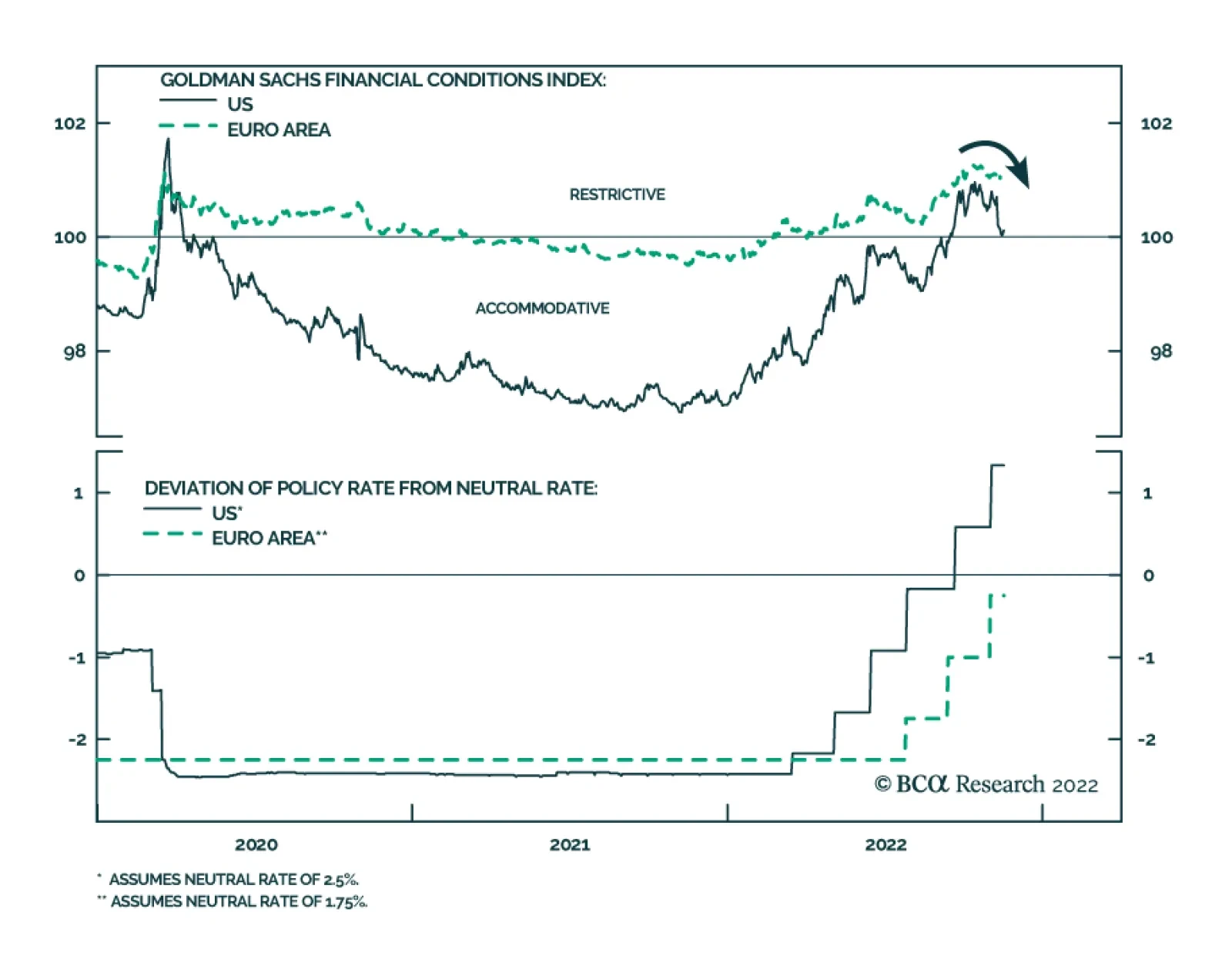

The latest equity rally and dollar selloff drove the recent easing in the Goldman Sachs Financial Conditions Indexes for both the US and Euro Area. To the extent that financial conditions gauge the availability of funding in an…

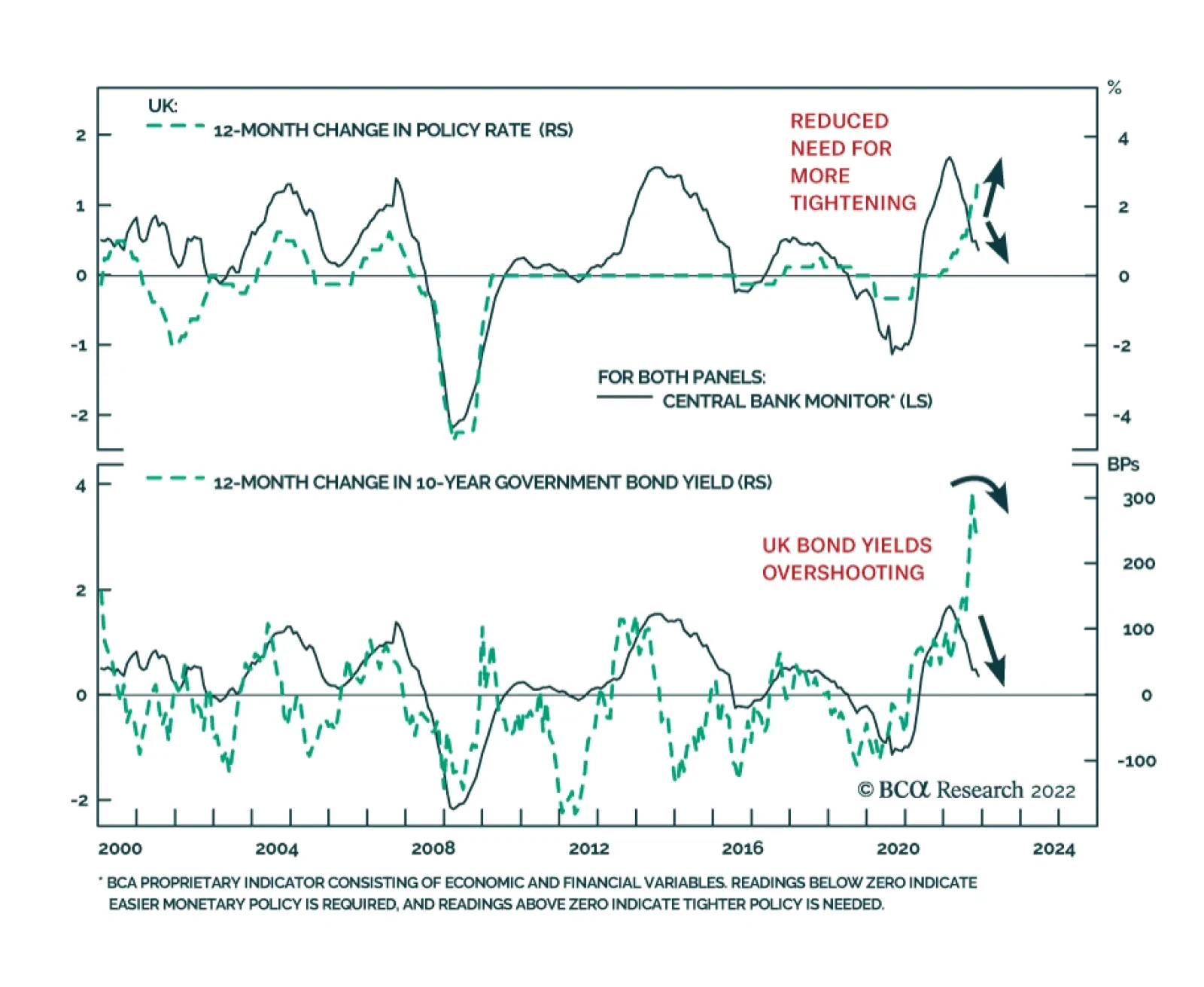

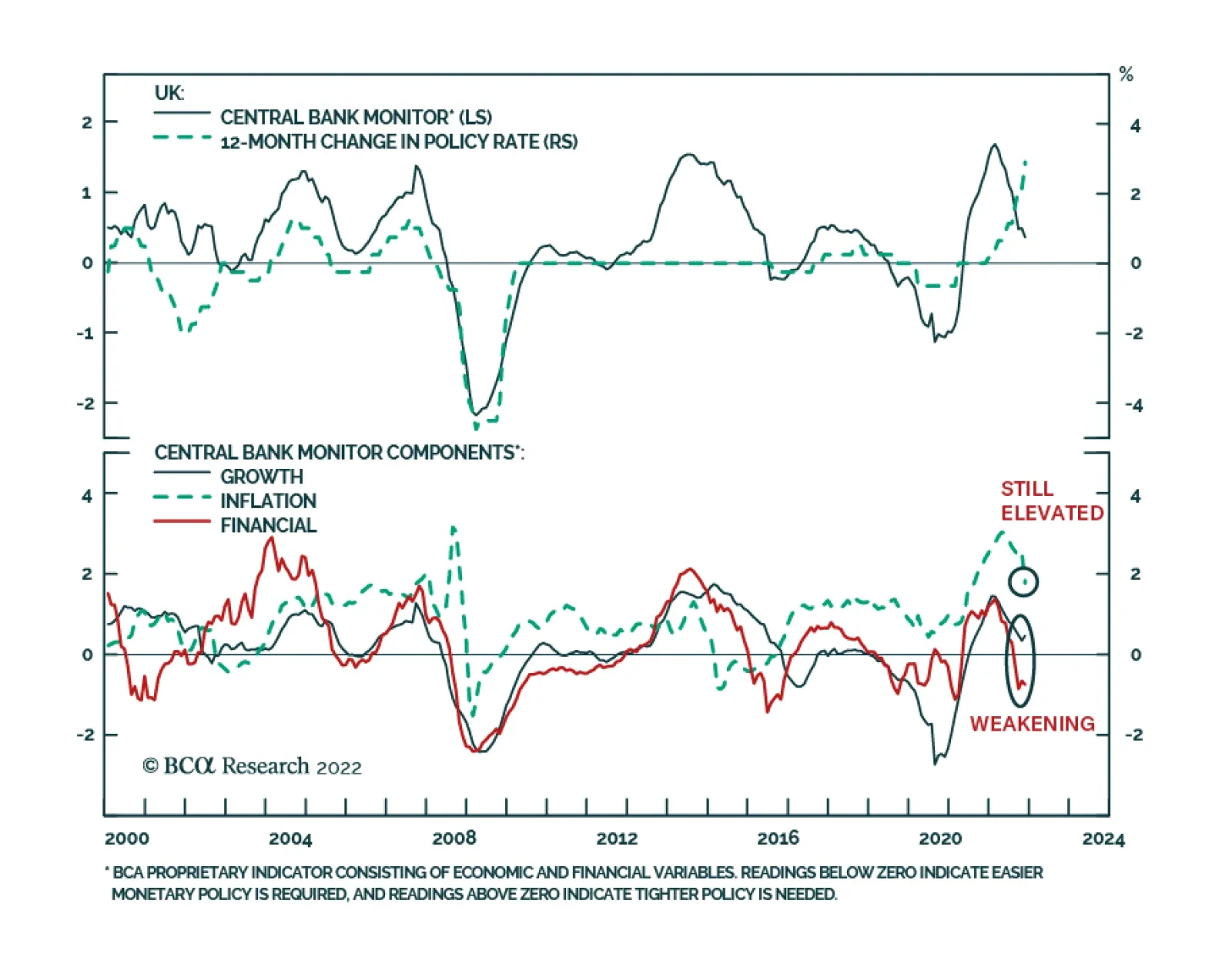

UK Chancellor of the Exchequer Jeremy Hunt’s Autumn Statement unveiled a new fiscal plan that marked a U-turn from his predecessor’s mini budget announcement in late-September. The GBP 55bn plan includes GBP 30bn in…

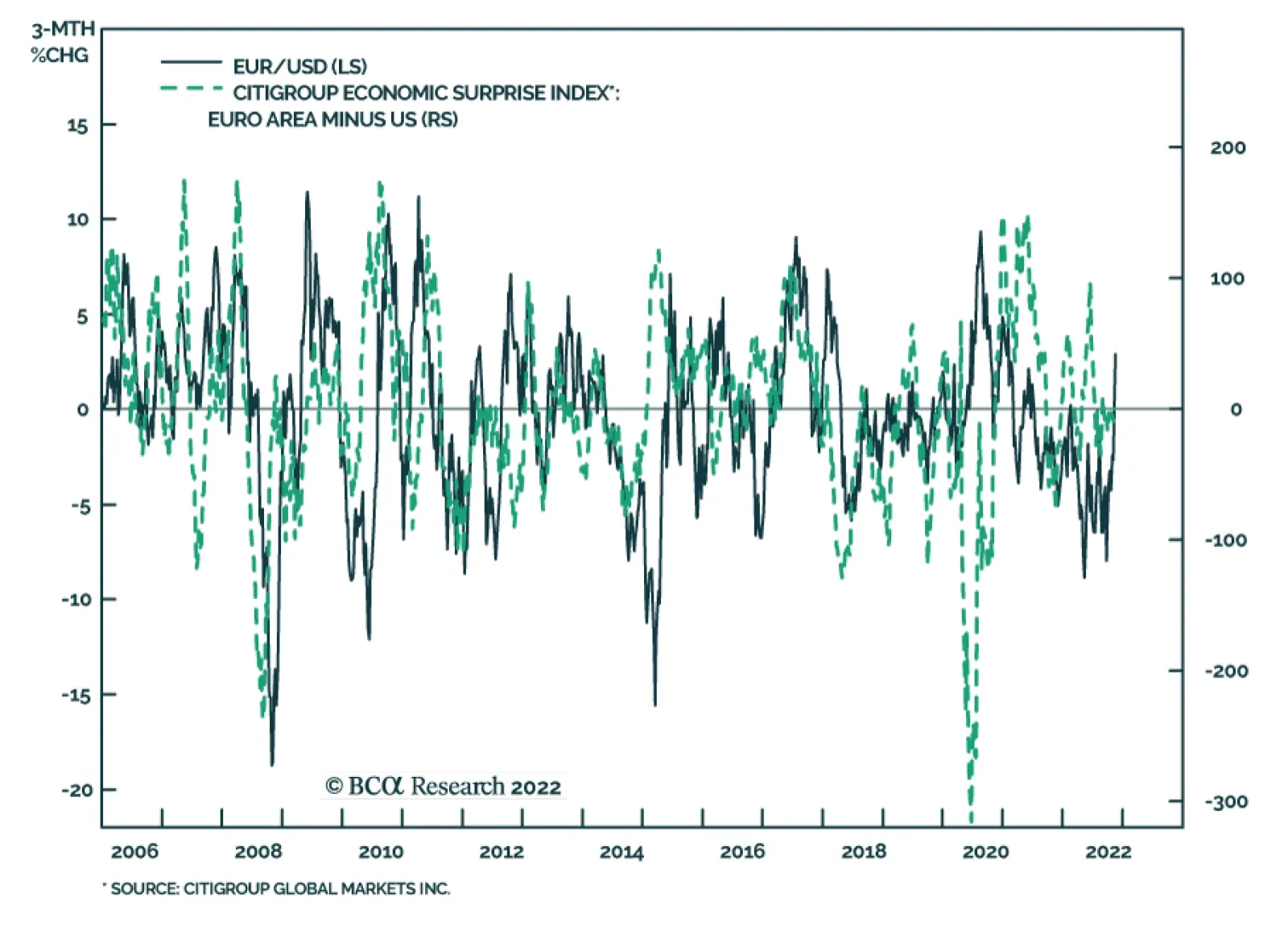

The narrative that the US can tolerate much higher interest rates, compared to the rest of the world has helped the dollar in 2022. In this report, we examine the sustainability of this thesis, from our holistic assessment of global…

Our 4Q22 and 2023 Brent forecasts remain at $100/bbl and $116/bbl. Upside price risk continues to dominate oil markets. We remain long the XOP and COMT ETFs to retain exposure to oil and gas producers’ equities, and higher commodity…

Price pressures remain intense in the UK. Headline CPI inflation jumped from 10.1% y/y to a 41-year high of 11.1% in October – surpassing expectations of a milder acceleration to 10.7%. Similarly, the month-on-month rate…

The messages from the deteriorating fundamental backdrop (tight monetary policy, slowing global growth) and improved credit valuation (elevated 12-month breakeven spreads) are giving conflicting signals on corporate bond strategy. We…

November’s reading of the ZEW Indicator of Economic Sentiment reveals that investors are becoming less pessimistic about the Eurozone economy. The expectations and current situation indices for Germany and the Euro Area…

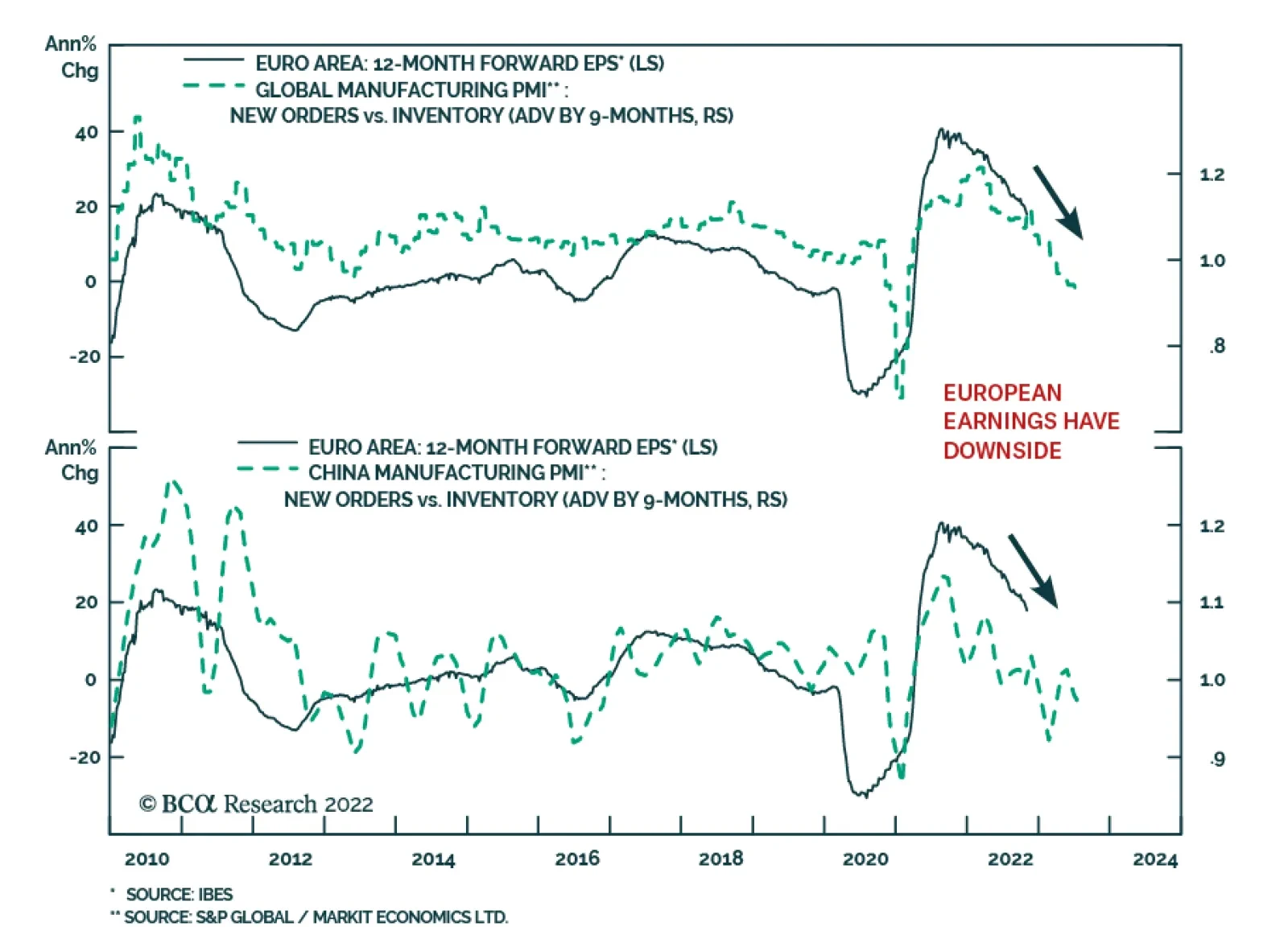

According to BCA Research’s European Investment Strategy service, although the decline in US CPI is a tailwind for European stocks, strong rallies are premature. Chinese growth shows no sign of improvement. Similarly,…

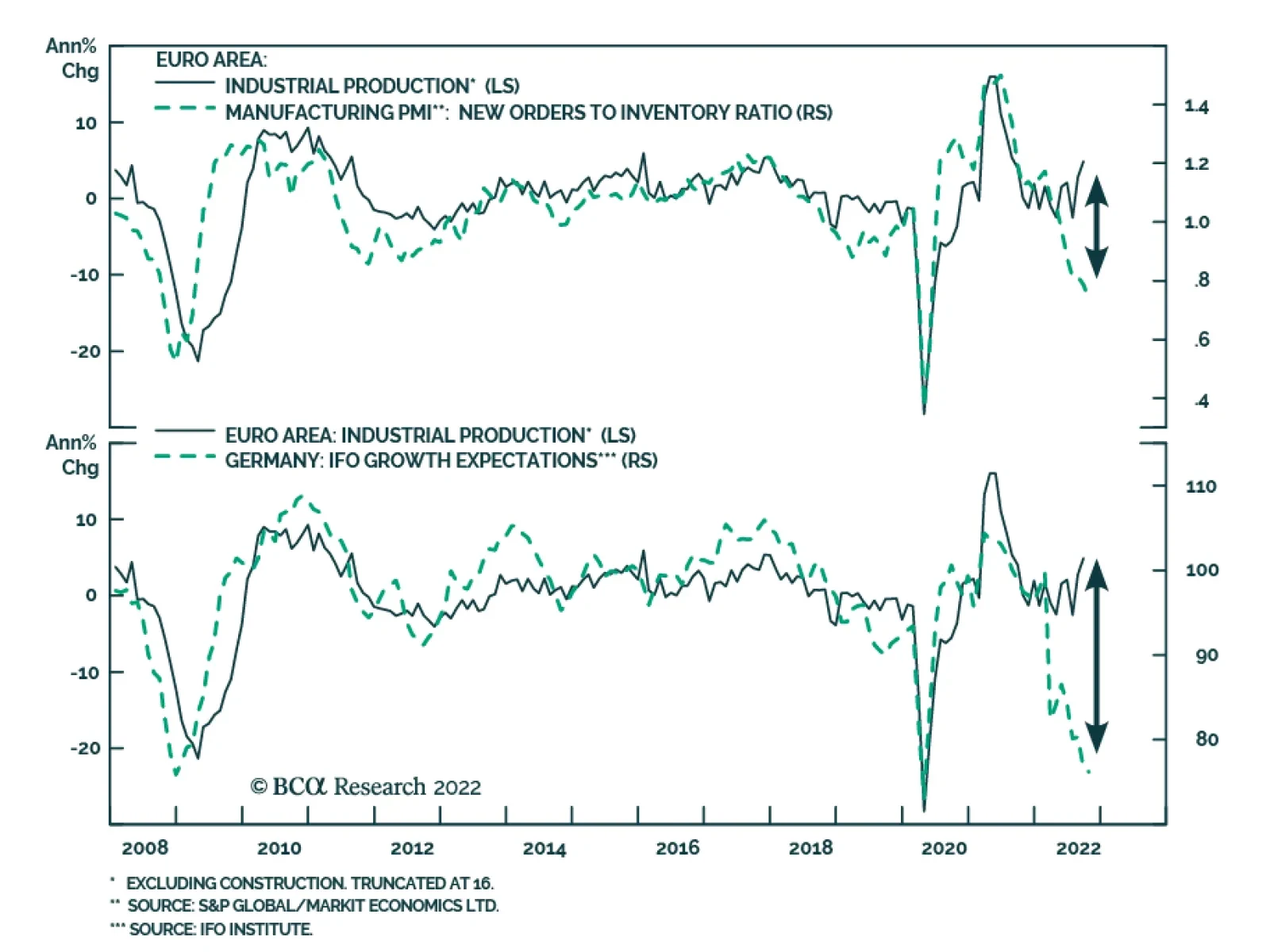

Euro Area industrial production expanded by 4.9% y/y in September, following an upwardly revised 2.8% y/y and beating expectations of a 3.0% y/y increase. Similarly, the 0.9% m/m increase also exceeded consensus estimates of 0.5…