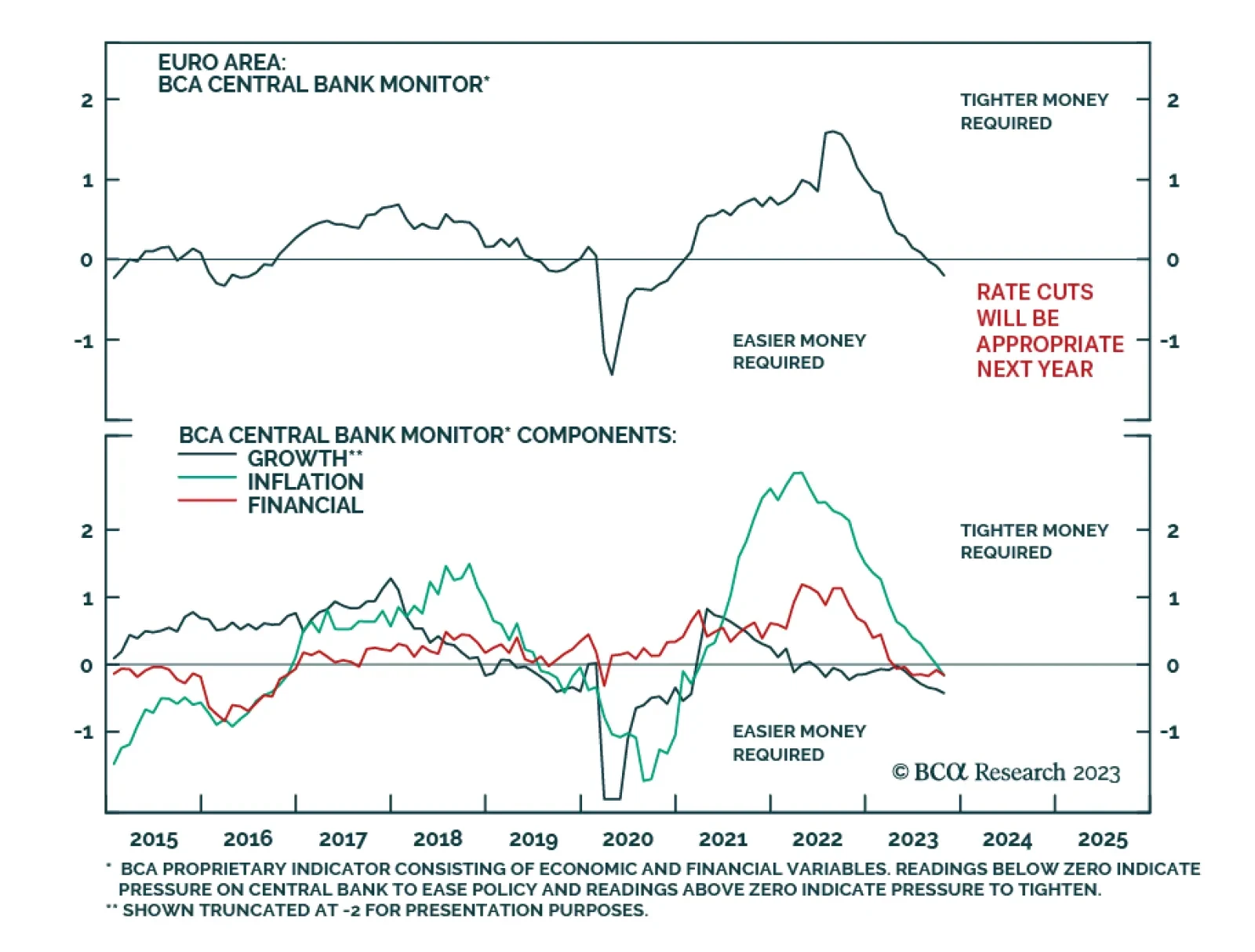

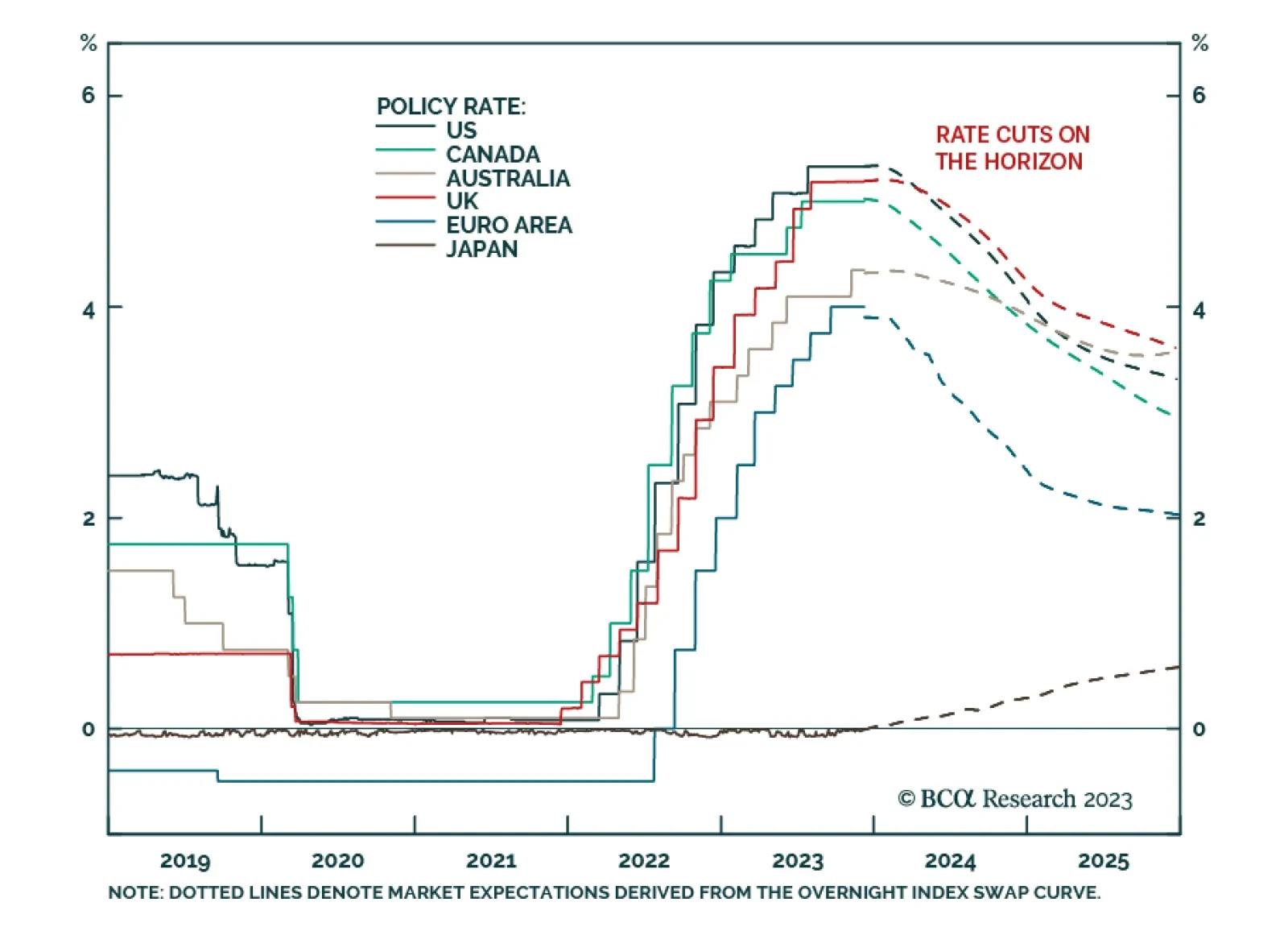

As expected, the ECB kept its policy rate unchanged on Thursday. In the updated macroeconomic projections, the central bank revised down its inflation and growth forecasts for next year. It now expects inflation to ease to 2.7…

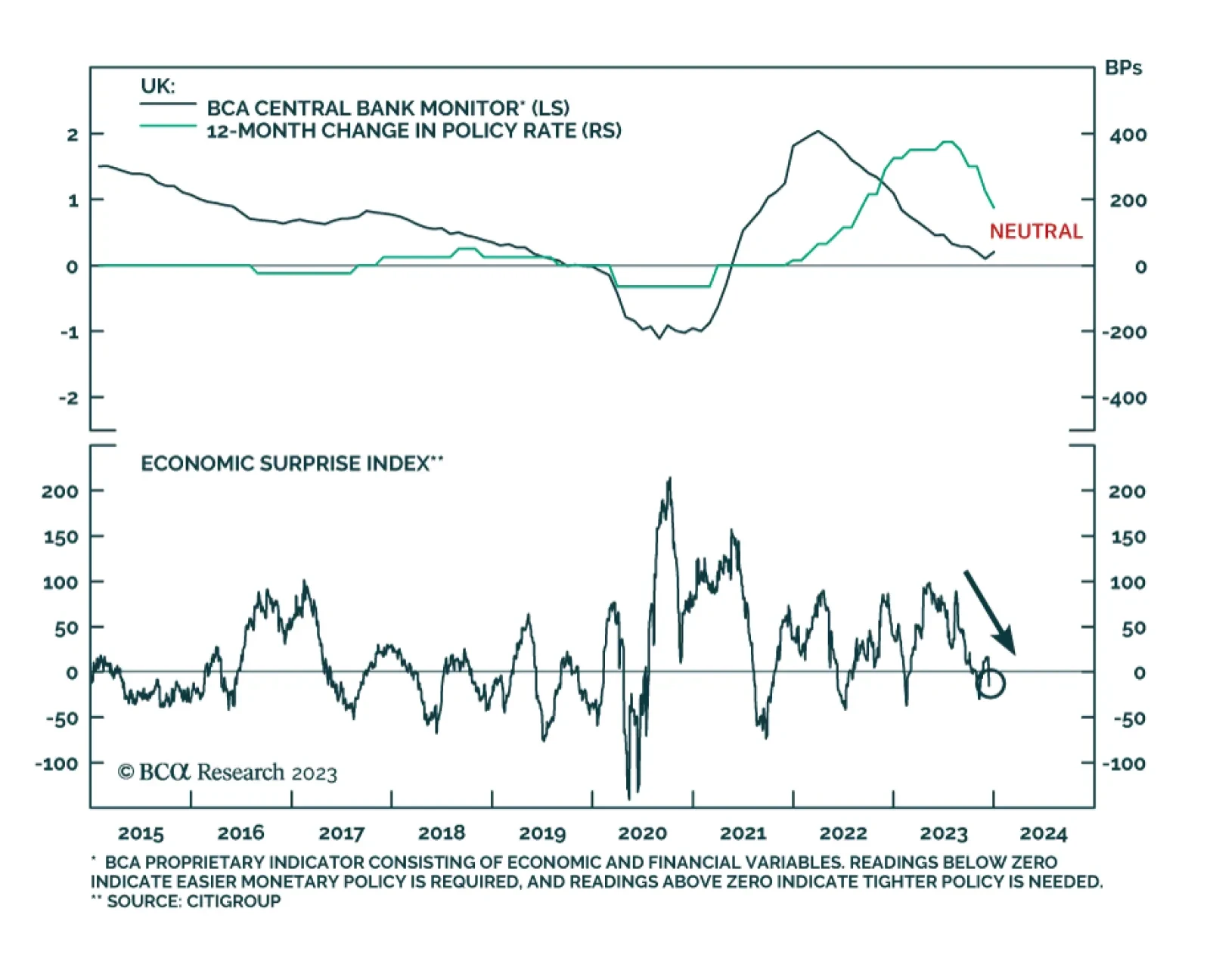

Weaker-than-anticipated economic data caused a sharp decline in UK gilt yields over the past few days with the 10 year yield now at its lowest since May. The weakness in economic data was broad-based across various…

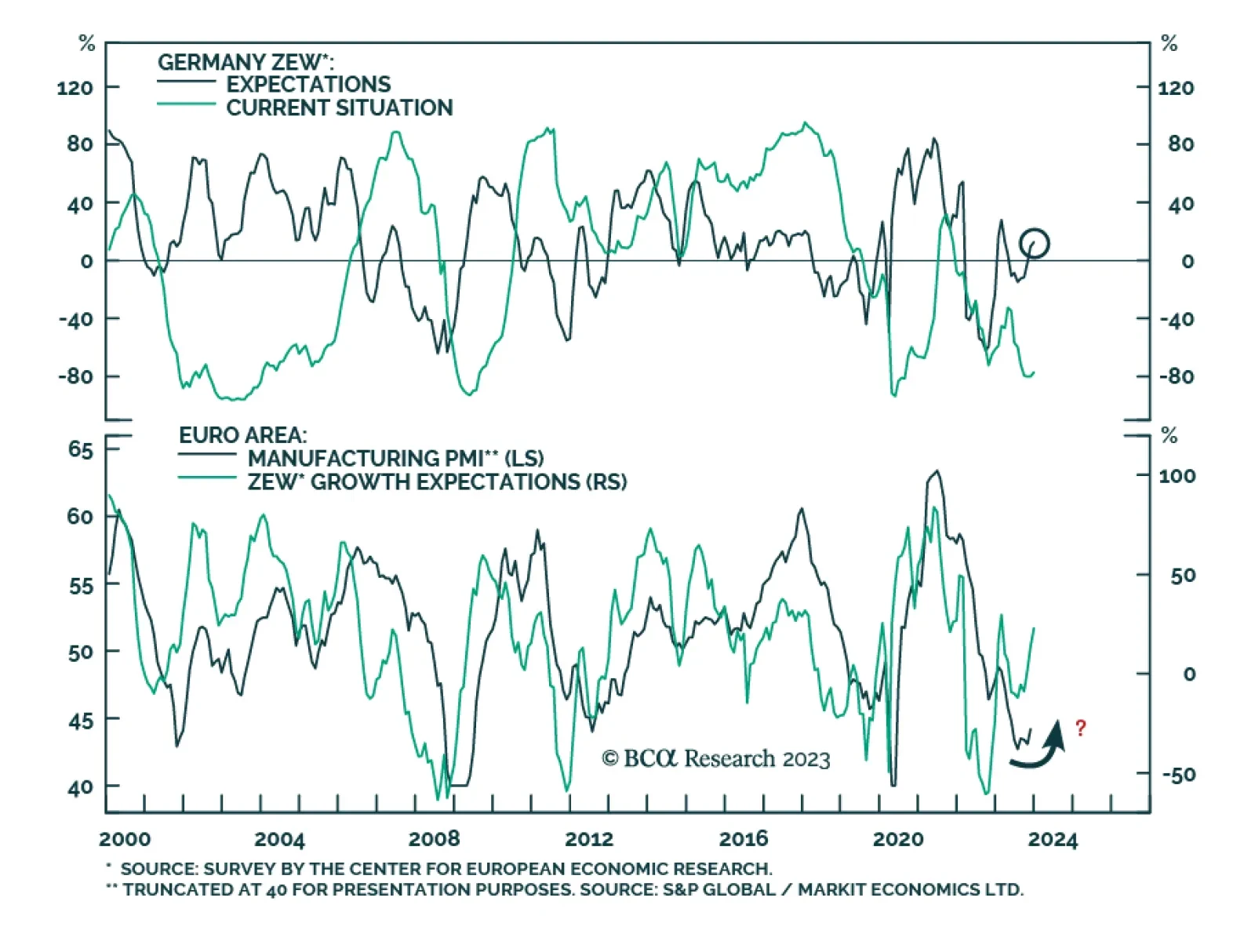

The continued improvement in German investor morale captured by the ZEW survey corroborates other indicators pointing to near-term support for Eurozone stocks. Economic sentiment jumped three points to a 9-month high of 12.8 in…

According to BCA Research’s European Investment Strategy service, European equities near cycle highs are vulnerable to weaker earnings. The team’s earnings model for Eurozone equities continues to point to a double…

Multiple major DM central banks are scheduled to decide on monetary policy this week. The US Fed will meet on Wednesday, followed by the ECB, BoE, and Norges Bank on Thursday. It comes after the BoC and RBA both opted to keep…

The recent decline in yields has powered European equities higher, however, this rally cannot last if earnings decline meaningfully. With this in mind, are our earnings models flagging risks for stocks next year?