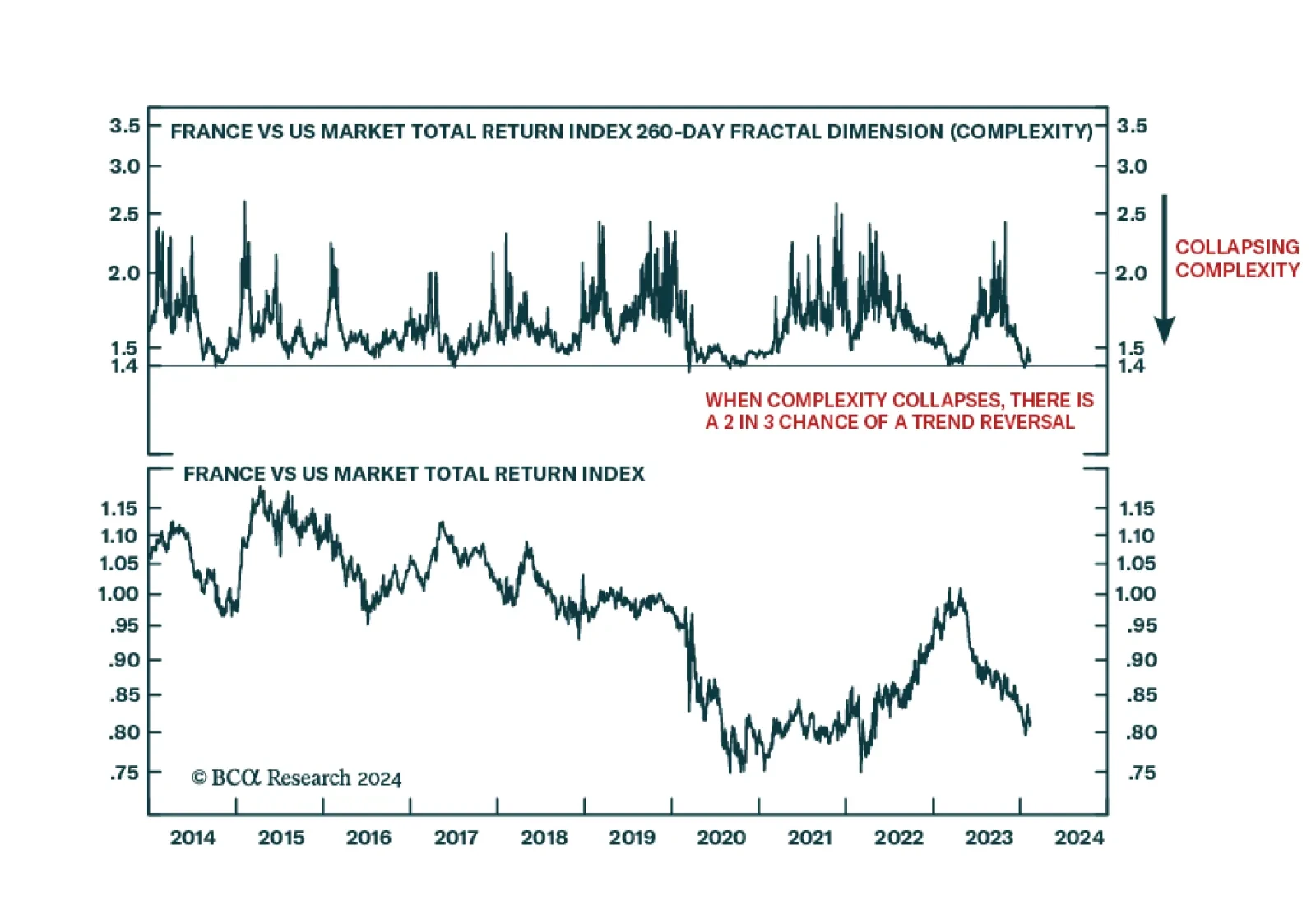

According to BCA Research’s Counterpoint service, European stocks will be the big winners of the 2020s. Every decade has a big loser and a big winner. Which stock market will be the winner through the remaining two-…

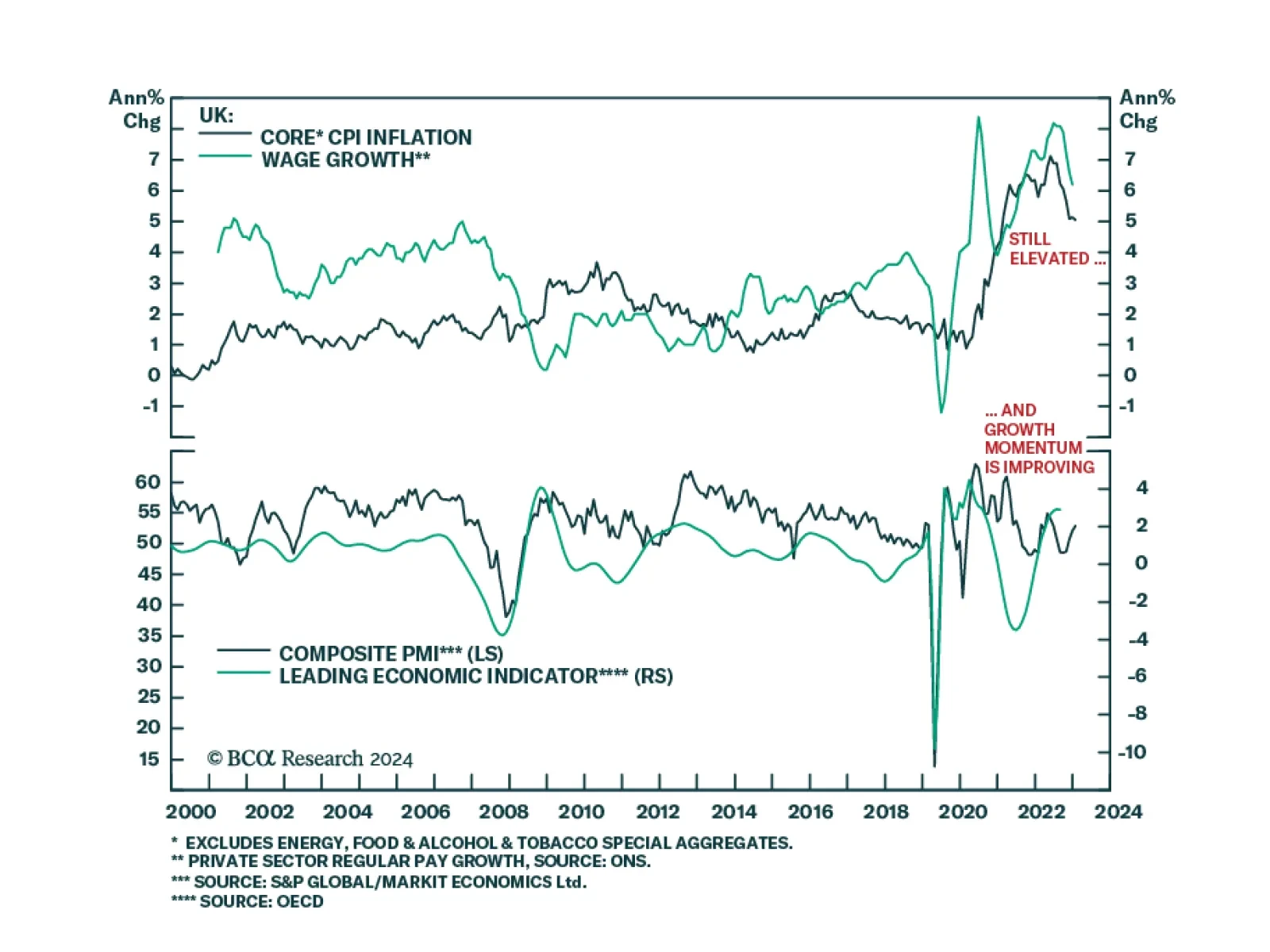

The UK inflation release for January came in slightly softer than anticipated. Both headline and core CPI were unchanged on year-over-year basis at 4.0% and 5.1%, respectively – below expectations of slight accelerations.…

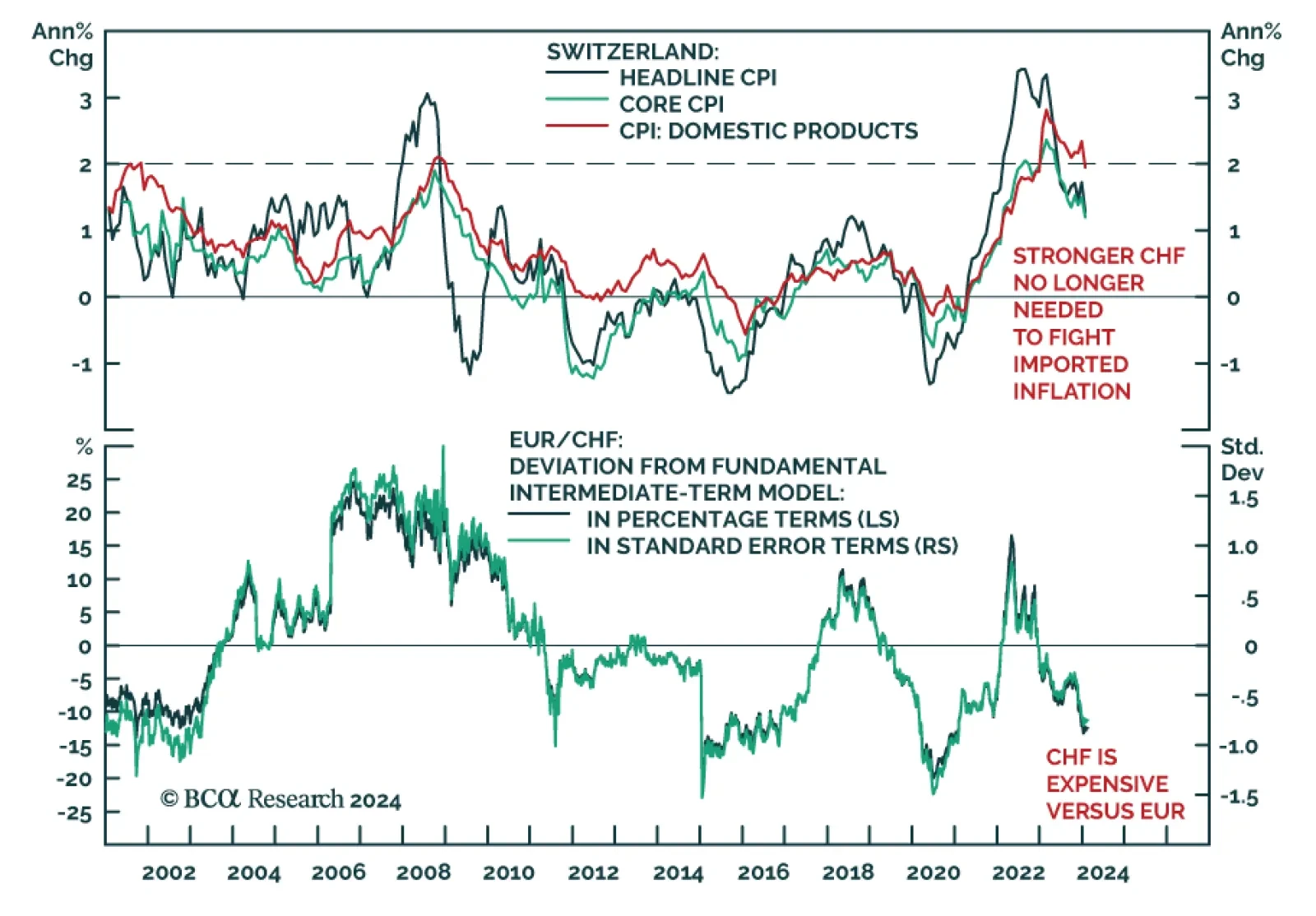

The Swiss franc is among the worst performing major currencies so far this year. This marks a reversal following its stellar performance last year. The Swiss National Bank’s (SNB) support for the domestic currency…

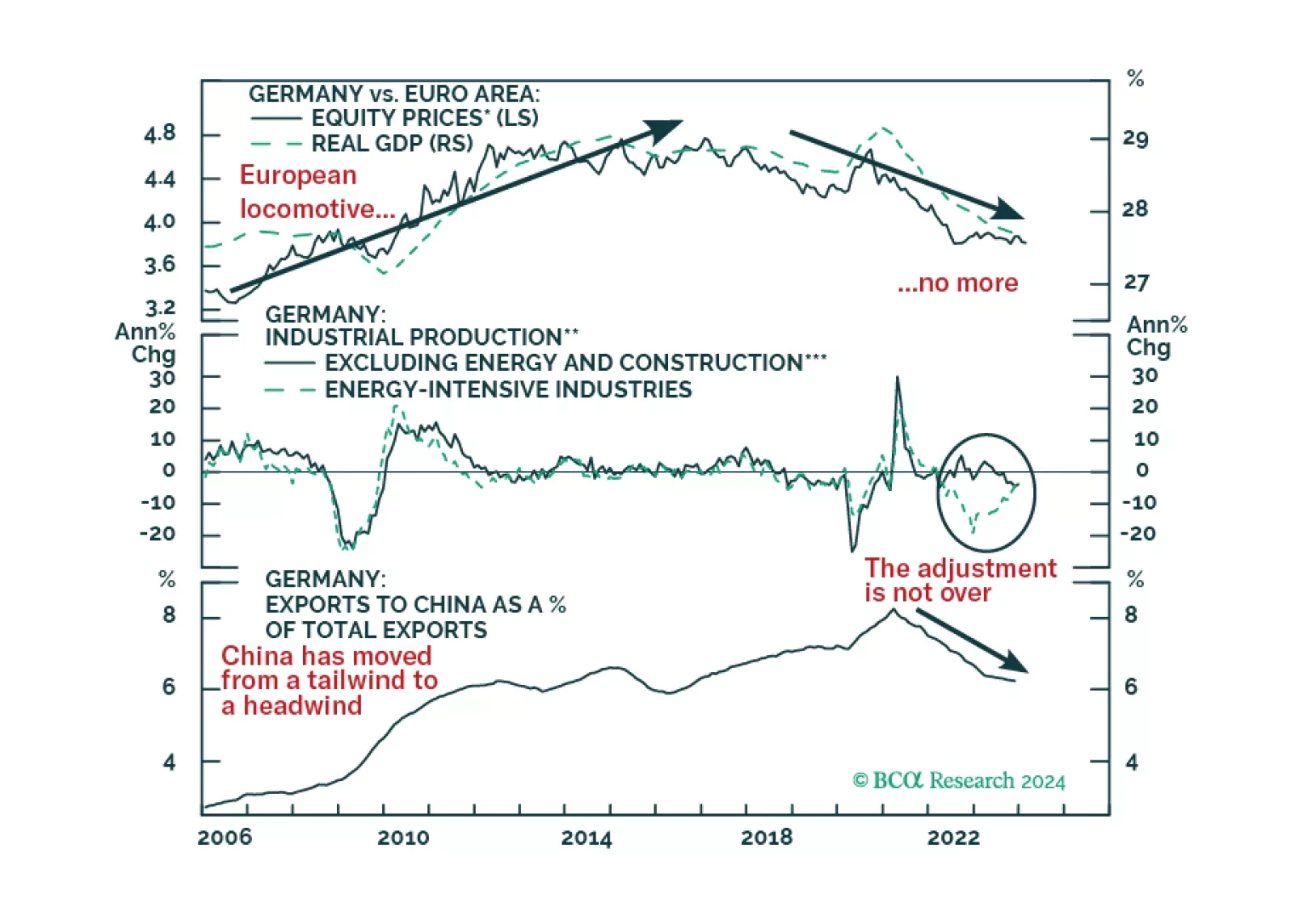

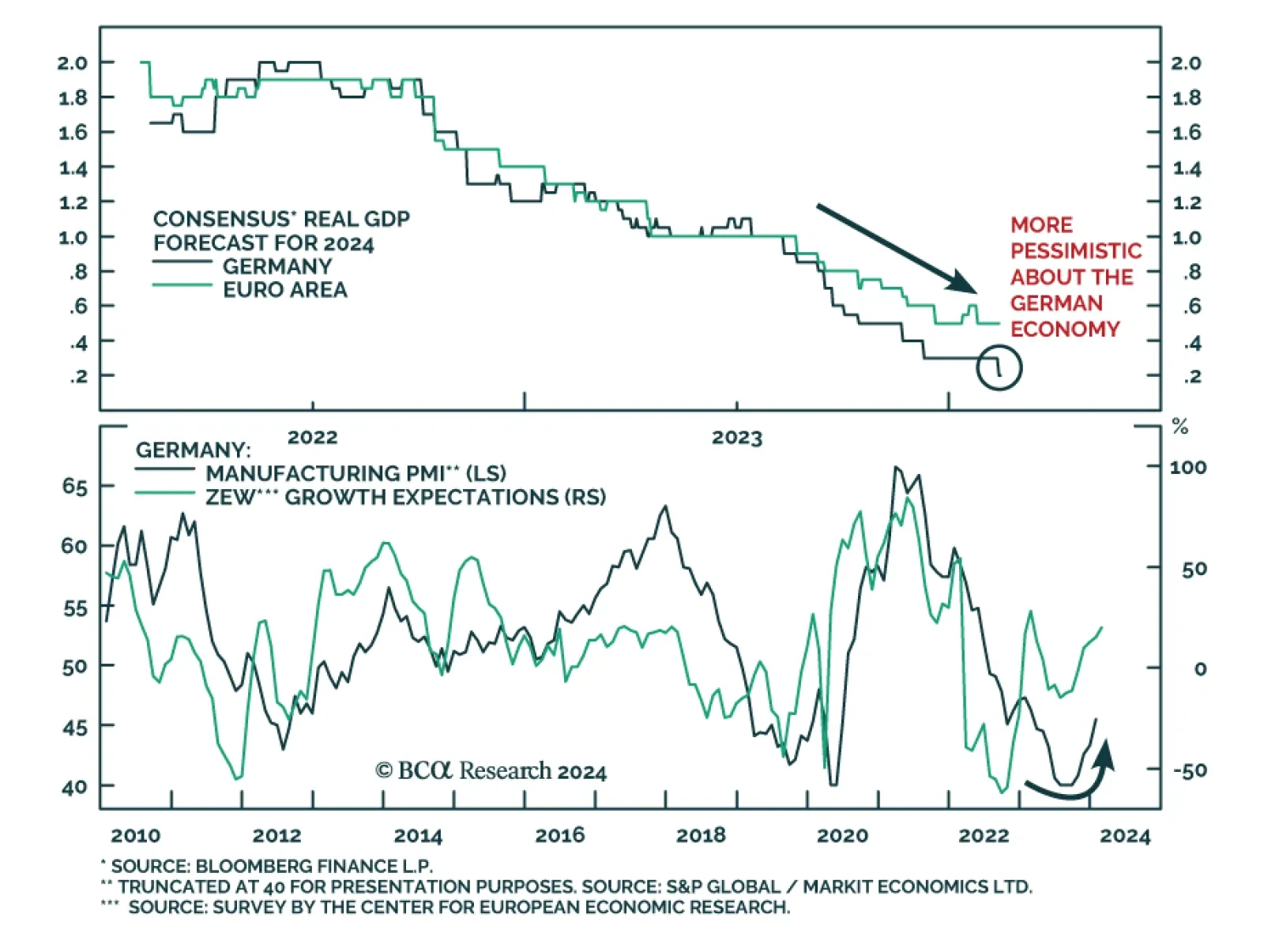

The German economy was a laggard at the end of last year, posting a 0.3% q/q real GDP contraction in Q4 2023 while the broader Eurozone economy stagnated. Importantly, while economists have been revising up their 2024 forecasts…

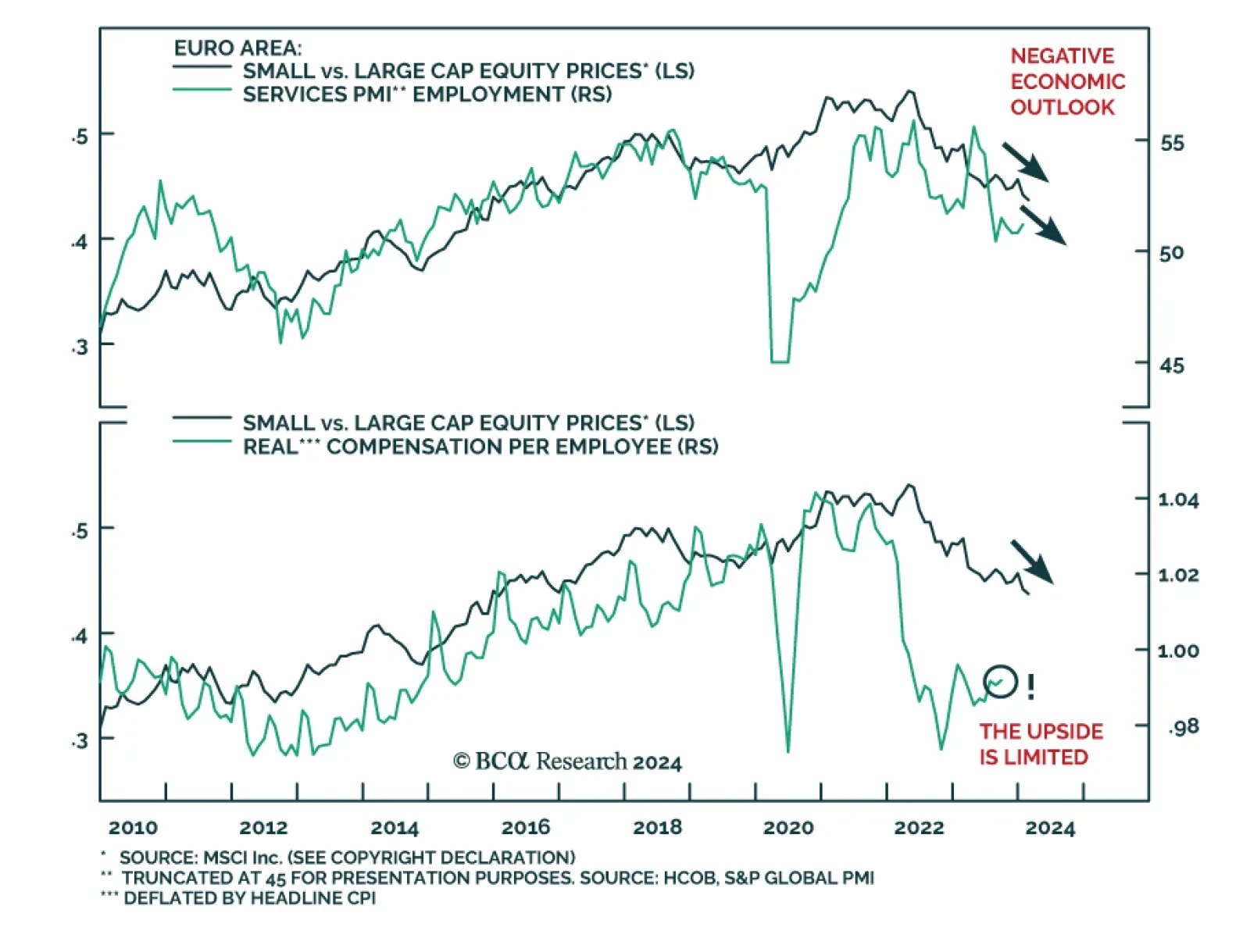

Euro area small-cap stocks are attractively valued compared to their large-cap counterparts. They have underperformed by 20% since April 2022, but small caps’ earnings have kept pace with those of large-cap firms. Hence,…

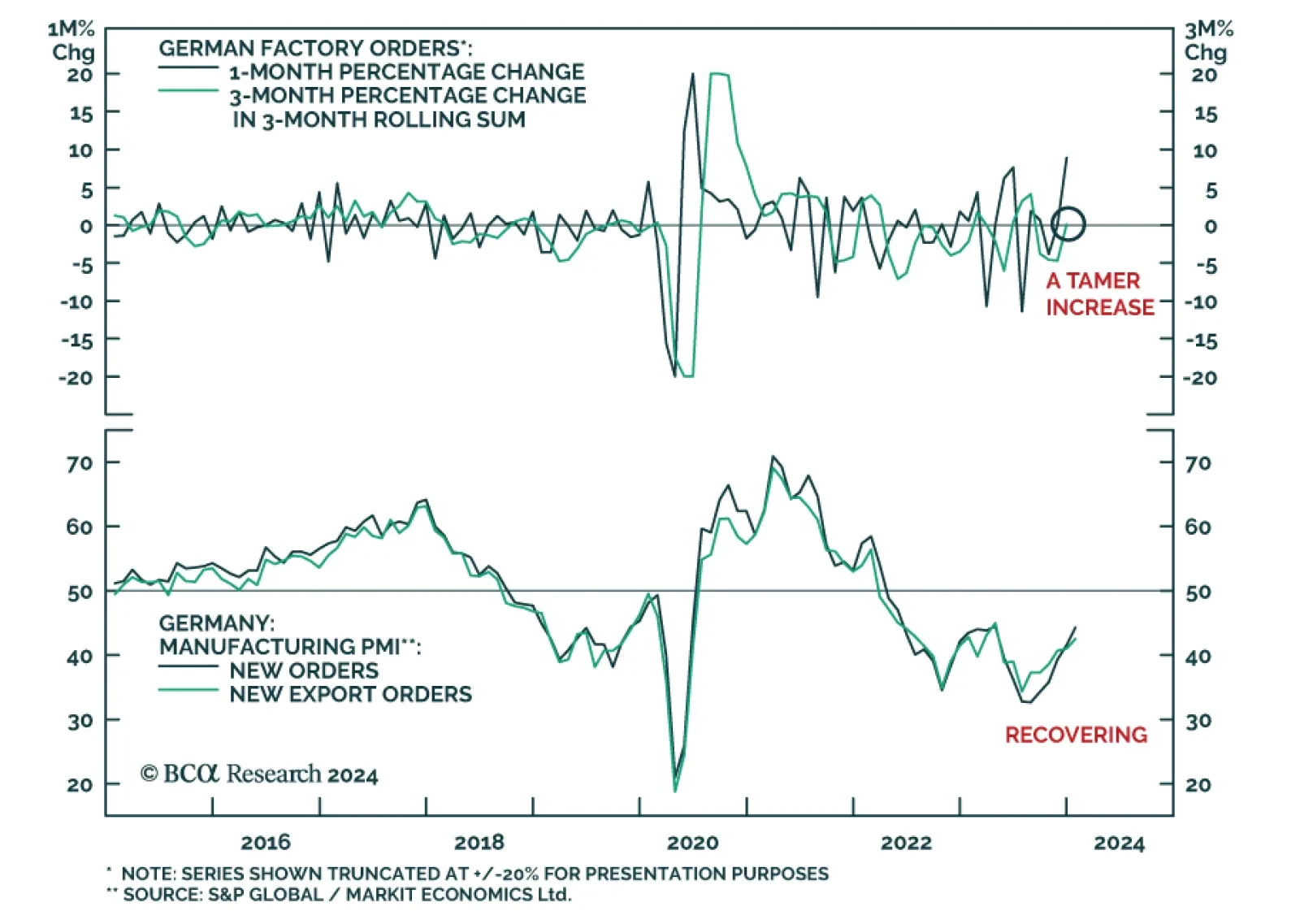

German factory orders delivered a positive surprise on Tuesday, unexpectedly increasing on both a monthly and annual basis. The 8.9% m/m increase in December came in well above consensus estimates of a 0.2% m/m decline. This…

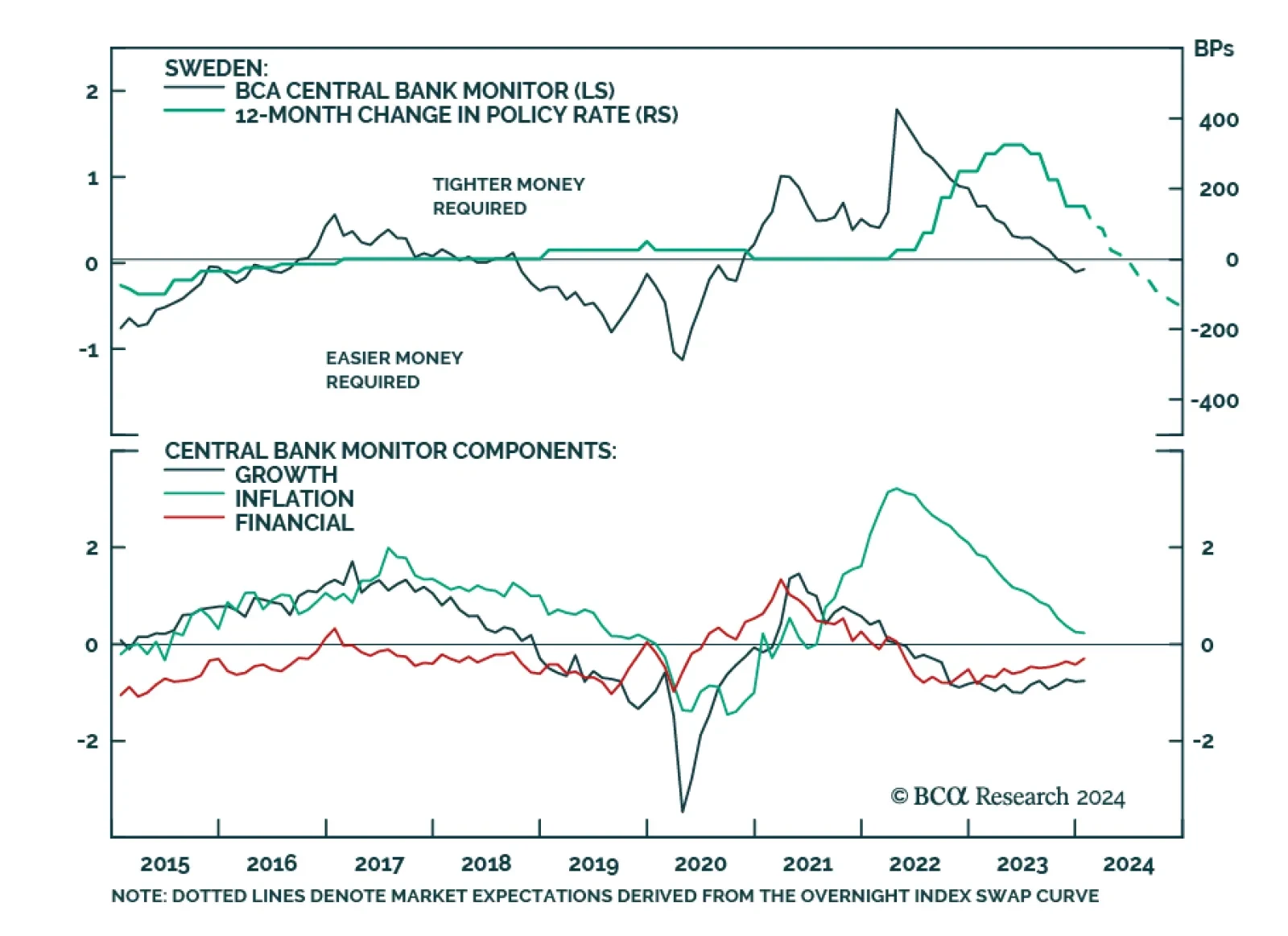

BCA Research’s European Investment Strategy service upgrades Swedish government bonds to neutral from underweight within European fixed-income portfolios. The Riksbank kept its policy rate steady at 4% last week.…

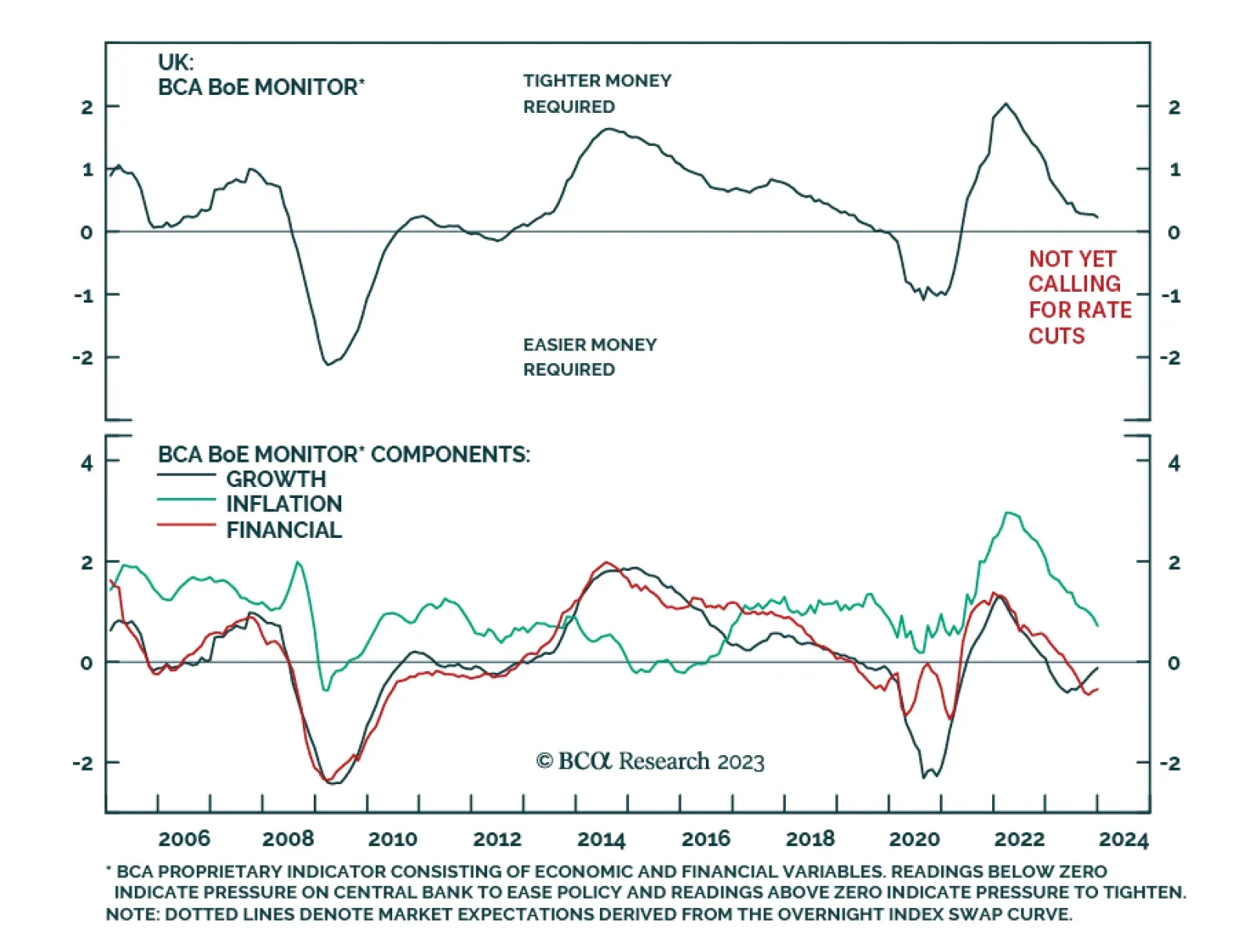

As expected, the Bank of England voted to keep its bank rate unchanged at 5.25% on Thursday – maintaining policy on hold for the fourth consecutive meeting. Two of the nine MPC members voted in favor of a 25bps rise (one…

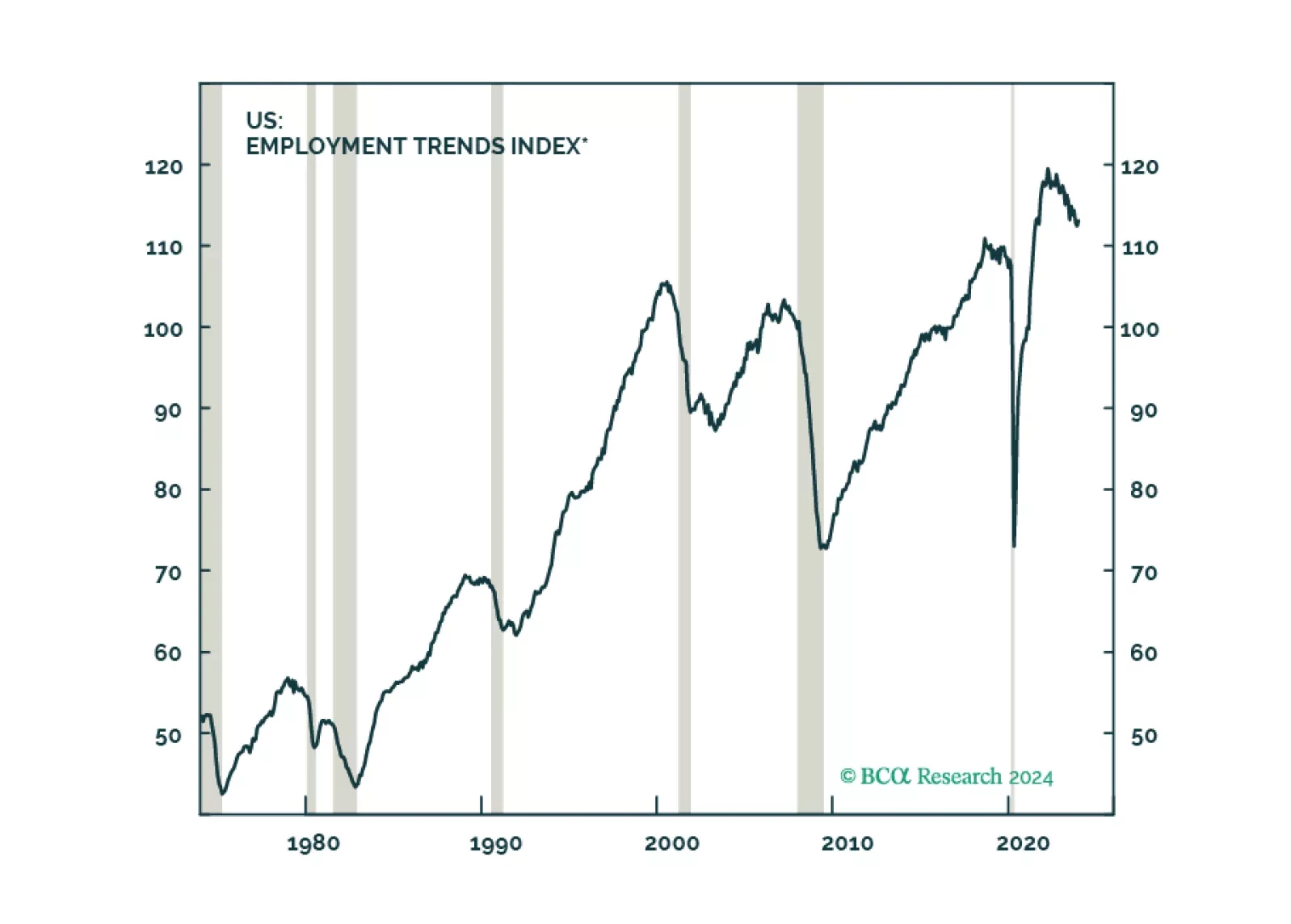

When will the US also buckle under high rates? We expect a US recession to begin around mid-year. Stay defensive.