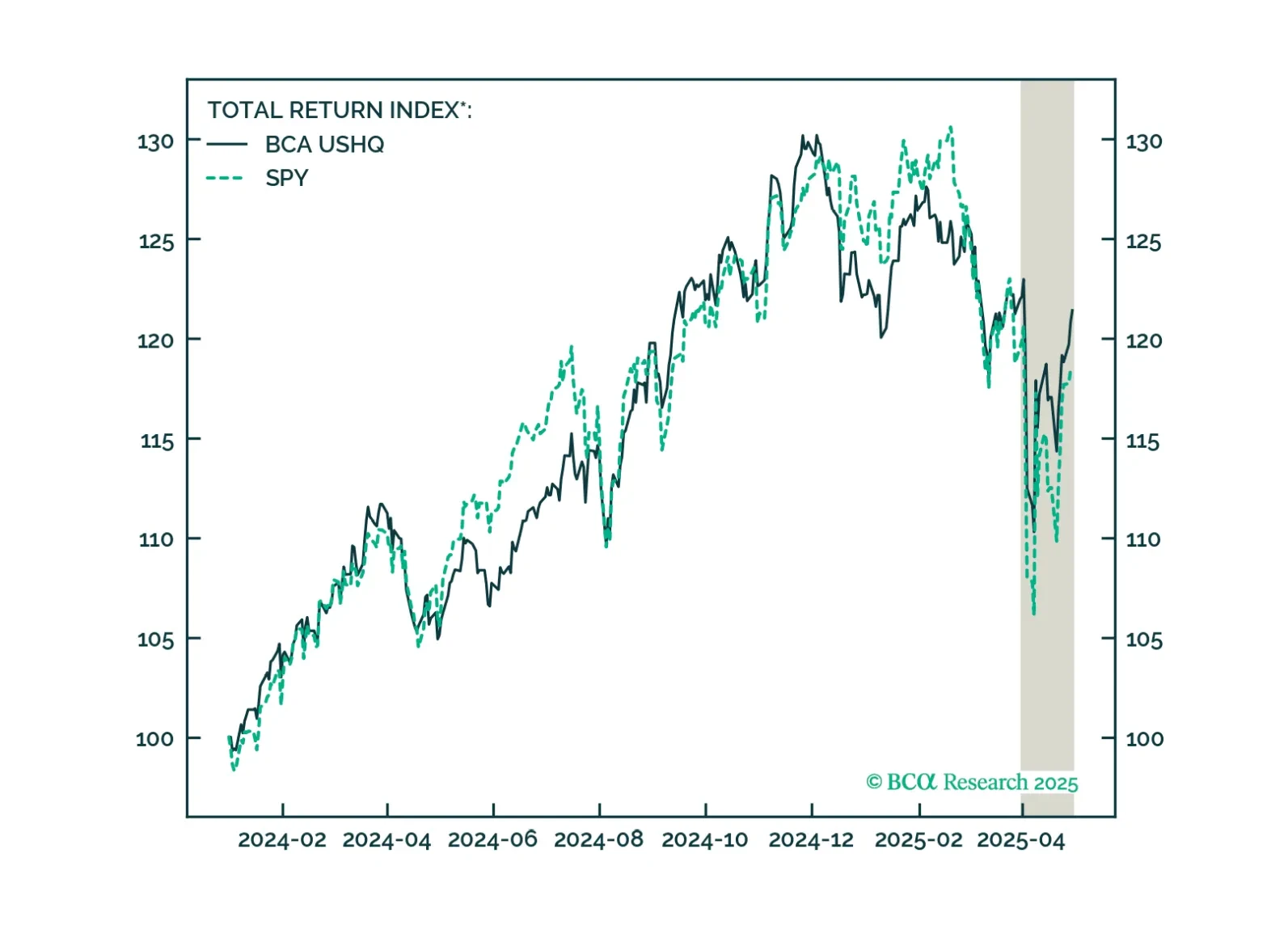

The US High Quality (USHQ) portfolio outperformed on the margin through April, returning -0.6%, whilst its SPY benchmark returned -1.2%. On a trailing three-month basis, performance remains robust vs. benchmark, with USHQ generating…

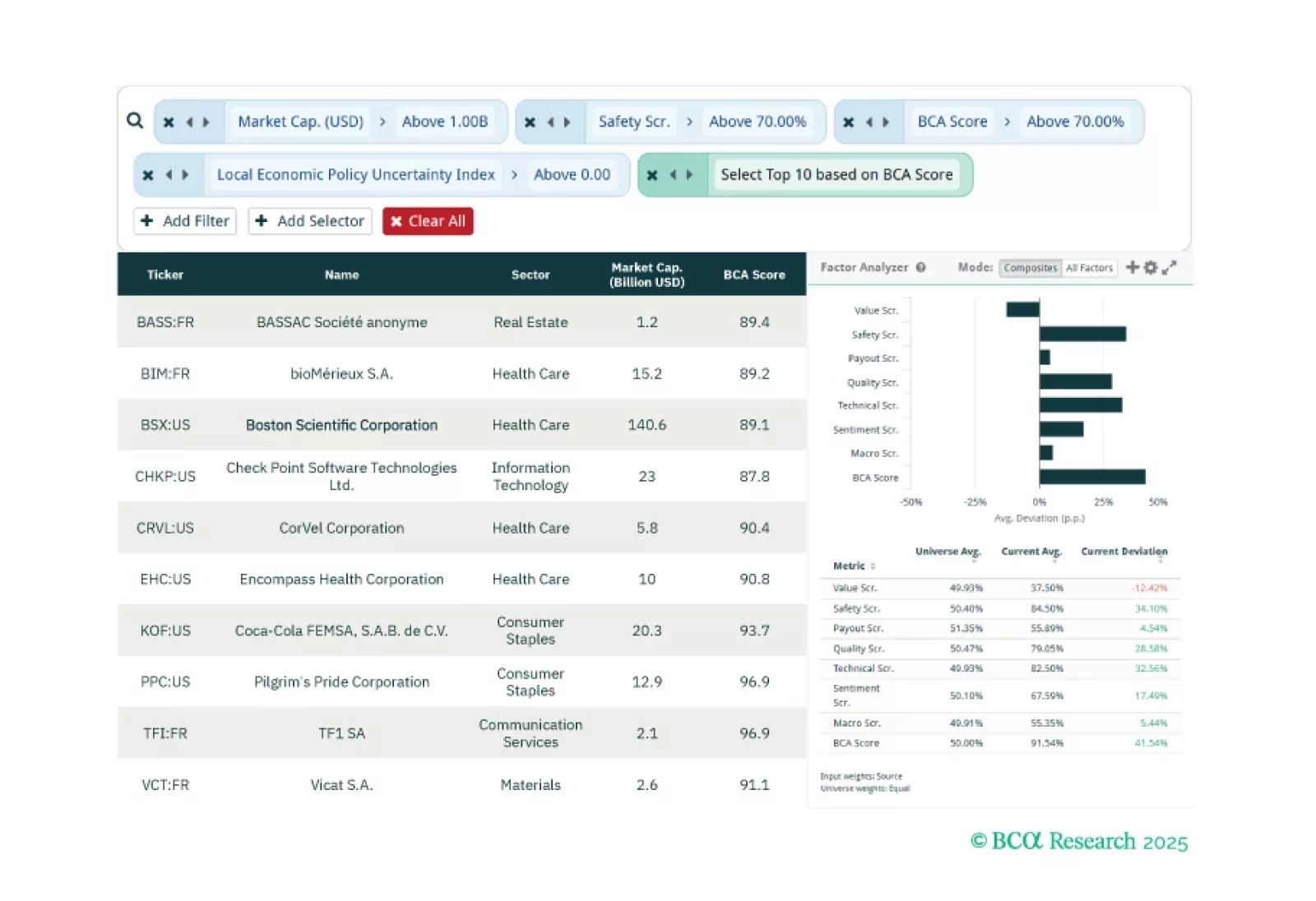

This week, our three screeners all cover equity plays centered around safe stock selection within Equity Analyzer.