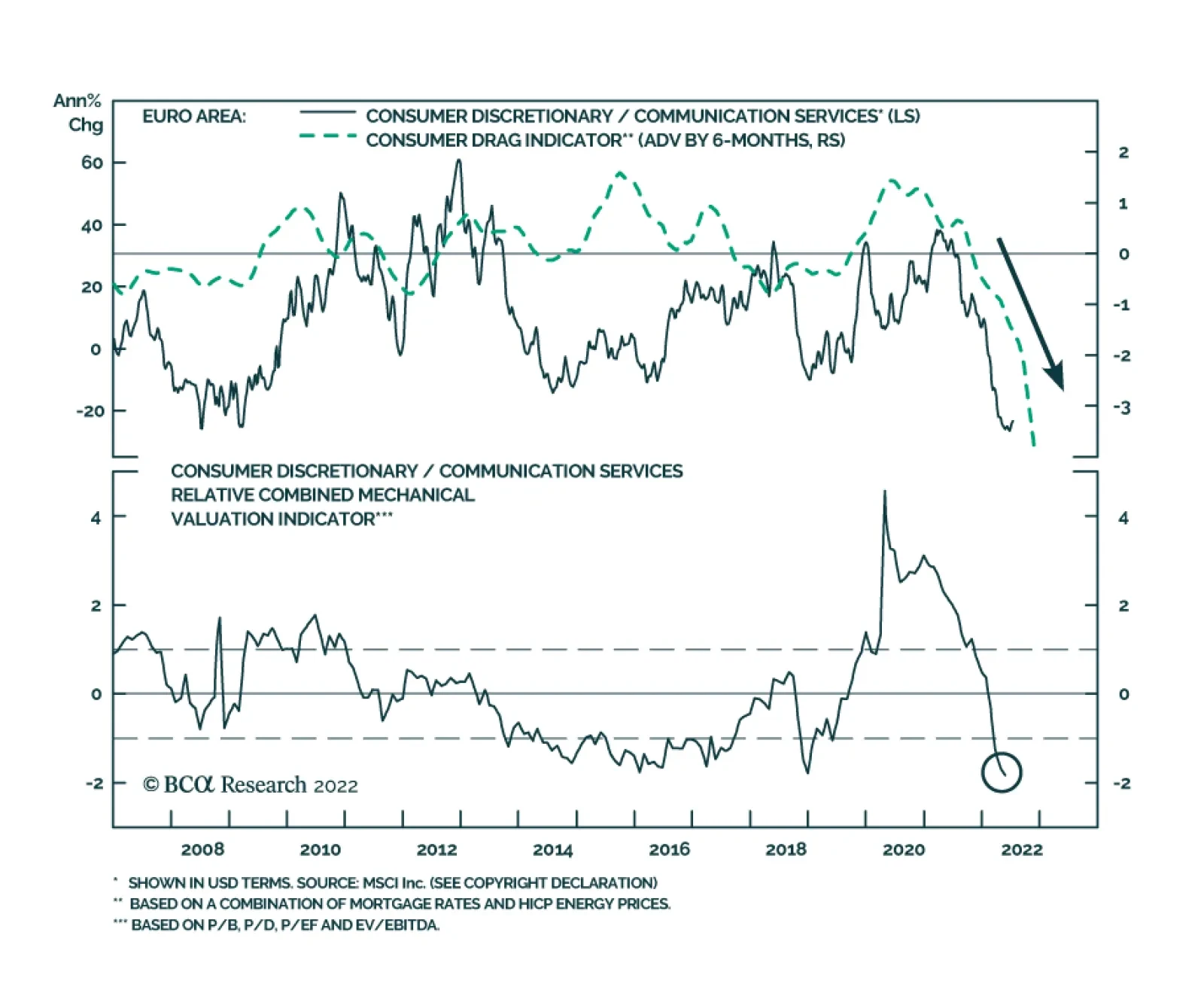

The energy crisis remains a headwind to the eurozone economy, raising the possibility that Europe will need to ration electricity this winter. Indeed, the European Commission’s measure of consumer confidence slumped this…

Listen to a short summary of this report. Executive Summary The TIPS Market Foresees A Sharp Deceleration In Inflation TIPS breakevens are pointing to a rapid decline in US inflation over the next two…

Executive Summary China's Unemployment Over the past week we have been visiting clients along the US west coast. In this report we hit some of the highlights from the most important and frequently asked questions. Xi…

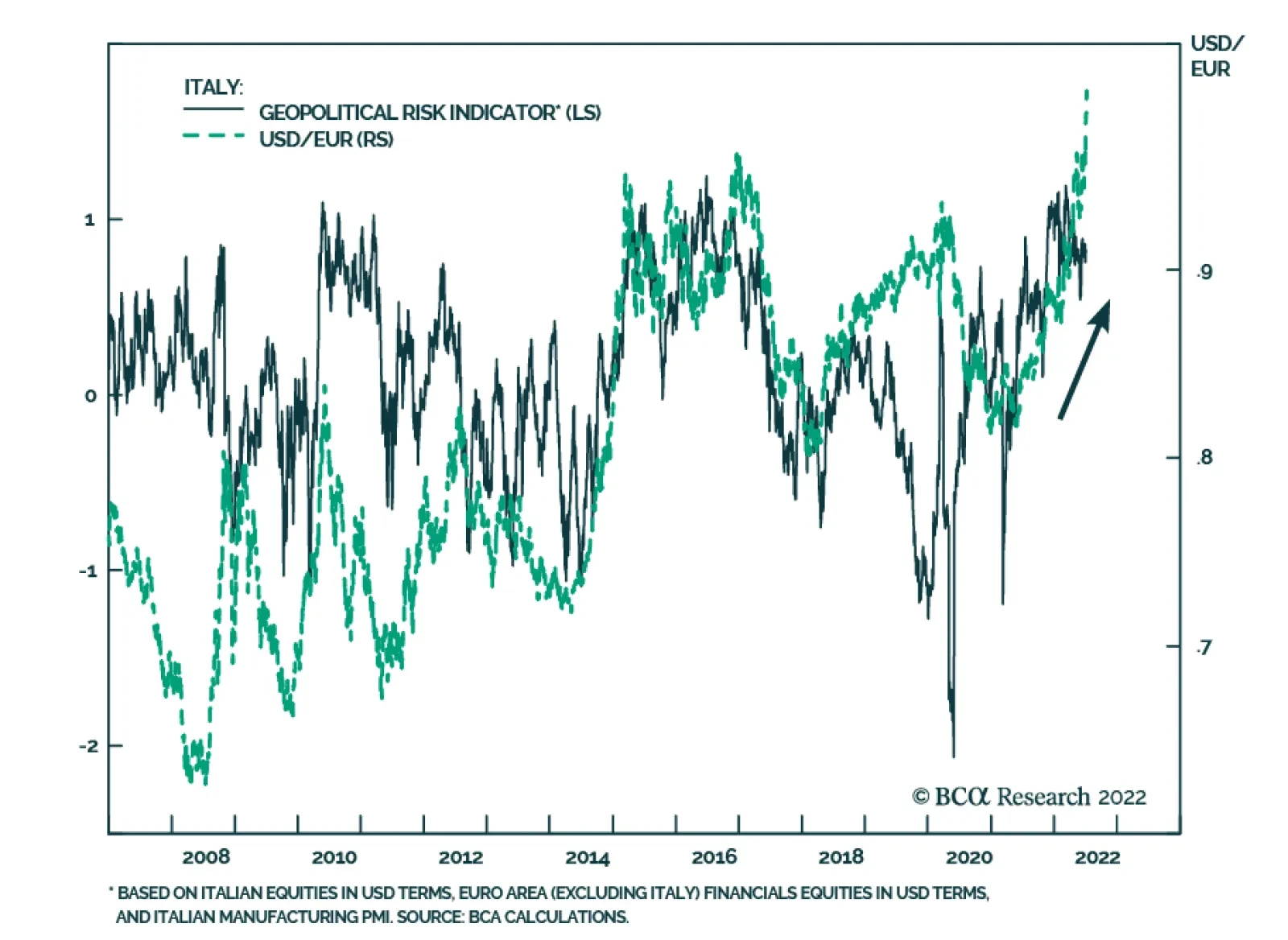

Italy entered a new round of political turmoil on Thursday after the populist Five Star Movement refused to support Prime Minister Draghi’s government on a parliamentary vote for a EUR 26 bn inflation-relief package.…

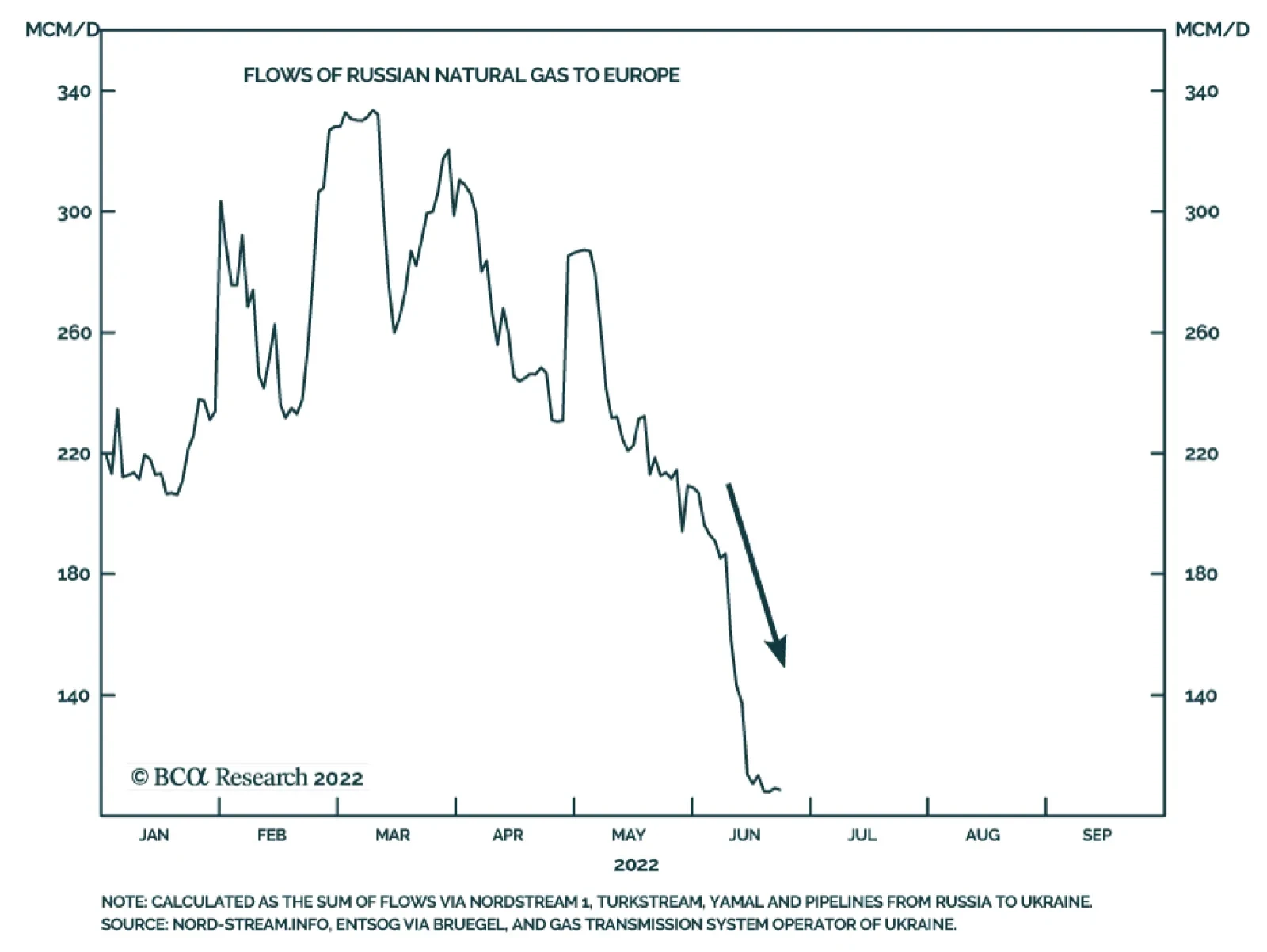

While recession fears have spread to industrial metals and oil markets, natural gas prices have been soaring. Dutch Title Transfer Facility (TTF) natural gas prices are up roughly 100% since June 1 and over 350% y/y. Supply-…

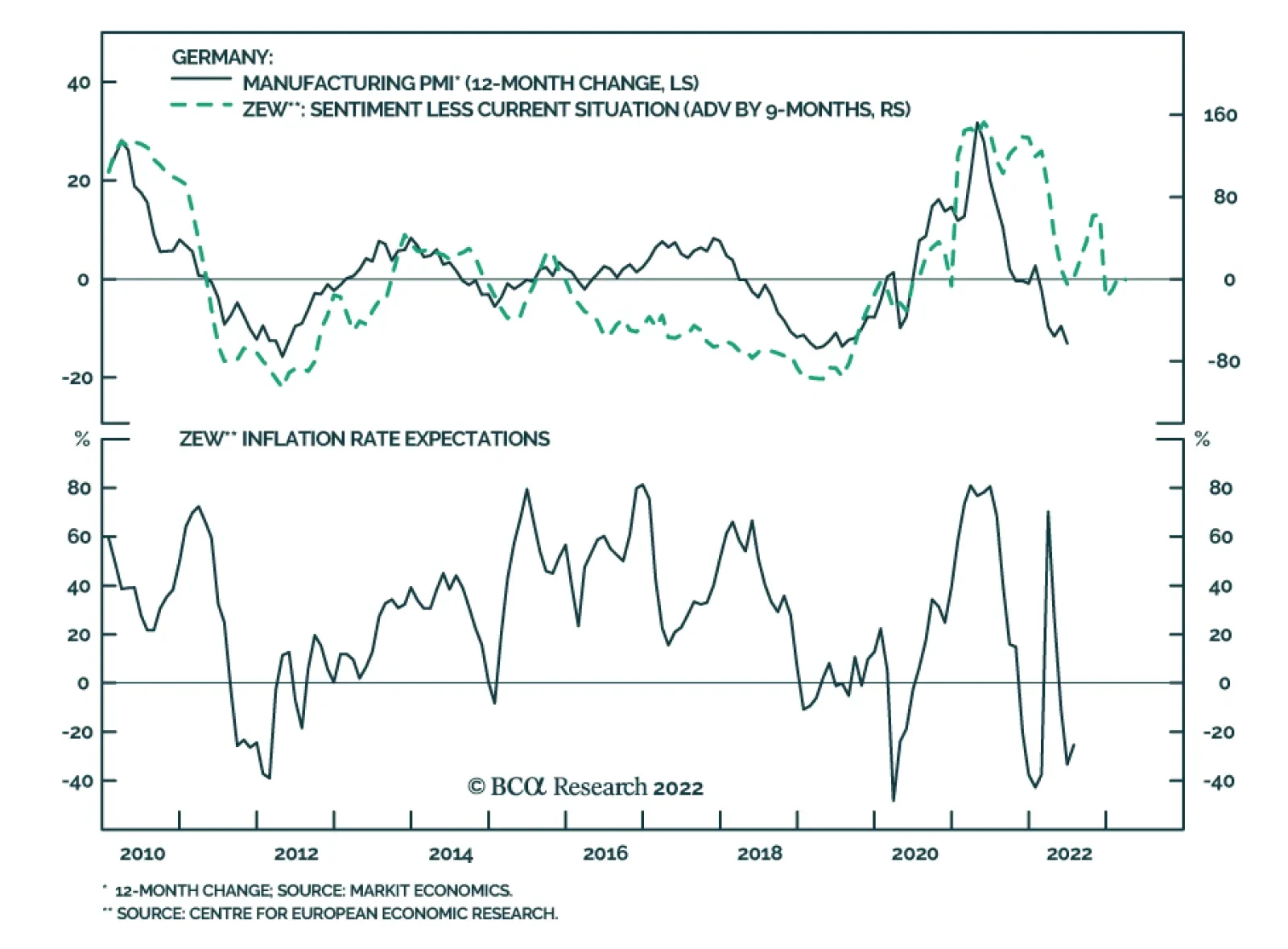

The ZEW survey of investor sentiment sent a cautionary signal on Tuesday. German sentiment slumped in July to the lowest level since 2011. The current situation and expectations indices dropped by 18.2 and 25.8 points,…

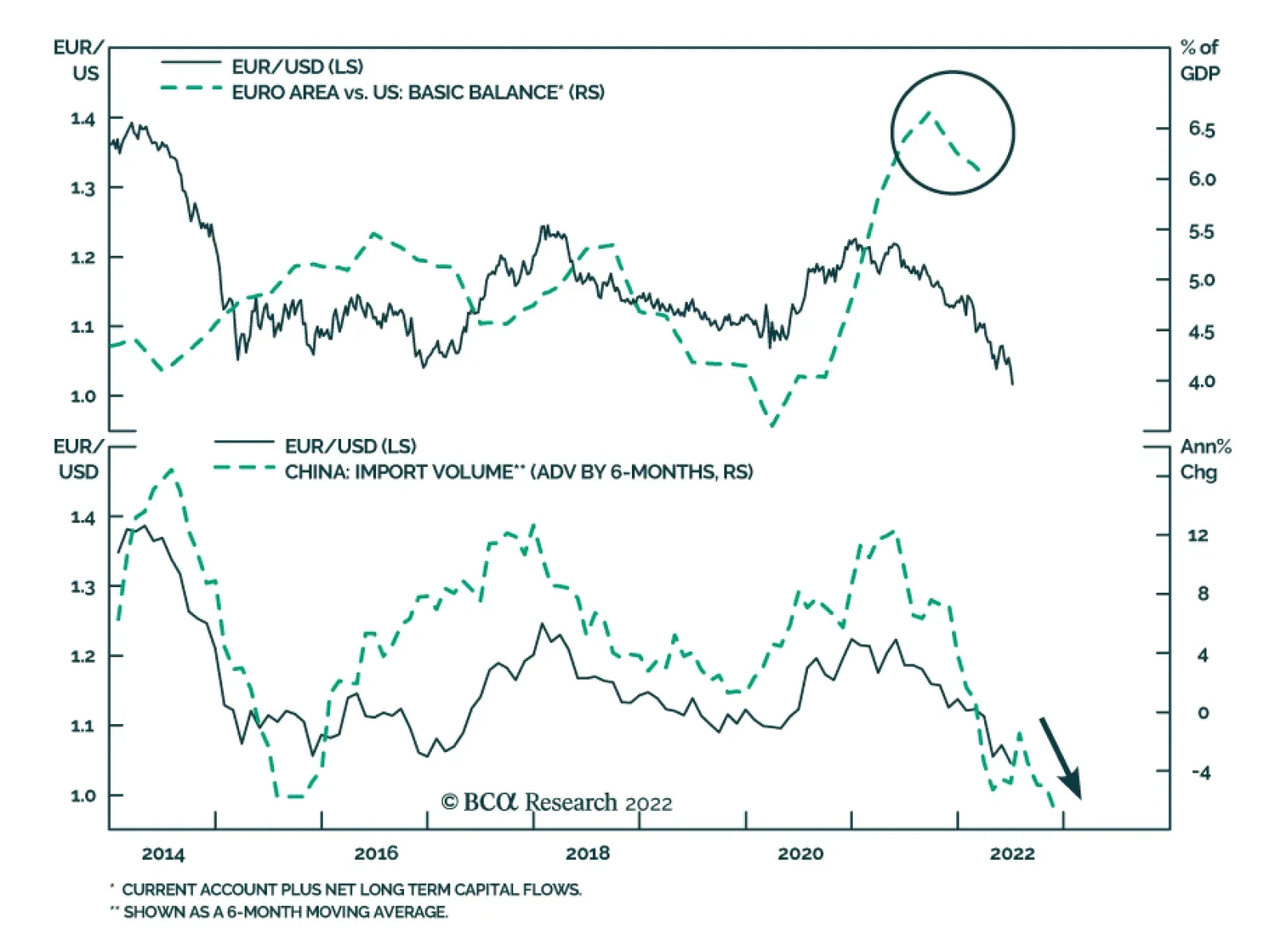

According to BCA Research’s European Investment Strategy service, while EUR/USD possesses ample upside over the coming 12 months, there is roughly a 1/3 chance that it will plunge to 0.9 by the winter. The euro benefits…

Executive Summary Don’t Try Catching Falling Euros The euro is inexorably moving toward parity. However, many positives could still save EUR/USD, a cheap currency that will benefit if the fears of a global recession recede…

Executive Summary Caught In Risk-Off Selling Weak Chinese and European economies are suppressing copper demand and helping to temper prices in a market that remains fundamentally tight. Weaker US GDP growth could put the…

Executive Summary Our recommended model bond portfolio outperformed its custom benchmark index by +24bps in Q2/2022, improving the year-to-date outperformance to a solid +72bps. The Q2 outperformance came entirely from the credit side…