Great Power Rivalry is taking another leg up as Russia and China further align their geopolitical interests. Investors should stay long USD-CNY, favor defensives over cyclicals, and markets like North America and DM Europe that have…

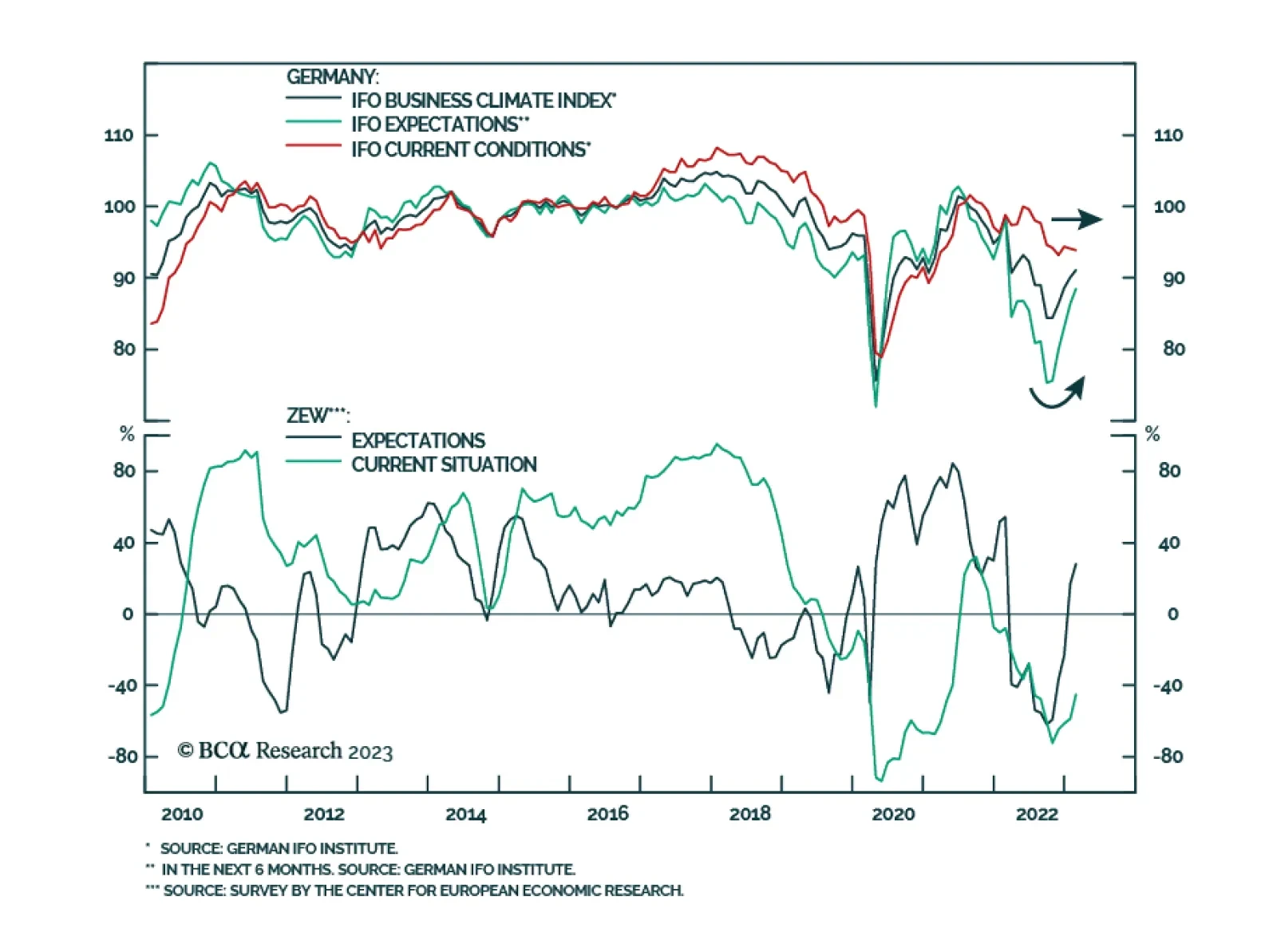

The German Ifo Business Climate Index increased by 1 point to 91.1 in February, broadly in line with consensus estimates. In particular, the improvement comes on the back of a 2.1-point rise in the expectations component which is…

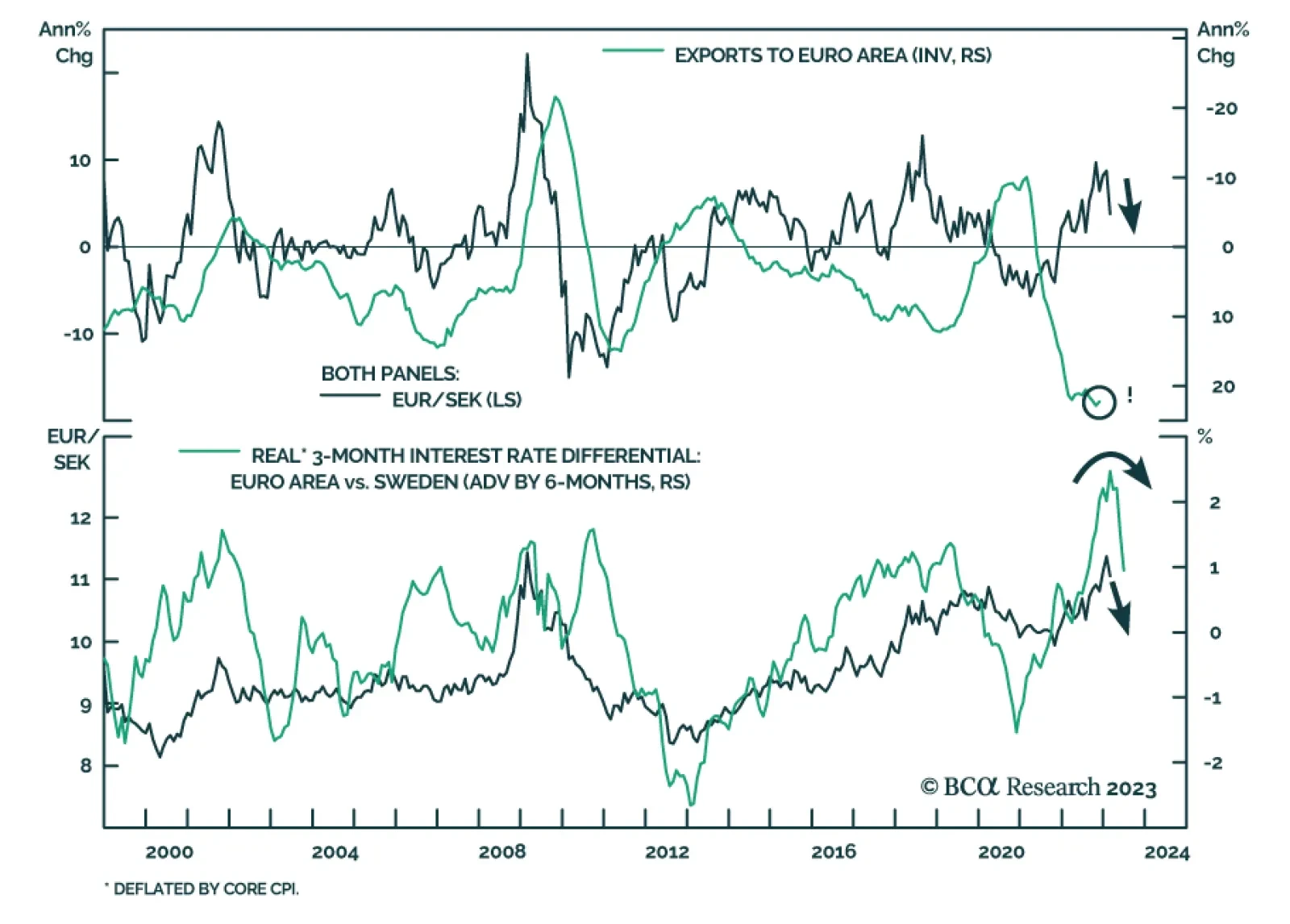

The EUR/SEK has been on a strong upward trend, appreciating 13% since its 2021 lows. However, its bull run is coming to an end. According to BCA’s European Investment Strategy team, this cross is now expensive and short-…

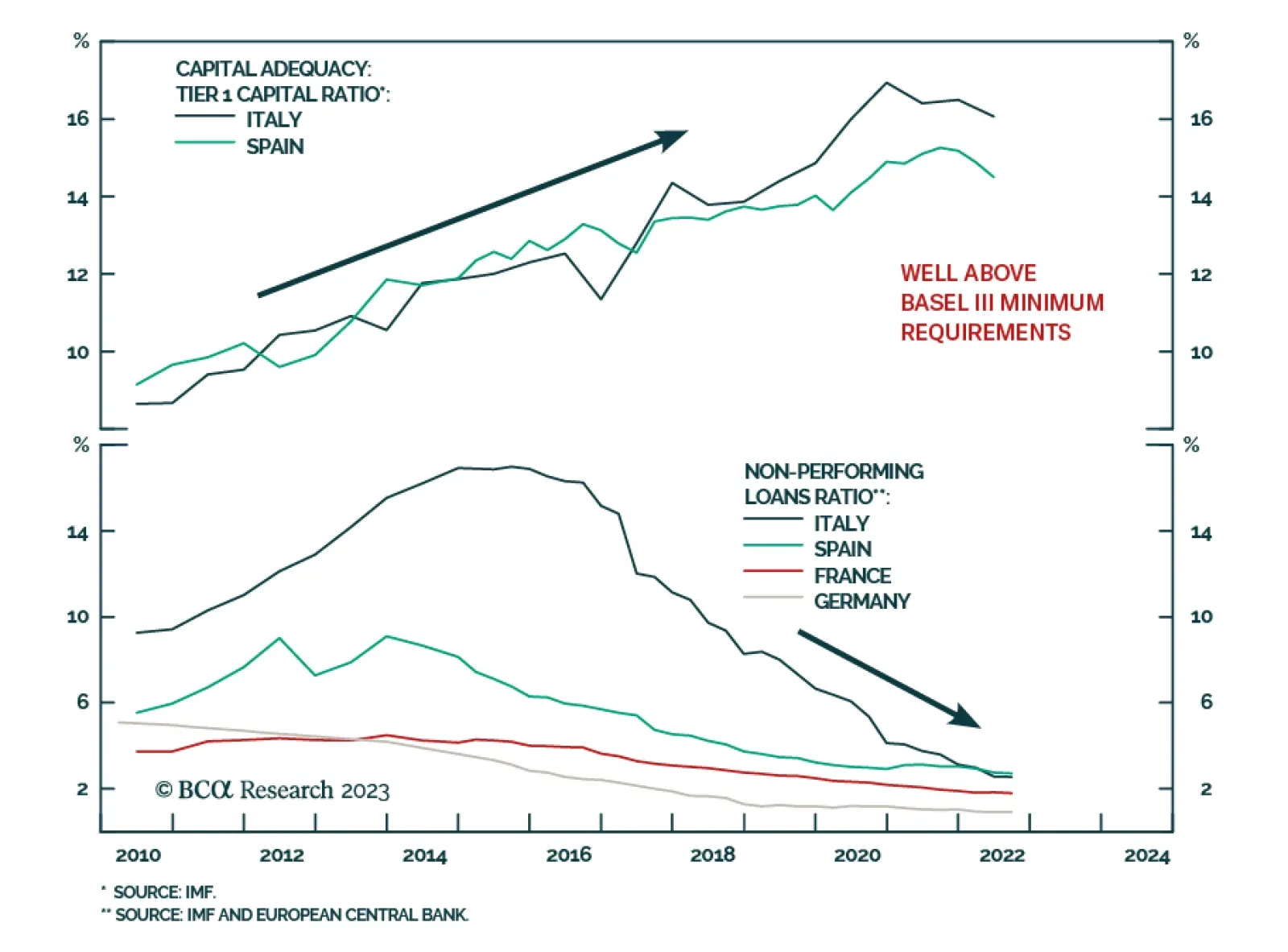

According to BCA Research’s European Investment Strategy service, the green light to buy and overweight European banks and financials will come once the ECB relents on its hiking campaign. The positive long-term outlook…

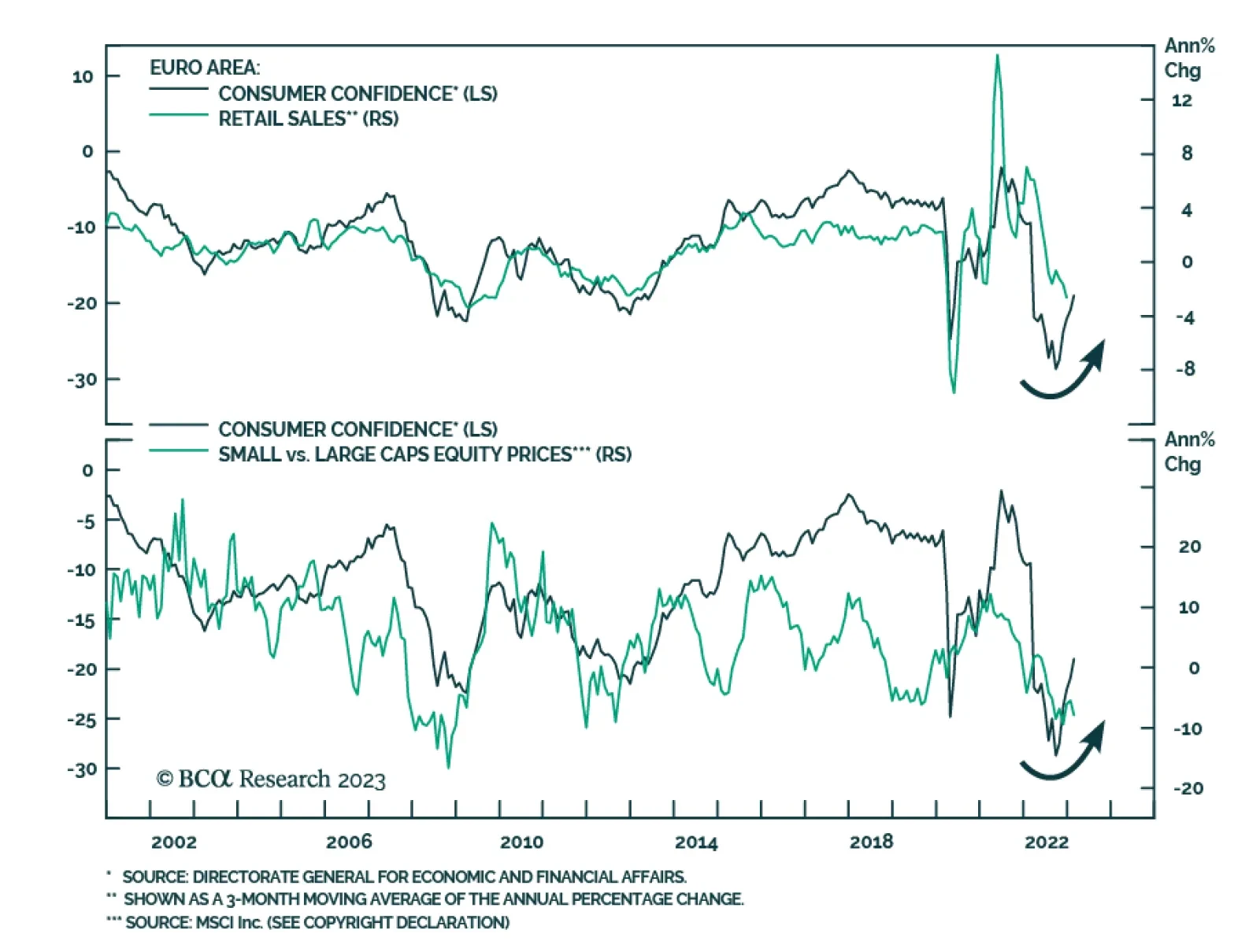

The preliminary estimate of the European Commission’s consumer confidence indicator rose by 1.7 points to a 1-year high of -19 in February, in line with expectations. This marks the fifth consecutive improvement in…

Long-term drivers, including the growing ability of banks to returns cash to shareholders, point toward a strong structural performance for European financials. However, the ECB’s aggressive tightening campaign could still spoil the…

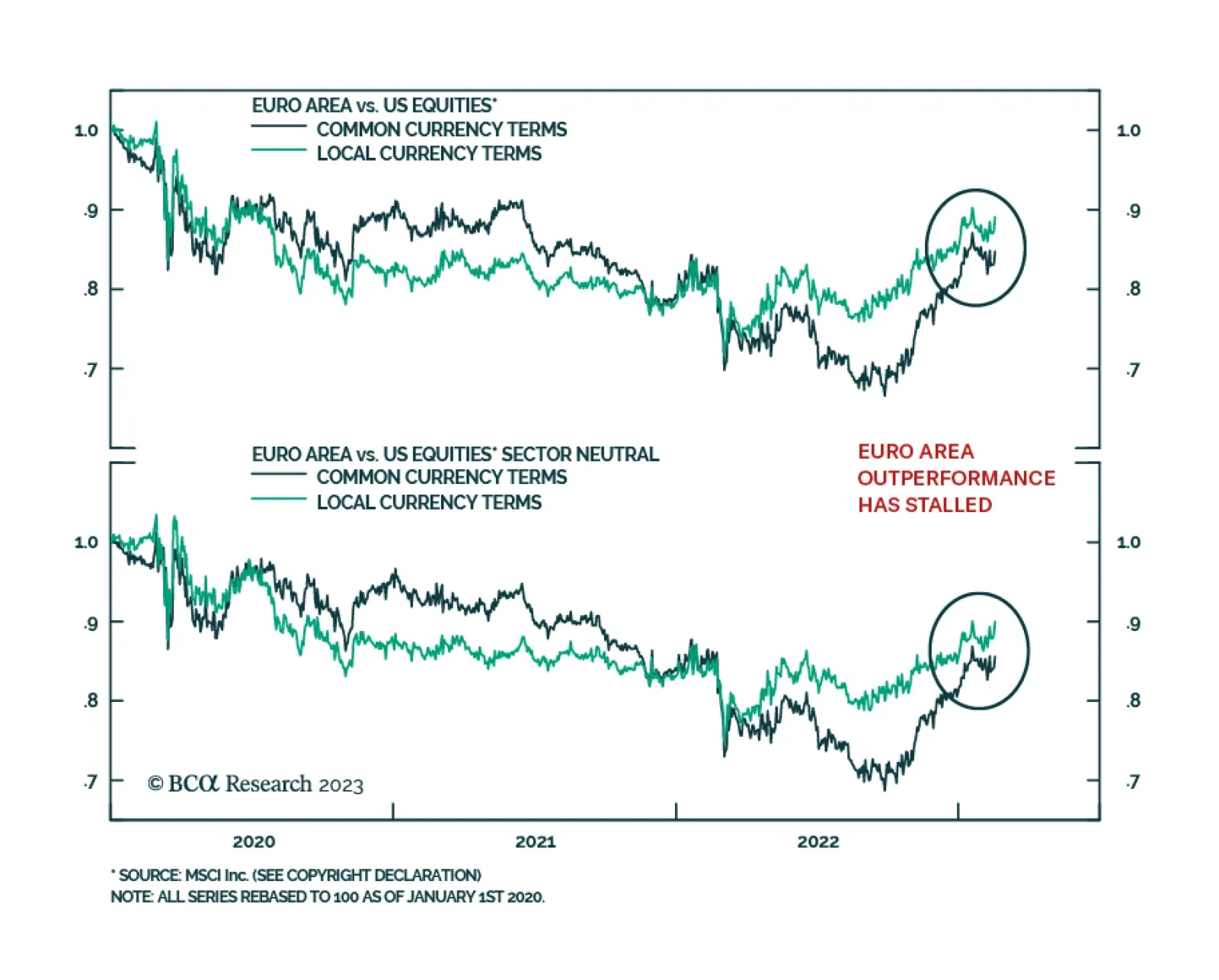

The four-month-long outperformance of Eurozone equities relative to US stocks has recently stalled. Multiple factors explain this dynamic. A strengthening US dollar reduces foreign gains when expressed in US dollars. Thus,…

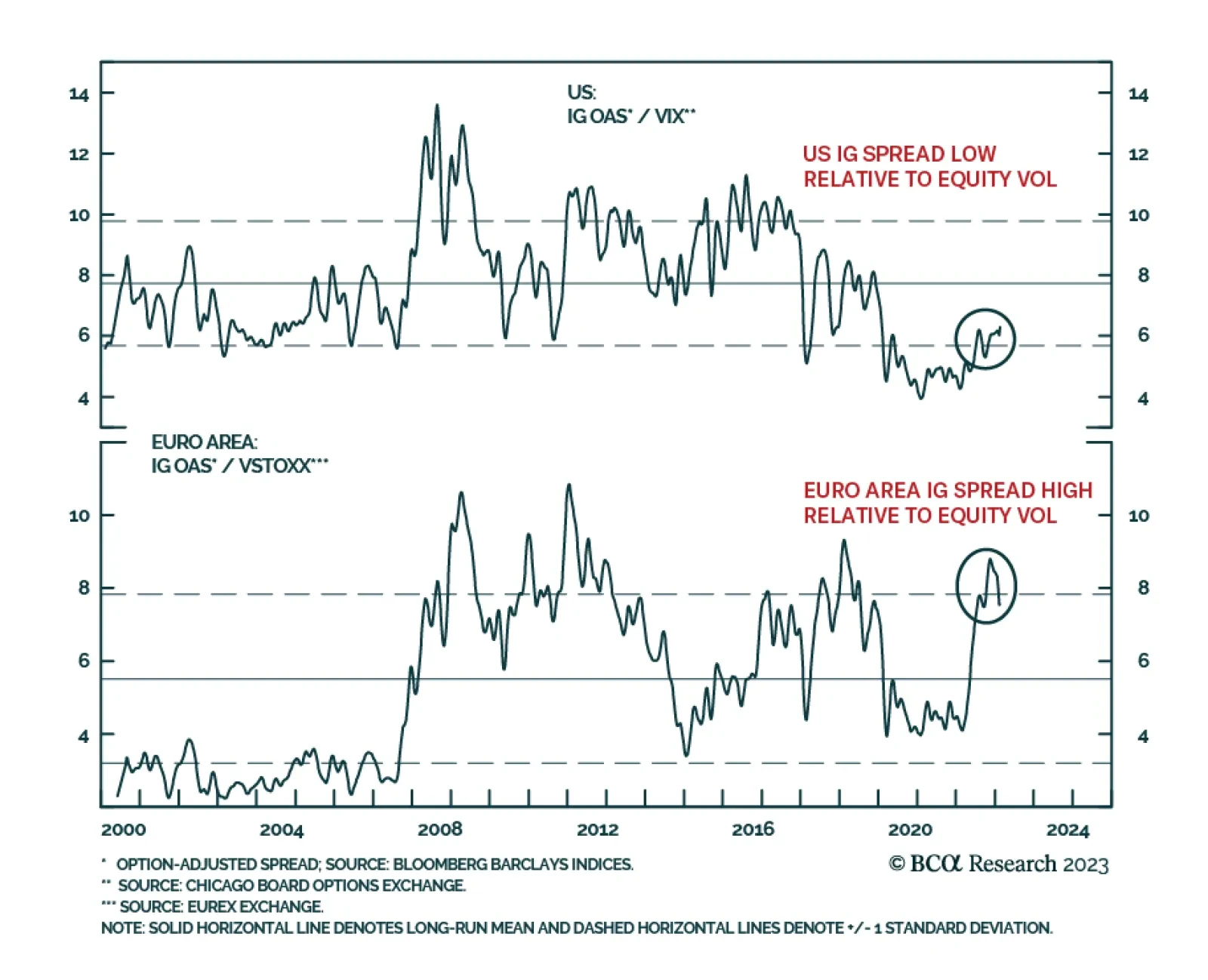

According to BCA Research’s Global Fixed Income Strategy service, European investment grade corporates are the most attractive among corporate bond markets in the US and Europe. Last year’s rise in US and European…

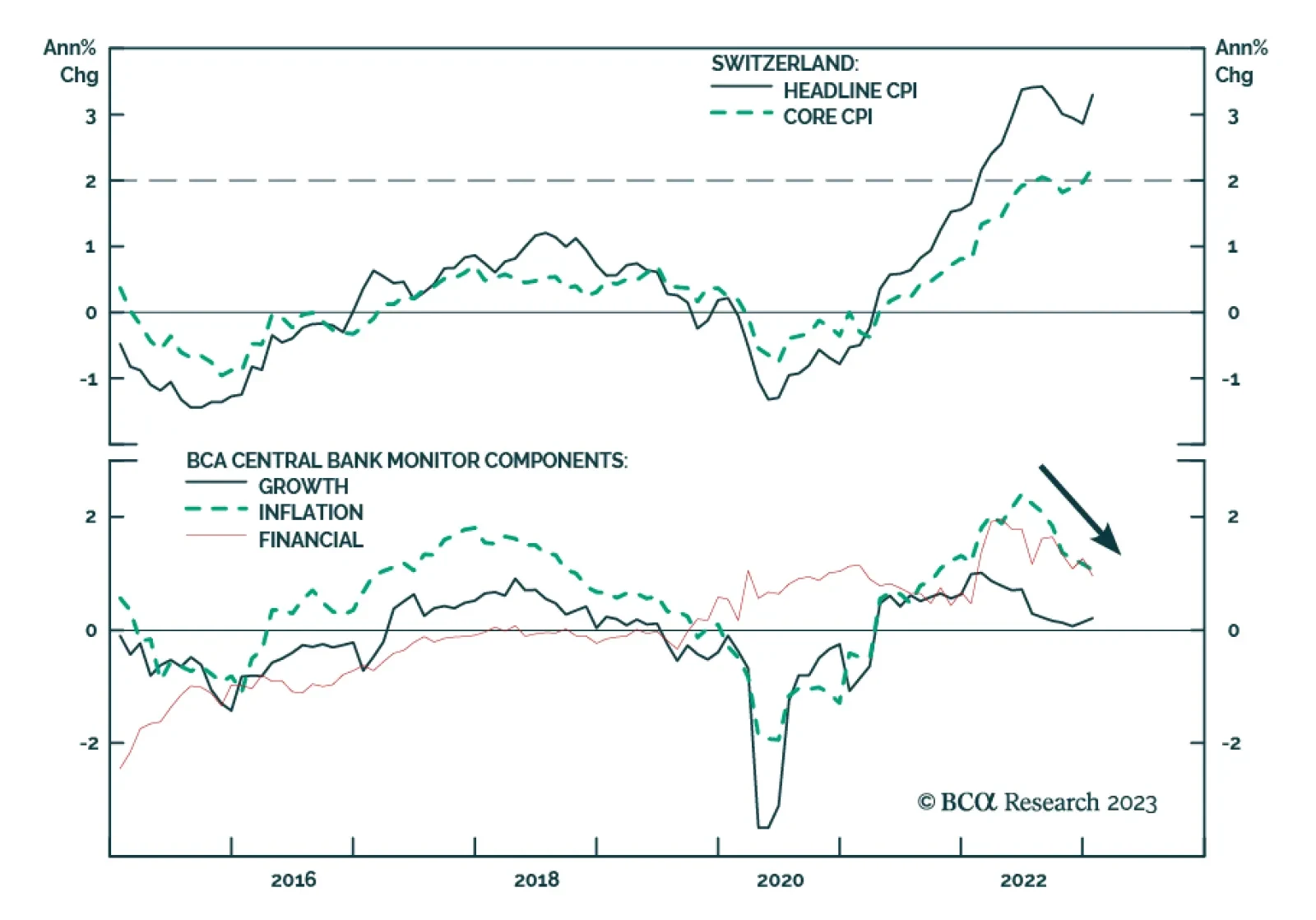

Data released on Monday shows Swiss inflation reaccelerated and came in above consensus estimates in January. Headline CPI inflation rose from 2.8% y/y to 3.3% y/y, exceeding expectations of 3.1% y/y. Notably core CPI…