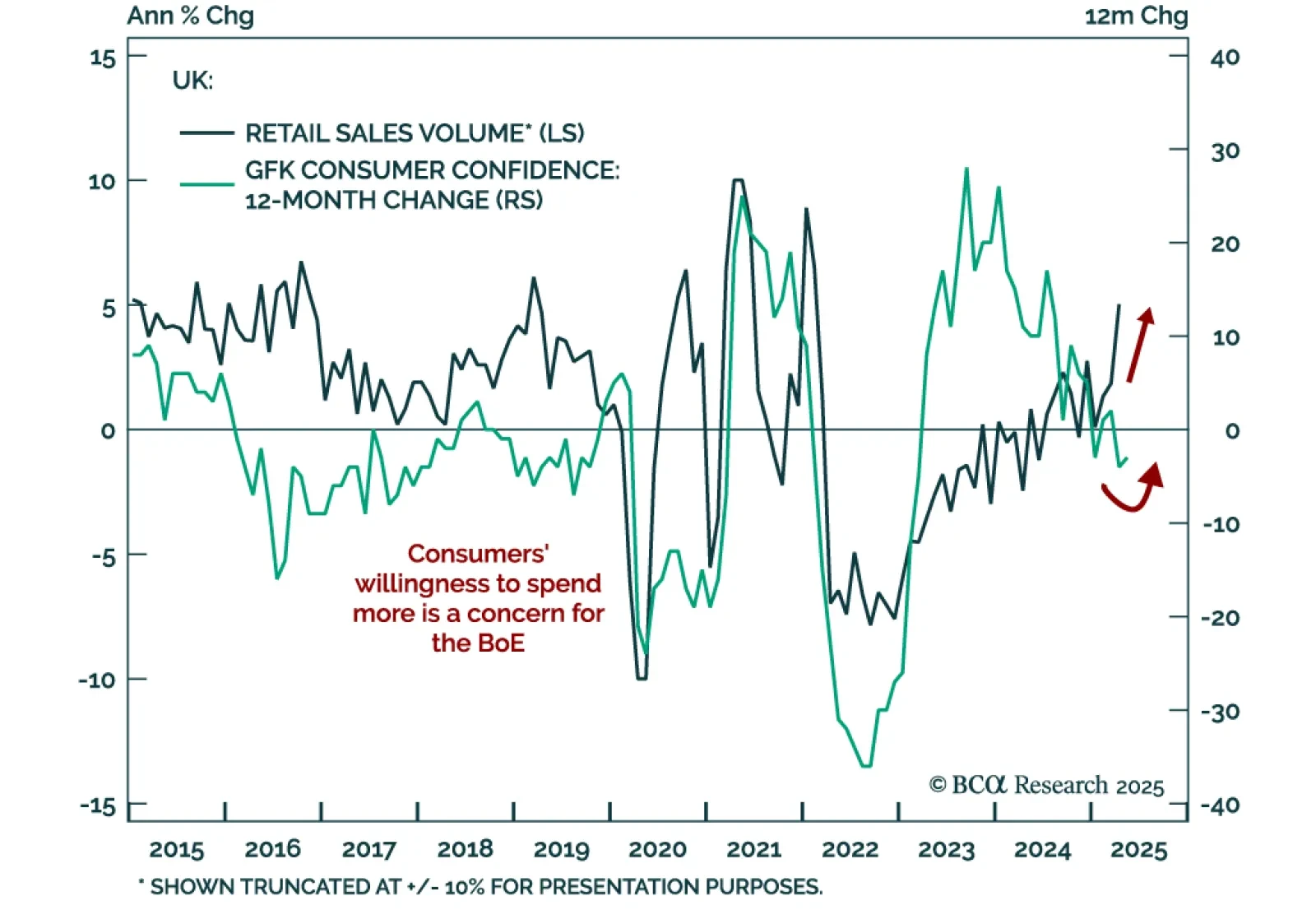

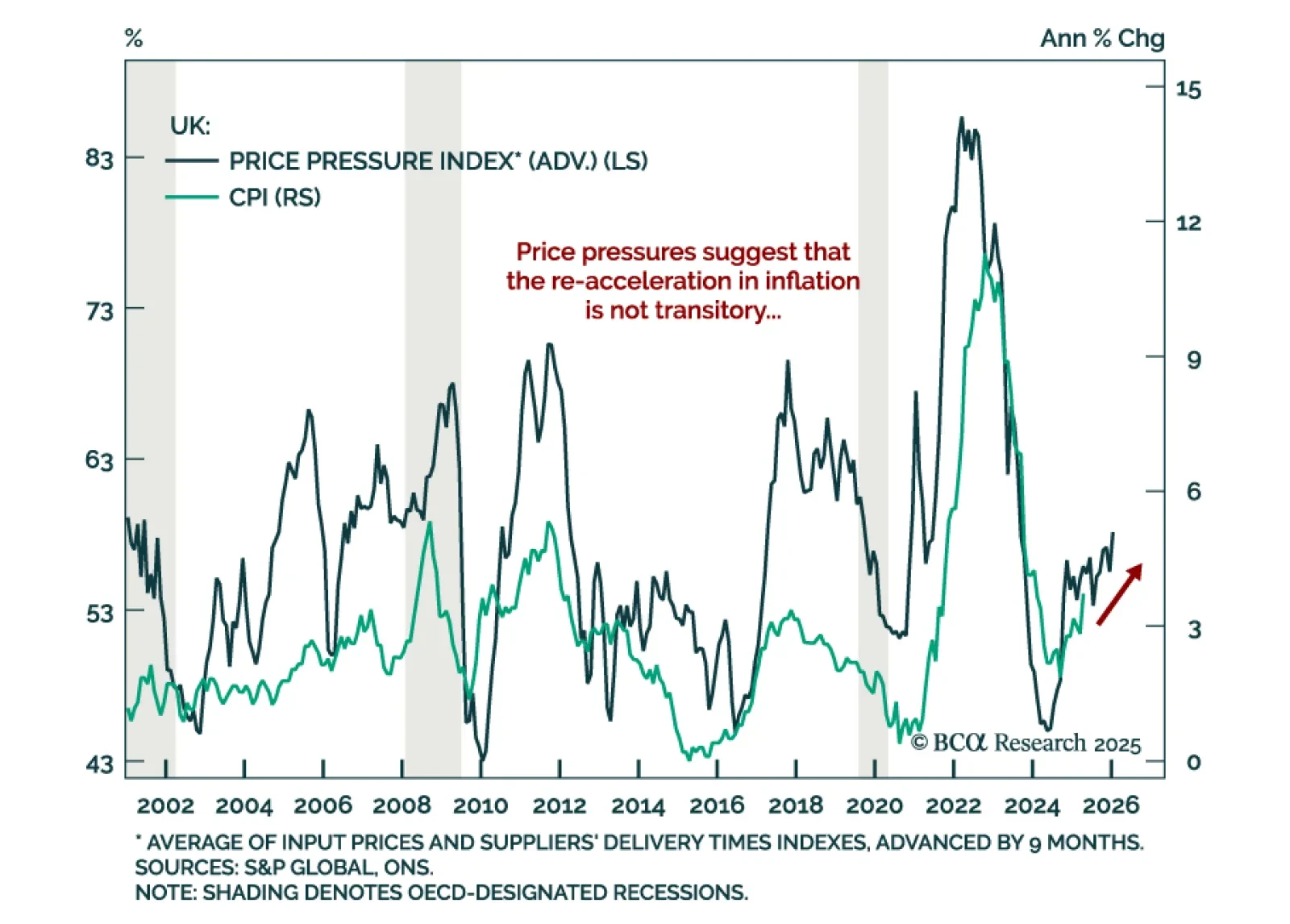

The rebound in UK retail sales and consumer confidence surprised to the upside, and suggests that the re-acceleration in inflation observed earlier this week may not be transitory. UK retail sales rose 1.2% m/m in April…

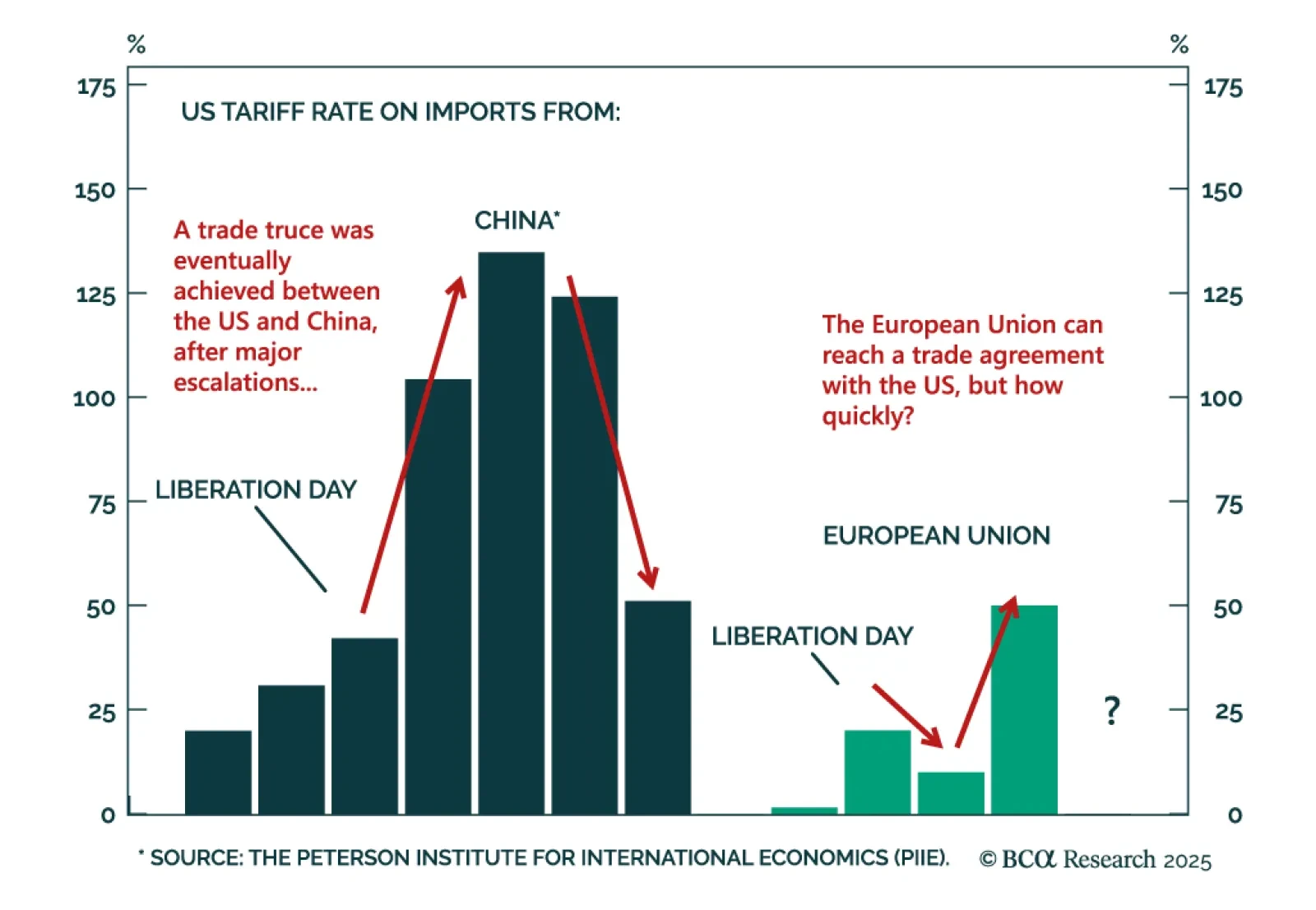

Last Friday, President Trump announced new 50% tariffs on imported goods from the European Union (EU), effective June 1st, and threatened US company Apple with 25% tariffs unless it made iPhones in the US. Global stock markets…

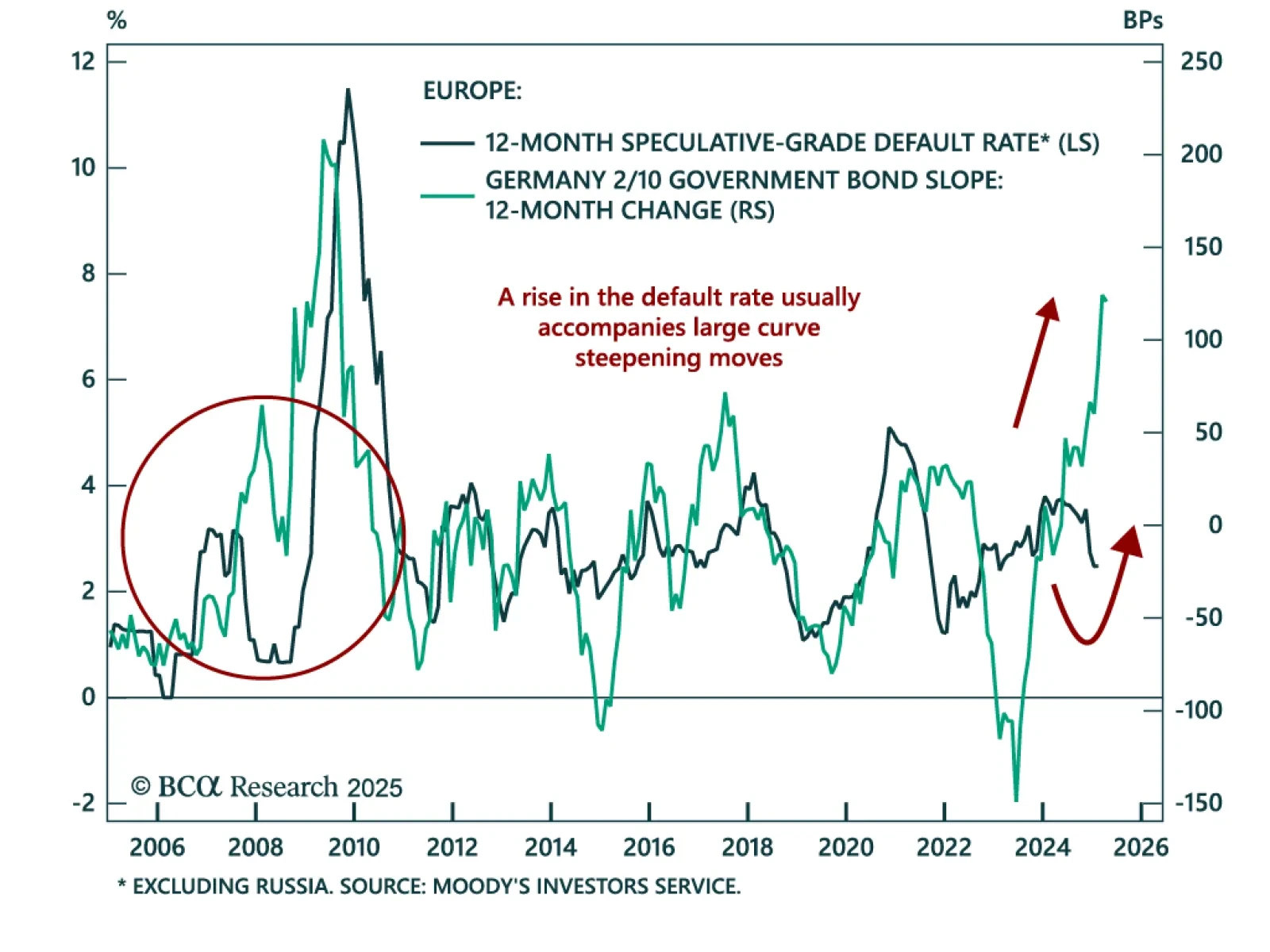

European corporate bond spreads have more room to narrow in the near term, but their next big leg is up. After a significant widening in option-adjusted spreads caused by stagflation fears in the US and “Liberation Day,”…

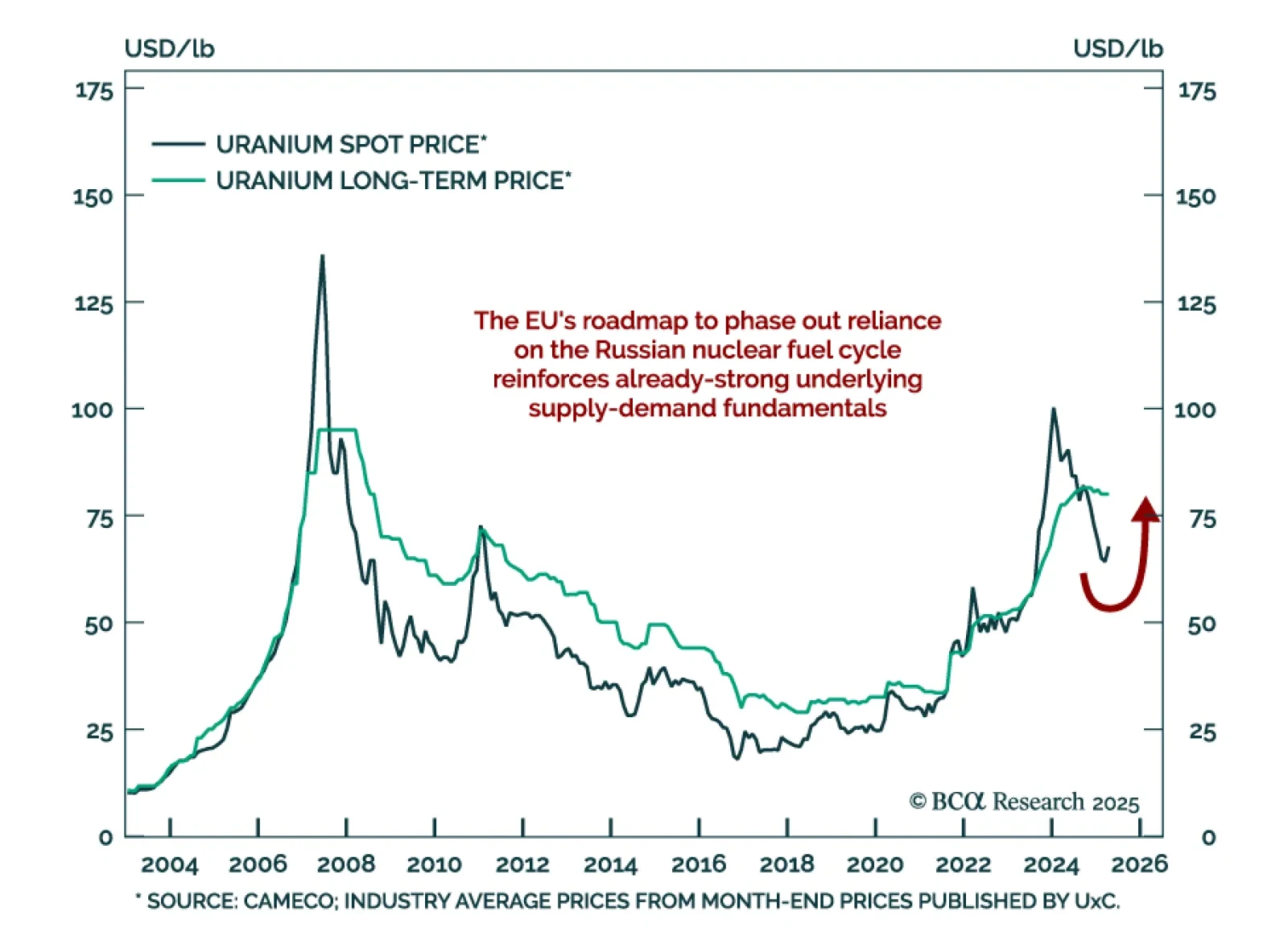

Uranium spot prices may have found a floor after falling to $64/lb from a $107/lb peak in February last year. This drawdown has been unexpected considering the strength of the underlying supply-demand fundamentals for uranium.…

UK inflation surprised to the upside in April. Headline inflation rose to a 15-month high of 3.5%, from 2.6% the month before. Core inflation also surprised above estimates, printing 3.8% vs. 3.4% in March. Services inflation climbed…

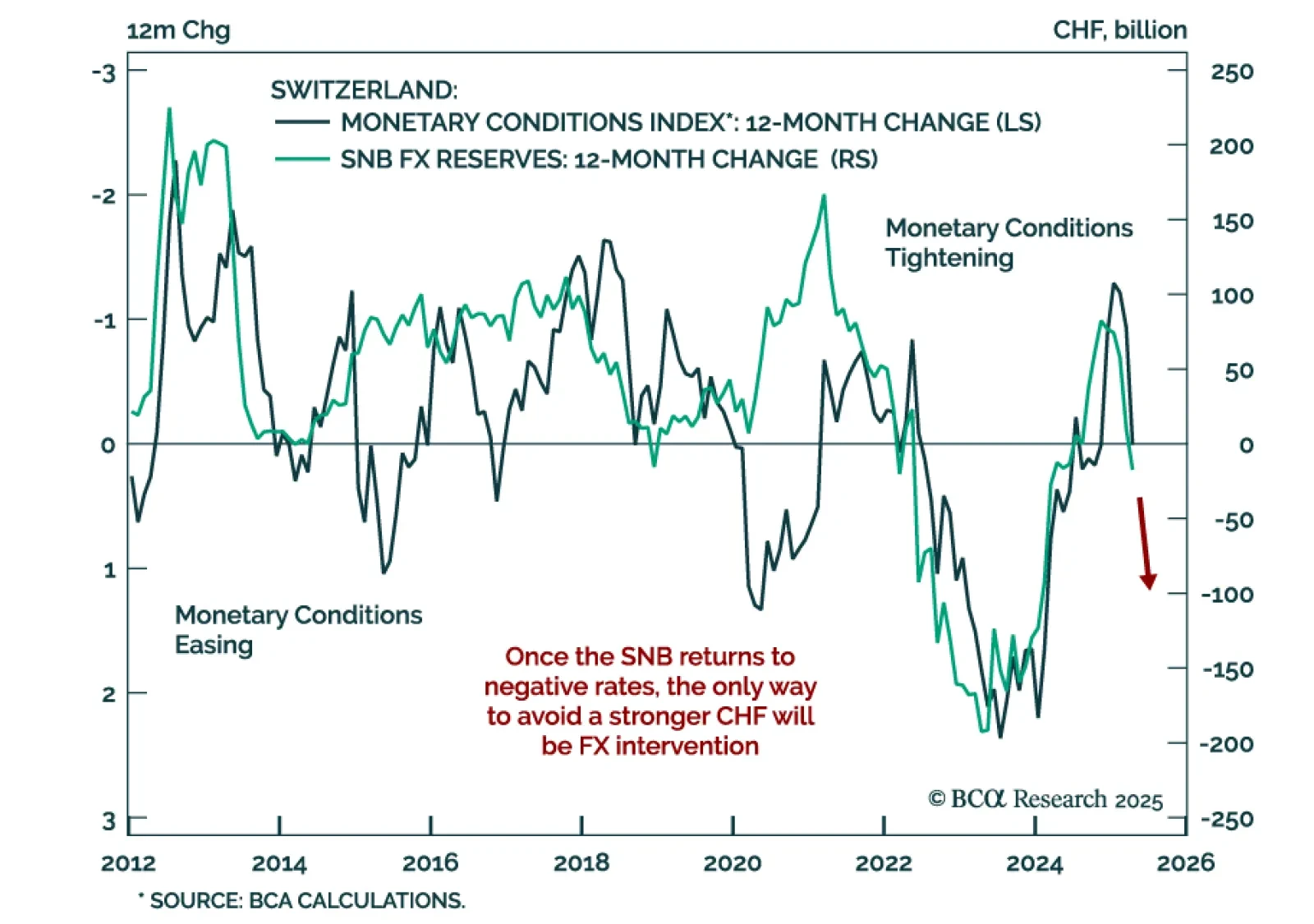

Swiss National Bank will have to resort to negative interest rates and FX intervention before year-end. Swiss inflation fell to 0% year-over-year in April, or the lower end of the SNB’s 0%-2% target range, and the continued…

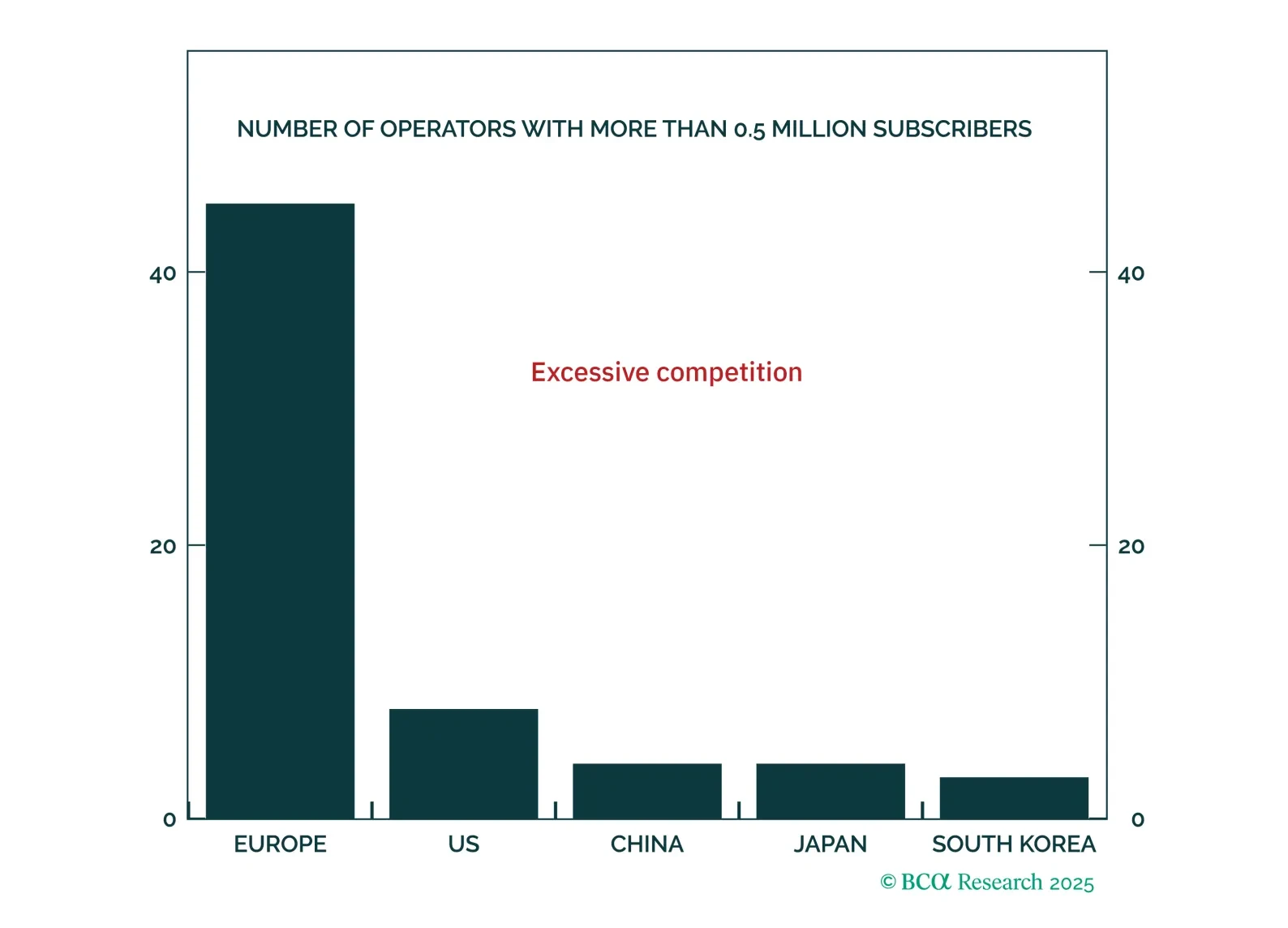

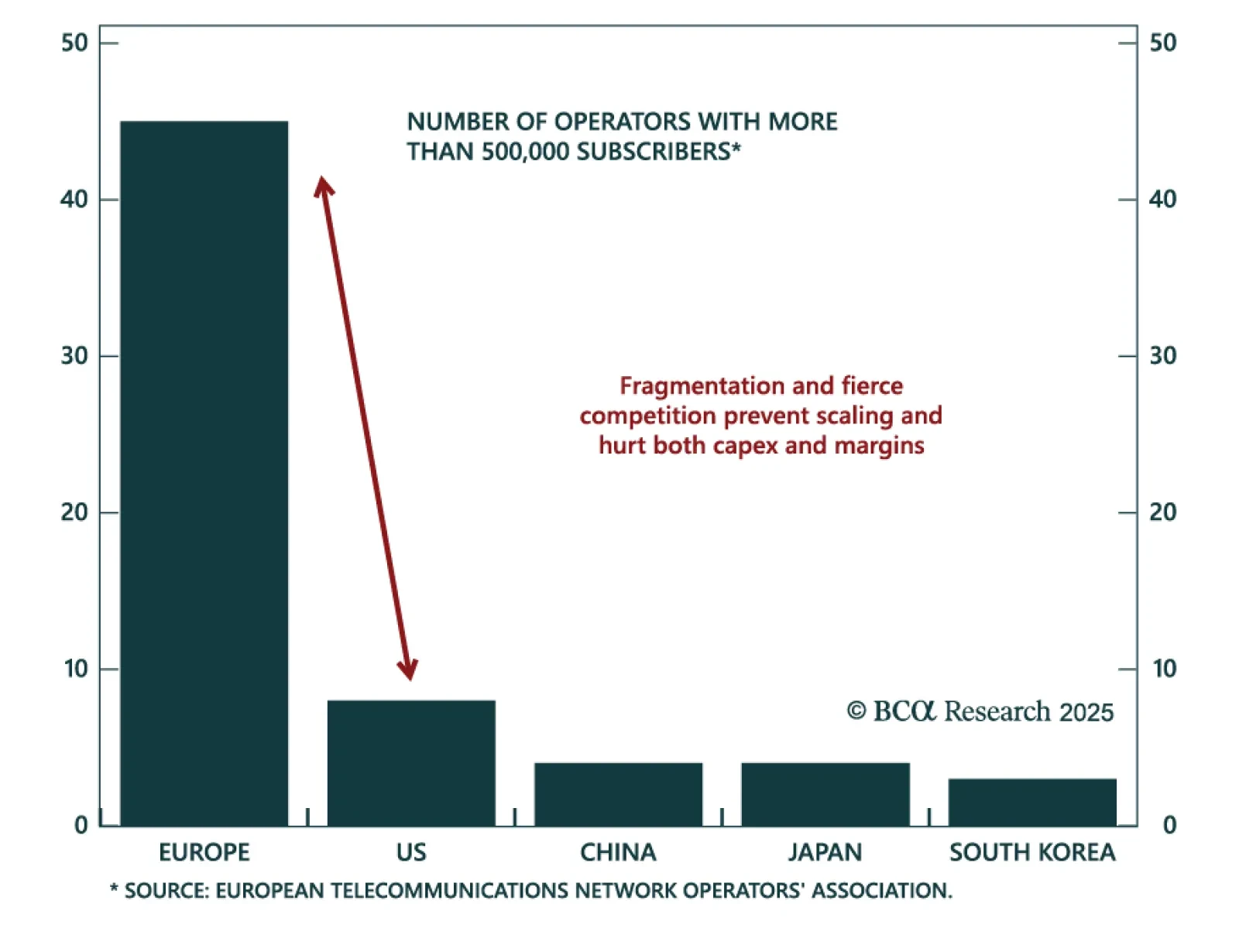

Our European strategists are upgrading the communication services sector to overweight on a structural investment horizon. In March, they highlighted the sector's near-term attractiveness. Since the Great Financial…

The European bond market is pricing in a more optimistic outlook. The BTP-Bund spreads have narrowed 30bps since April 9 and are now within reach of their pre-Ukraine war level. BCA’s European strategists do not share this…

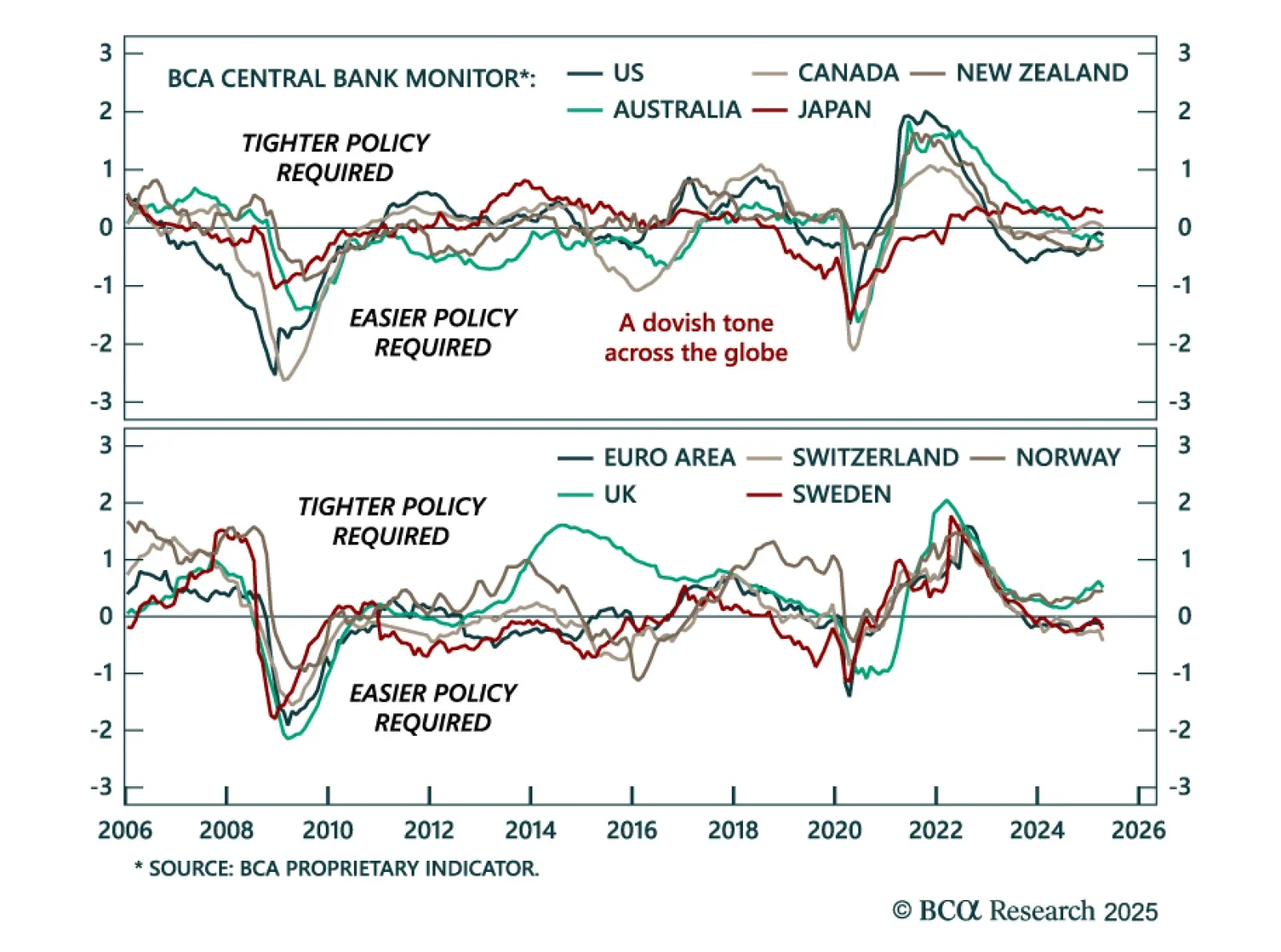

Expect broad-based dovish surprises from major central banks, and stay overweight UK and euro area government bonds. Our Global Fixed Income, European, and FX strategists published a joint update of BCA’s Central Bank Monitors. They…