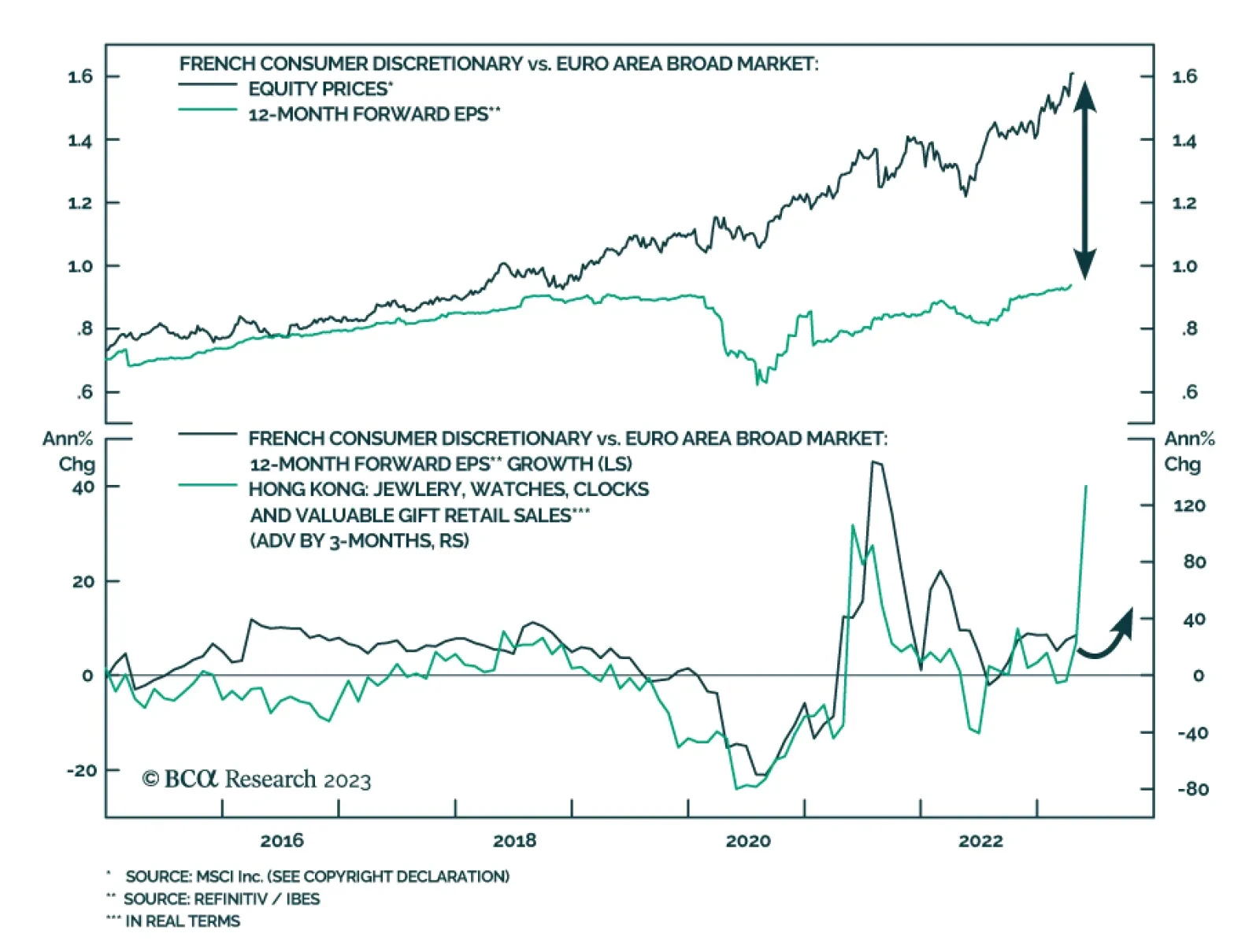

French MSCI consumer discretionary shares have performed strongly over the past year, booking a gain of 31%. Consequently, they have outperformed global consumer discretionary by 42%, and the Eurozone stock market by 24%. As a…

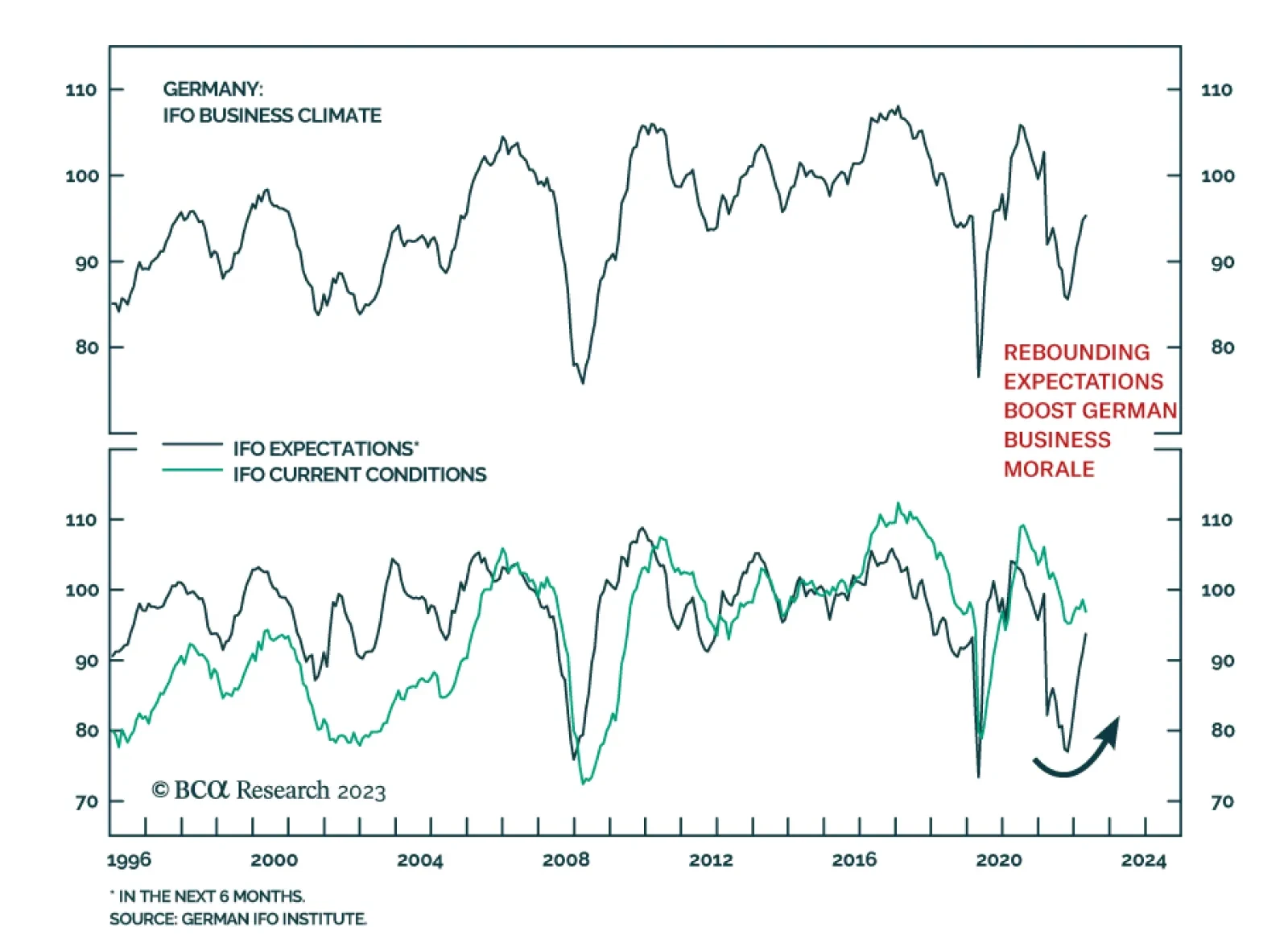

Germany’s Ifo Business Climate Index inched up from 93.2 to 93.6 in April, slightly above anticipations of a more muted rise to 93.4. Interestingly, a 1.2-point increase in the Expectations components drove the improvement…

European equities continue to inch closer to record highs, yet, their earnings outlook is deteriorating. How can investors build hedging portfolios using the message from earnings and valuations to protect themselves against the…

We are increasing our gold price target to $2,200/oz, given the increasing risk of fiscal dominance in the US, rising geopolitical risk, the return of trading blocs and currency debasement risk. These risks also will increase…

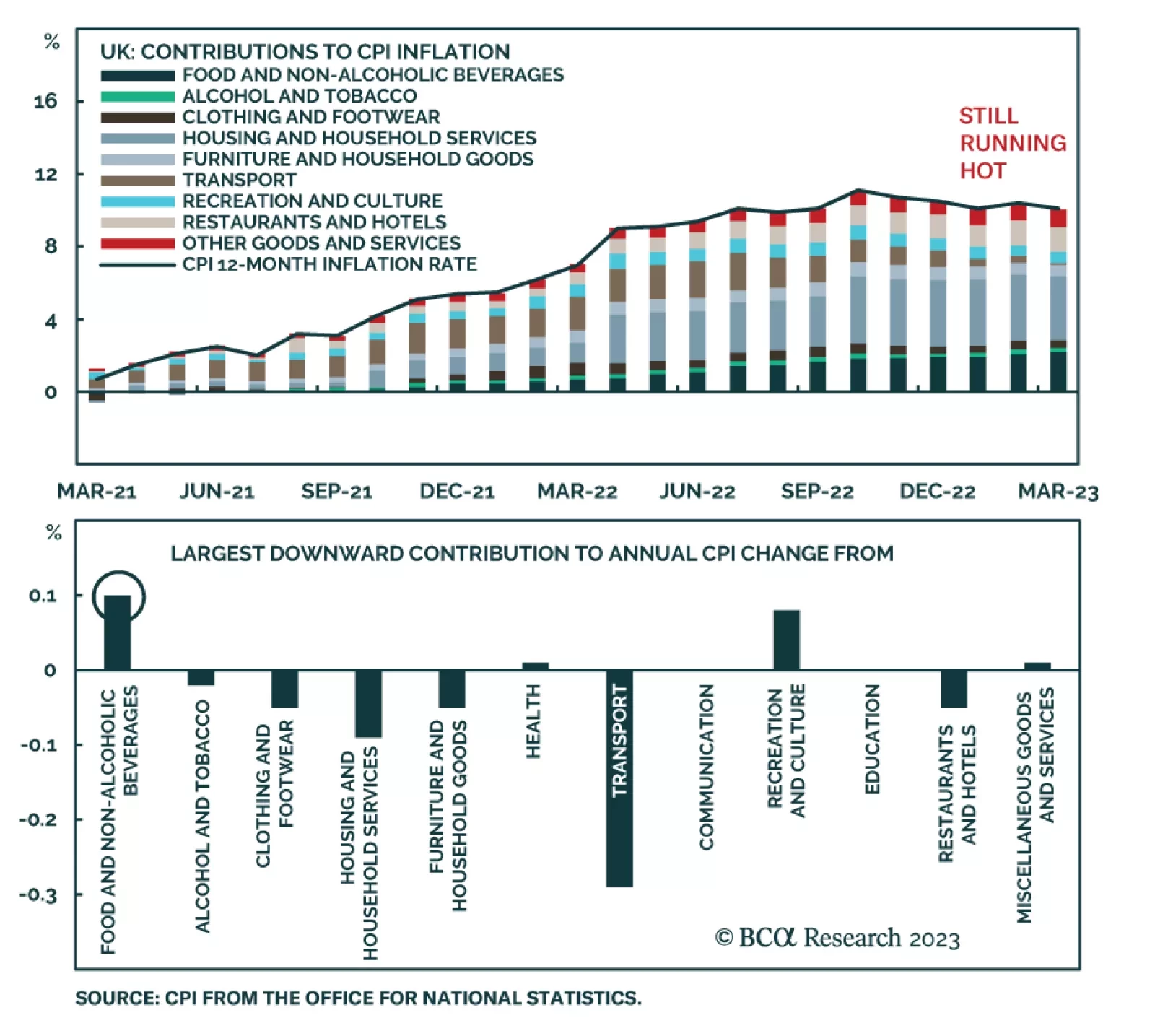

UK inflation came in hotter-than-anticipated in March. Headline inflation remained in double digits at 10.1% y/y, above expectations that it would recede from 10.4% y/y to 9.8% y/y. Similarly, the core index was unchanged at 6.2…

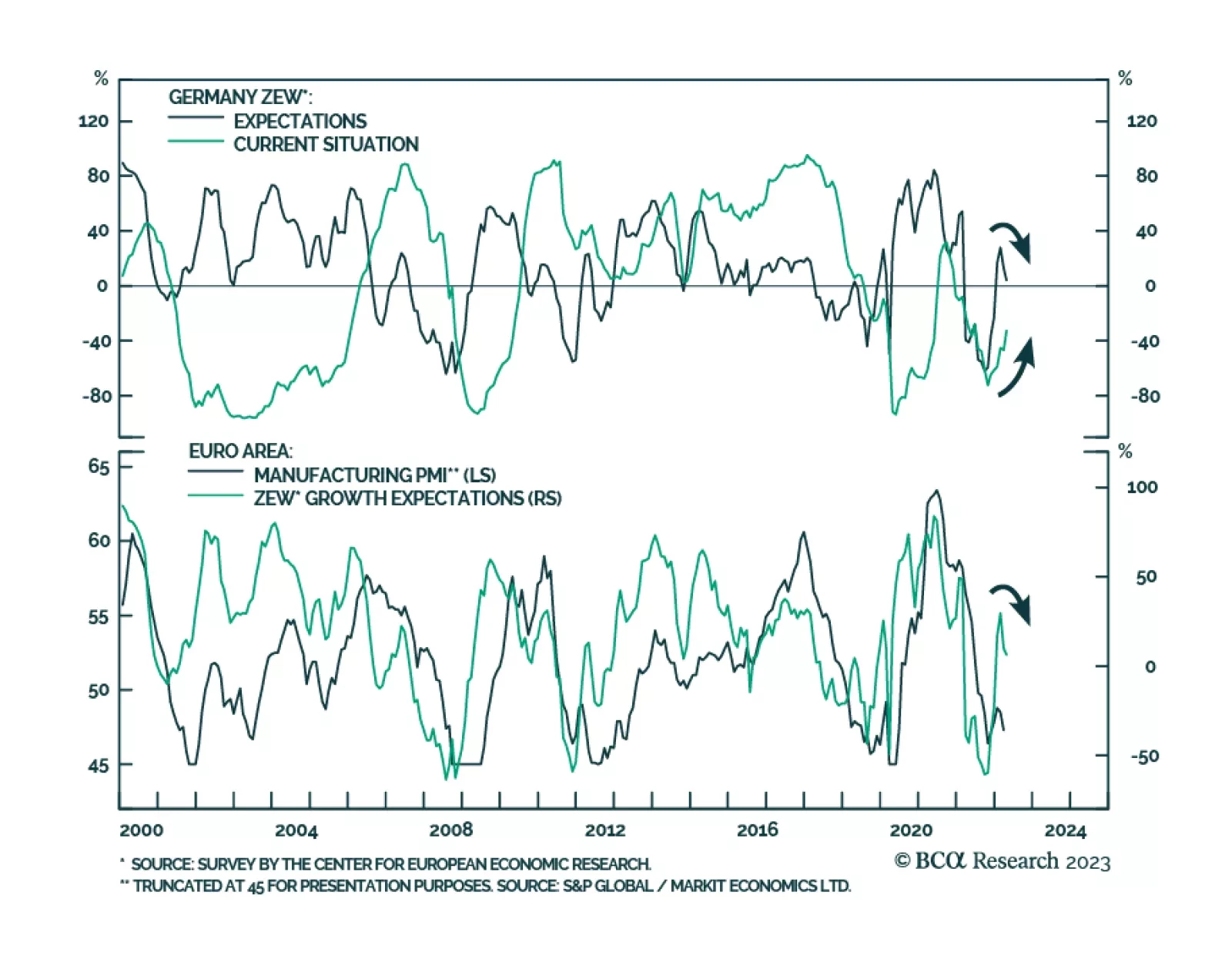

The ZEW Survey of German investor sentiment unexpectedly deteriorated in April. The sentiment index fell 8.9 points to 4.1, disappointing consensus estimates of an uptick to 15.6 and recording its second consecutive monthly…

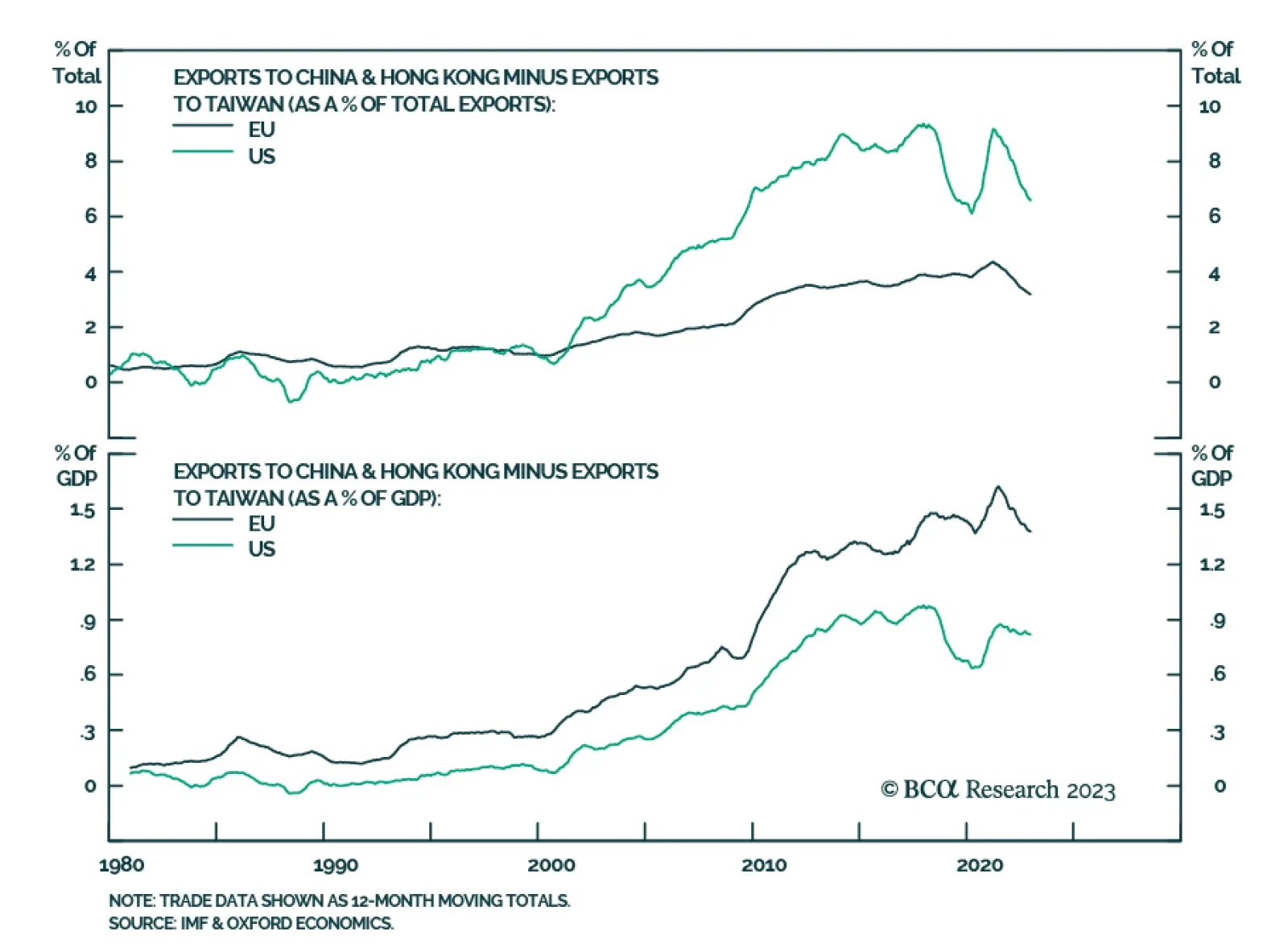

The reason why the EU will try to balance economic ties with China along with defense ties with the US for as long as possible is not strictly economic. Europe and the US are much more reliant on China than Taiwan for trade, but…

The top diplomats of the G7 countries – US, Japan, UK, Canada, Germany, France, Italy – plus the European Union are meeting in Karuizawa, Japan on April 16-18. The summits are going forward despite Japan’s…

We Introduce our new macro models for the Eurozone’s equity earnings, which include sectoral forecasts. Find out what they predict for the next six-to-nine months.

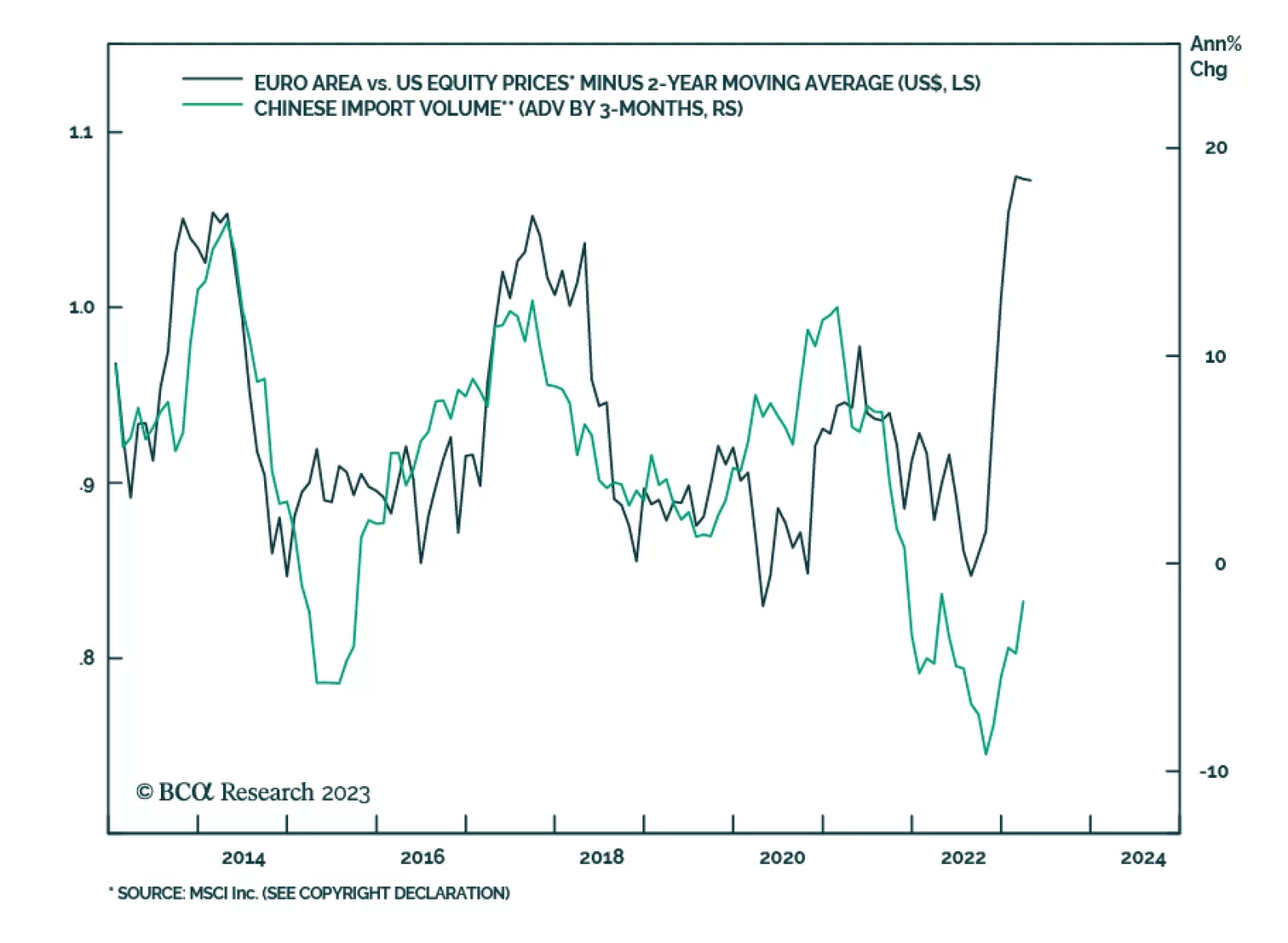

Euro Area stocks have gained 41.4% in USD terms since their late-September bottom. In the process, they have outperformed their US counterparts by 29%. After a brief period of weakness during the early-March bank turmoil,…