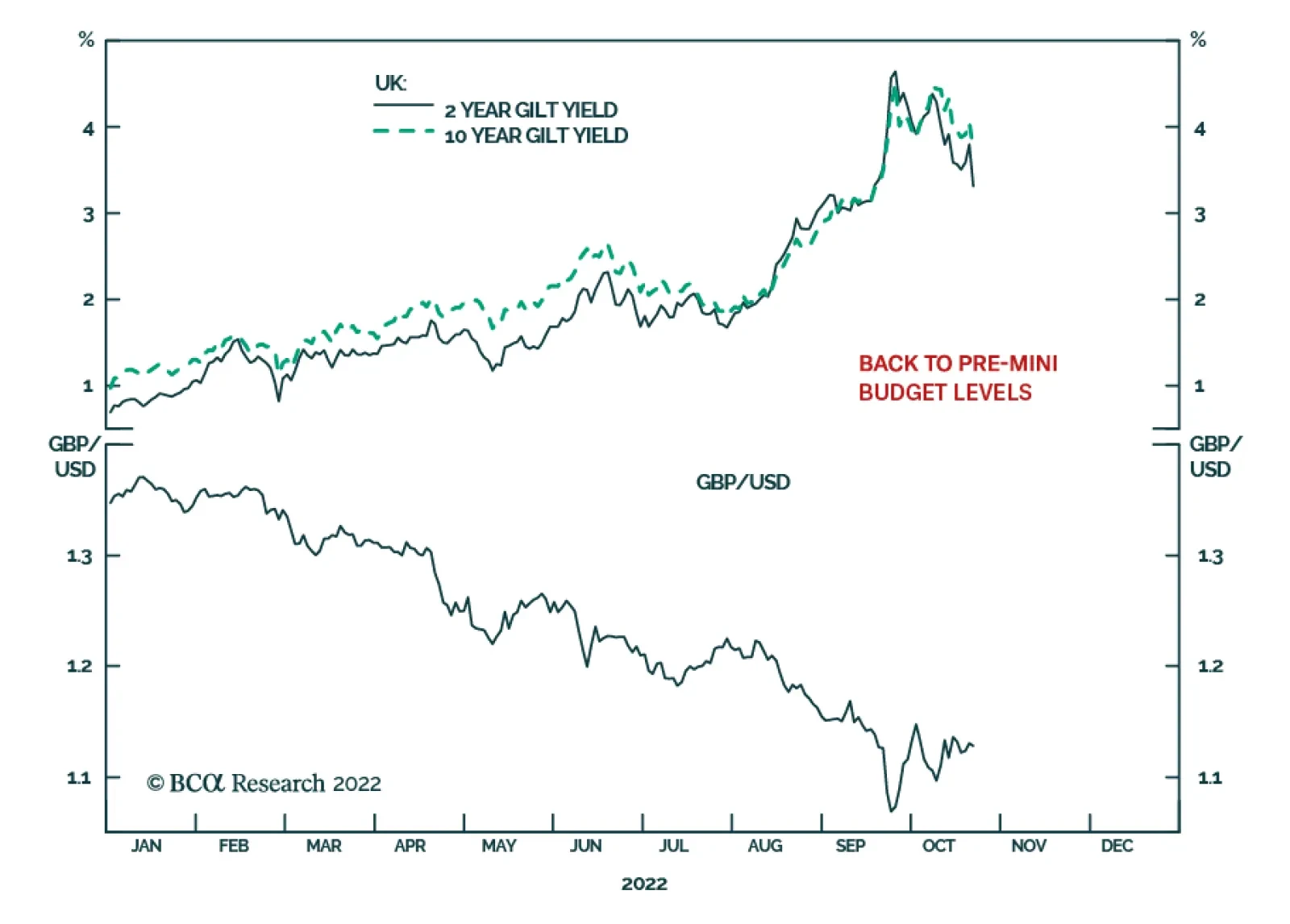

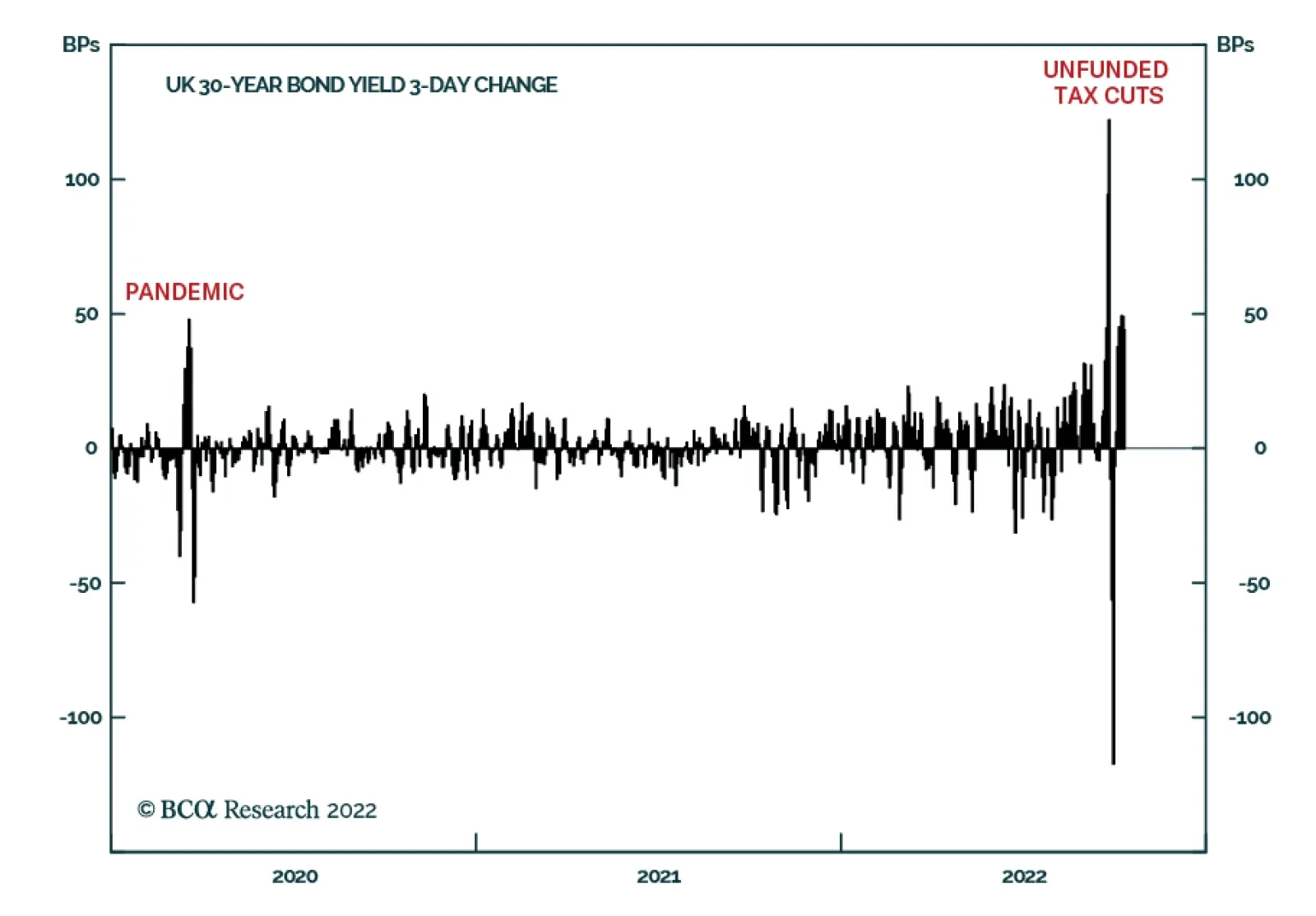

On Monday, UK Gilts rallied on news that former Chancellor of the Exchequer Rishi Sunak is the new leader of the Conservative Party. The 10-year yield fell by 31bps while the 2-year yield ended the day 24bps lower – levels…

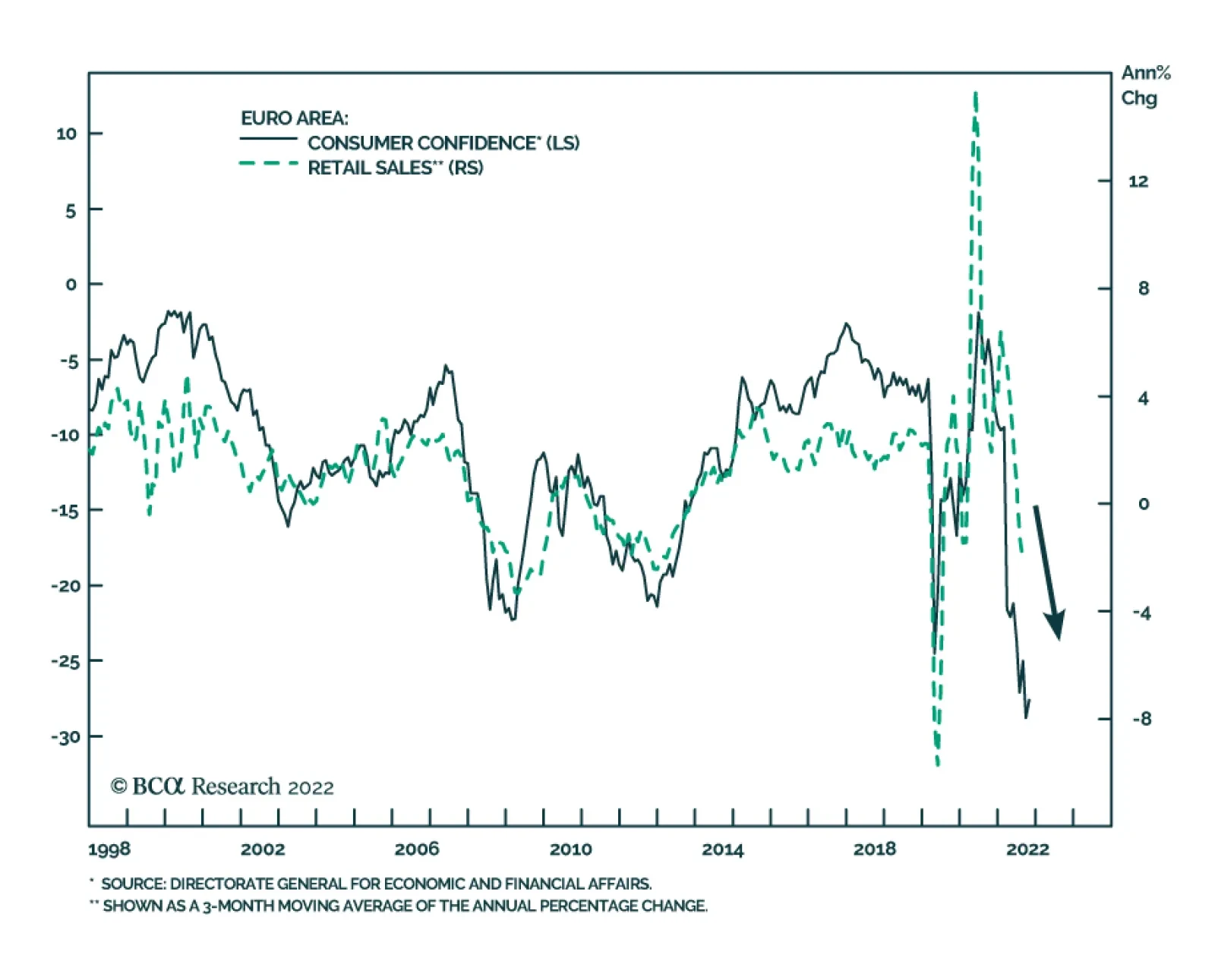

The October flash release of the European Commission’s Eurozone consumer confidence suggests that household sentiment remains exceptionally weak. Although the index unexpectedly ticked up from -28.8 to -27.6, it remains…

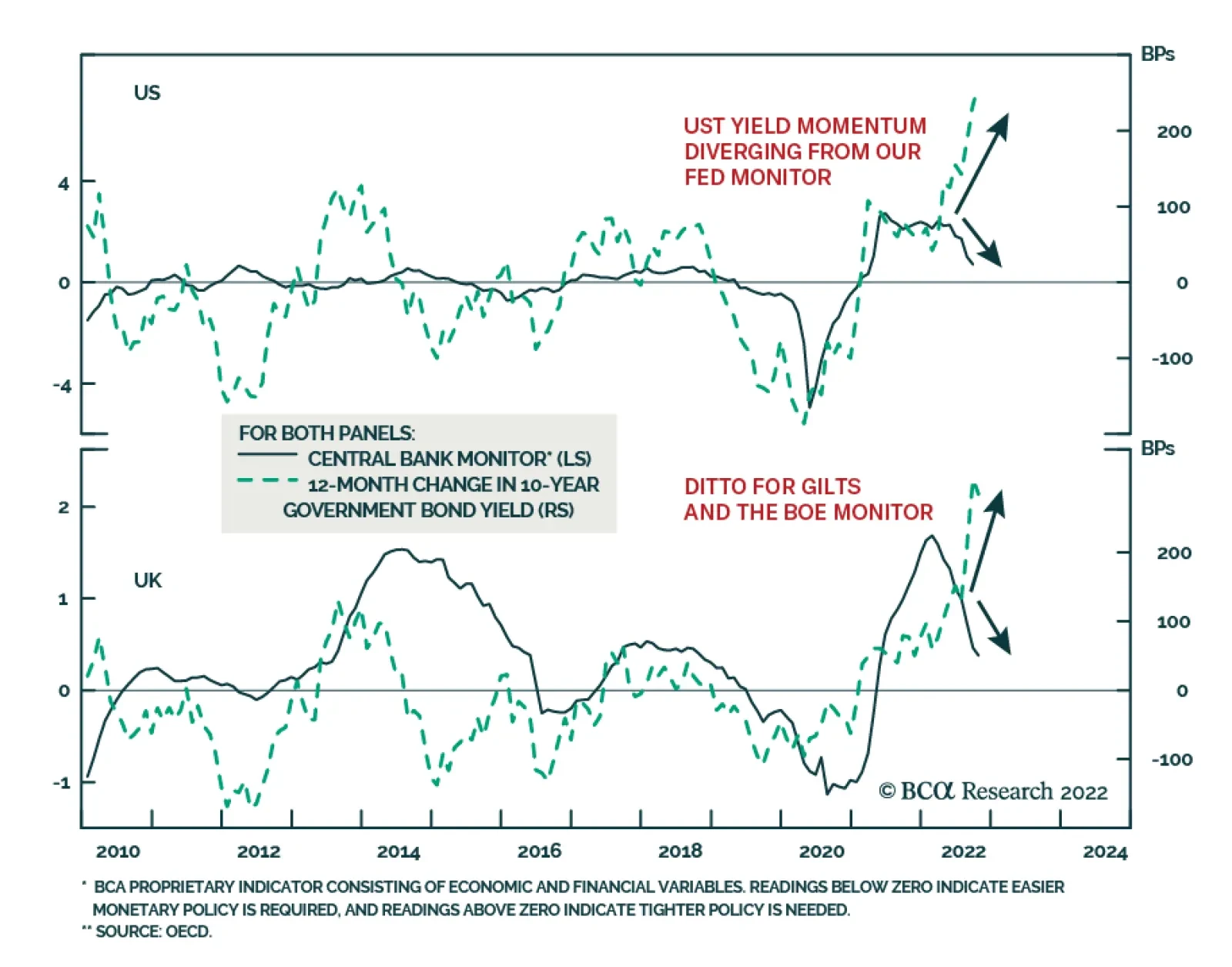

BCA Research’s Global Fixed Income Strategy service continues to recommend underweight allocations to US Treasuries and UK Gilts in global bond portfolios, while targeting a below-benchmark overall global duration exposure…

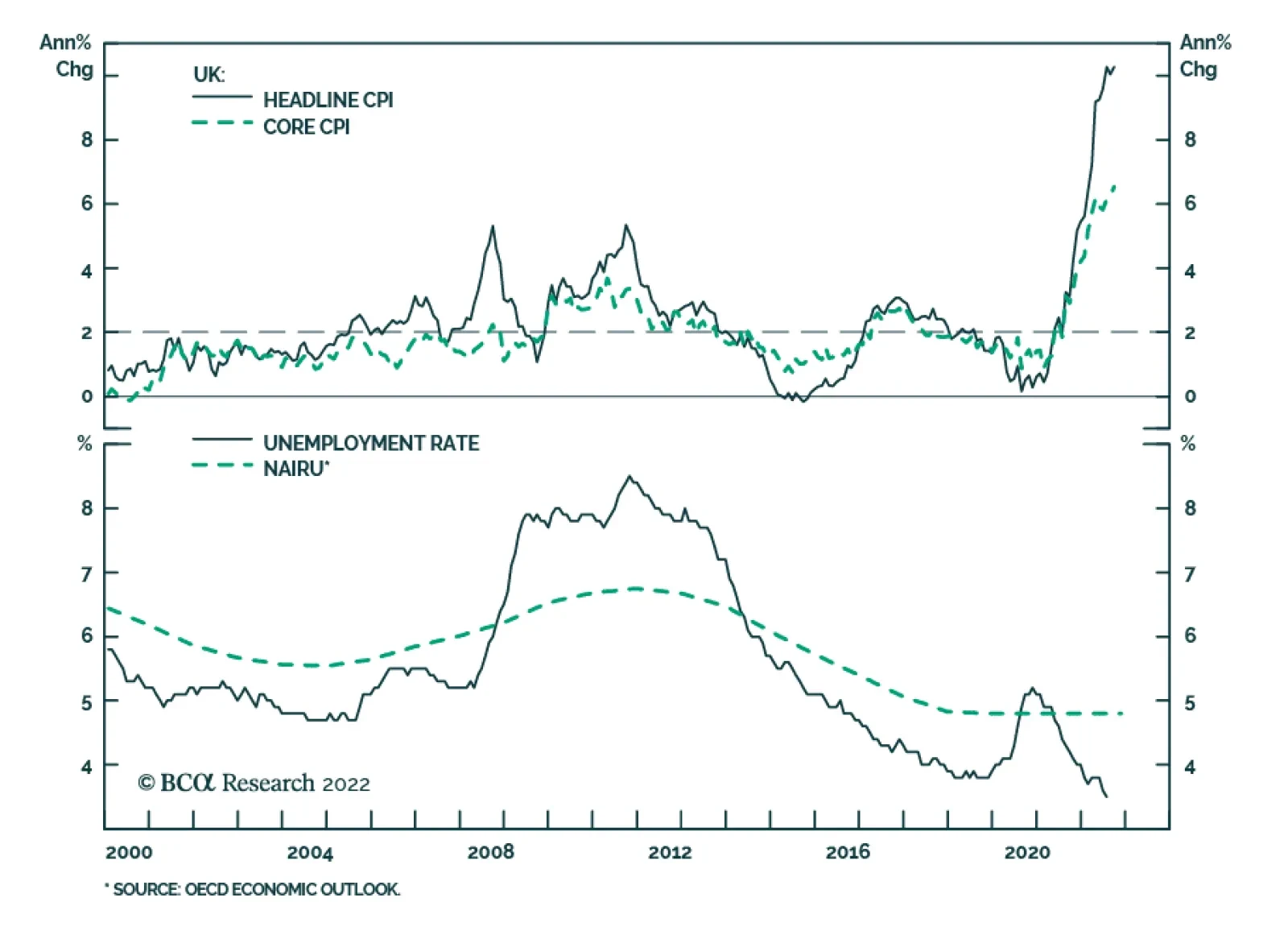

After moderating in August, UK CPI inflation firmed again in September, rising back up to its 40-year high of 10.1% y/y – slightly above expectations. Food and goods prices (particularly clothing and furniture &…

Is the US in a wage-price inflation spiral that could lead to more aggressive Fed rate hikes? Is it time to buy UK Gilts after a wild month of volatility? We answer "no" to both questions, as we discuss in this week’s report.

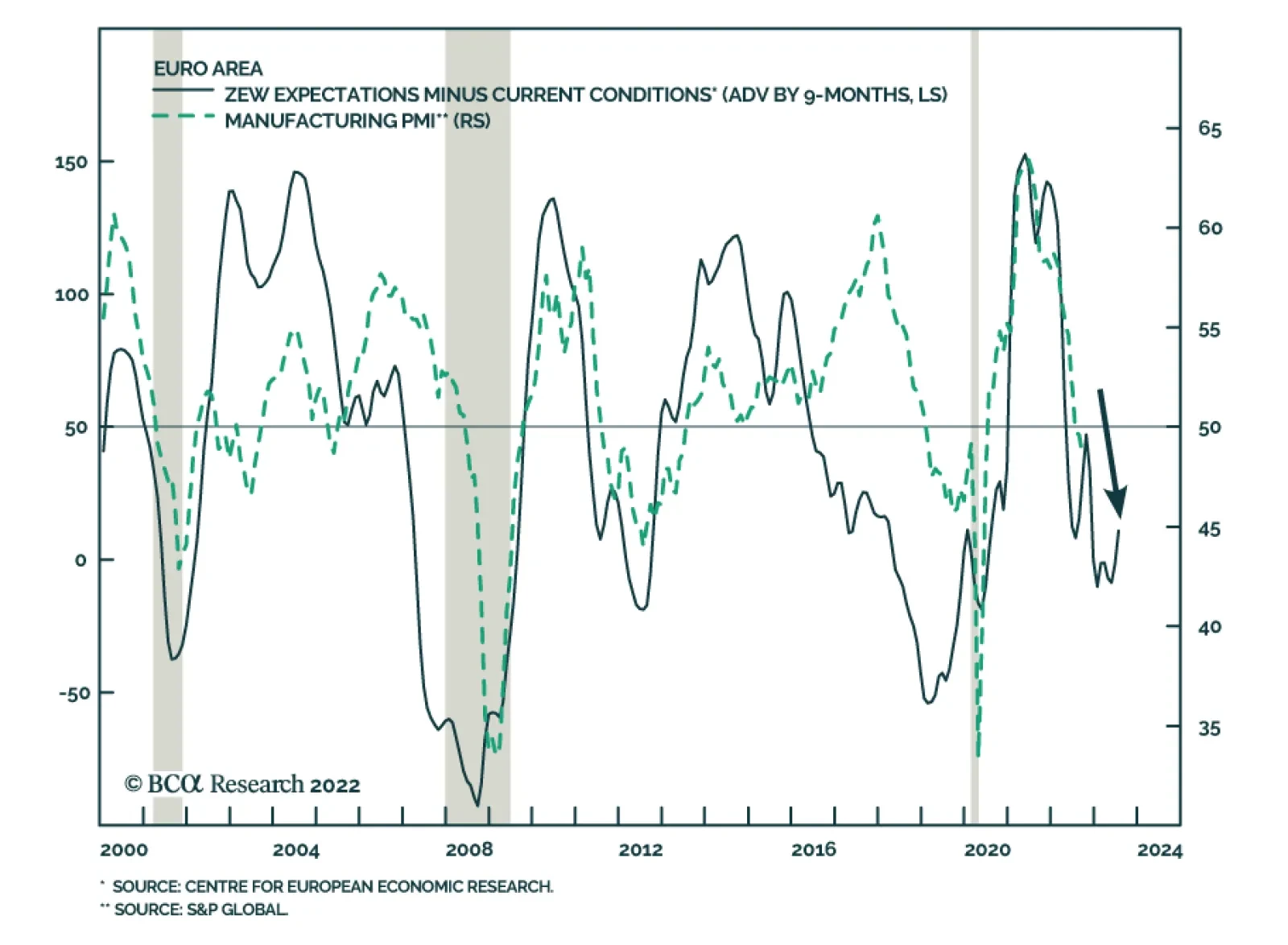

The ZEW survey of investor sentiment is signaling that economic conditions in the Eurozone are likely to deteriorate further. The spread between the expectations and current conditions components typically leads trends in the…

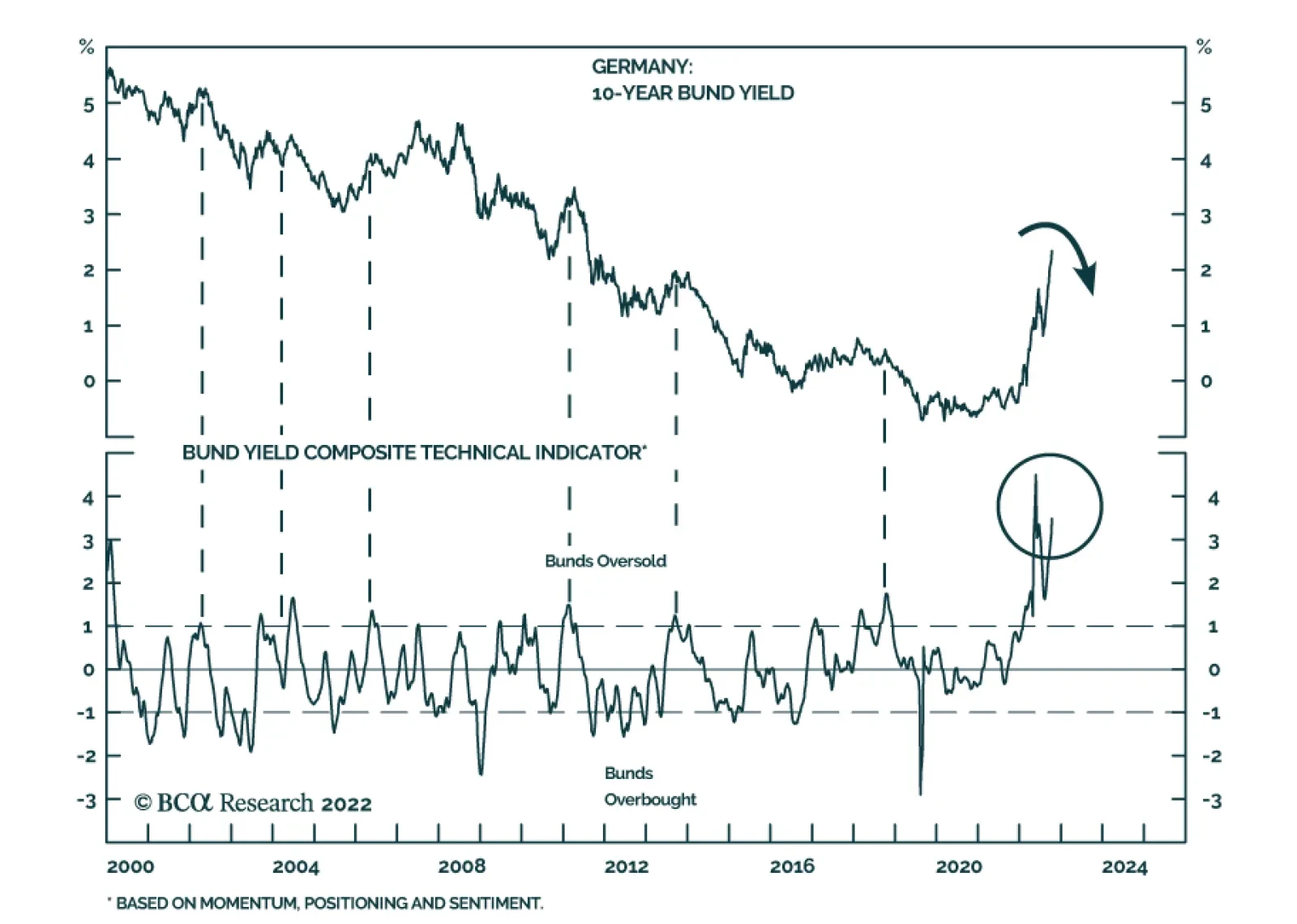

BCA Research’s European Investment Strategy service concludes that the German yield curve will invert and that German 10-year Bunds are a buy. Even though a global recession looms, central banks are unlikely to pause…

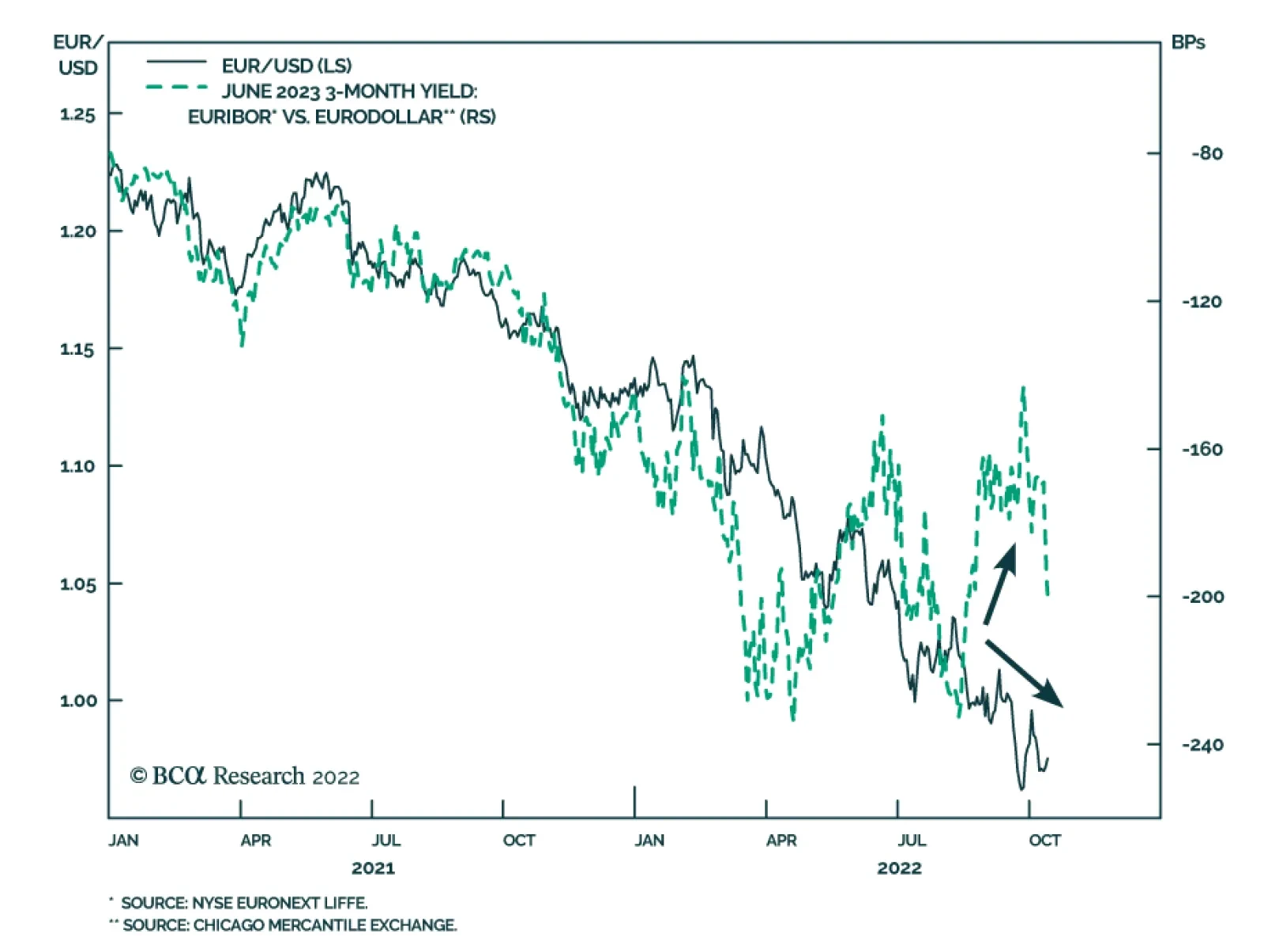

For most of last year and the first half of this year, the market consensus was that the Fed would be among the most hawkish major global central banks. As such, interest rate differentials provided a tailwind for the US dollar…

The ECB will continue to lift rates due to sticky inflation and a tight labor market. Will it be enough to push long-term German yields higher?

According to BCA Research’s Counterpoint service, the UK’s near death experience sends three salutary warnings to all investors. Warning 1: Beware ‘Hidden Leverage’ Hidden leverage is not unique…