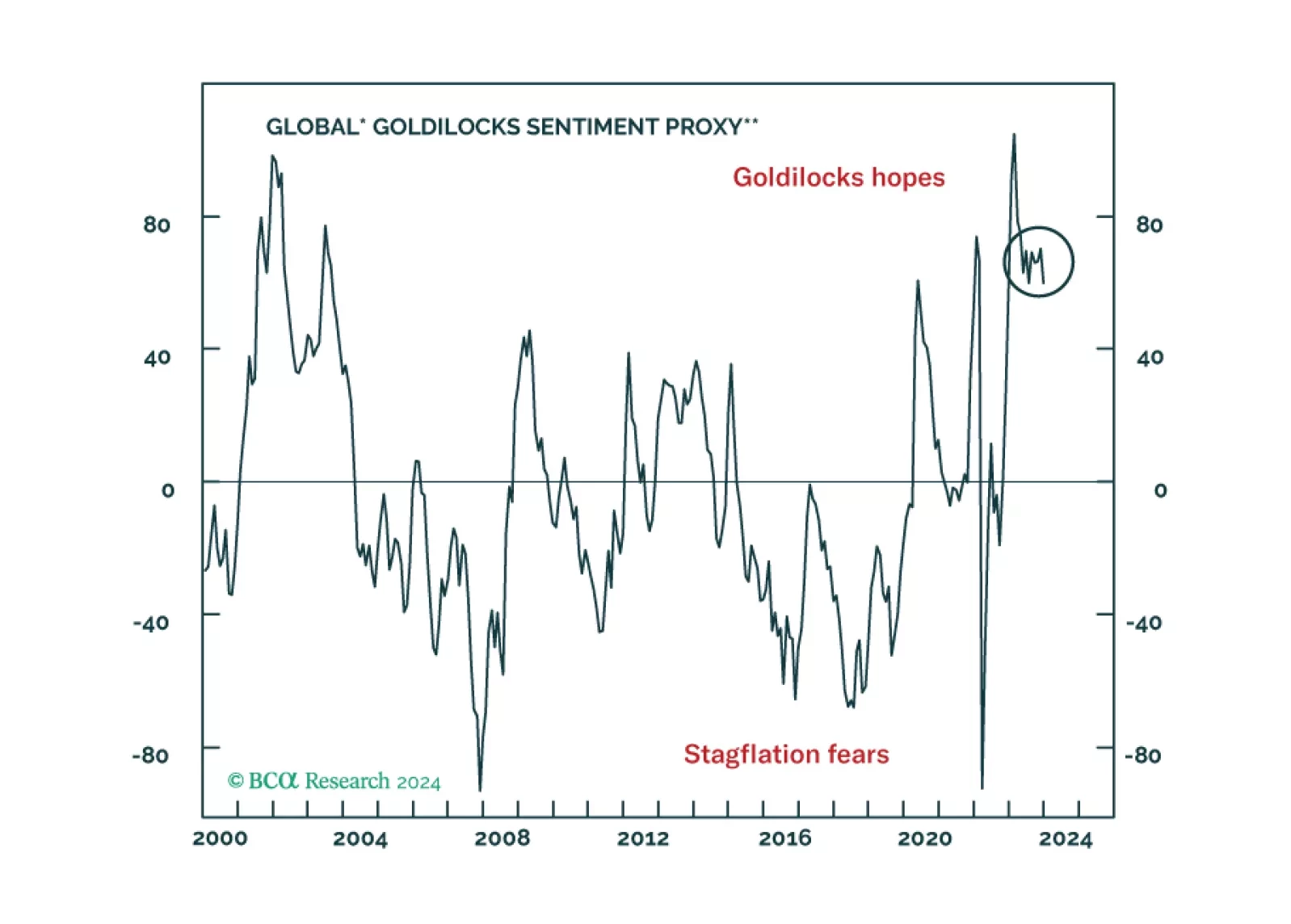

The soft-landing narrative has won, but is too much of a good thing now expected by investors?

In this brief Insight we examine the expanding Middle East conflict and update the situation in the Taiwan Strait on the eve of elections. The Houthis are a distraction and China is not likely to invade Taiwan in the near term, but…

The market’s pricing of a soft landing means that geopolitical risks are becoming more, not less, relevant in 2024. US domestic divisions will invite challenges as foreign powers rightly fear that US policy will turn more hawkish…

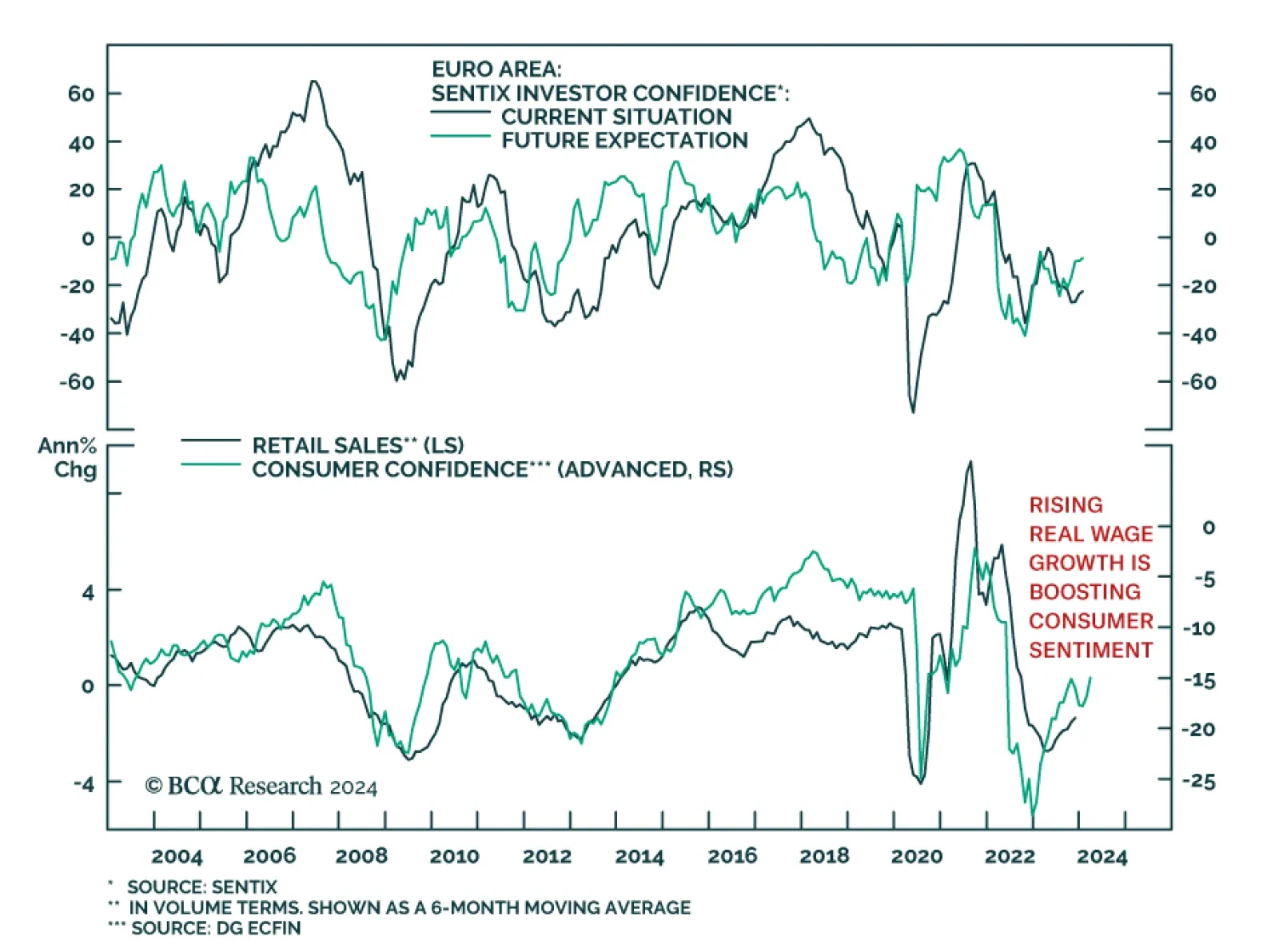

Optimism among investors and economic agents continues to improve in the Eurozone. The Sentix Economic Index for the Eurozone rose from -16.8 to -15.8 in January – in line with consensus expectations and marking the third…

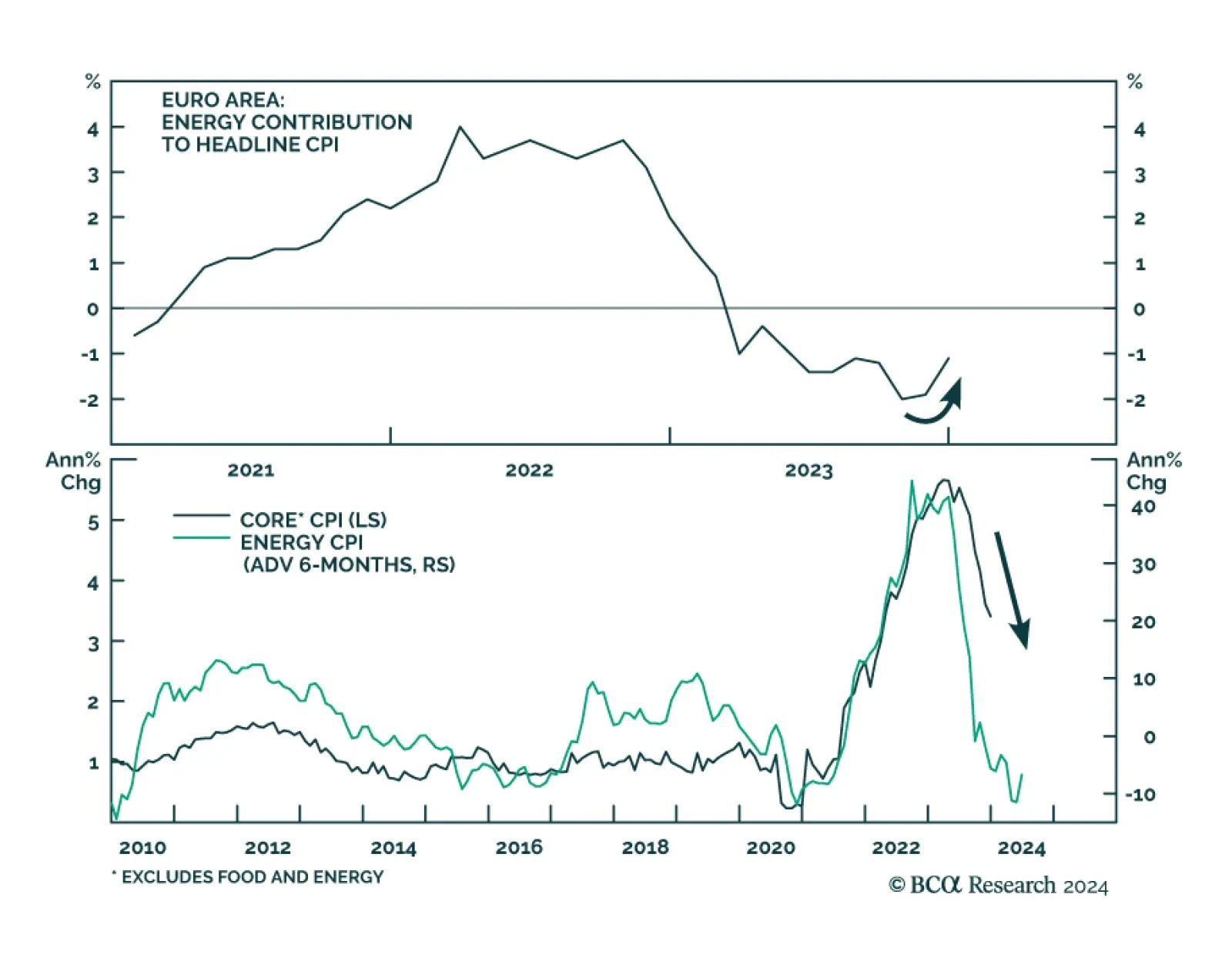

Friday’s Eurozone CPI inflation report was in line with consensus estimates. Headline inflation reaccelerated from 2.4%y/y to 2.9%y/y in December, in part reflecting the impact of the end of energy subsidies in Germany and…

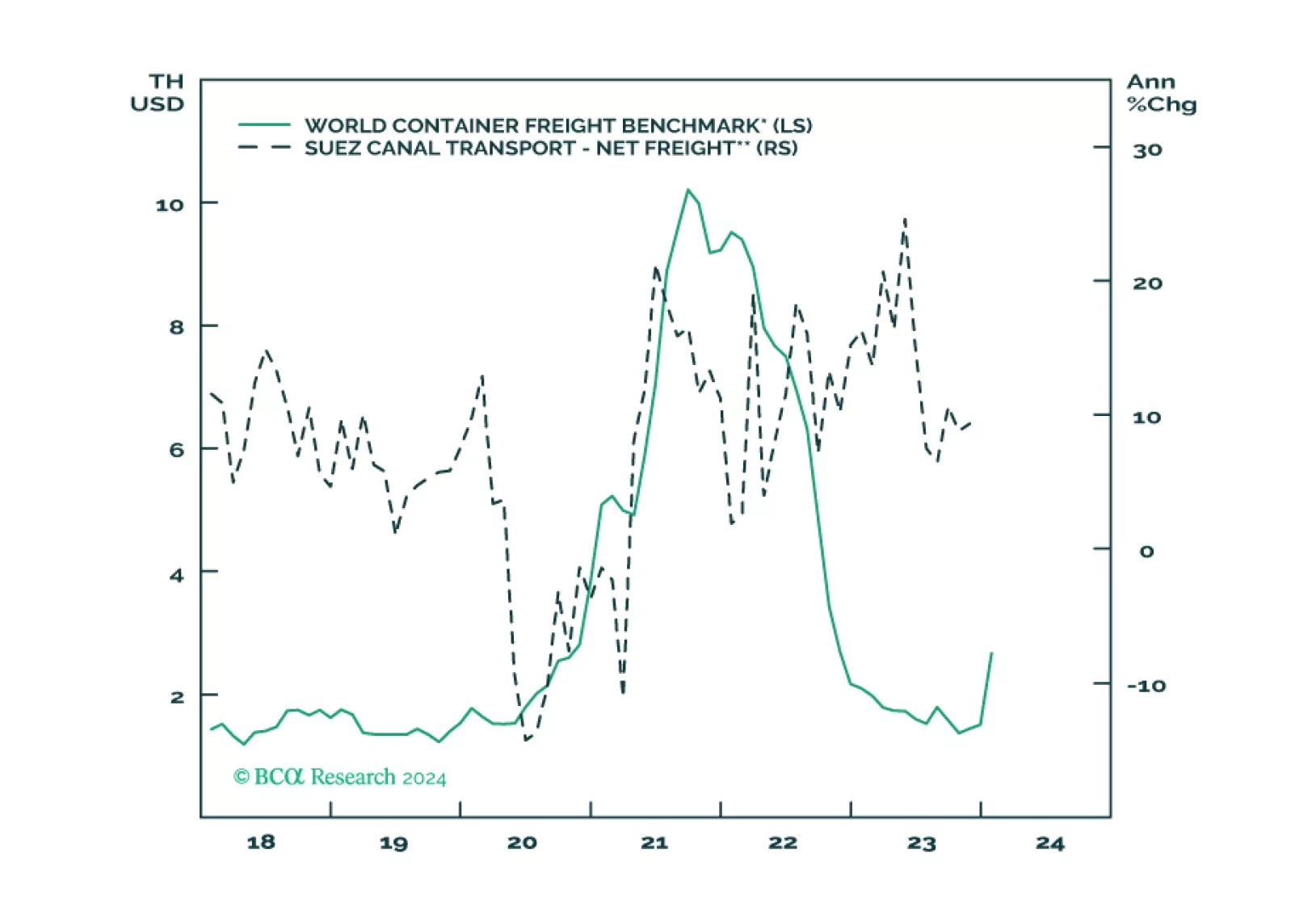

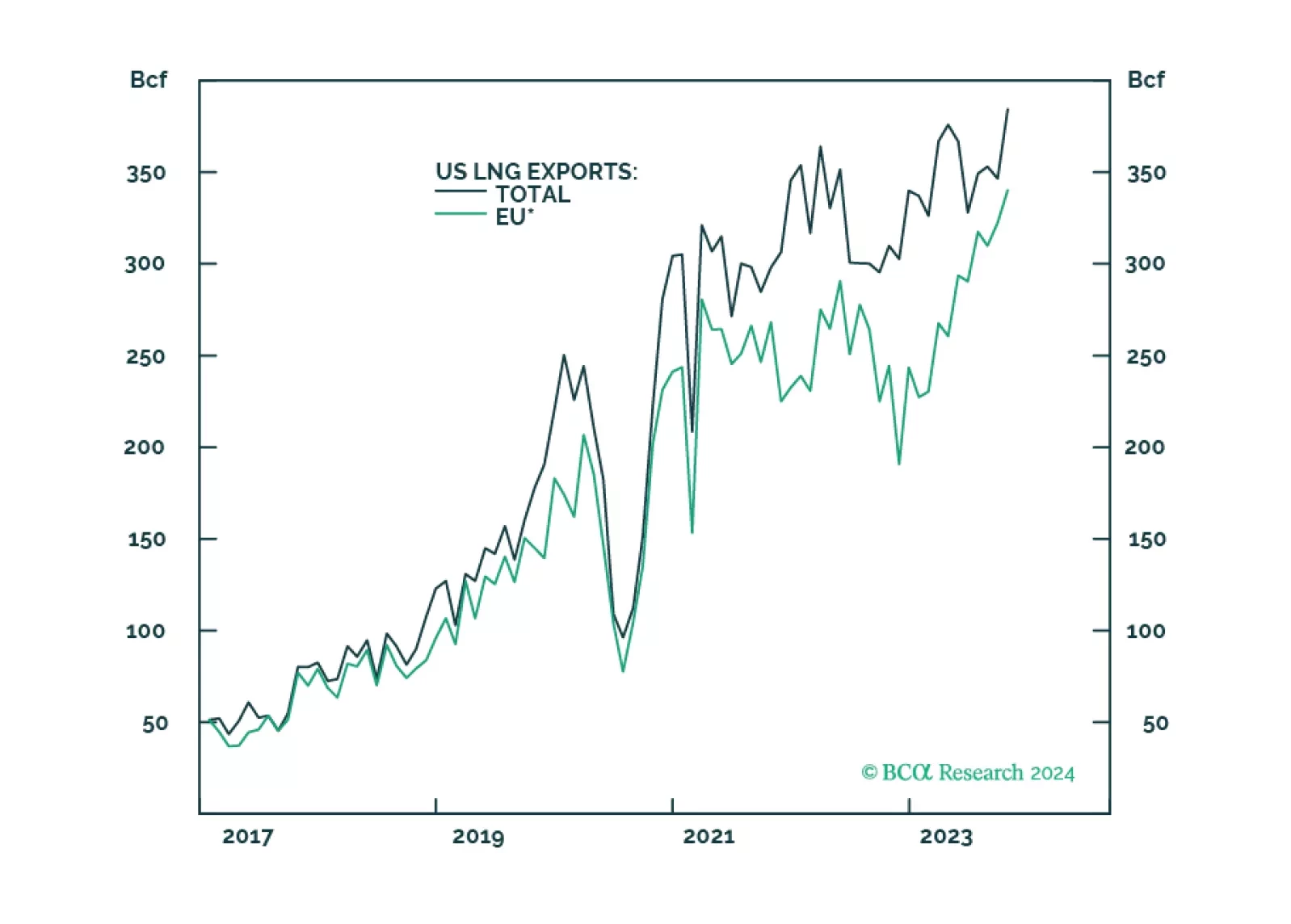

The attacks on Red Sea commercial tankers by Iran’s Yemeni proxies, the Houthi movement, are an inflation risk inasmuch as they lengthen voyage times for any shipping forced to avoid the Bab el-Mandeb Strait. The risk of an expansion…

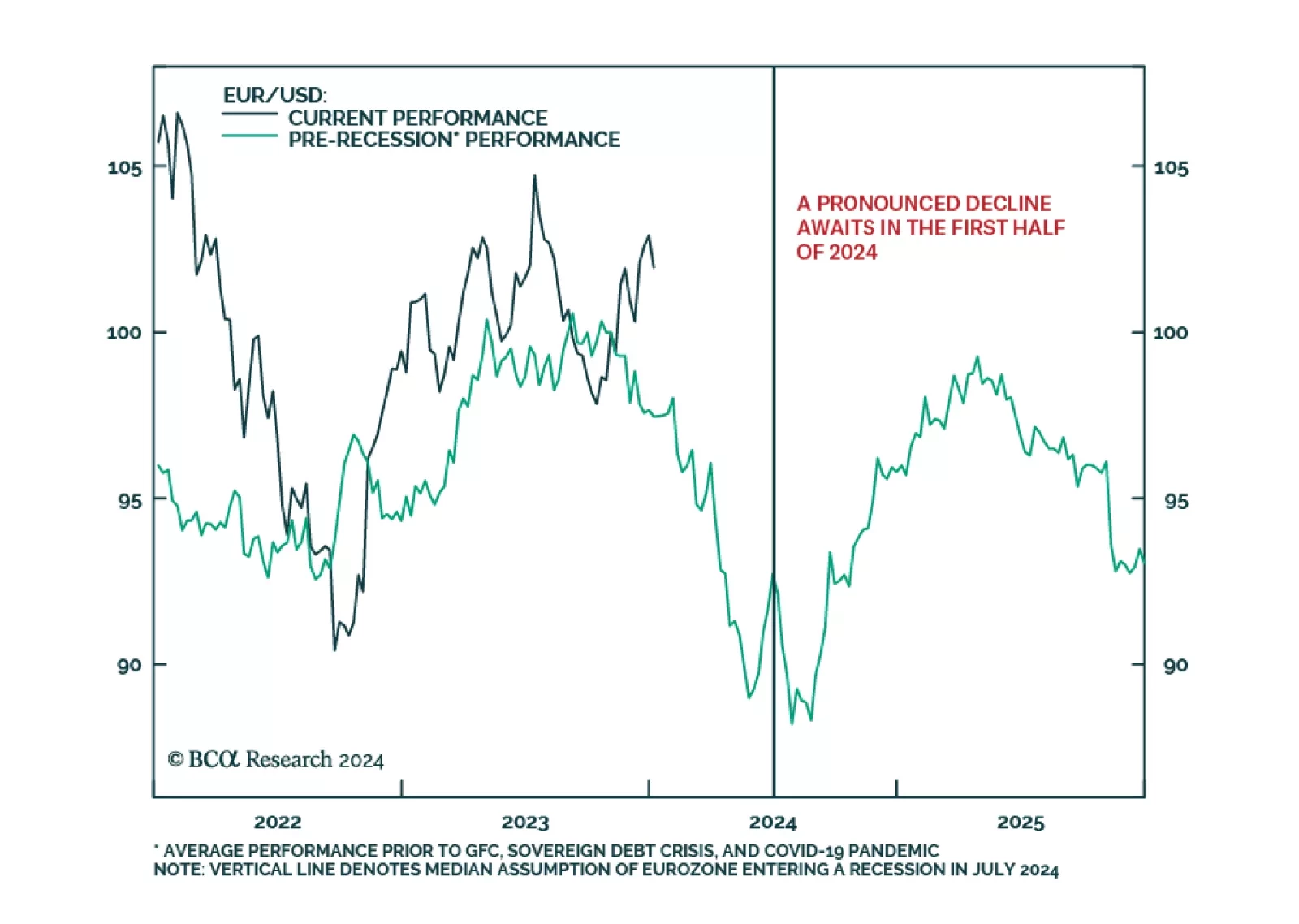

According to BCA Research’s European Investment Strategy service, the euro has ample attractive features that justify a positive long-term outlook. However, its pro-cyclicality and the dollar’s negative…

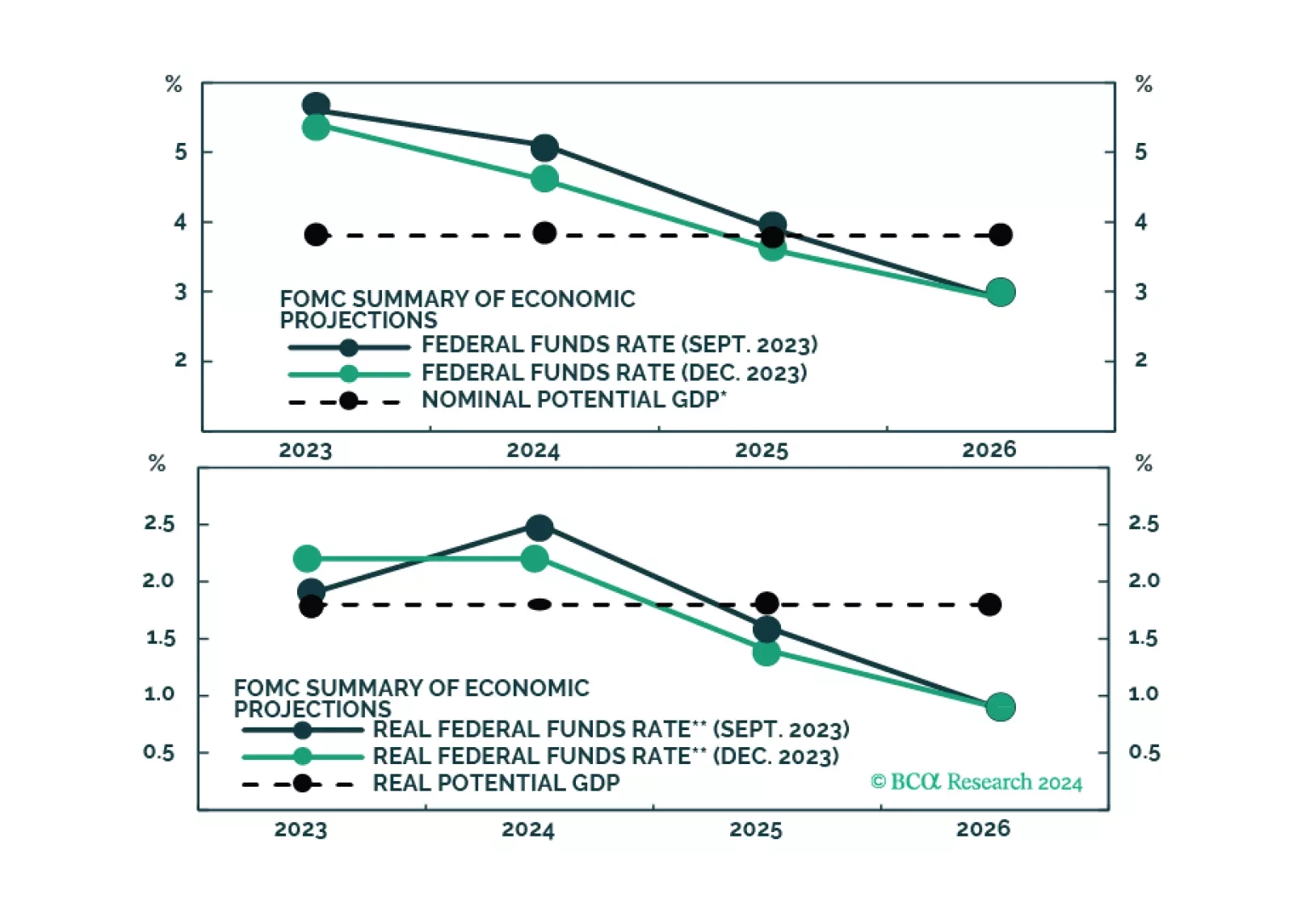

The market is excited by the idea that the Fed will cut rates early this year, even without a recession. But is that likely, with inflation still set to be around 2.8% mid-year?