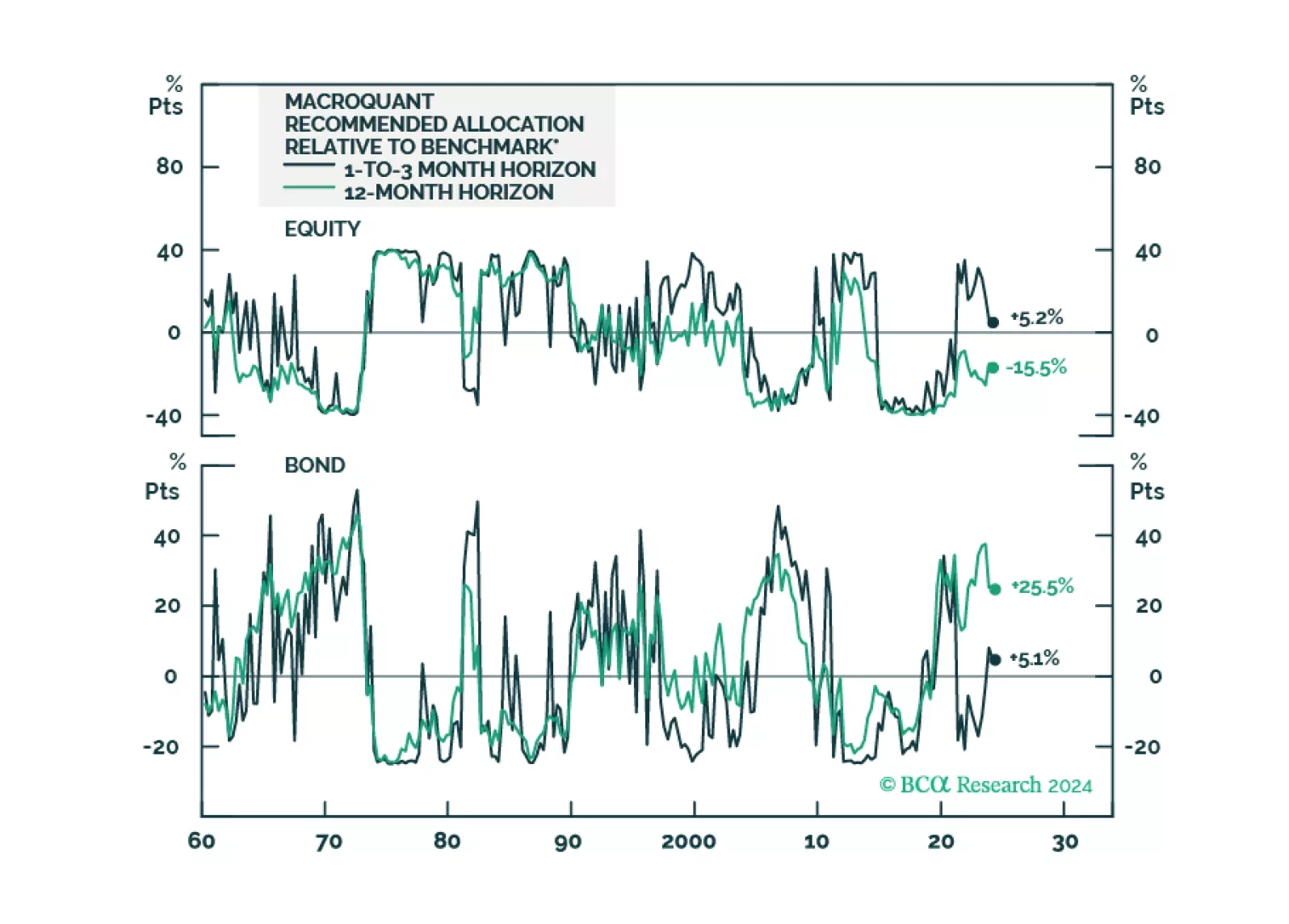

Following the release of the white paper yesterday, today we are sending you the inaugural issue of the MacroQuant Monthly, a report summarizing the output of our next-generation MacroQuant 2.0 model.

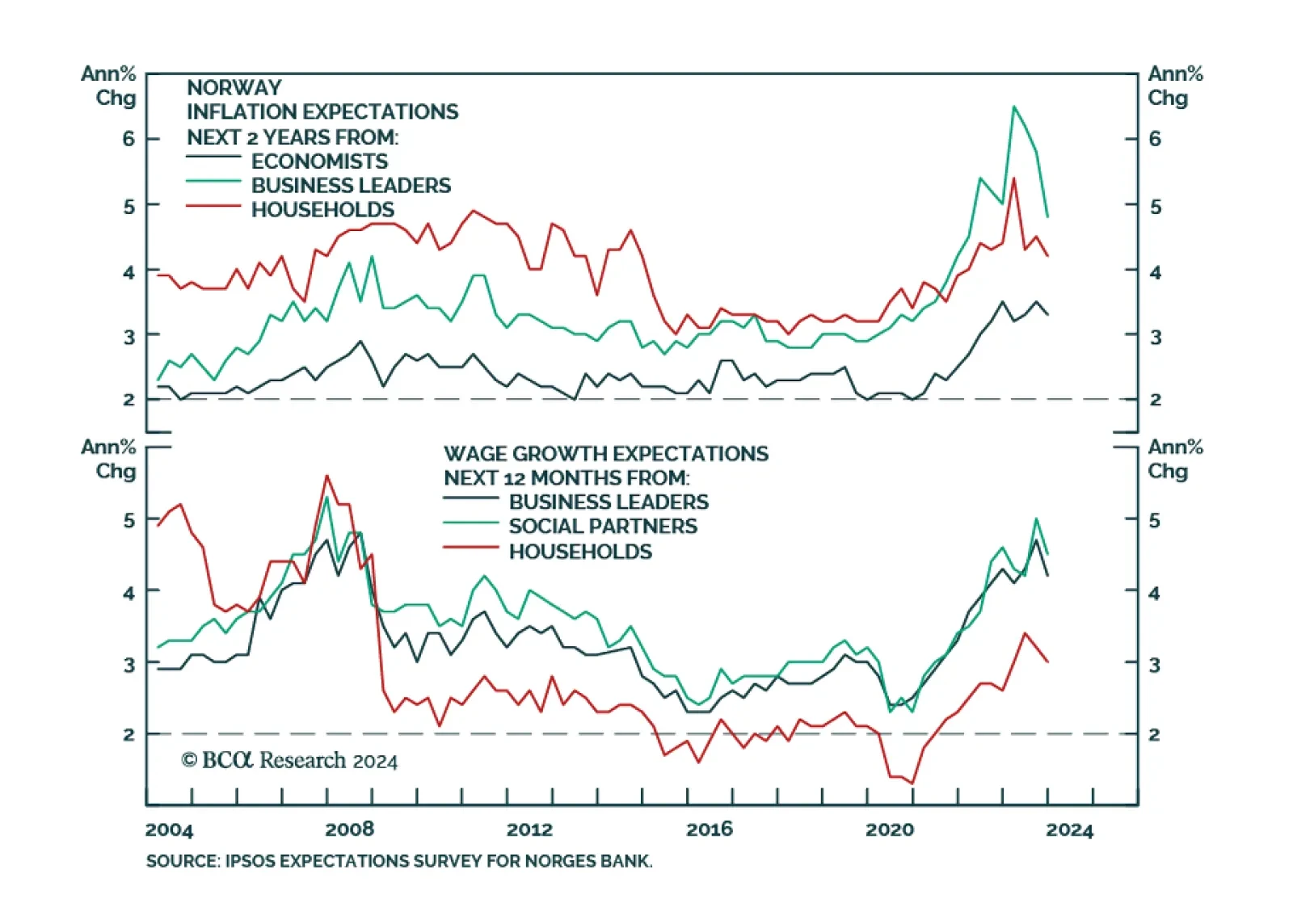

According to BCA Research’s Foreign Exchange Strategy service investors should remain long NOK/SEK. The Norges Bank kept policy on hold last week, but the bullish case for the NOK (albeit over the short term) remains in…

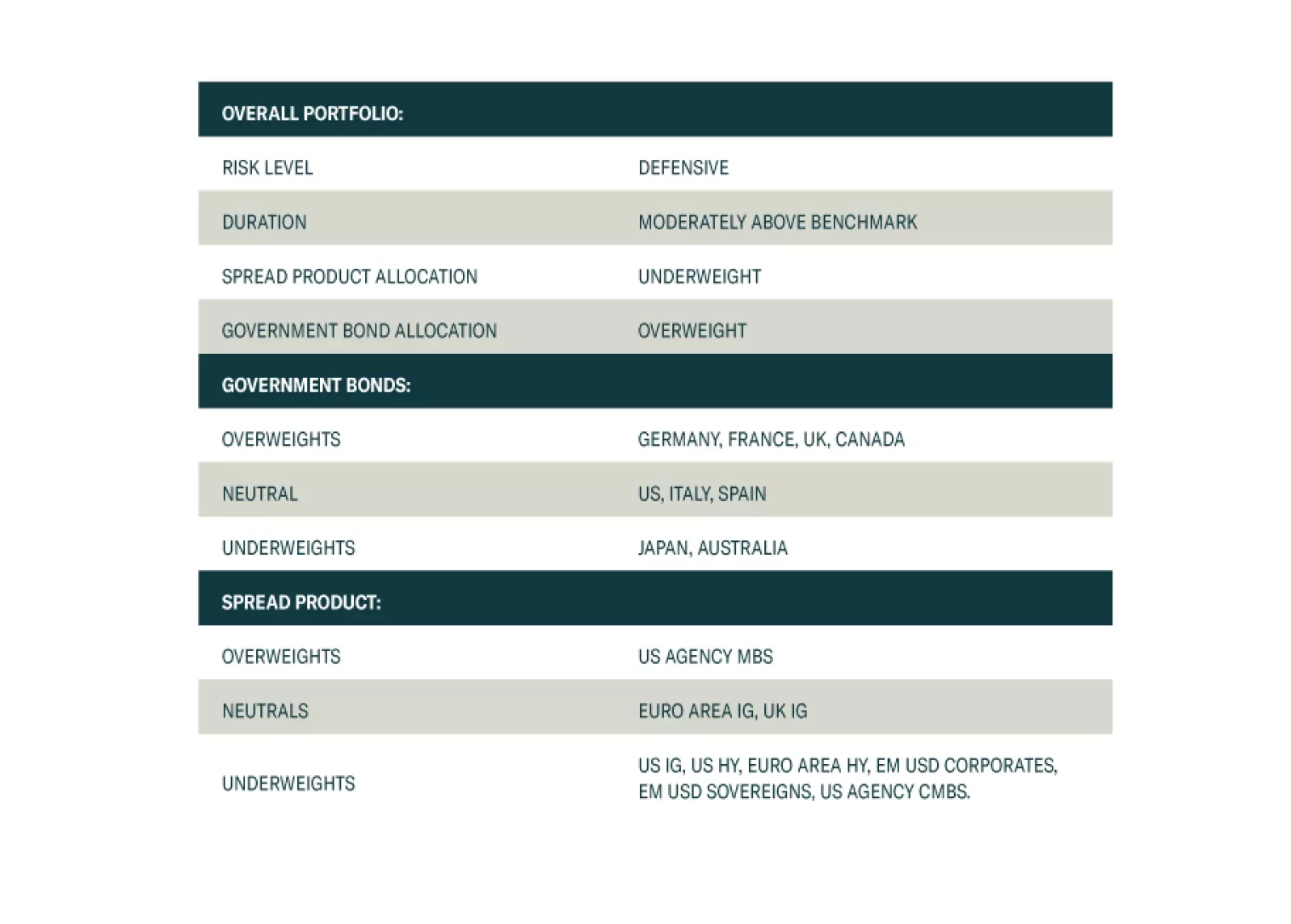

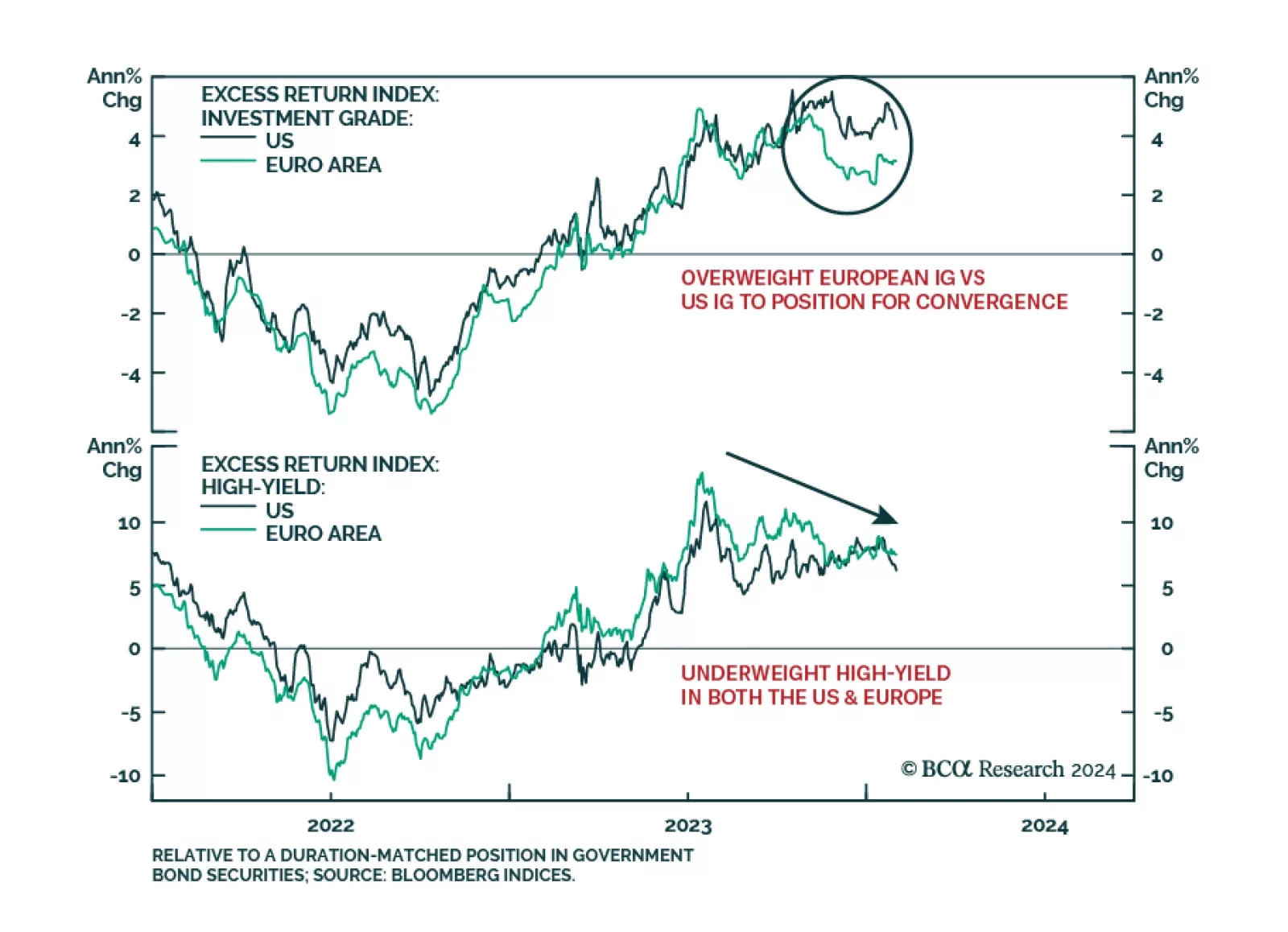

The strong H2/2023 rally in global credit markets can be attributed to lower global inflation and the associated reduction in global interest rate volatility. However, our colleagues at BCA Research’s Global Fixed Income…

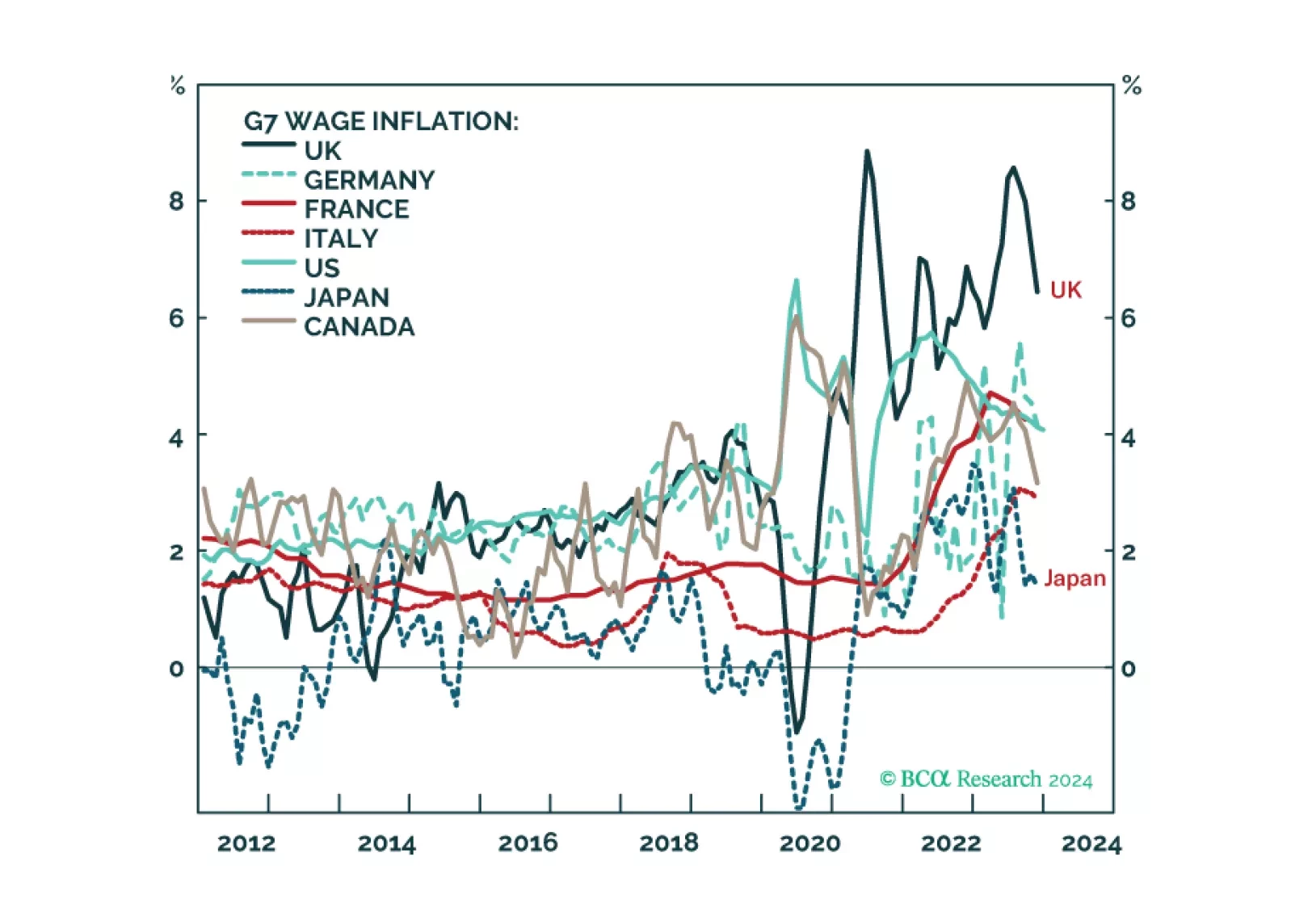

We describe and explain the wide disparity of wage inflation across G7 economies, and discuss what it means for the Fed, ECB, BoE, and BoJ policy moves in the coming year. Plus: we highlight two investments ripe for reversal, and two…

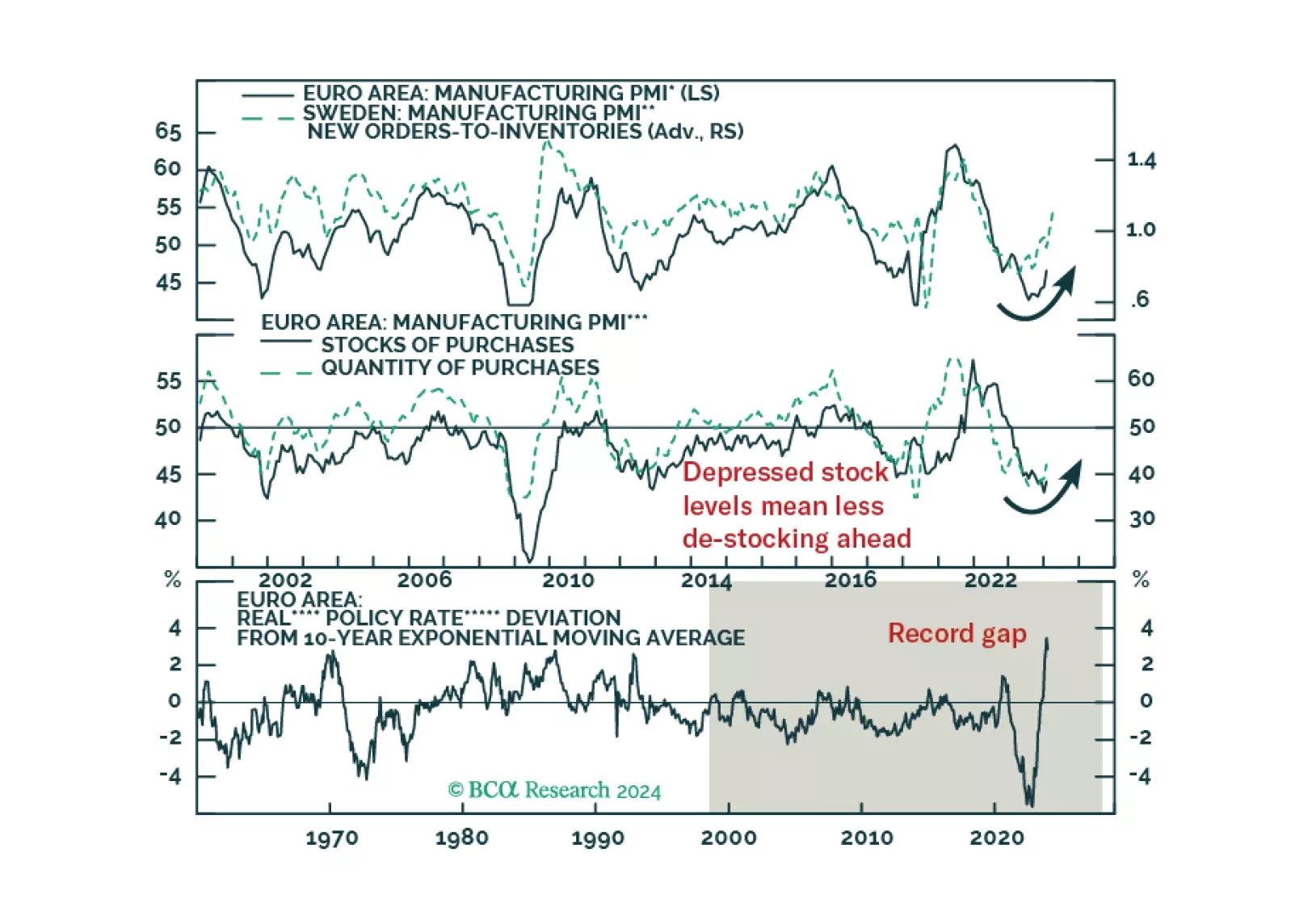

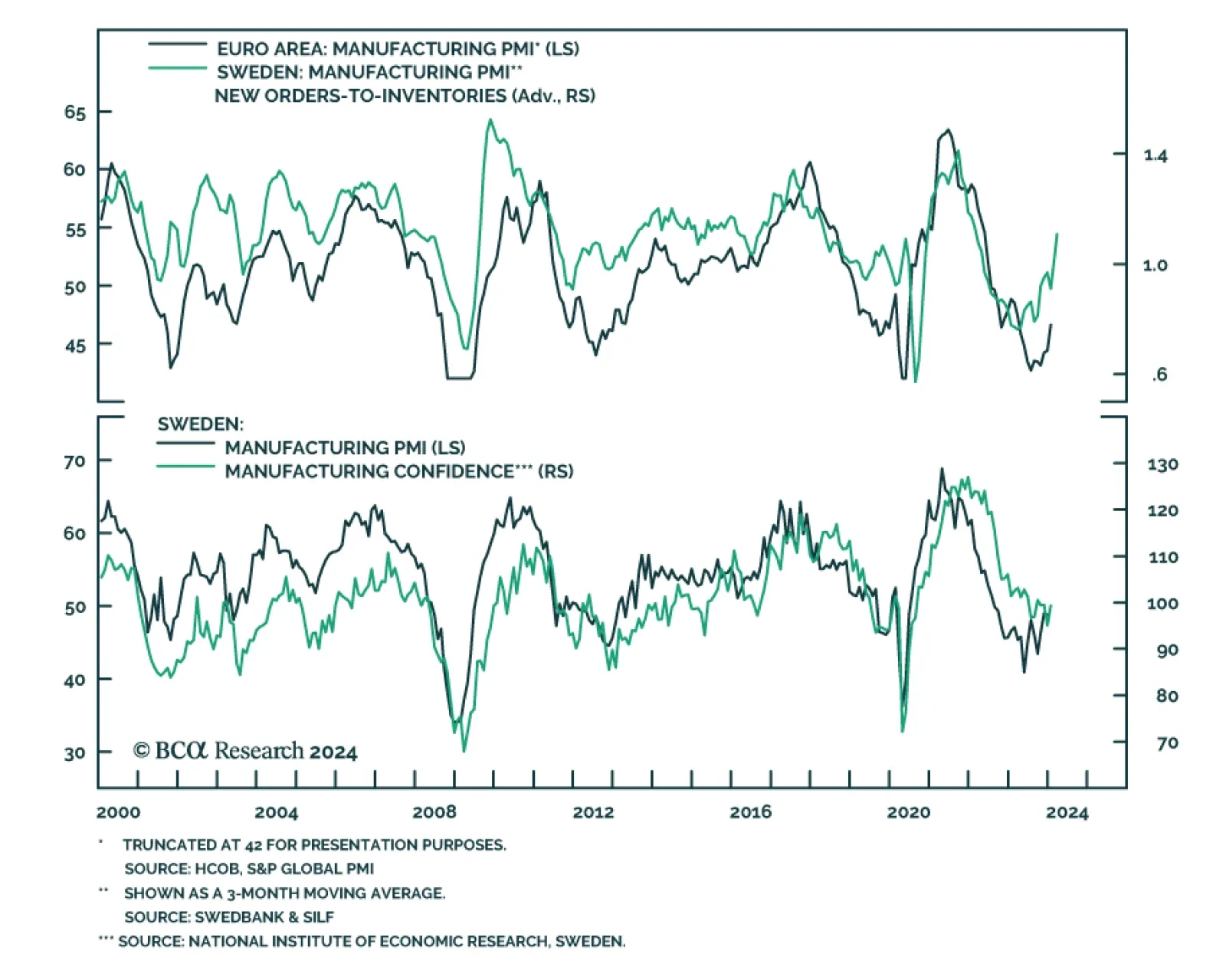

Over the past few months, we have been highlighting that several indicators are pointing to an industrial recovery in Europe. Notably, Swedish indicators were a cause for optimism. The Swedish PMI’s new orders-to-…

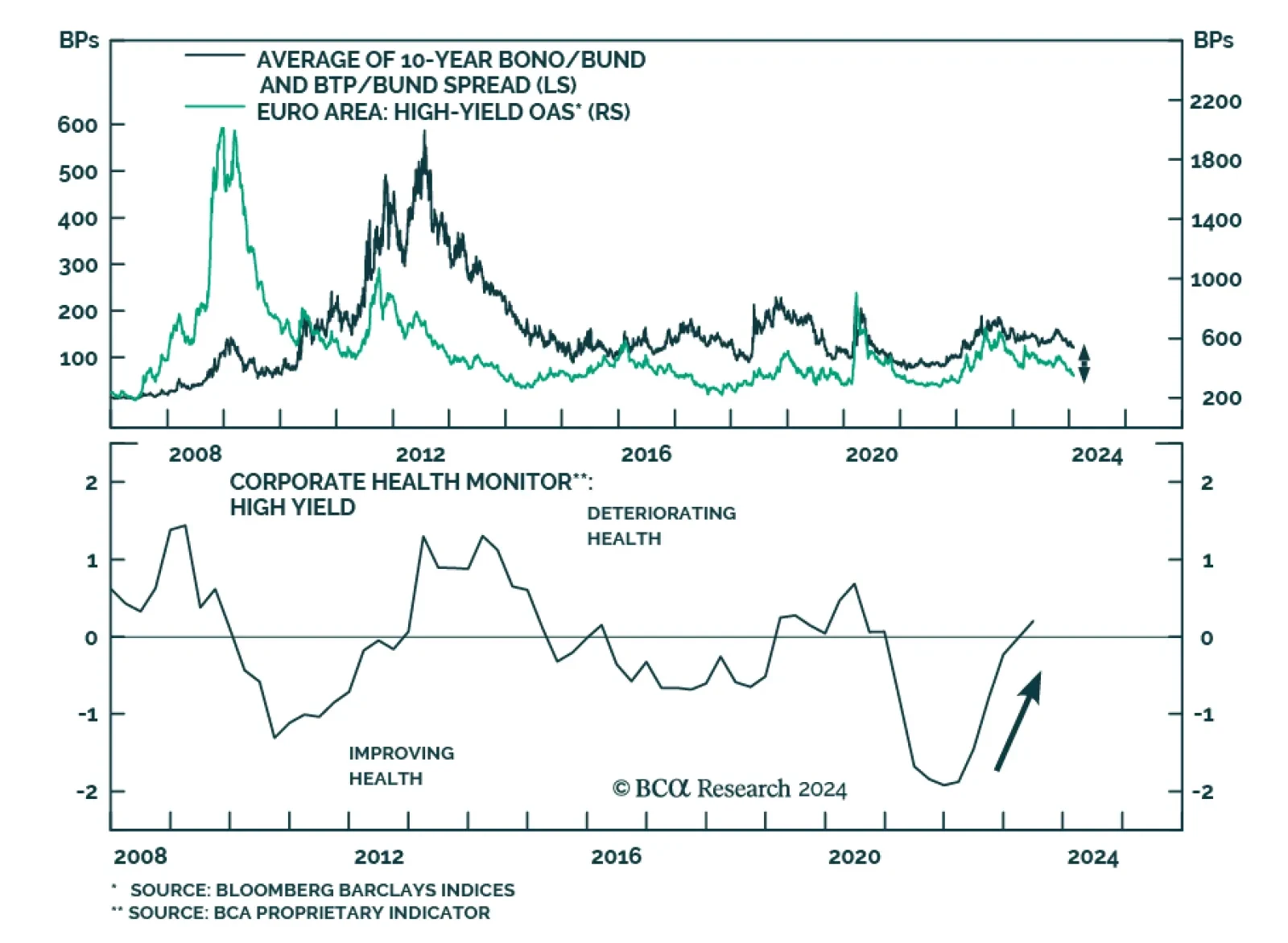

According to BCA Research’s European Investment Strategy service, European sovereign bonds in the periphery offer more upside than high-yield (HY) corporate bonds. Many question the outlook for peripheral bonds in Europe…

Is the rebound in European PMIs enough to boost the appeal of European risk assets?

We present the performance review of the Global Fixed Income Strategy Model Bond Portfolio for 2023. We also discuss the outlook for 2024 performance based on our Key Views for the year. The portfolio is positioned to benefit from a…

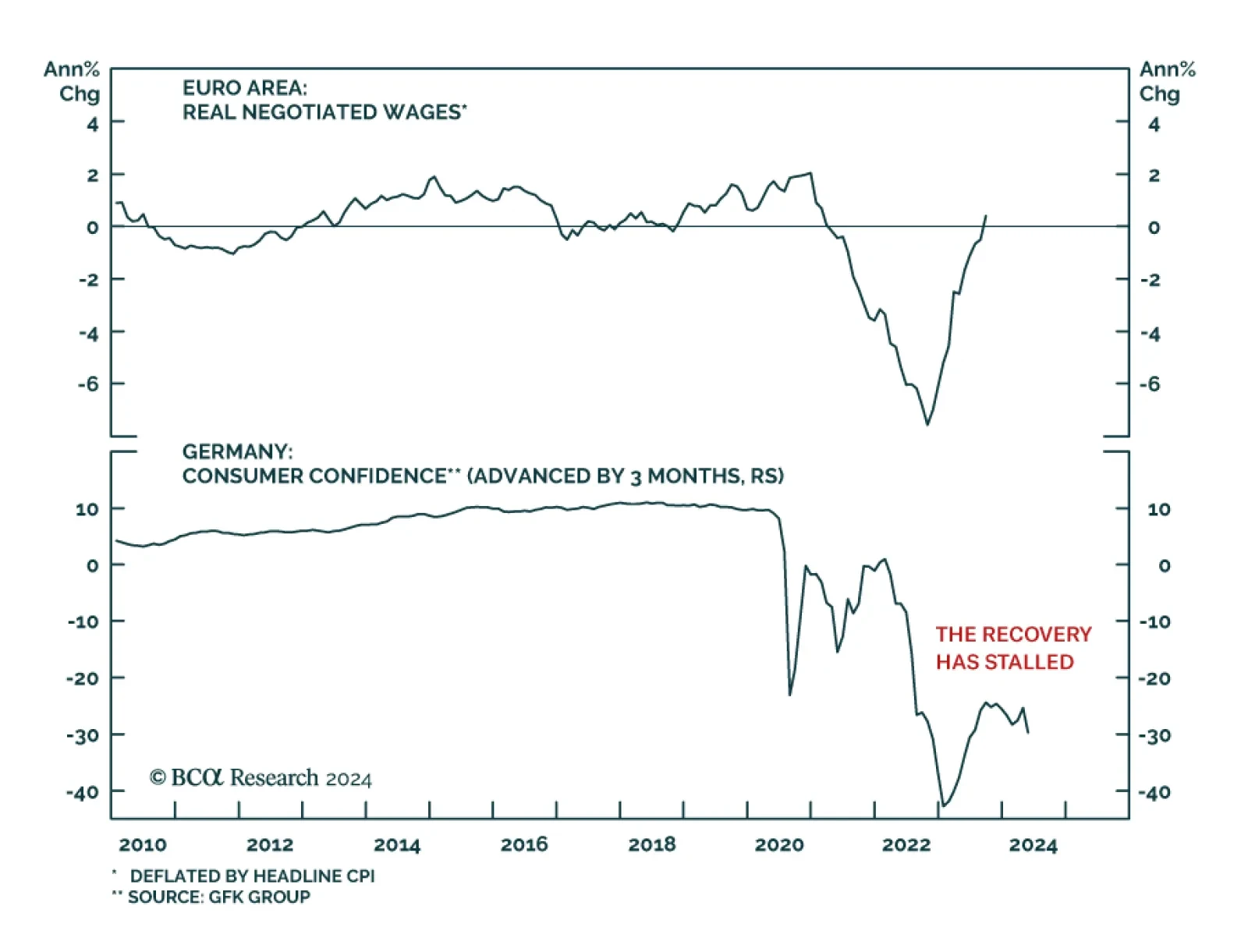

Over the past few months, falling inflation has provided a boost to real wages in the Euro Area which returned to growth in 2023Q3 after 9 consecutive quarters of decline. This dynamic in turn improved the purchasing power of…