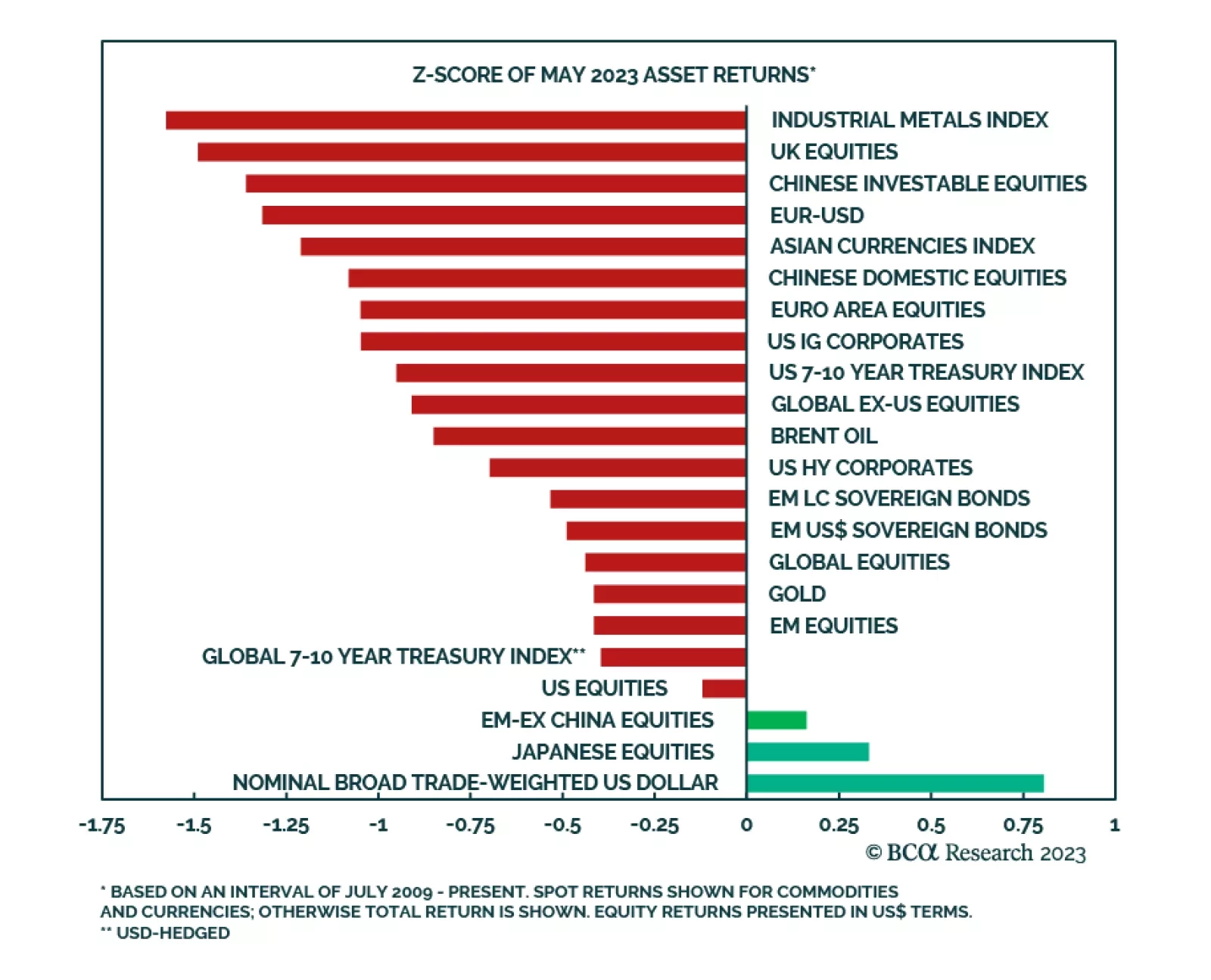

Global financial markets relapsed in May. After a relatively strong start to Q2, most of the major financial assets we track generated below average returns last month. A shift in investor expectations for the path of the Fed…

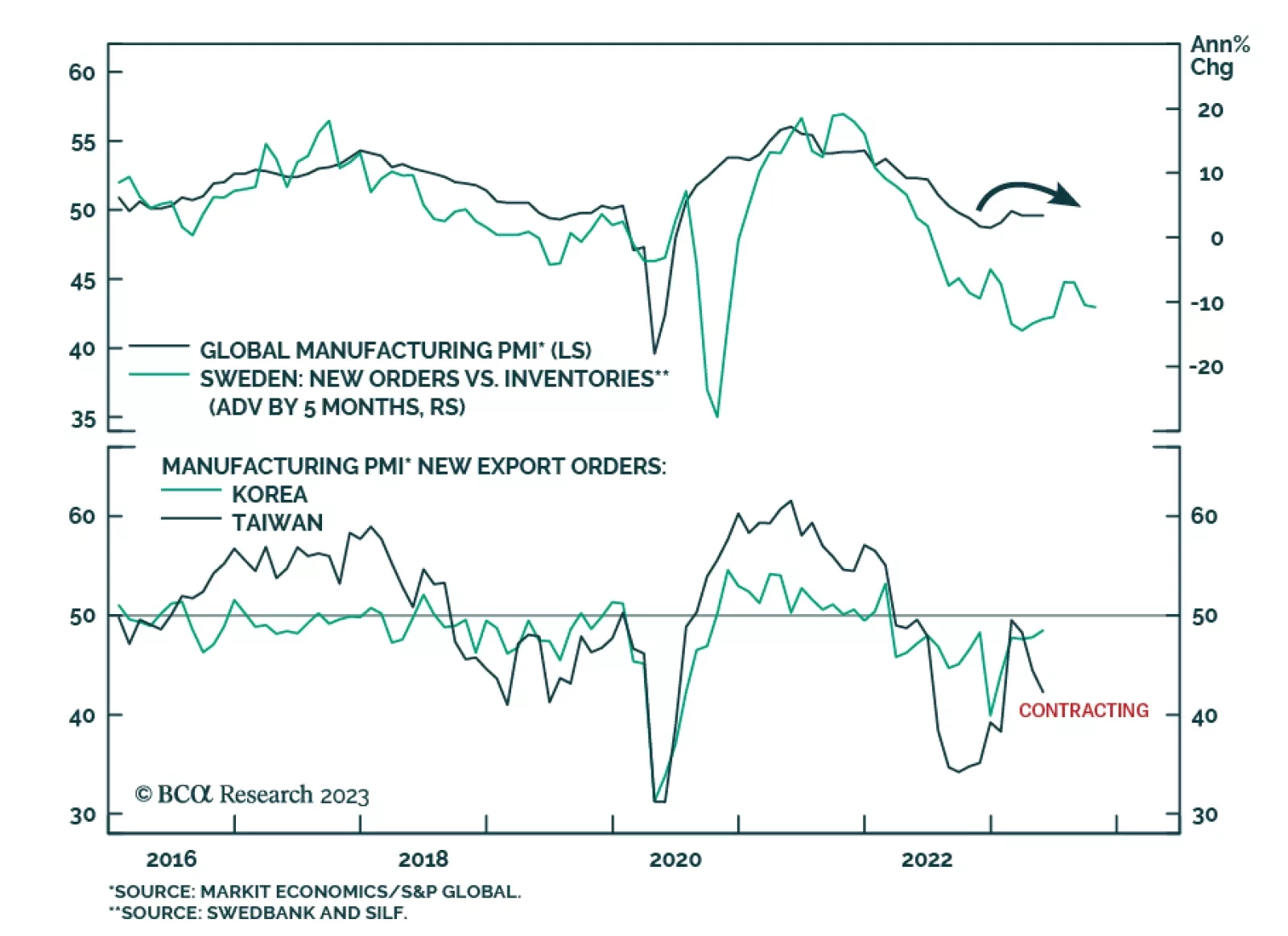

The Global Manufacturing PMI was unchanged at 49.6 in May – below the 50 boom-bust line for the ninth consecutive month. The details of the release were mixed. On the one hand, the Production sub-component rose to an 11-…

Risk assets would perform well over 12 months only if inflation falls to 2% without triggering a recession. That would be unprecedented. We recommend investors stay defensive.

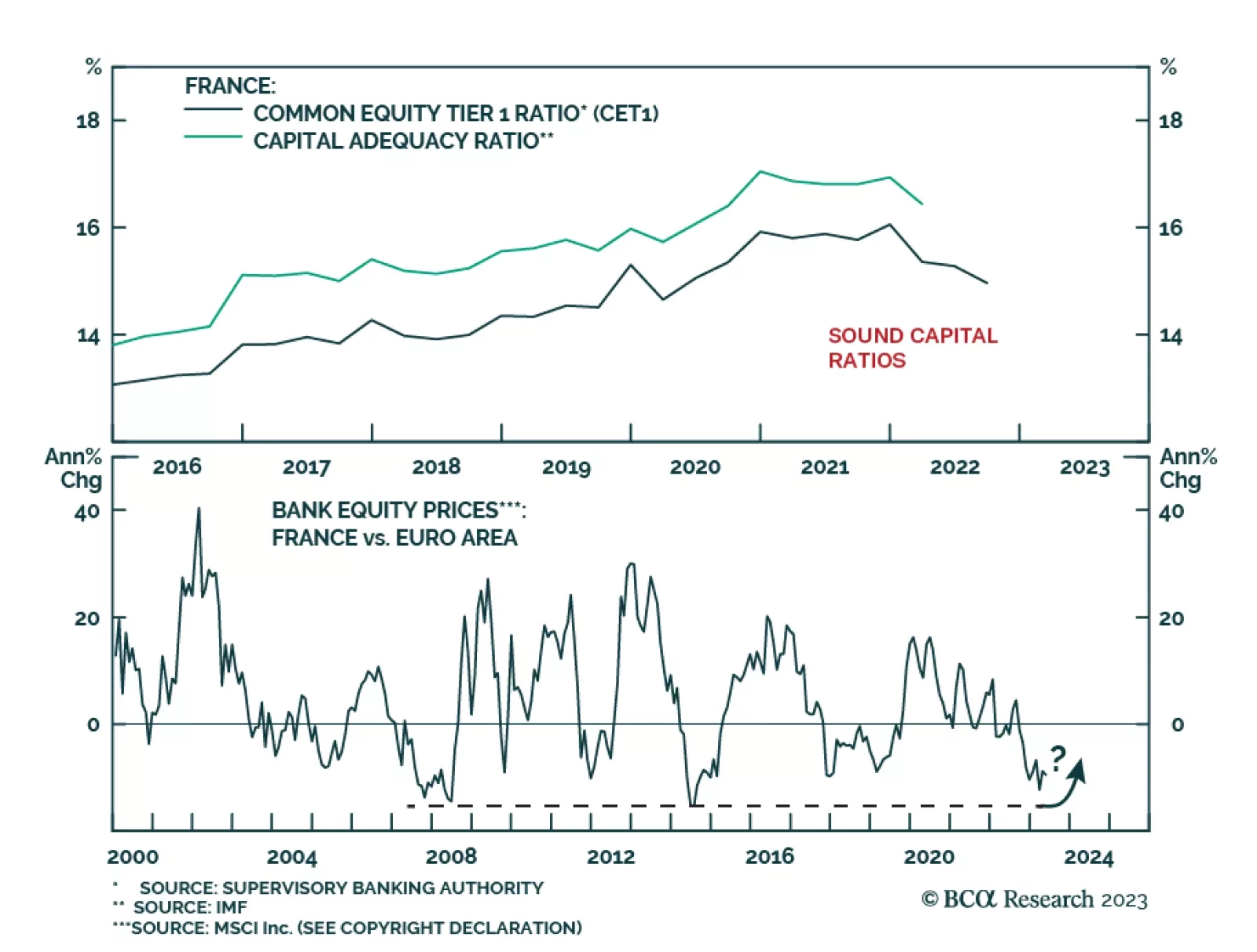

According to BCA Research’s European Investment Strategy service French banks are better positioned to weather current headwinds than their European peers. The team sees limited risks to the French banking sector from…

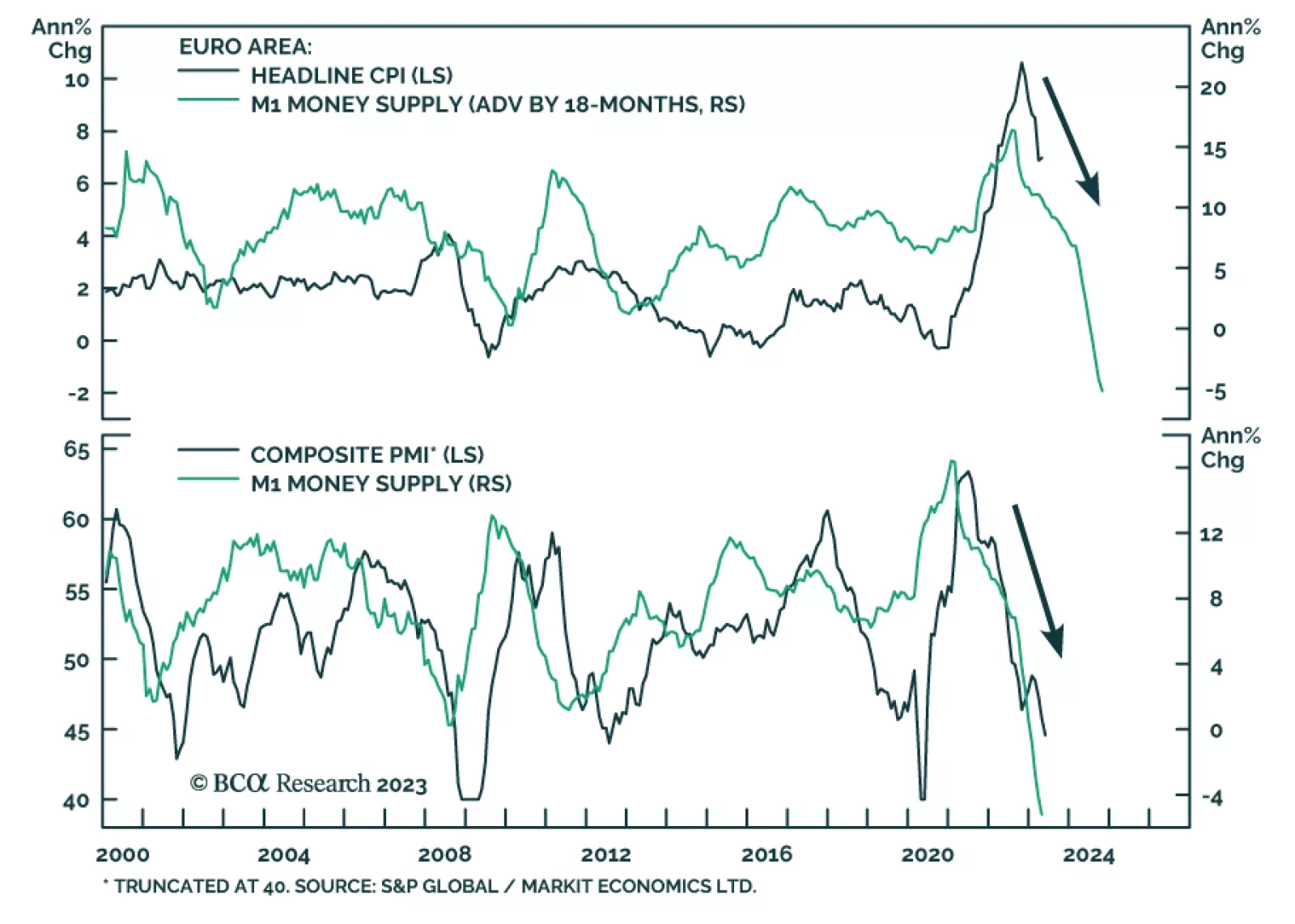

The latest Eurozone data releases show the impact of the ECB’s aggressive monetary tightening cycle. The contraction in M1 money supply – which includes currency in circulation and overnight deposits –…

President Erdogan and the Justice and Development Party emerged as the winner of the Turkish general election which was concluded yesterday. This victory means that their expansive policies of the past decade will continue, and…

In this Month-In-Review report, we go over the latest G10 data releases and rank currencies’ fundamental standing based on our updated macroeconomic model.

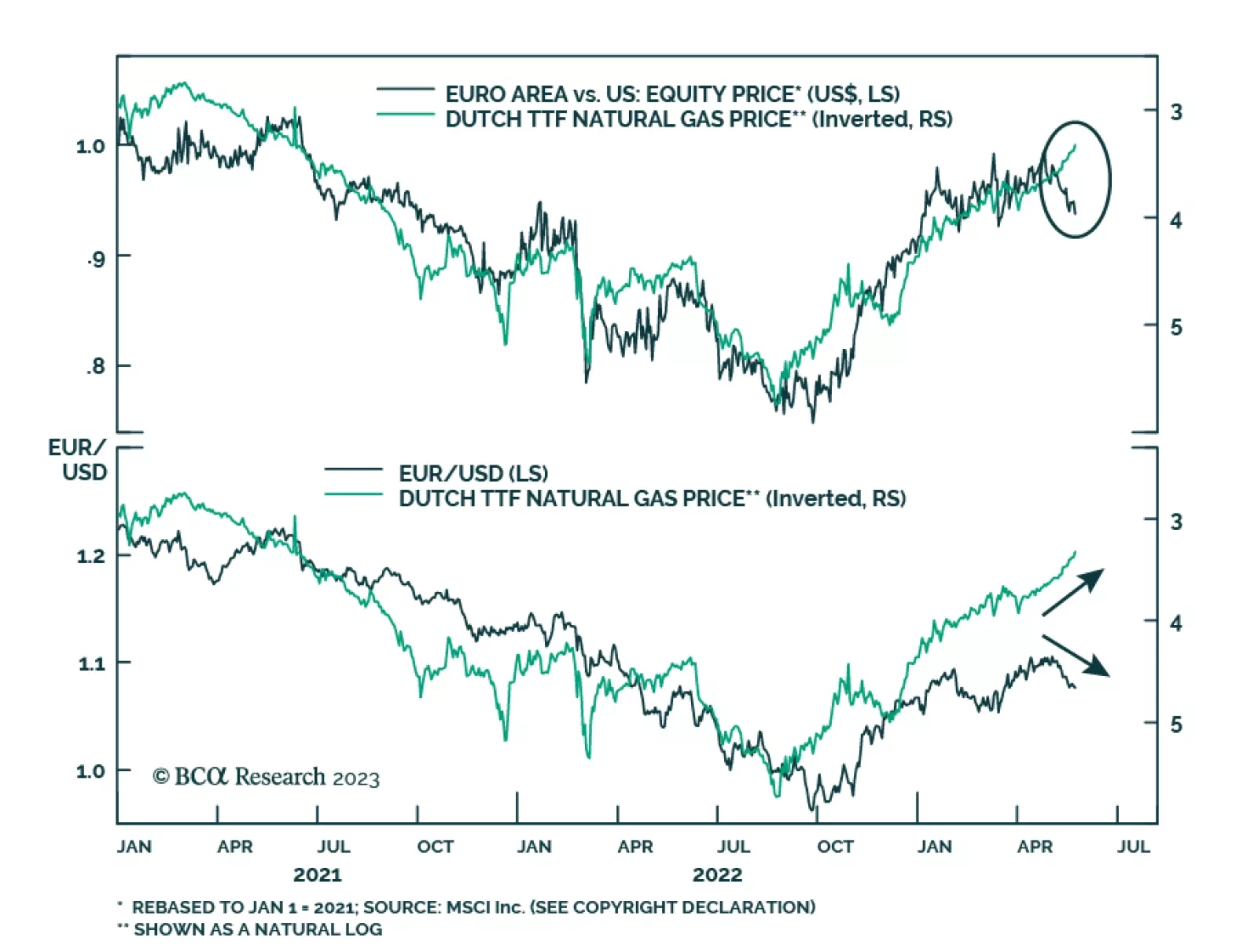

Over the past couple years, the price of natural gas has closely tracked the relative performance of European assets. Specifically, the underperformance of Euro Area stocks vis-à-vis US equities and the weakening EUR/USD…