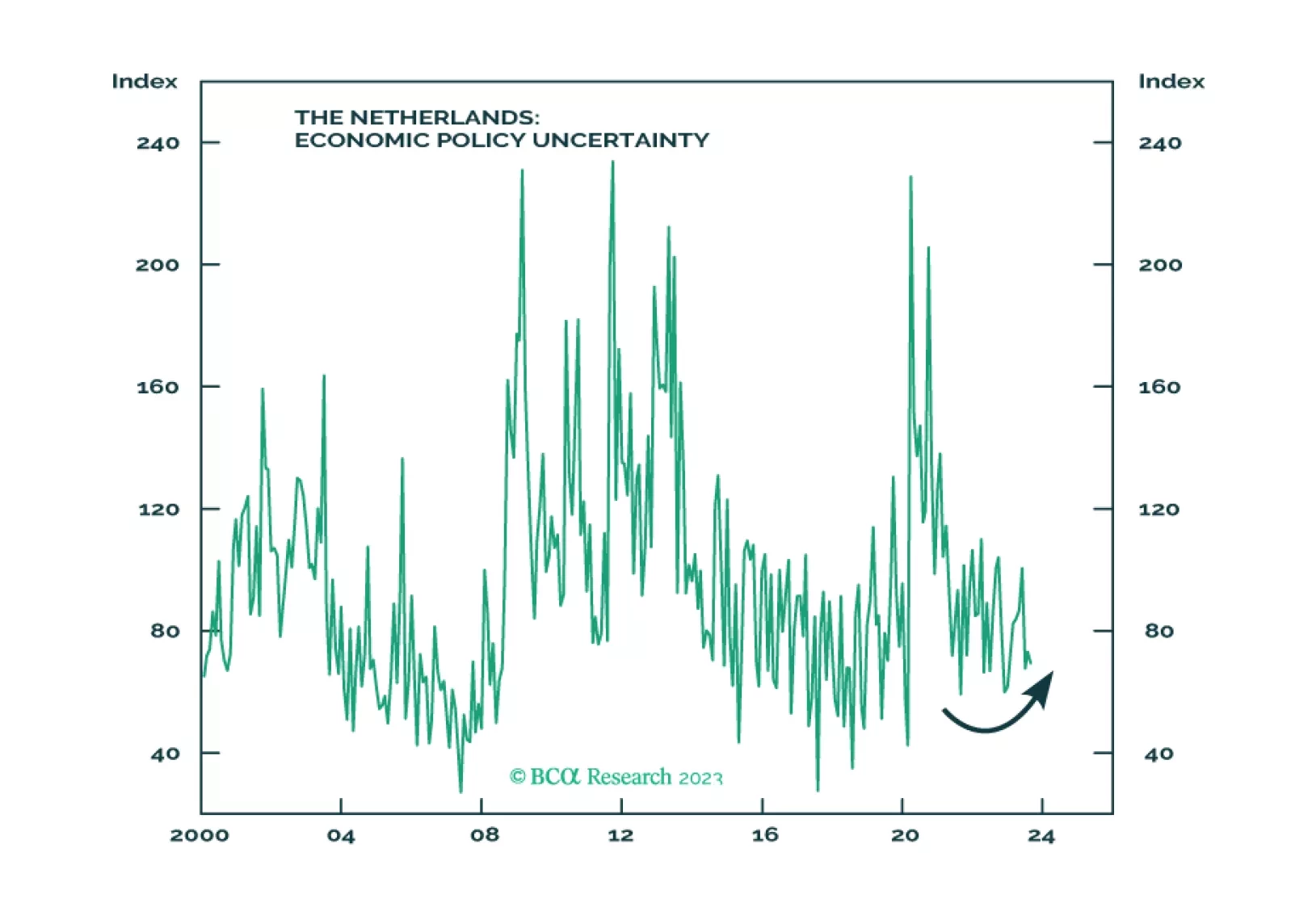

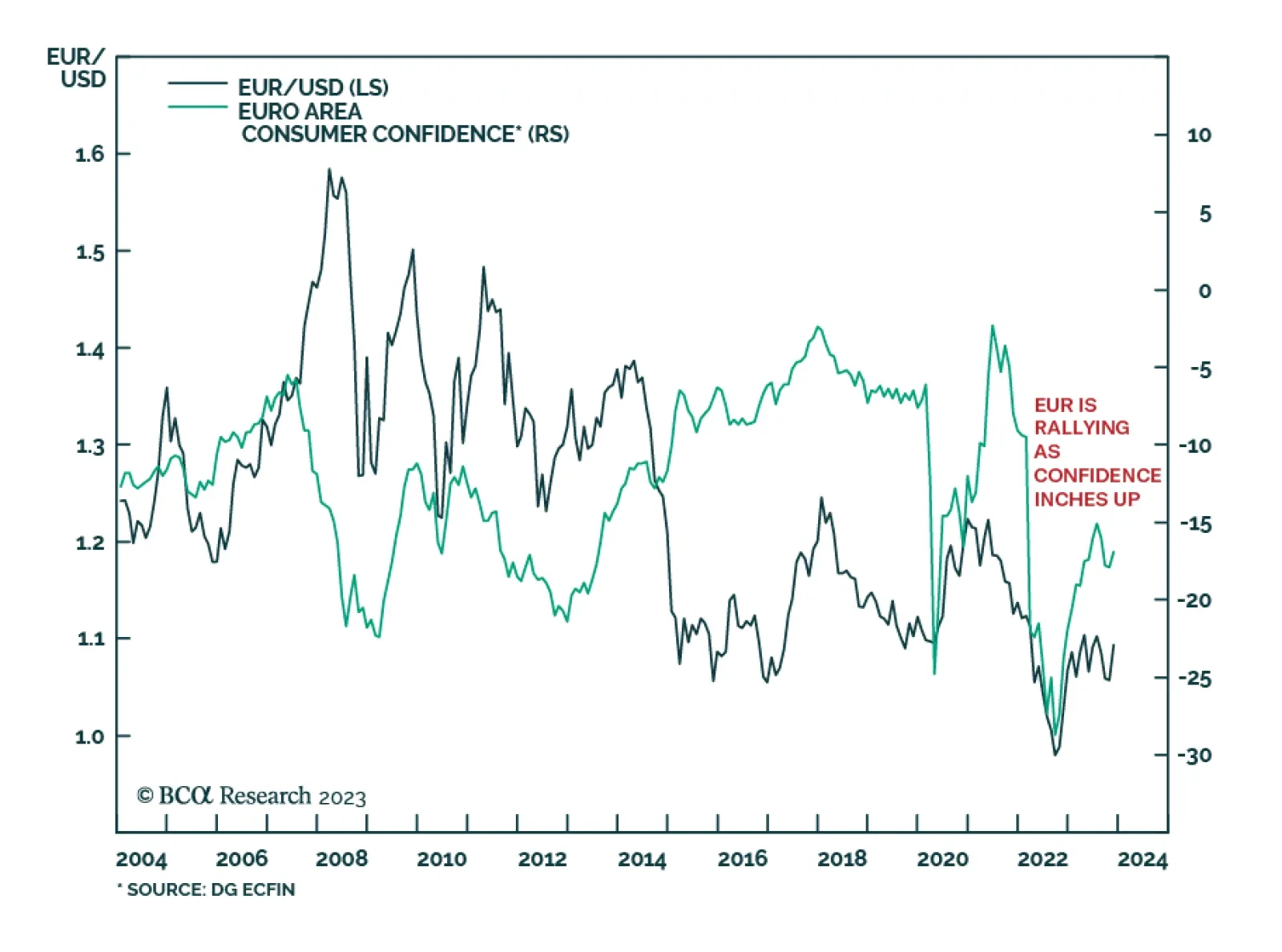

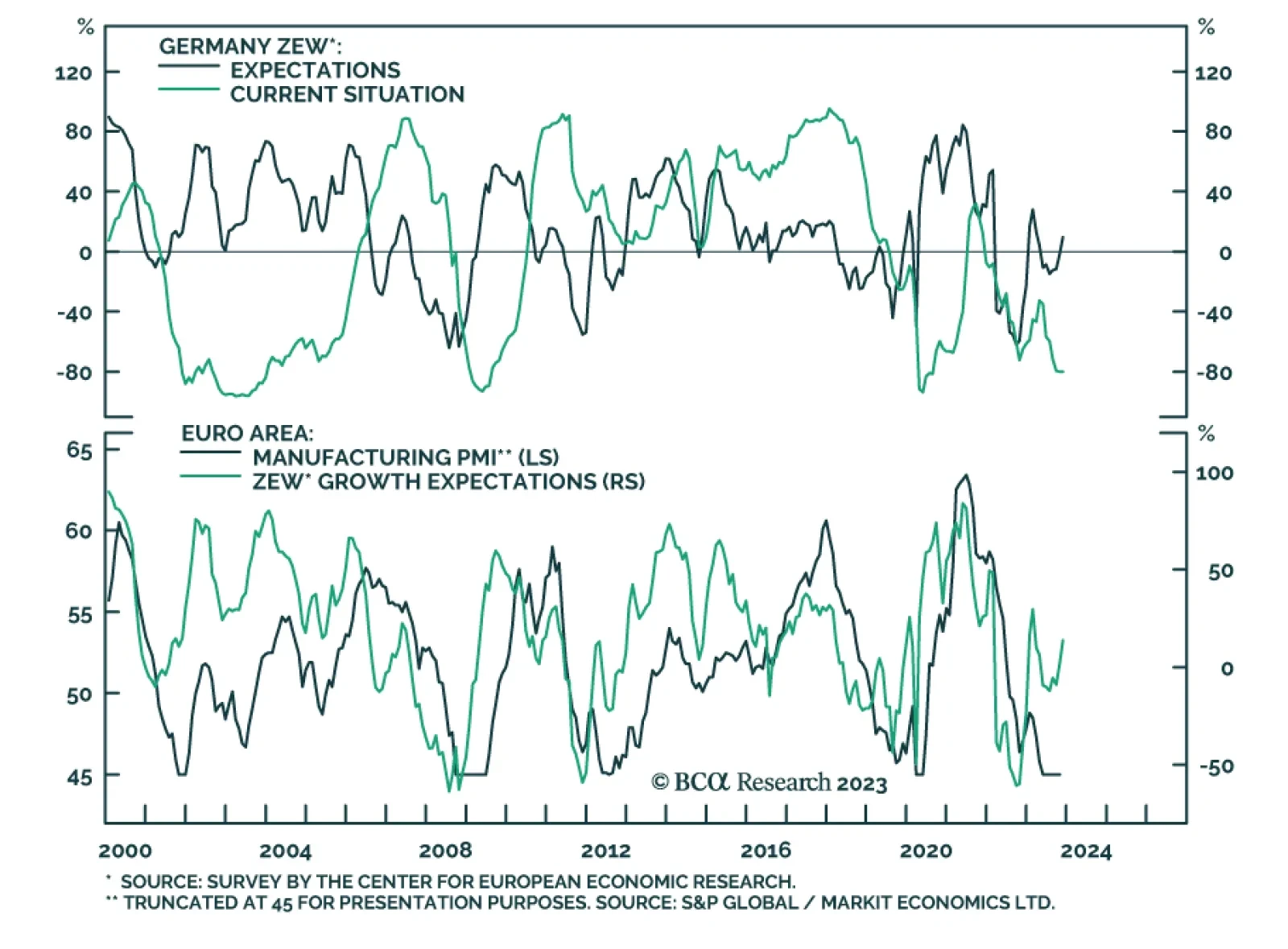

Confidence is on the mend in the Euro Area. The rebounding ZEW growth expectations index reveals that investors are becoming more optimistic. The German IFO's business climate index inched higher in October for the first time…

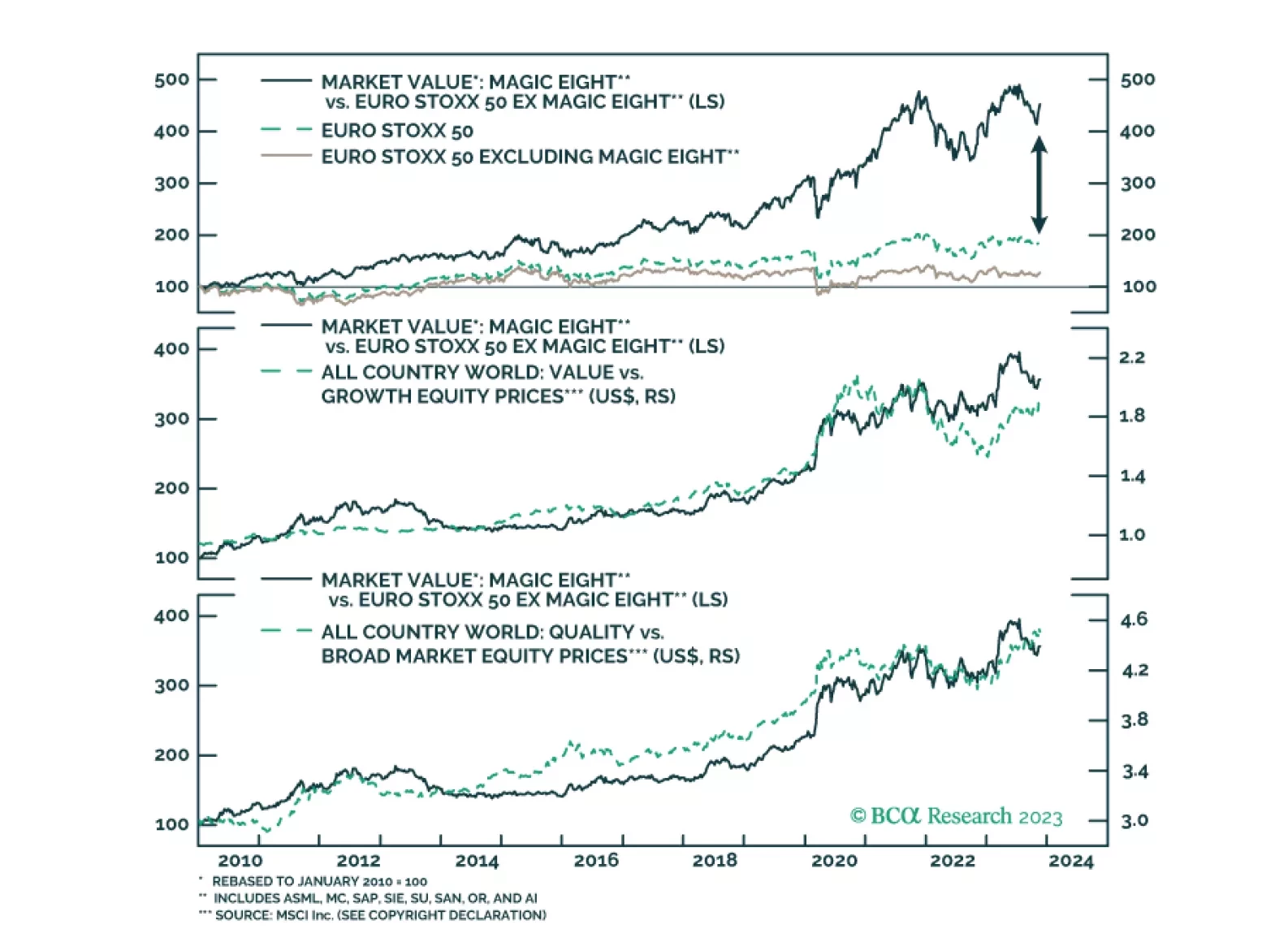

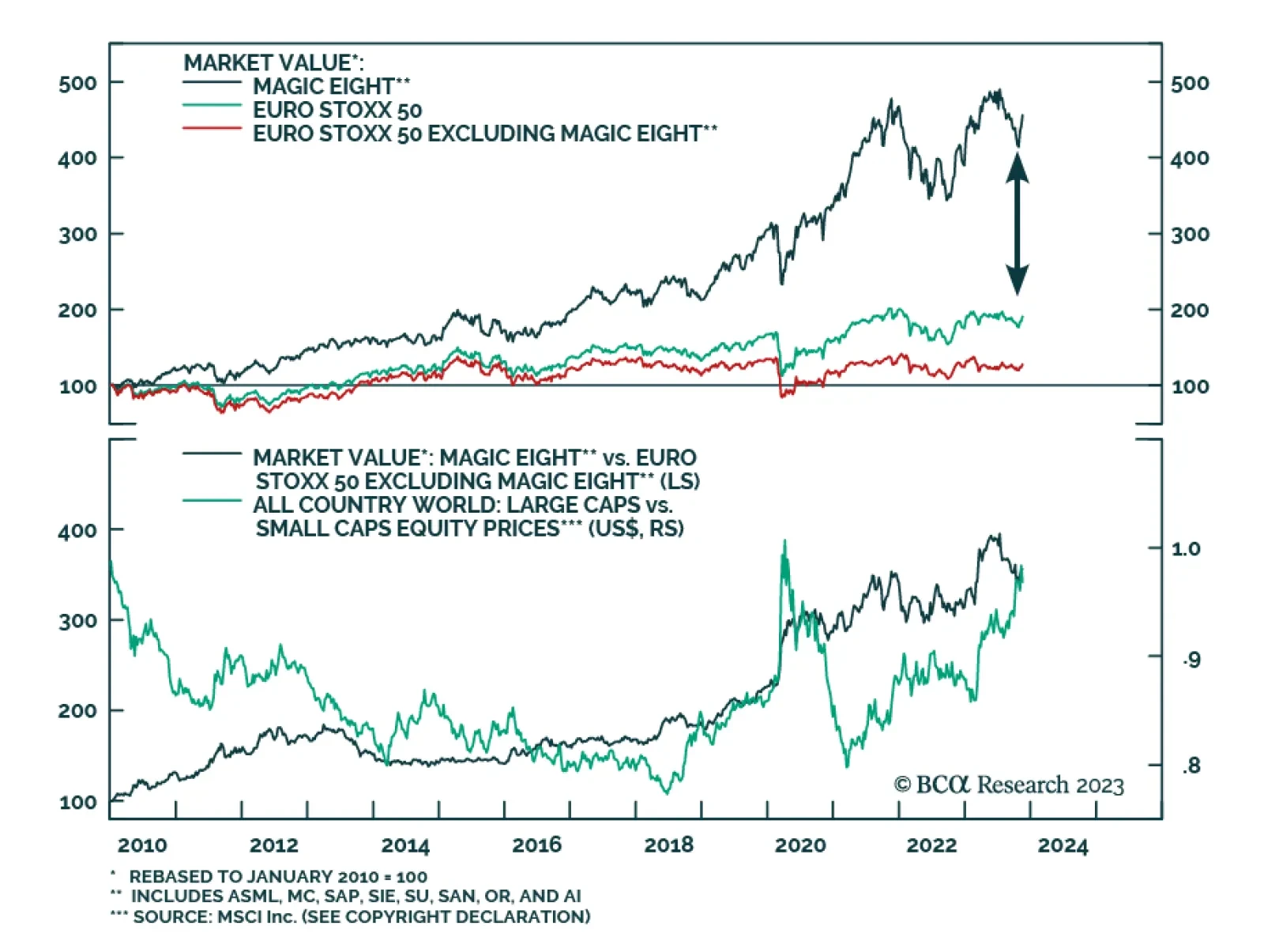

According to BCA Research’s European Investment Strategy service, the Magic Eight are the European counterpart to the US’ Magnificent Seven. The dominance of the so-called Magnificent Seven in the US S&P 500 is…

The US has the Magnificent Seven, Europe has the Magic Eight. What drives the performance of those eight stocks crucial to the European market?

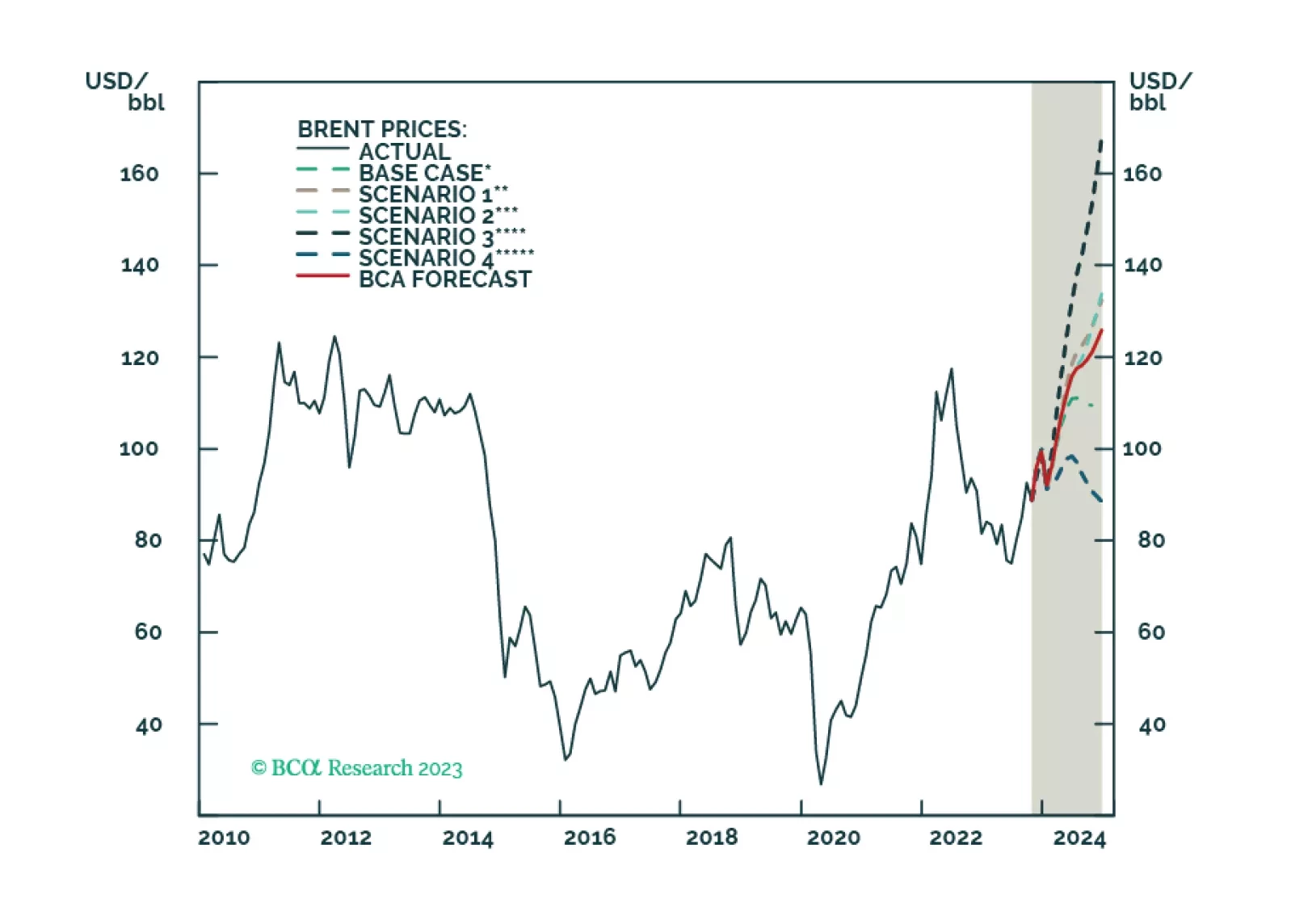

US and Chinese oil-demand strength will offset EU weakness next year. Incremental supply growth from non-OPEC 2.0 producers, coupled with a lower risk of the US enforcing its sanctions on Iranian oil exports, reduces our 2024 Brent…

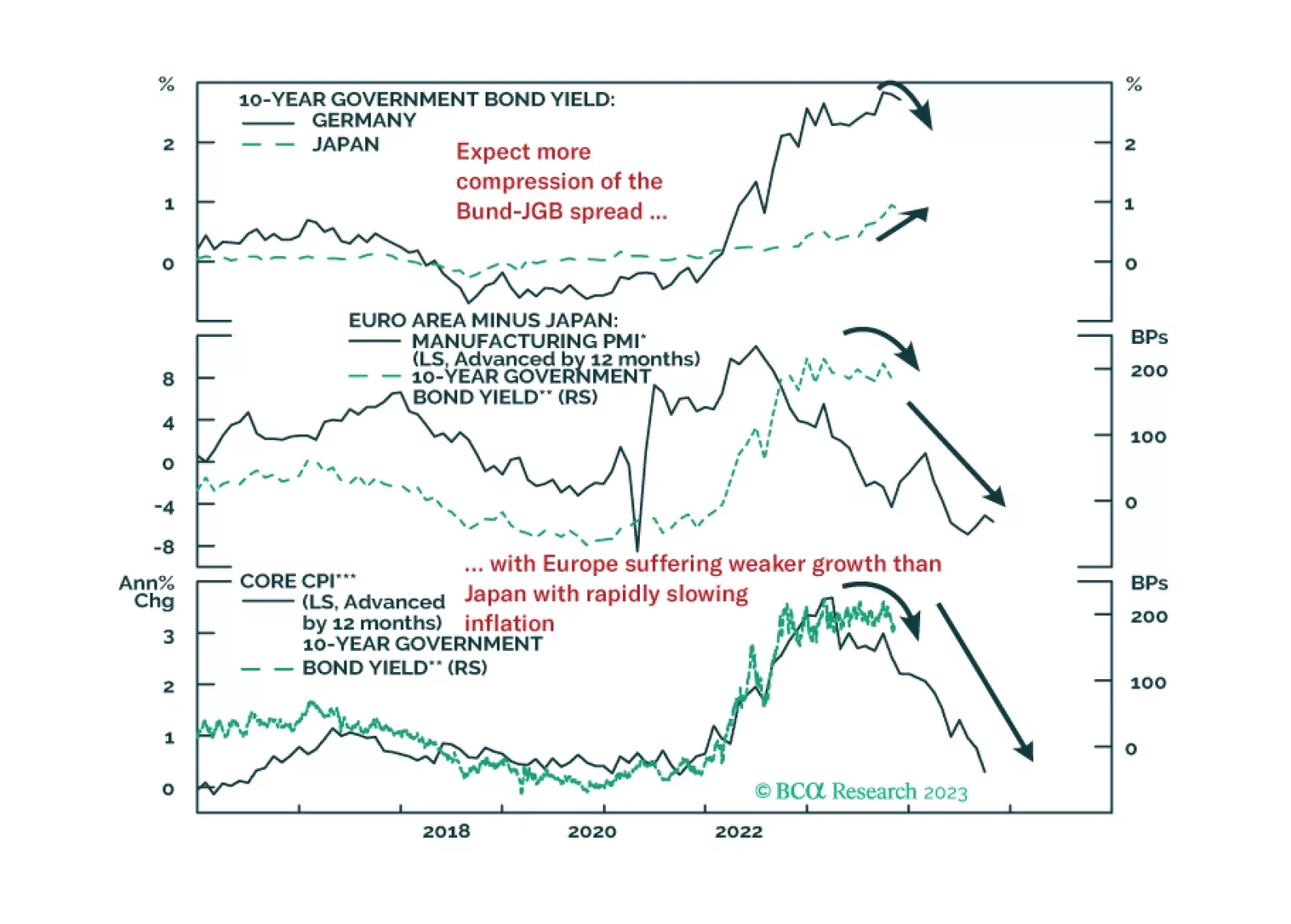

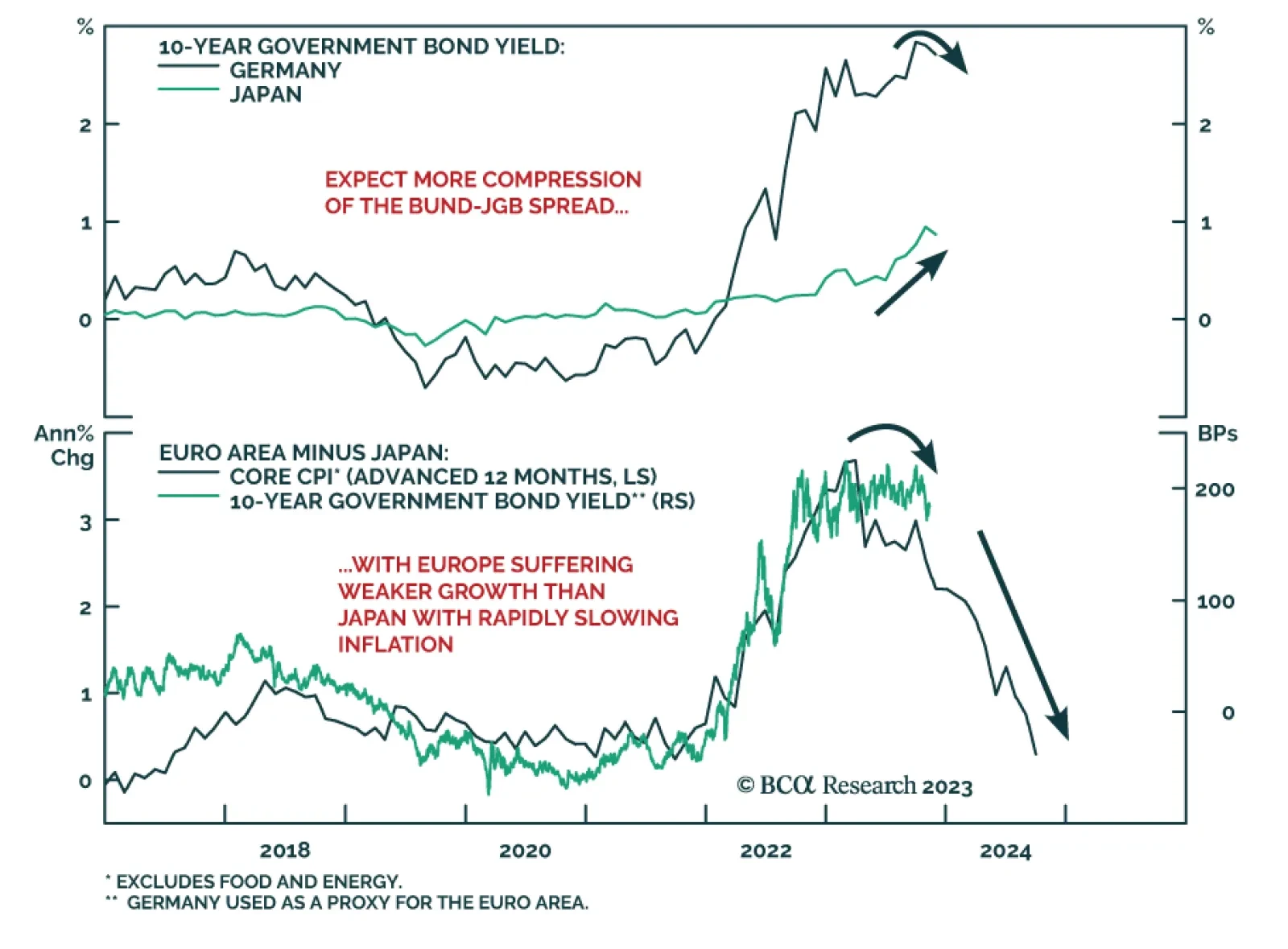

BCA Research’s Global Fixed Income Strategy service remains long 10-year German bunds vs short 10-year Japanese government bonds (JGBs) as a tactical trade. This trade mirrors the team's two highest conviction…

The ZEW survey of investor sentiment continues to send an optimistic signal. German sentiment jumped from -1.1 to +9.8 in November – its highest level since March and beating expectations of a smaller improvement to 5.0.…

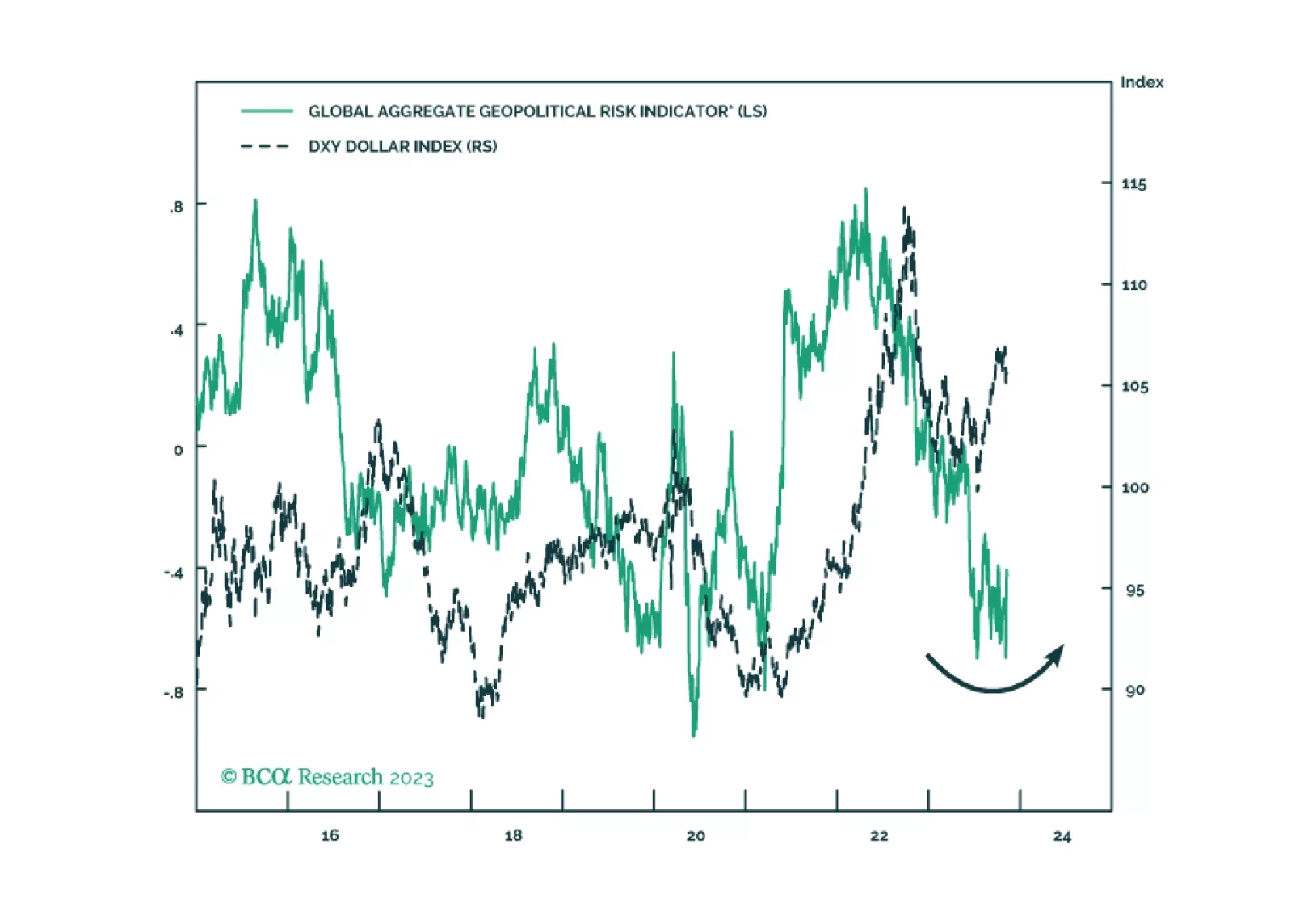

Amid a range of geopolitical narratives, what matters is that the US strategy of economic engagement with its rivals is failing, giving rise to a new strategy of containment that will reinforce the secular rise in geopolitical risk.…

In this Insight, we review the performance and rationale for our current set of tactical fixed income trade recommendations. Our highest conviction positions also happen to be our most successful trades: positioning for a narrowing…

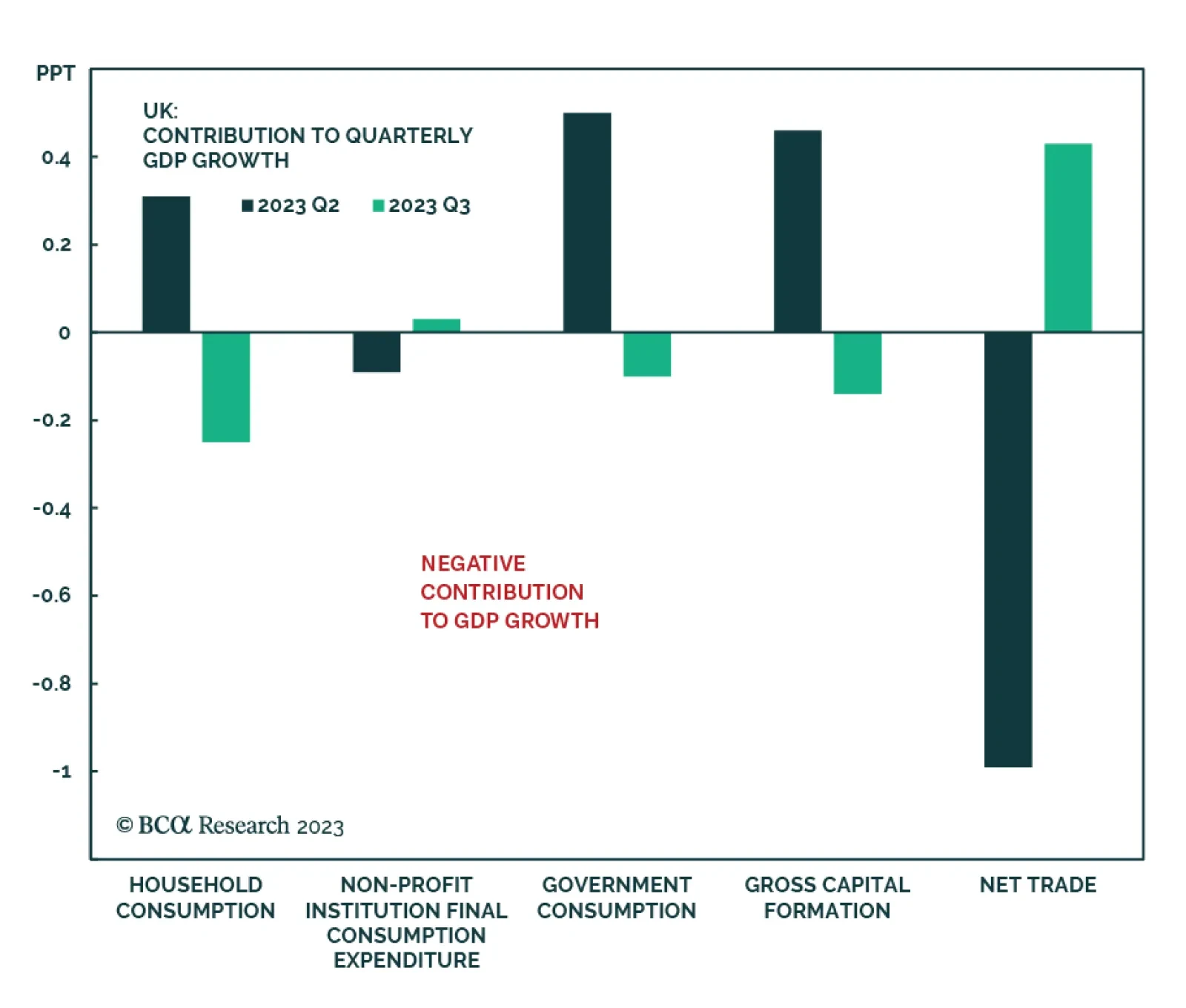

The UK economy stagnated in Q3 – a deterioration from the minor 0.2% q/q expansion in the prior quarter. Although the Q3 figure is slightly better than anticipations of a 0.1% q/q contraction, the details of the report are…