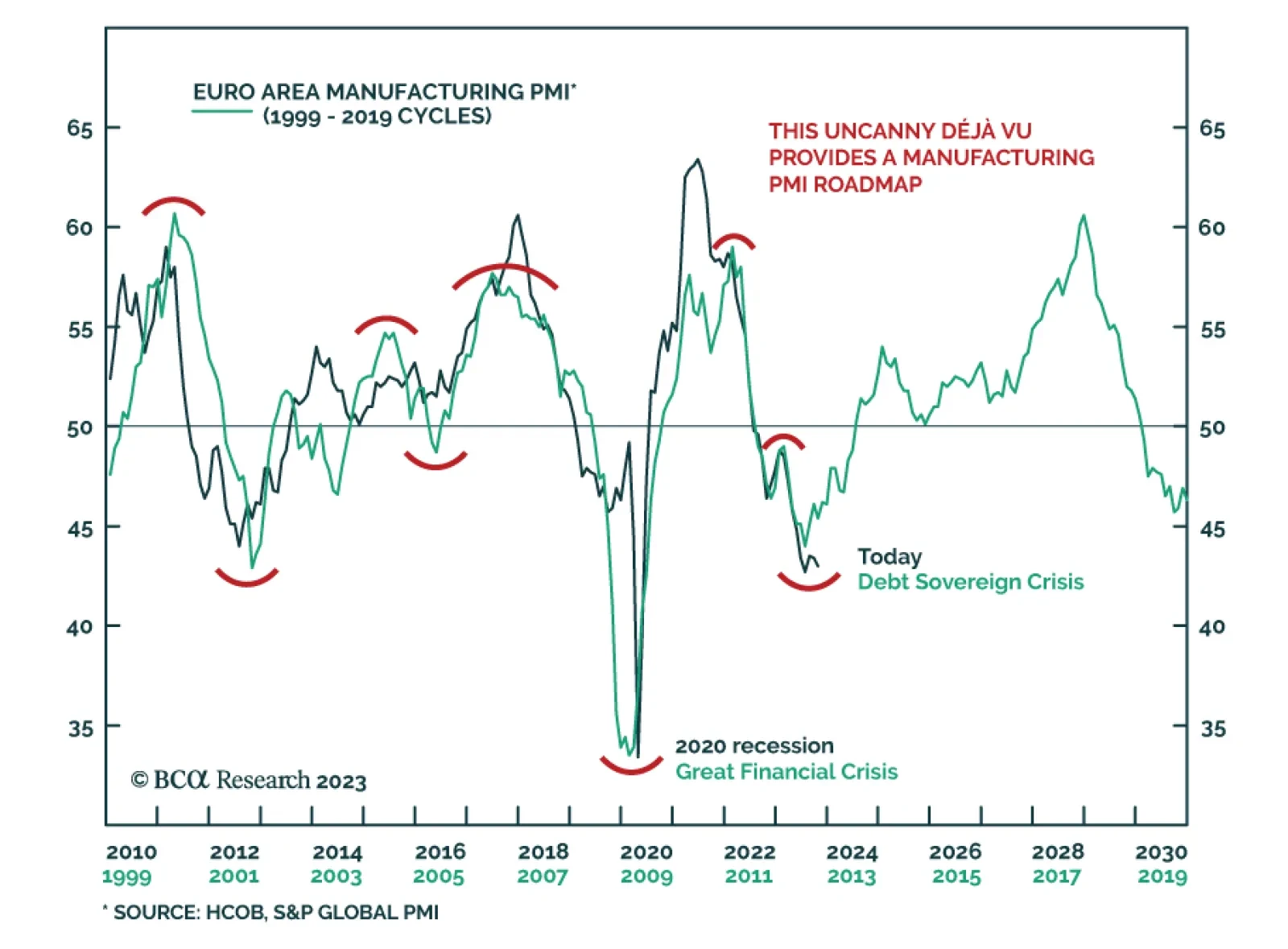

According to BCA Research’s European Investment Strategy service, 2012 provides a tentative roadmap of the next Eurozone manufacturing cycle. The resemblance between today and 2012 is uncanny. The overlap matches the…

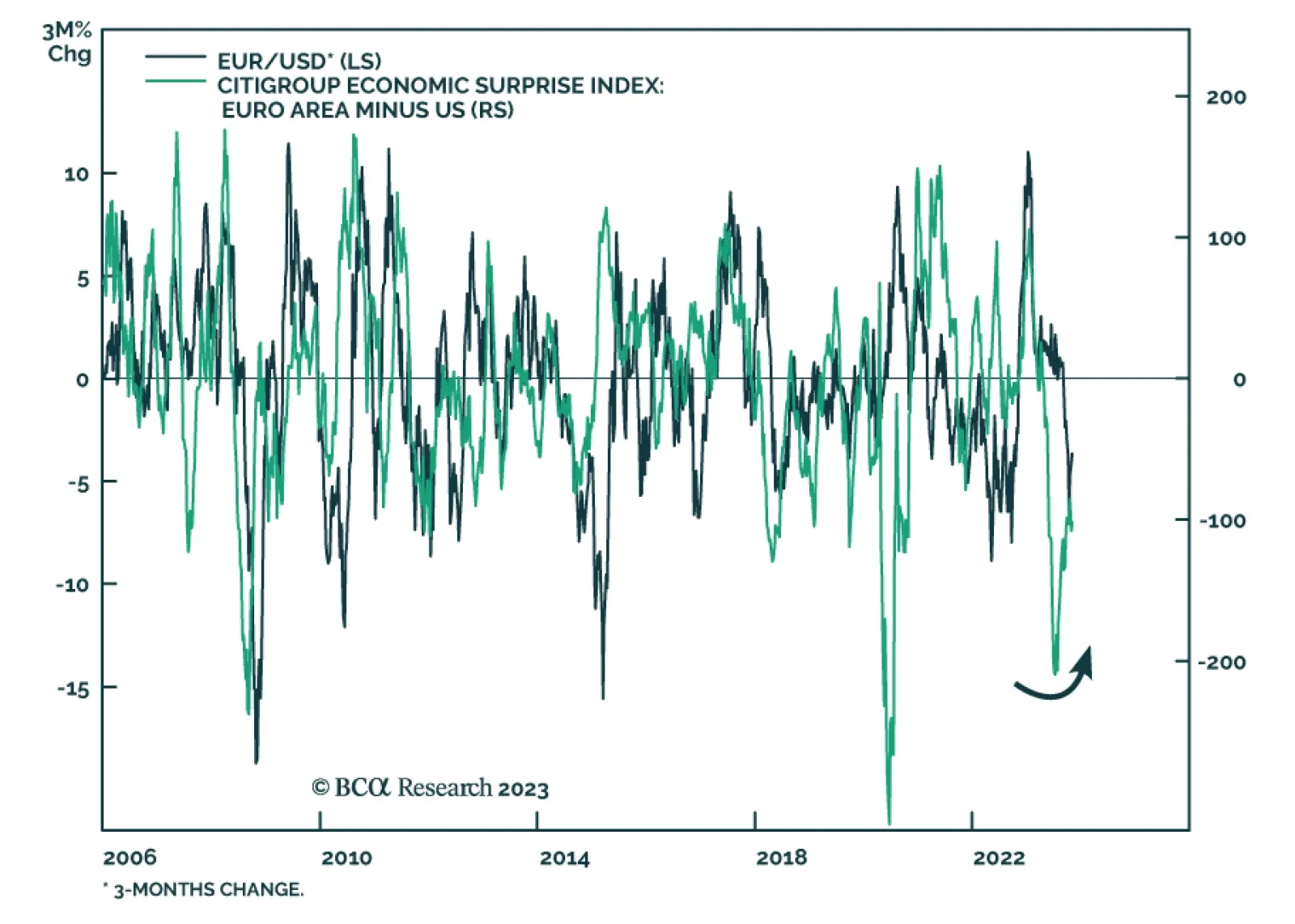

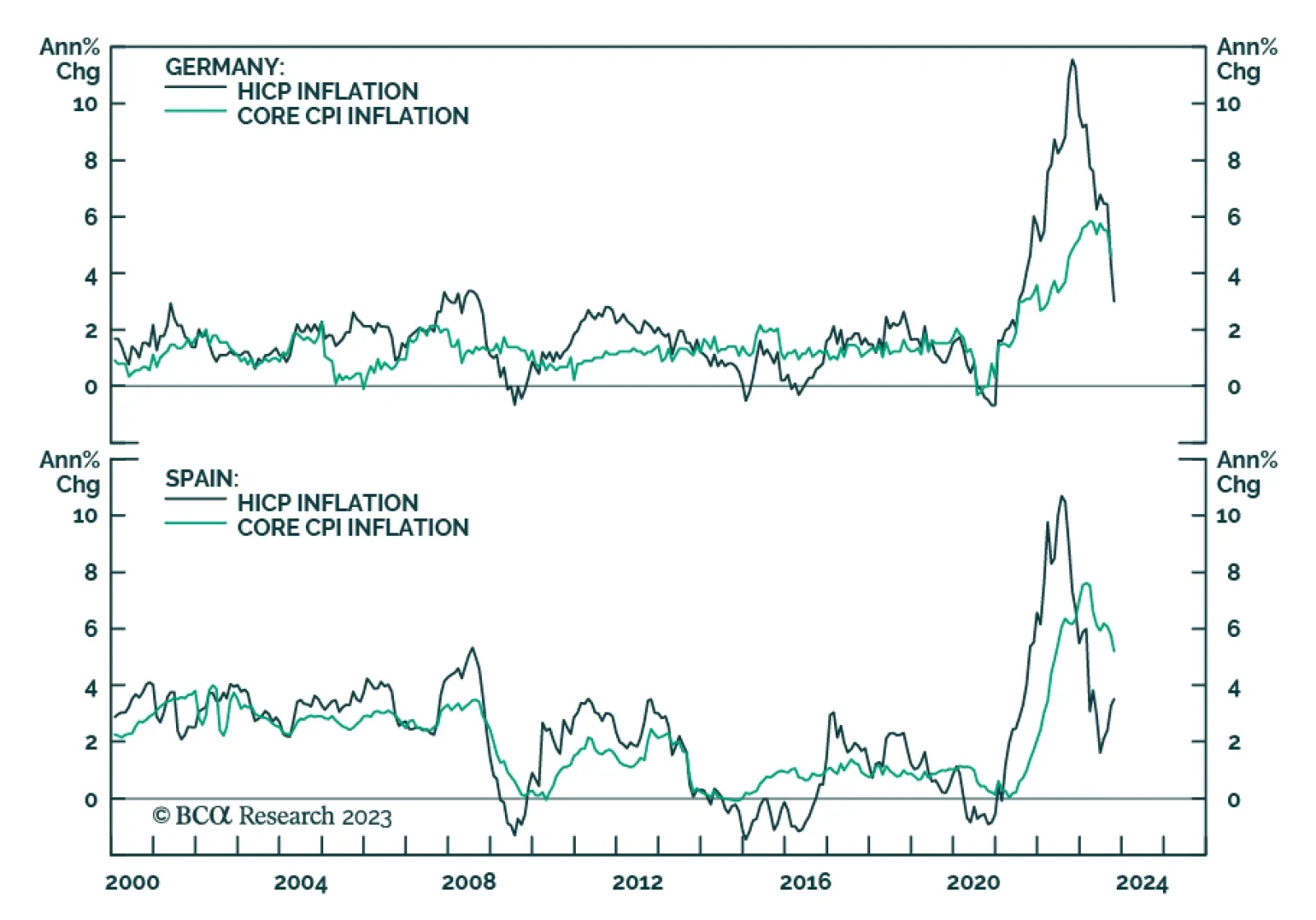

The Eurozone's October inflation release confirmed the signal from the German and Spanish reports that price pressures are moderating. CPI inflation softened from 4.3% y/y to 2.9% y/y (below expectations of 3.1% y/y) while…

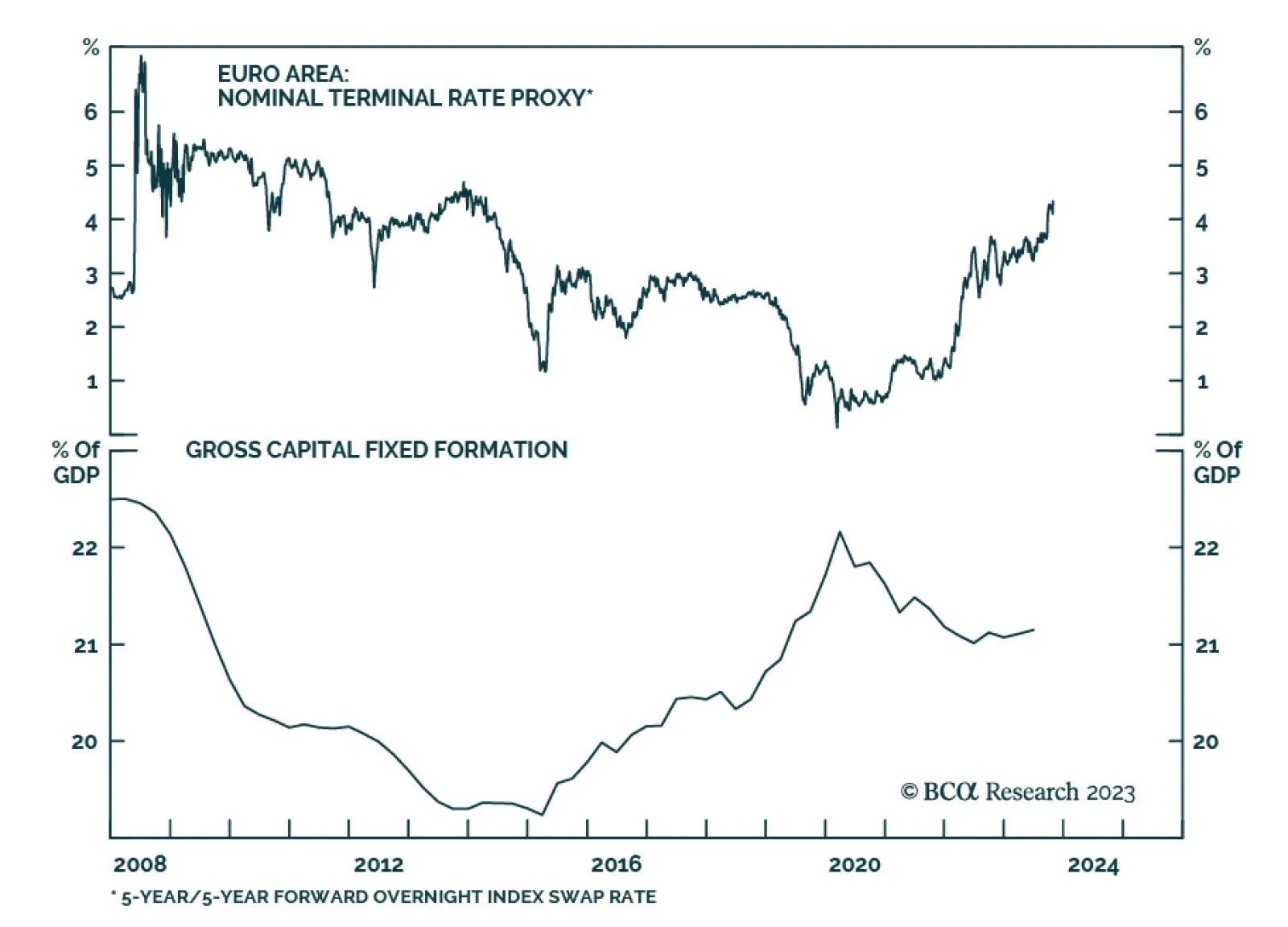

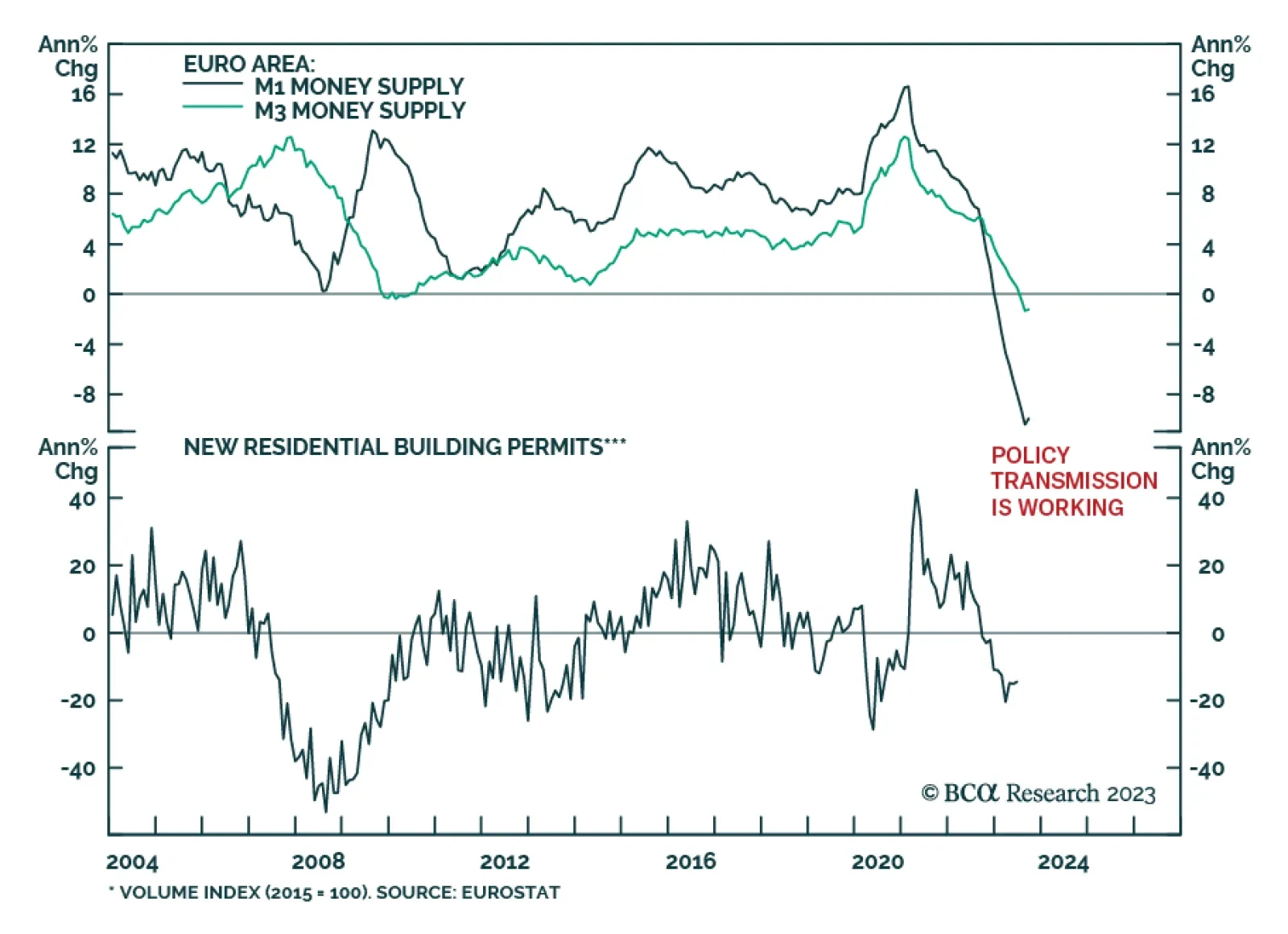

The European money market curve anticipates three rate cuts by October 2024. This pricing is appropriate considering the outlook for European growth next year. BCA’s Europe strategist expect a recession in the second half…

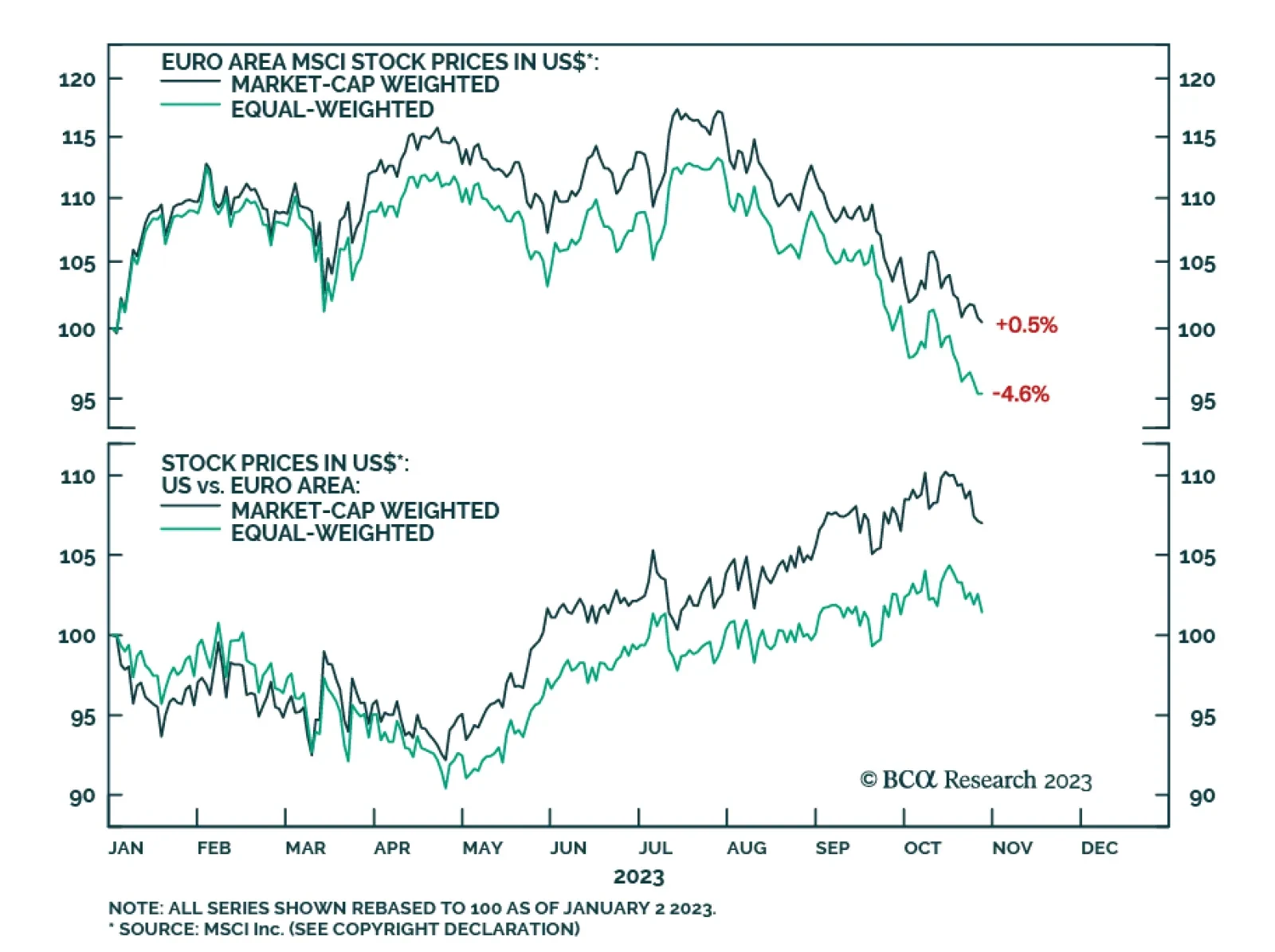

In a recent Insight we highlighted that the S&P 500's year-to-date rally is narrow in breadth and that the equal weighted index has erased all its year-to-date gains. This is also true in the case of the Euro Area where…

Eurozone economic data sent a positive signal on Monday. Preliminary CPI releases from Germany and Spain show price pressures continue to moderate. In Germany, the harmonized index declined by 0.2% m/m while the annual rate of…

As expected, the ECB kept policy on hold on Thursday. In a unanimous decision, it maintained the deposit rate at an all-time high of 4% following 10 consecutive increases. Ultimately, the tone of the communication was on the…

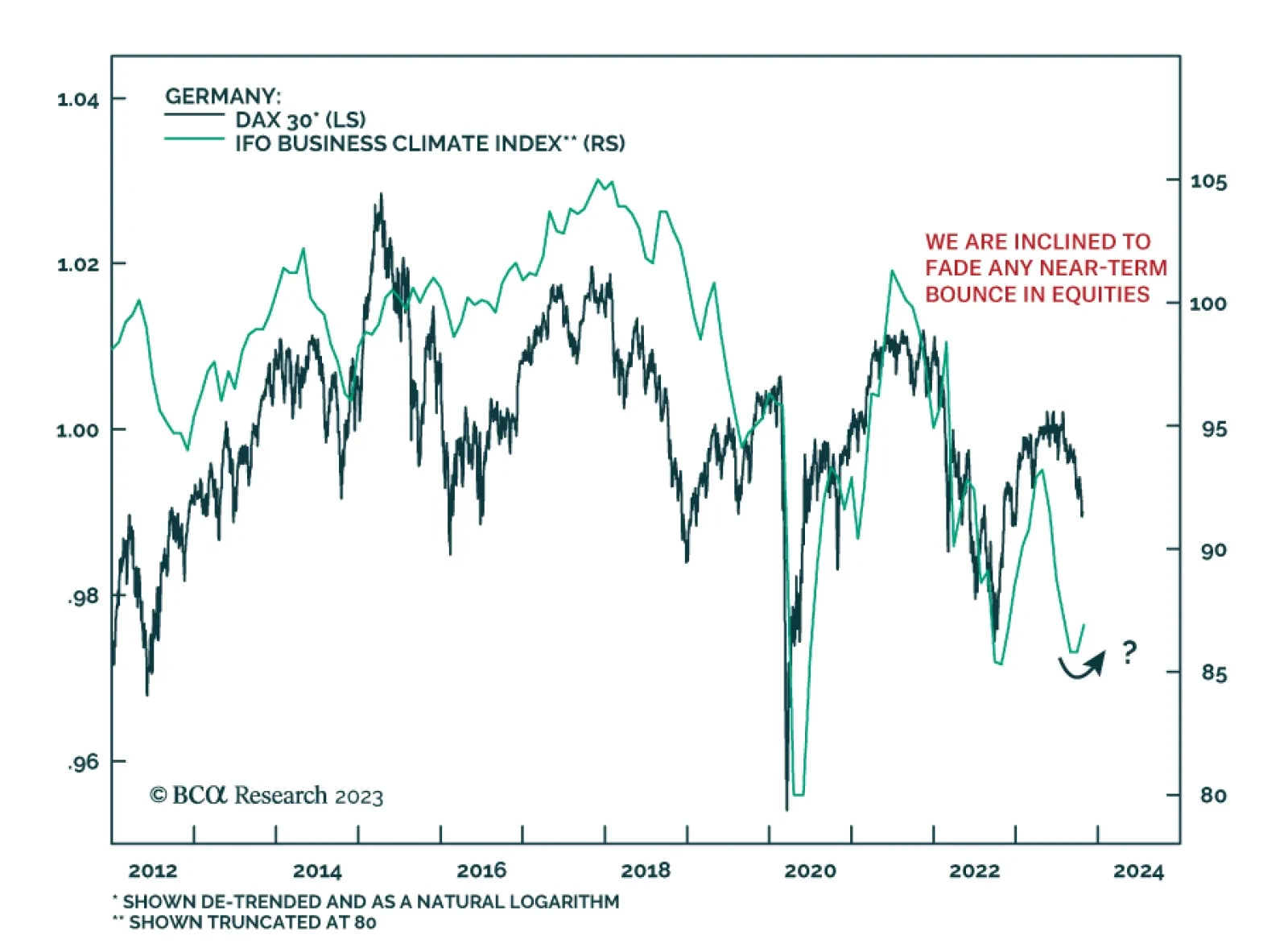

Results of the October German IFO survey corroborate the positive signal from the latest ZEW survey. The headline Business Climate Index increased for the first time since April, rising from 85.8 to 86.9, above expectations of 86…

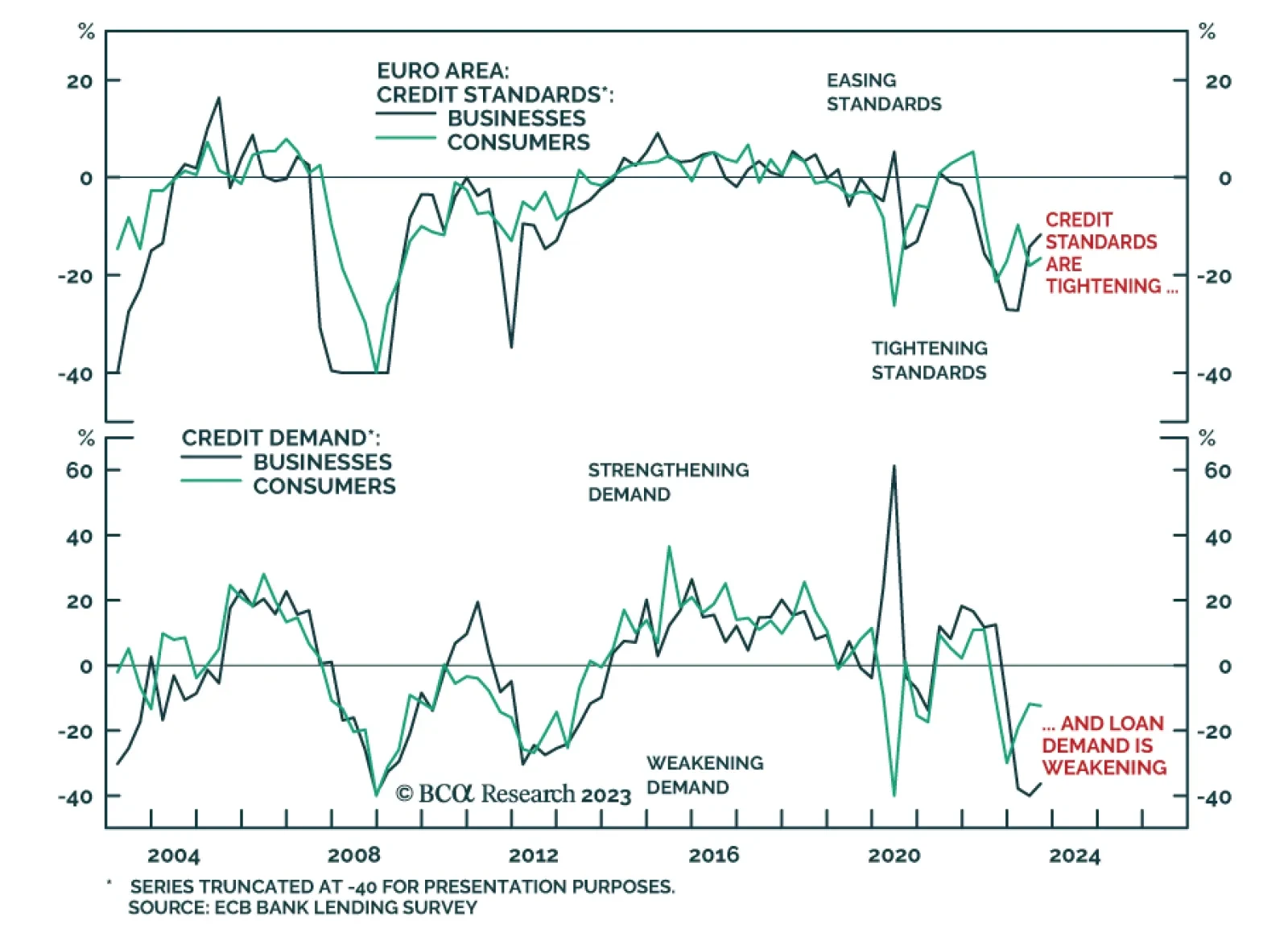

Results of the ECB's Q3 Bank Lending Survey indicate that the impact of tight monetary policy is weighing down on lending conditions and loan demand in the Euro Area. In terms of credit standards, the survey results reveal…

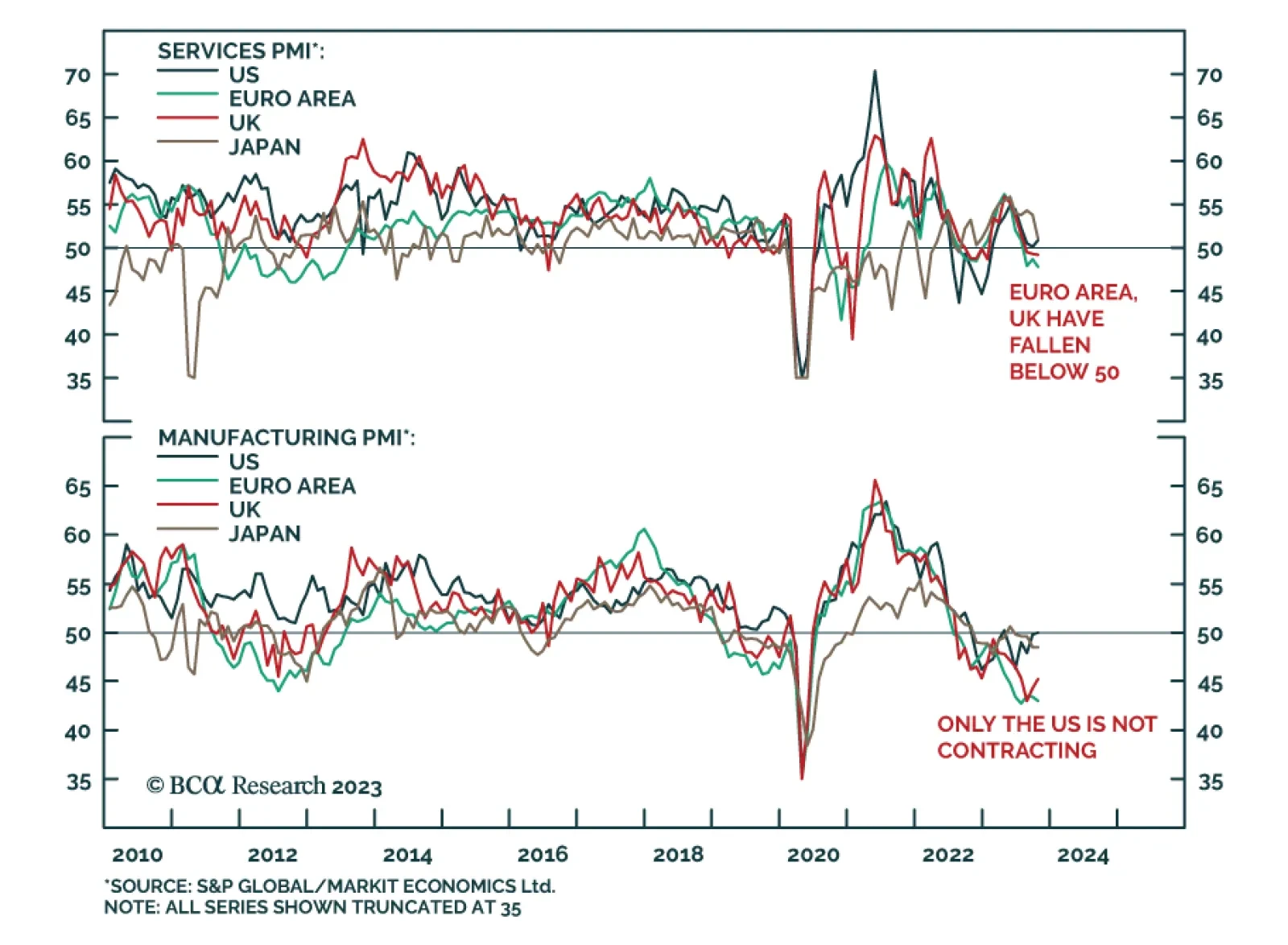

The flash PMI estimates from S&P Global delivered a mixed message about economic conditions across DM economies in October. The Eurozone composite index unexpectedly fell from 47.2 to a nearly three-year low of 46.5 on the…