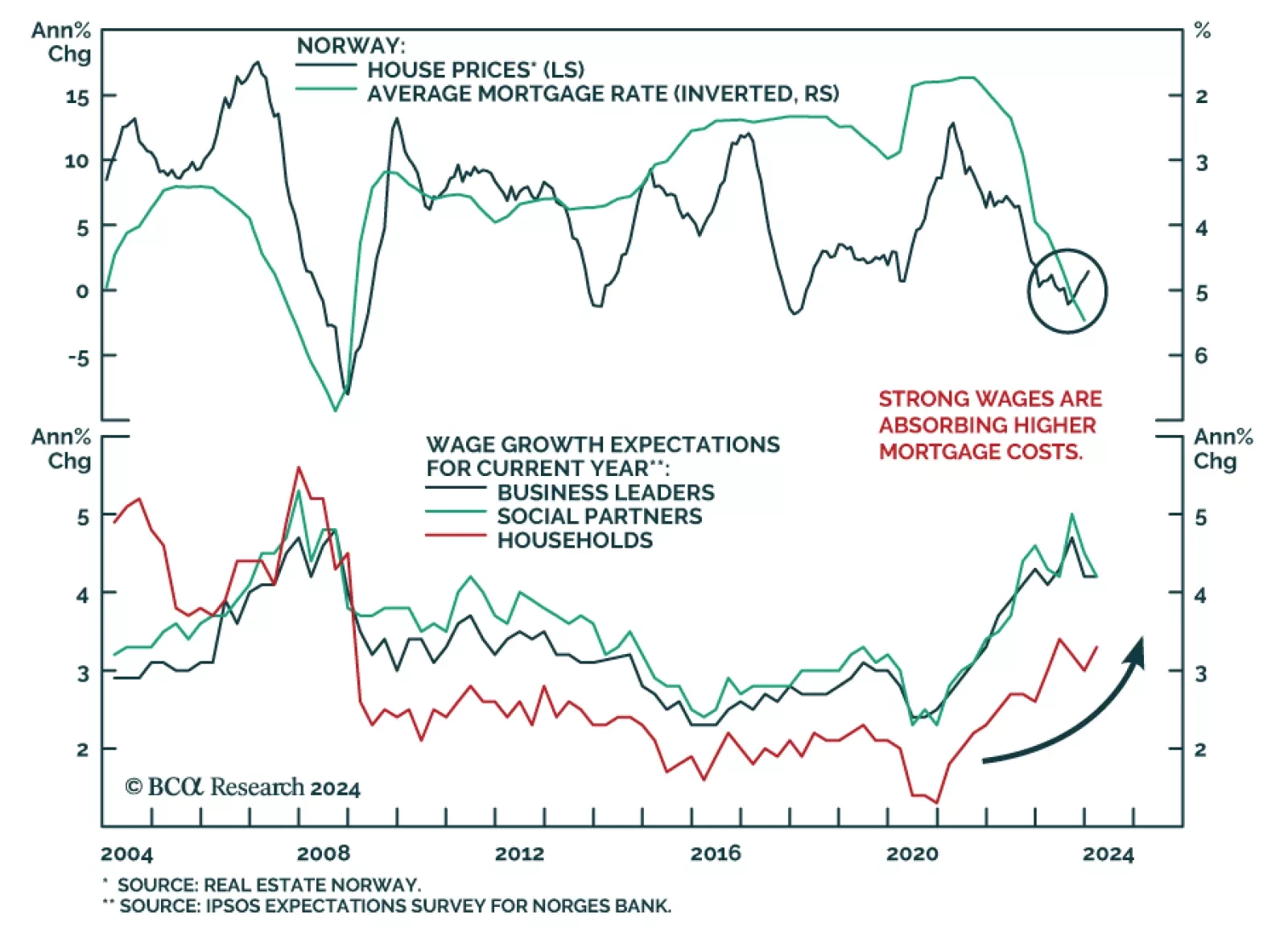

Data out of Norway is becoming increasingly positive, and there is a strong investment case to be made for the country, with bullish implications for both equities and the currency: Retail sales remain robust and are…

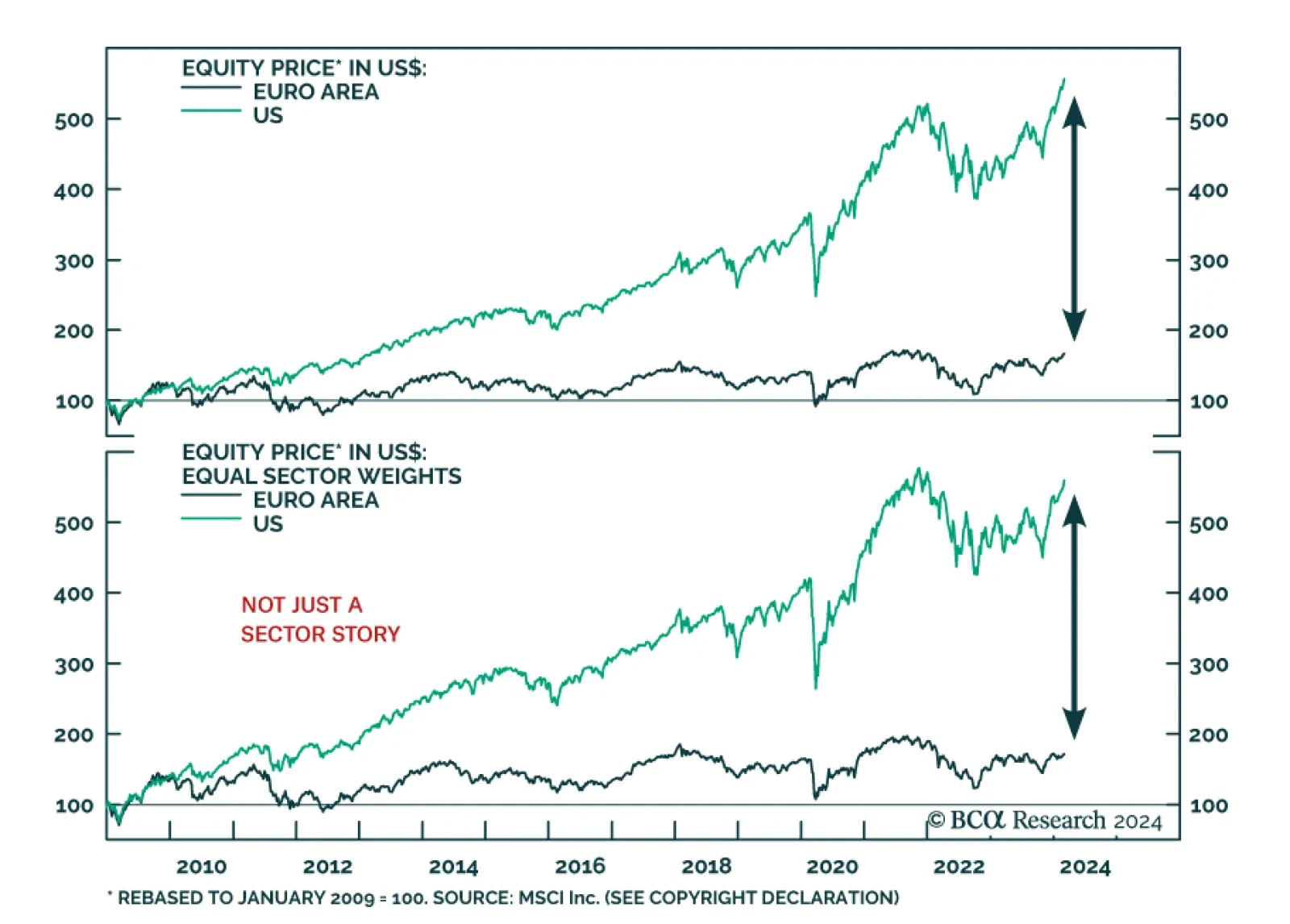

According to BCA Research’s European Investment Strategy service, the underperformance of European assets relative to the US is due its lagging productivity, even after adjusting for sectoral compositions in their stock…

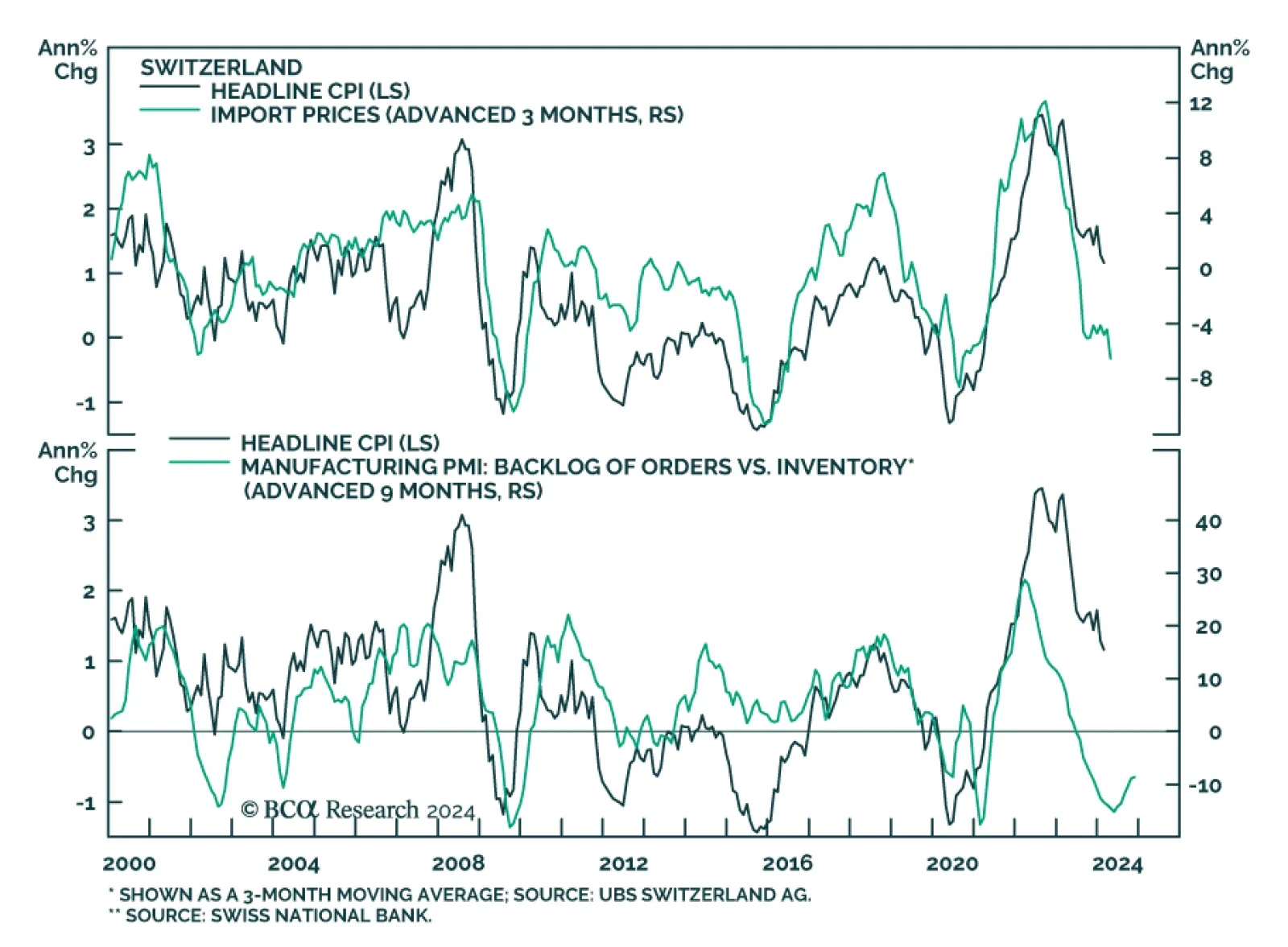

Swiss annual inflation continued to decelerate in February, with headline CPI now at 1.2% and core at 1.1%. This is remarkable since inflation continues to track well below the 1.8% forecast by the Swiss National Bank (SNB) for…

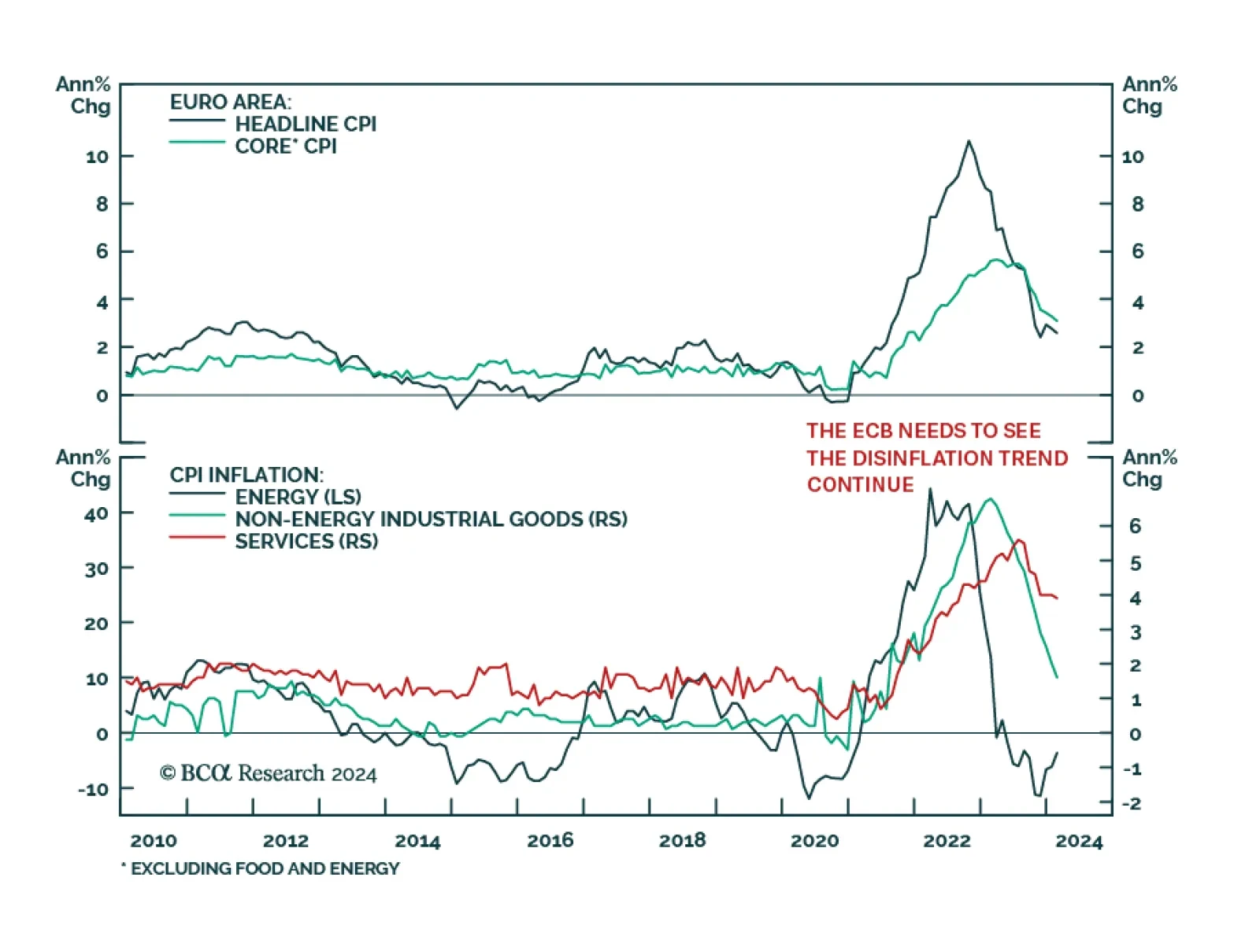

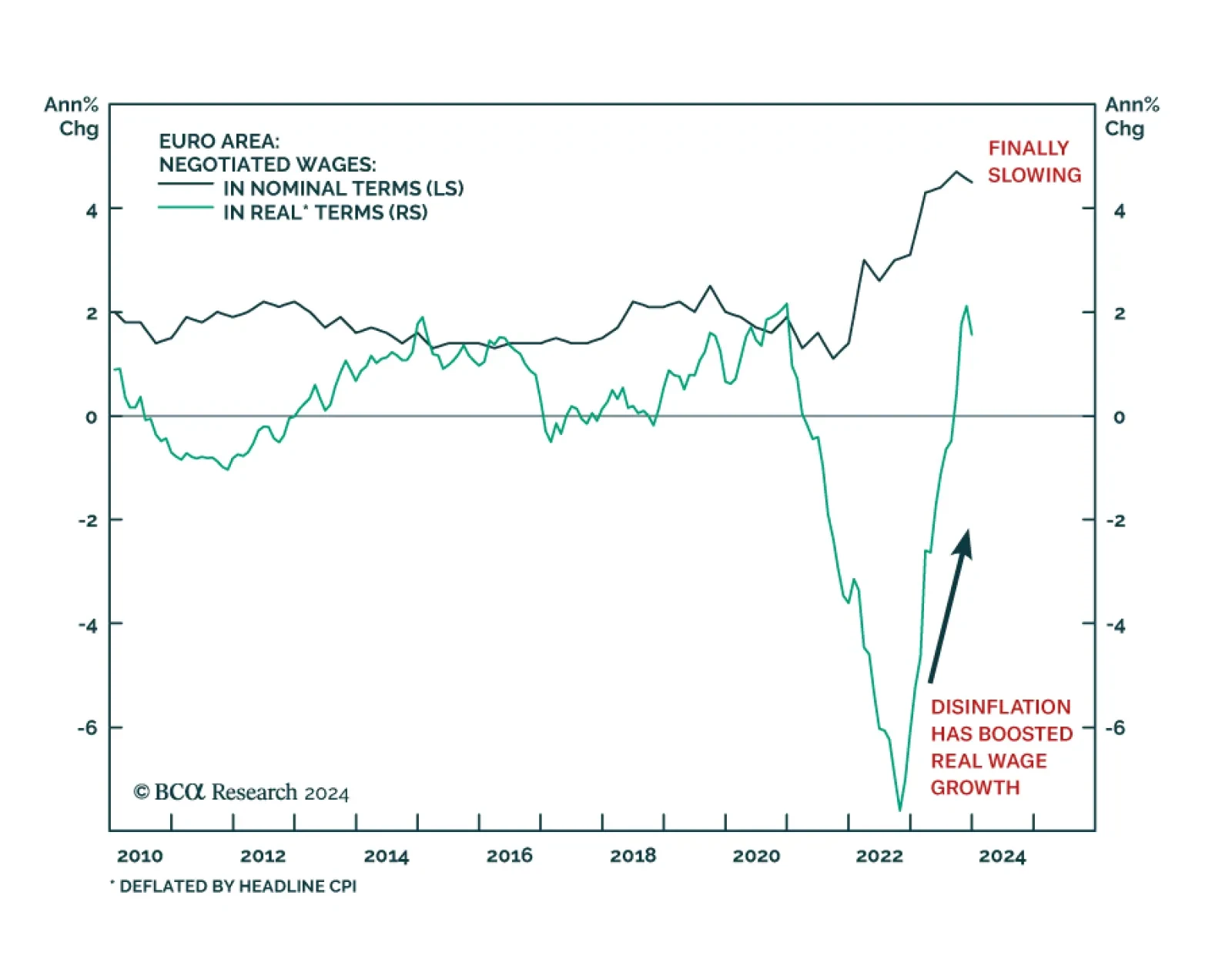

The preliminary Eurozone inflation release suggests that price pressures eased by less than anticipated in February. Headline CPI inflation slowed from 2.8% y/y to 2.6% y/y (slightly above expectations of 2.5% y/y. Similarly,…

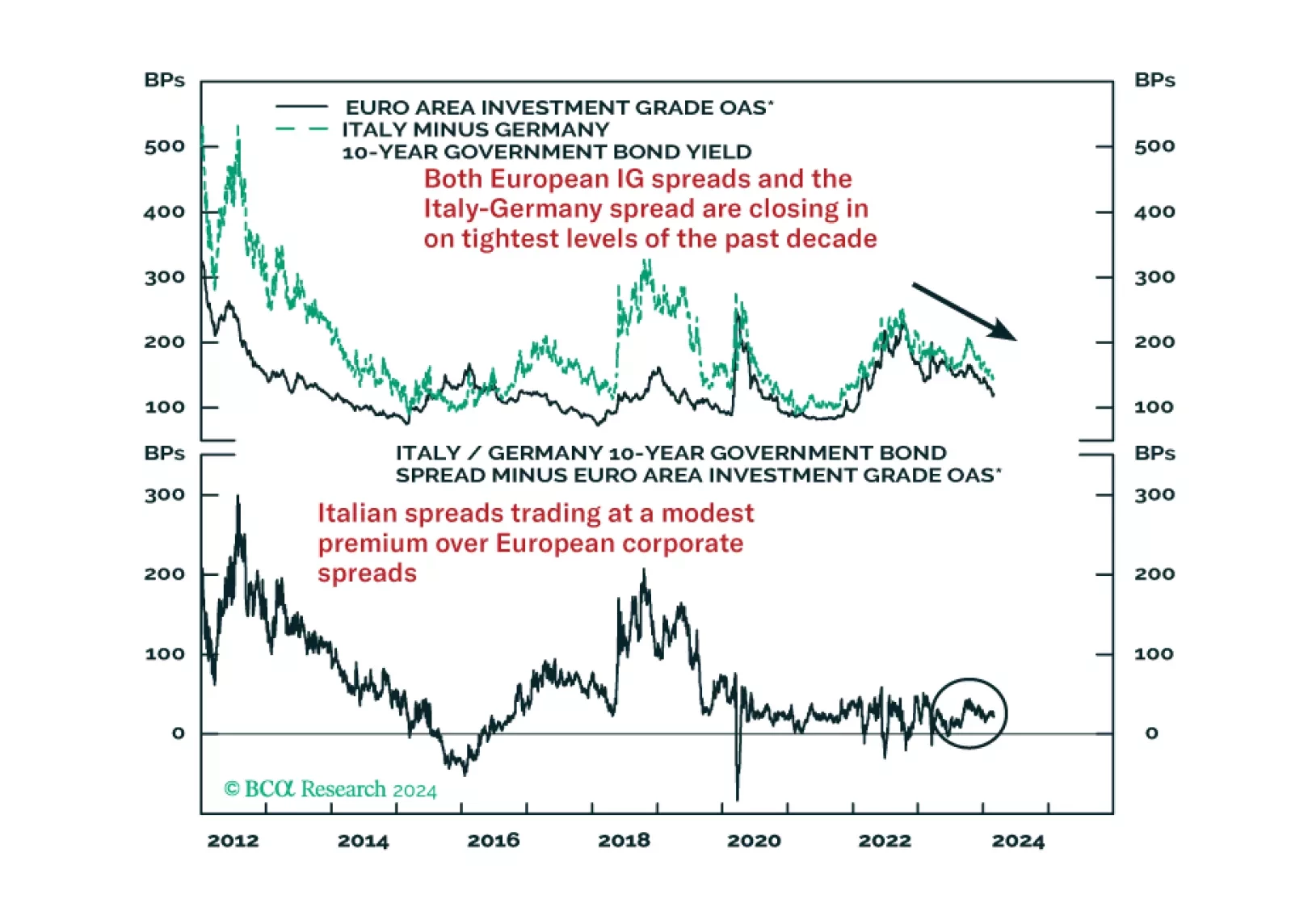

In this Strategy Insight, we take a comparative look at two of the largest spread product sectors in Europe – Italian government bonds and investment grade corporates. We make the case for favoring Italy over investment grade in the…

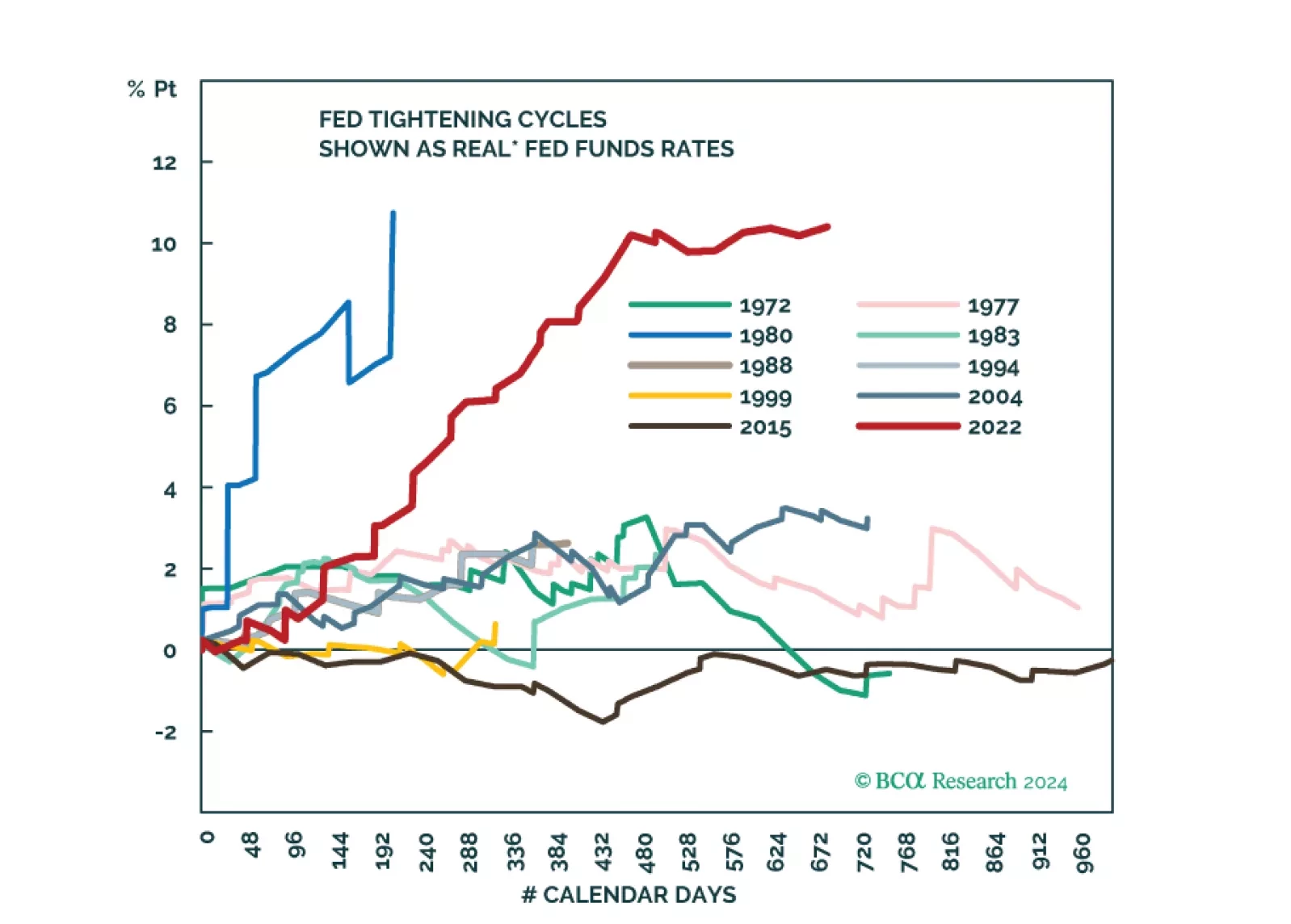

Amid patchy global growth, the US economy remains resilient. However, tight monetary policy will eventually trigger a recession in the US too. The stock market rally has been very narrow. Stay underweight risk assets.

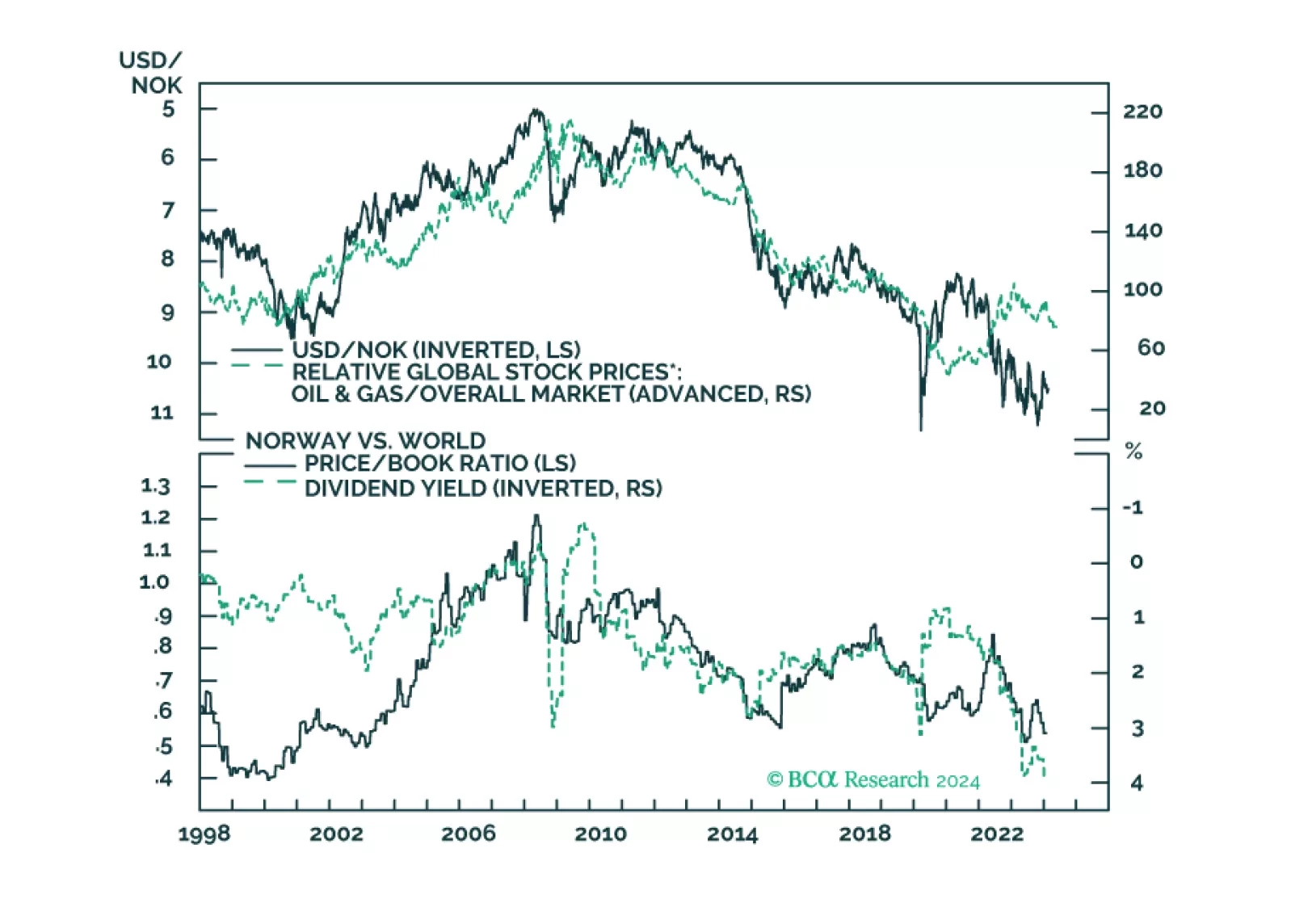

In this insight, we provide an update on the Norwegian krone, with attractive trade ideas over a long-term horizon. Shorter-term, our neutral-to-positive view on the dollar keeps us on the sidelines for USD/NOK.

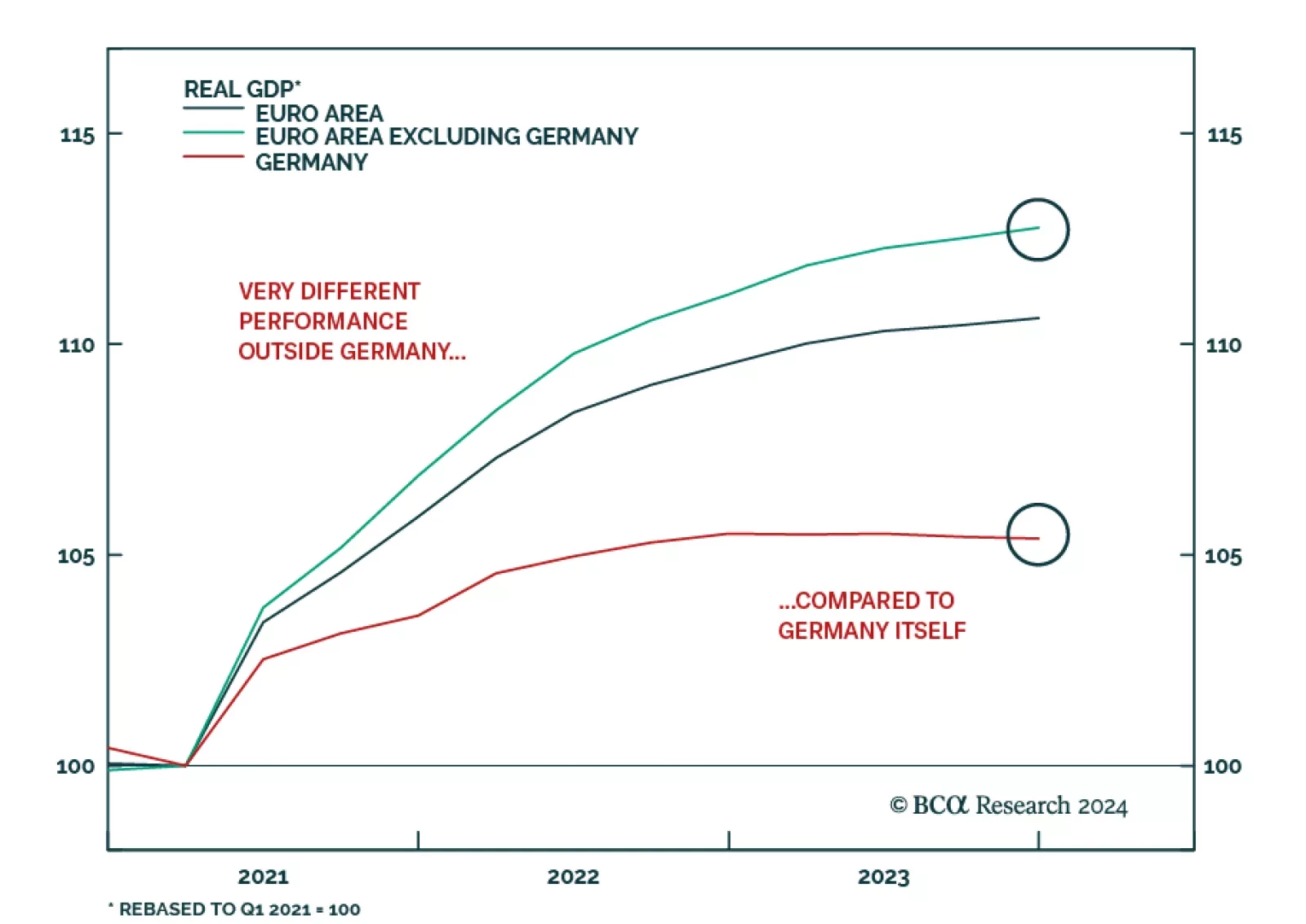

According to BCA Research’s European Investment Strategy service, Germany will likely drag the overall Euro Area into contraction, even if, individually, other countries manage to avoid a recession. This slightly better…

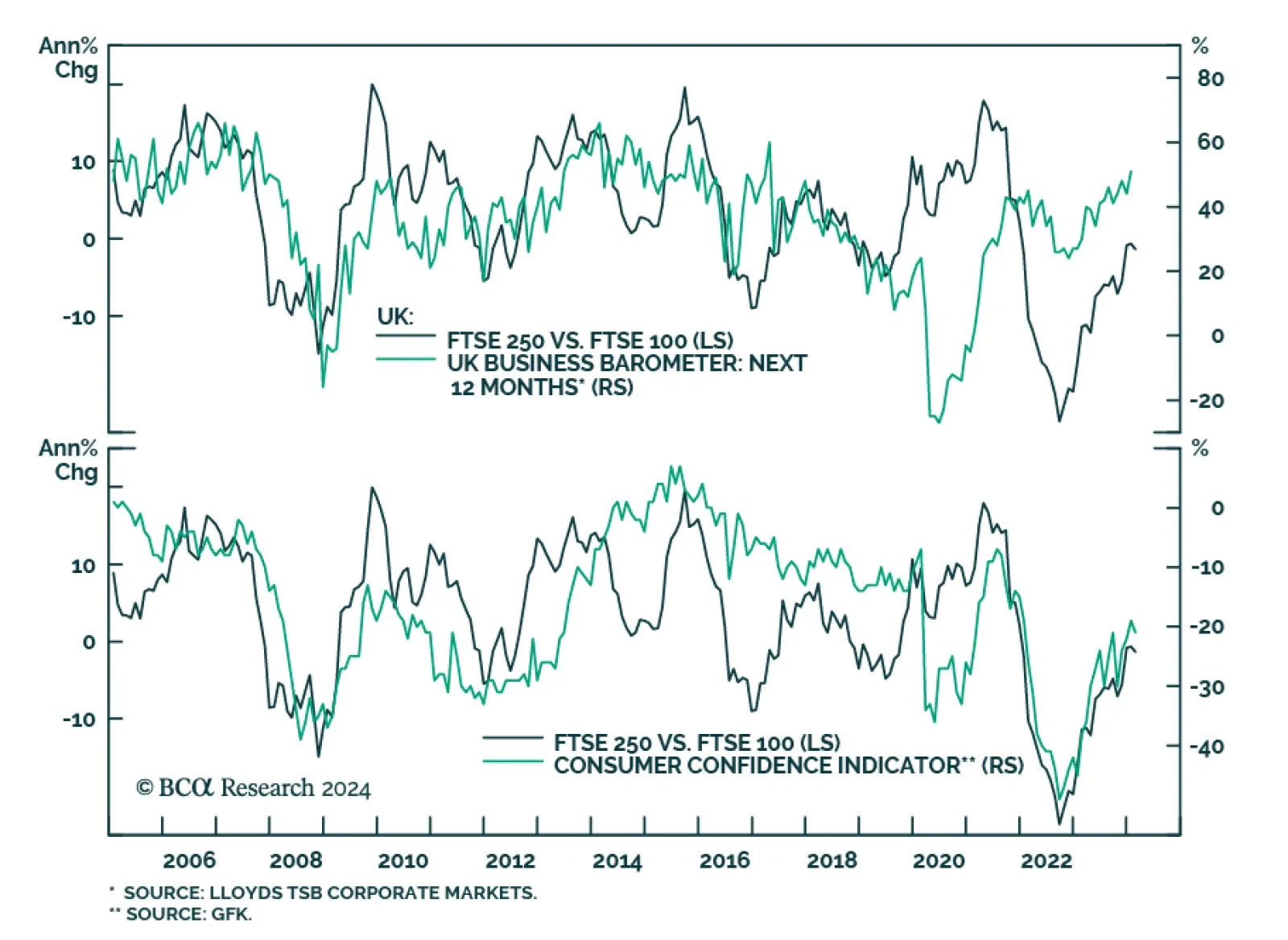

The FTSE 250 has been outperforming the FTSE 100 since late October 2023, with the former gaining 13.7% versus 3.9% in the case of the latter over this period. To the extent that UK small cap stocks are more exposed to…

The messaging from the minutes of the ECB’s January meeting was similar to the Fed. Although Governing Council members noted that “for the first time in many meetings, the risks to reaching the inflation target were…