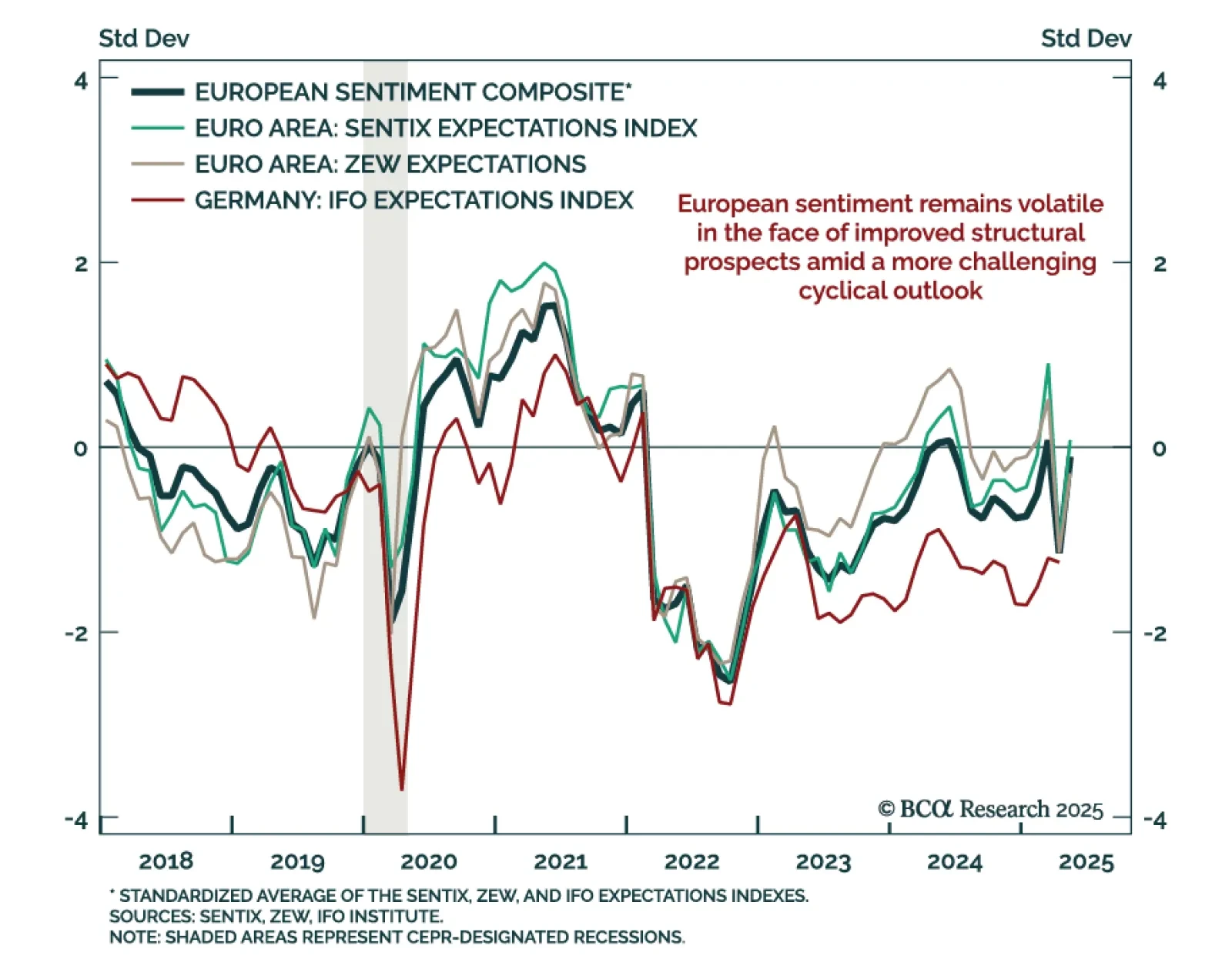

The rebound in Eurozone sentiment is encouraging but headwinds persist, justifying a defensive stance on European assets. The May ZEW expectations index jumped to 11.6 from -18.5 in the Eurozone, with Germany’s gauge also rising to…

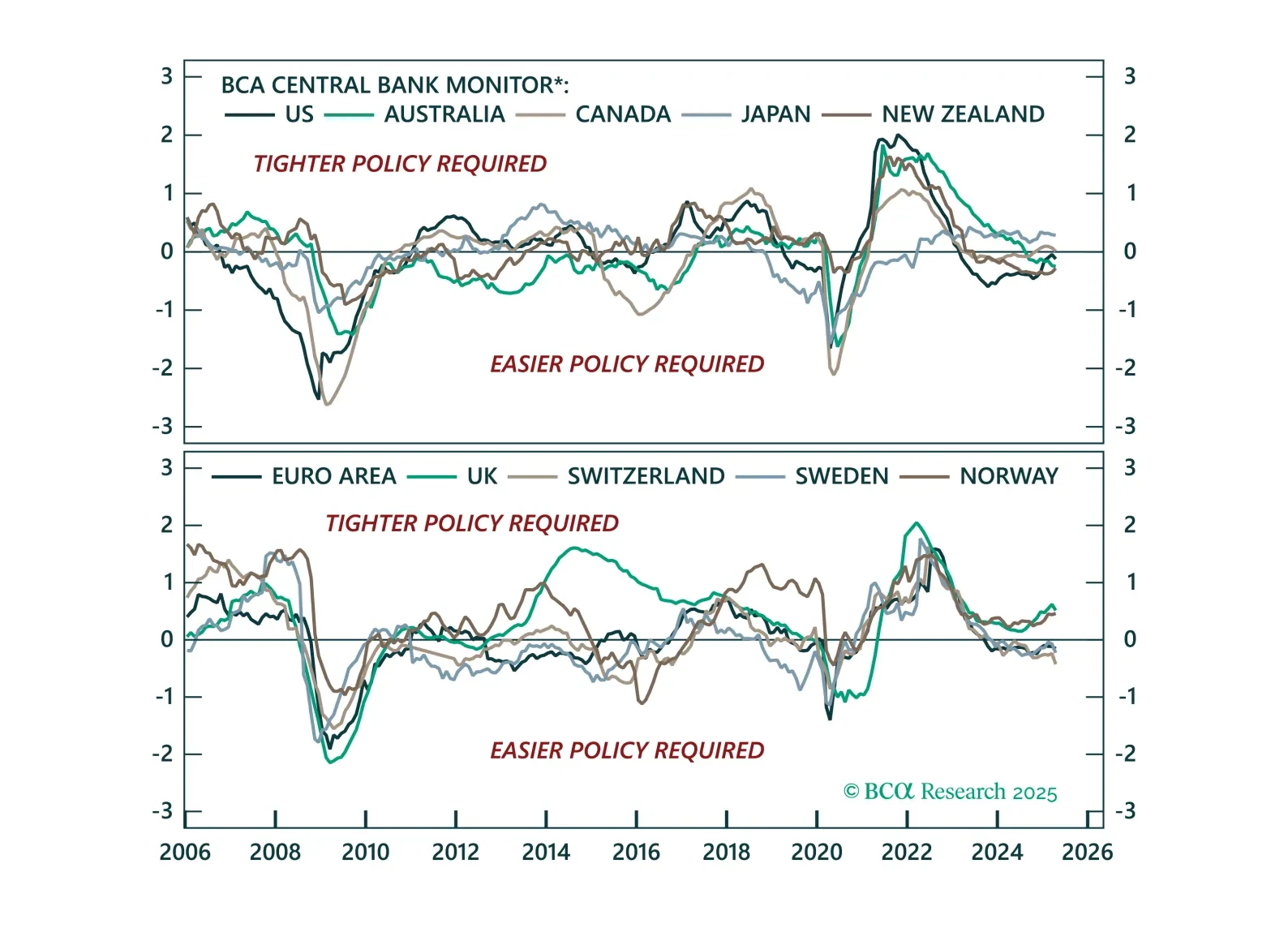

The easing bias remains, but not all central banks are equal. This Central Bank Monitor update reveals who is ready to cut more and who is still pretending not to.

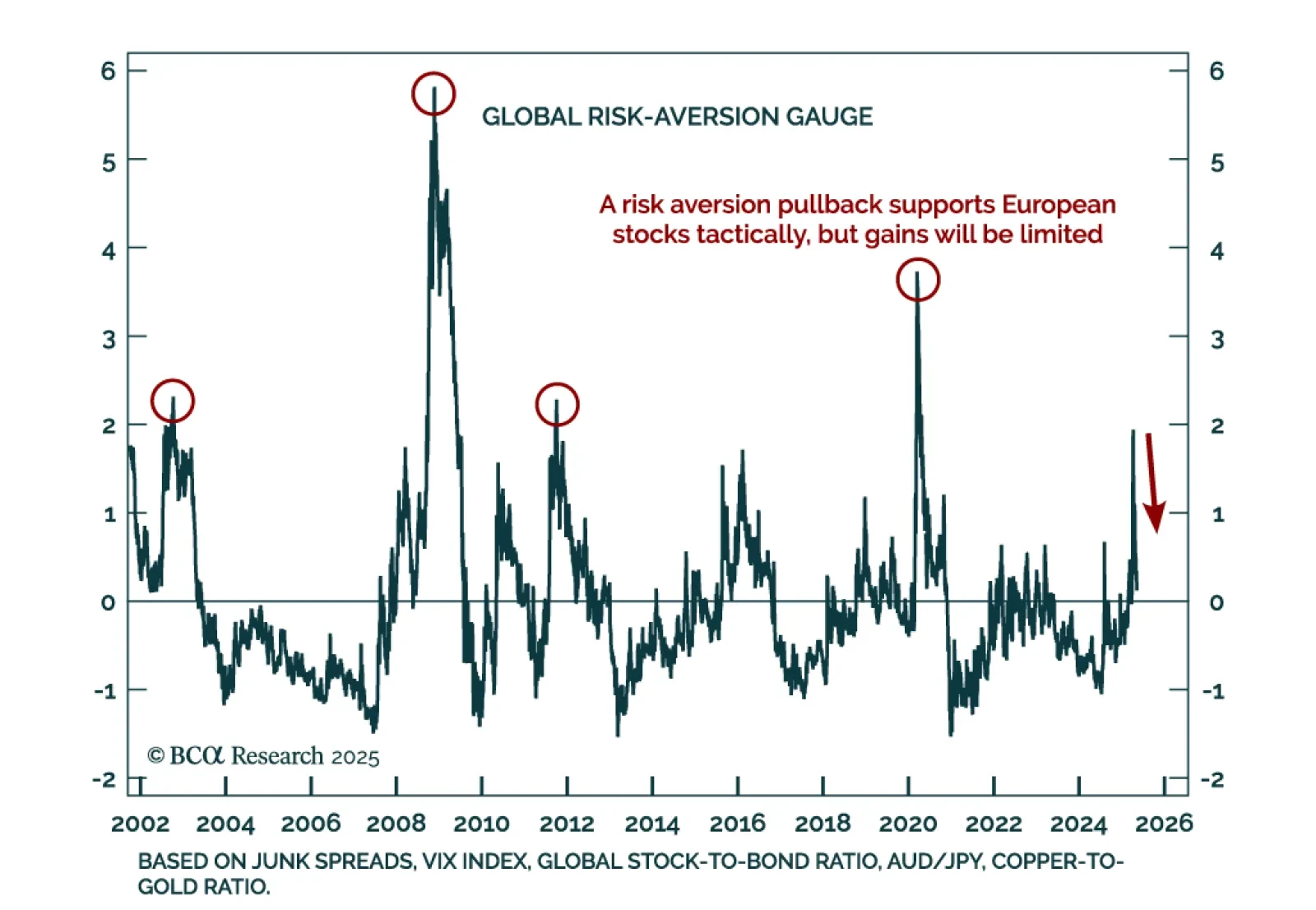

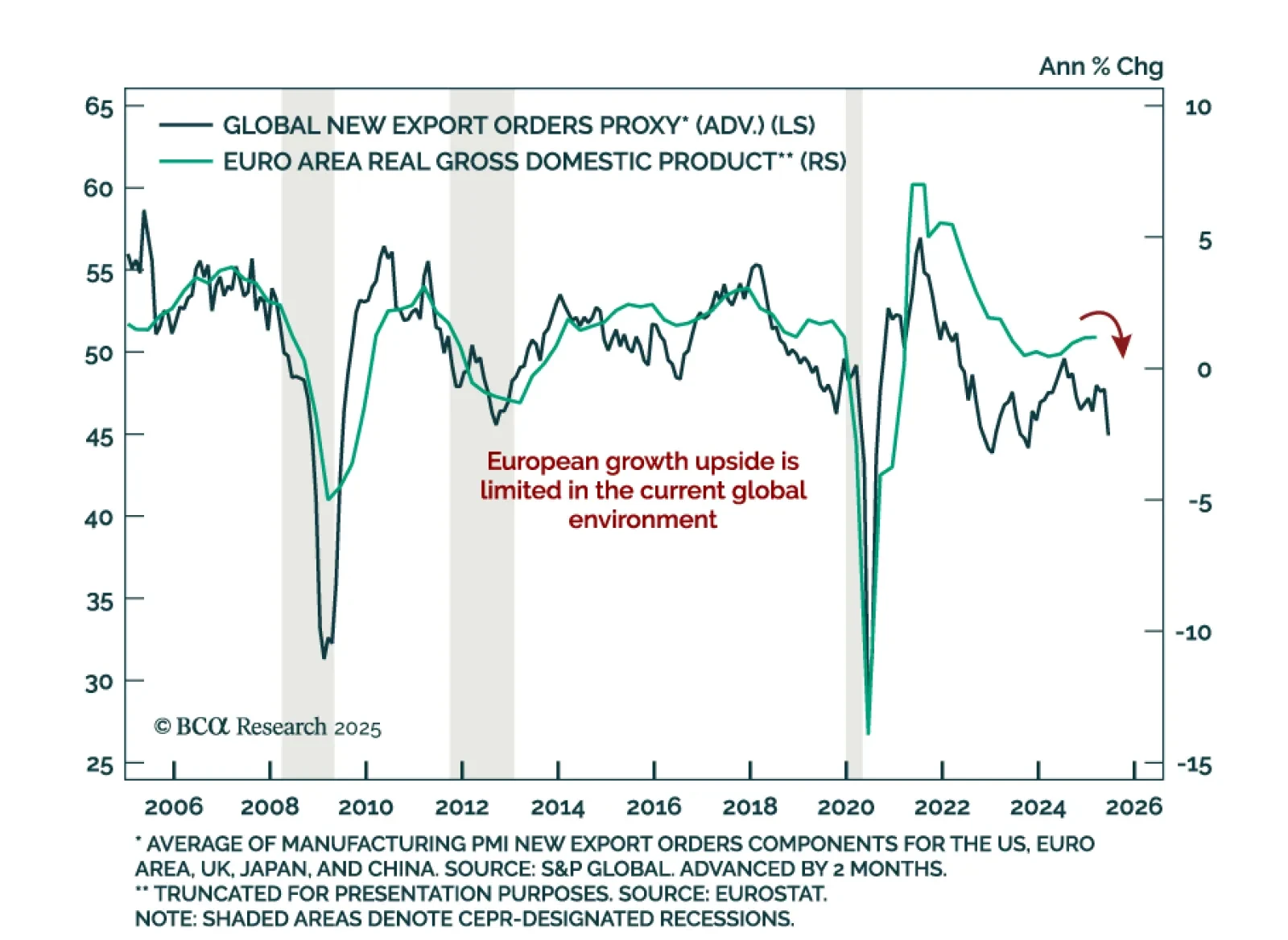

European equities have some short-term support, but global growth risks will cap gains. Our Chart Of The Week comes from Mathieu Savary, Chief European Investment Strategist. Mathieu sees probable but limited upside for European…

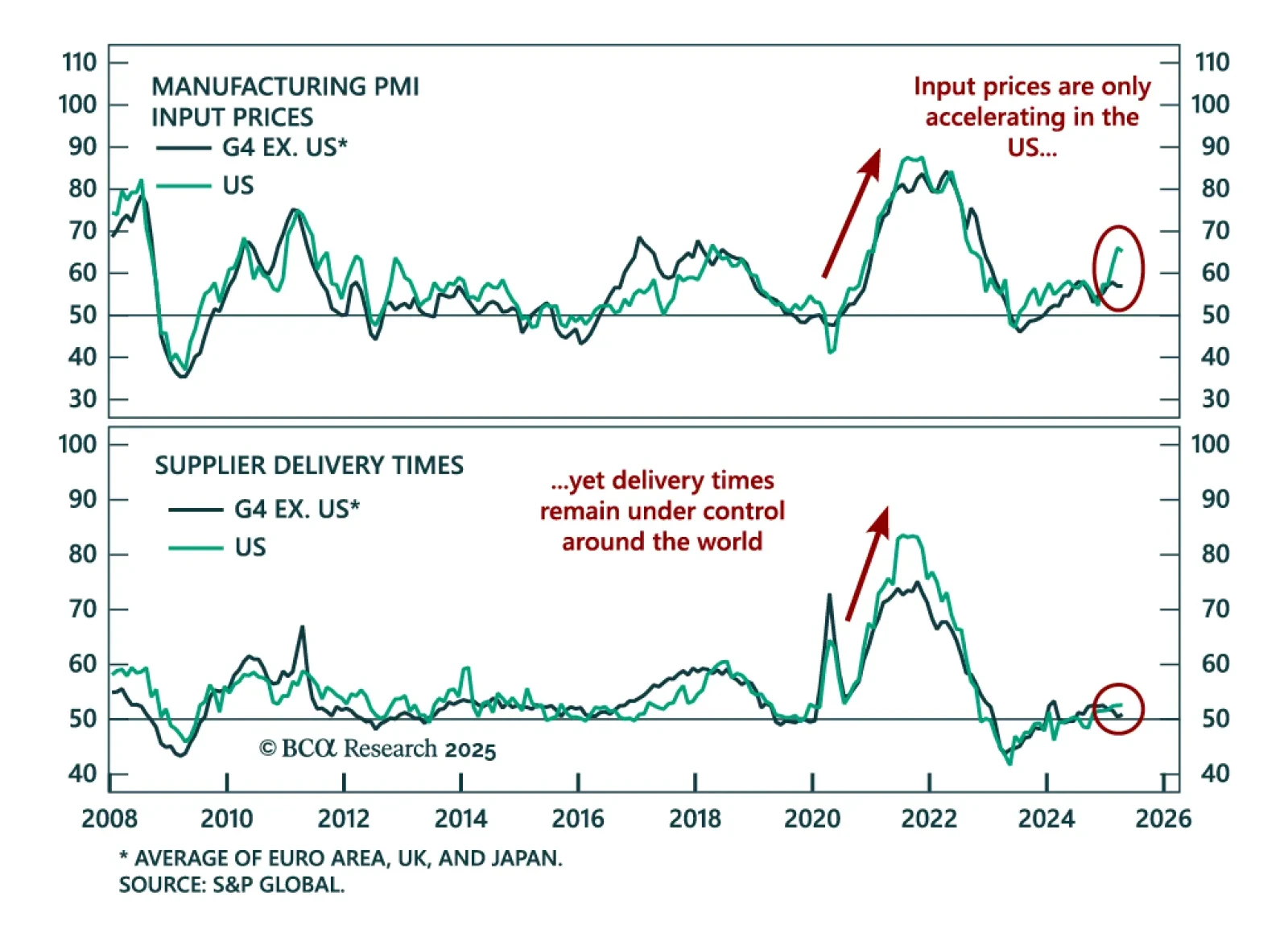

The inflation divergence between the US and Eurozone drives our call to stay long US duration. Inflation, typically a lagging indicator, blends slow-moving labor pressures with fast-moving supply drivers. The COVID inflation spike…

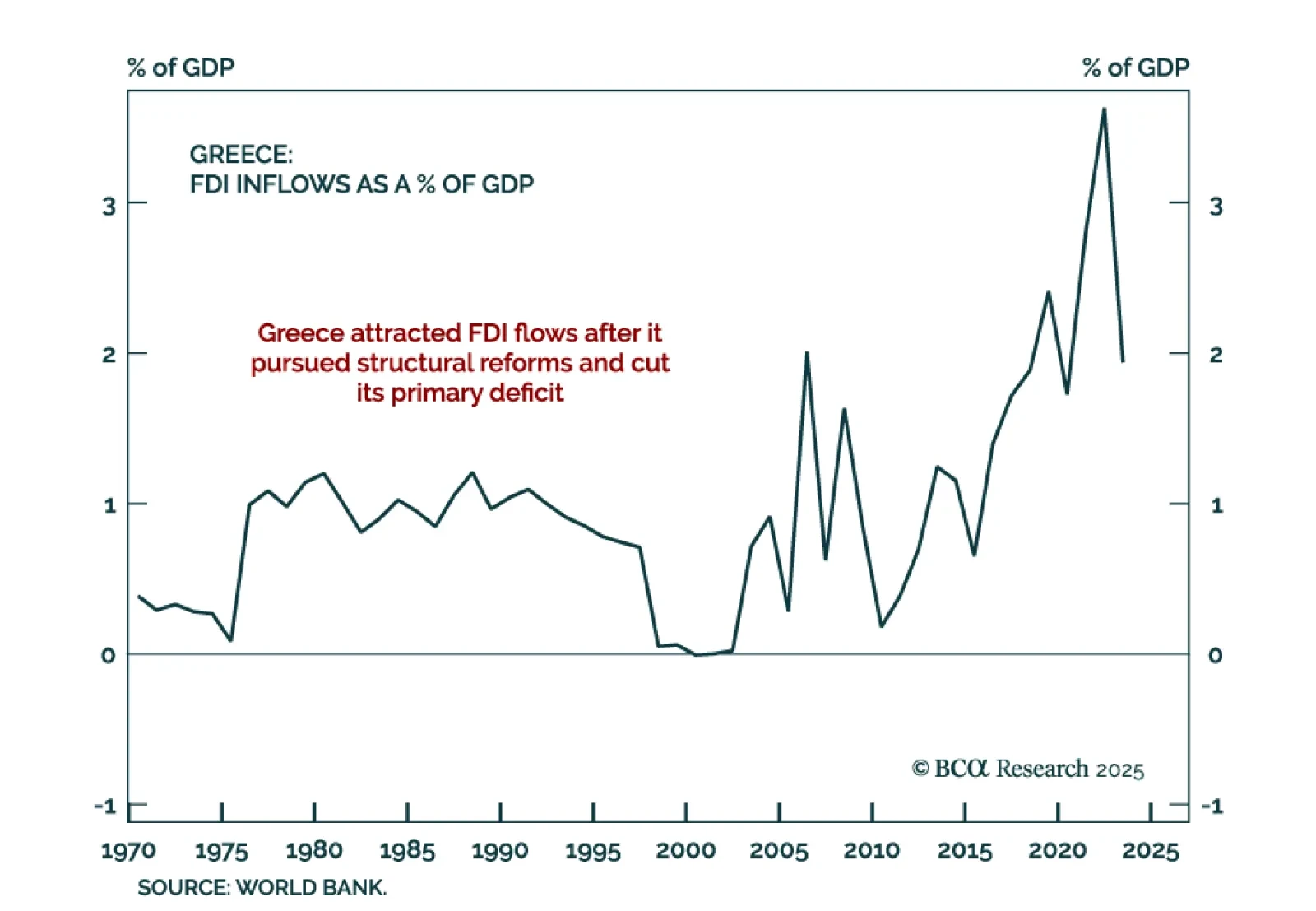

Our GeoMacro strategists remain negative toward US equities as President Trump’s efforts to limit the foreign investments of US firms will undercut their competitiveness. FDI brings clear strategic and financial gains, both…

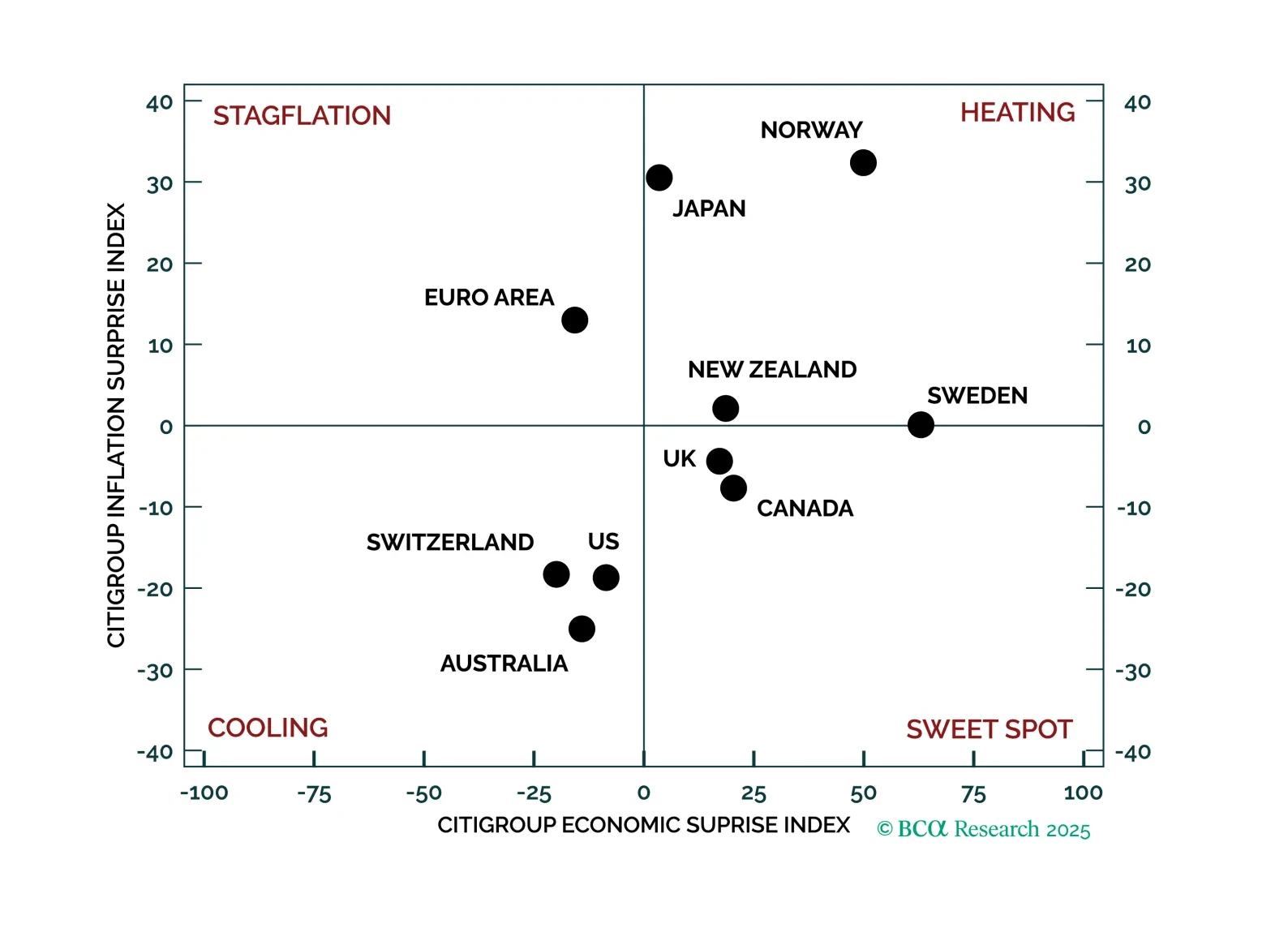

We apply our systematic approach to investing based on economic, inflation, and monetary policy surprises to the major global bond markets. The economic regimes defined by the current macro-surprises setup confirm our existing fixed-…

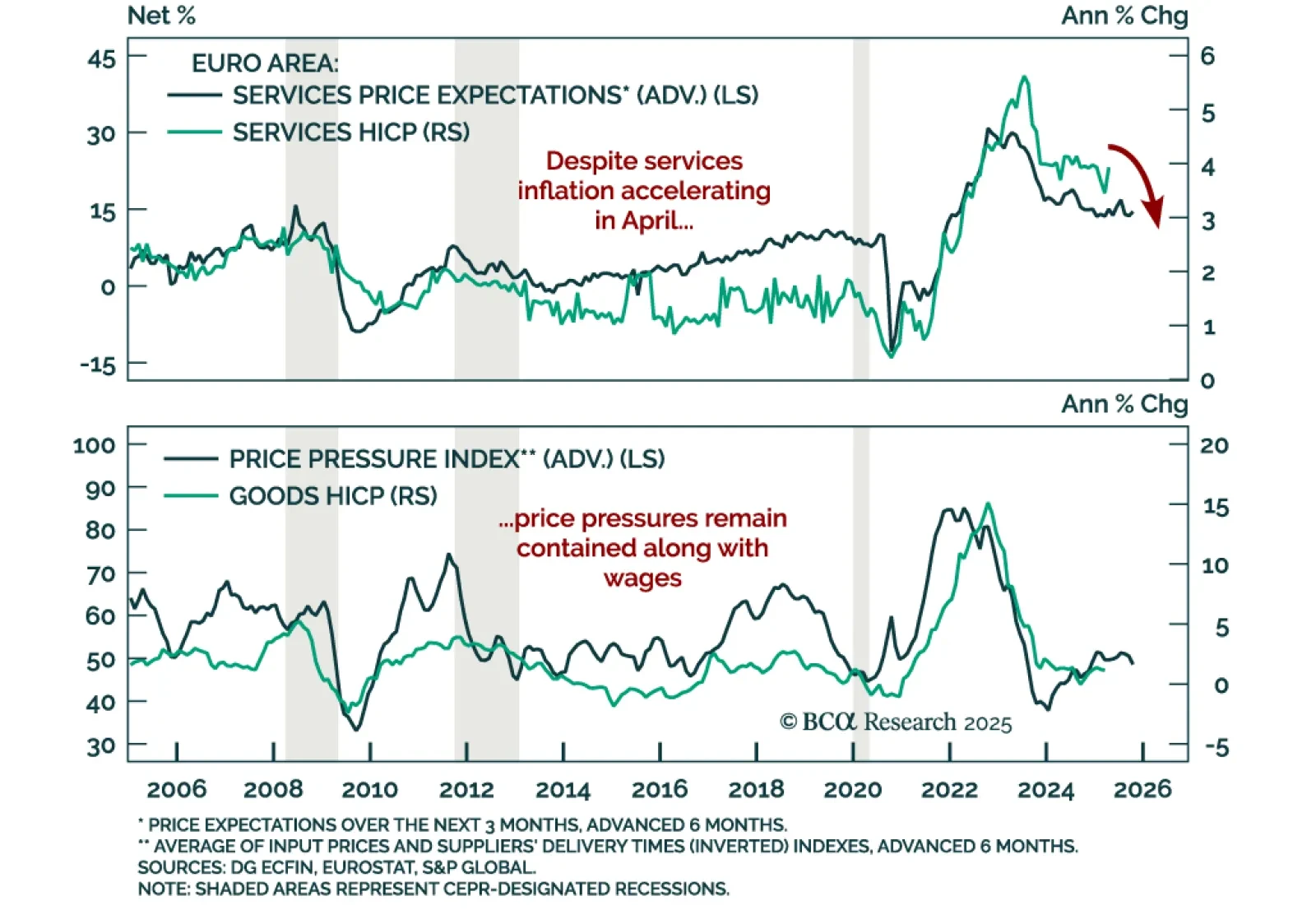

April’s Eurozone inflation data supports BCA’s bullish Bund stance and cautious view on EUR/USD. Headline HICP inflation held steady at 2.2% y/y while core ticked up to 2.7% from 2.4%. Services inflation rebounded to 3.9%,…

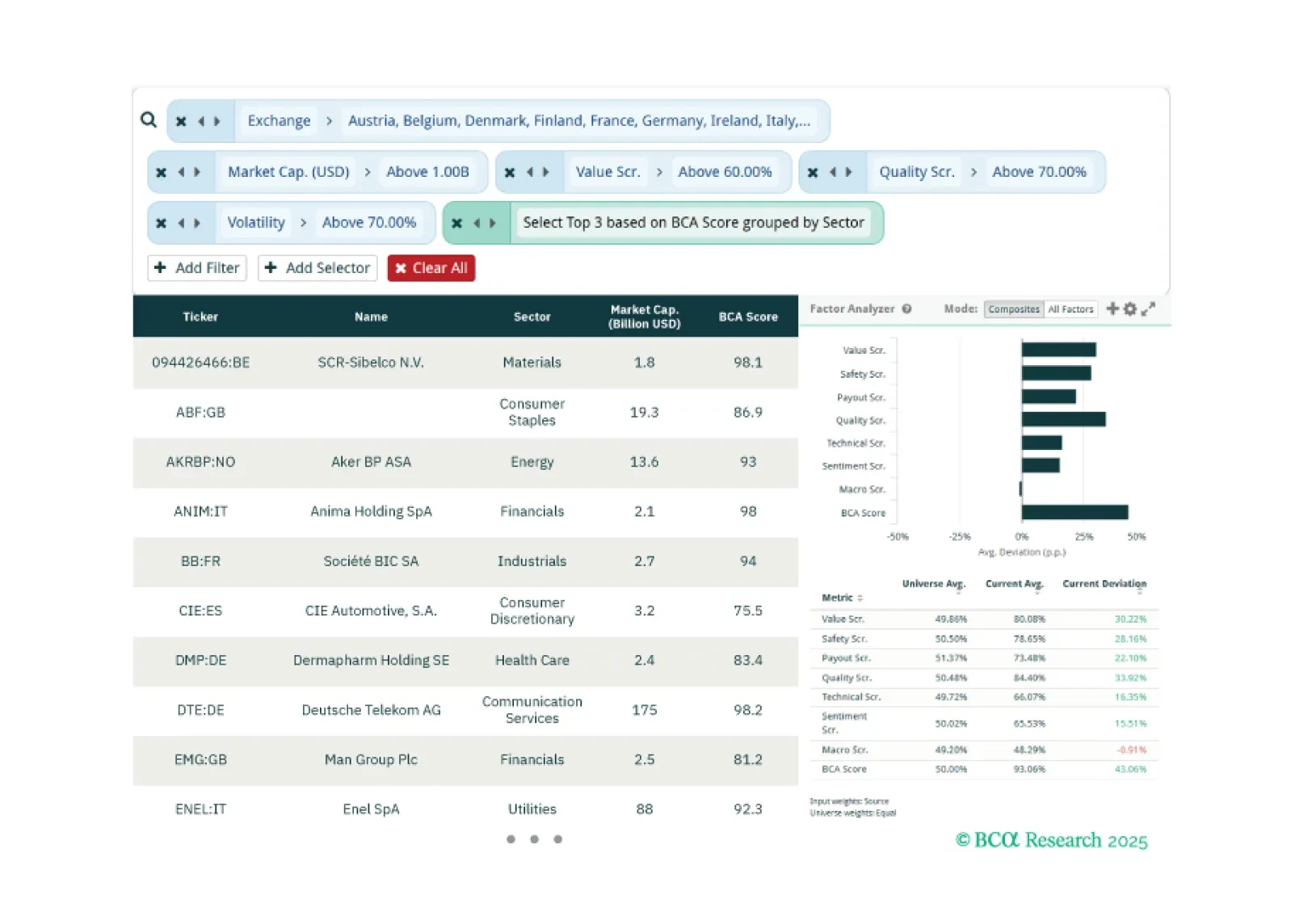

This week, our three screeners cover: Favoring European equities over US equities, cybersecurity stocks, and large caps with large moves in their BCA Score.

Eurozone GDP beats expectations, but trade distortions and weakening demand momentum support a risk-off Eurozone playbook. Flash Q1 GDP rose 0.4% q/q (1.2% y/y), up from 0.2% in Q4, driven largely by net exports. A key contributor…

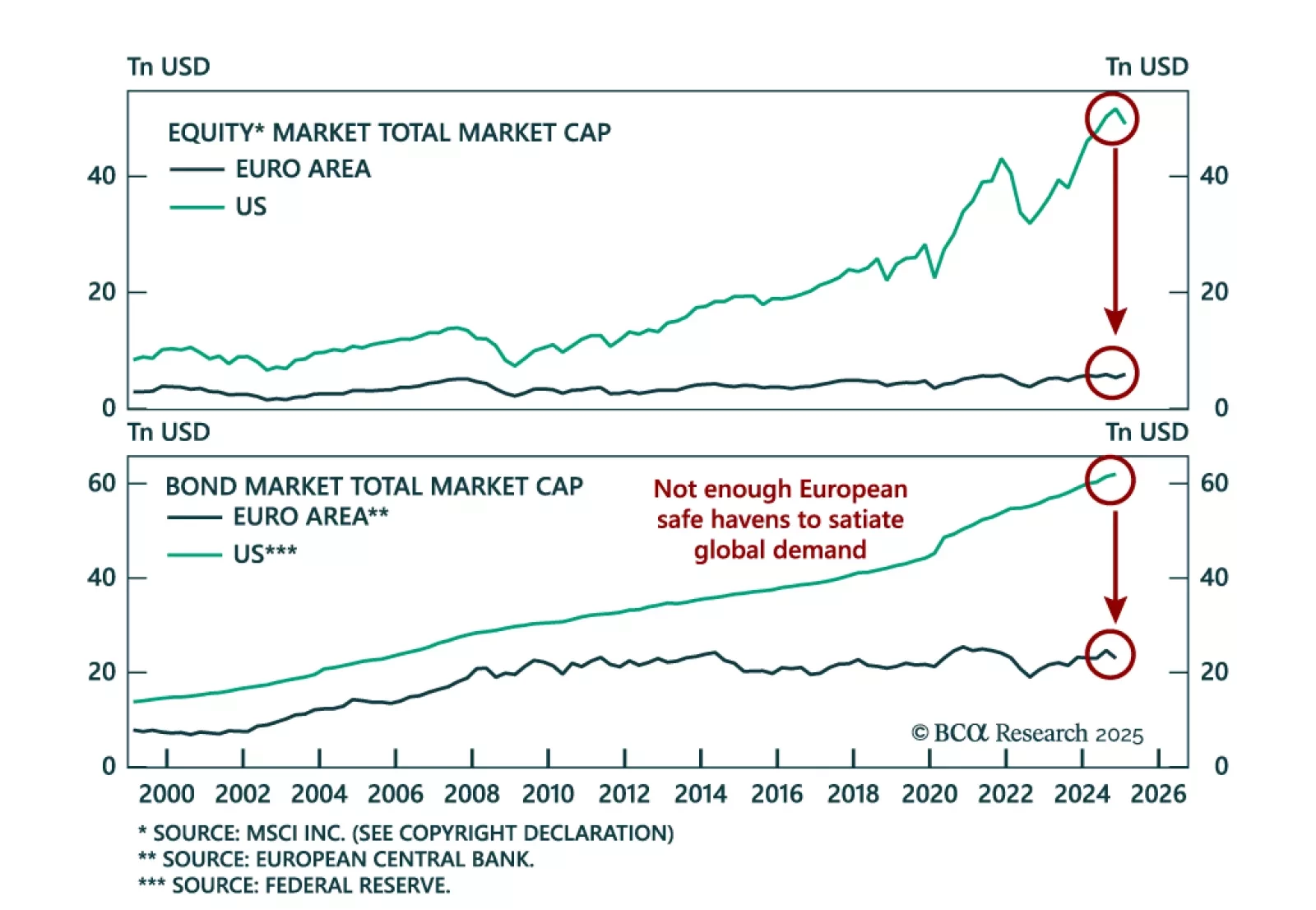

Our European Investment strategists maintain a defensive stance. Favor bunds as an emerging safe-haven complement to US Treasurys and a value tilt in equities. While the dollar and US fixed income remain the global anchor, EUR/USD…