Aggressive monetary tightening has always led to recession, although the timing is uncertain. The effects of high interest rates are starting to be felt. Investors should stay risk off and buy government bonds as a safe haven…

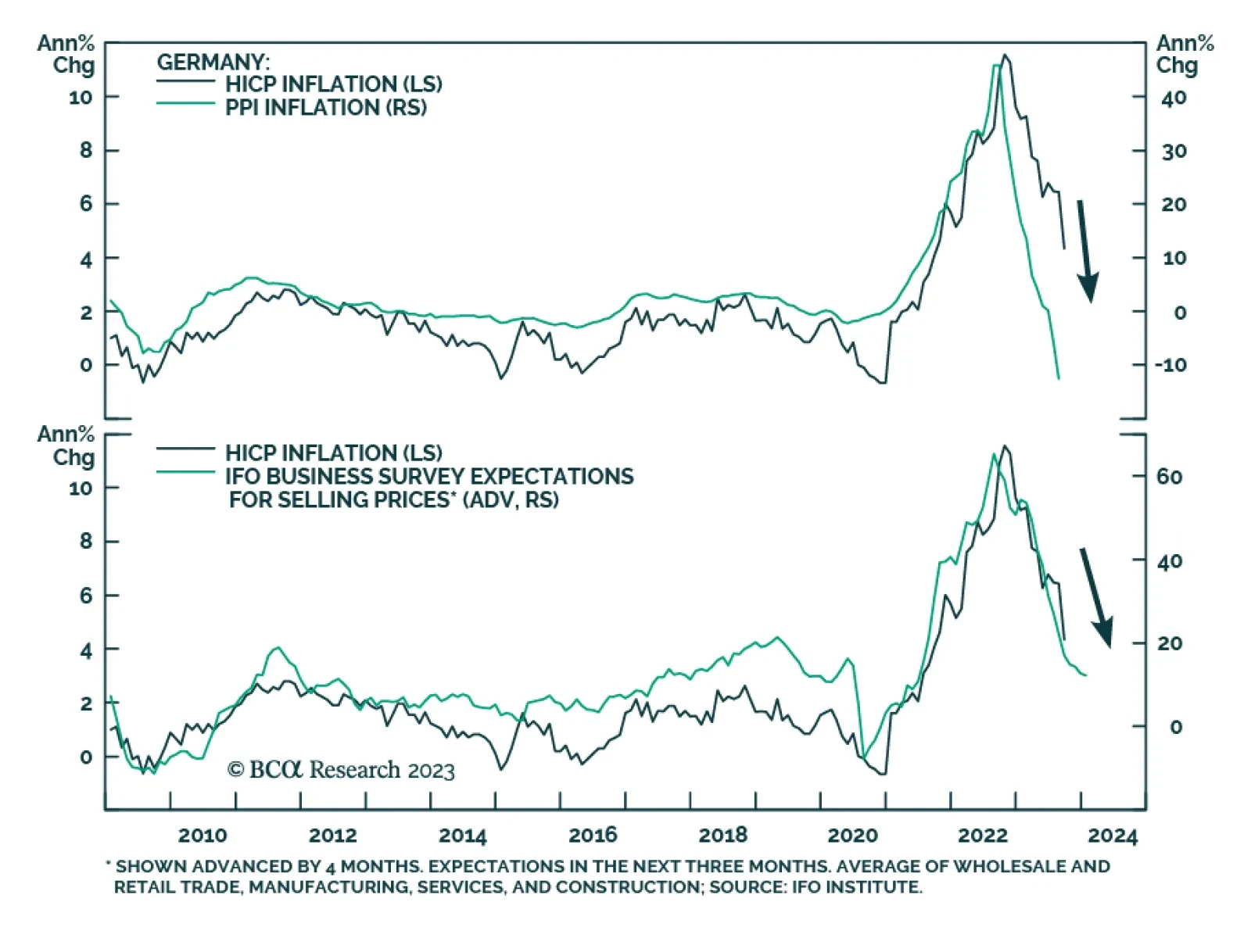

German inflation delivered an optimistic signal about the disinflation trend on Thursday. The headline CPI EU harmonized index collapsed from 6.4% y/y to 4.3% y/y in September– its lowest level since September 2021 and…

In this Strategy Outlook, we present the major investment themes and views we see playing out for the rest of 2023 and beyond.

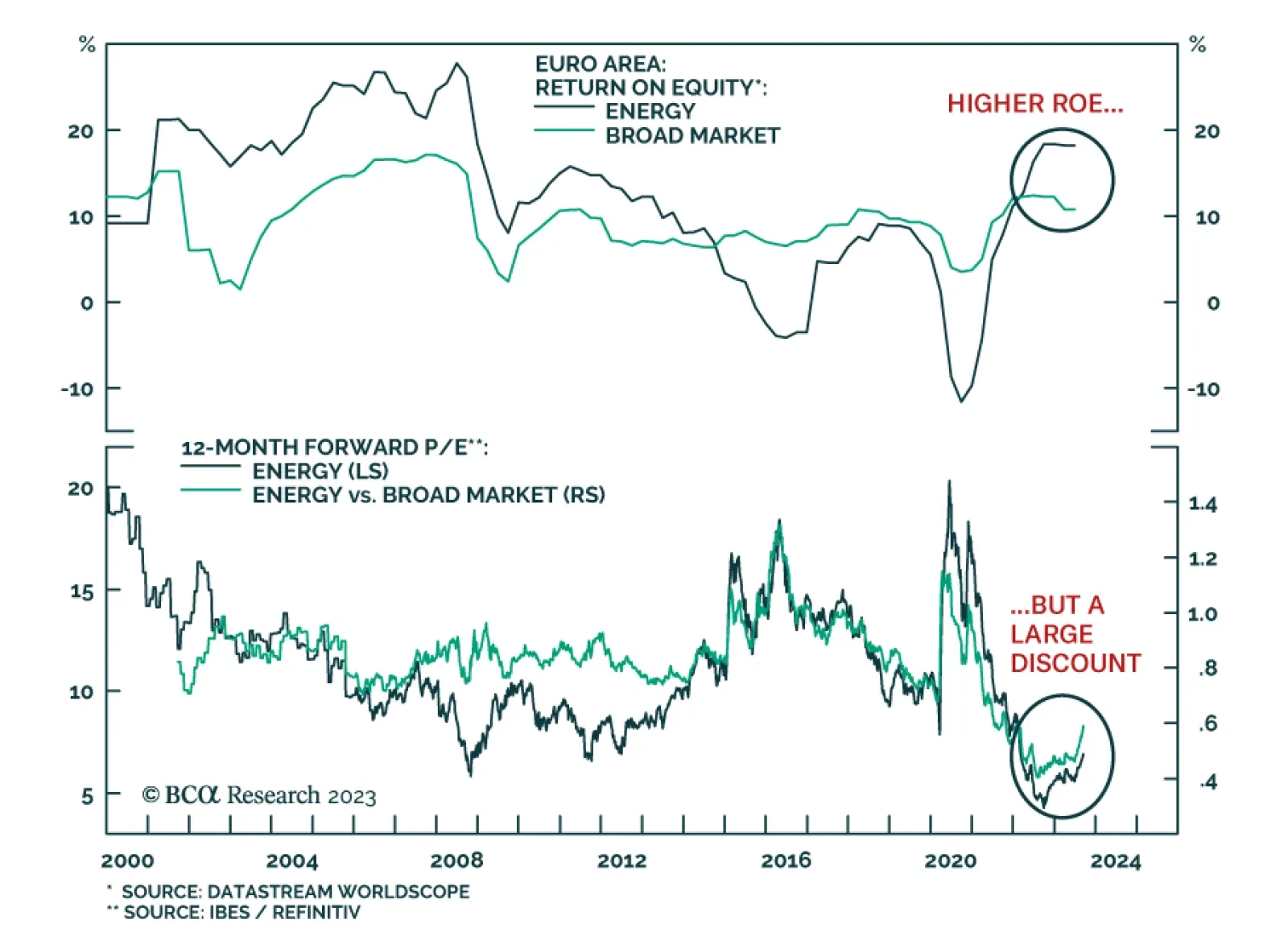

According to BCA Research’s European Investment Strategy service, energy stocks are an appealing overweight as a hedge against oil supply cuts. For now, the earnings of the energy sector continue to lag that of the broad…

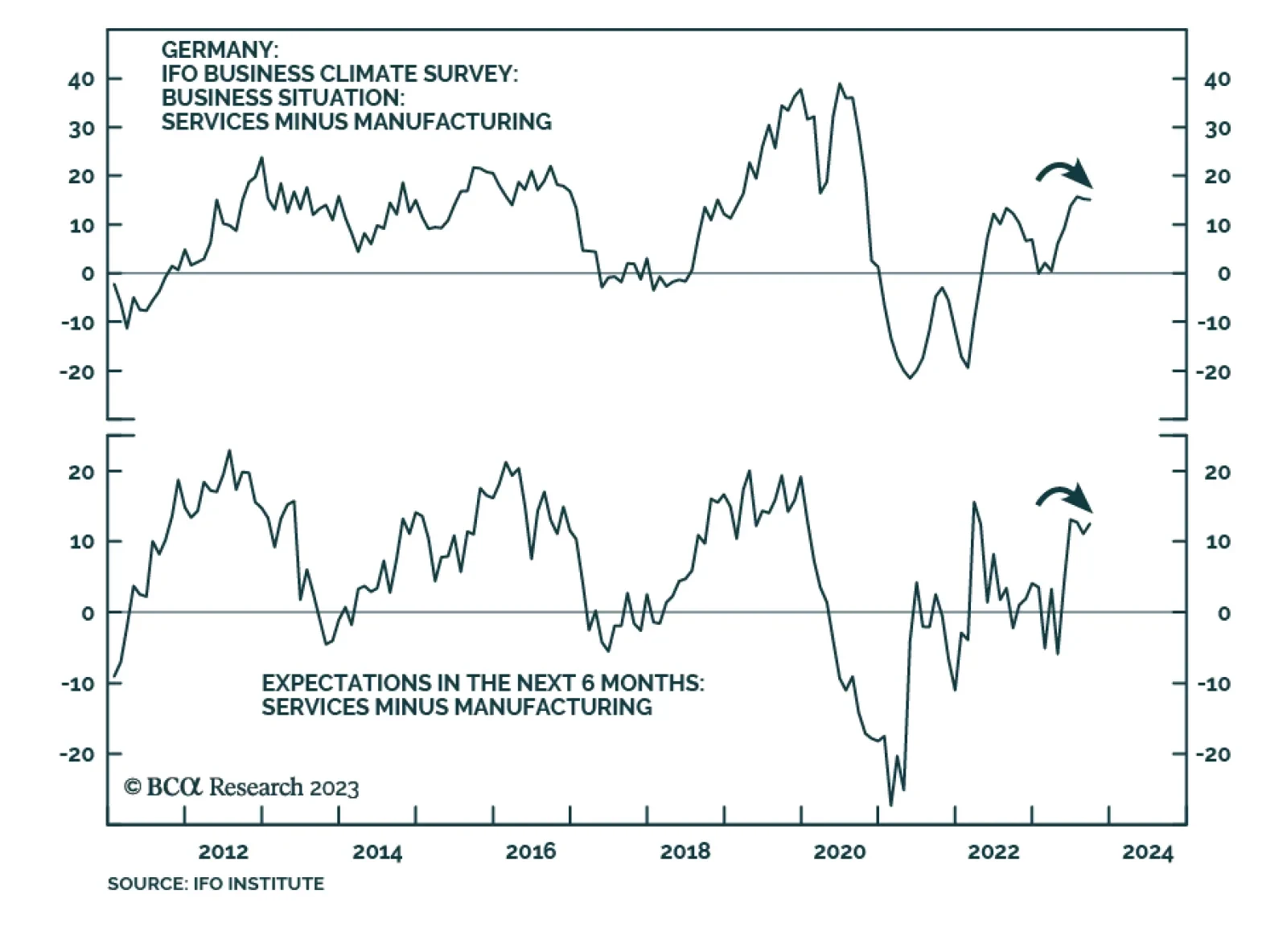

The message from the German Ifo is that although business sentiment continues to weaken, the pace of deterioration slowed in September and appears to be in the process of bottoming. The Business Climate Index’s marginal…

European stocks and the euro continue to weaken; soon, they will test the bottom of their recent trading range. Which sectors can protect investors against this downdraft?

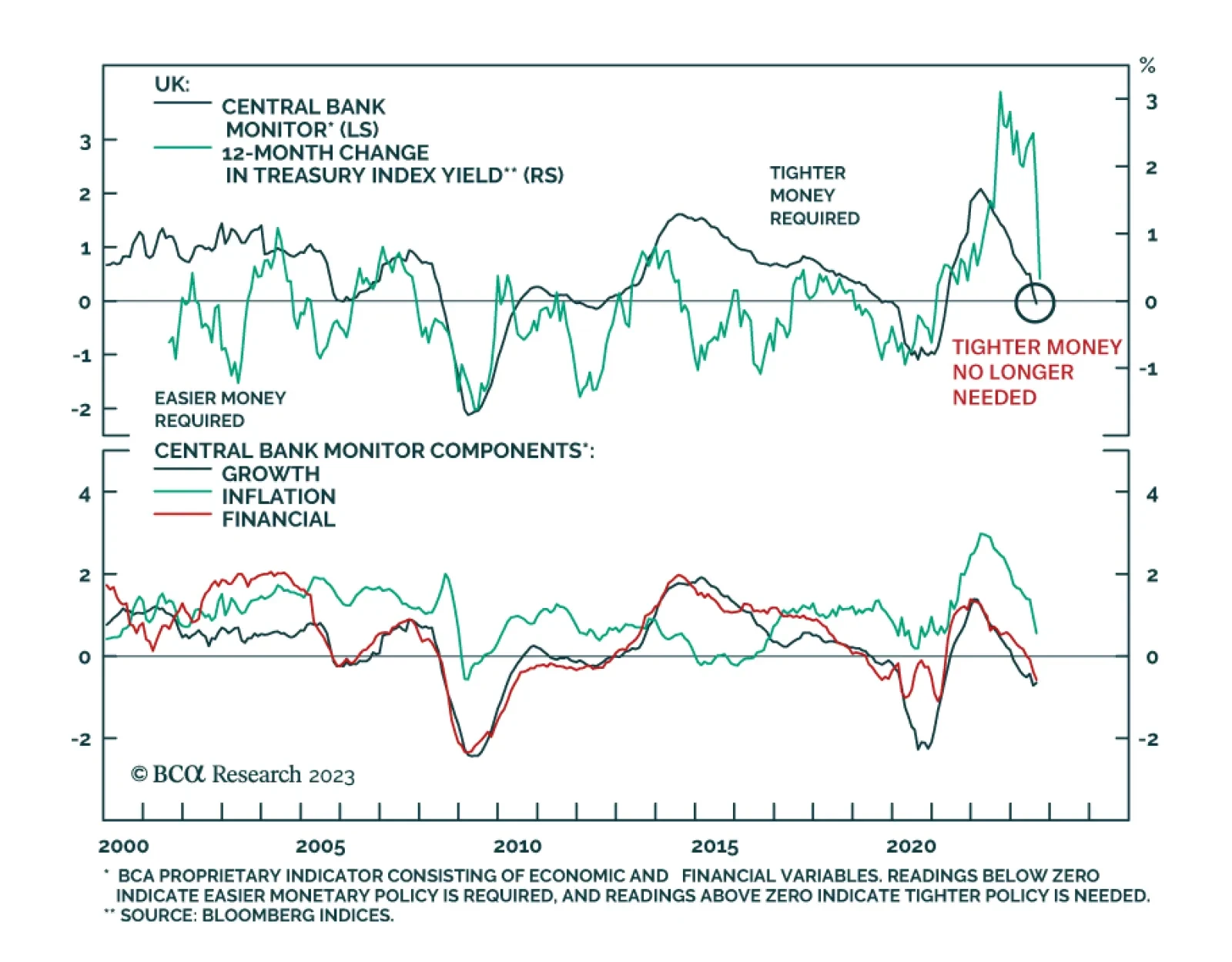

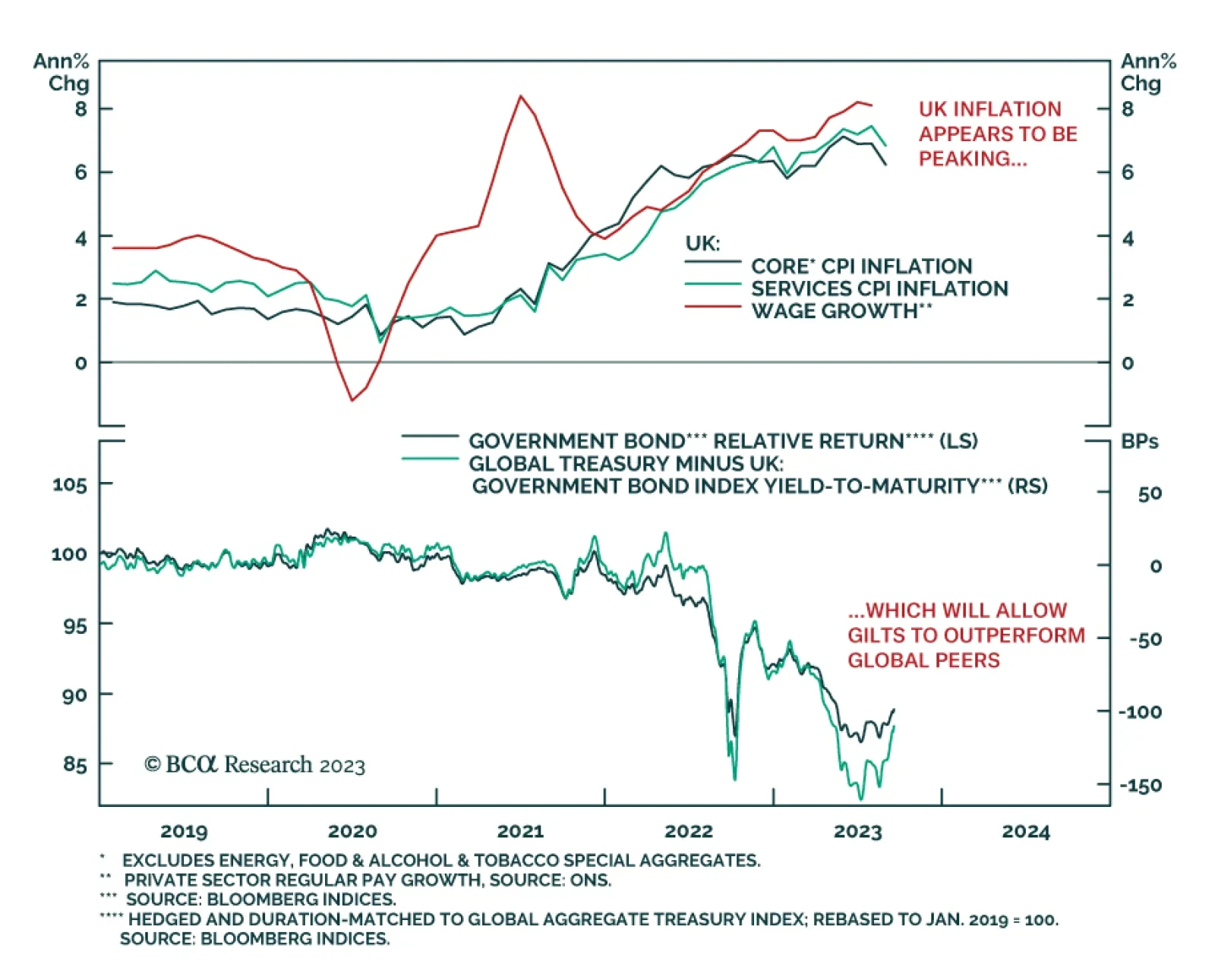

The Bank of England’s Monetary Policy Committee voted 5-4 in favor of maintaining its bank rate at 5.25% on Thursday. The four members that voted against the pause all preferred a 25-basis point rate increase. The tight…

We continue to expect Brent crude to trade just above $101/bbl in 4Q23, and to average $118/bbl in 2024. Higher volatility looms. We expect Russia will cut oil production next year as part of a concerted effort to undermine Biden’s…

The August UK inflation report produced a large downside surprise. Headline CPI rose +0.3% month-on-month, versus expectations of a +0.7% increase. Year-over-year headline CPI inflation slowed to 6.7% from 6.8%, a sizeable miss…

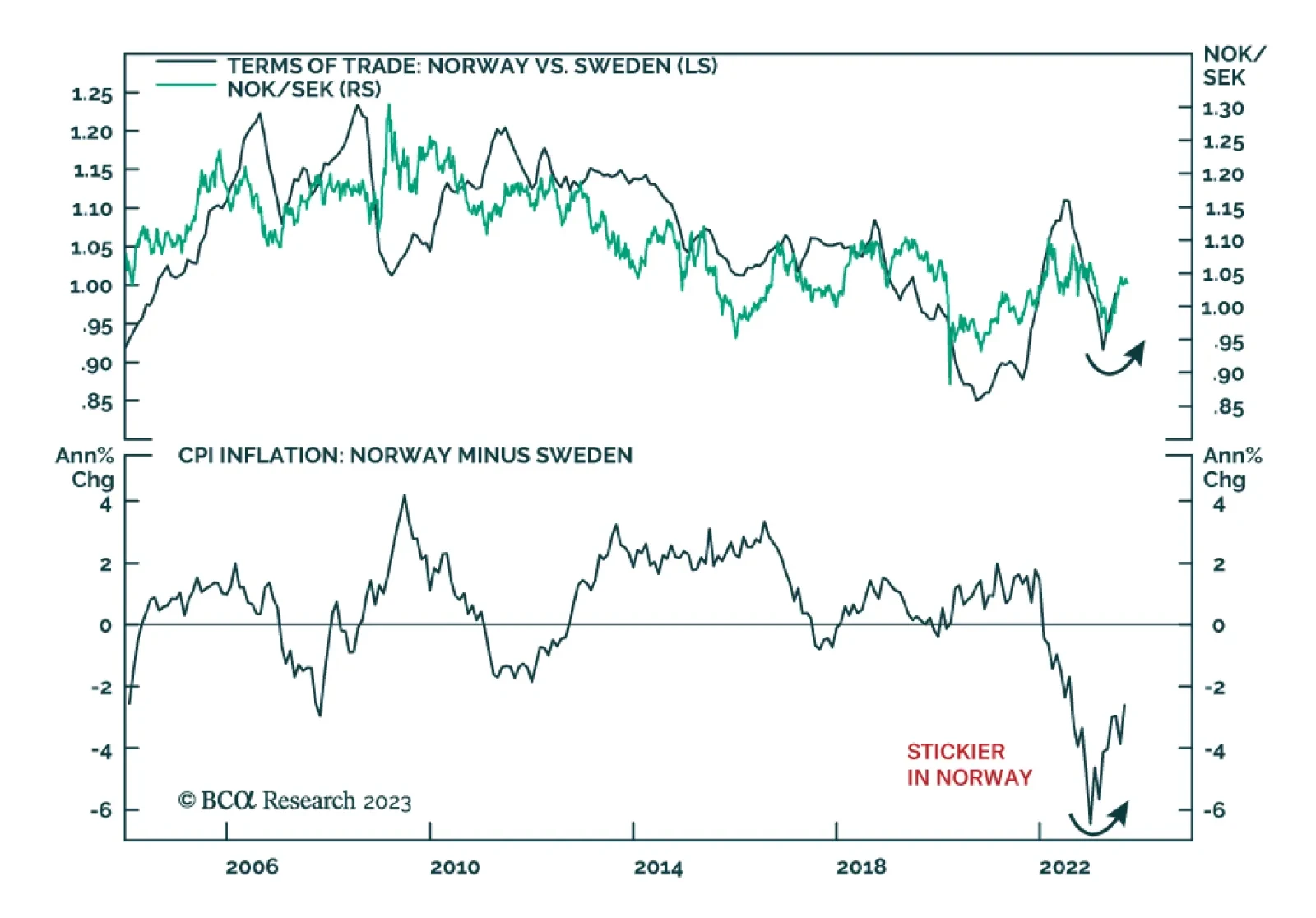

Scandinavian currencies are bearing the brunt of the recent US dollar strength. The Swedish krona and Norwegian krone are the worst performing G10 currencies since the DXY’s mid-July bottom, losing 8.6% and 7.6% of their…