This week’s report examines the state of the global monetary tightening cycle and addresses some frequently asked questions about the Fed’s QT program. New yield curve trades are recommended for the US and German yield curves.

Stay short Greater China assets. Stay long Japanese yen. Hold back on Brazil for now but look forward to opportunities in future.

The ECB increased interest rates and announced the start of its balance sheet wind down; yet, markets took the news as a dovish outcome. Are we really getting close to the end of the ECB’s tightening campaign? How asset prices will…

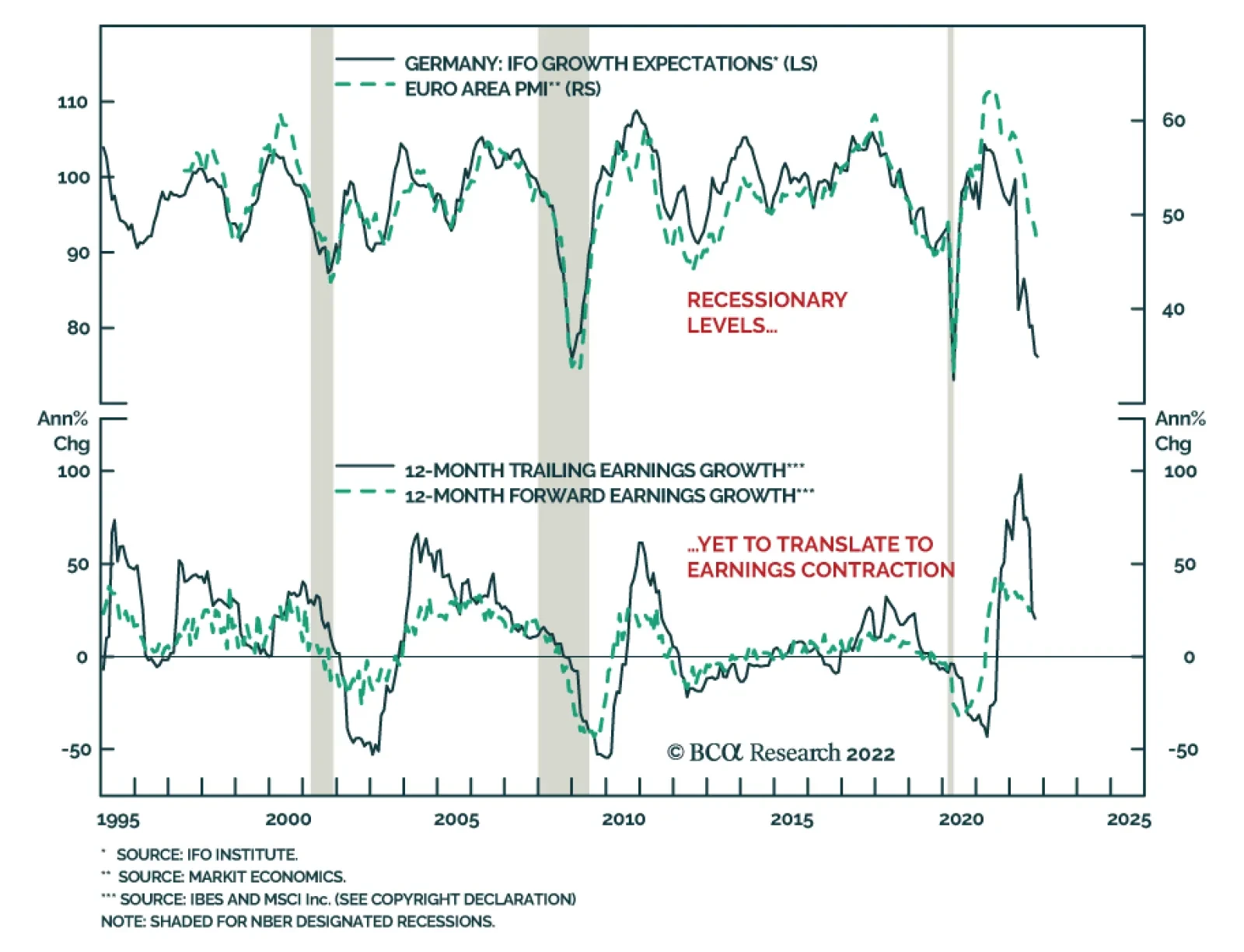

Preliminary estimates indicate that German GDP growth accelerated by 0.3% q/q in Q3 from 0.1% q/q in Q2 and against expectations it would contract. The performance of the German economy is all the more notable that not only was…

As expected, the ECB delivered another 75bp rate hike on Thursday. It also announced changes to the TLTRO terms and conditions – raising the borrowing costs of the facility, and offering banks an early repayment option. The…

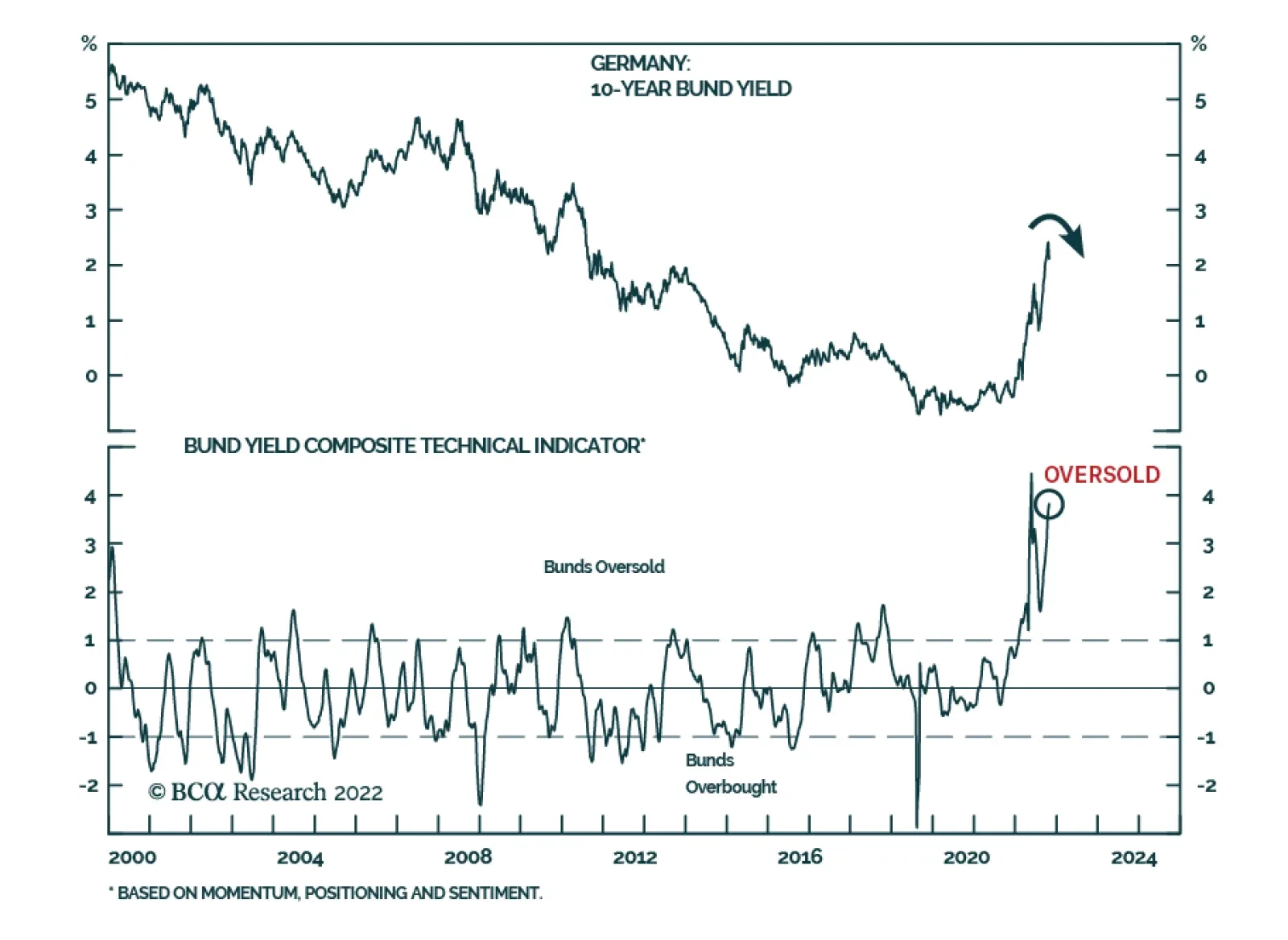

Falling inflation will allow bond yields to decline in the major economies over the next few quarters. As such, we recommend that investors shift their duration stance from underweight to neutral over a 12 month-and-longer horizon…

Despite uncertainty and intrusive government policy, natural gas and oil markets have managed to direct much-needed supplies to Europe going into winter. Natgas markets attracted massive LNG inflows – at a cost of record-high prices…

In Section I, we note that while recent inflation developments point to some supply-side and pandemic-related disinflation, they also point to potentially stickier inflation over the coming several months. The inflation, monetary…

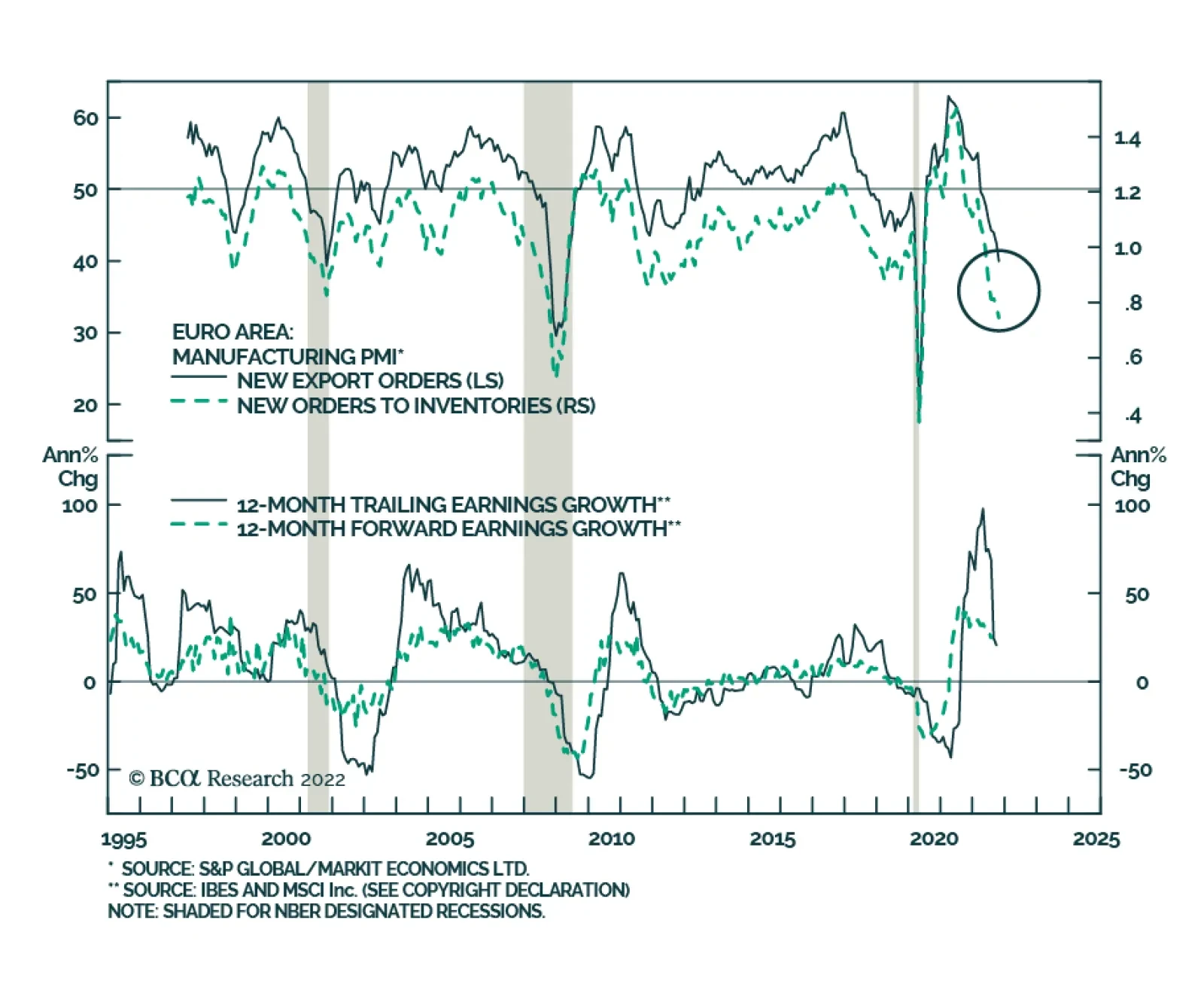

It takes time for wage inflation to die. So, if 2022 was the year that central banks’ monster tightening killed bond and stock market valuations, then 2023 will be the year that it finally reaches the economy and kills profits, jobs…

The Ifo Business Climate Index for Germany was broadly unchanged at 84.3 in October, beating consensus expectations of a decrease to 83.5. The 0.4-point decline in the Current Assessment index was better than consensus estimates…