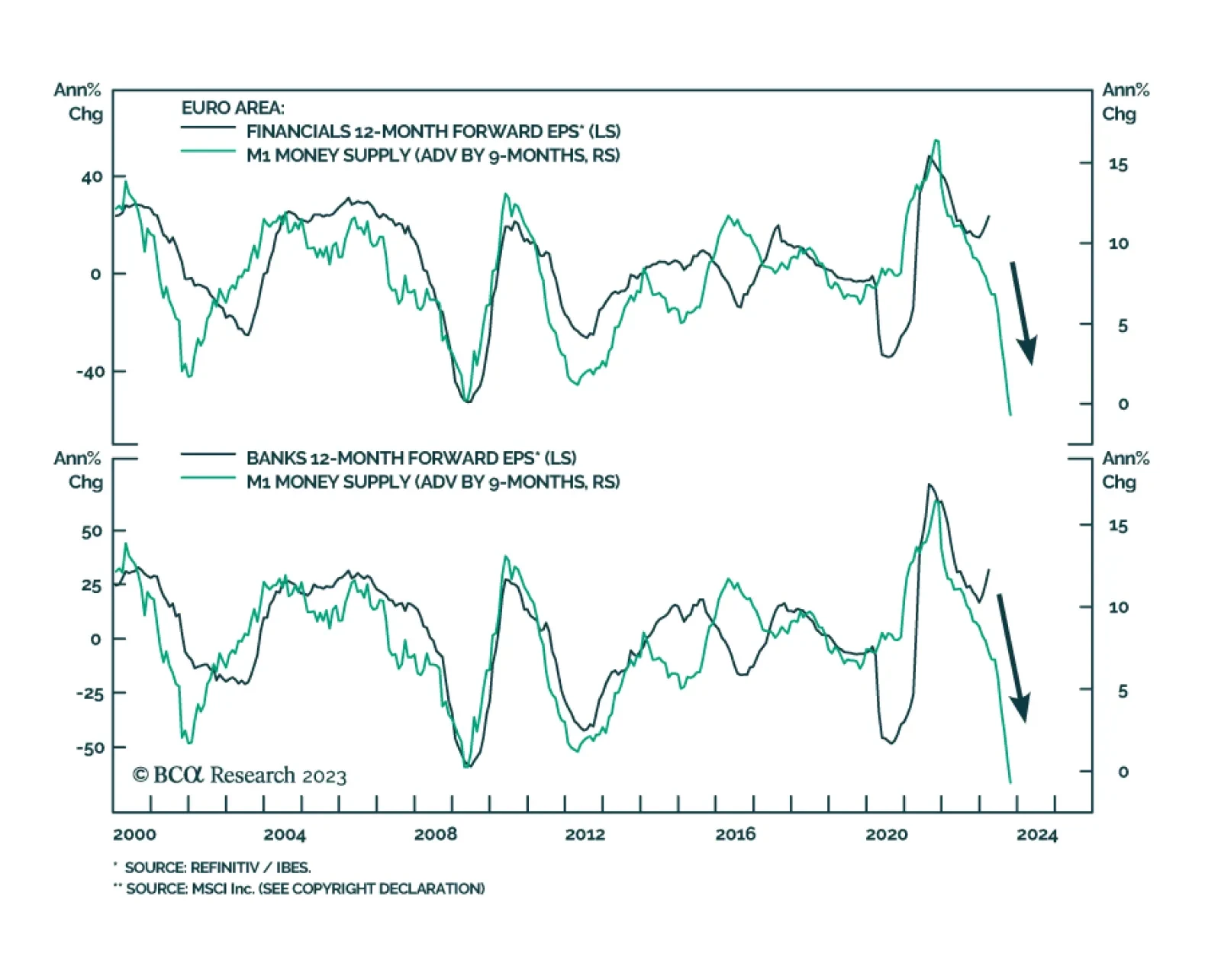

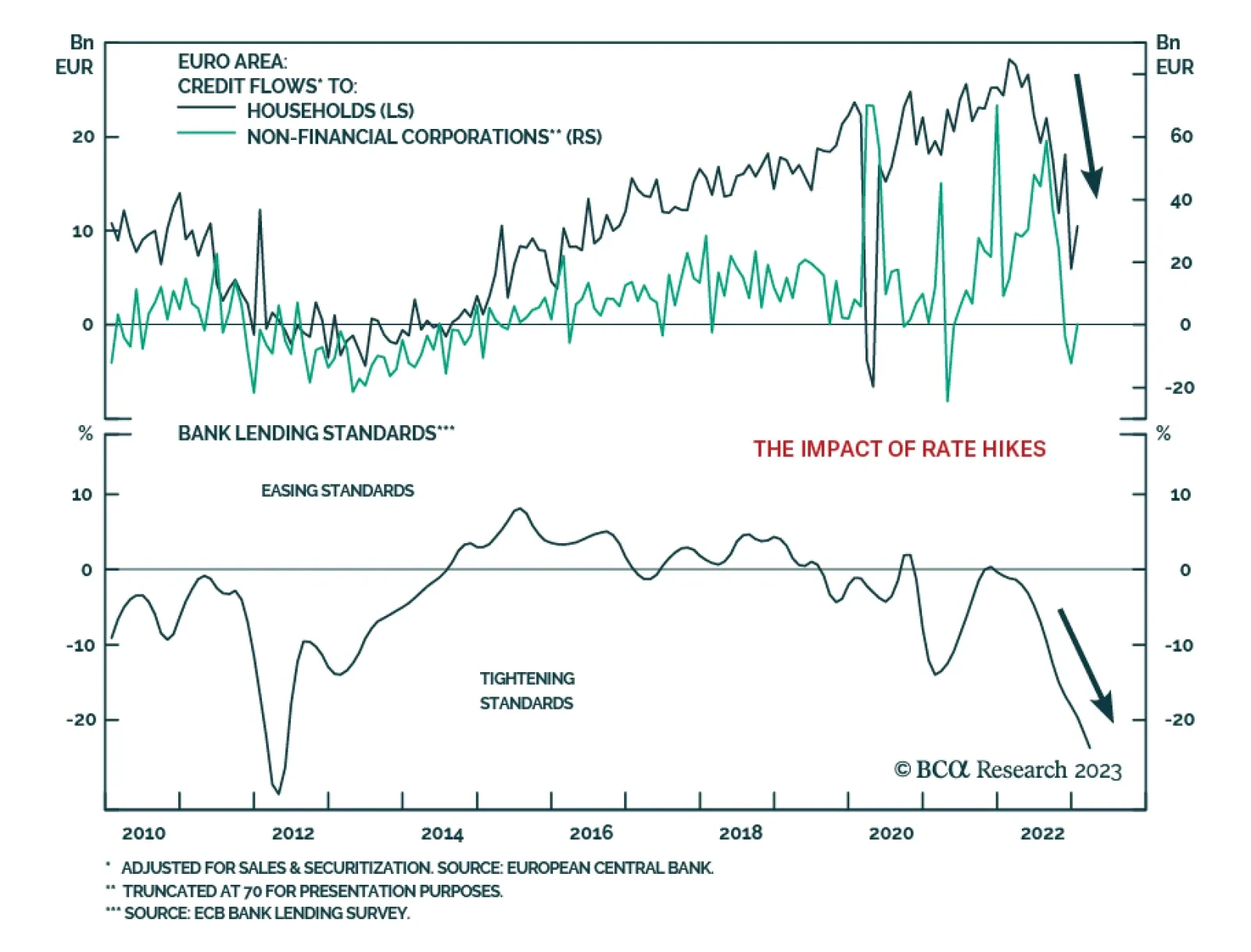

According to BCA Research’s European Investment Strategy service, the odds of a policy mistake whereby the ECB pushes interest rates to 4% or more have melted. On a near-term basis, the Credit Suisse saga will continue…

The turmoil in US regional banks will weigh on economic growth. Arguably, it would be better for the broader stock market if growth slowed because banks became more conservative in their lending than if it slowed because the Fed had…

Despite the European banking turmoil, the ECB followed through on its pledge to deliver a 50bps rate hike on Thursday. However, President Christine Lagarde refrained from providing any explicit forward guidance about the path for…

Bank failures are another ‘canary in the coal mine’ warning that a US recession is imminent, yet stocks, bonds, and the oil price are still a long way from fully pricing it.

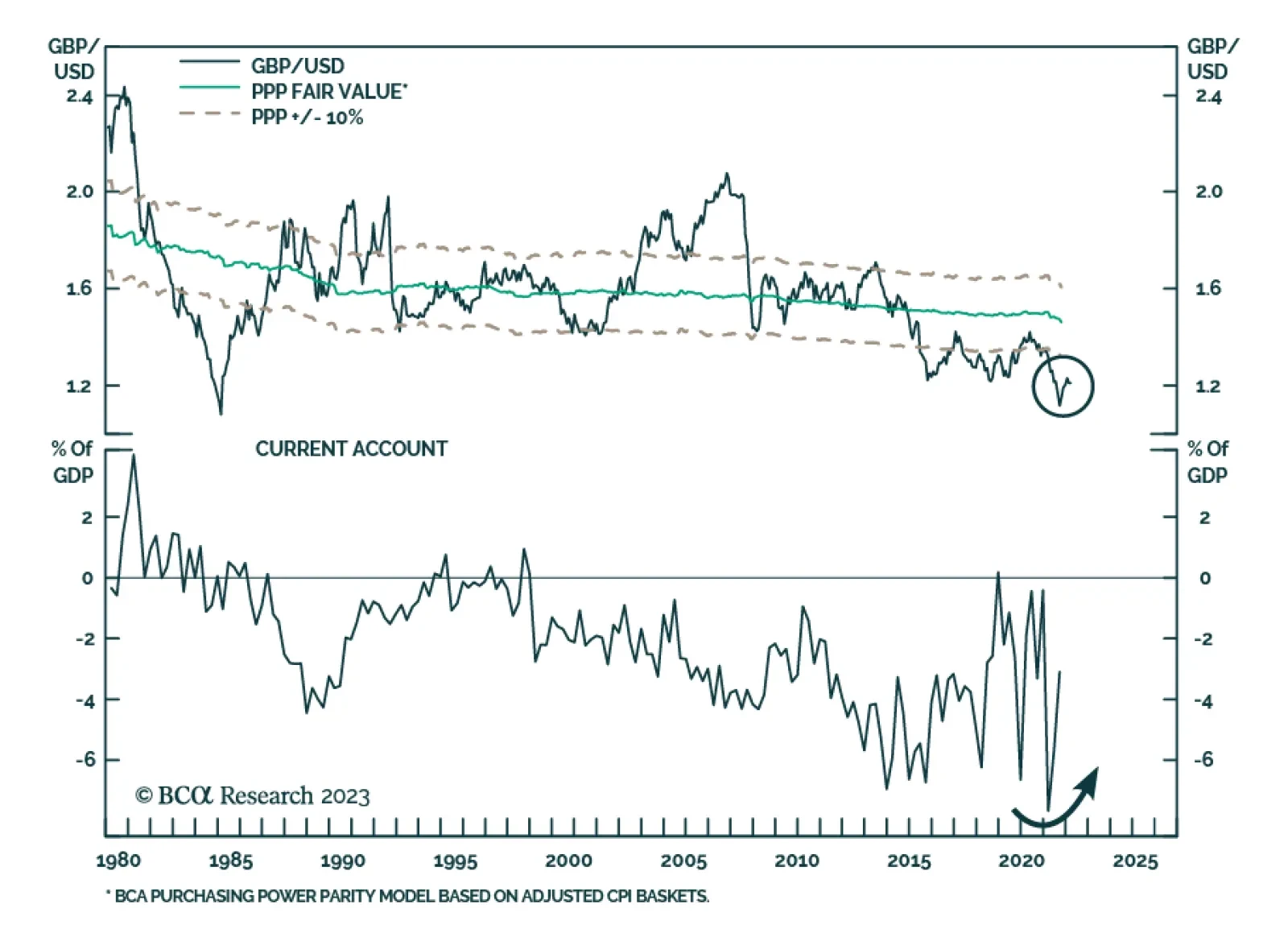

BCA Research’s European Investment Strategy service concludes that on a long-term basis, the pound is an attractive currency, but the near-term outlook is challenging. The long-term appeal of the GBP rests on three…

The UK economy is more resilient than was feared last year. While this will not help UK stocks, the Footsie’s long term prospects are appealing.

The development of trading blocs and the rise of economic warfare will lead to the inefficient allocation of resources. Higher fiscal outlays and tight commodity supplies will feed into energy prices driving headline inflation. It…

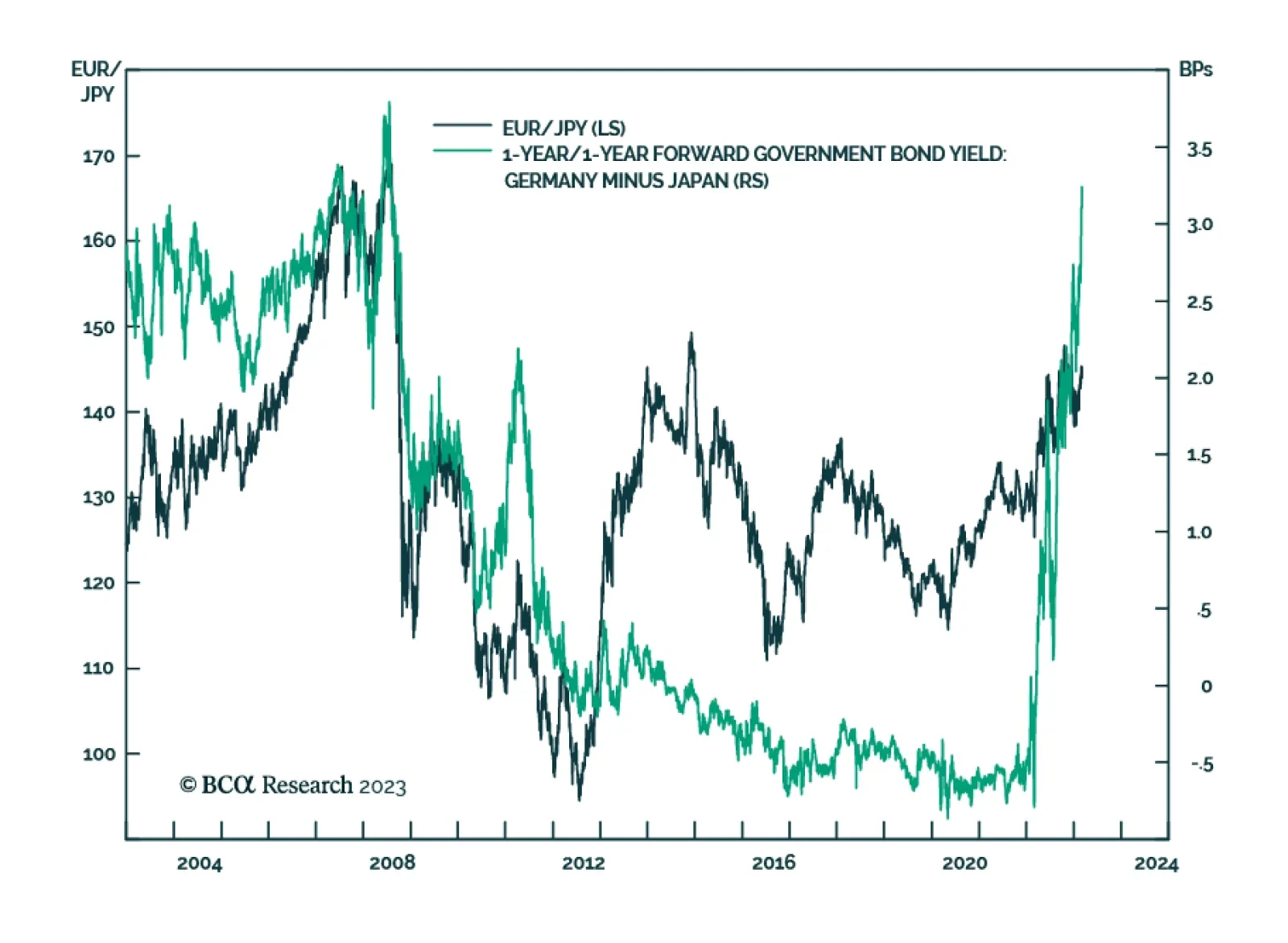

The strength in the euro versus the yen since May 2020 can be divided into two phases. During the first phase, from May 2020 to June 2021, the ebbing of the worst of the pandemic and the re-opening of the global economy boosted…

The combination of collapsing energy inflation and cooling wage inflation means that euro area core inflation will slump later this year. We discuss the consequences.

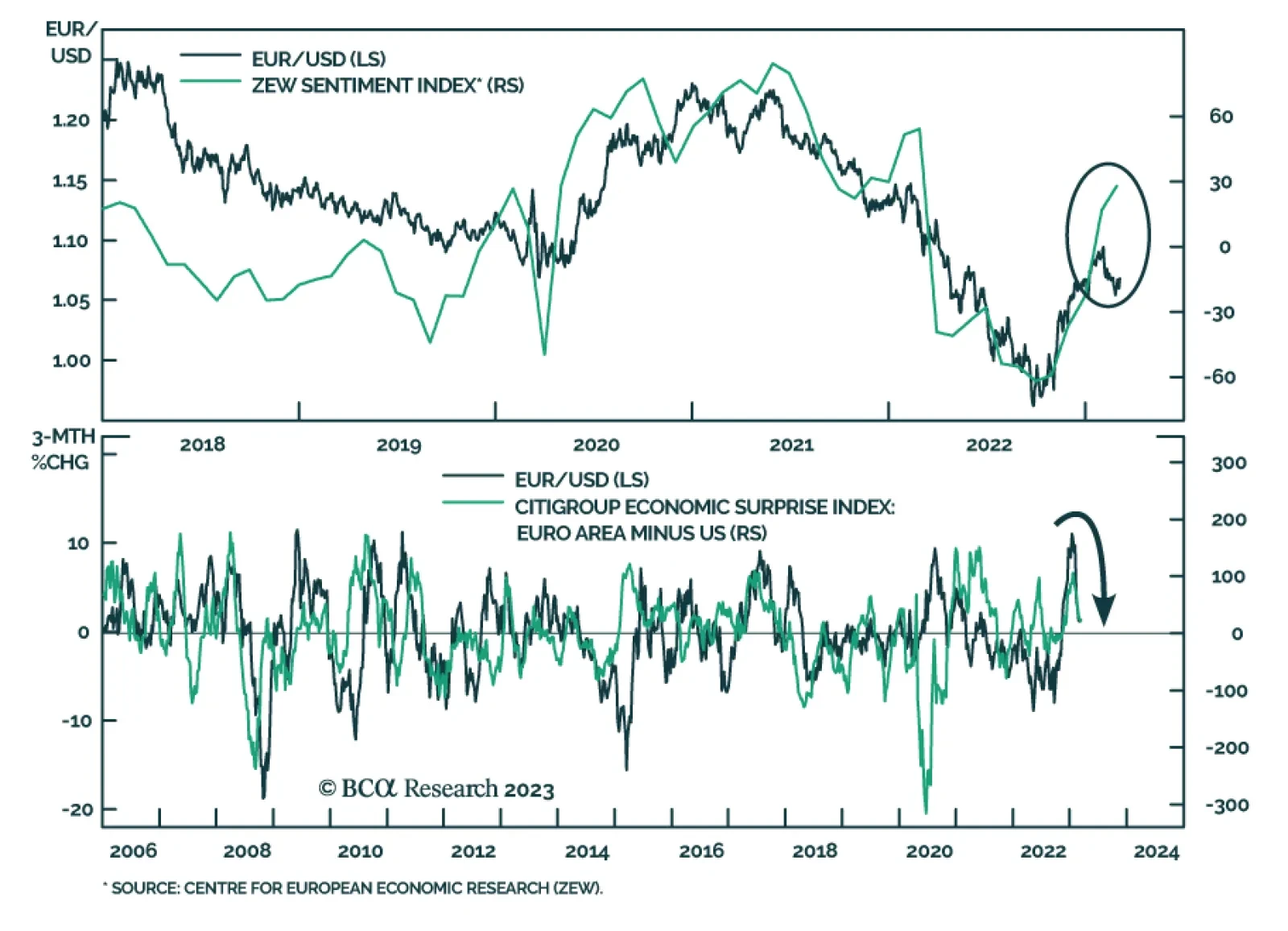

BCA Research’s European Investment Strategy & Foreign Exchange Strategy services conclude that for the next one-to-three months, European data could continue to underwhelm US variables, which will weigh on the euro.…