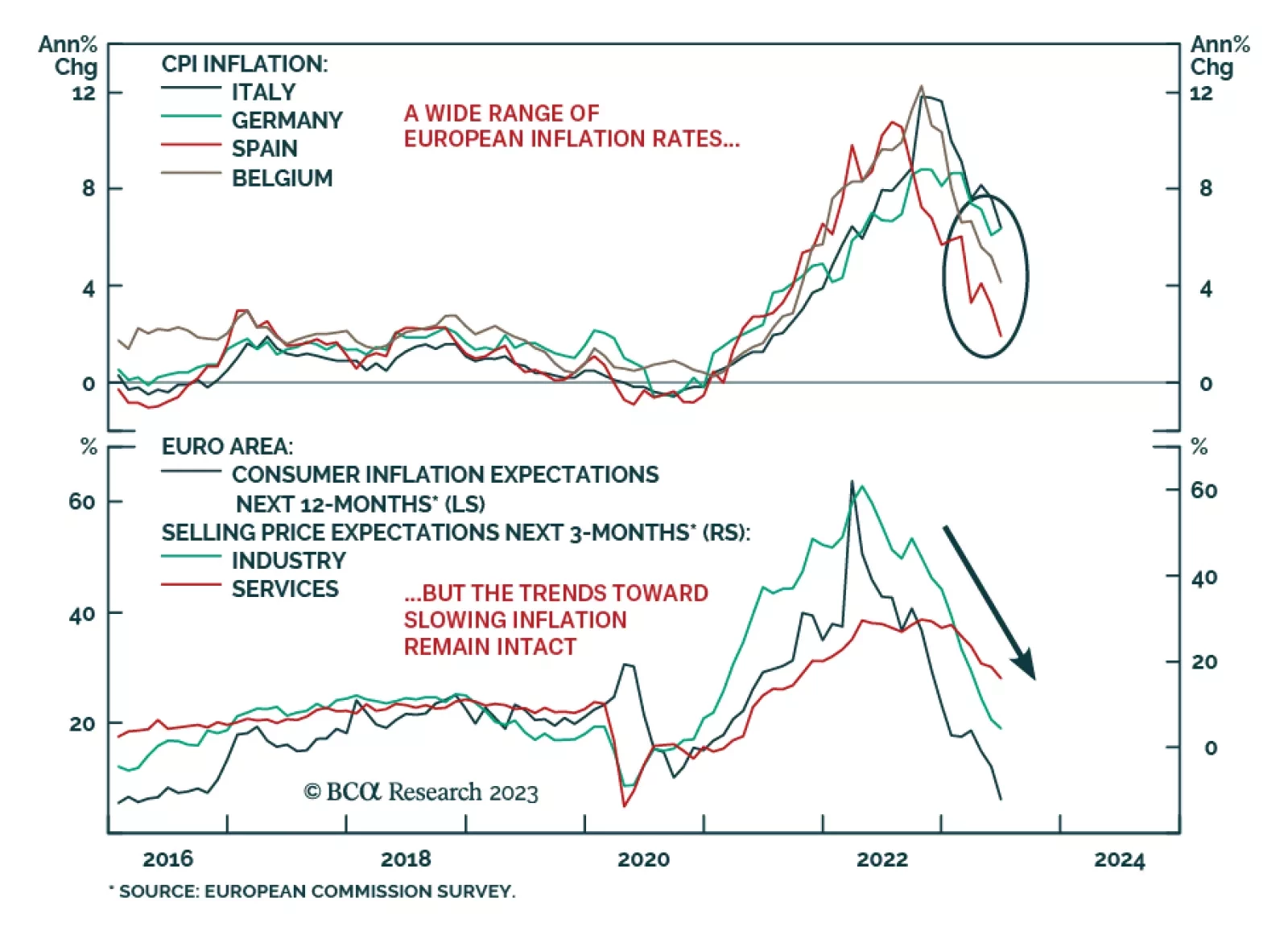

The preliminary inflation prints for June in the major euro area economies highlight a growing divergence in inflation outcomes. There was good news: headline CPI inflation in Italy fell to 6.7% in June from 8.0% in May, while…

In Section I, we reiterate why a soft economic landing remains improbable in the US. Some reasonable estimates of the level of excess savings point to their depletion in a year’s time, but other estimates indicate a much earlier end…

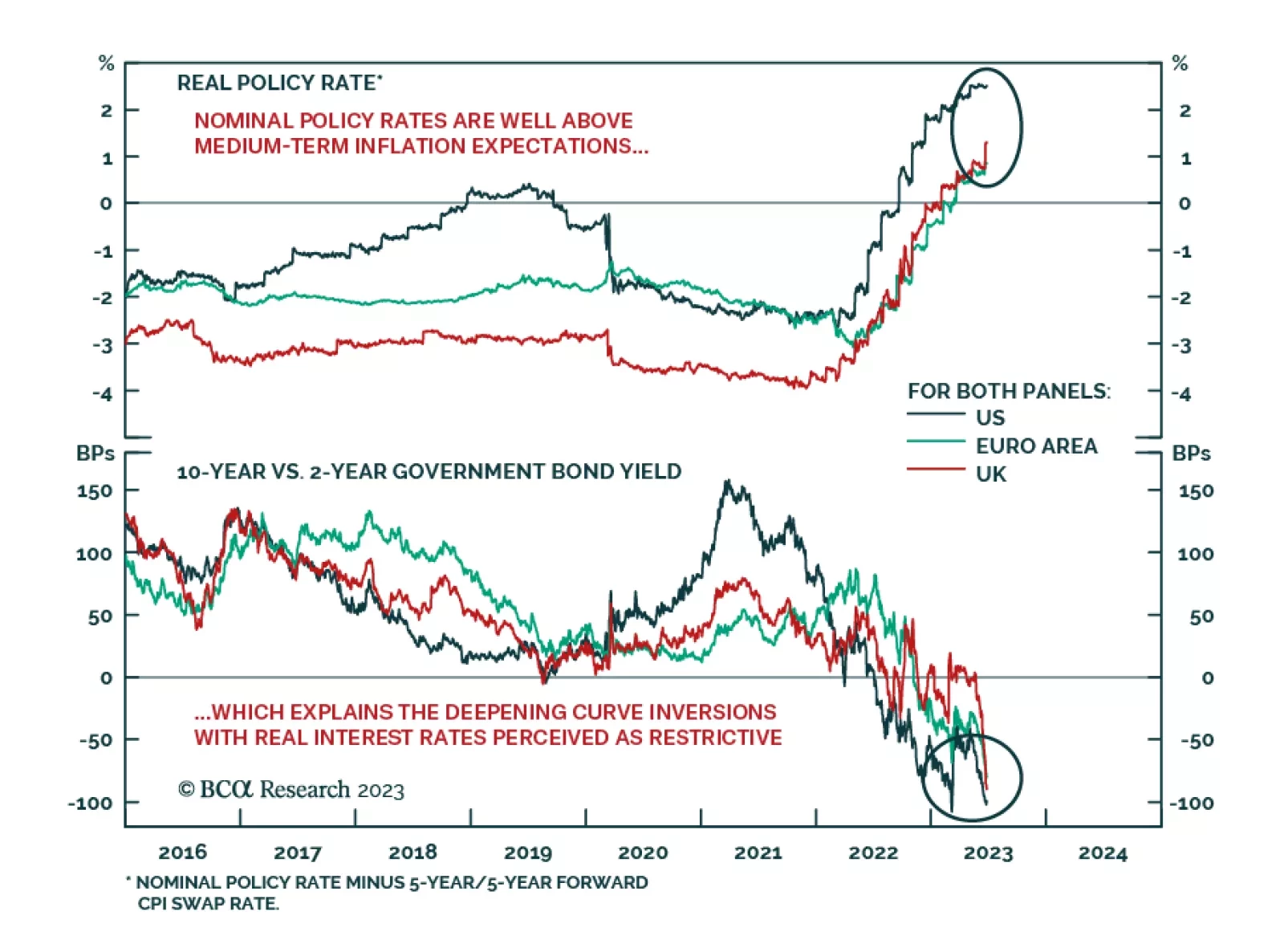

Has the yield curve lost its ability to “predict” recessions? The widely-followed 2-year/10-year US Treasury curve now sits at -100bps, but it has been inverted since April 2022. Investors have seemingly been on…

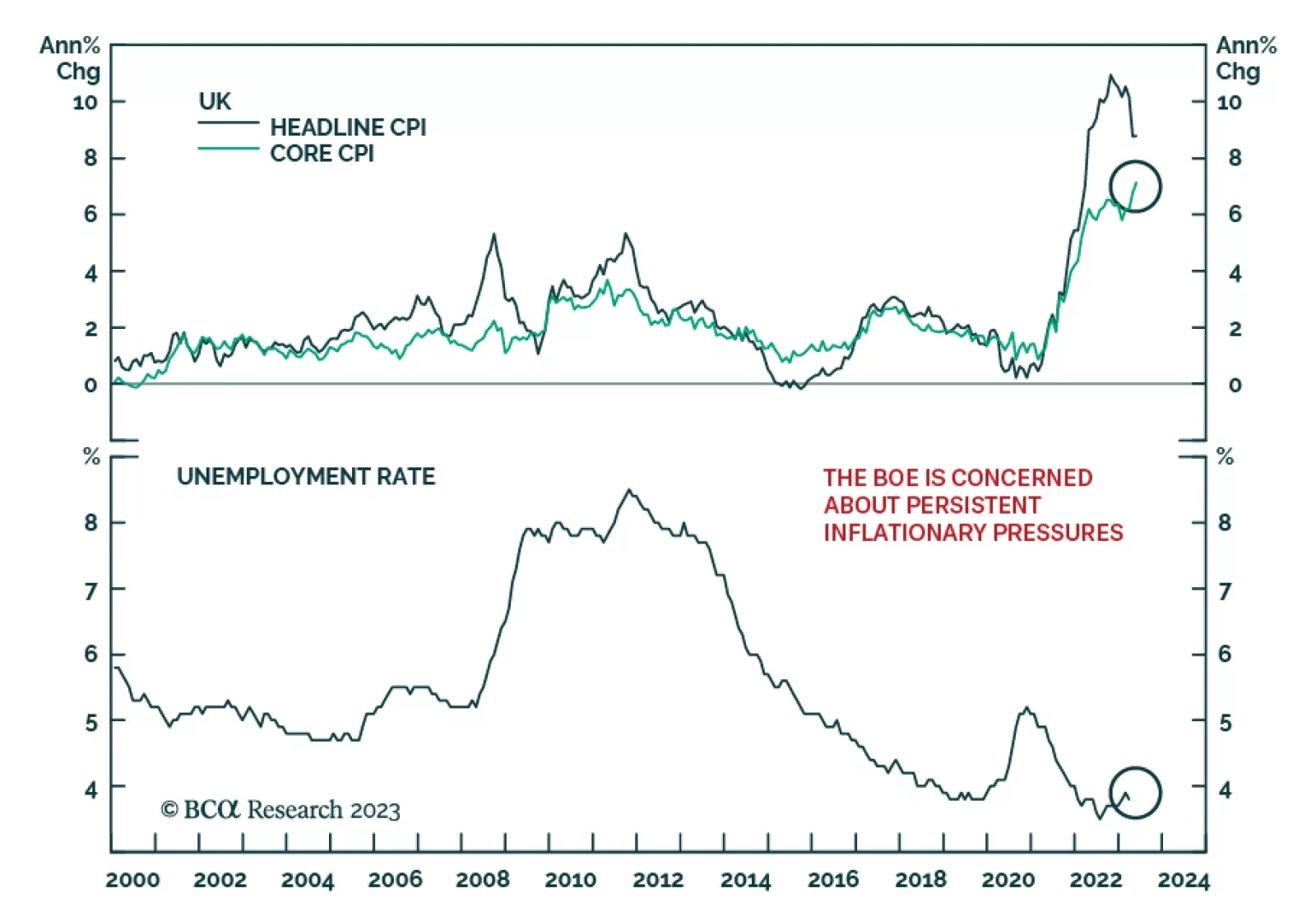

The market does not grasp the implied depths of recessions that will be needed to prevent inflation expectations from un-anchoring. Among the major economies, the most vulnerable to a deep recession is the UK. We explain why, and…

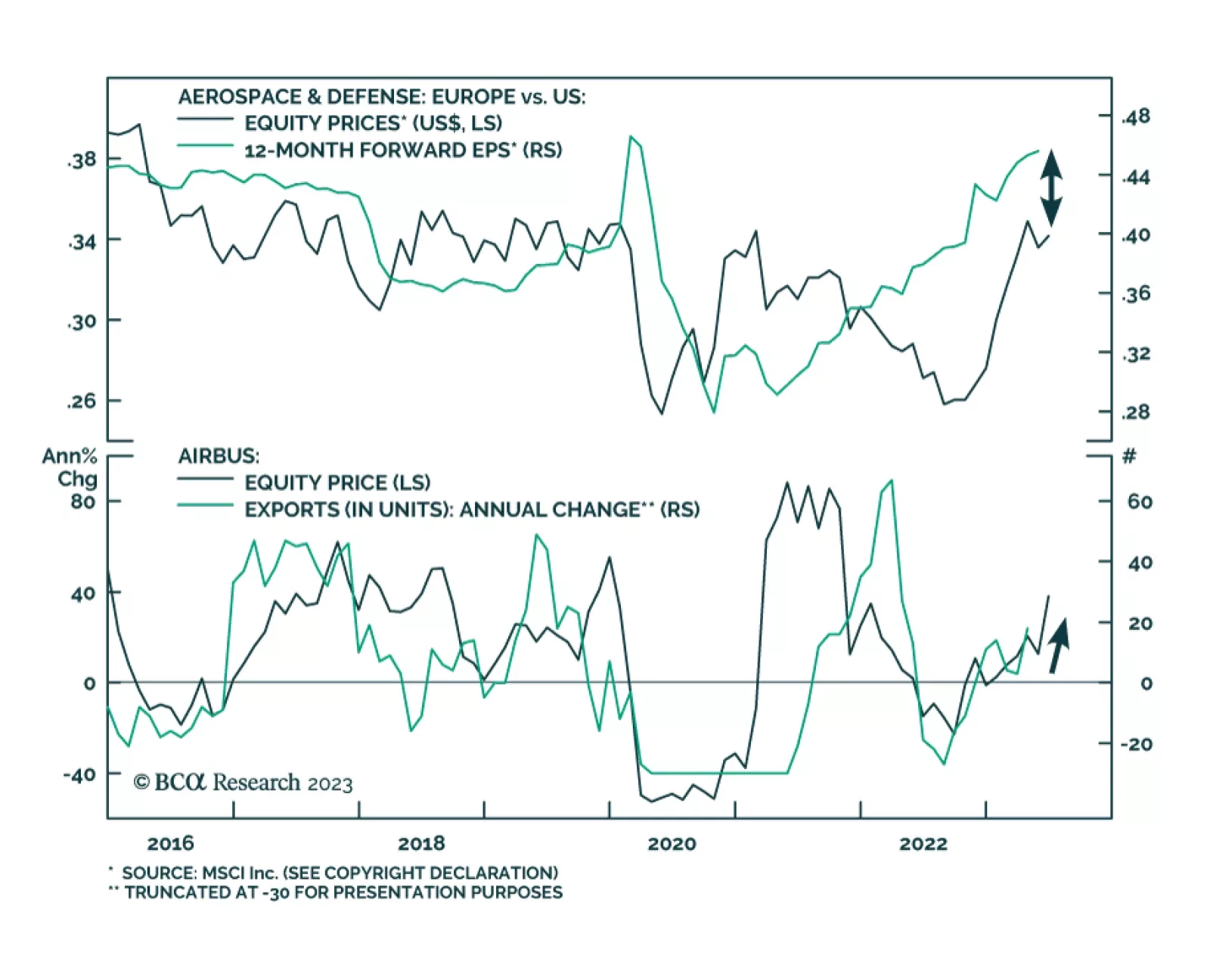

European aerospace and defense stocks are on the offense. Year-to-date, they are up 20% in absolute terms and 24% relative to their US counterparts, both in US dollar terms. The relative 12-month forward earnings suggest that…

The Bank of England surprised markets with a larger-than-anticipated 50bps rate hike on Thursday, raising its policy rate to 5% versus expectations of 4.75%. Seven of the nine MPC members voted in favor of the rate increase.…

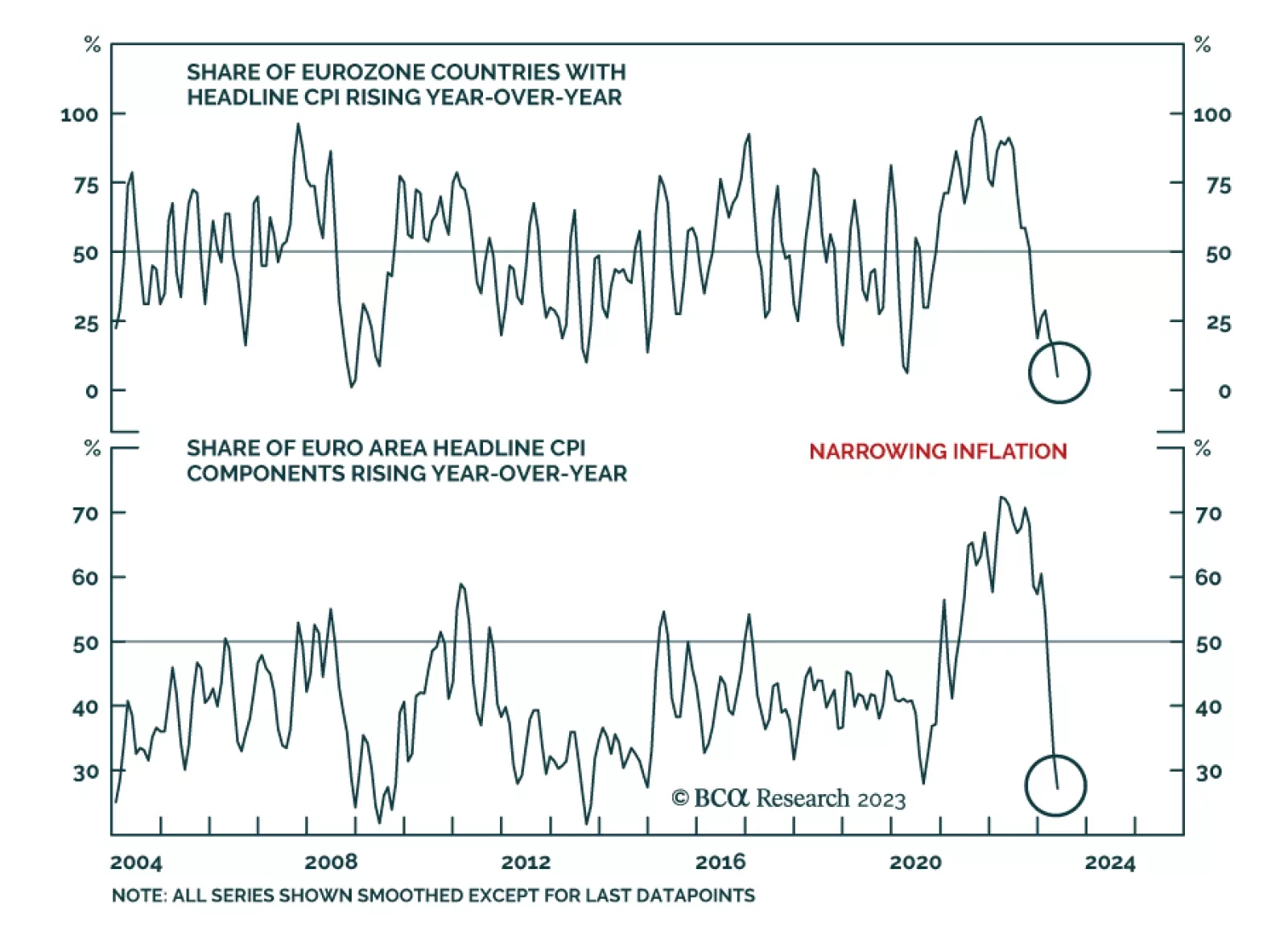

According to BCA Research’s European Investment Strategy service Eurozone inflation likely to diminish further. First, policy is tight. The impact on leading economic variables is already visible, with M1 collapsing,…

In this Insight, we discuss the currency and bond market implications of last week’s ECB and Bank of Japan policy meetings. The conclusion: the ECB is on a path to an overly hawkish policy mistake, while the Bank of Japan’s dovish…