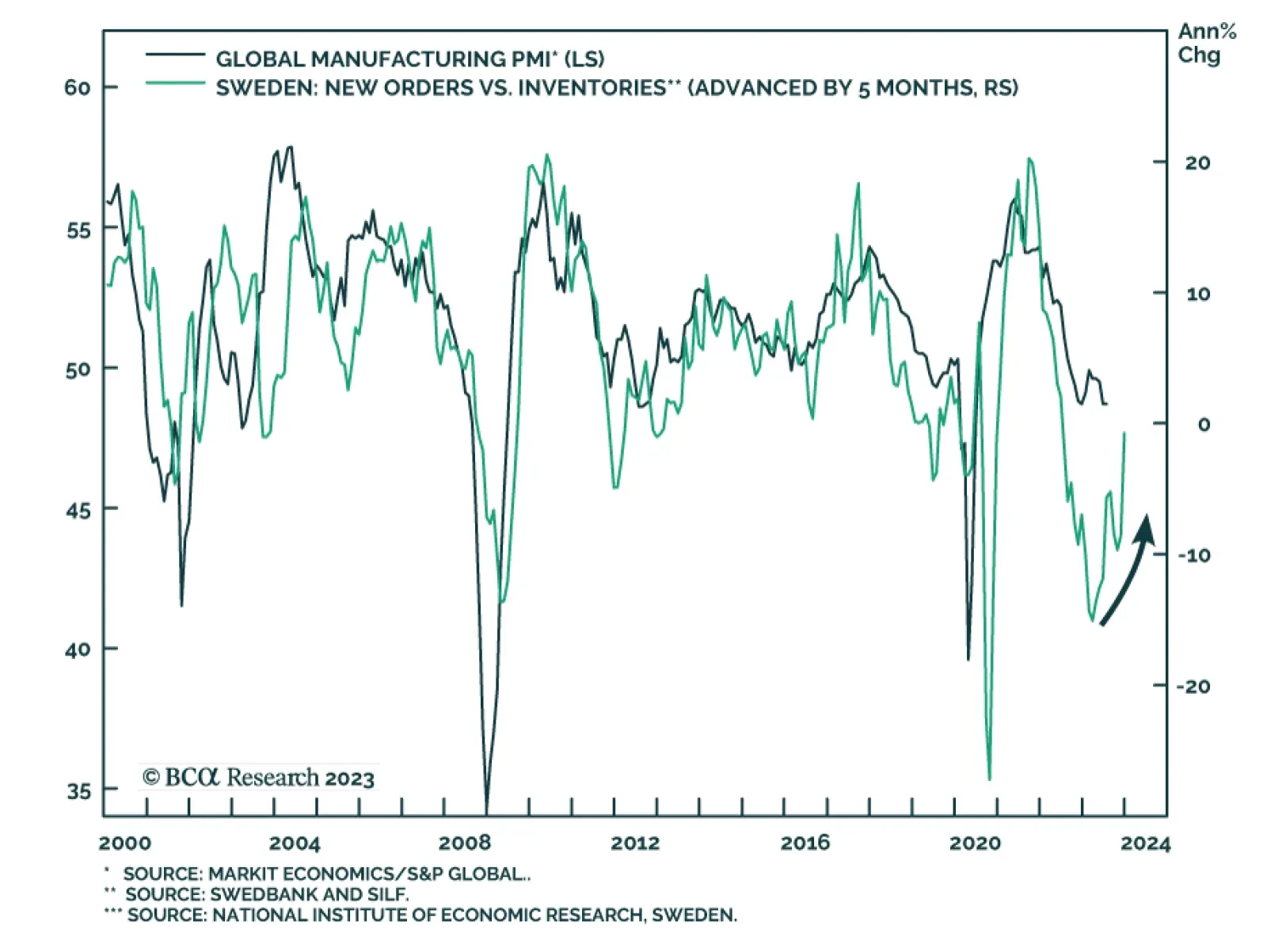

The Global Manufacturing PMI remained unchanged at 48.7 in July, indicating that the pace of decline steadied at the start of the third quarter. The details of the release show accelerating rates of decline in production, new…

History suggests that a “soft landing” is highly unlikely after such an aggressive Fed tightening cycle. The rally could continue for a little longer but, on the 12-month horizon, market risks are very skewed to the downside.

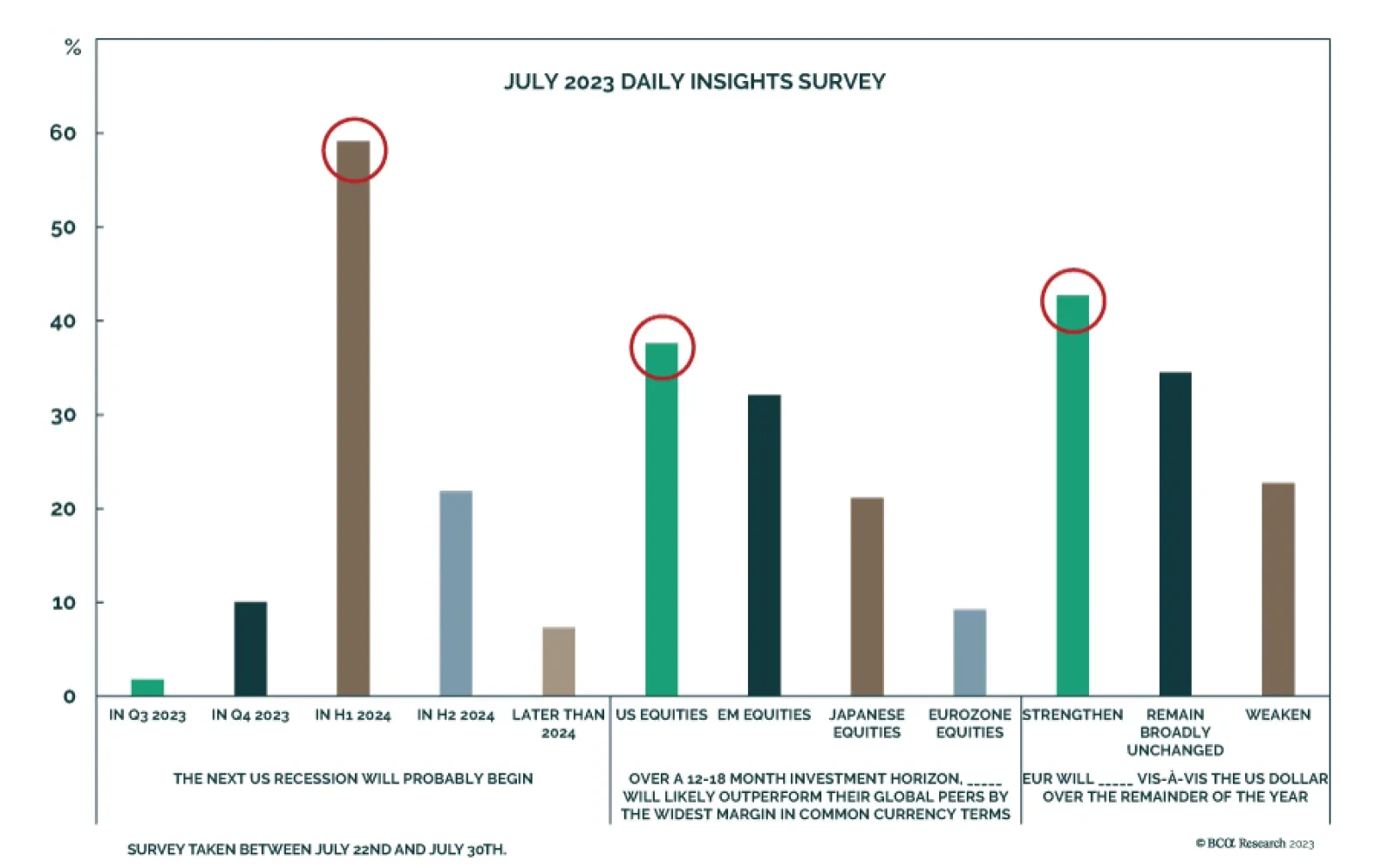

In the monthly Daily Insights Survey we conducted over the past week, we asked about our readers’ outlook for the US economy, regional equity allocation, and EUR/USD. On the outlook for the US economy, the majority of…

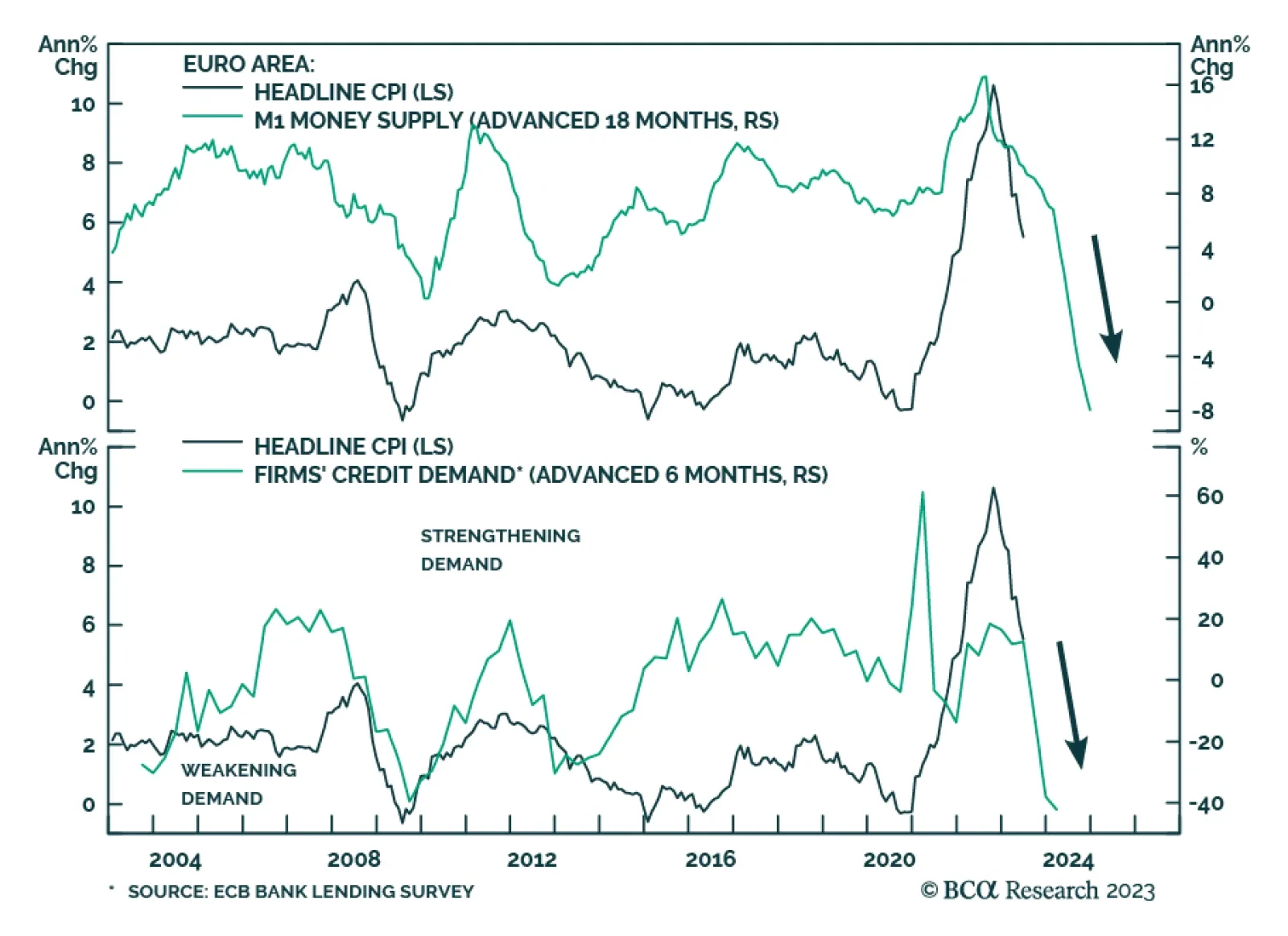

The Eurozone economy returned to expansion in the second quarter with real GDP rising by 0.3% q/q – beating expectations of 0.2% q/q. This follows an upwardly revised 0.0% in Q1 and a 0.1% contraction in Q4 2022. In…

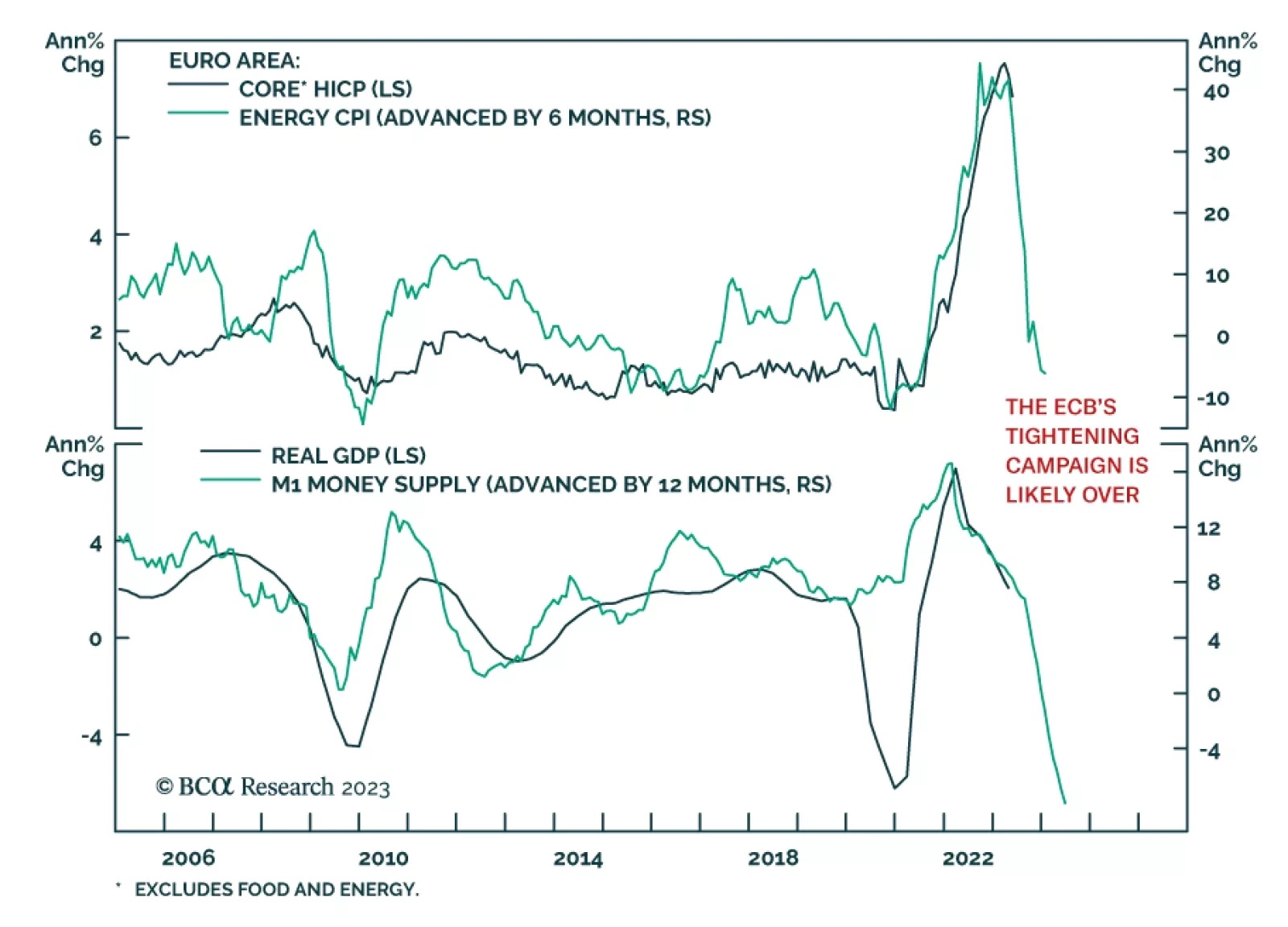

The ECB’s tone has changed decisively. Intransigent forward guidance is gone; data dependency is in. What does this transition mean for the path of European interest rates and the euro?

The DXY will continue to have near-term upside, as economic growth holds up in the US, while it deteriorates in other parts of the world. Remain constructive on the DXY at current levels, but pivot to a short position on evidence US…

The US is not out of the woods when it comes to inflation, which means that it is too early to conclude that the Fed can stop raising rates. Any further increase in inflation risk would prompt us to turn more cautious on stocks.

As expected, the ECB delivered a 25 basis point rate increase on Thursday, raising the policy rate to its 2001 record high of 3.75% and marking its ninth consecutive rate increase. The most important takeaway from the meeting is…

In Section I, we audit the market’s “soft landing” narrative in response to a meaningful challenge to our cautious stance from recent financial market developments. We acknowledge that US economic growth was stronger in the first…

Among the critical materials needed for the global energy transition, Li is expected to see the largest increase in demand from 2022 to 2050. Li supply is not constrained, but continued investment in mining and refining will be…