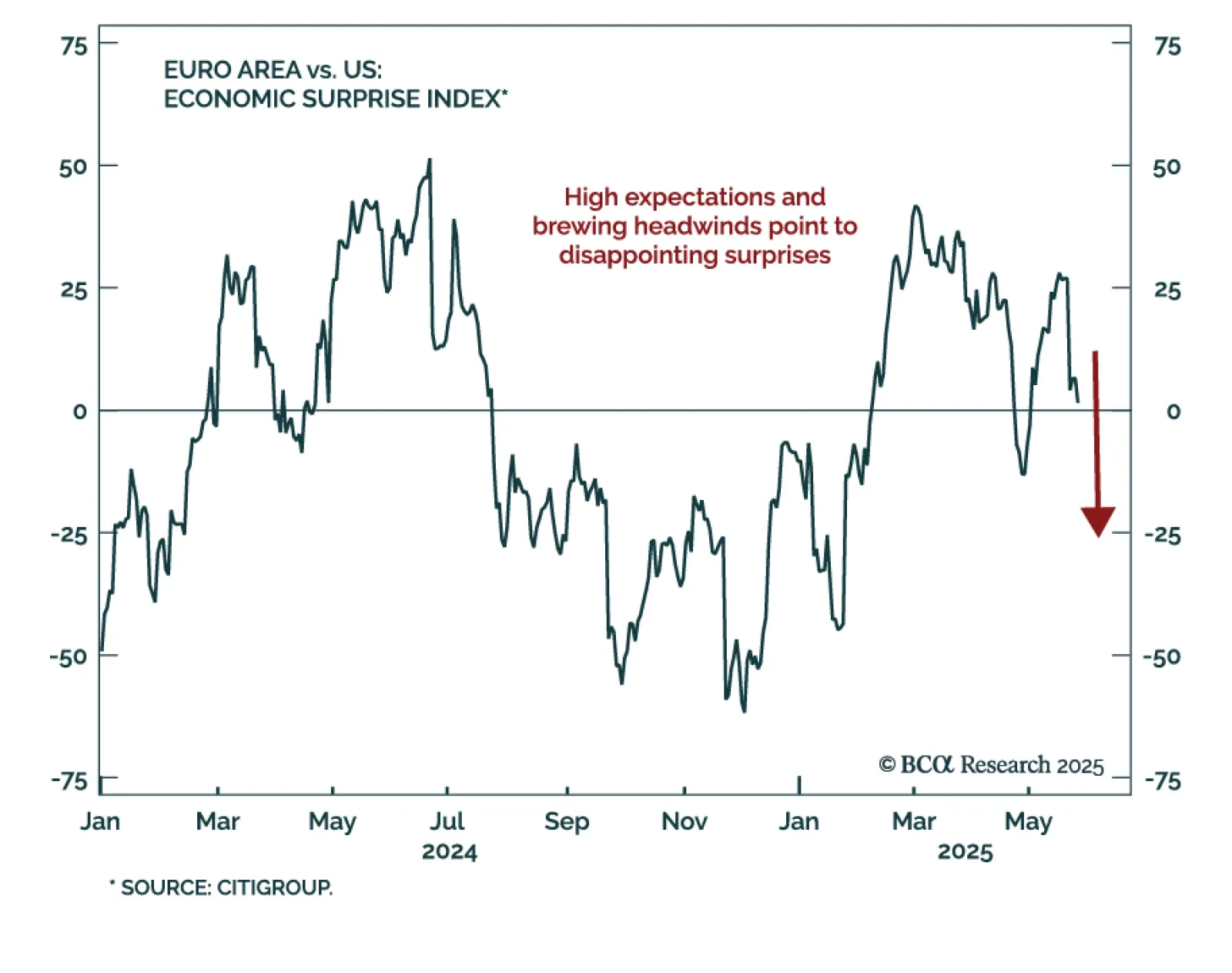

The ECB is changing its tone, but don’t call it a pivot. Slower cuts, sticky disinflation, and a soft growth patch shift the opportunity set. We break down the tactical bond trades and why EUR/USD dips are still for buying.

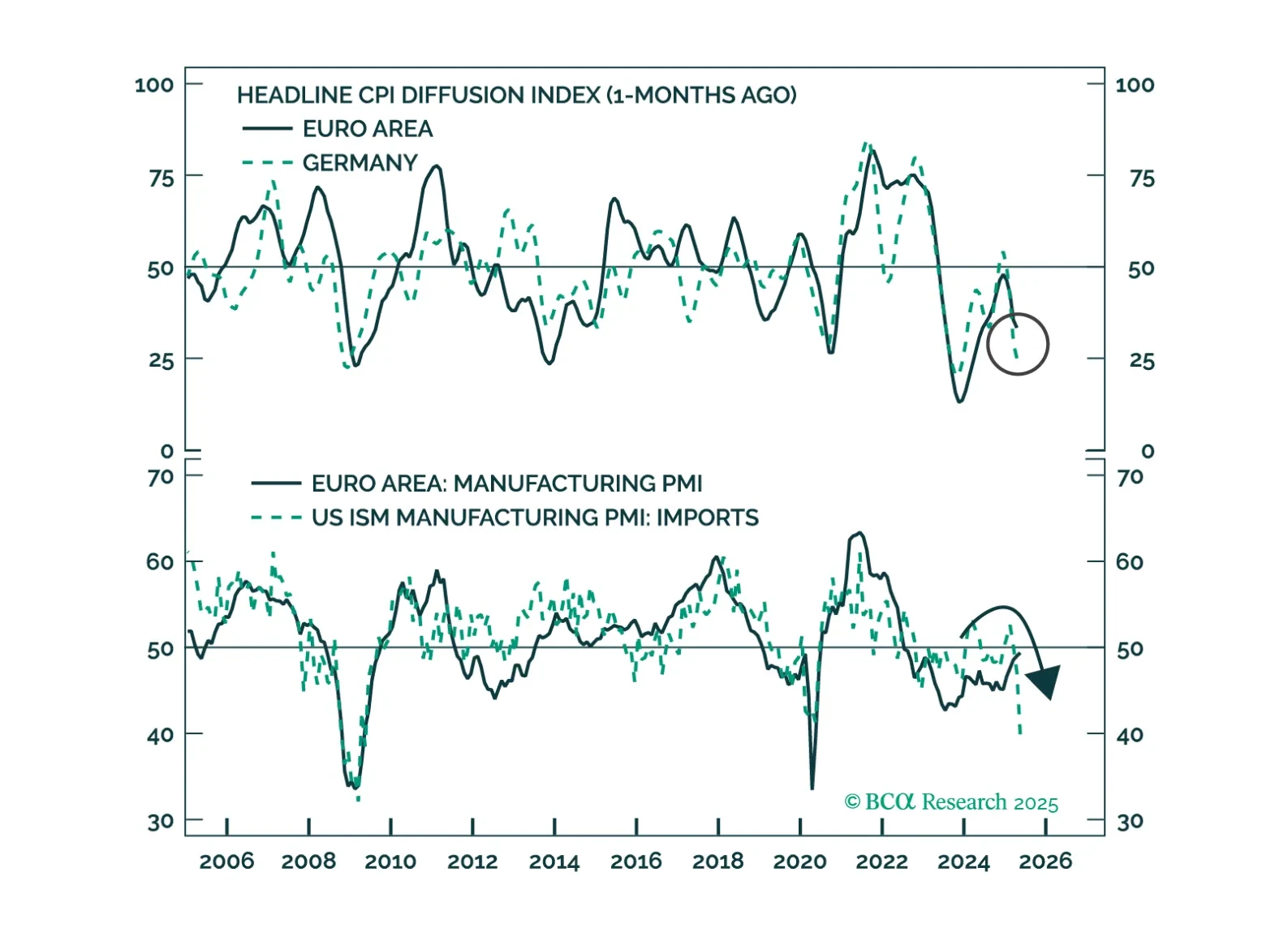

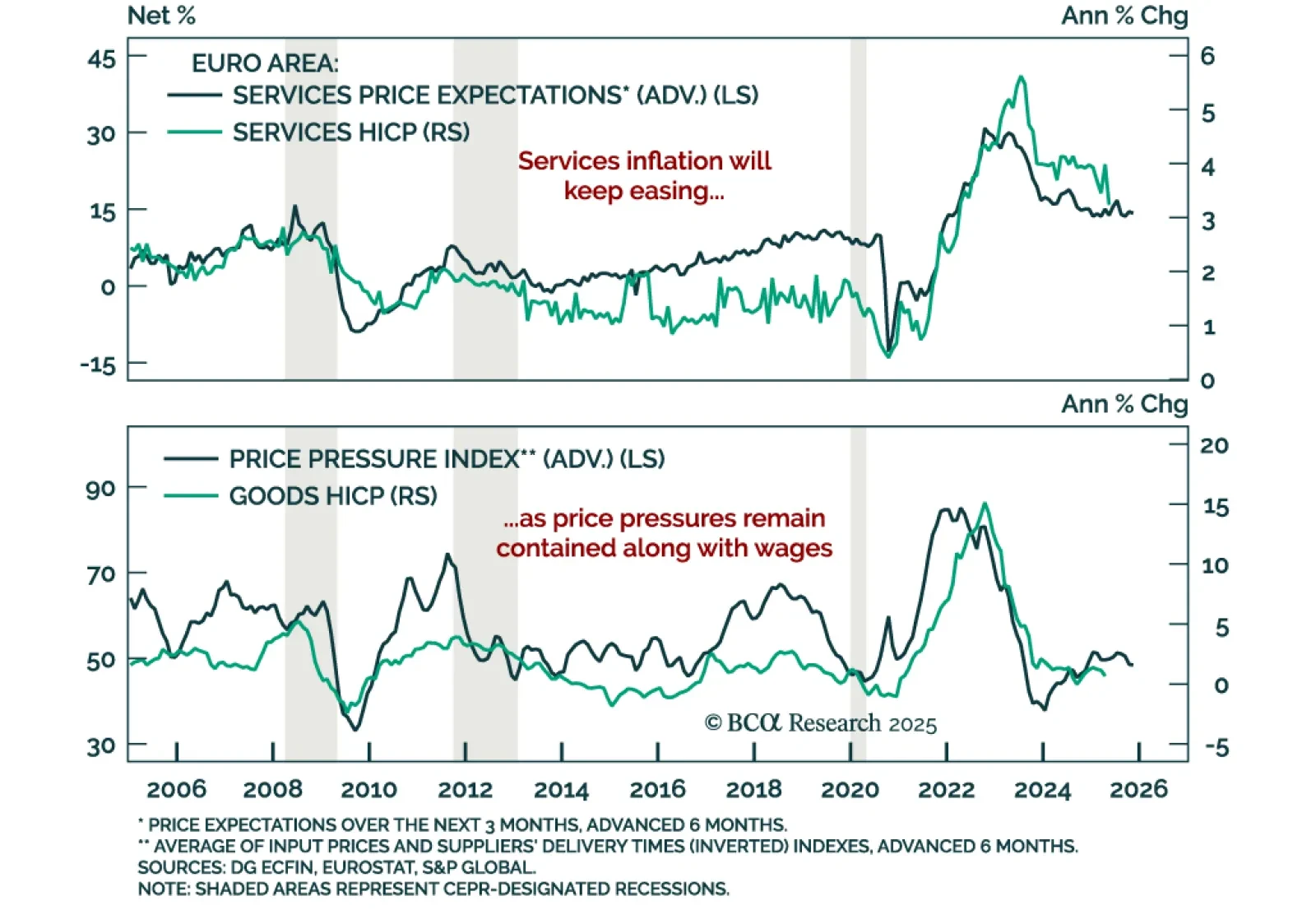

Cooler May inflation in the Eurozone and Switzerland reinforces the case for an ECB rate cut and supports our defensive positioning across European rates and FX. Headline Eurozone HICP fell to 1.9% y/y from 2.2%, with core down to 2.…

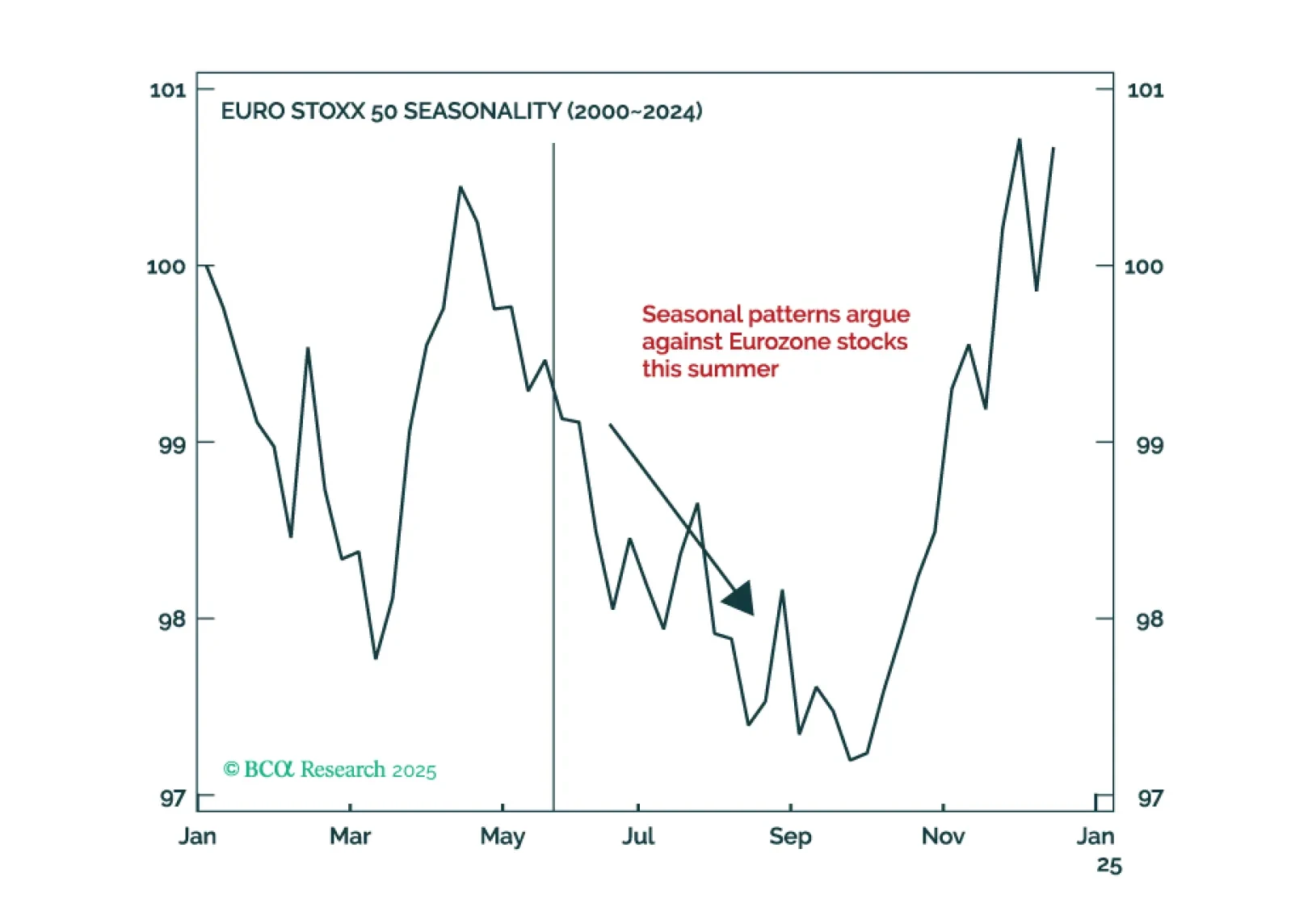

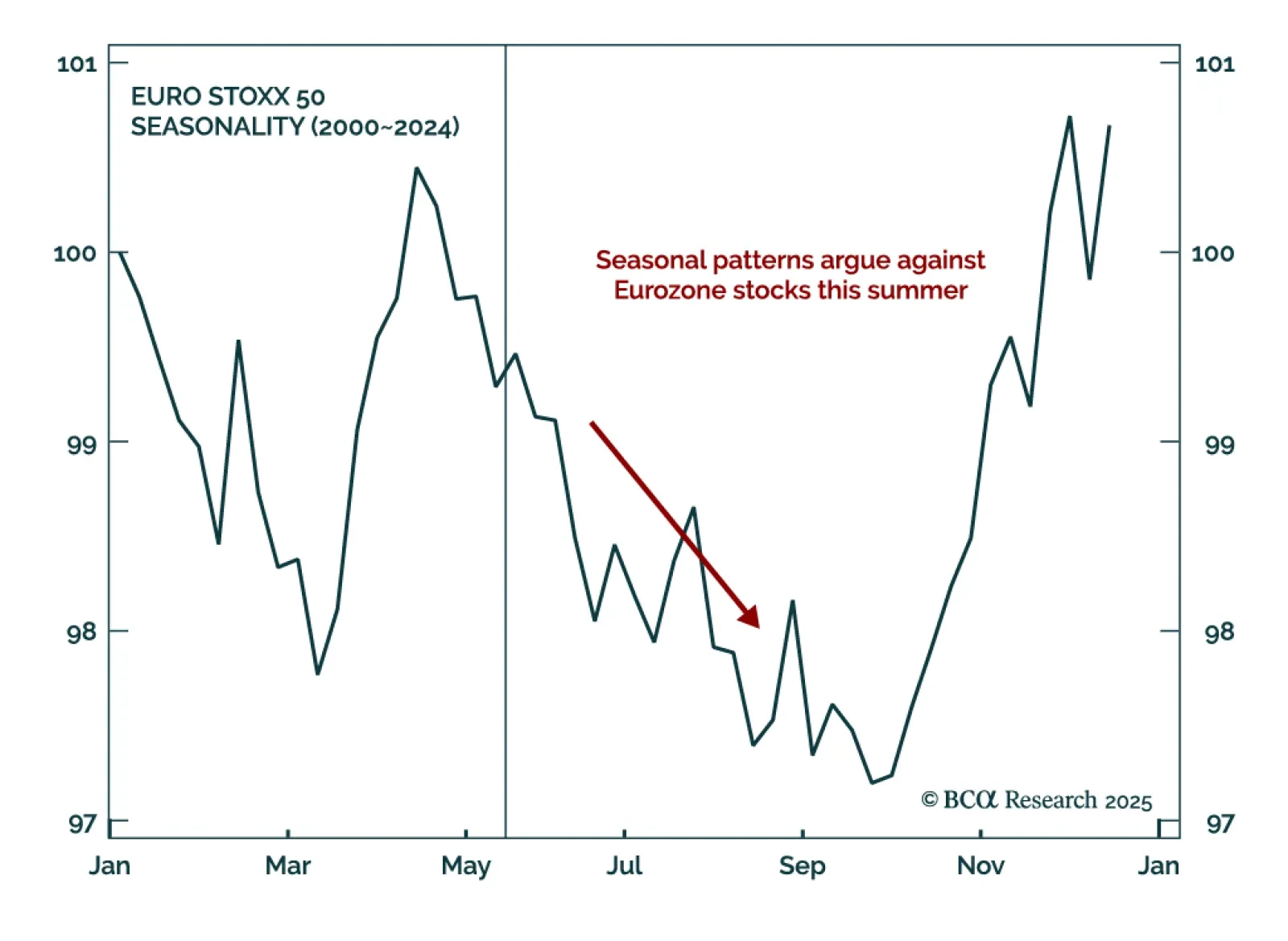

Our European strategists expect the EURO STOXX 50 to remain rangebound between 4750 and 5500 this summer, creating a punishing environment for buy-and-hold investors. With the index near the top of its range, they recommend trimming…

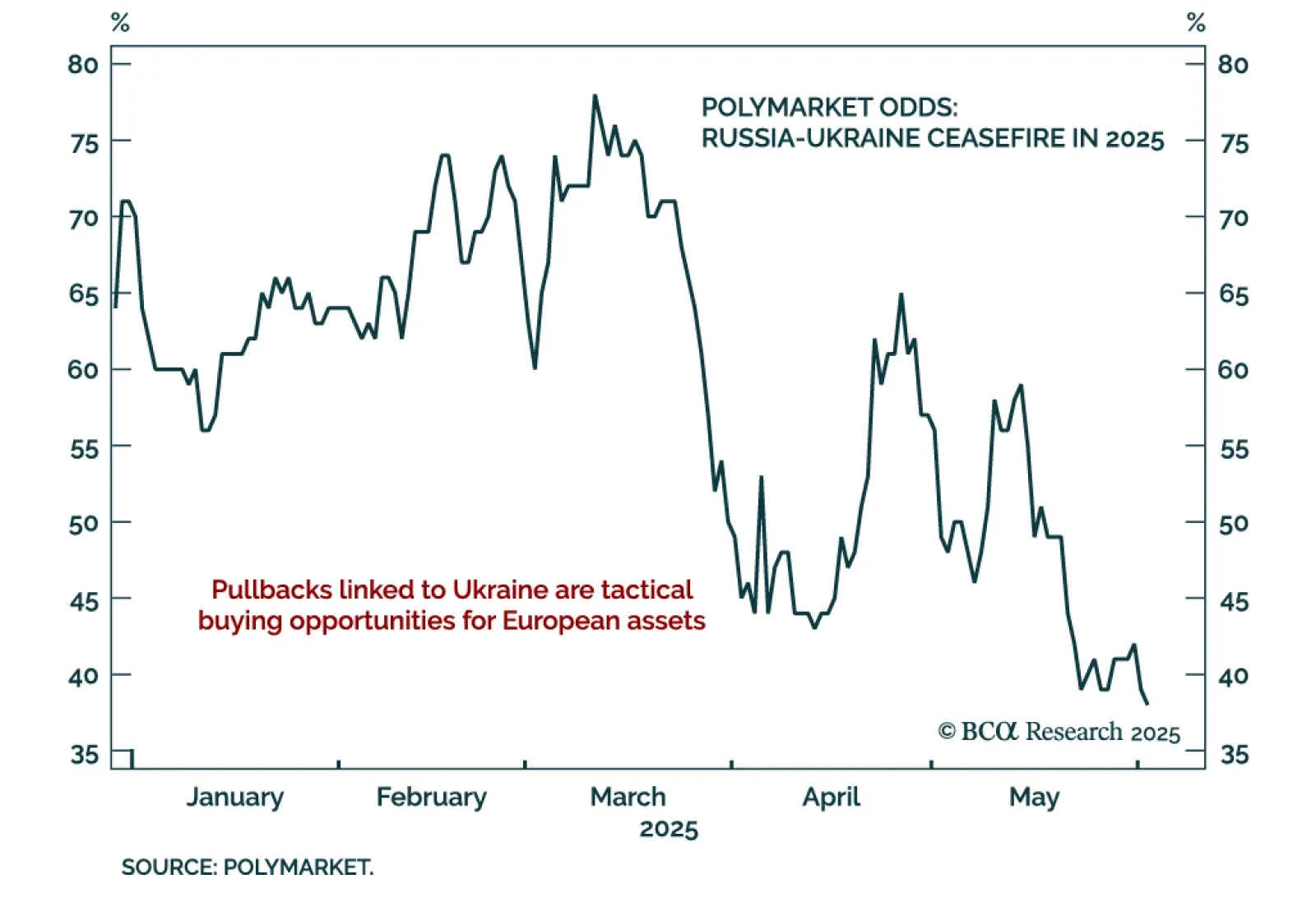

Ongoing military tensions between Ukraine and Rusia and renewed US-EU trade friction reinforce tactical opportunities to add European exposure on dips. Ukraine’s drone strike on Russian air assets and the limited outcome of the…

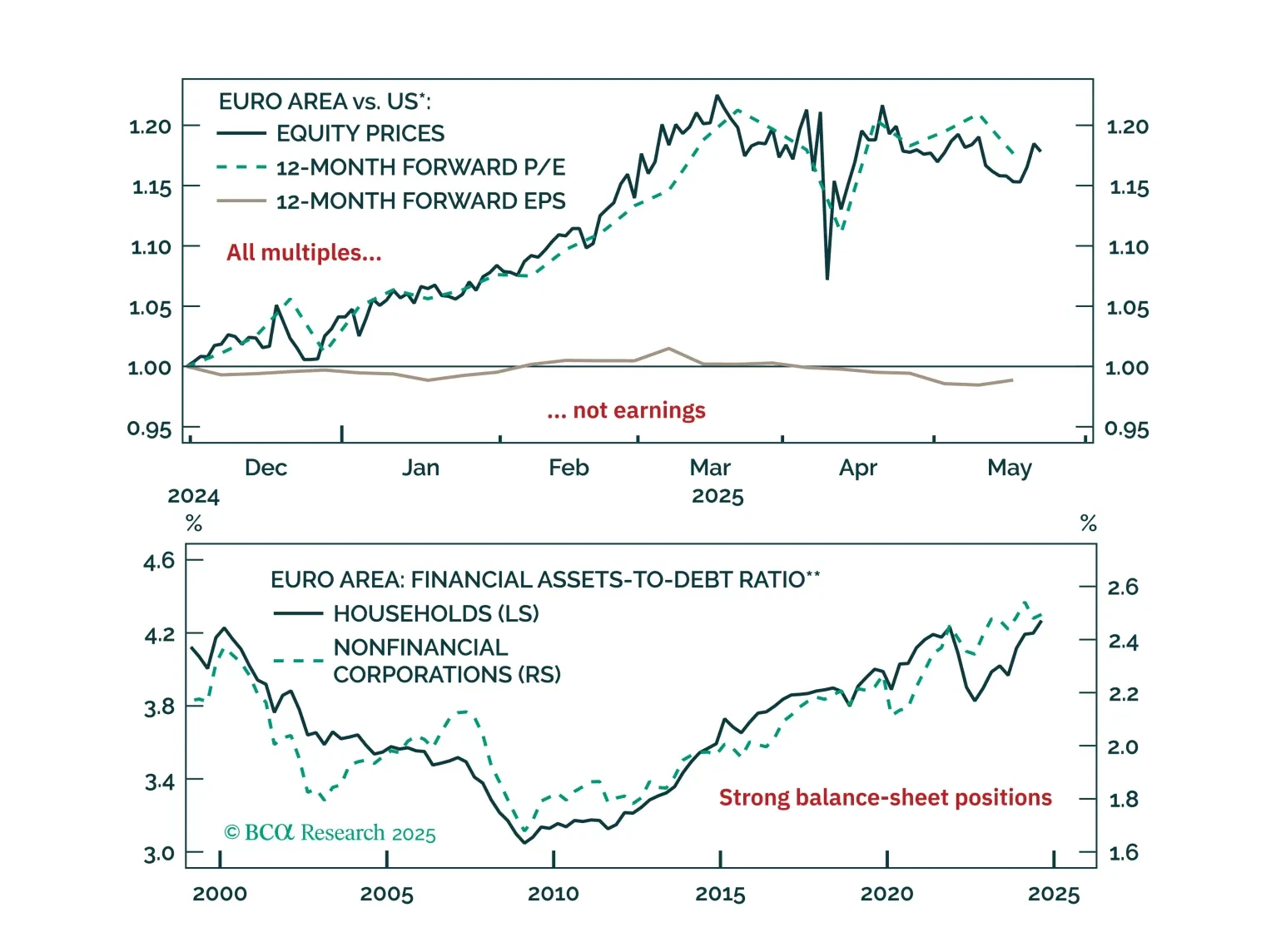

European equities will face a clash of powerful forces this summer. Expect sharp swings and false breaks, creating an ideal terrain for nimble traders but a minefield for buy-and-hold investors seeking steady gains.Within this backdrop,…

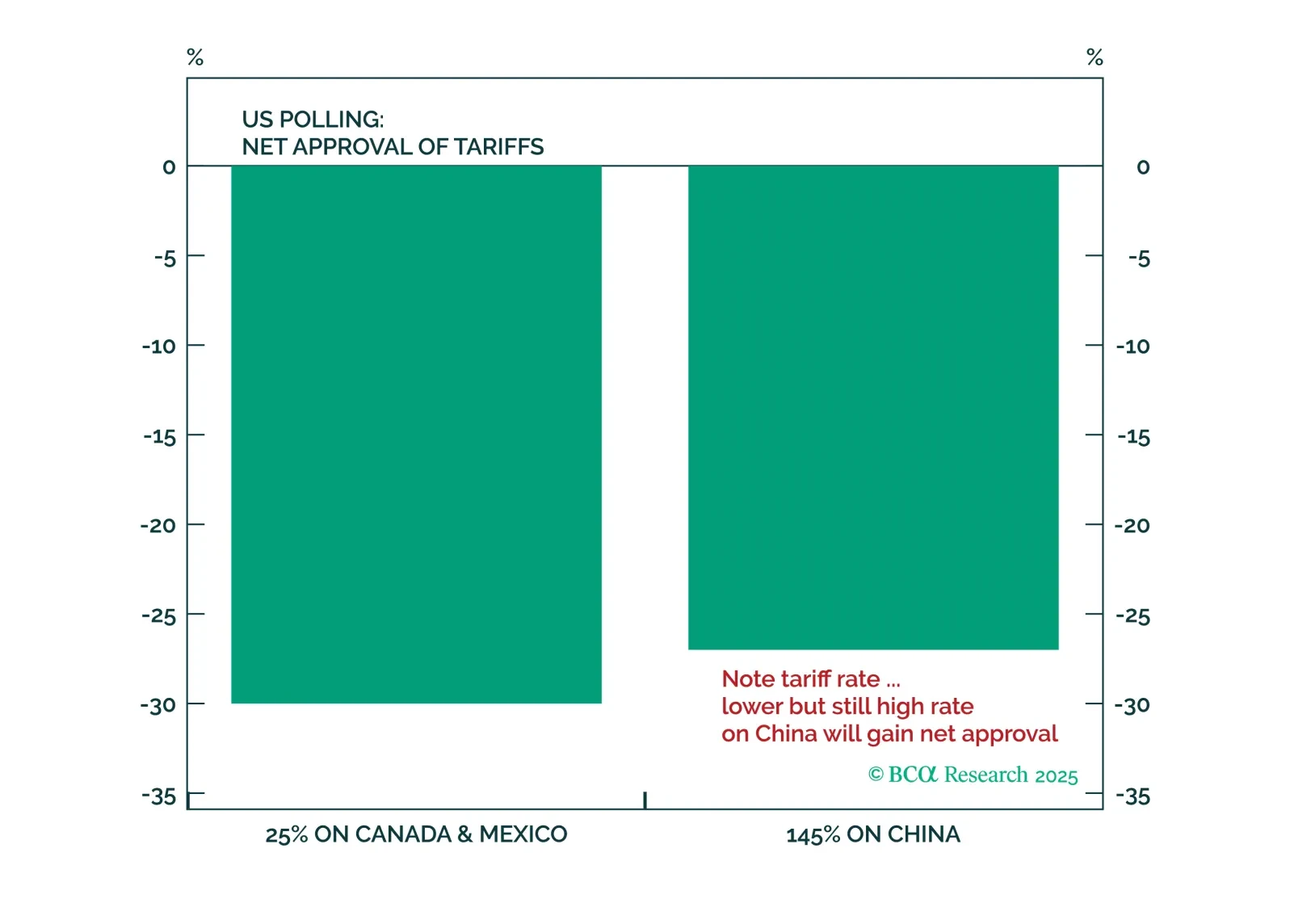

President Trump faces new restrictions on his trade powers coming from the US judicial branch, but they will not prevent him from continuing to restrict trade and investment with China. Rather, they will establish some curbs against…

The structural outlook for European assets remains bright, but near-term headwinds argue for longer duration and caution on equities. Here are three takes that call for a temporary pullback in European assets, and two that explore…

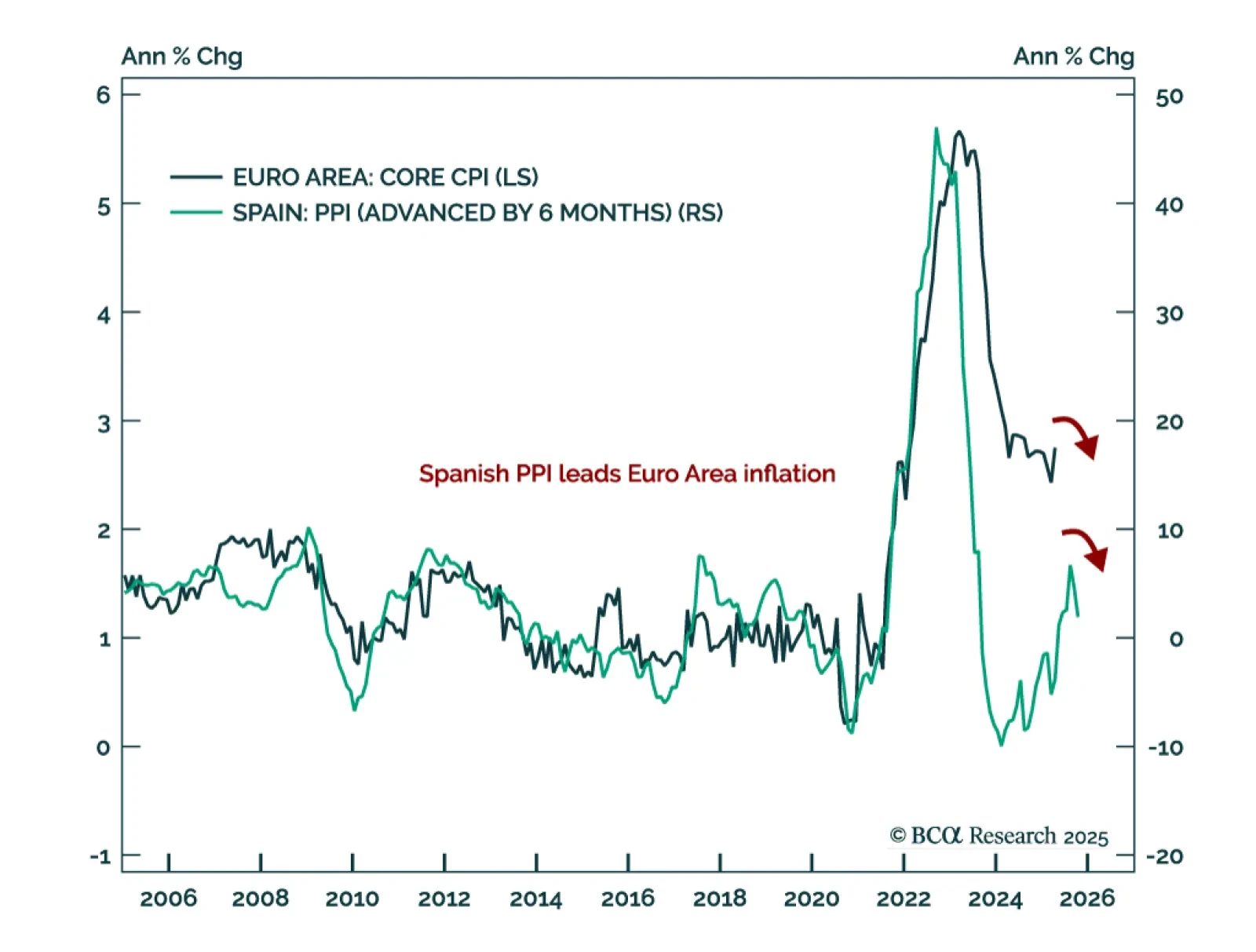

Producer prices in Spain surprised to the downside, foreshadowing a relapse in Euro Area inflation and cementing the ECB’s dovish stance. The Spanish PPI index fell to 1.9% in April, continuing the disinflation trend from the last…

Five questions, five answers from the road. We unpack what Europe’s biggest investors are worried about right now, from trade‑war whiplash to bund‑versus‑Treasury positioning; and where the real opportunities still lie.

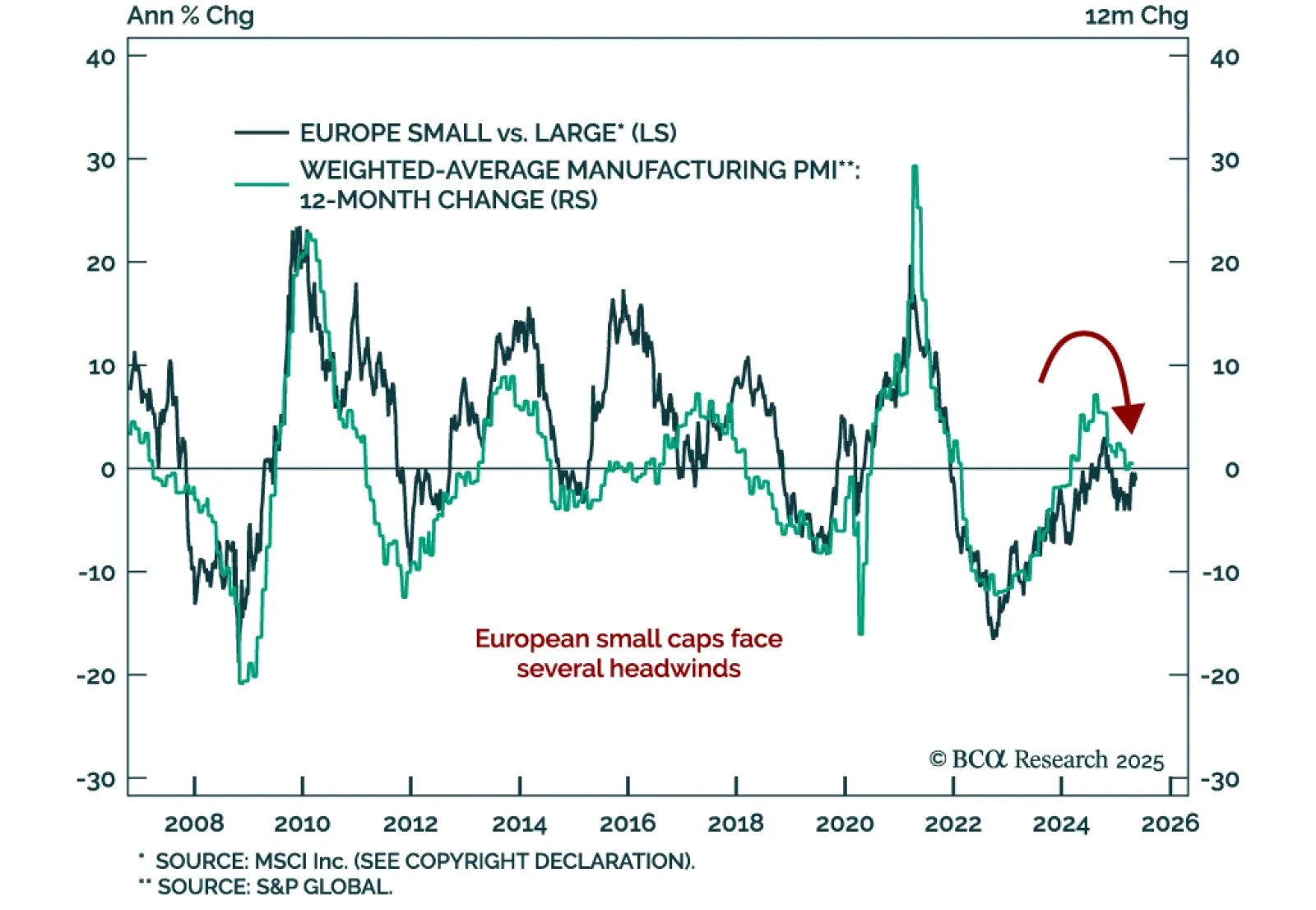

The outperformance of European small caps is coming to an end. Our Chart Of The Week comes from our European Investment Strategy team.The team identifies several headwinds for small caps in Europe in the near term. Small caps’…