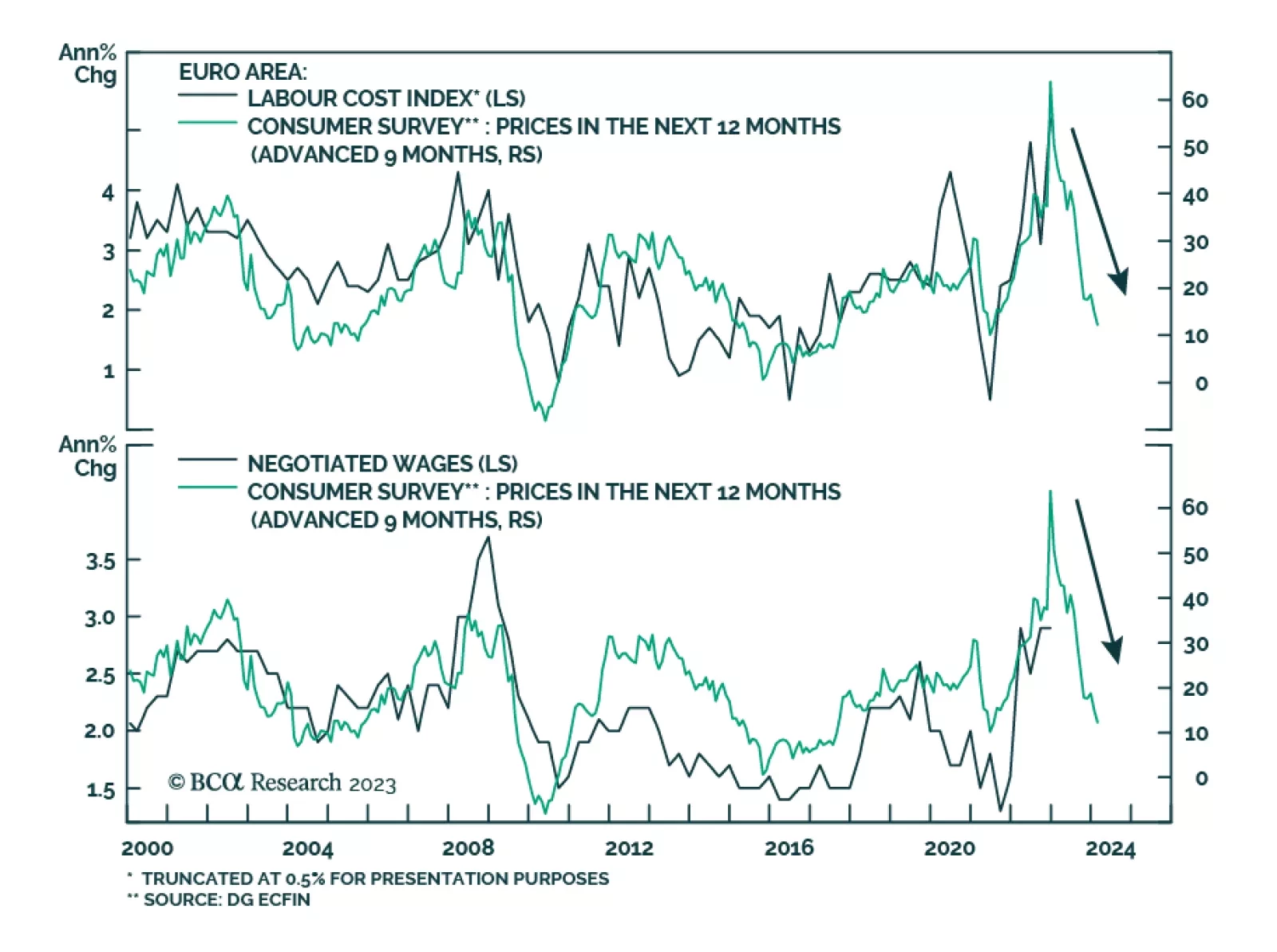

Eurozone households are becoming less concerned about the near-term outlook for inflation. The results of the latest ECB Consumer Expectations survey show a significant drop in median 12-month inflation expectations from 5.0% in…

What’s going on? The market-weighted stock market is up. But the equally-weighted stock market is not up. Neither is credit. Neither are industrial metal prices. Neither is the oil price, despite two waves of OPEC output cuts. We…

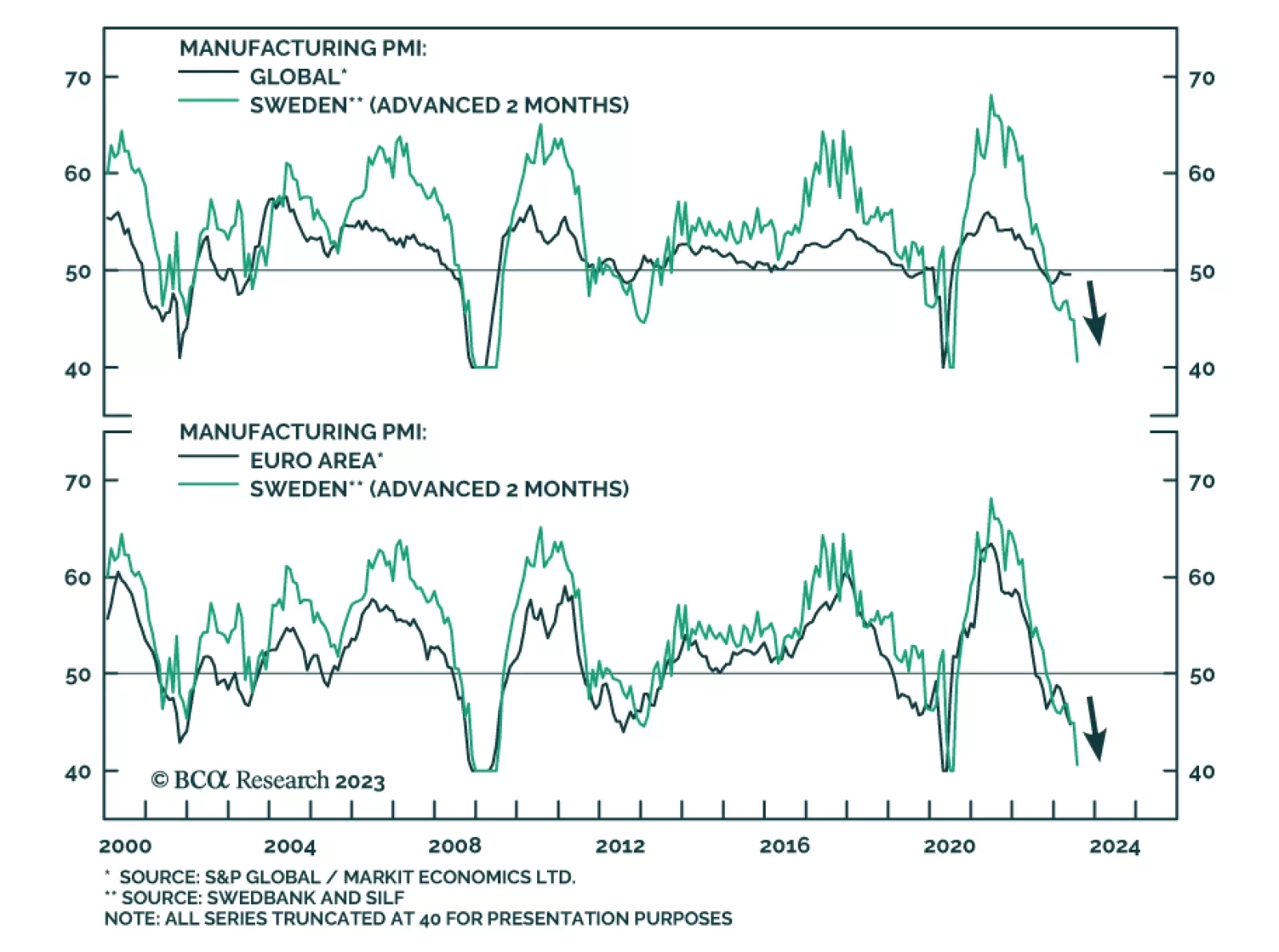

The Swedish manufacturing PMI declined to 40.6 in May, the lowest level since June 2020. This deterioration in Sweden’s manufacturing activity not only reflects the domestic economy, but it also highlights weaknesses in the…

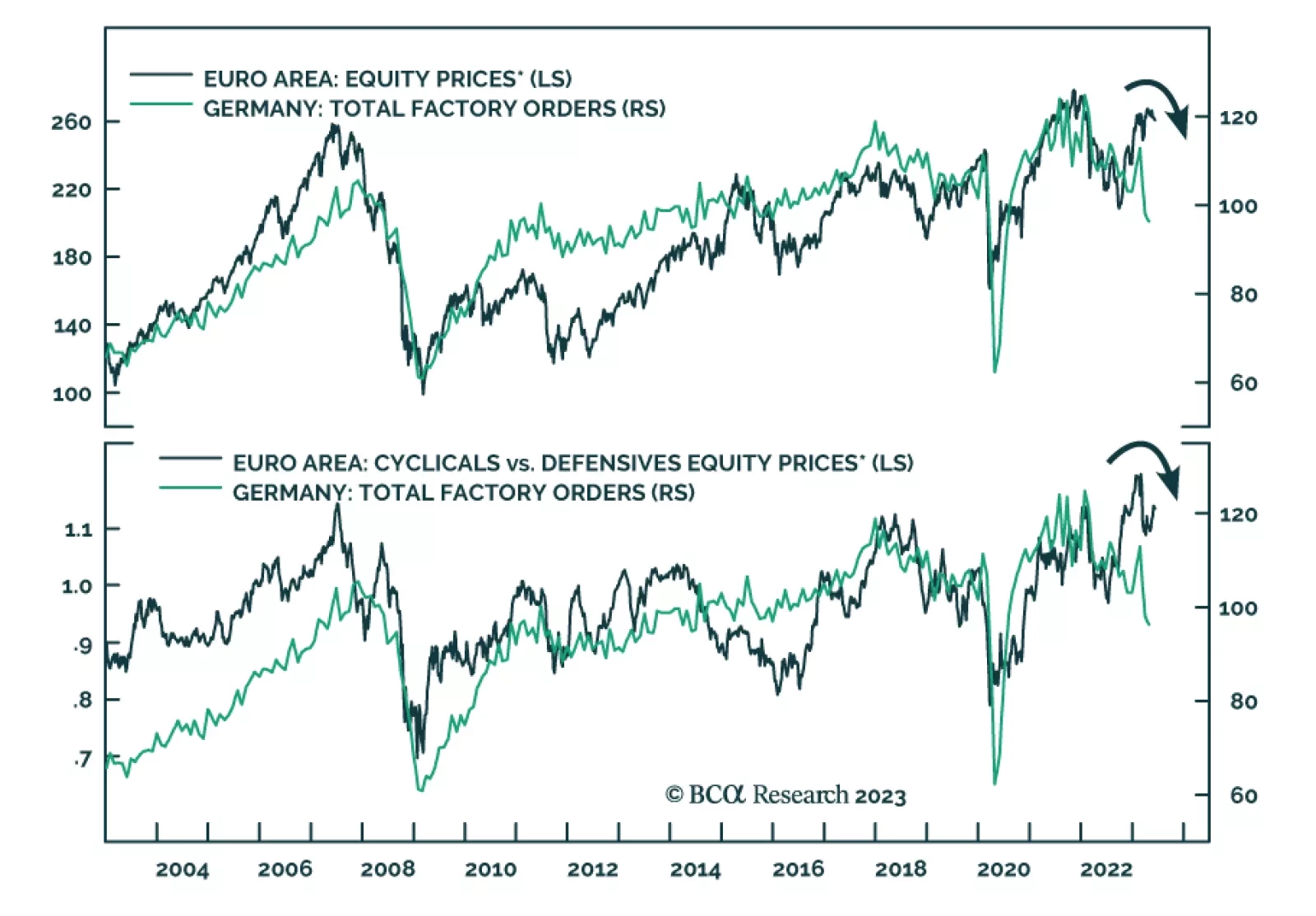

Tuesday’s German factory orders release sent a disappointing signal about industrial demand. Although the pace of decline eased from -10.9% m/m to -0.4% m/m in April, it fell below expectations of a 2.8% m/m increase. Both…

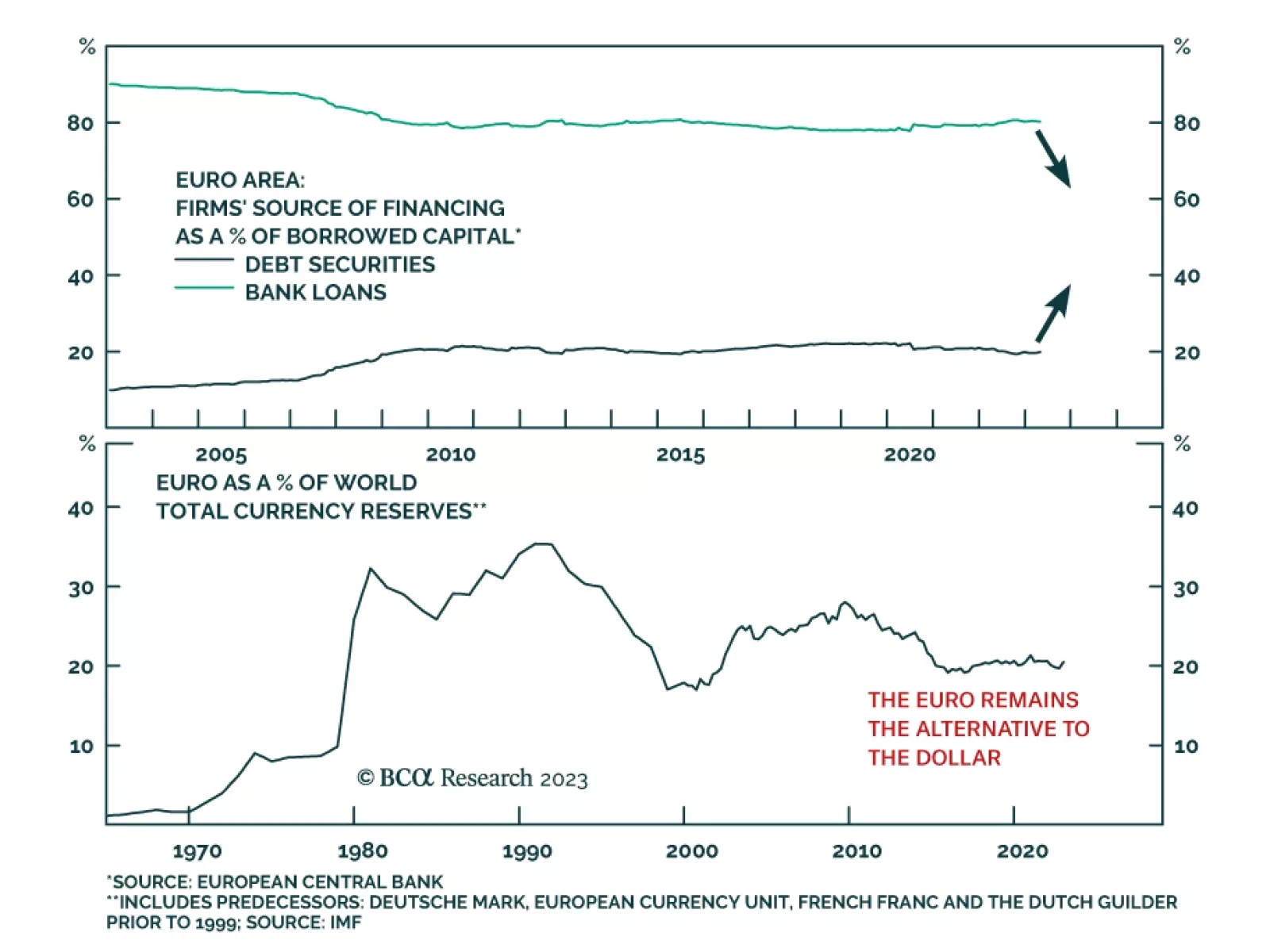

According to BCA Research’s European Investment Strategy service, although the ECB faces important challenges in the coming year, its success in maintaining price stability and in preserving the euro’s integrity are…

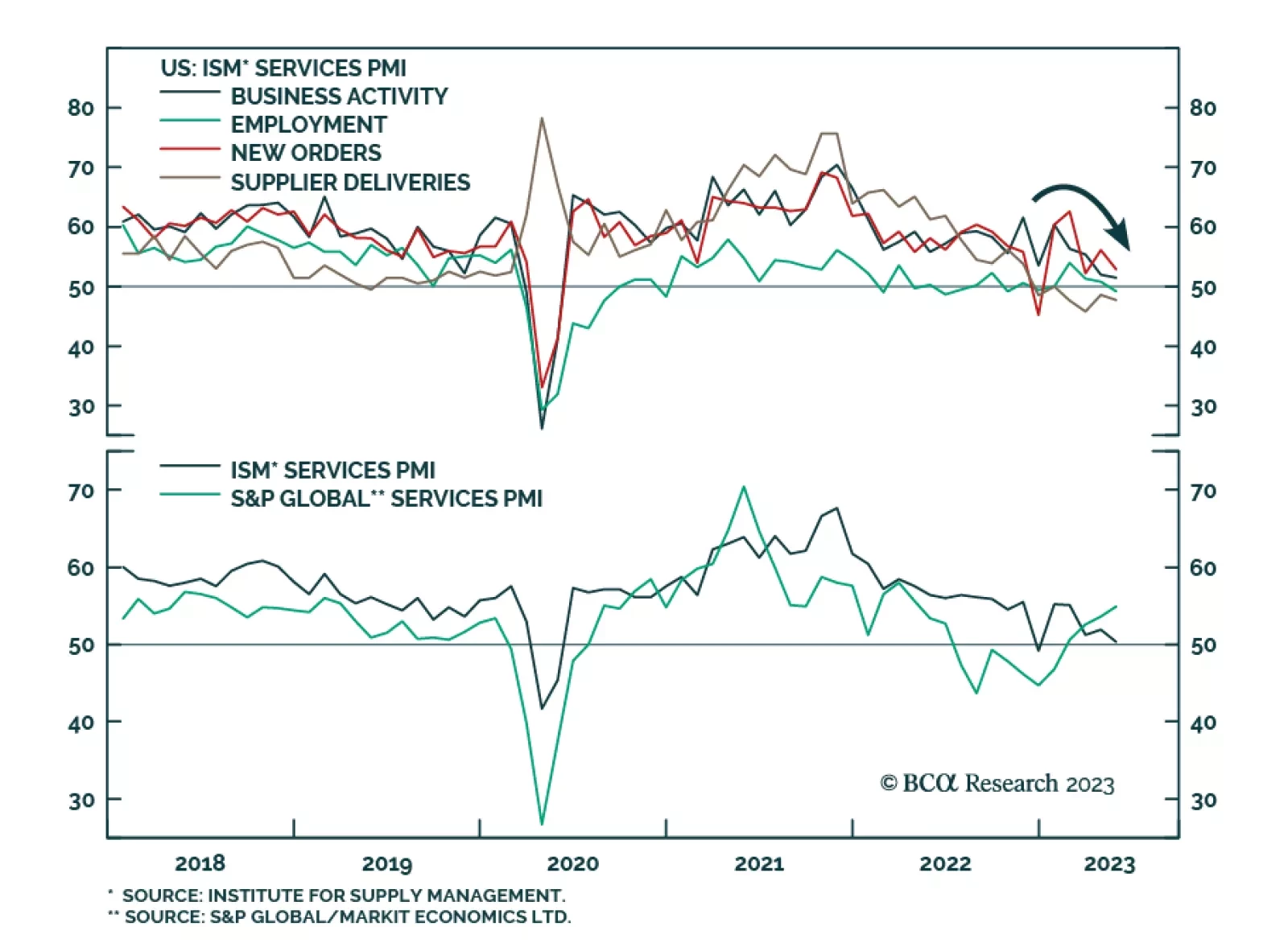

The ISM PMI sent a disappointing signal about US service sector activity in May. The headline index unexpectedly fell from 51.9 to 50.3 – the weakest level since December and surprising expectations of an improvement to 52.…

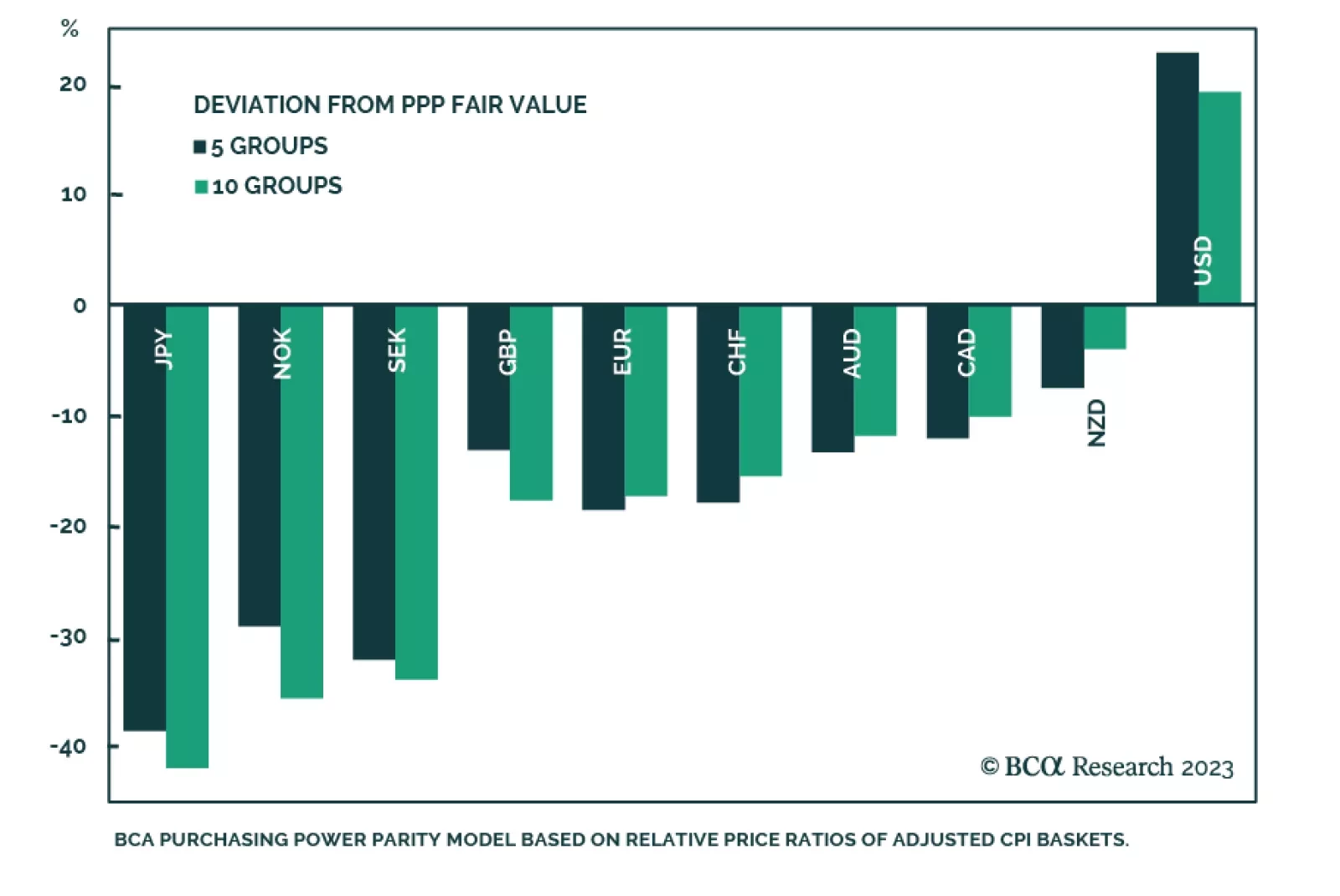

In our FX strategists’ models, the Norwegian krone is one of the cheapest currencies. On its own, valuation is usually not a sufficient catalyst to unlock value in any currency. That said, there are a few signs that the…

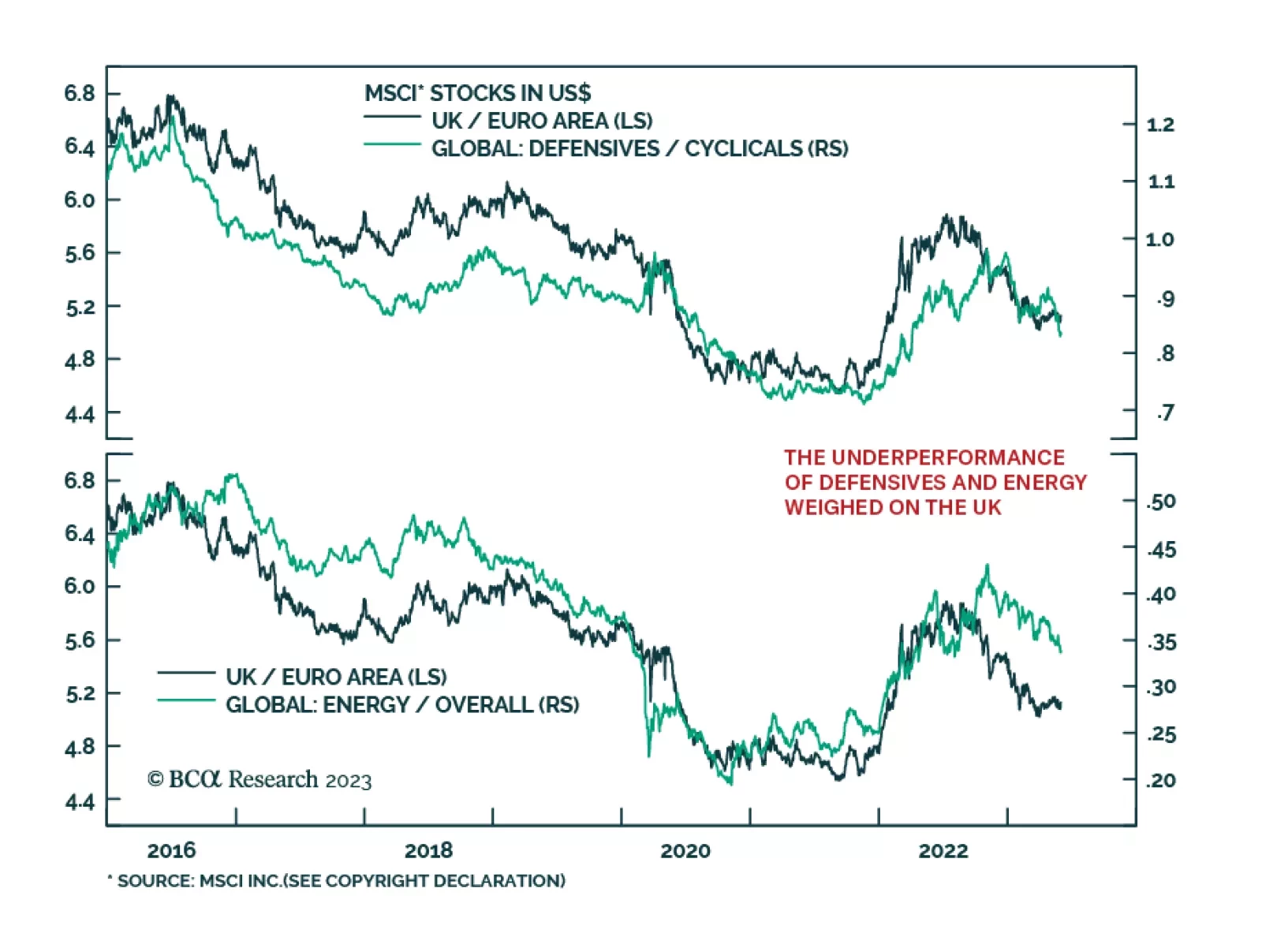

In our May In Review Insight, we showed that last month, UK stocks posted the lowest z-score among all major global equity markets, underperforming their Eurozone peers. What explains this relative weakness? The chart above…

In this report, we follow up on the upgrade to our US duration stance from last week with a review of our rates views and government bond allocations outside the US. We conclude that while we now find US Treasuries to be more…