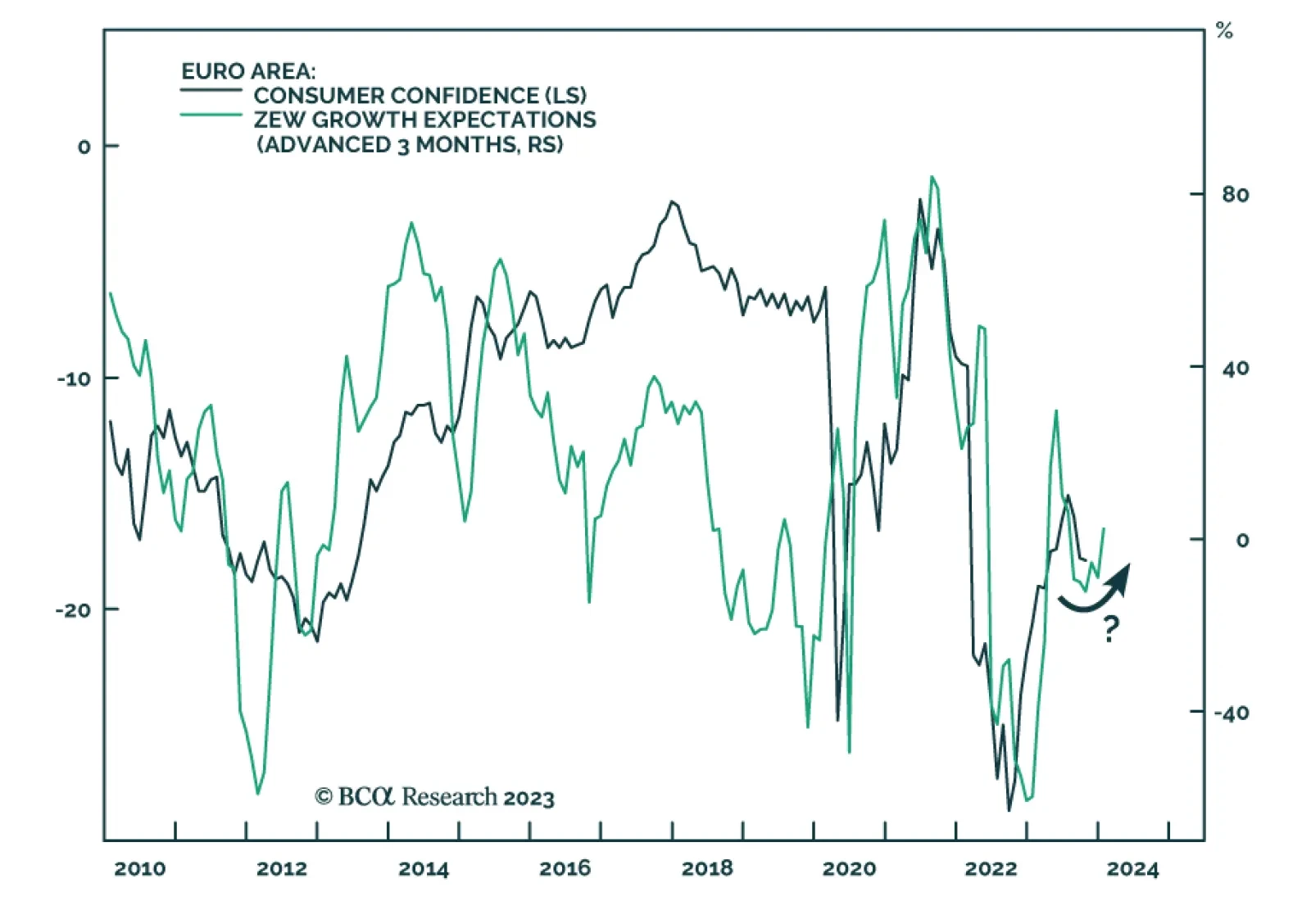

The European Commission's preliminary release for Consumer Confidence painted a murky picture for consumer sentiment on Monday. The headline print of -17.9 was largely unchanged from the previous month's print of -17.8,…

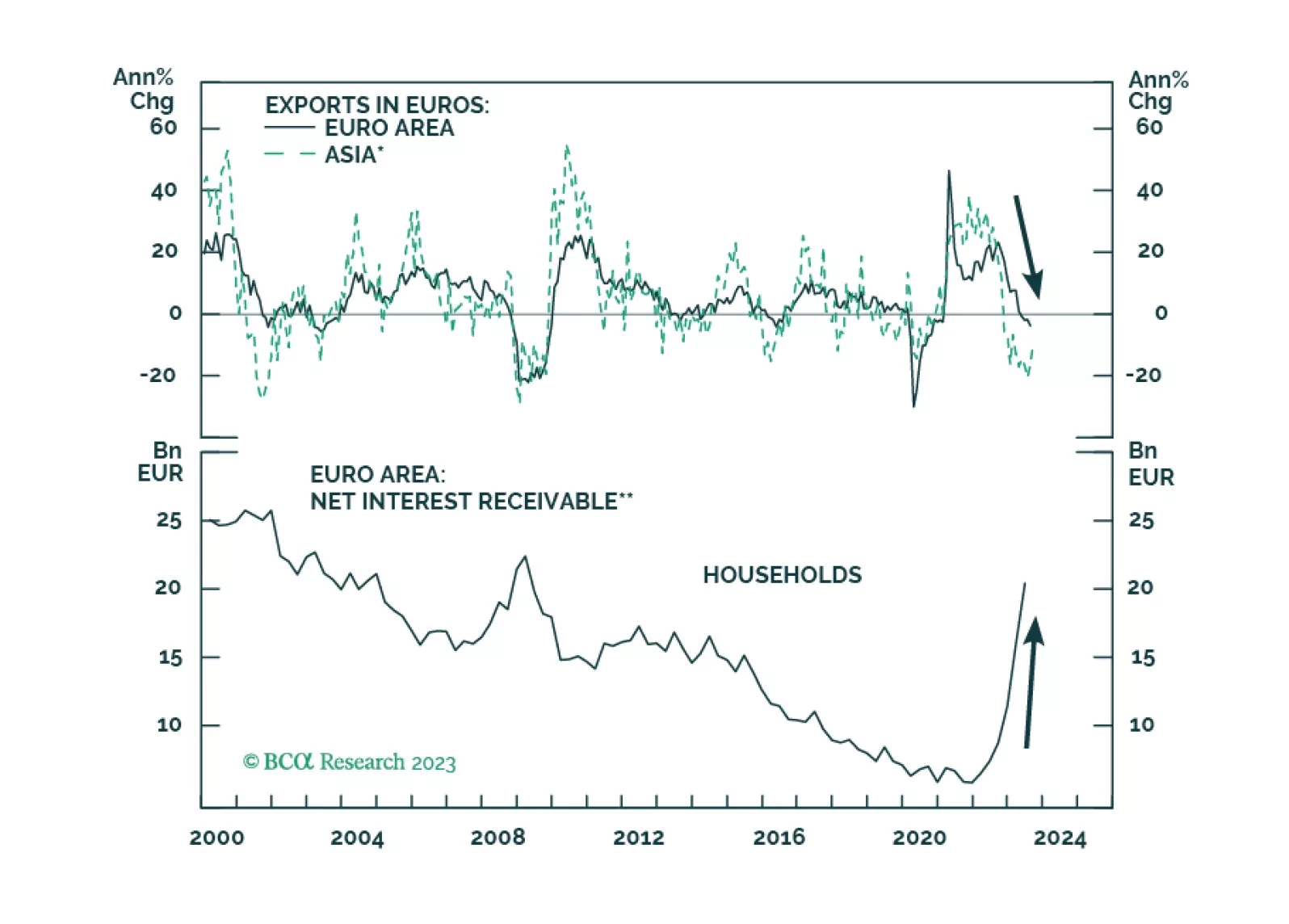

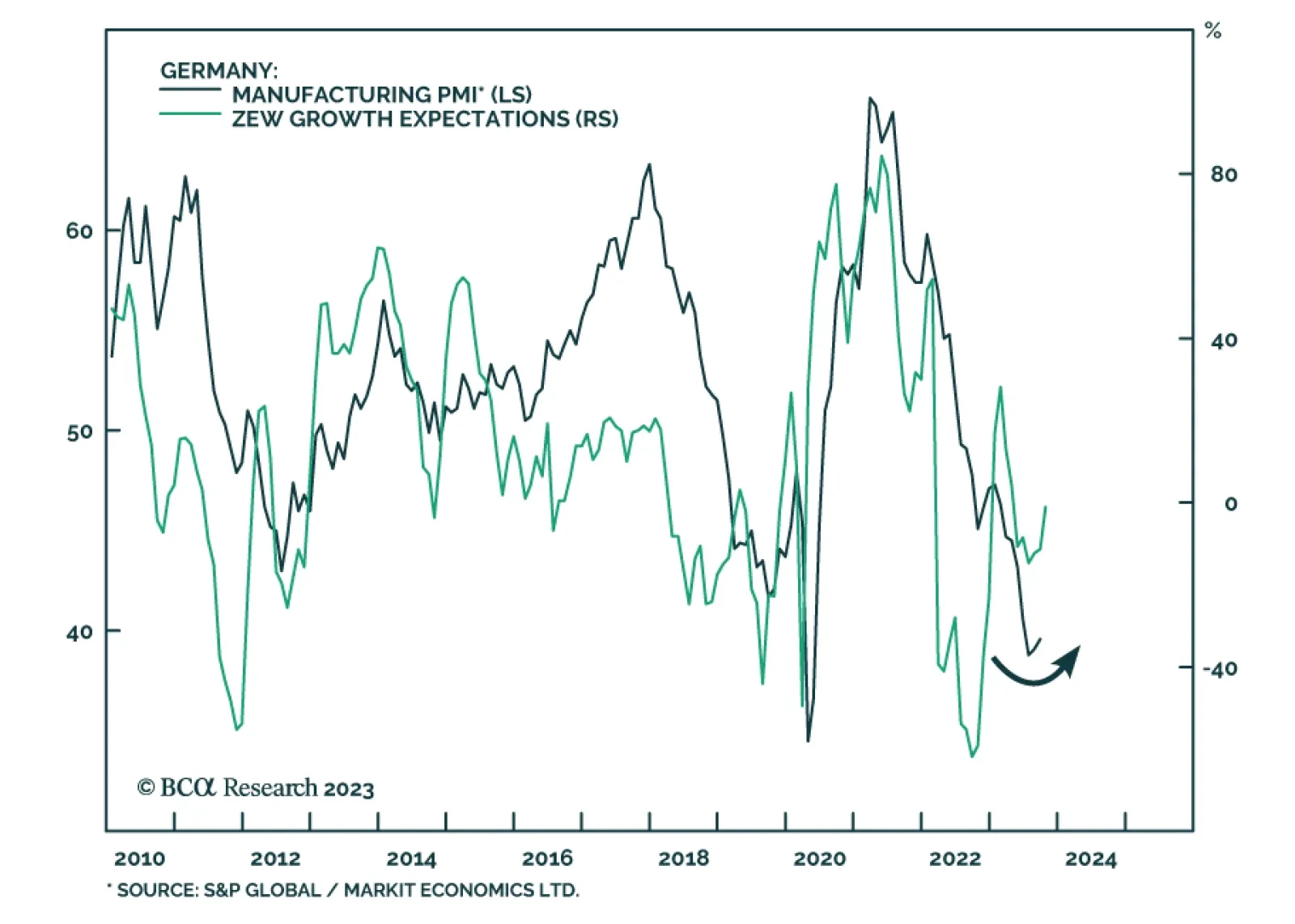

Europe’s weak patch is not about the ECB’s policy tightening, at least not yet. 2024 is another story, and the ECB’s policy will prompt a Eurozone’s recession around the summer.

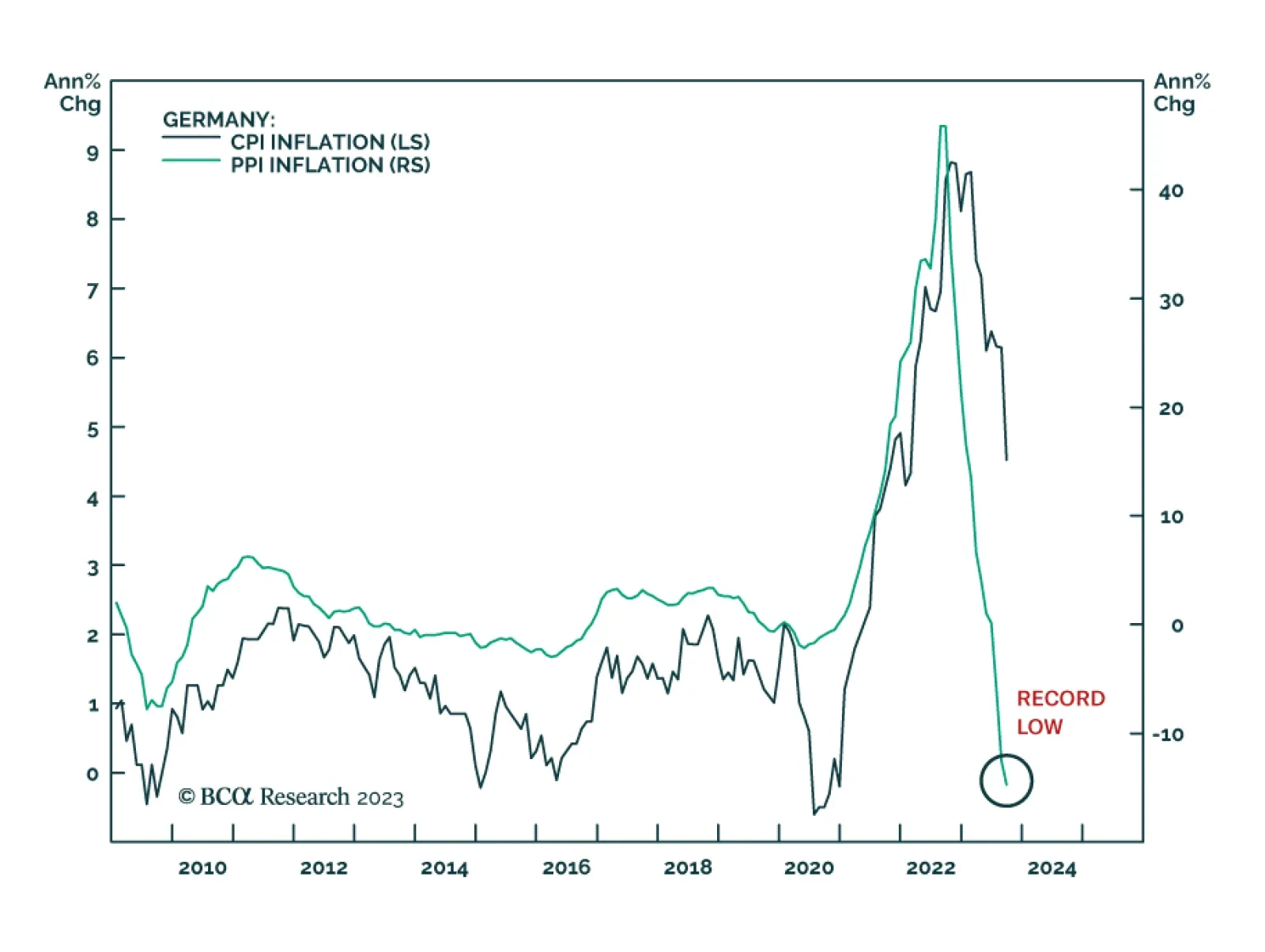

German producer prices declined by a new record 14.7% y/y in September, broadly in line with expectations of -14.1% y/y and a steeper pace of contraction than August's -12.6% y/y. Meanwhile, the monthly rate of change…

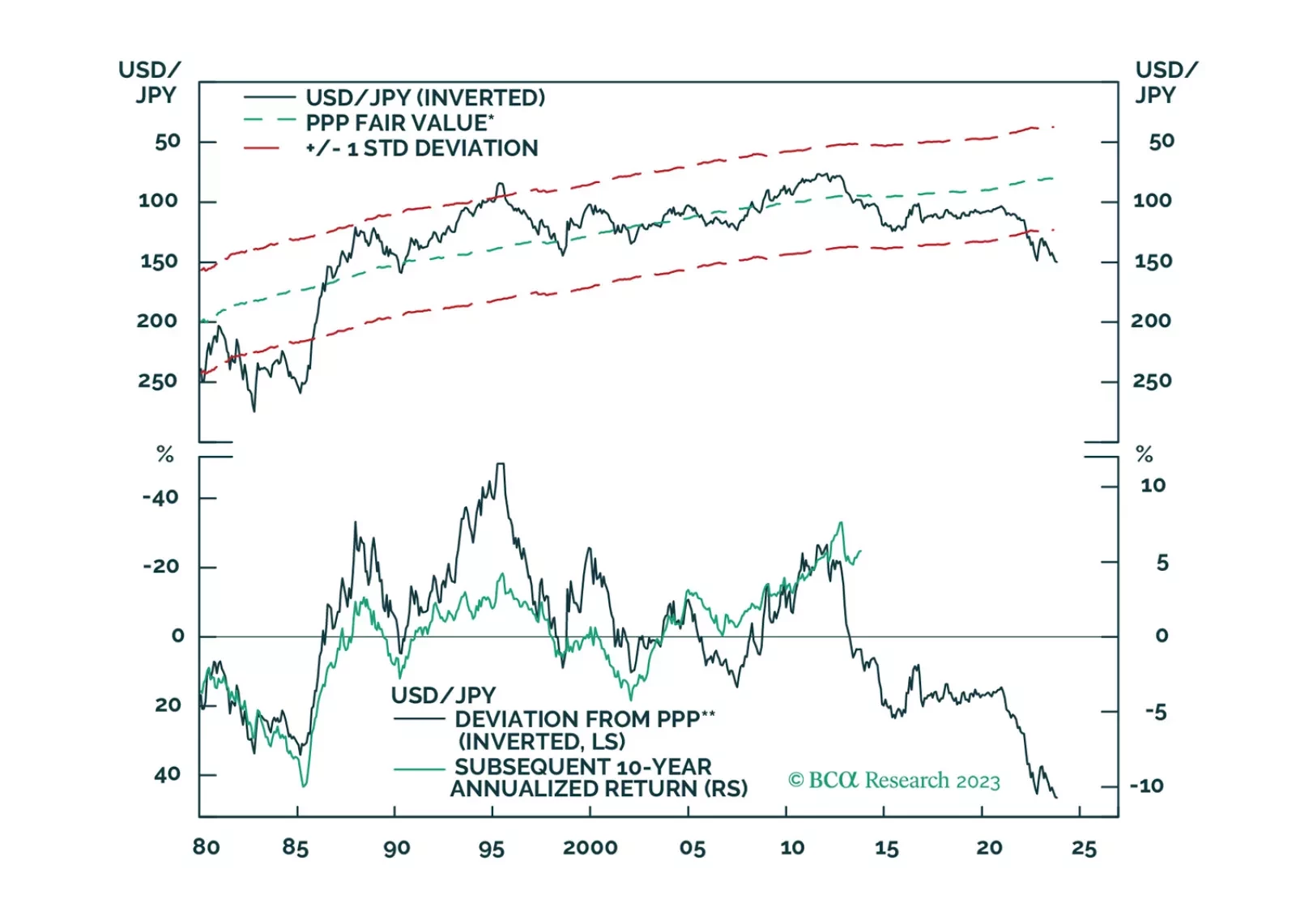

There is a high probability that the global economy will tip into recession in the second half of 2024. A long yen position is an excellent hedge against that risk.

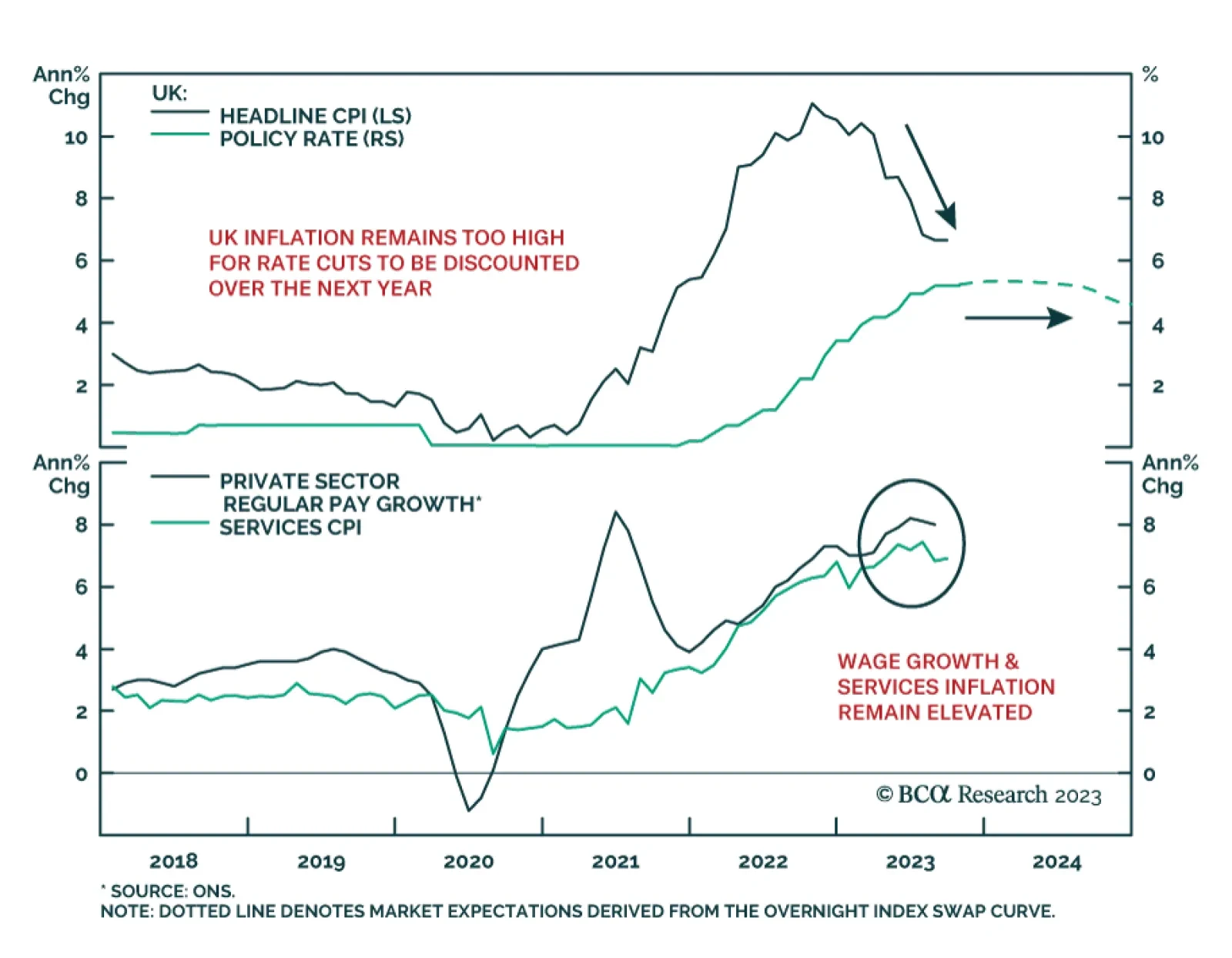

The data releases this week in the UK were disappointing for those that have been looking for a major downshift in UK inflation – most importantly, the Bank of England (BoE). The CPI report for September came in above…

In this report, we present the quarterly review of the Global Fixed Income Strategy Model Bond Portfolio. The portfolio remains positioned for slower global growth momentum over the next 6-12 months, favoring government bonds over…

The ZEW survey of investor sentiment sent an optimistic signal on Tuesday. German sentiment rebounded sharply from -11.4 to -1.1 in October – its highest level since April. Lower inflation expectations and a sharp increase…

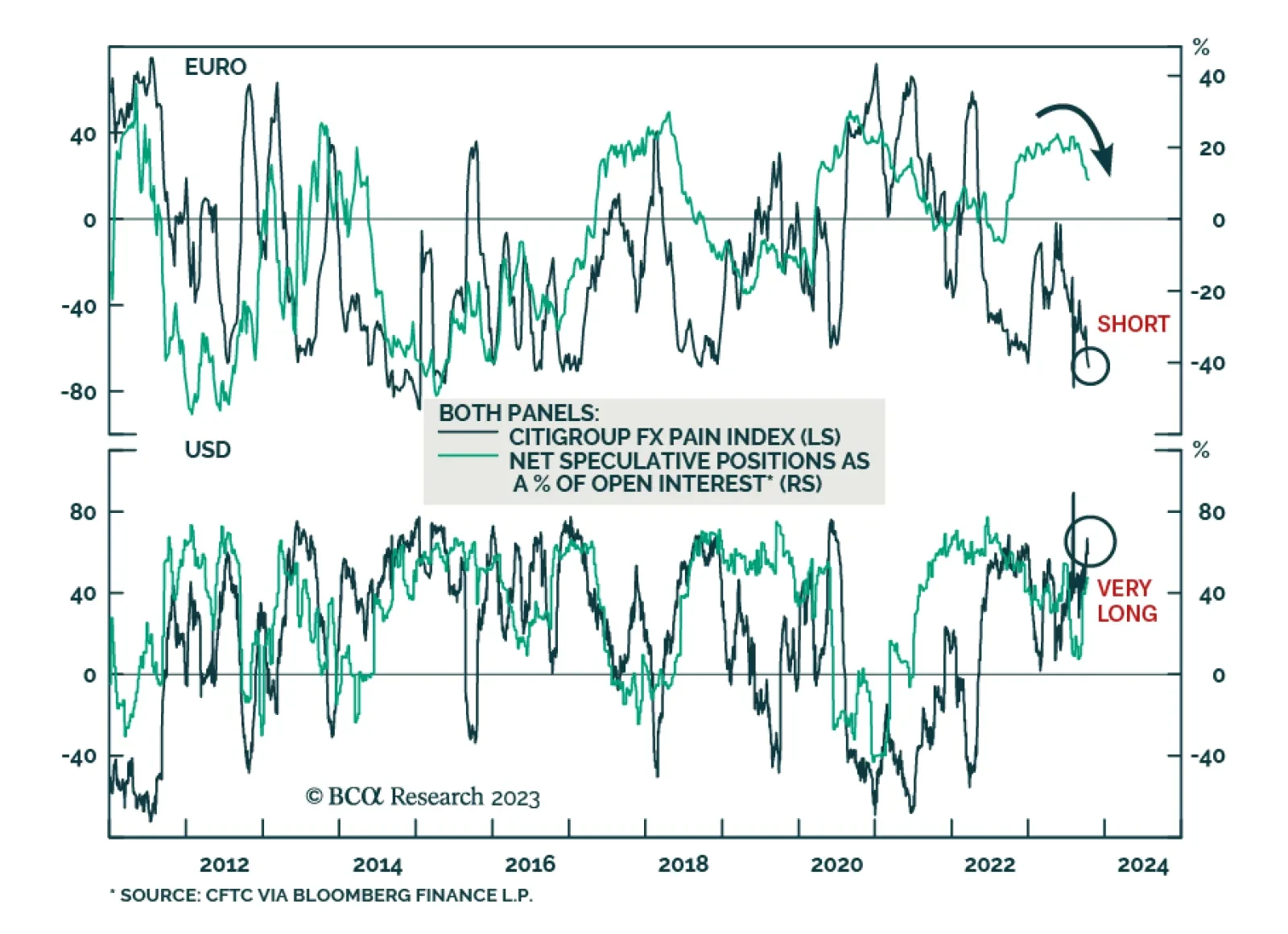

According to BCA Research’s European Investment Strategy service, the euro's correction is now advanced. During the first week of the month, EUR/USD briefly dipped below 1.045. Previously, the team argued it would…

Yields remain the force dominating the evolution of markets. A peak in yields would help European assets rebound, but the war in the Middle East could push higher energy prices, with negative consequences for Europe.

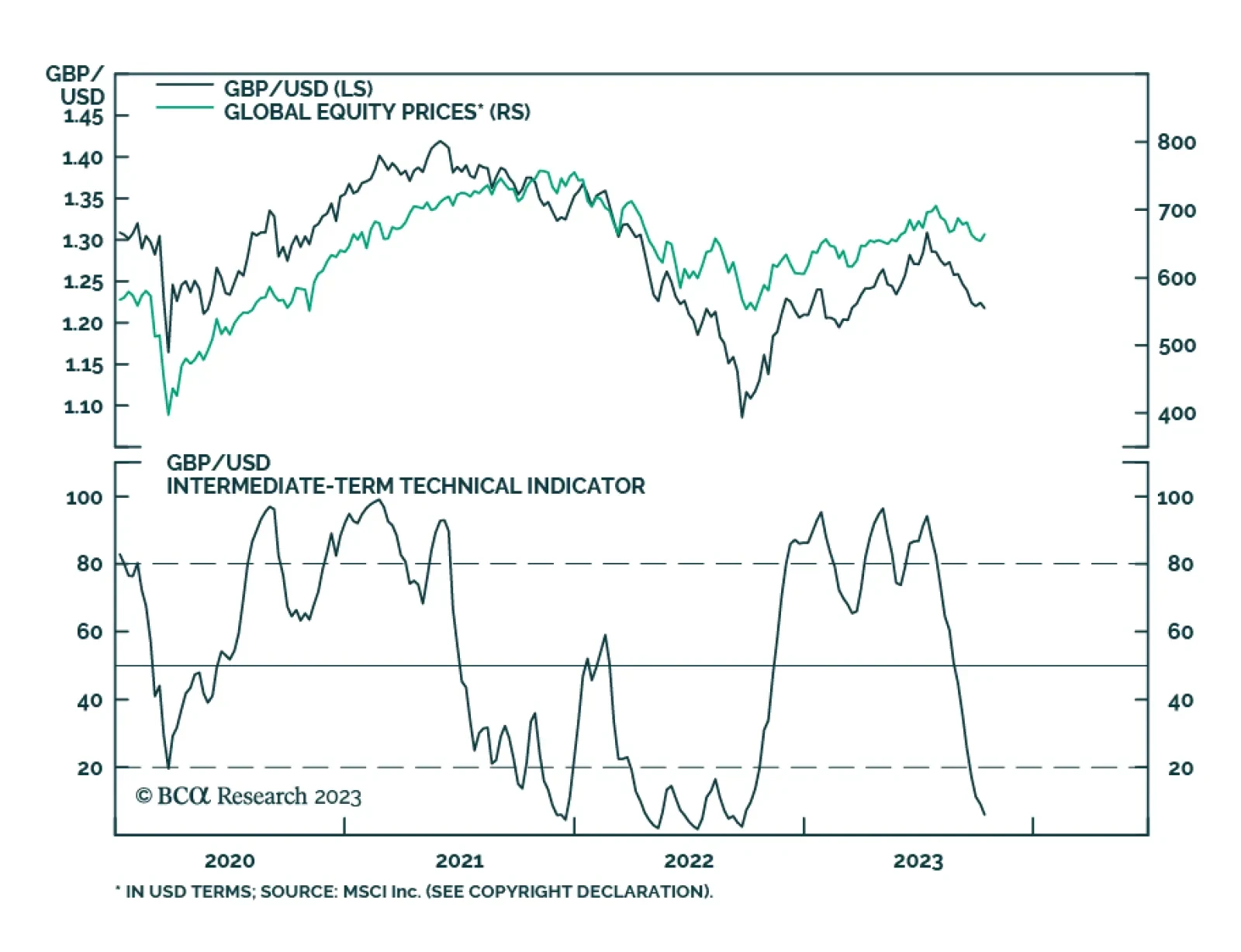

Back in May, our foreign exchange team suggested the risk to sterling was to the downside. Indeed, GBP/USD is down 8% from its recent peak. While dollar strength largely explains this move in GBP/USD, there have been other…