Is the BoE’s emergency intervention in its bond market a British idiosyncrasy that global investors can ignore? No, the UK’s near death experience sends three salutary warnings, with implications for all investors.

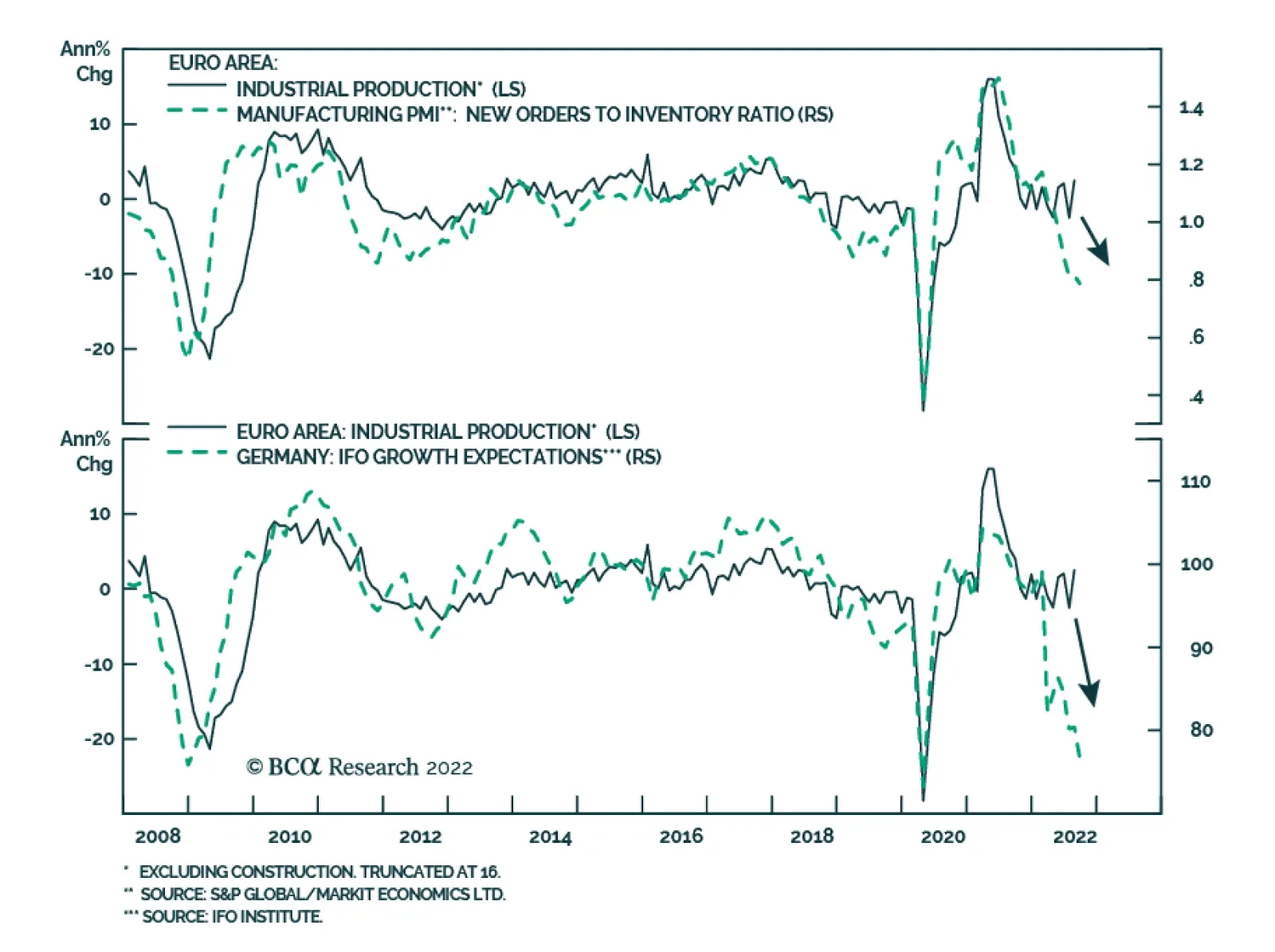

Eurozone industrial production grew by 1.5% m/m in August – double the expected rate of increase – following a 2.3% contraction in July. The production of capital goods and consumer goods led the August increase.…

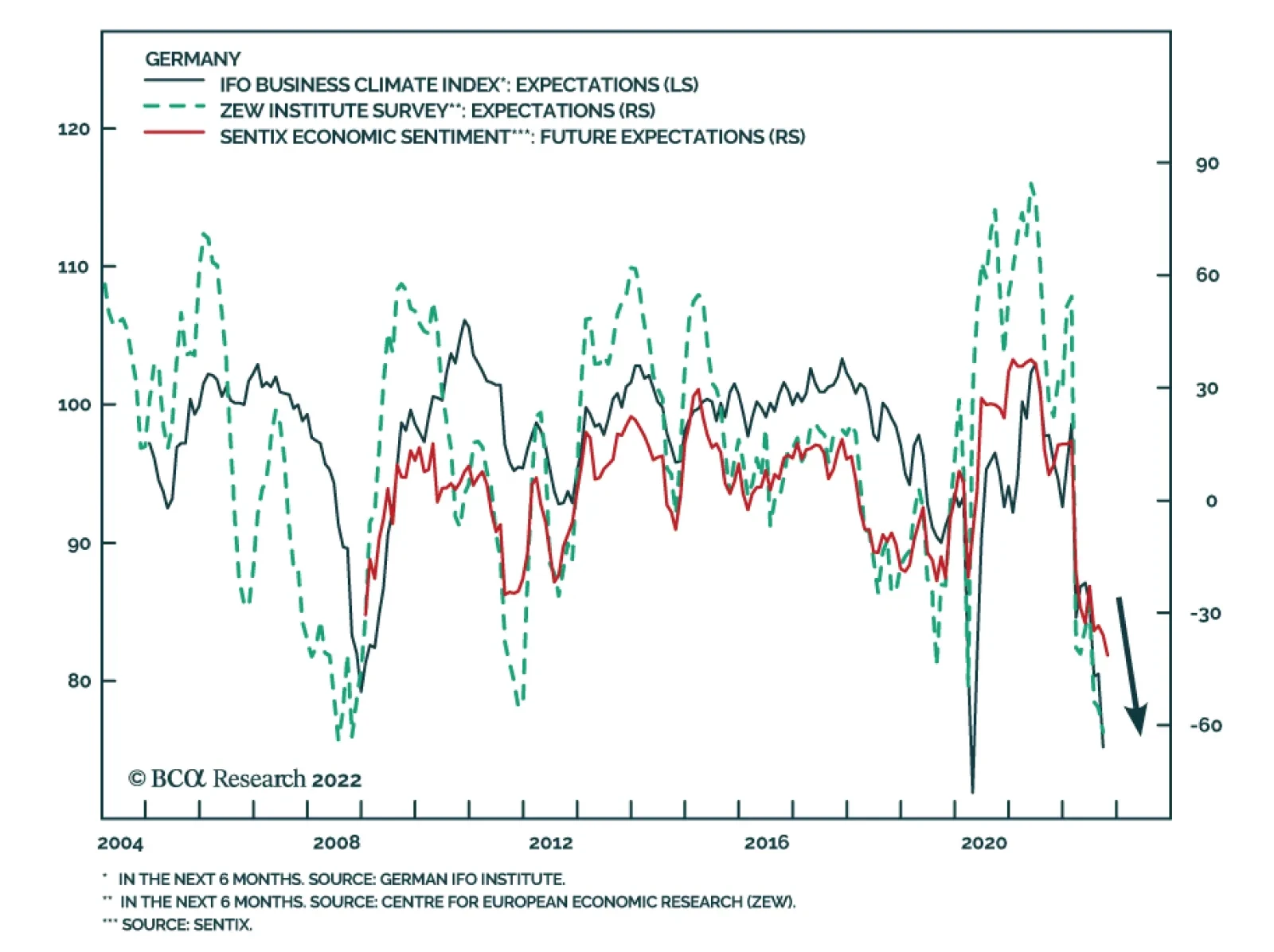

The Sentix measure of Eurozone Investor Confidence sunk 6.5 points in October to -38.3, marking the lowest level since May 2020. Both the Current Climate and Expectations components of the index deteriorated with the latter…

Our preferred tactical global fixed income trades for the rest of 2022 into early 2023 are all expressions of our views on relative monetary policy shifts within the main developed market economies. These involve bets on a…

Sentiment toward stocks is depressed and European valuations have declined substantially. However, the earnings outlook remains poor. Which side will win?

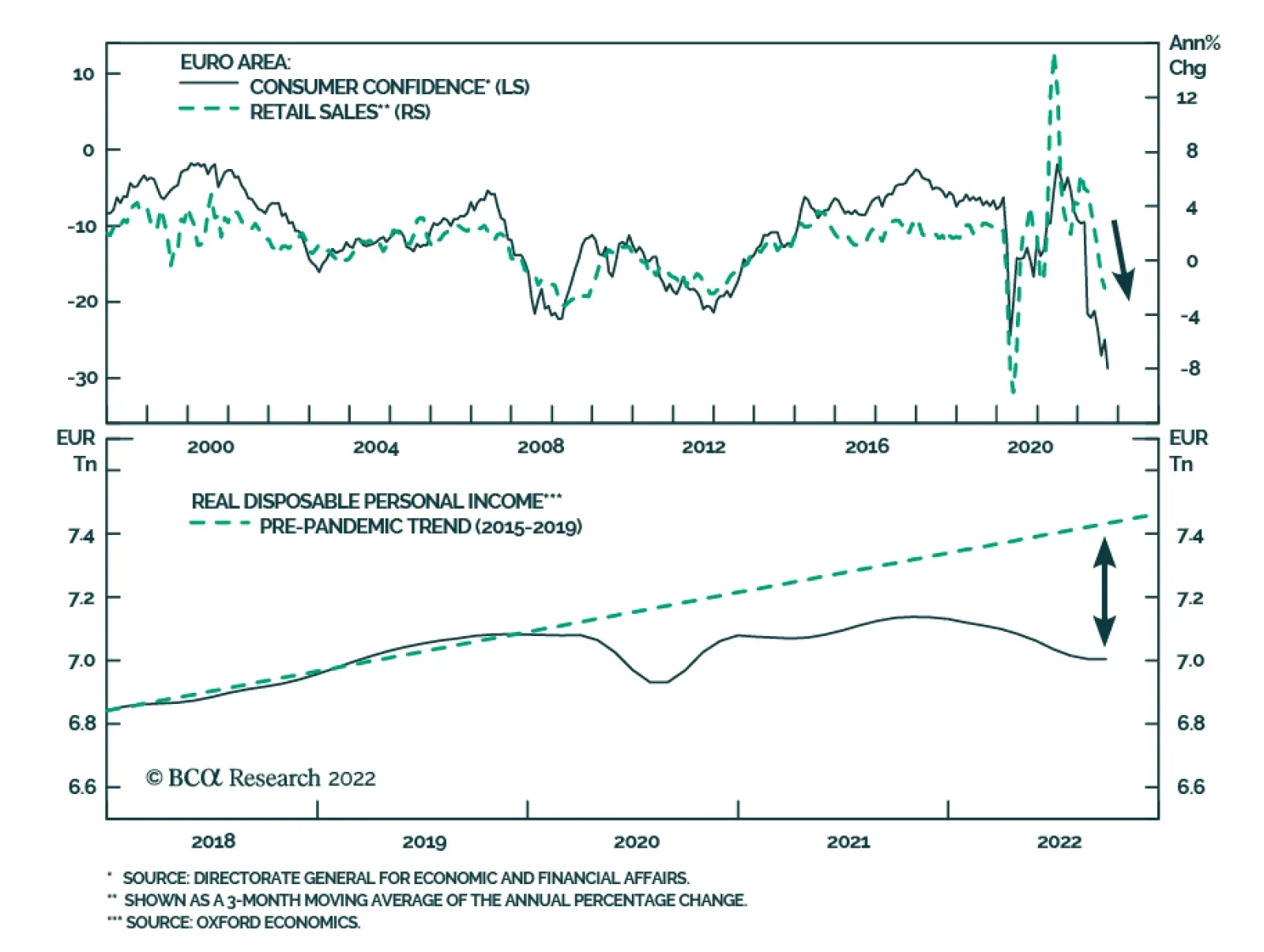

The volume of retail sales in the Eurozone fell by 2% y/y in August, marking the third consecutive month of decline and a steeper drop than July’s 1.2% contraction. Notably, it was a slight disappointment to expectations of…

The Fed says that to get back to 2 percent inflation, the US unemployment rate must increase by ‘just’ 0.6 percent through 2023-24. All well and good you might think, except that the Fed is forecasting something that has been…

Russia’s conflict with the West will escalate and trigger more bad news for risky assets this fall. Beyond that, stalemate looms. Latin American equities present a potential opportunity once the macro and geopolitical backdrop…

This week, we present our quarterly review of the BCA Research Global Fixed Income Strategy (GFIS) model bond portfolio for Q3/2022. We also discuss the model portfolio’s expected performance over next 3-6 months after our recent…