The US economy will experience a period of benign disinflation over the next few quarters. Beyond this goldilocks period, either the economy will slip into a mild recession in 2024, or more ominously, a second wave of inflation will…

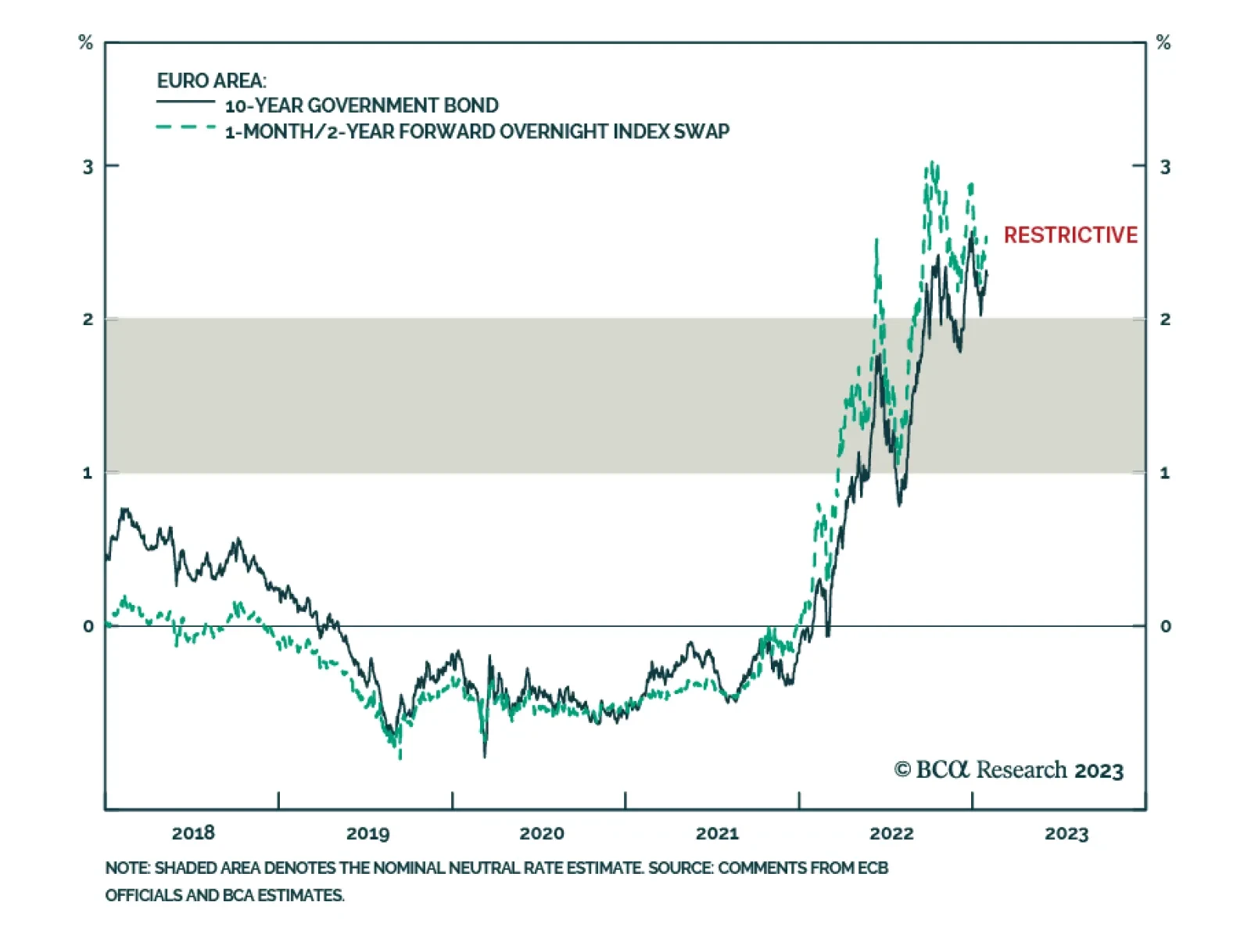

As expected, the ECB raised its three policy rates by 50bps on Thursday and signaled that it intends to raise interest rates by another 50bps at its next meeting in March. During the press conference, President Christine Lagarde…

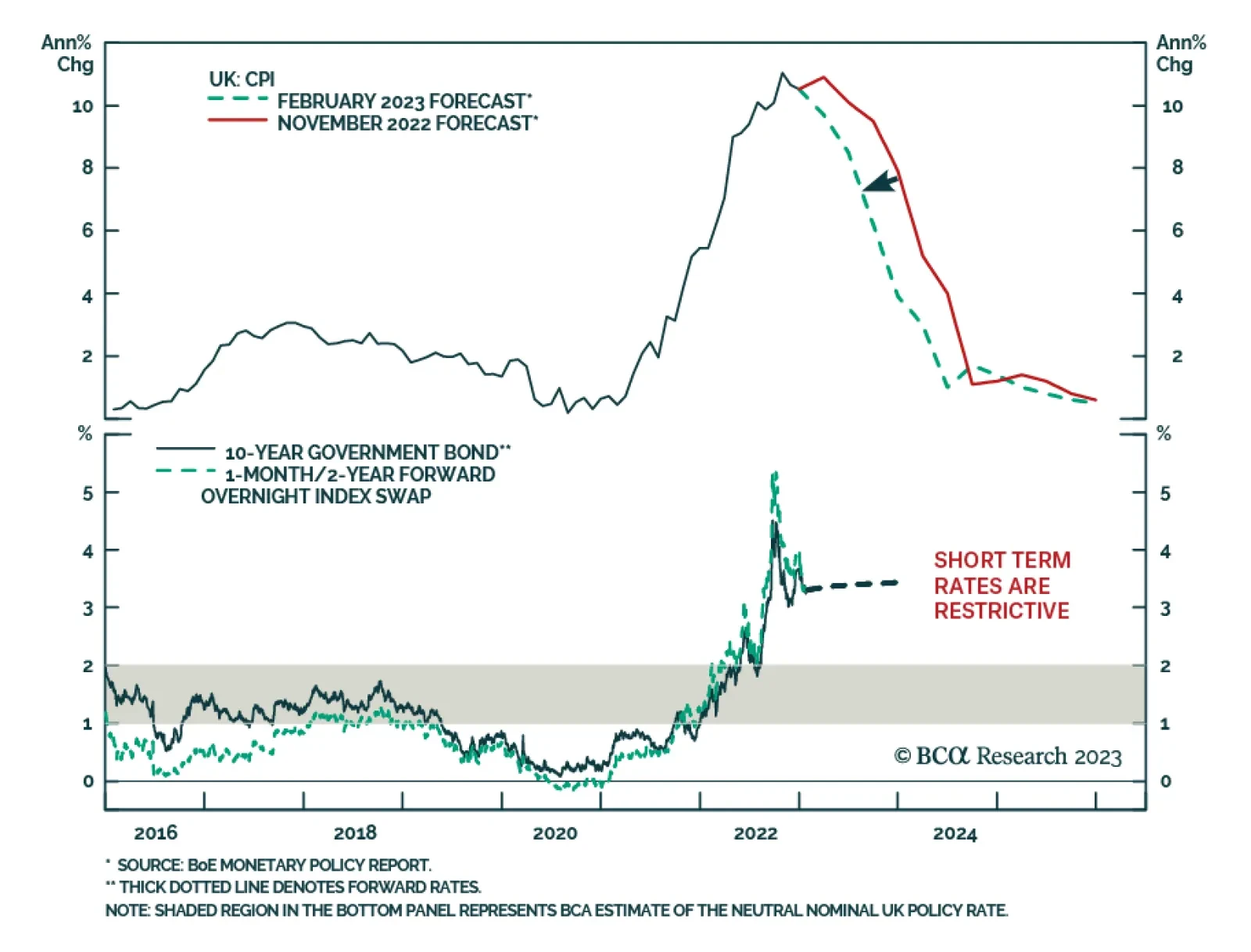

As anticipated, the Bank of England raised the Bank Rate by 50bps to 4% on Thursday, with two of the nine MPC members voting to keep it unchanged. While the central bank acknowledged that CPI inflation has likely peaked, it…

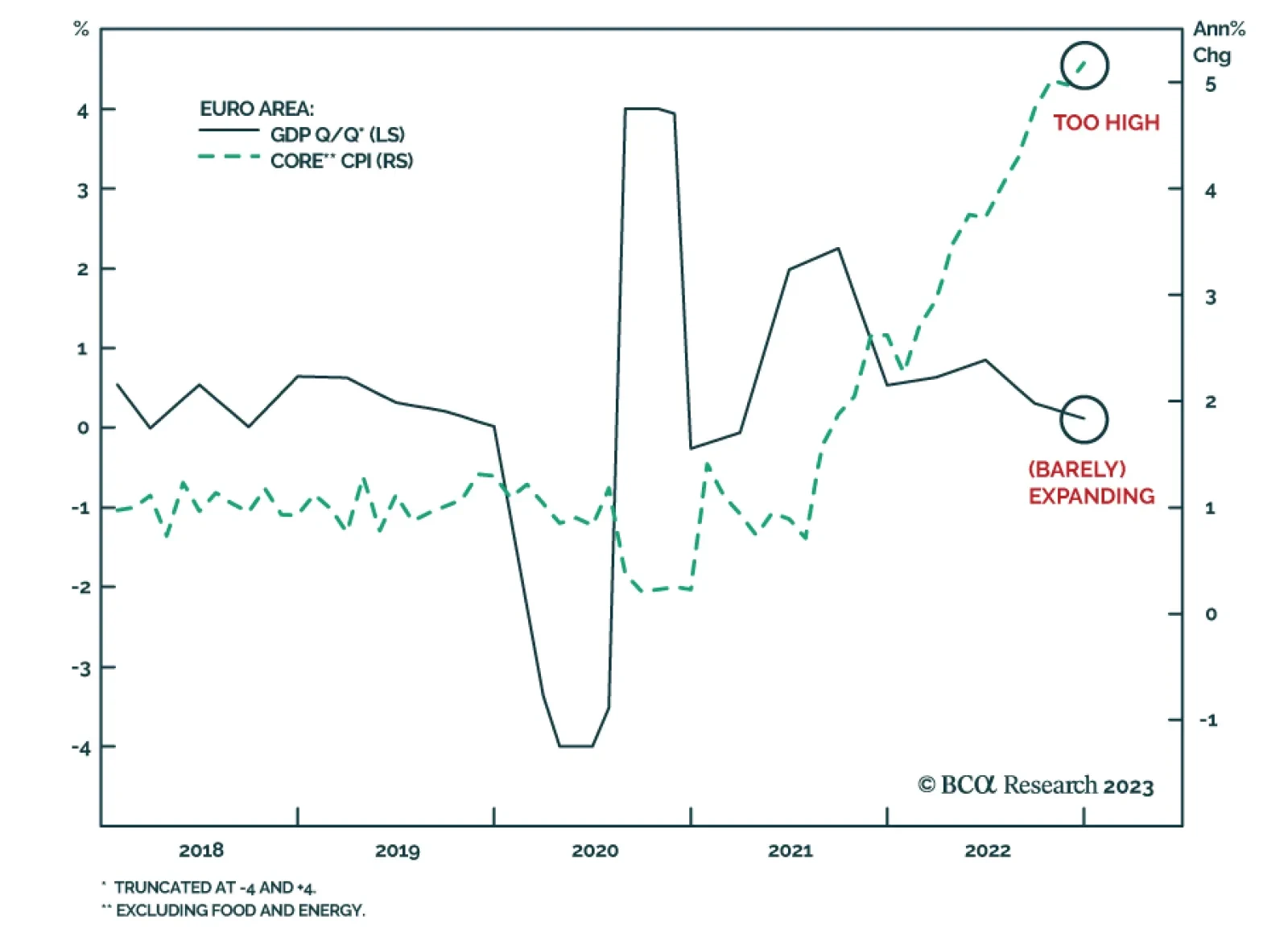

The preliminary GDP estimate suggests that the Euro Area economy expanded by 0.1% q/q in Q4 2022, beating expectations of a 0.1% q/q contraction. The improving energy situation due to milder-than-anticipated weather, as well as…

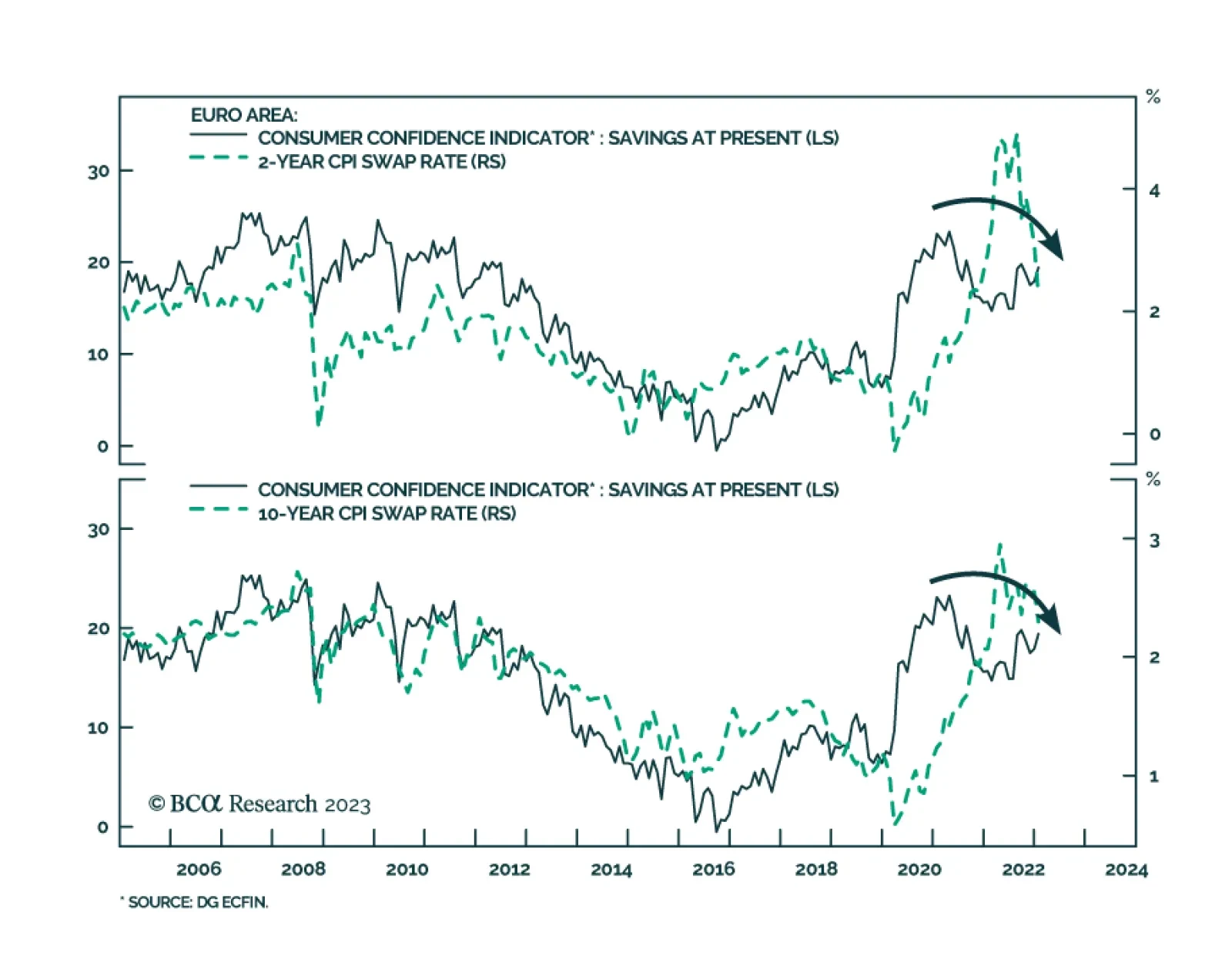

According to BCA Research’s European Investment Strategy service, Eurozone domestic demand is likely to be firm in 2023. Declining inflation will have a positive impact on consumption because it will lift real wages,…

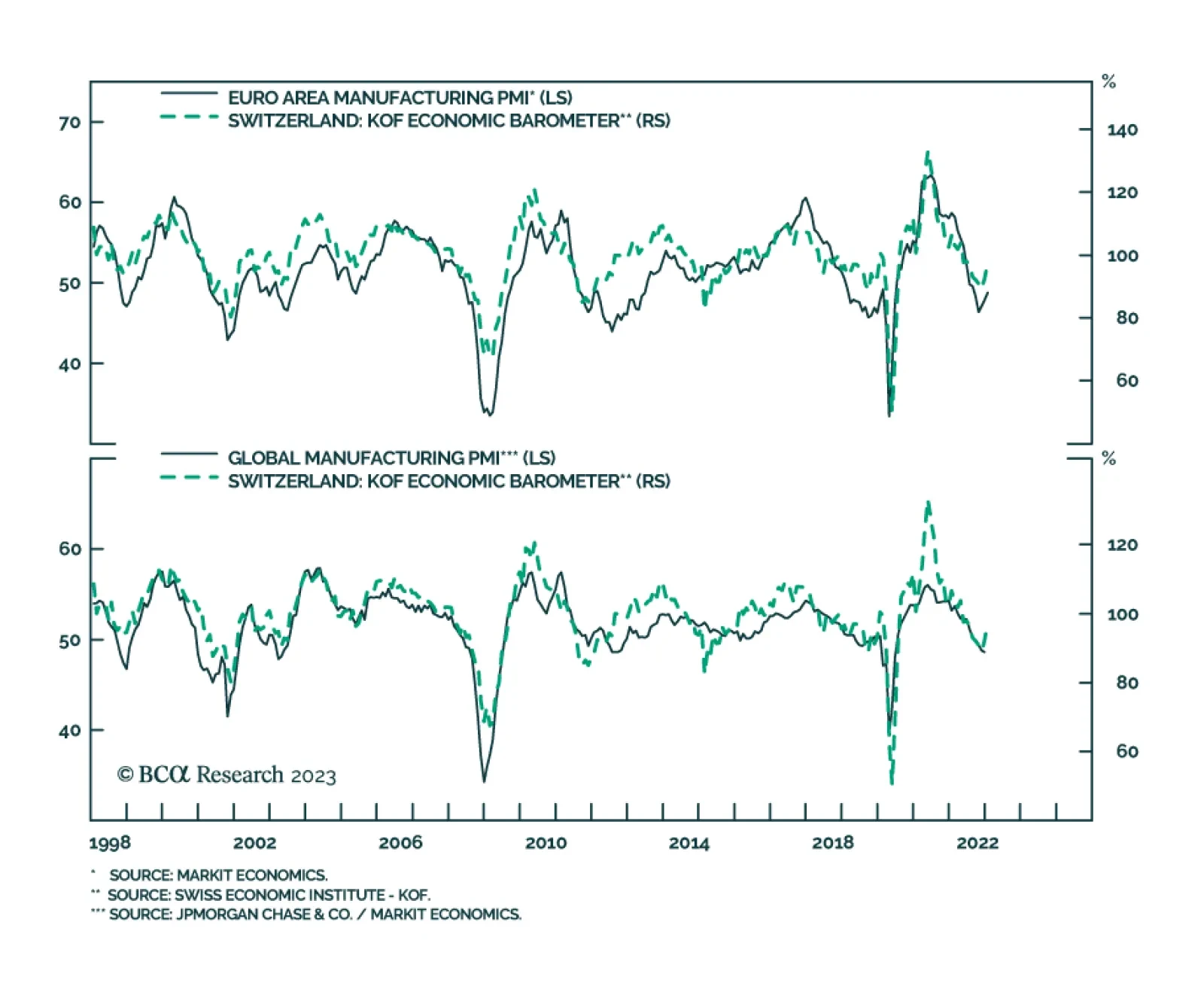

The Swiss KOF Barometer jumped 5.7 points to 97.2 in January, marking the second consecutive monthly increase, pushing the index to the highest level since June 2022. Importantly, the January increase reflects improvements across…

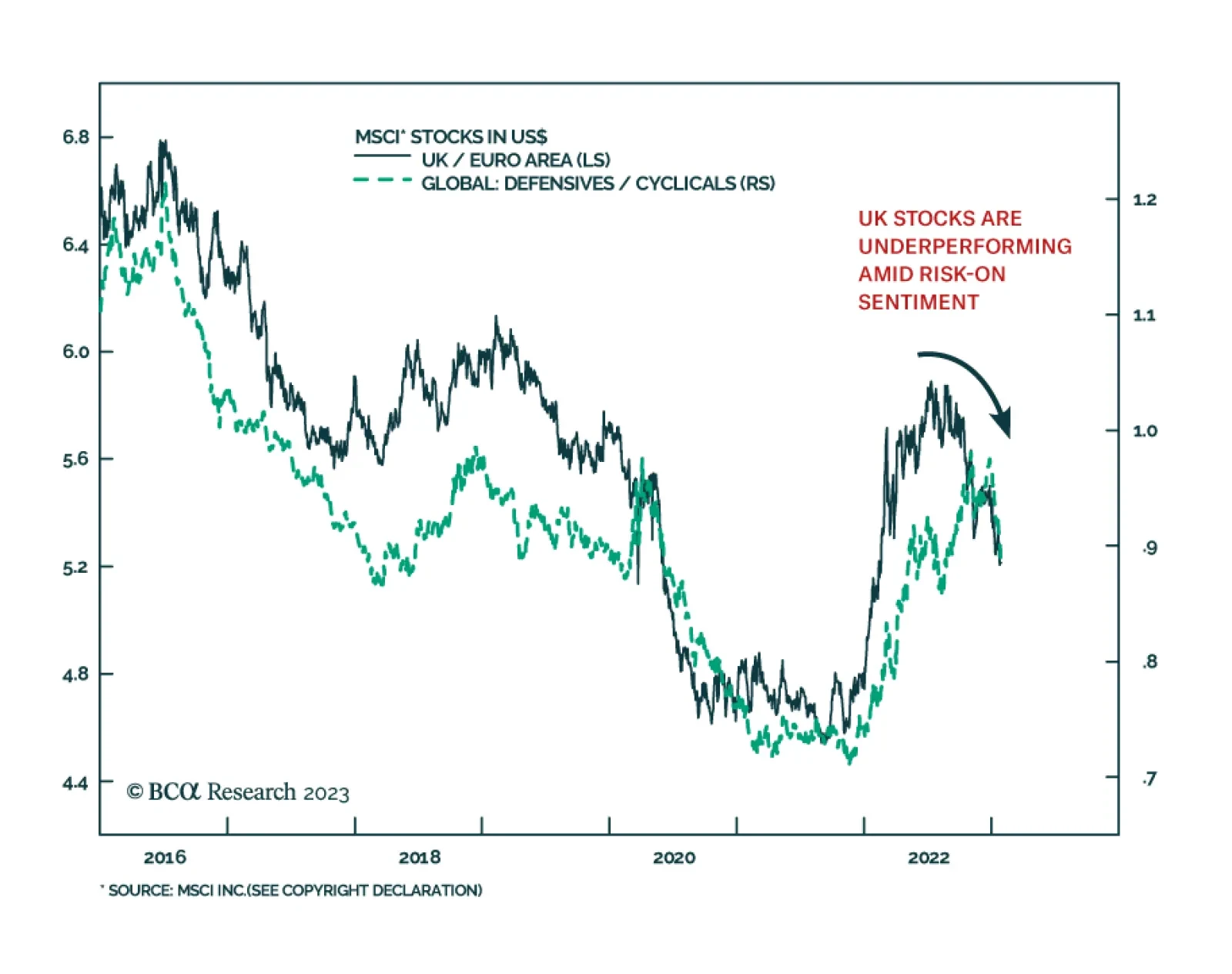

UK stocks have been underperforming their Eurozone peers recently. The MSCI Euro Area index’s 39% gain in the four months since its trough dwarfs the UK benchmark’s 27% increase since its September 27 bottom. Notably…

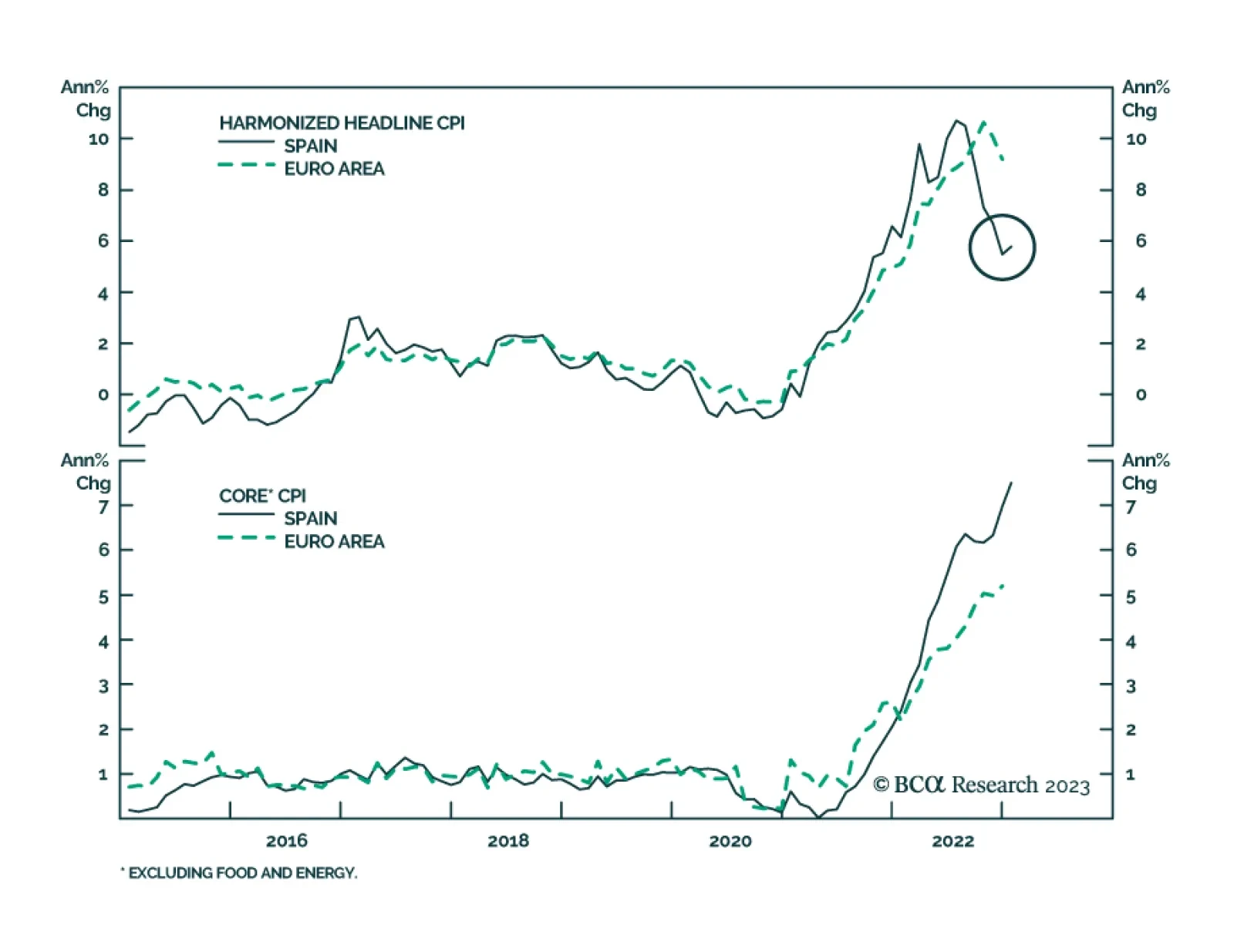

Preliminary estimates suggest that Spanish headline harmonized CPI inflation (HICP) accelerated to 5.8% y/y in January, from 5.5% y/y, largely surpassing expectations for a moderation to 4.8% y/y. A reacceleration of fuel prices…