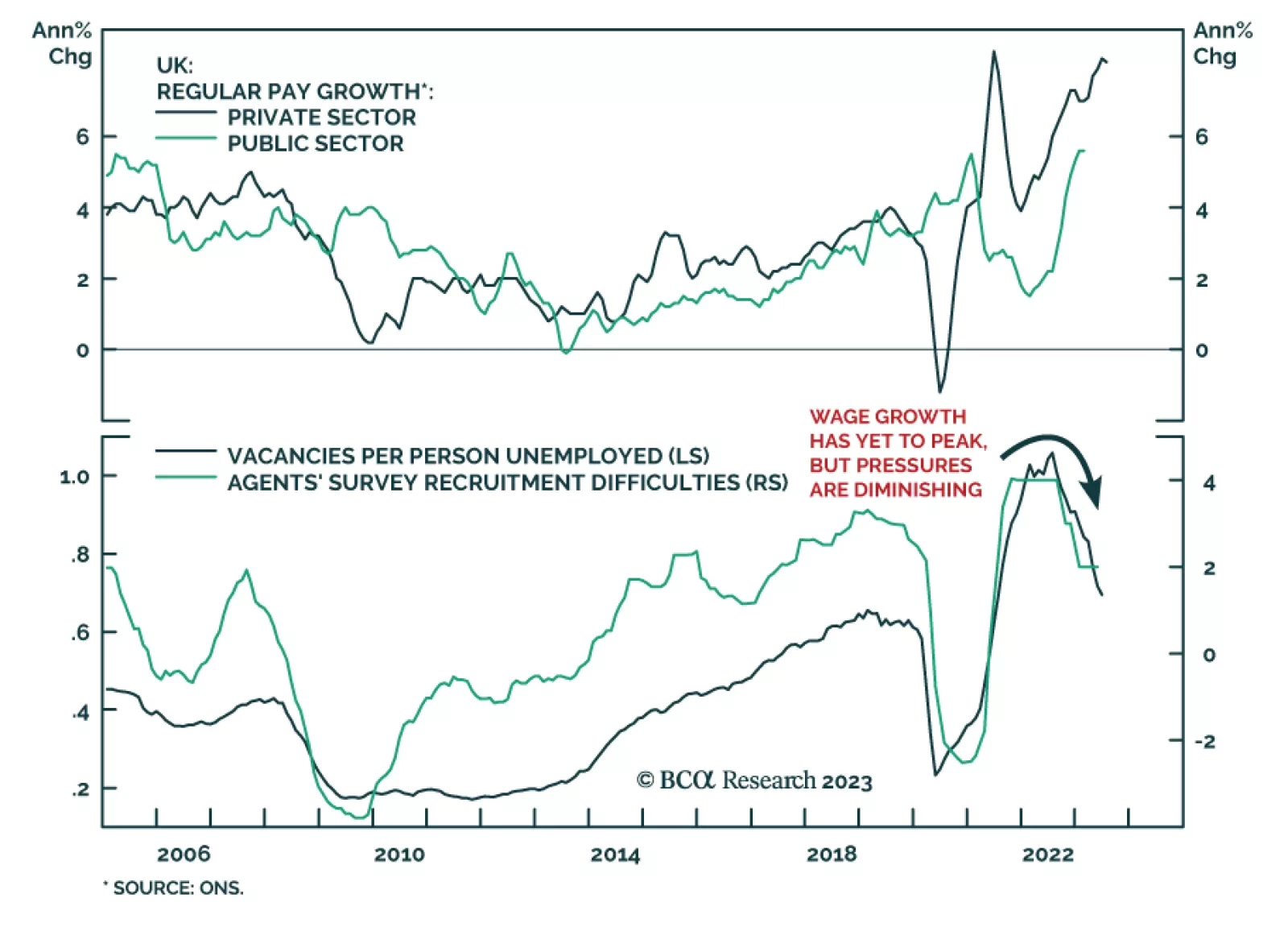

The latest UK labor market developments complicate the Bank of England’s task when it meets next week. The unemployment rate ticked up from 4.2% to 4.3% in the three months to July as employment fell by 207 thousand.…

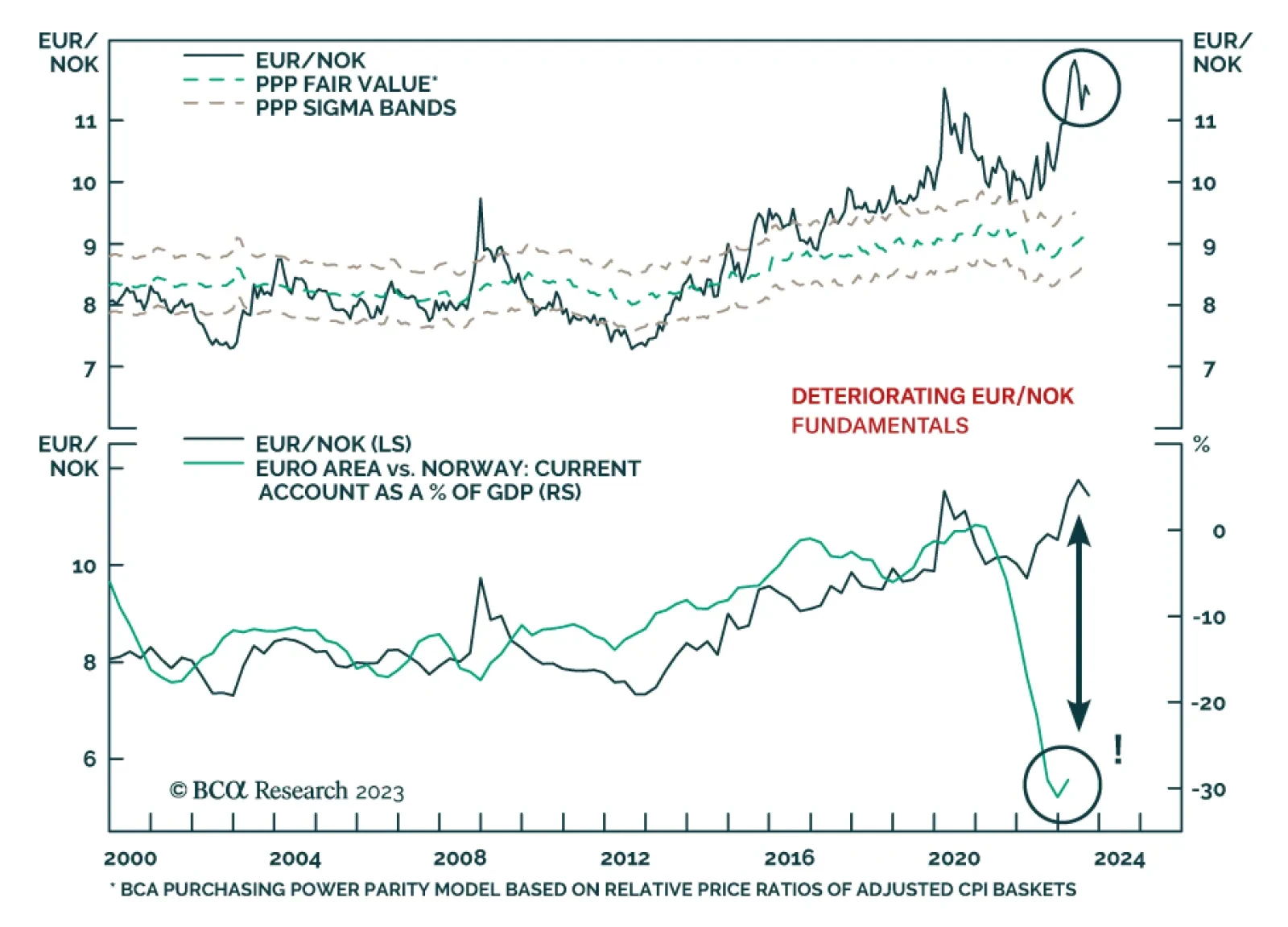

According to BCA Research’s European Investment Strategy service, valuations, interest rate differentials, and higher oil prices favor the NOK over the EUR. Higher oil prices, especially when they reflect tightening…

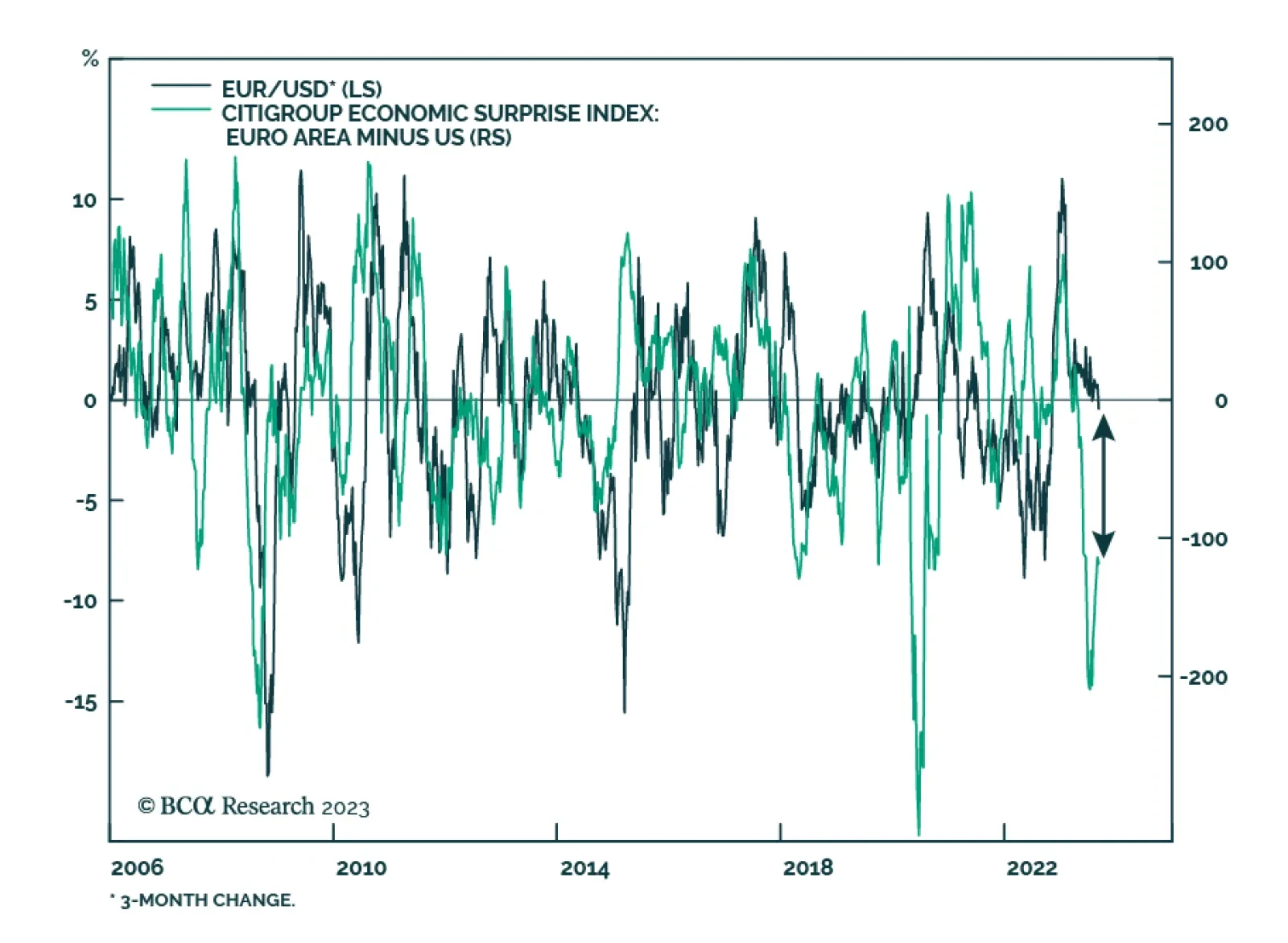

The euro has weakened sharply since mid-July as US growth continues to outperform that of the Eurozone. Is a new bear market afoot for the common currency?

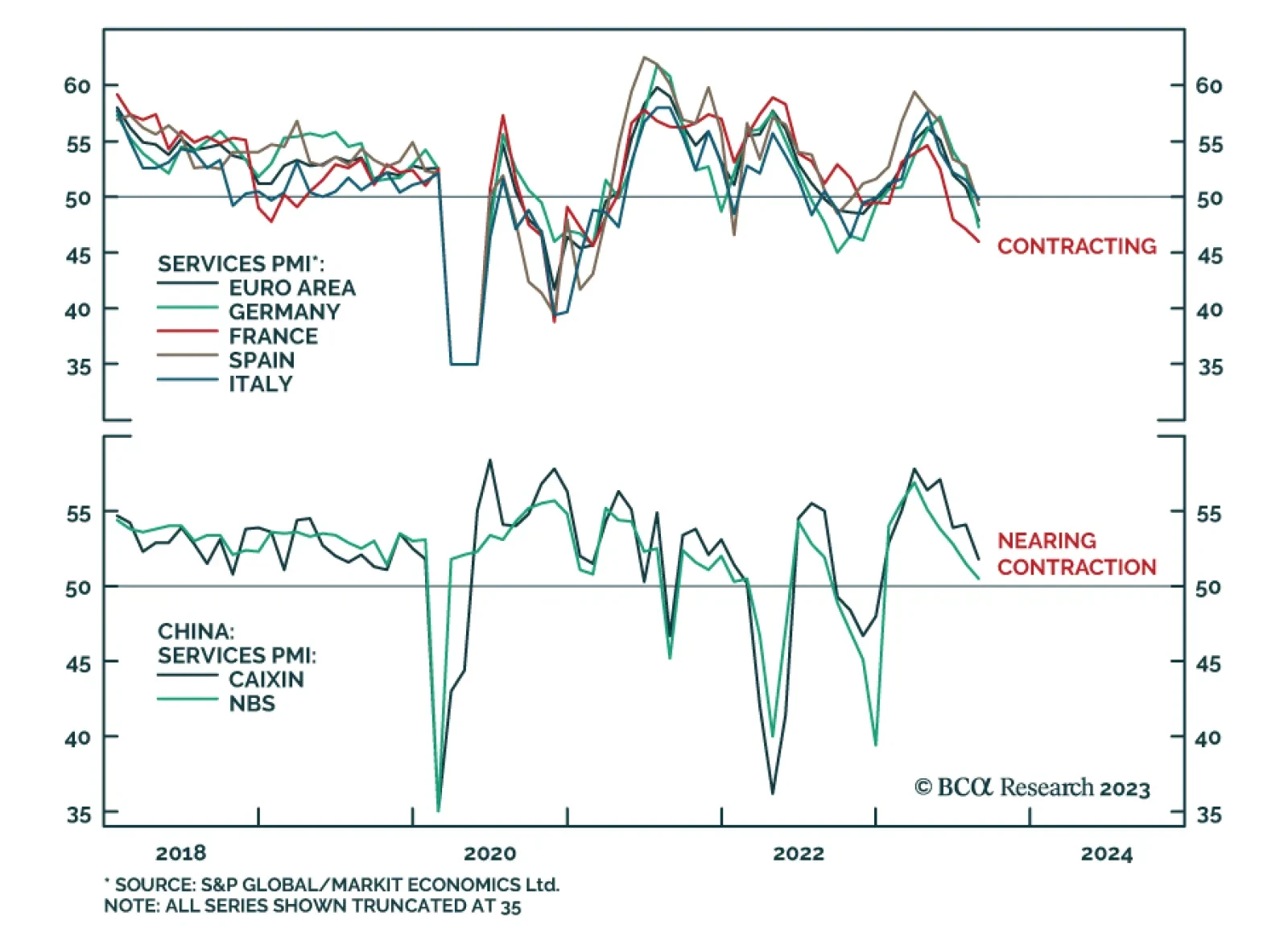

If we look at global growth as an aircraft, the plane is experiencing failing engines and will lose more altitude in the coming months. Yet, neither Chinese authorities, nor the Fed or the ECB will be quick to come to the rescue as…

Recent Eurozone economic data indicate that restrictive monetary policy and the global manufacturing downturn are weighing down on the region’s economy. In particular, new orders at German factories plunged by 11.7% m/m…

The geopolitical backdrop remains negative despite some marginally less negative news. China’s stimulus is not yet large or fast enough to prevent a market riot. Two of our preferred equity regions, ASEAN and Europe, are struggling…

The final PMIs for August delivered a pessimistic update on service sector conditions in the Euro Area and China. The Eurozone services index was unexpectedly revised down from 48.3 to 47.9 – indicating a more pronounced…

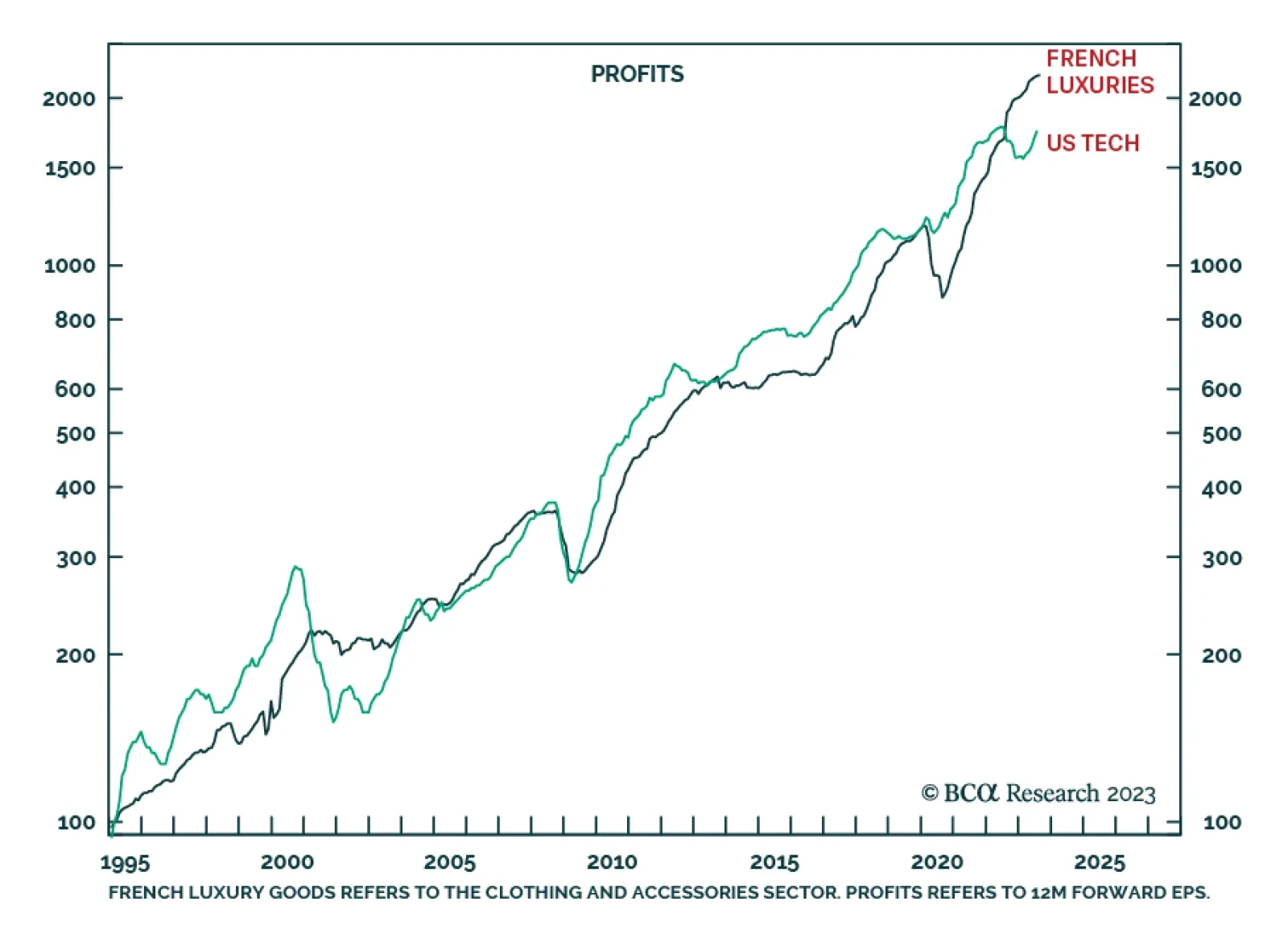

The stock market’s pre-eminent growth sector is not US technology, it is French luxury goods. On most time horizons over the past decades, French luxuries have trumped US technology on profit growth, price performance and…

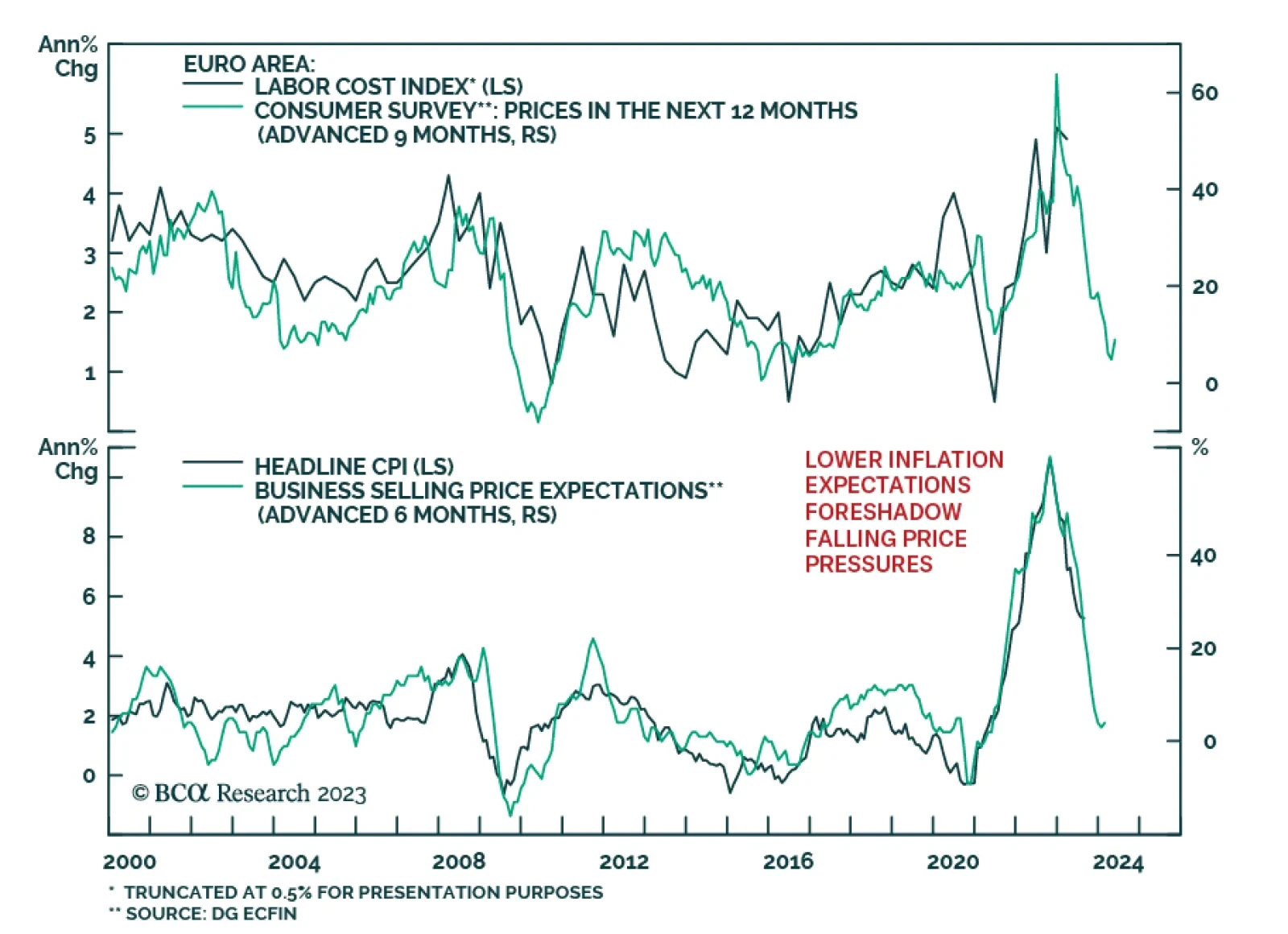

Eurozone headline inflation surprised to the upside in August, confirming the signal from the preliminary German and Spanish releases. The year-on-year gauge was unchanged at 5.3% – surprising expectations of a deceleration…