In Section I, we review the three possible economic scenarios over the coming year, and underscore that the “soft landing” scenario remains improbable. A “no landing” scenario could occur, but it would ultimately lead back to the…

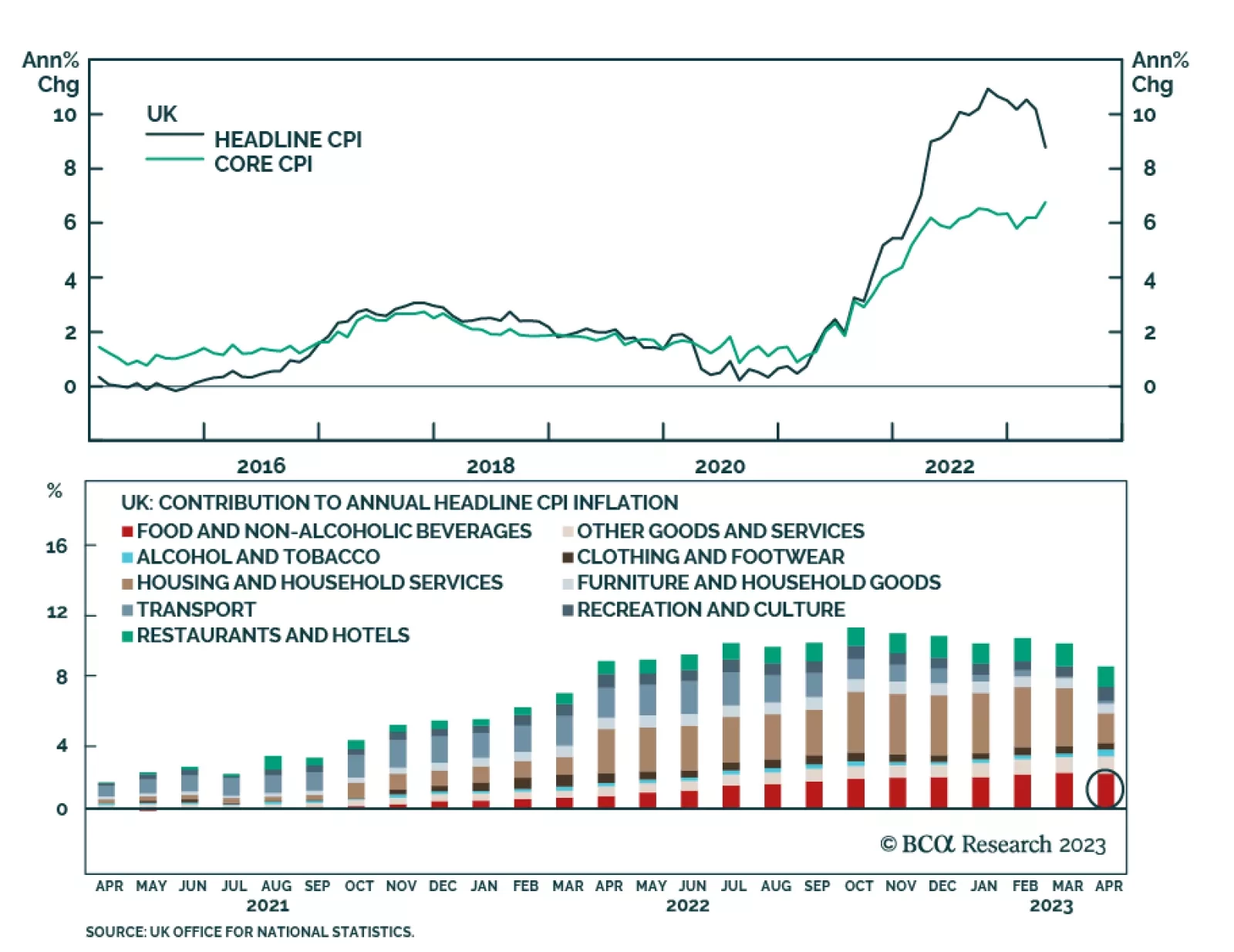

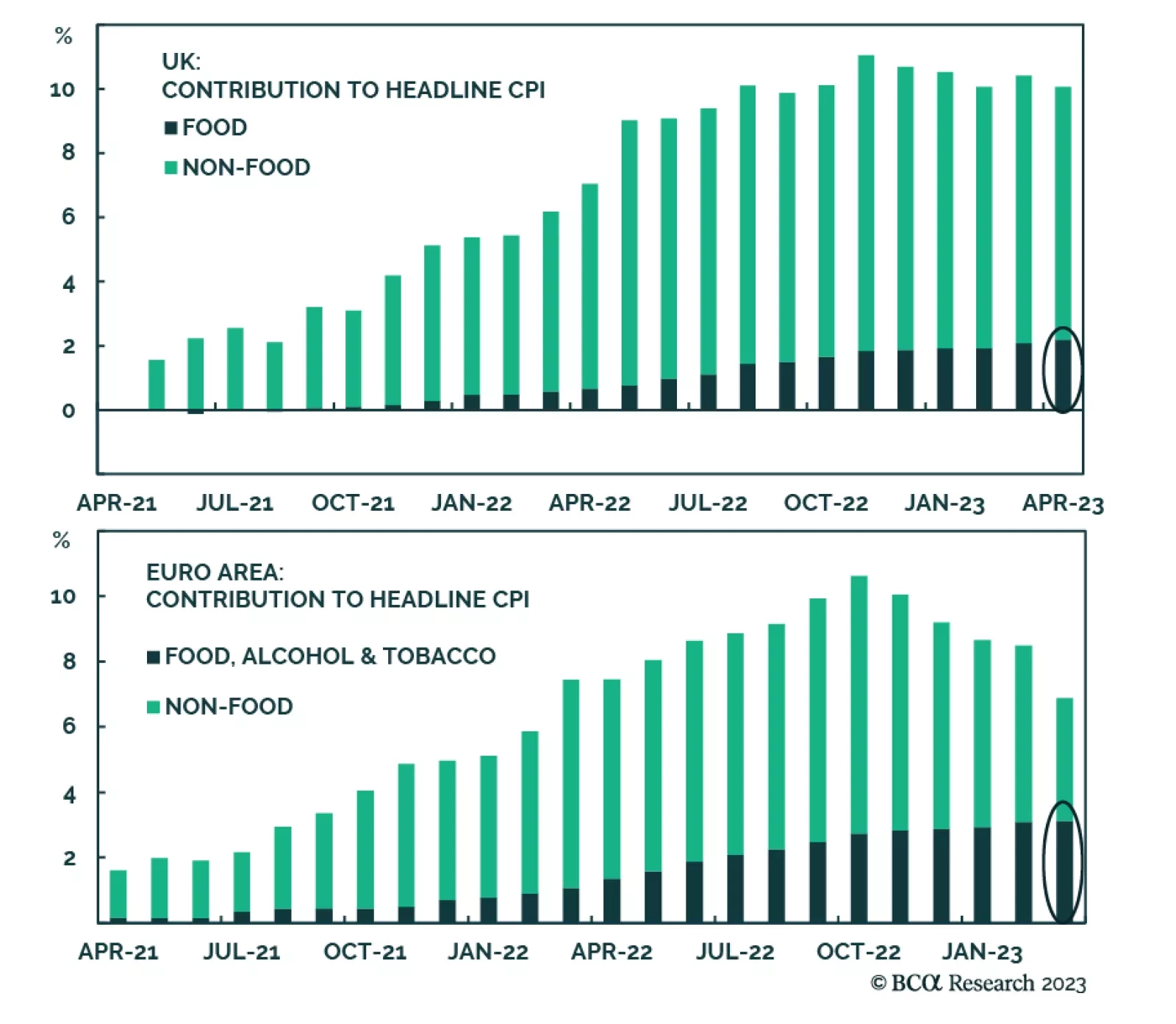

UK headline inflation fell by less than expected in April. The decline from 10.1% y/y to 8.7% y/y came above consensus estimates calling for a more pronounced drop to 8.2% y/y. And although the annual figure now stands at its…

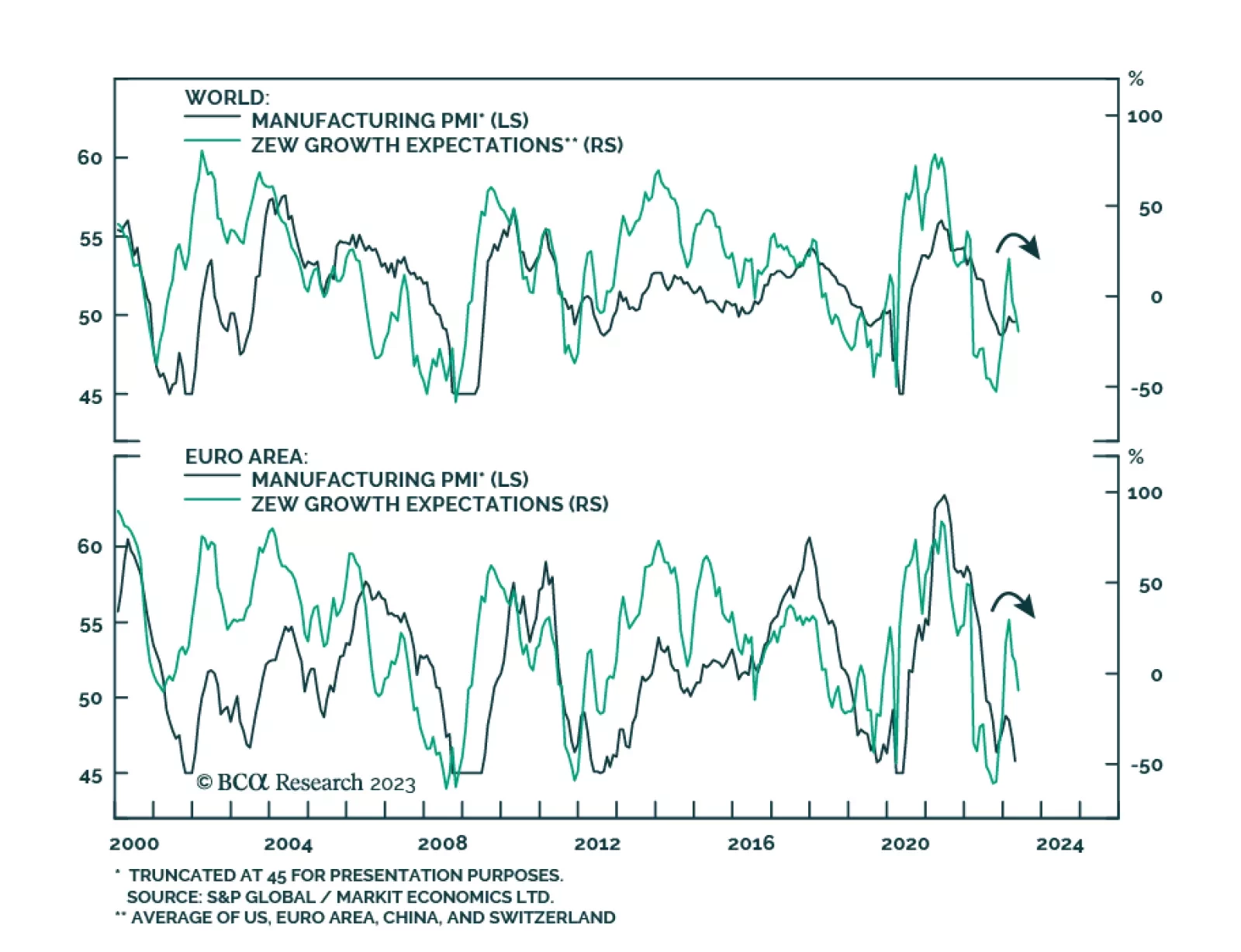

In recent insights we have noted a recent deterioration in European sentiment indicators such as the ZEW and Sentix. Similarly, measures of manufacturing activity are deteriorating. The flash estimate of the HCOB Eurozone…

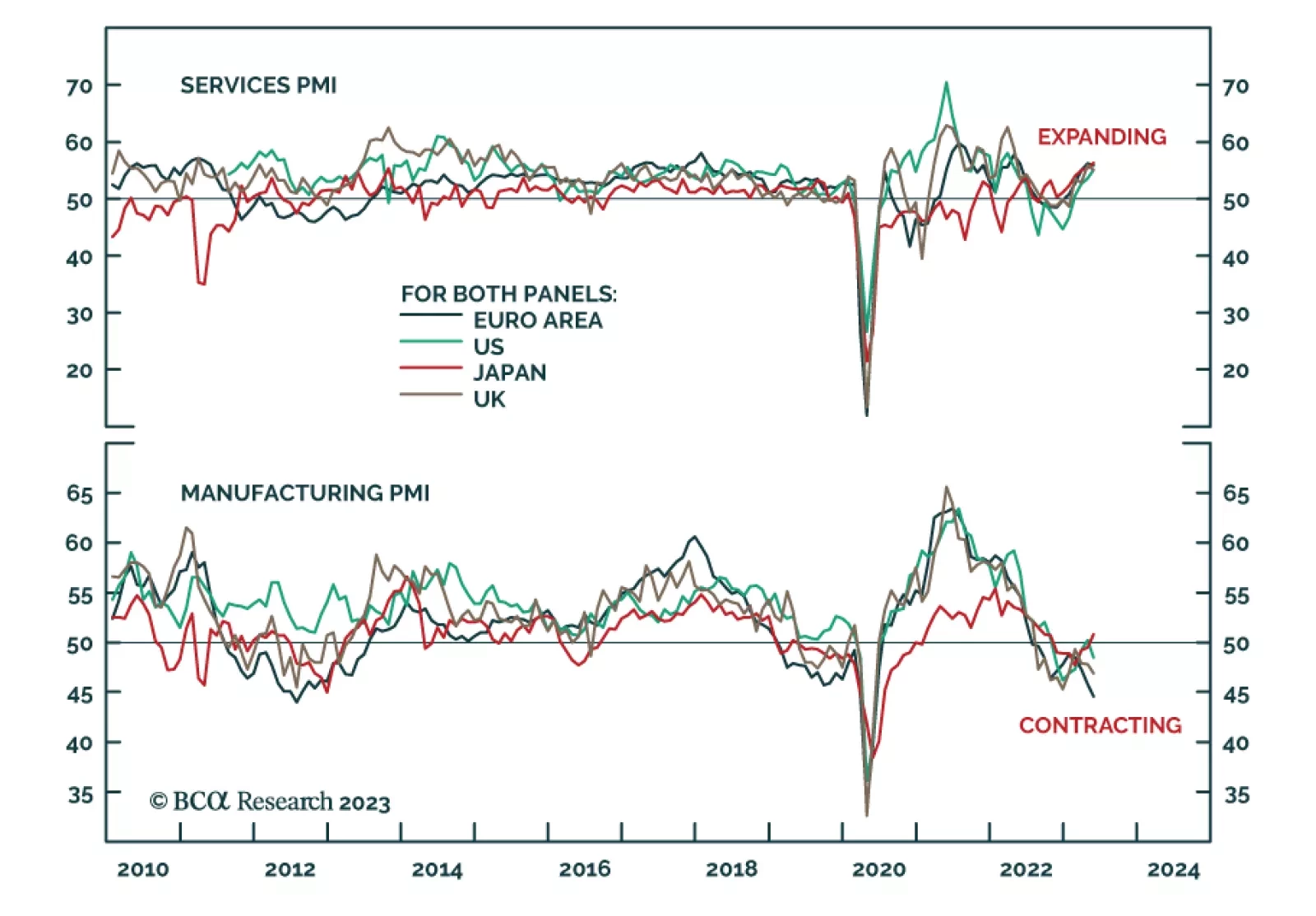

Preliminary PMI releases for May continue to show a divergence in activity across DM economies. On the one hand, the pace of expansion of service sector activity accelerated. The US Services PMI rose from 53.6 to 55.1 –…

The lift to European investor sentiment from the ebbing energy crisis is now in the rear-view mirror. The German ZEW Indicator of Economic Sentiment fell back below 0 in May to -10.7 from 4.1. The negative reading indicates that…

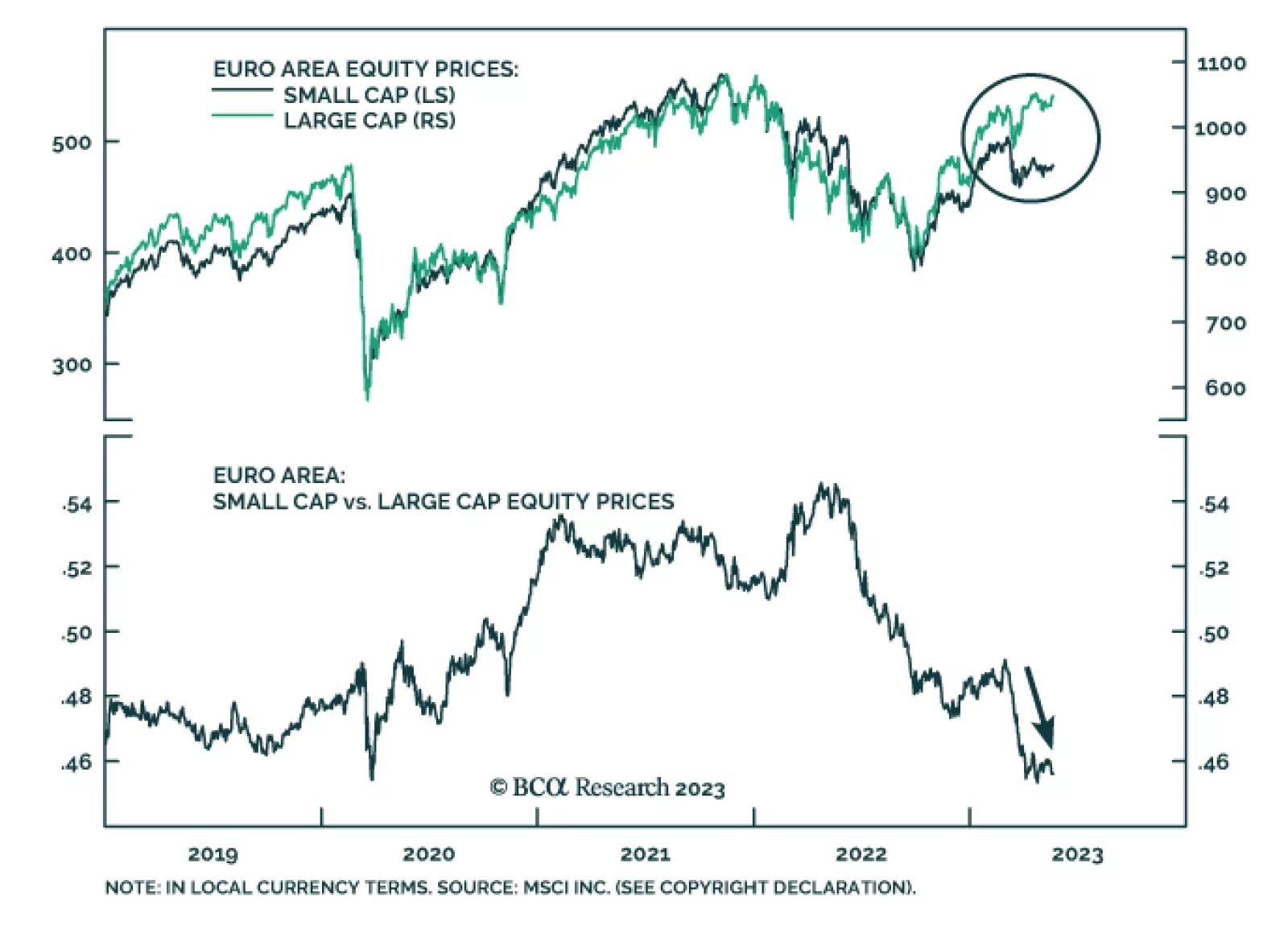

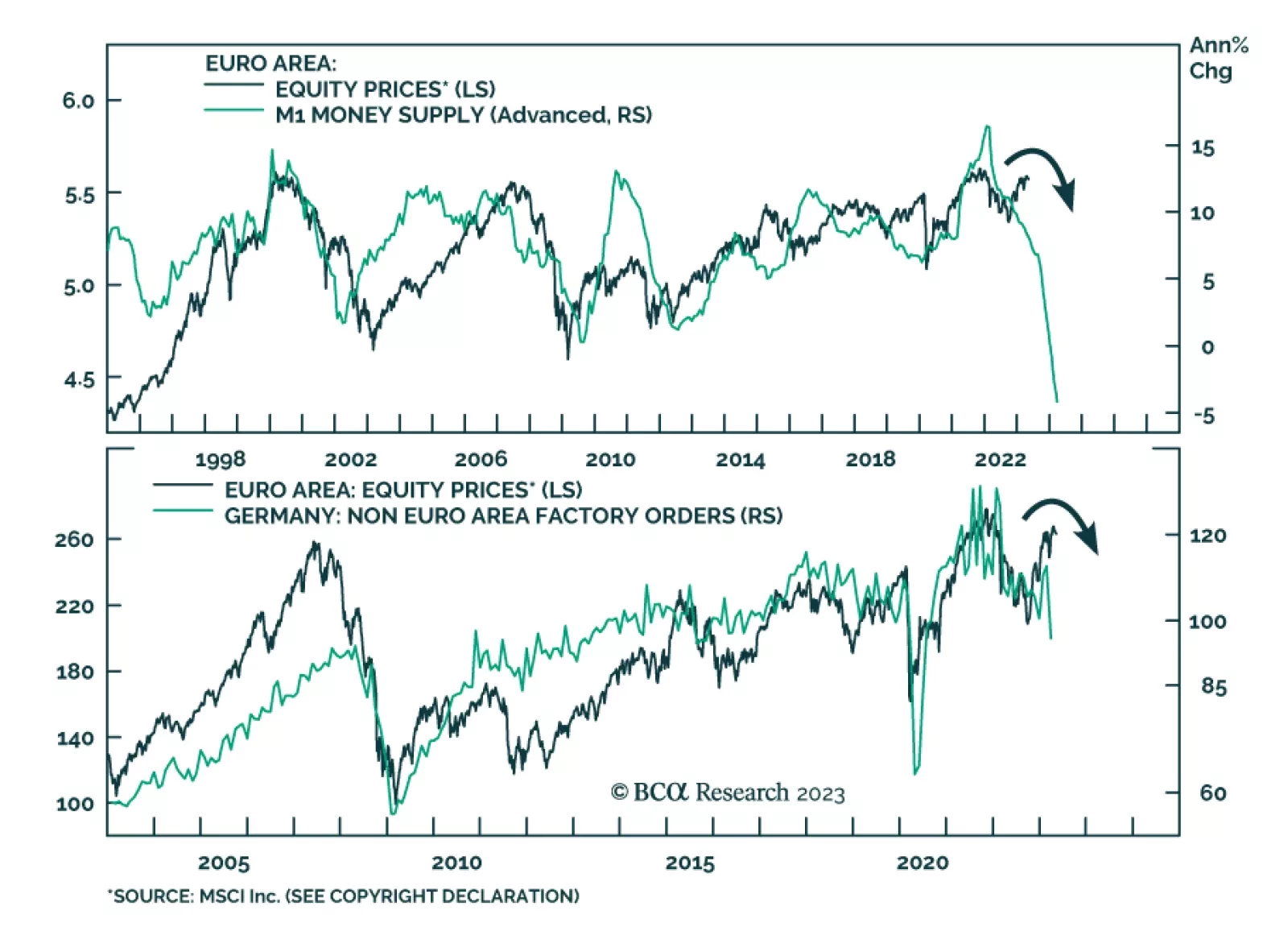

According to BCA Research’s European Investment Strategy service, a large set of variables points to some additional correction in European stocks over the coming months. The collapse in the Euro Area M1 is consistent…

A restrictive policy by the ECB and a weak manufacturing sector will create headwinds for European stocks this summer. How should investors position their portfolios in this context?

In Thursday’s BoE meeting, policymakers highlighted that stronger-than-anticipated food price gains contributed to recent upside surprises in the UK’s inflation rate. Rapidly climbing food inflation hit a 19.6% y/y in…