Our Central Bank Monitors support the recent shift in tone from central bankers in Europe. Find out what it means for European fixed-income portfolio allocation.

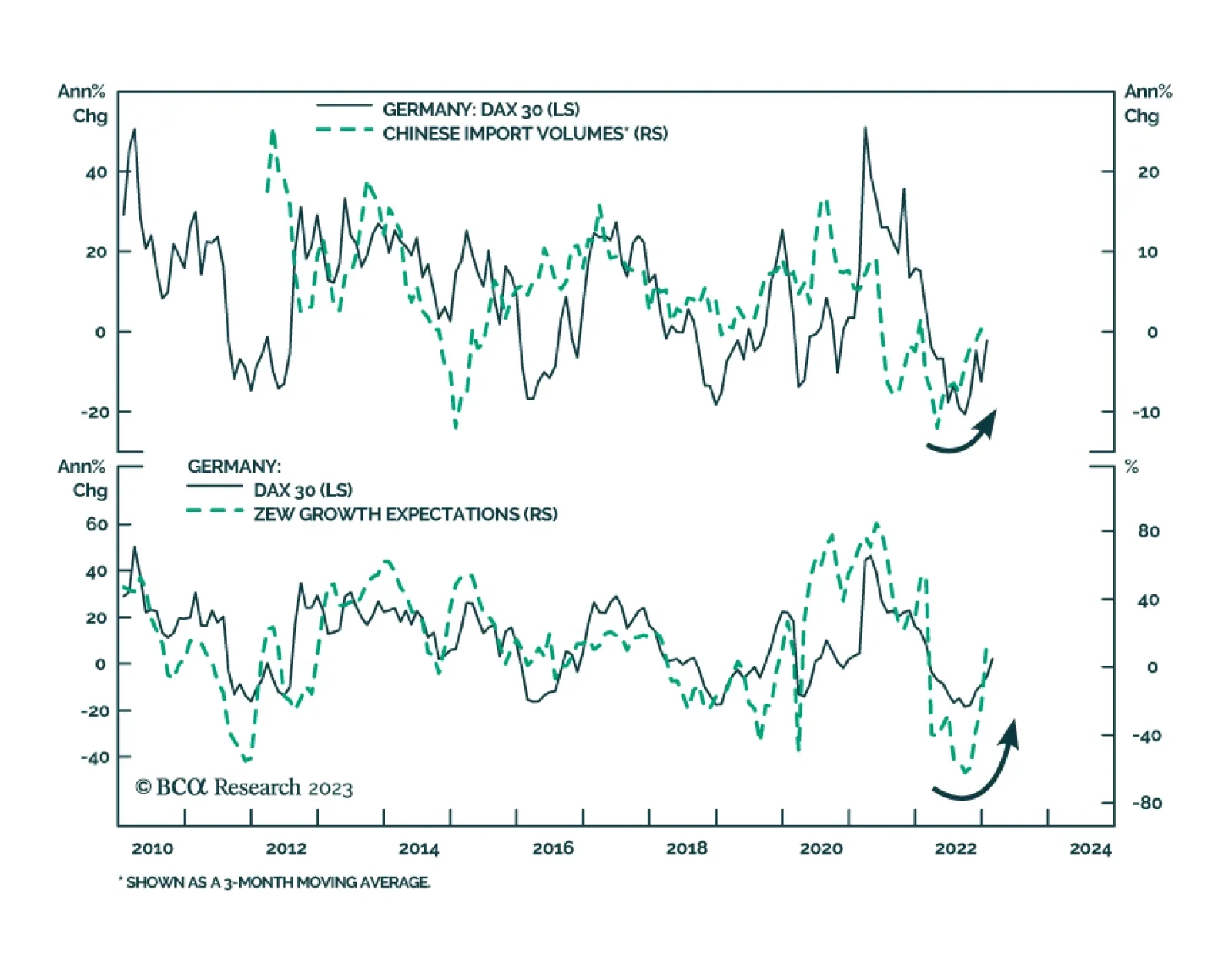

The German DAX has rallied by 26.4% since the beginning of Q4 2022, outperforming the Euro Stoxx 50 by 5.7% in the process. With industrial equities accounting for a relatively large share of the German index, the bourse is…

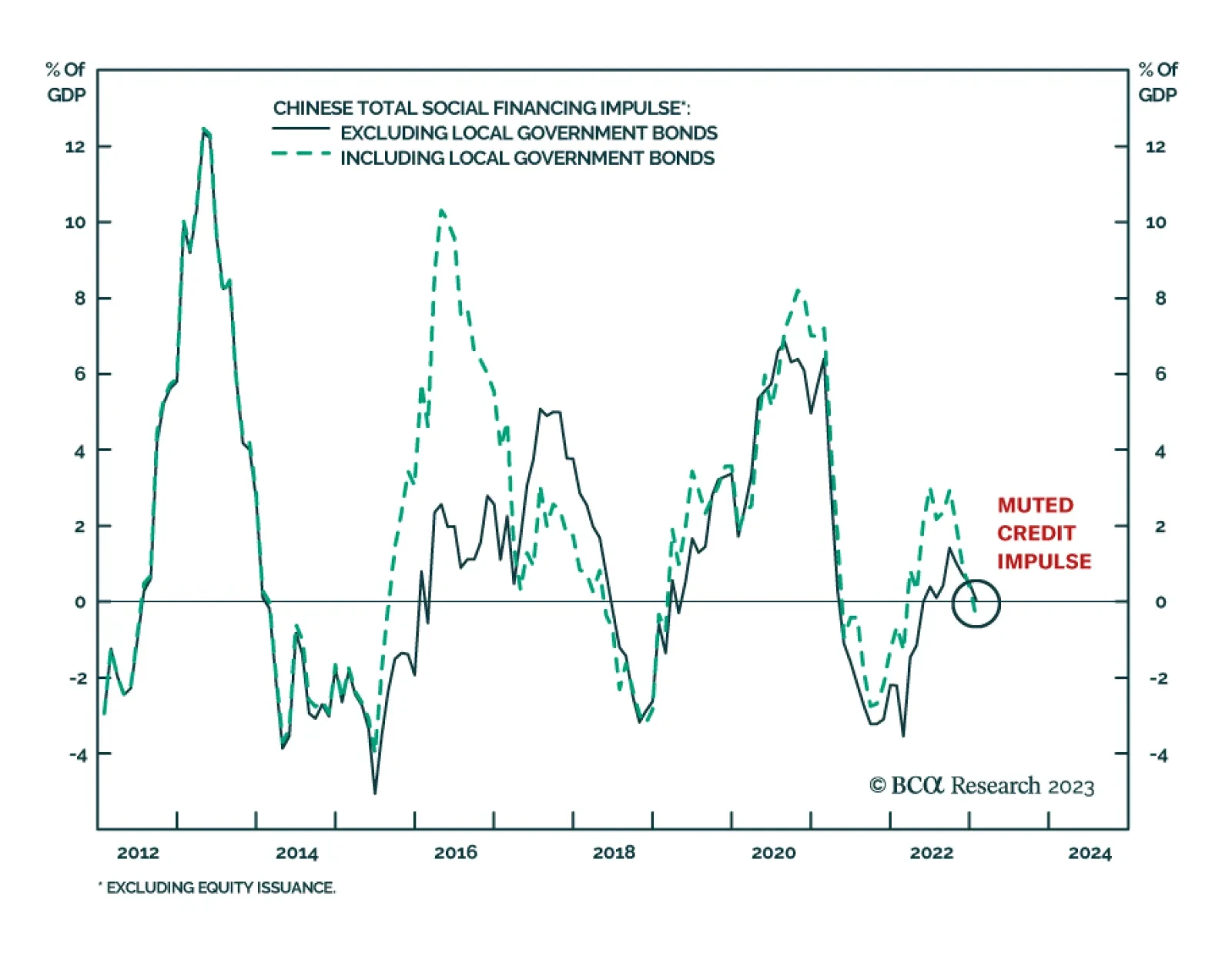

Chinese money and credit data were stronger than expected in January. The RMB 5.98 trillion surge in total social financing is significantly above December’s RMB 1.31 trillion increase and beat expectations of a RMB 5.40…

Ironically, increased confidence that the economy can withstand higher bond yields may be necessary to lift yields to a level that is actually detrimental to growth. Thus, until more investors are convinced that a recession will be…

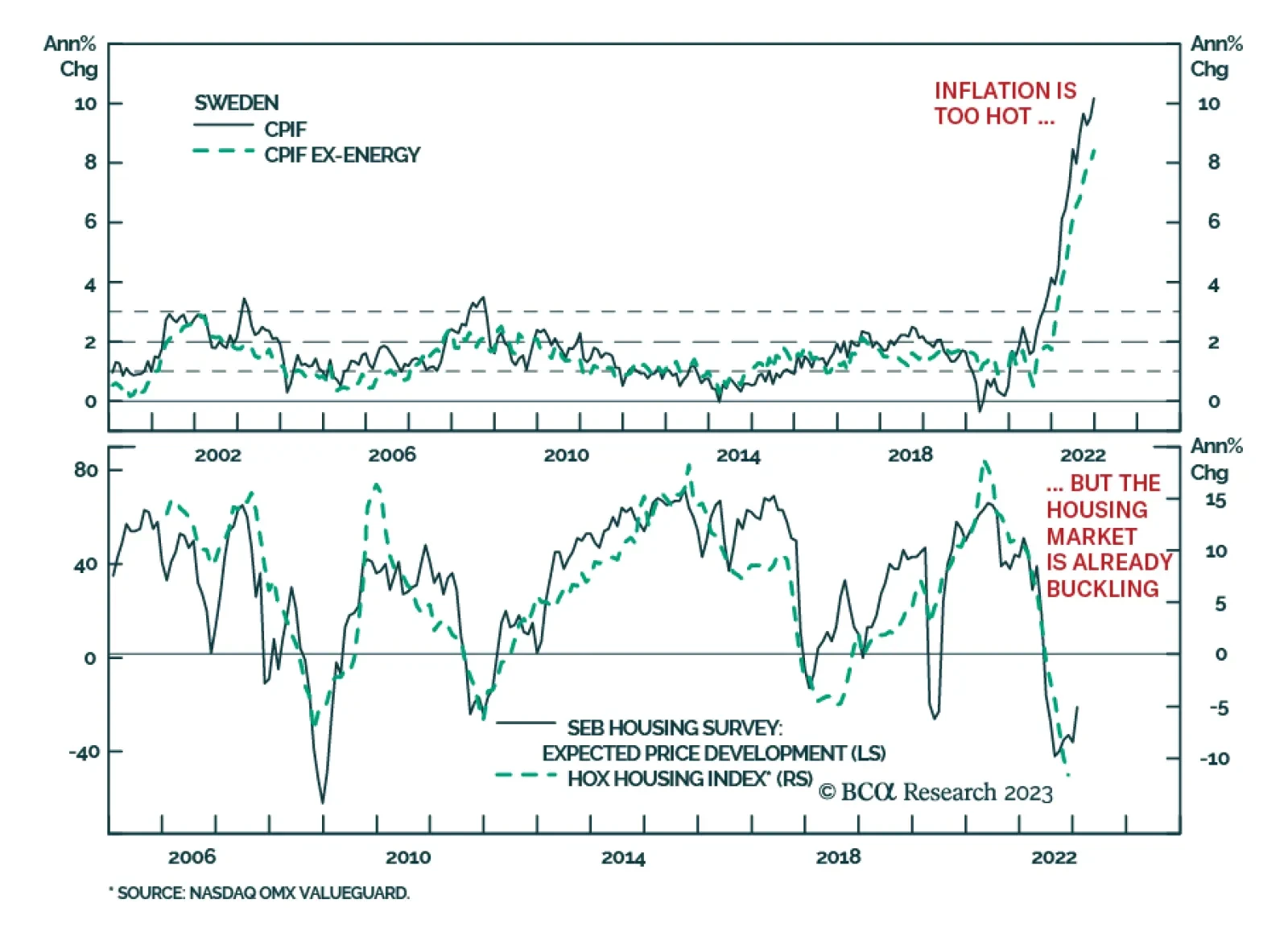

As expected, Sweden’s Riksbank delivered a 50 bp rate hike at its meeting on Thursday, bringing the policy rate to 3.0%. and signaled that further hikes are likely. Moreover, it announced that beginning in April it will…

The Fed is betting that the usual non-linearity of unemployment is different this time, but so far, there is nothing to suggest that it is different. We discuss the key signposts to watch out for, plus the implications for interest…

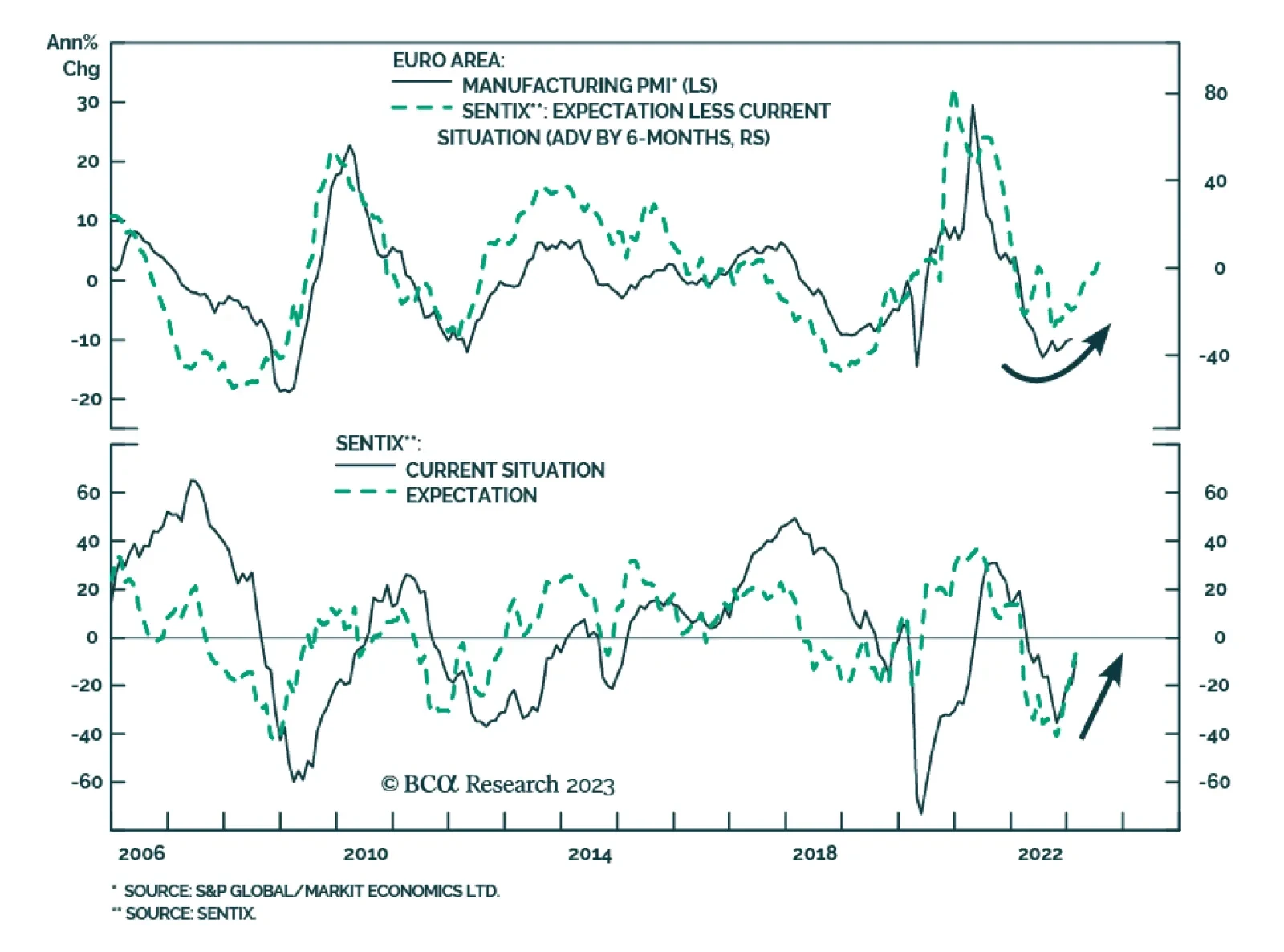

The February Sentix Index continues to send a positive signal about investor morale. The Eurozone measure jumped 9.5 points to -8, beating expectations of a more muted rise to -13.5. Notably, the February surge marks the fourth…

This week, we articulate what the actions of the three major central banks that met (Fed, ECB and BoE) mean for currency markets. This is within the context of our analysis of the latest data releases in the G10, that allows us to…

Financial markets were taken on a wild ride between Wednesday and Friday of this week, with hugely important monetary policy meetings in the US, euro area and UK along with a rash of economic data. Despite all the news, noise and…

The ECB and the BoE provided a comforting signal to markets that the end of the respective tightening campaigns is coming before the summer. In the process, they are closing their hawkishness gap relative to the Fed.