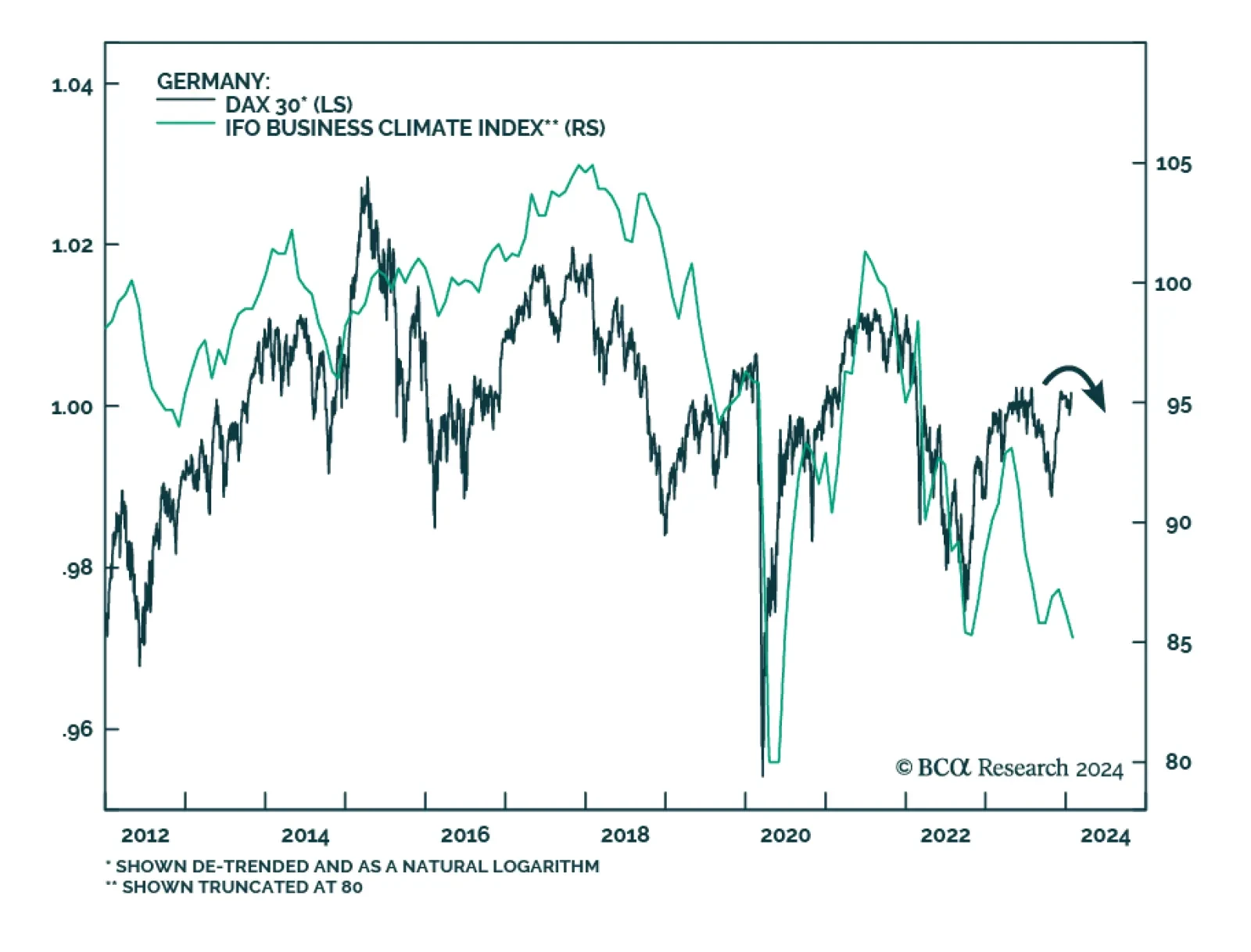

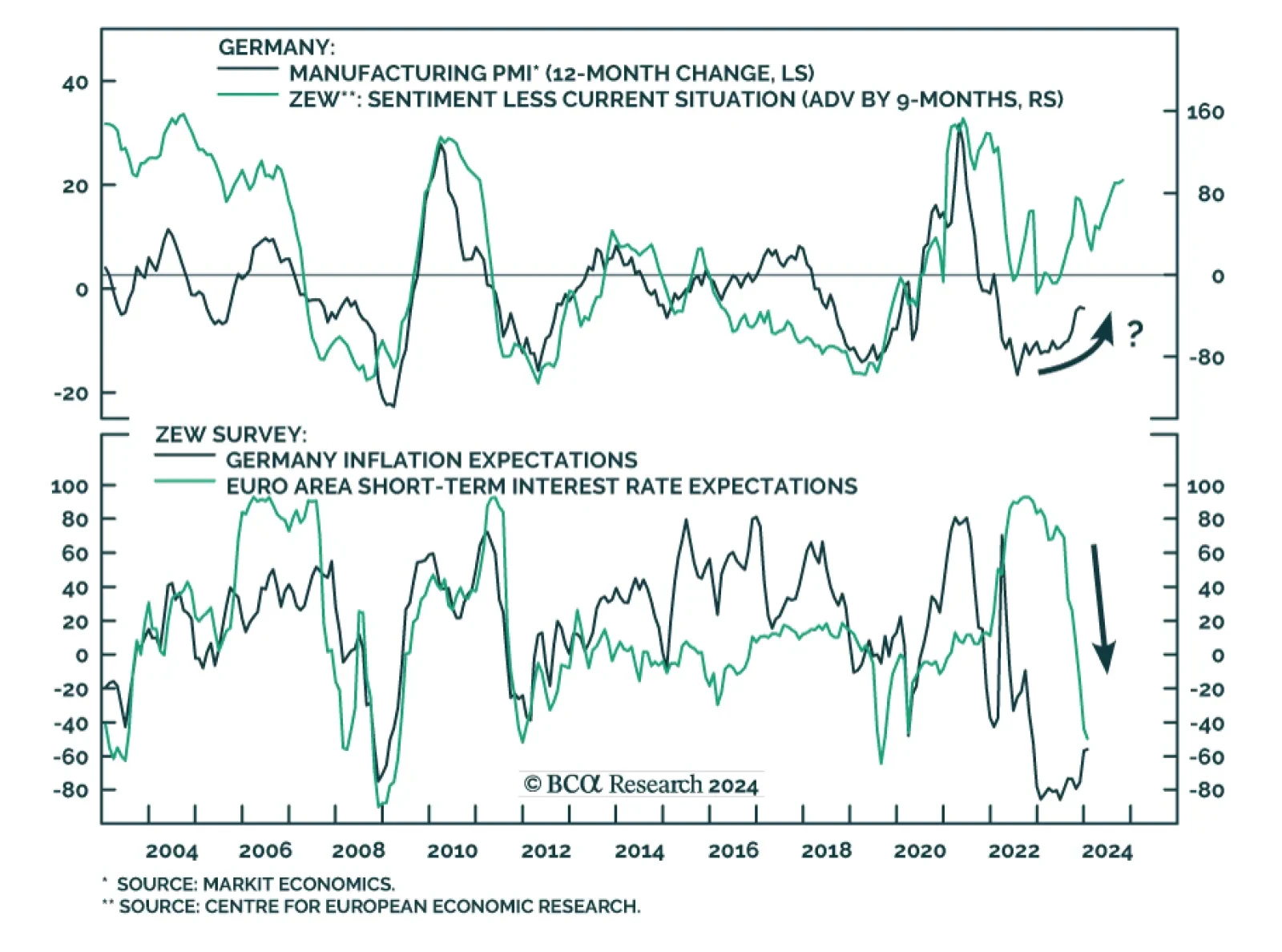

Germany’s IFO survey is sending a warning. The Business Climate Index unexpectedly fell for the second month in a row in January. Importantly, increased pessimism about the current situation and the outlook are driving this…

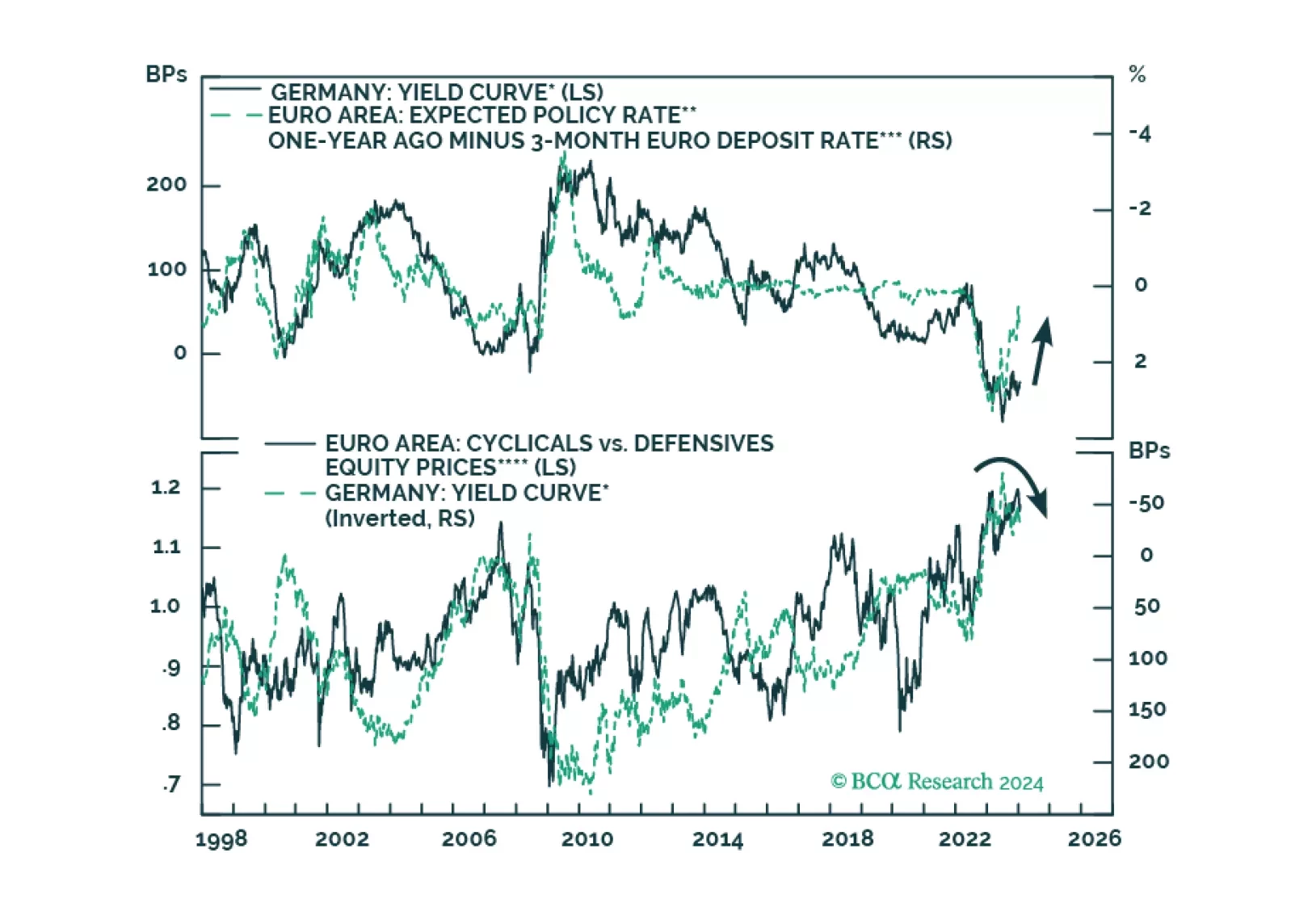

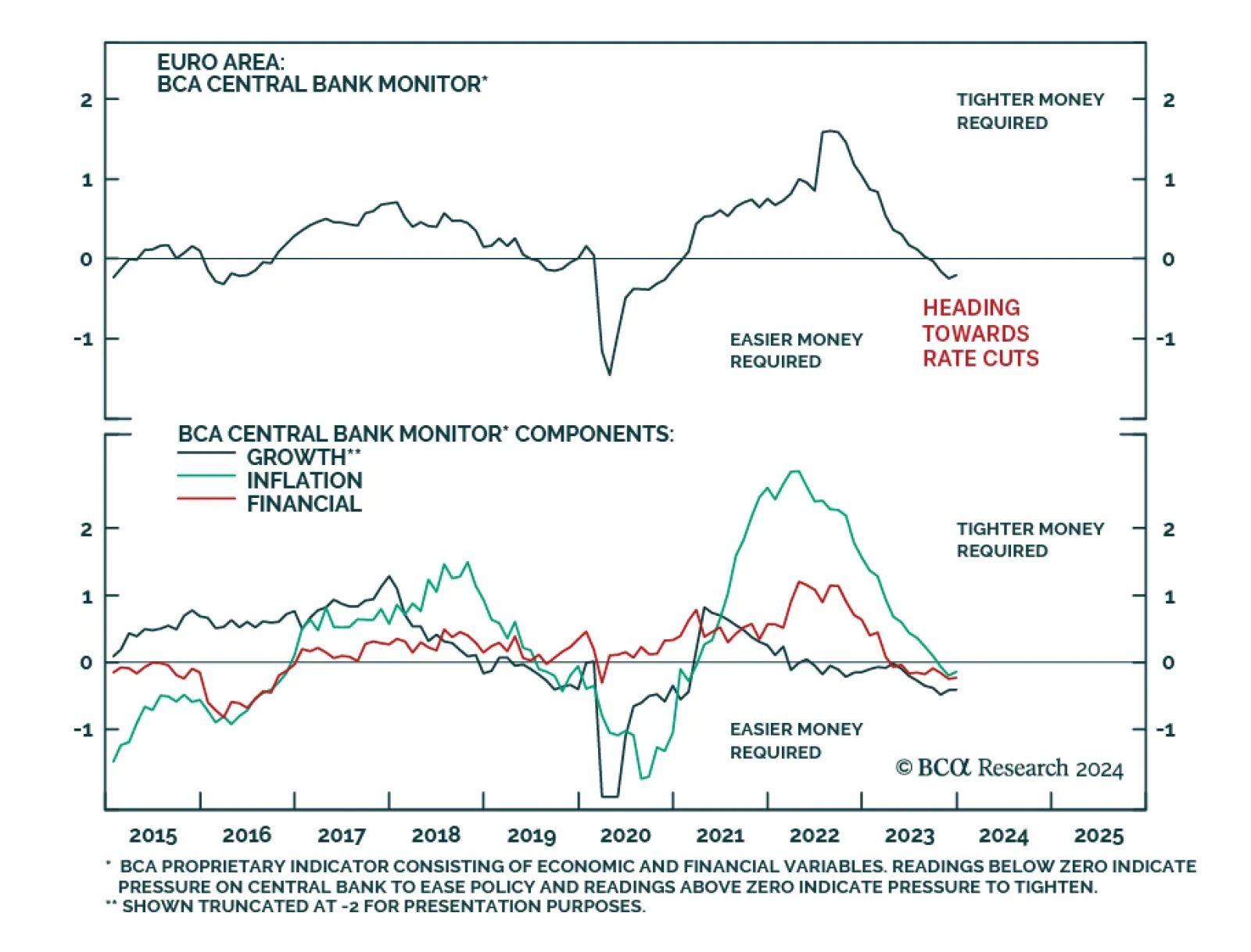

Government bond yields rallied and yield curves steepened across the Eurozone on Thursday following a less hawkish than anticipated tone from the ECB. As expected, the central bank kept policy rates unchanged and reiterated that…

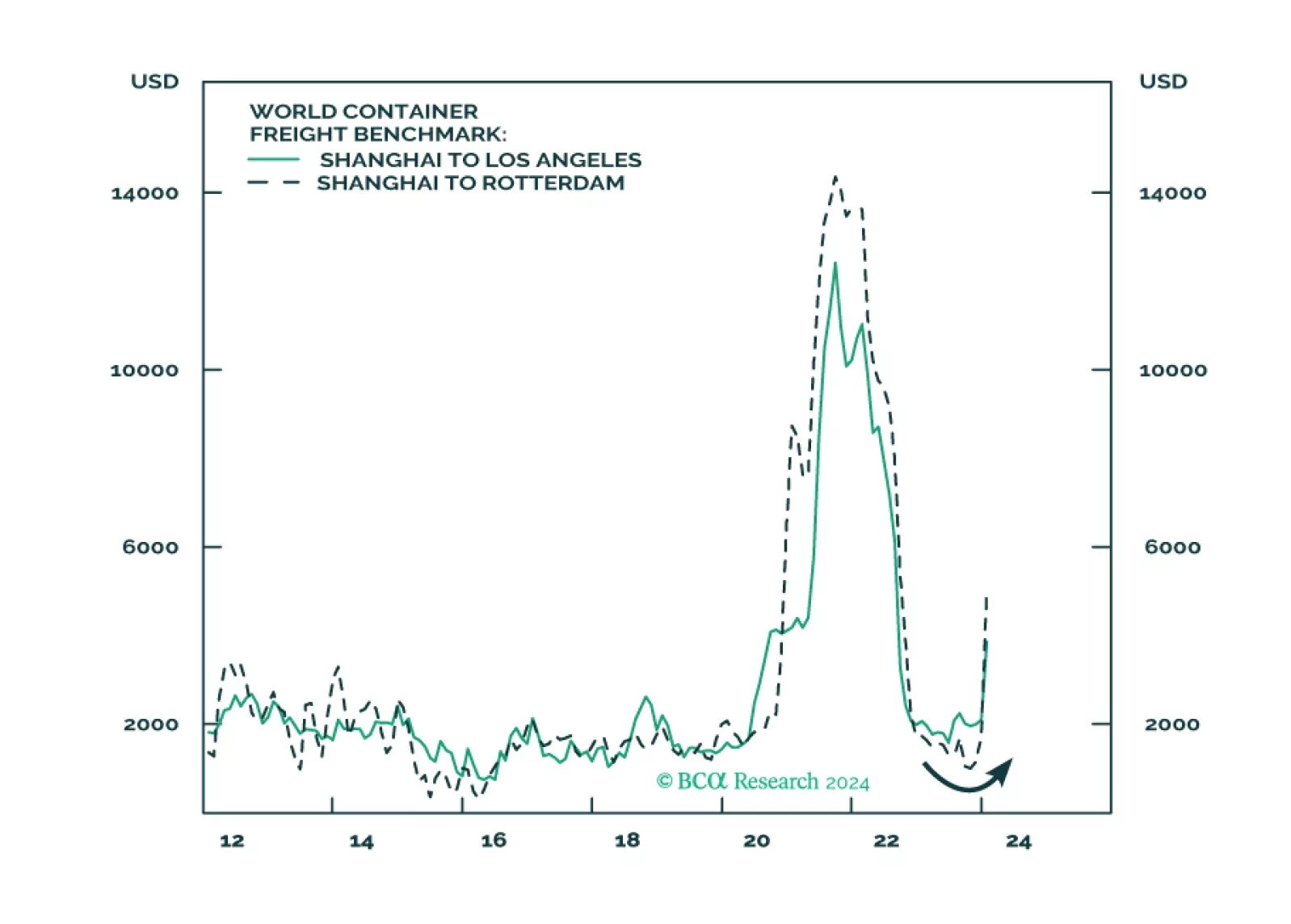

Middle East conflict, extreme US policy uncertainty, Chinese economic slowdown, US-Russian proxy war, and Asian military conflicts do not create a stable investment backdrop for 2024. Our top five “black swan” risks may be highly…

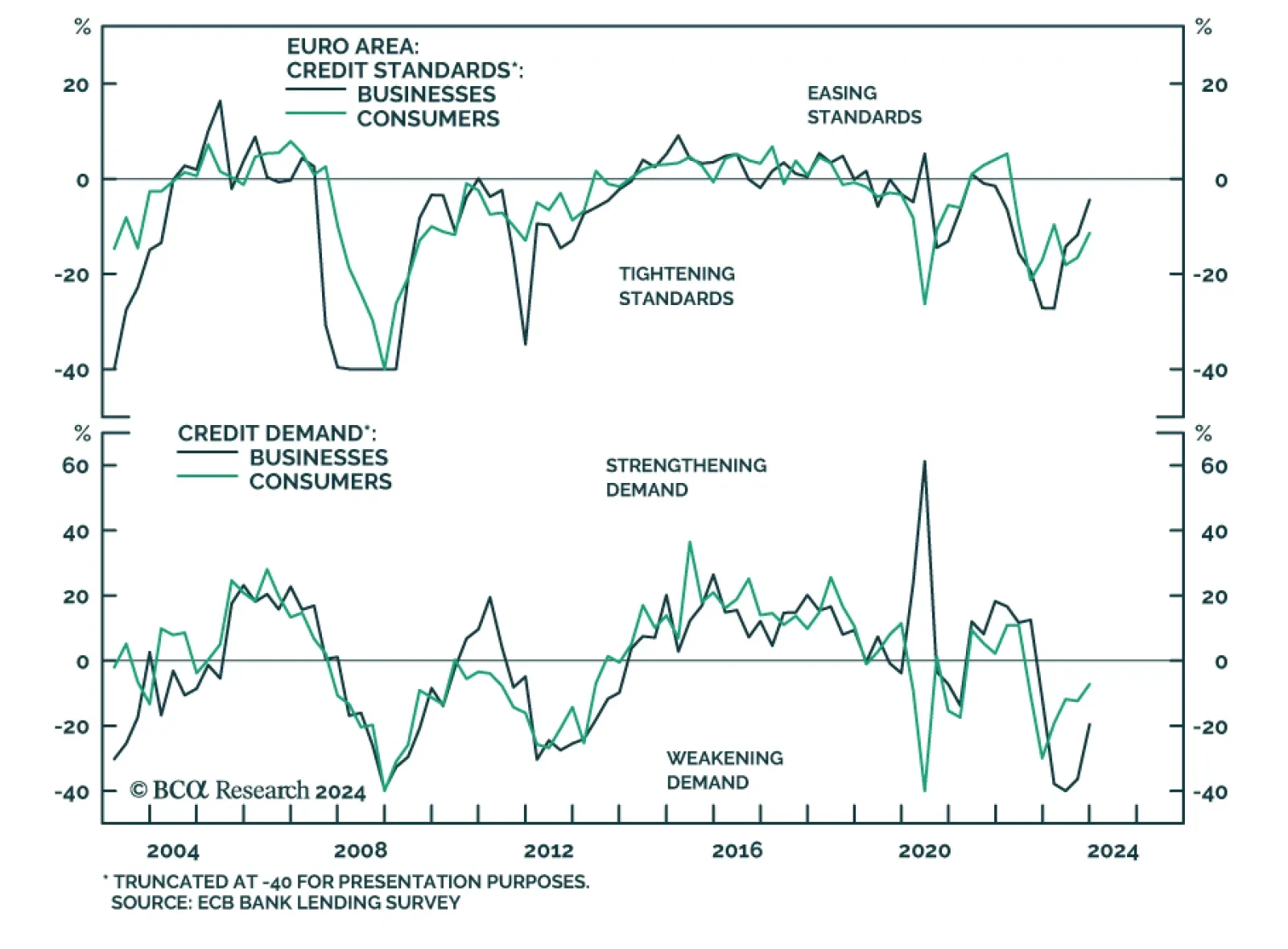

Results of the ECB’s quarterly Bank Lending Survey suggest that the tight monetary policy stance is still weighing on the Eurozone economy. Banks tightened credit standards for businesses and consumers further in Q4…

BCA Research’s European Investment Strategy service concludes that investors should go long German curve steepeners. Last week at Davos, European Central Bank (ECB) President Christine Lagarde leaned heavily against the…

The ECB will begin cutting rates in June, what does this start date imply for the yield curve and European cyclicals?

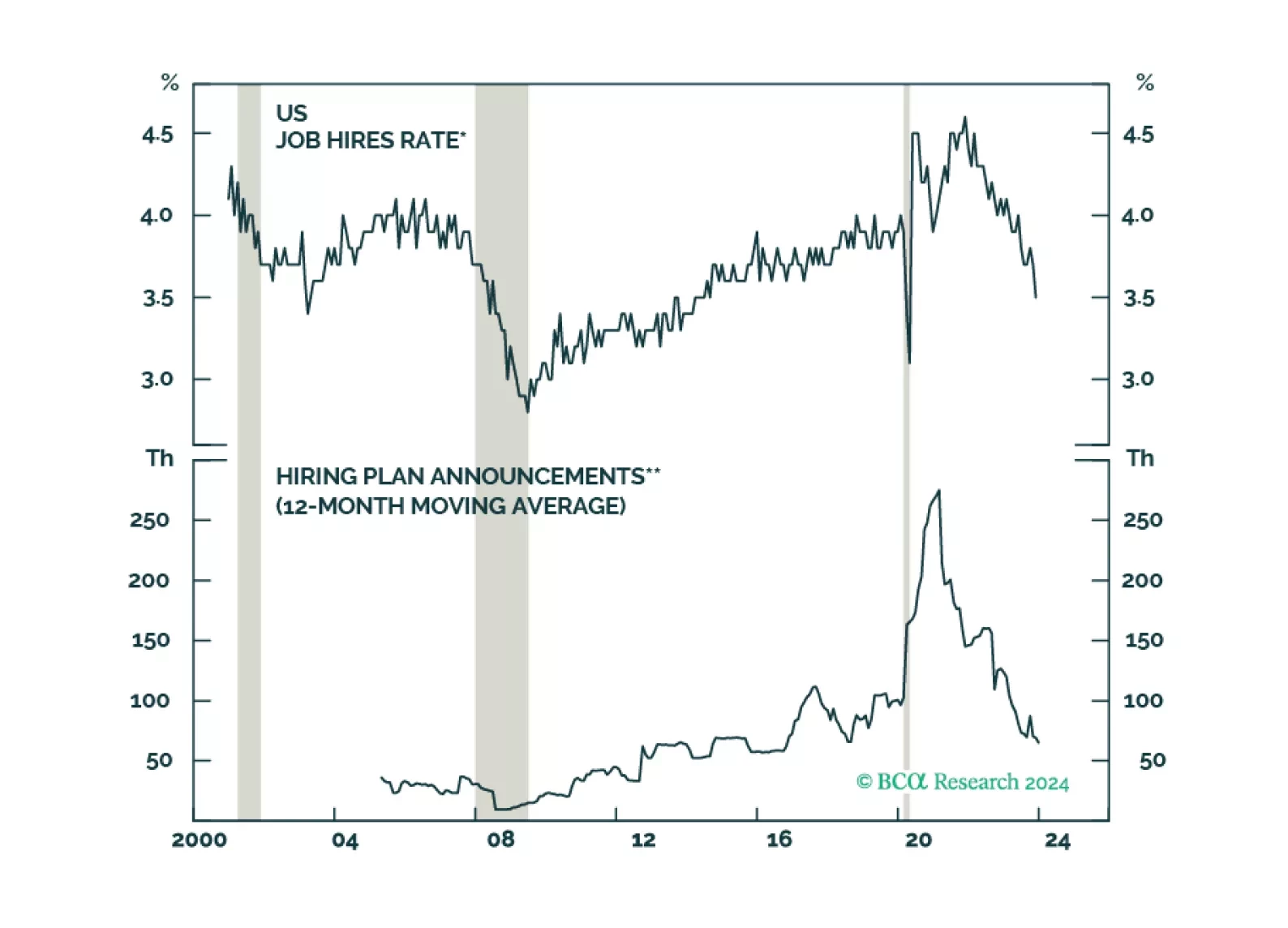

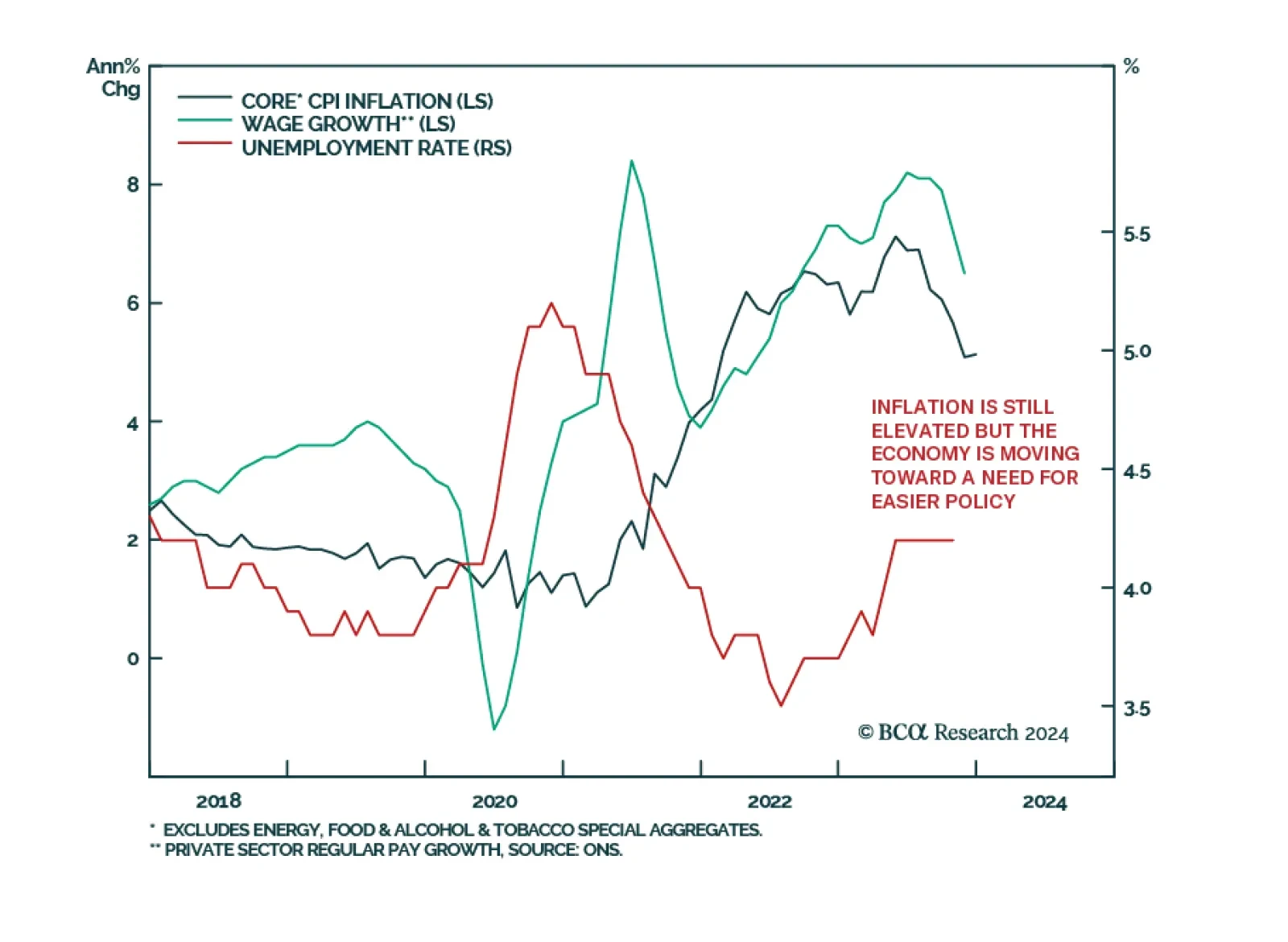

Investors have taken comfort in the fact that unemployment has remained low in the major economies. But underneath the surface, there are clear signs that labor demand is weakening. The clock keeps ticking towards our H2 2024…

The British pound was the best performing G10 currency on Wednesday as UK gilts sold off meaningfully with the 10-year yield ending the day nearly 19 basis points higher. An unexpected acceleration in CPI inflation in December…

Results of the ZEW survey sent a slightly positive signal on German investor sentiment. The economic expectations indicator rose to an 11-month high in January – beating consensus estimates of a decline. This increased…

According to BCA Research’s European Investment Strategy service, investors should not chase European equities higher from current levels. The soft-landing narrative has captured the minds of investors. The expectations…