The latest US and Eurozone CPI inflation releases both surprised to the downside, fueling optimism among investors that central banks will soon pivot. However, US labor market dynamics remain very tight. The November…

In this Strategy Outlook, we present the major investment themes and views we see playing out next year and beyond.

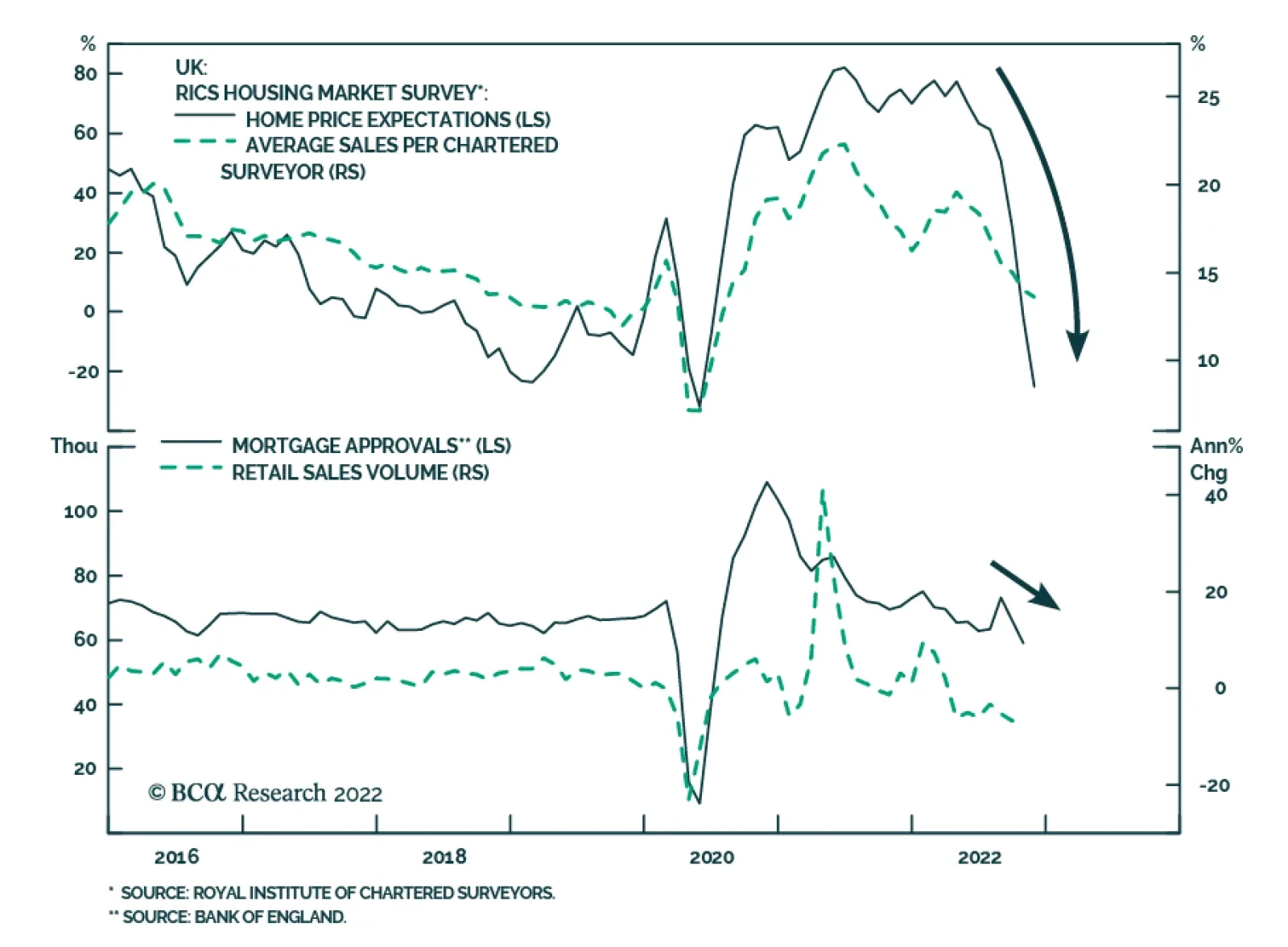

The UK Royal Institution of Chartered Surveyors’ (RICS) house price net balance – which is calculated as the difference between the share of property surveyors expecting house prices to increase and those that expect…

The pandemic gave older Americans and Brits a massive carrot and stick to retire early. The carrot being a surge in wealth, the stick being a risk to health. In other major economies, the carrots and sticks were smaller or non-…

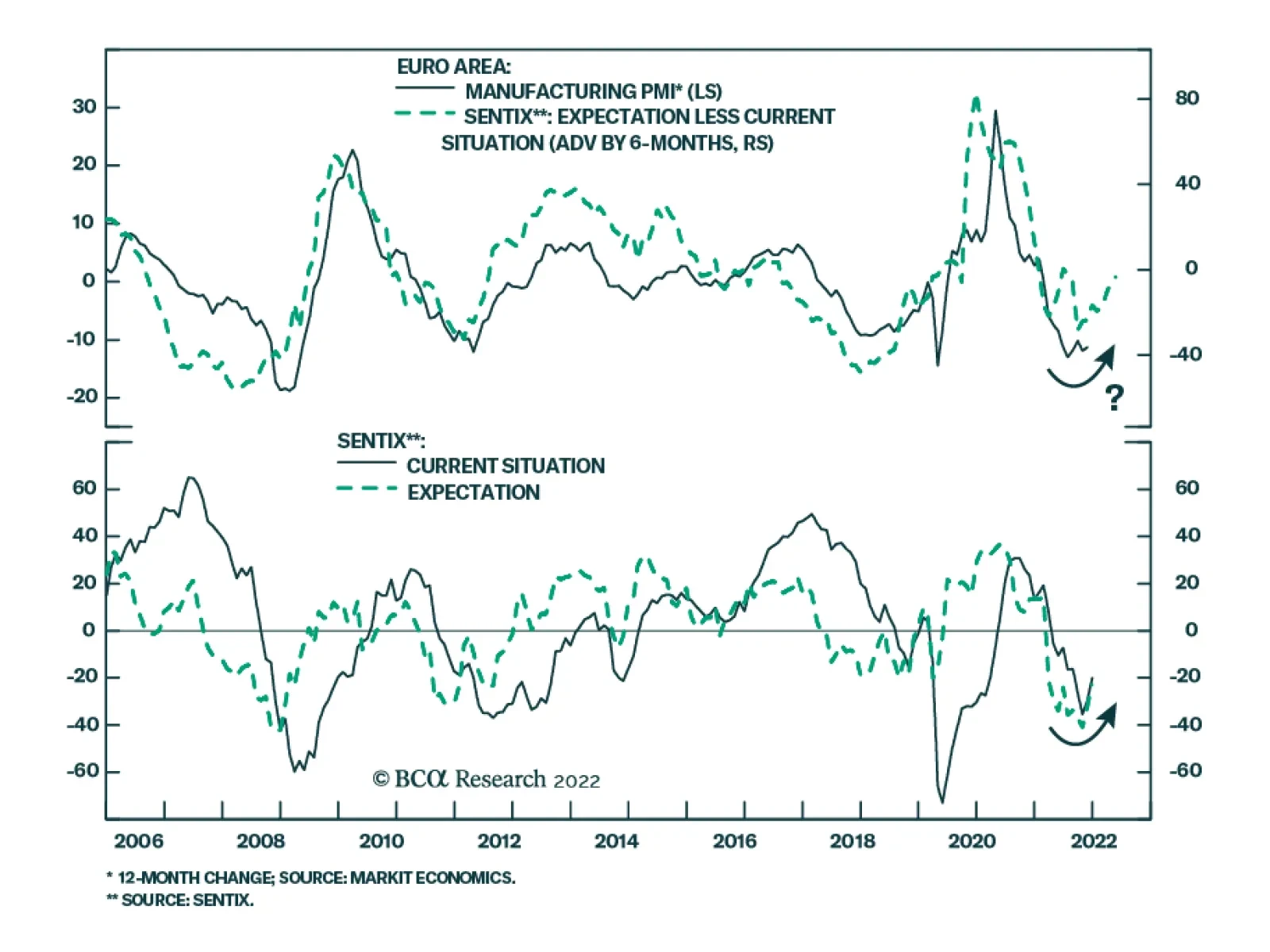

The December Sentix Economic Index sent a positive signal about investor morale. The overall index for the Eurozone jumped from -30.9 to -21 – beating expectations of a more muted improvement to -27.5. Both the current…

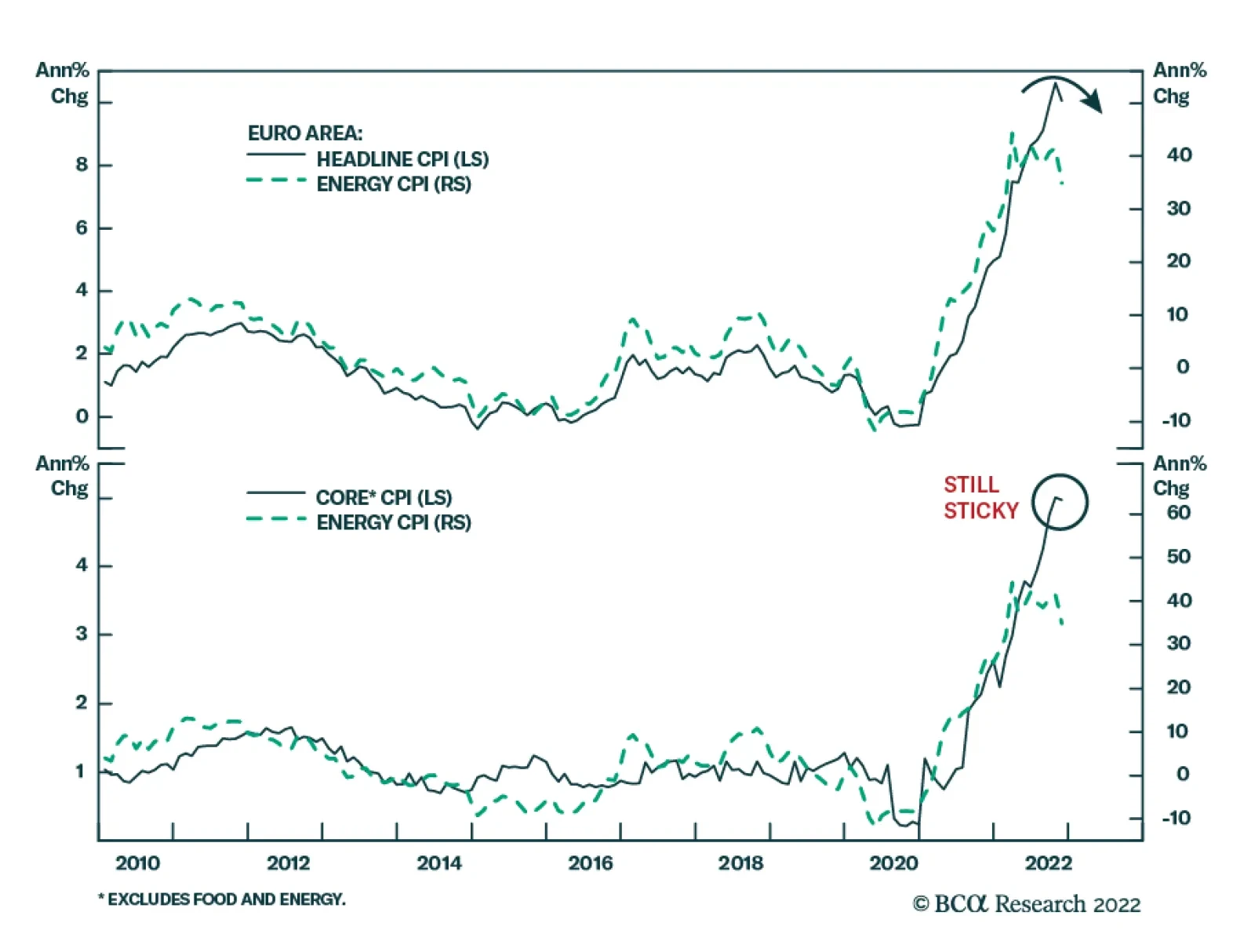

European inflation will decline through 2023, which will greatly help households and consumption. But can European inflation remain low after that?

MacroQuant is overweight bonds, underweight equities, and neutral on cash. Within the equity universe, the model is underweight the US and overweight Japan, the UK, and Australia.

Recession is not yet fully priced in, so markets have further to fall next year. But watch for a buying opportunity in the second half.

Euro Area headline CPI inflation eased by more than anticipated in November. The annual rate moderated from 10.6% y/y to 10.0% y/y, while the monthly figure showed a 0.1% m/m decline in prices following October’s 1.5% m/m…