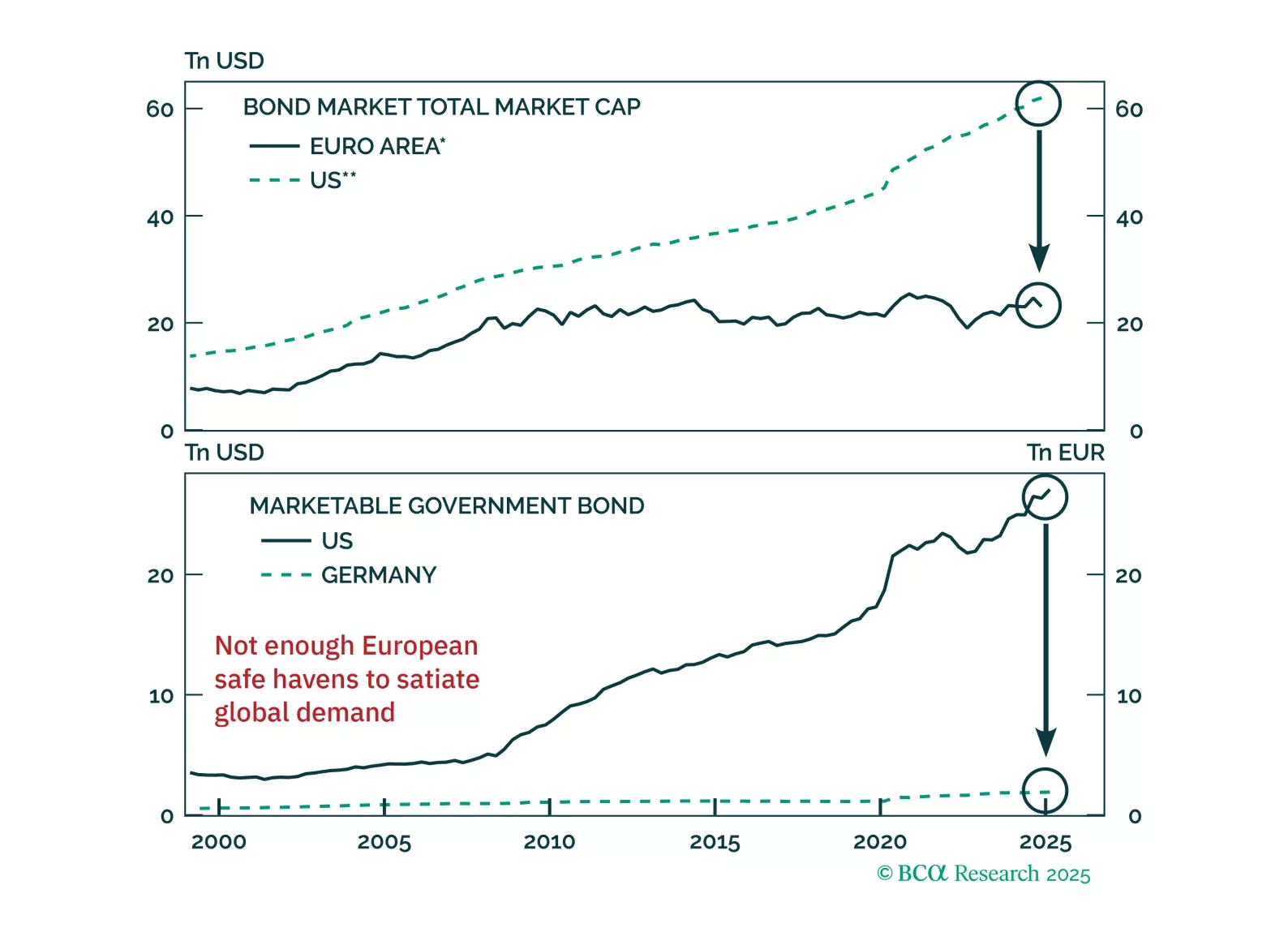

Are bunds the new Treasurys? The euro and German debt are gaining favor as safe havens, but markets may be overplaying the shift. Our latest report dissects what's durable, what's not, and how to trade the dislocation.

US Treasuries typically outperform both equities and global government bonds during downturns. Recent political shifts could lessen that outperformance this cycle, but we doubt it will disappear completely.

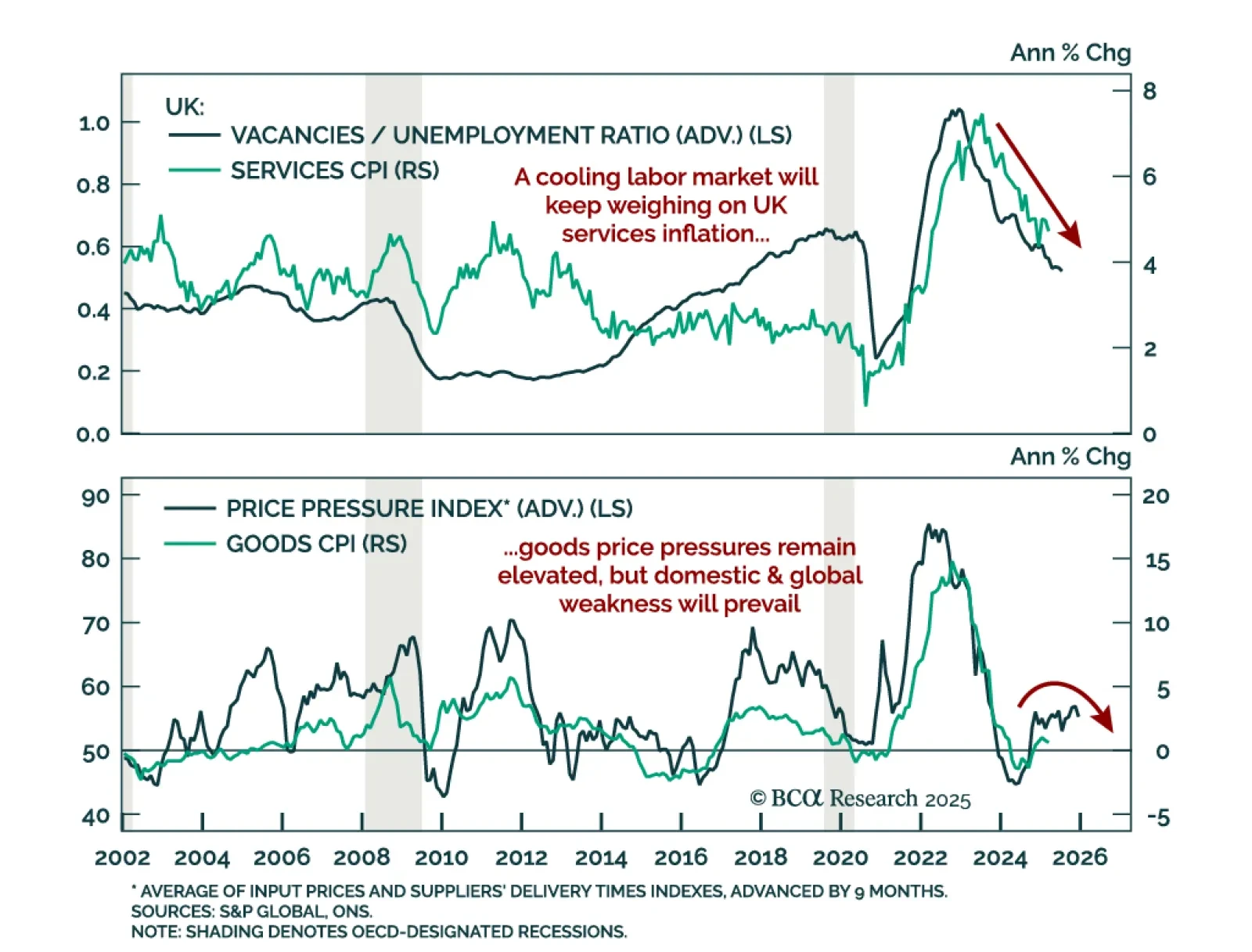

The latest UK data supports a May BoE cut, reinforcing our overweight in Gilts as growth headwinds build and inflation cools. Employment declined by 78k in March, accelerating from February’s downwardly revised 8k drop, while…

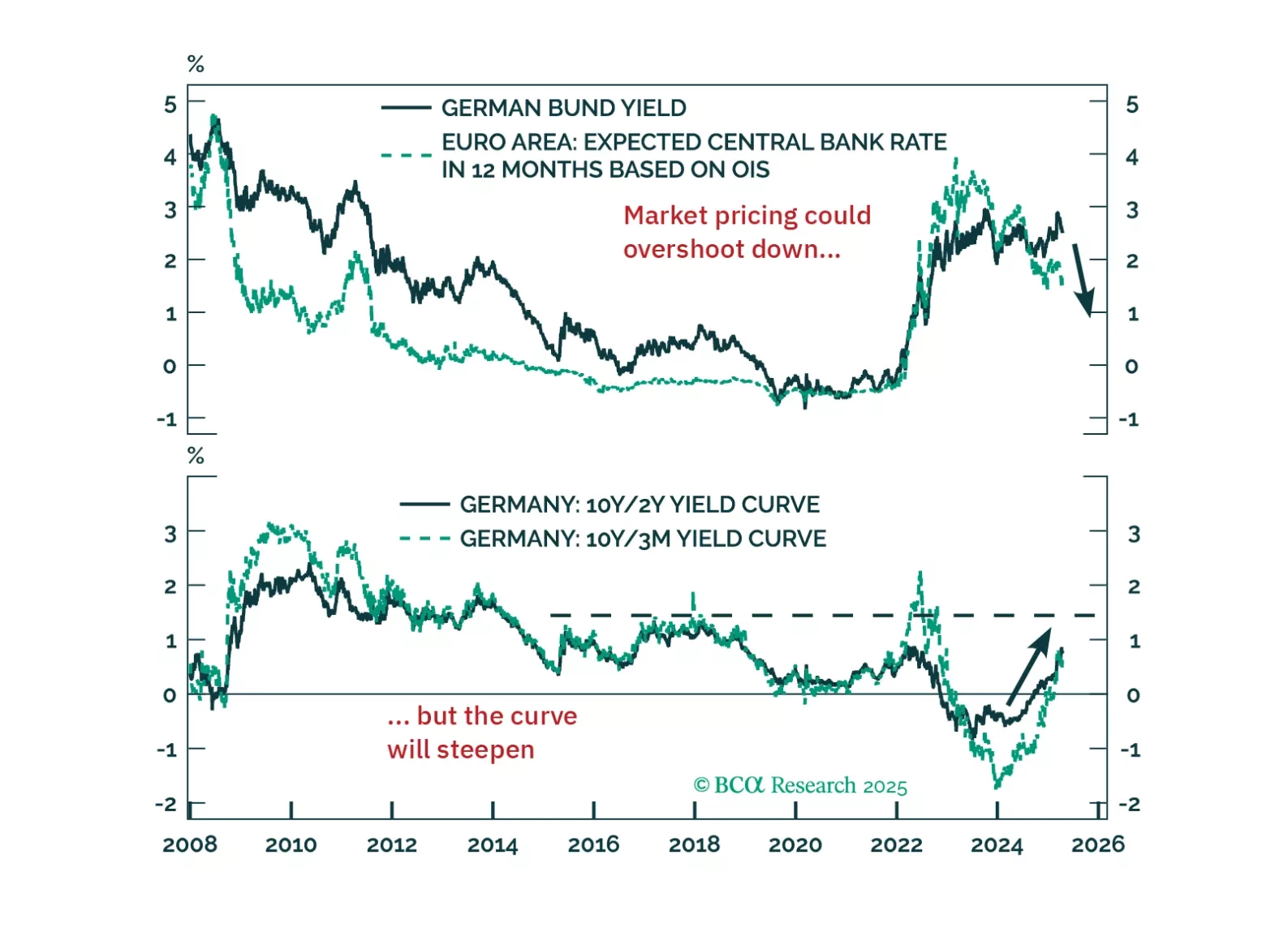

The ECB’s latest 25 bps cut and President Lagarde's notably dovish tone amid rising trade uncertainty reinforce our long December 2025 ESTR futures versus SOFR position. The deposit facility rate now stands at 2.25%, and Lagarde…

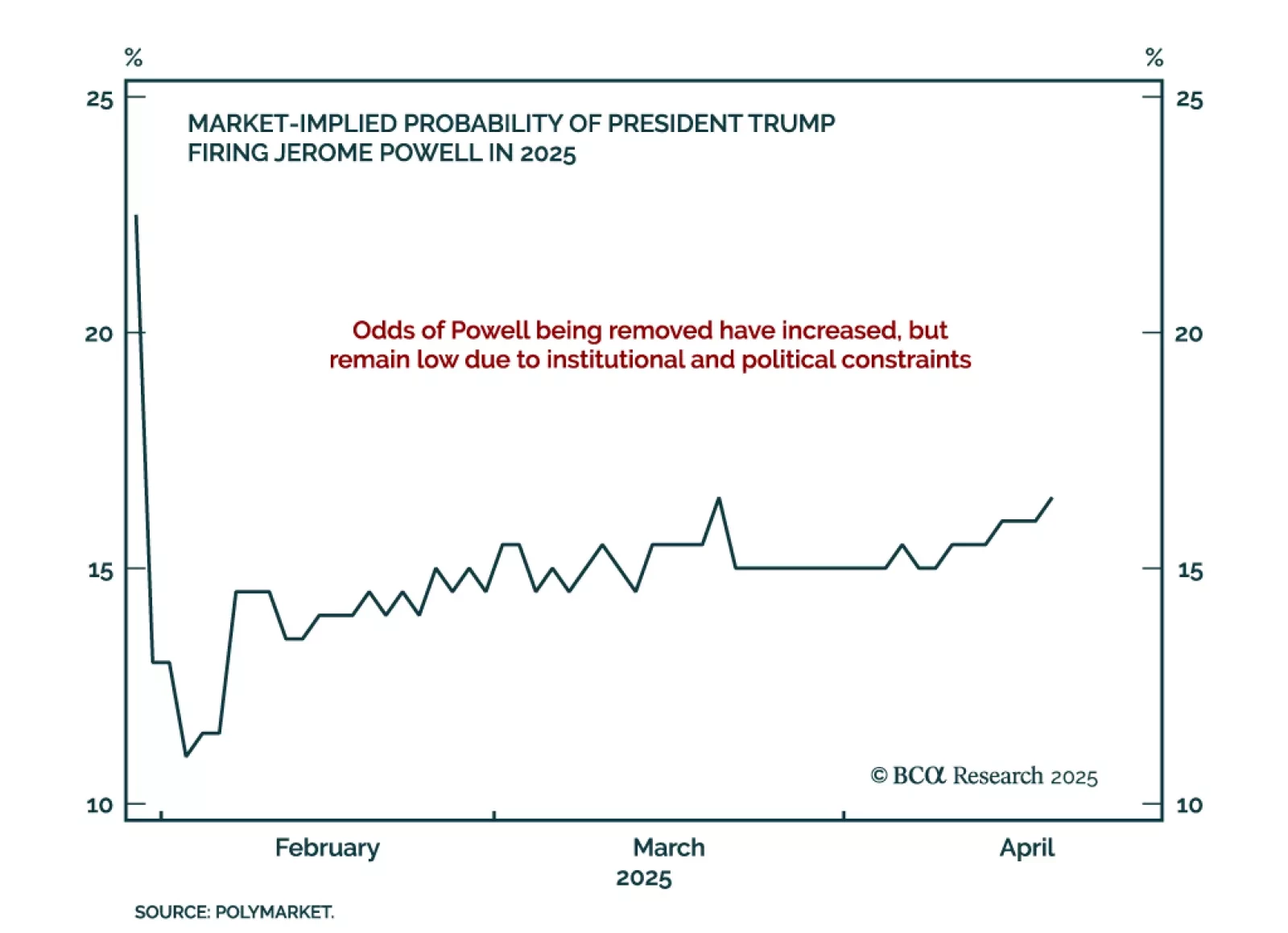

Trump’s renewed attacks on Fed Chairman Jerome Powell raise policy uncertainty but are unlikely to lead to Powell’s removal, reinforcing our expectation for continued restrictive policy and supporting our long duration stance. Trump'…

Europe’s deflation problem is getting harder to ignore. This week’s ECB cut is just the beginning — tariffs, the euro’s rally, and softening demand all point to more easing ahead. We explain what it means for yields, equities, and…

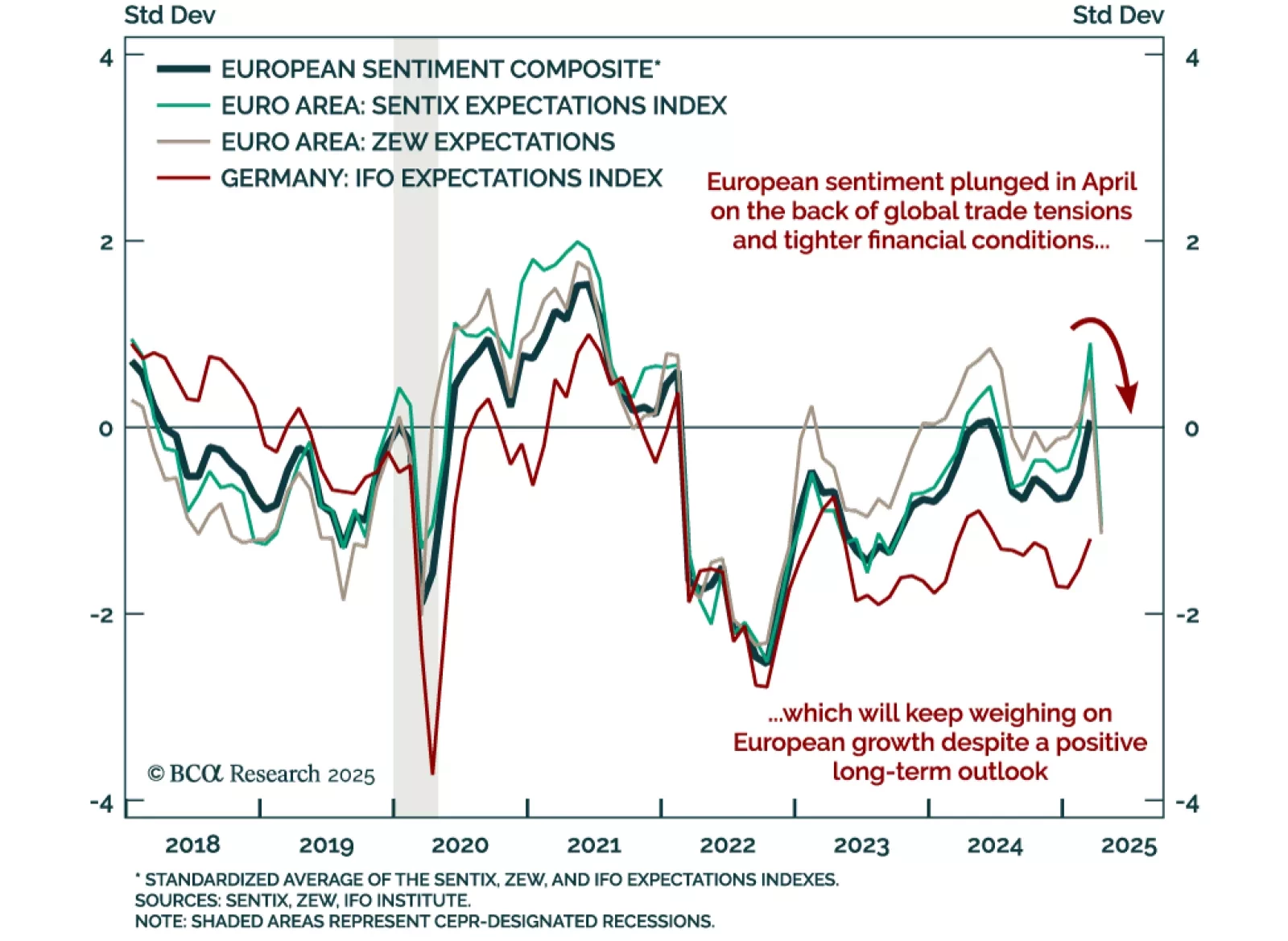

Eurozone sentiment has sharply deteriorated, reinforcing a cautious stance on European assets over the next 6 to 12 months. The April ZEW expectations index for the eurozone collapsed to -18.5 from 39.8, while Germany’s gauge also…

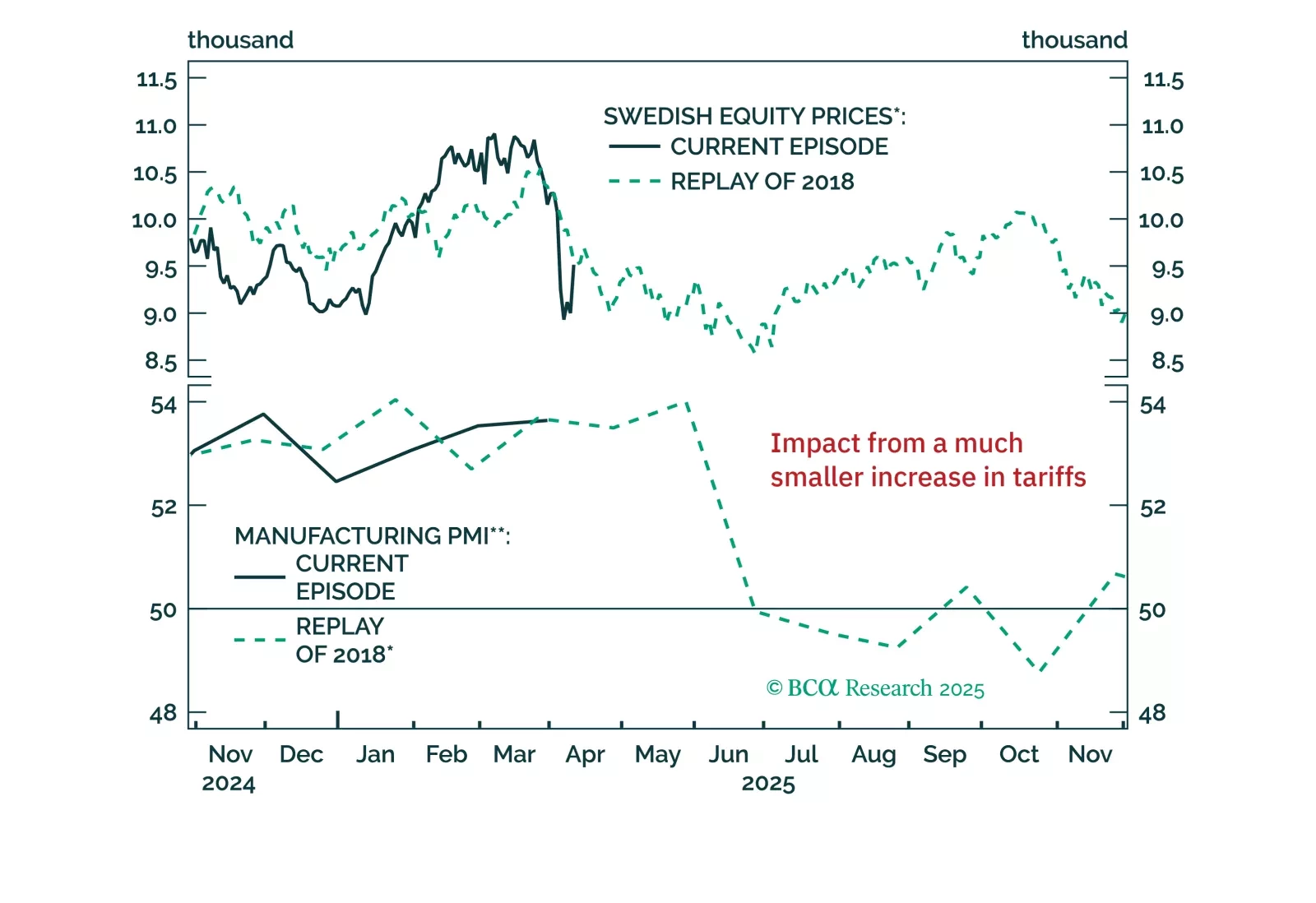

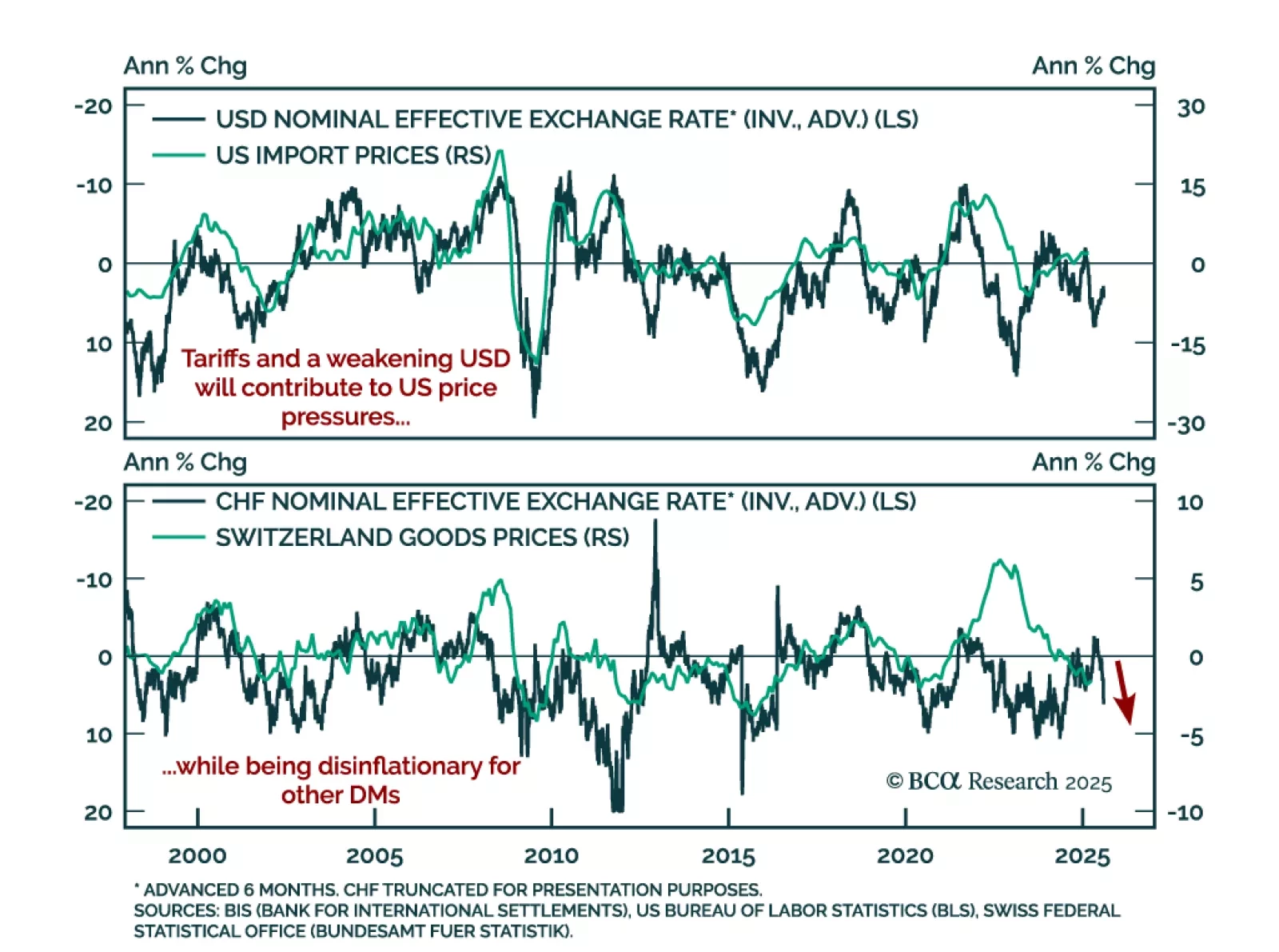

Tariff-driven inflation is diverging across economies, with the US facing mounting pressures while disinflation persists elsewhere. In theory, US tariffs should strengthen the dollar and weaken targeted currencies. In practice, the…

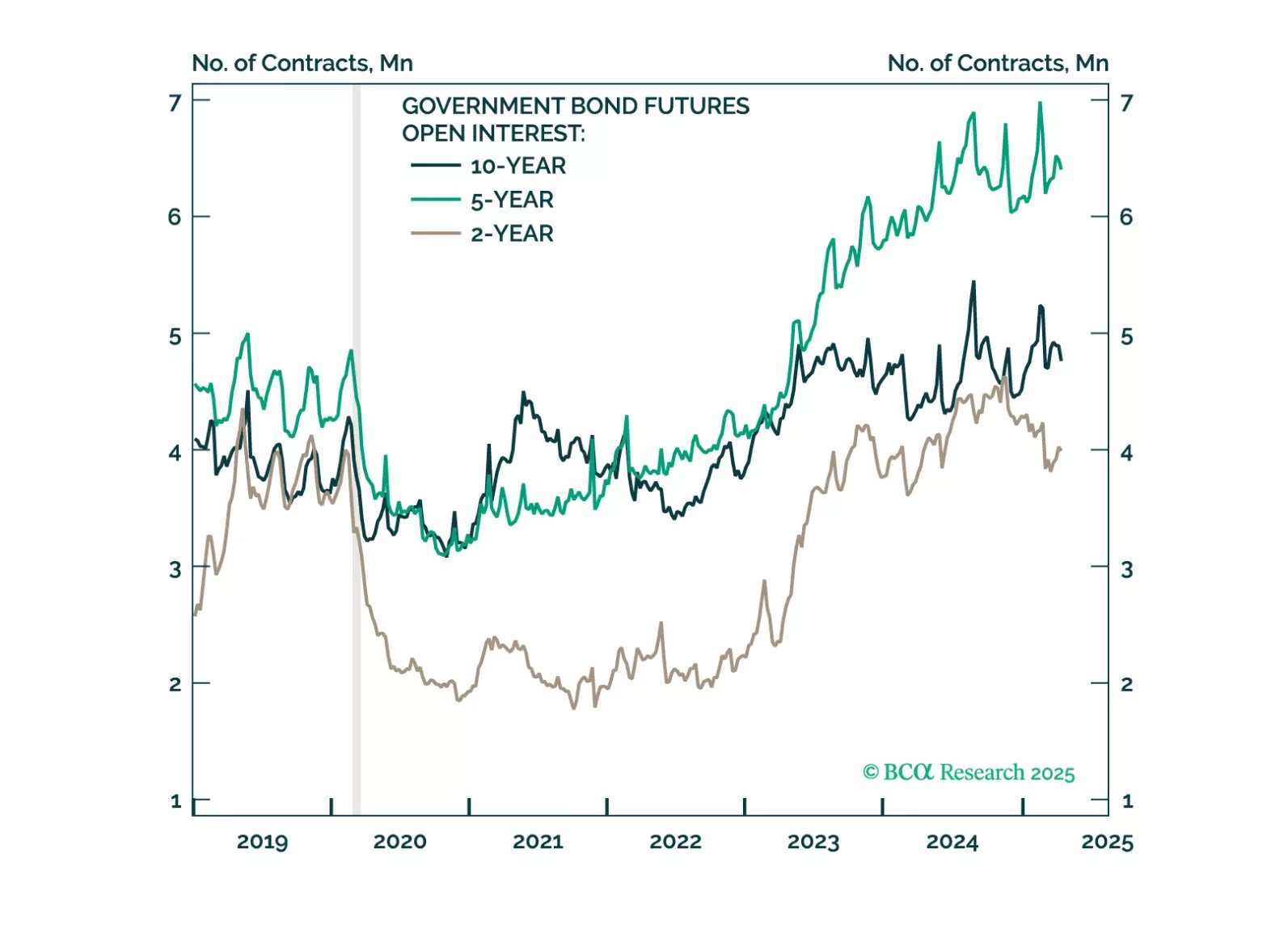

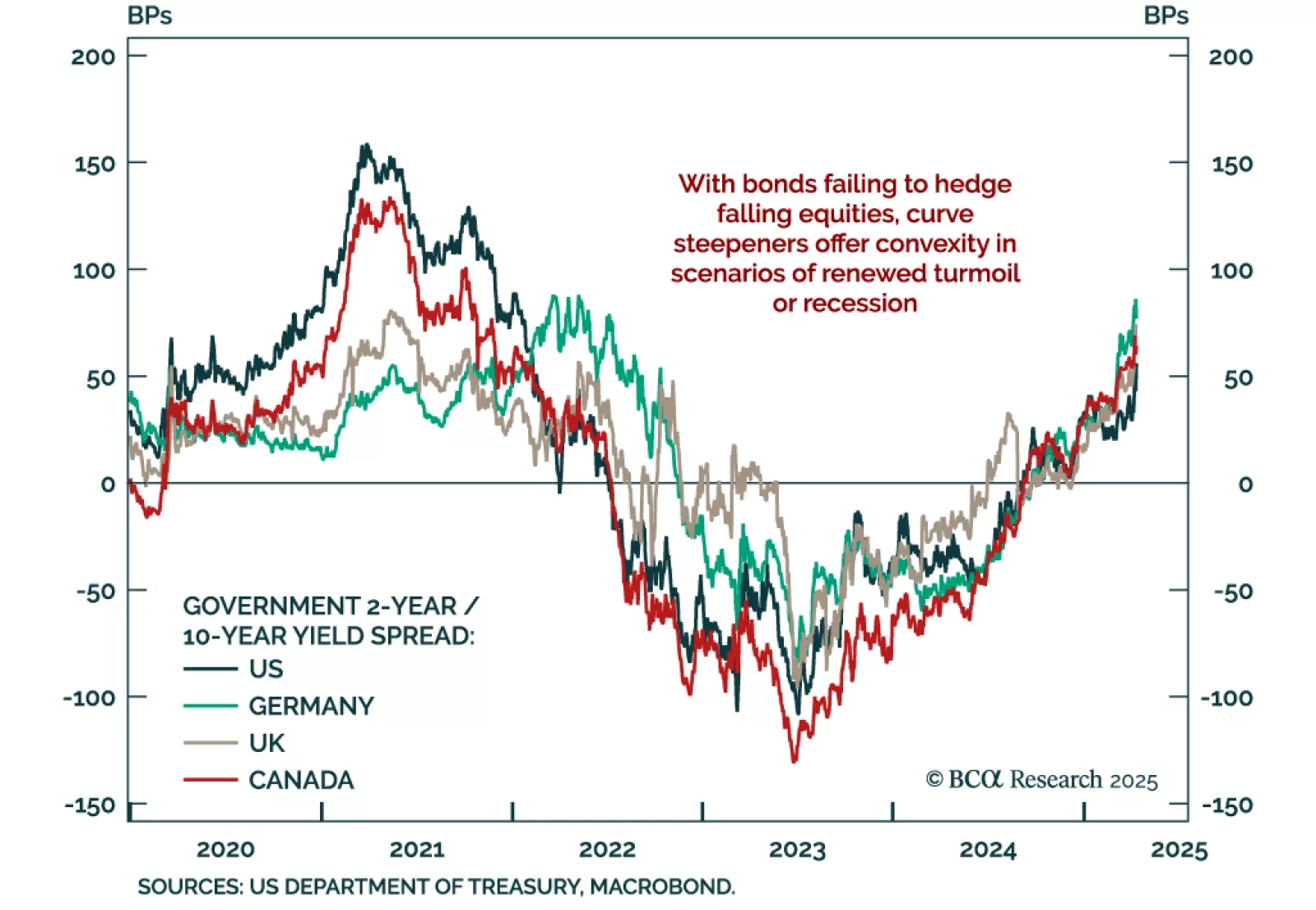

Bonds are failing to deliver defensive convexity; asset allocators should look to tactical curve steepeners for protection. Despite rising growth fears, Treasury yields have risen sharply at the long end. This is a clear break from…