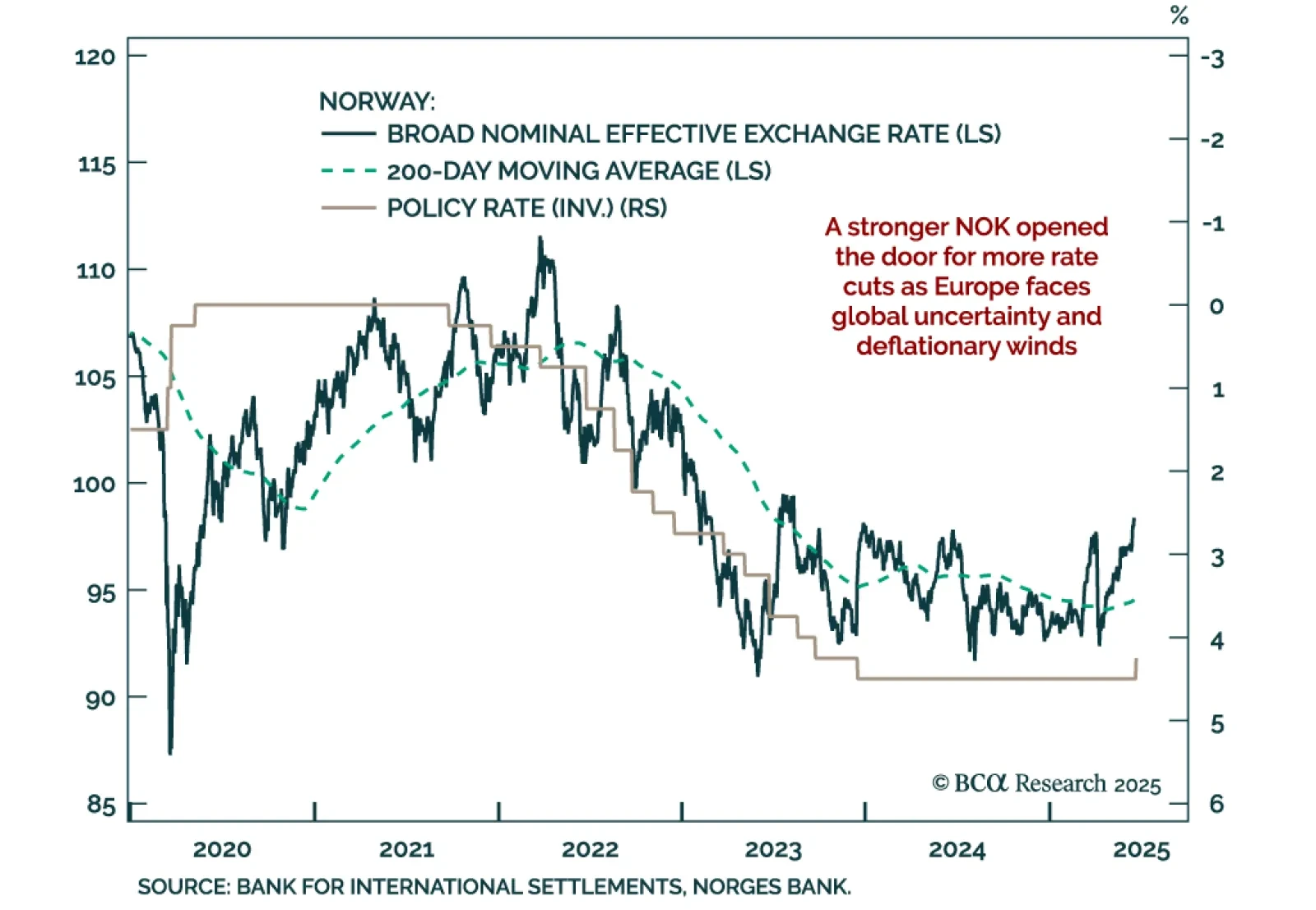

A stronger Norwegian krone has opened the door to more rate cuts, making Norwegian government bonds more attractive. Our Chart Of The Week comes from Jeremie Peloso, European Strategist. With its surprise 25 basis point cut, the…

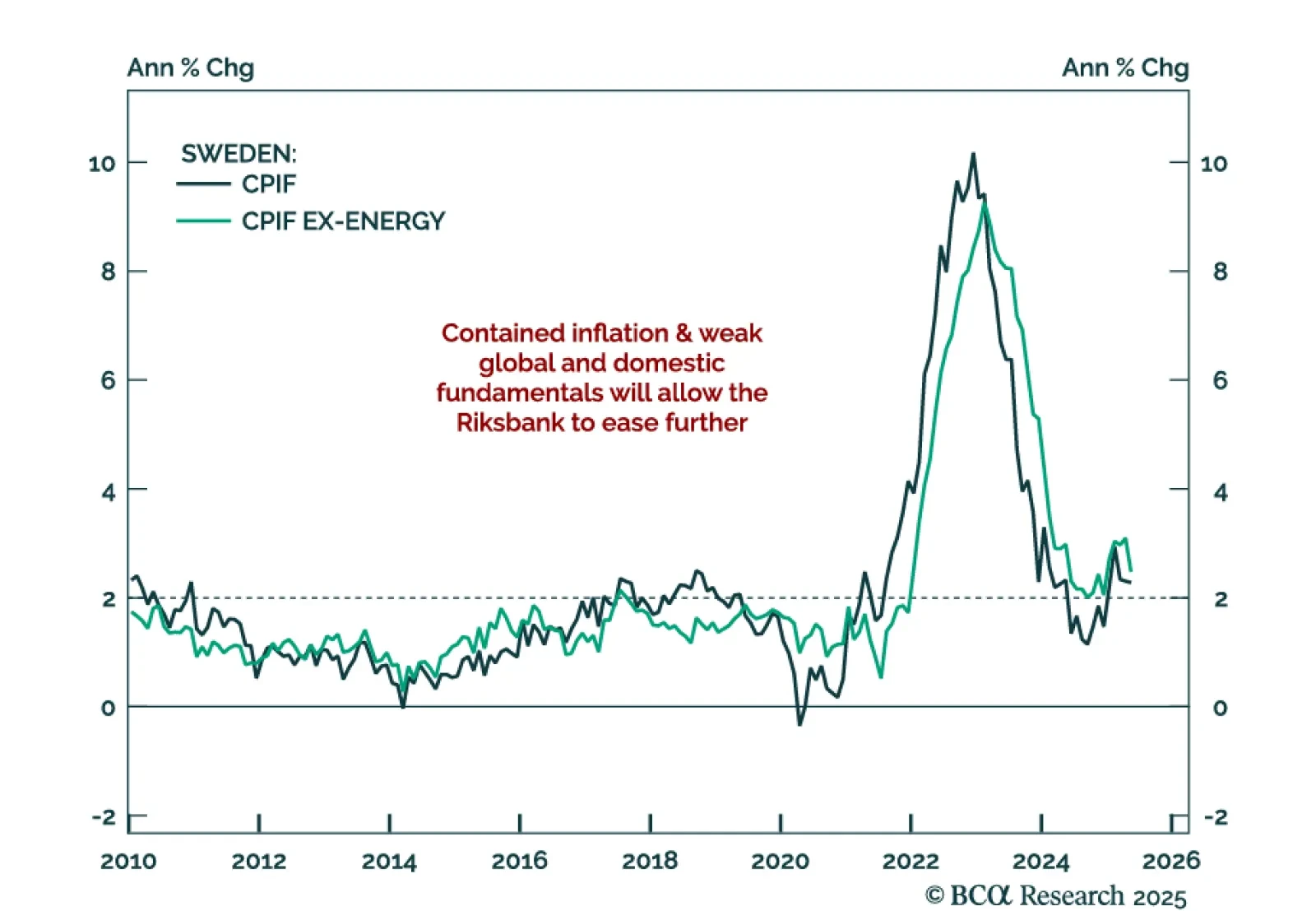

Sweden’s economic fragility and disinflation support further easing, reinforcing our long SEK rates and NOK/SEK trades. The Riksbank cut rates by 25 bps to 2.0% and projected an additional cut, consistent with prior OIS pricing.…

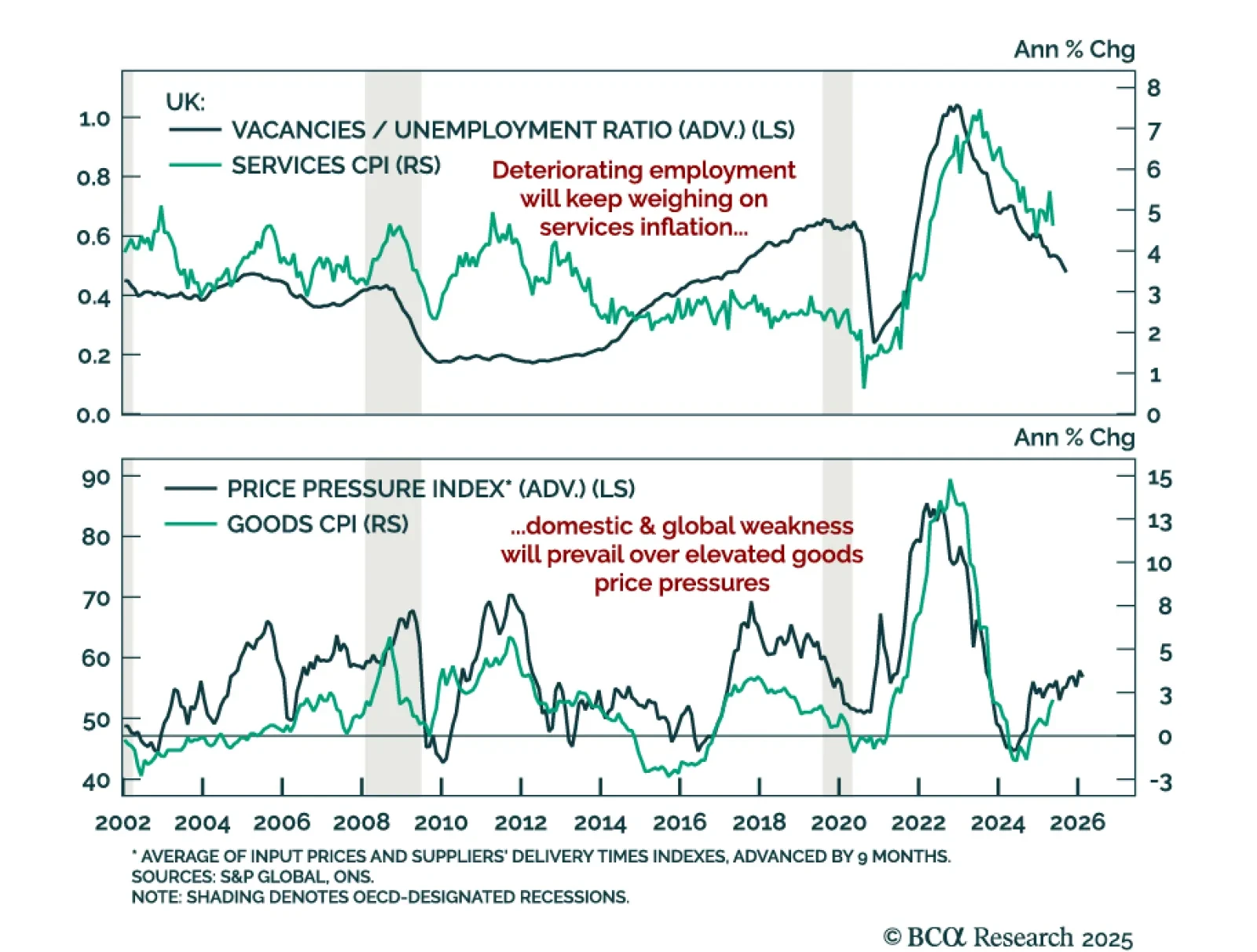

UK disinflation and labor market softening support our overweight in Gilts and short GBP trade. UK CPI came in slightly hotter than expected in May, with headline inflation at 3.4% y/y (vs. 3.5% in April) and core CPI meeting…

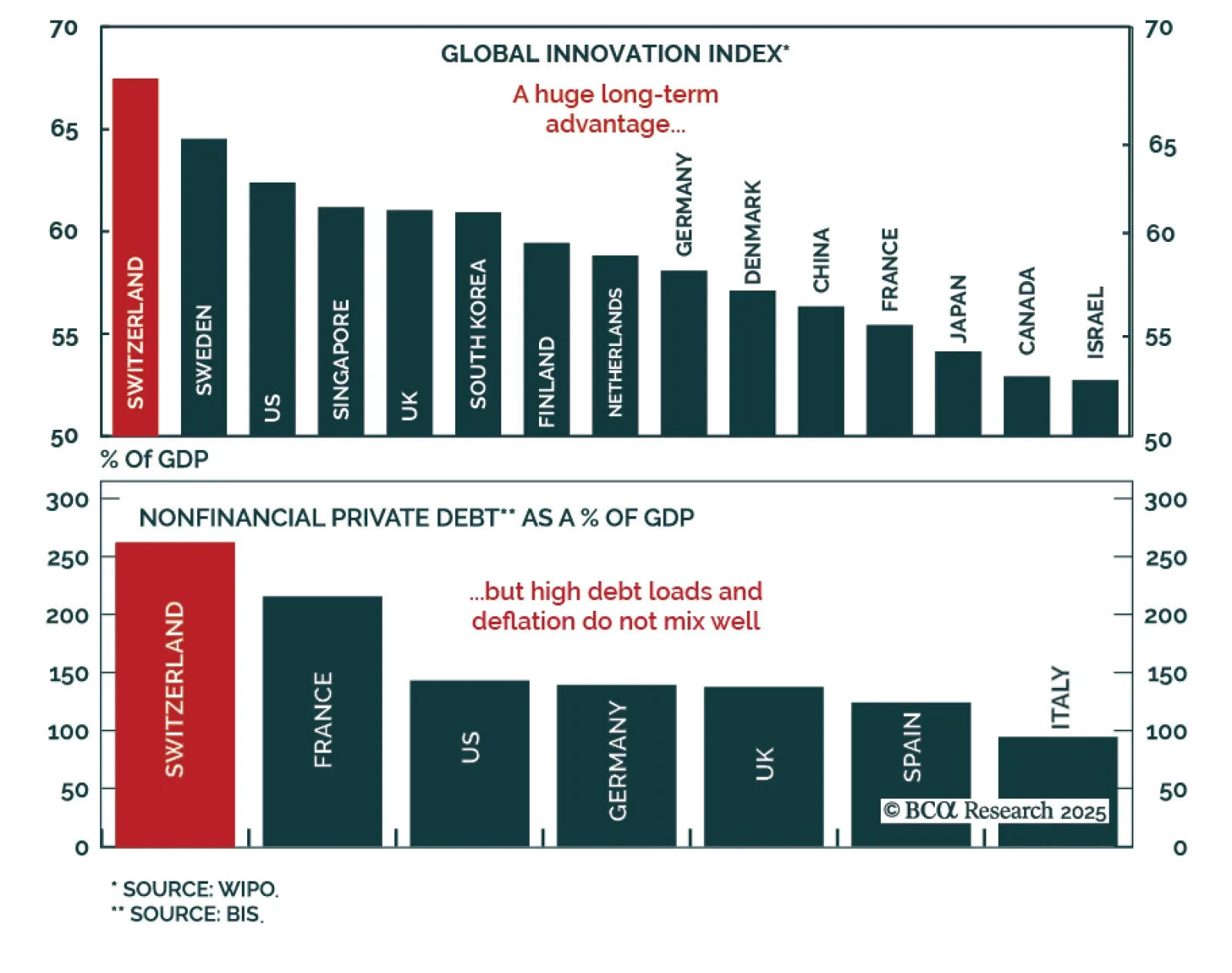

Our European Investment strategists believe Switzerland is no longer a tactical haven and recommend underweighting CHF and Swiss equities in favor of Swiss bonds. The country retains strong structural fundamentals: High productivity…

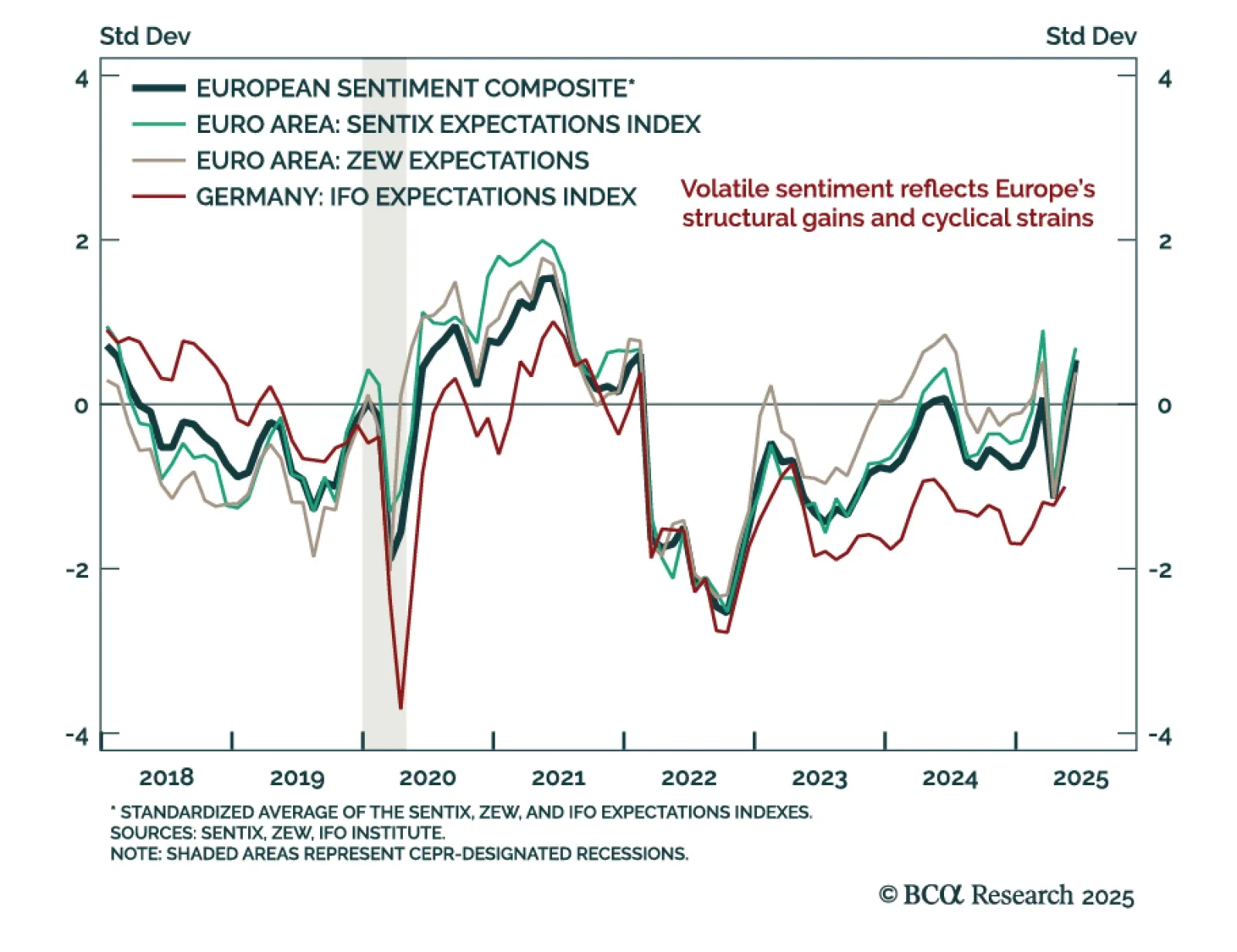

ZEW expectations jumped in May, but underlying macro fragility supports a cautious stance on eurozone assets. The ZEW expectations index for the euro area rose to 35.3 from 11.6, with Germany also beating expectations. The current…

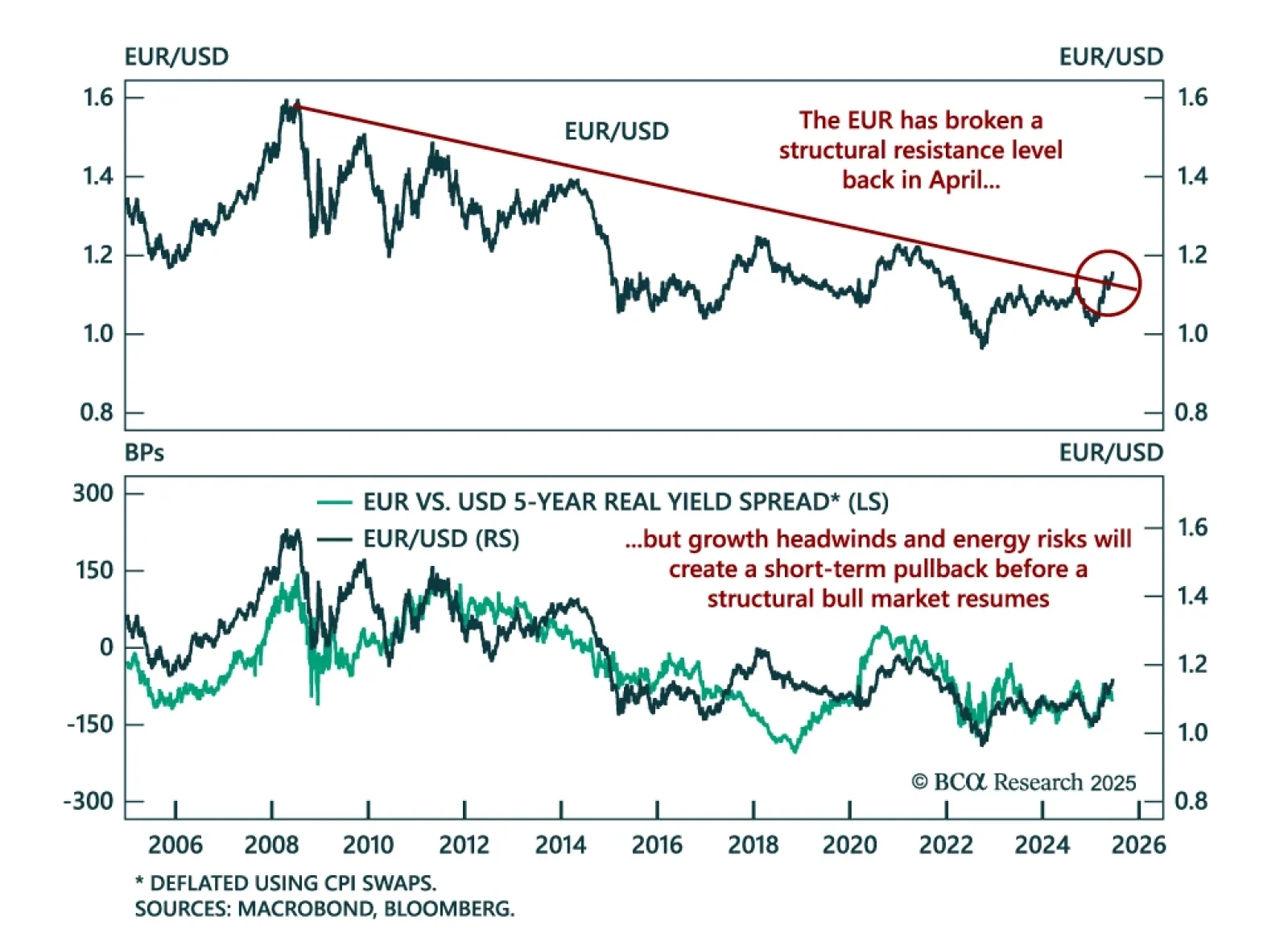

Short term euro upside is limited despite a structural bull case, as fragile growth, easing ECB policy, and geopolitical risks cap further gains. EUR/USD broke above structural resistance in April amid optimism over German stimulus…

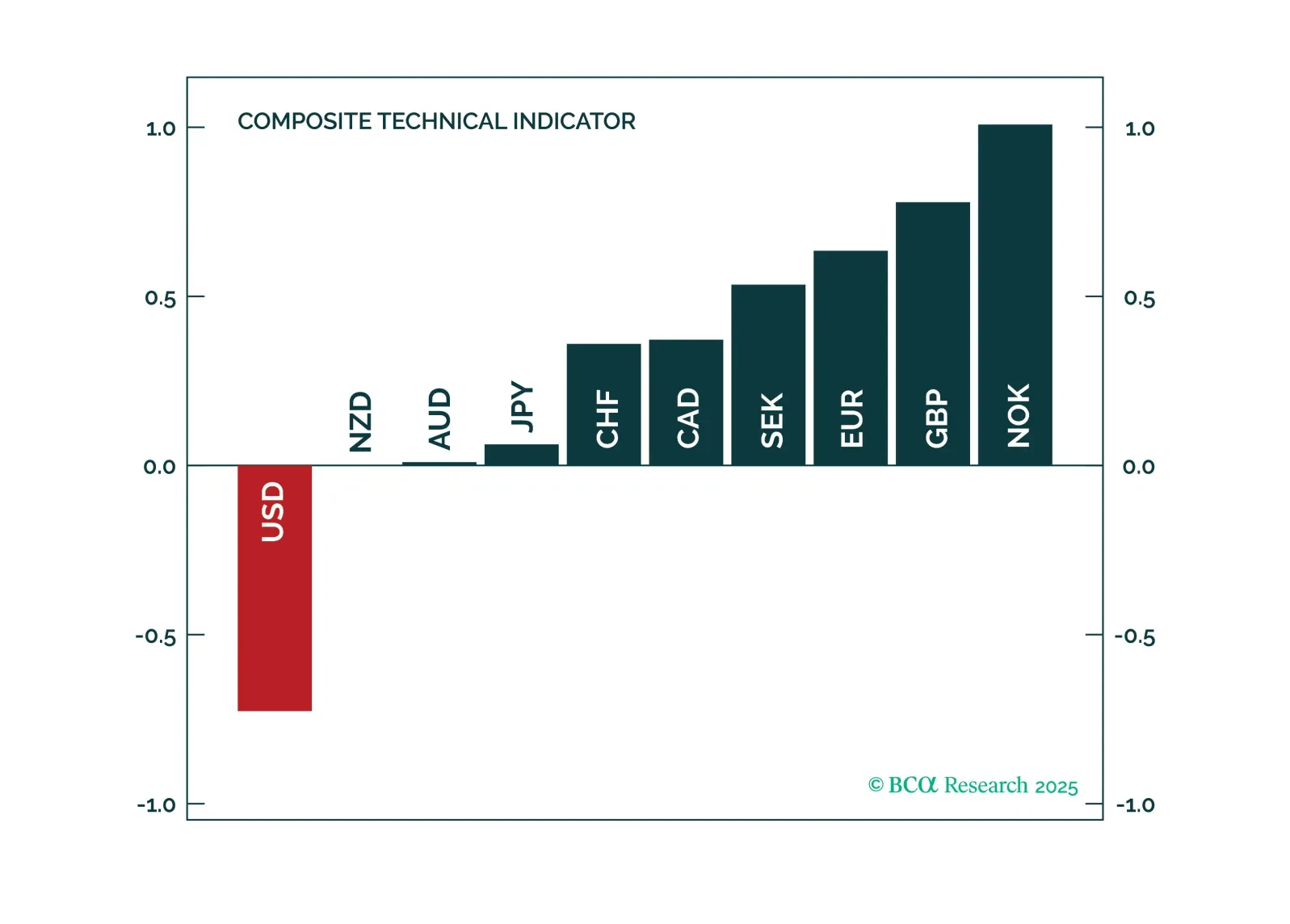

In this FX note, we provide a rationale for why it is important to pay attention to technical indicators, while still keeping your eyeball on the structural factors that drive currencies. This report answers the following questions:…

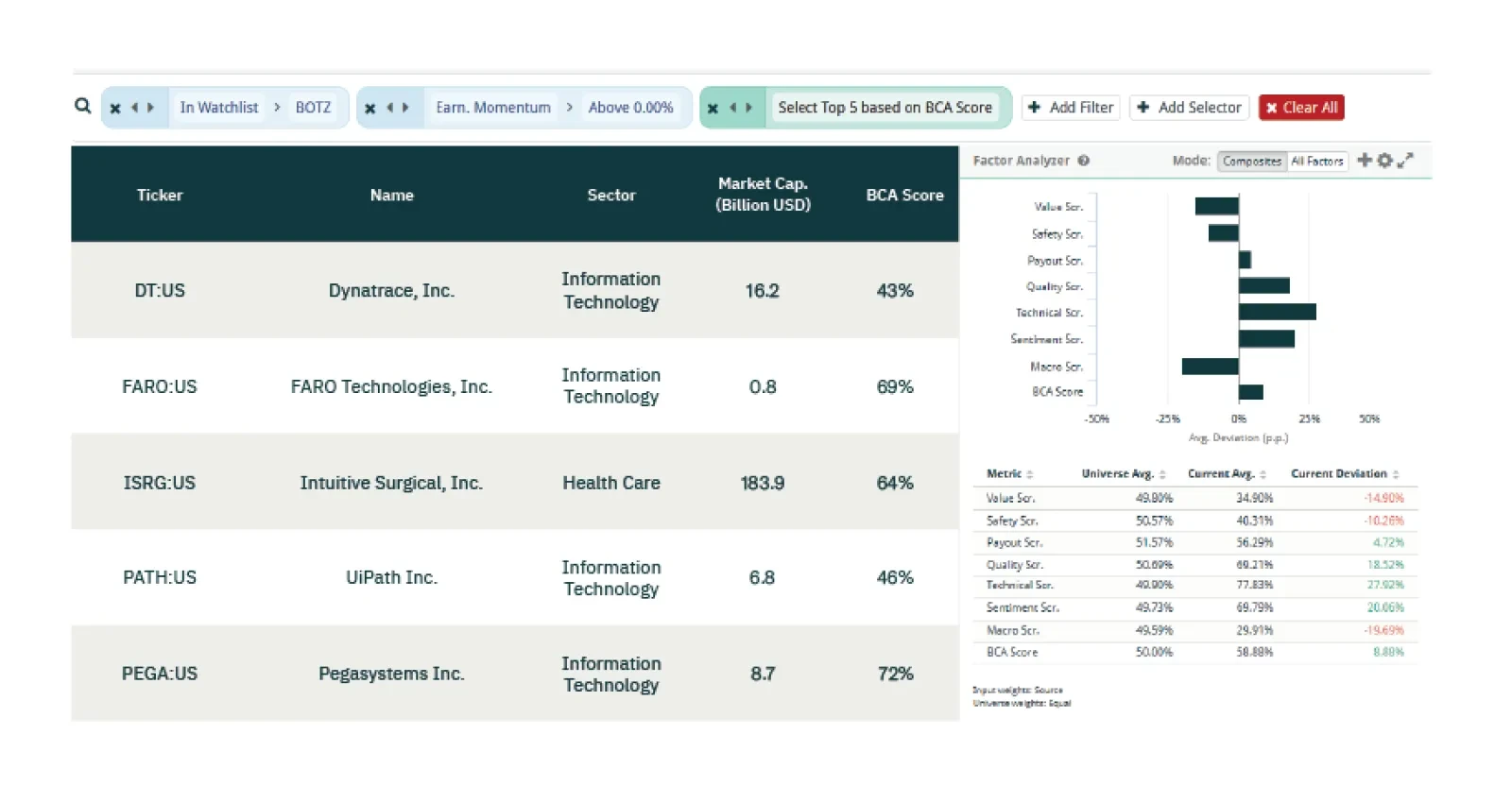

This week our three screeners explore equity trades in Robotics, European Quality and Technical, and Hong Kong.

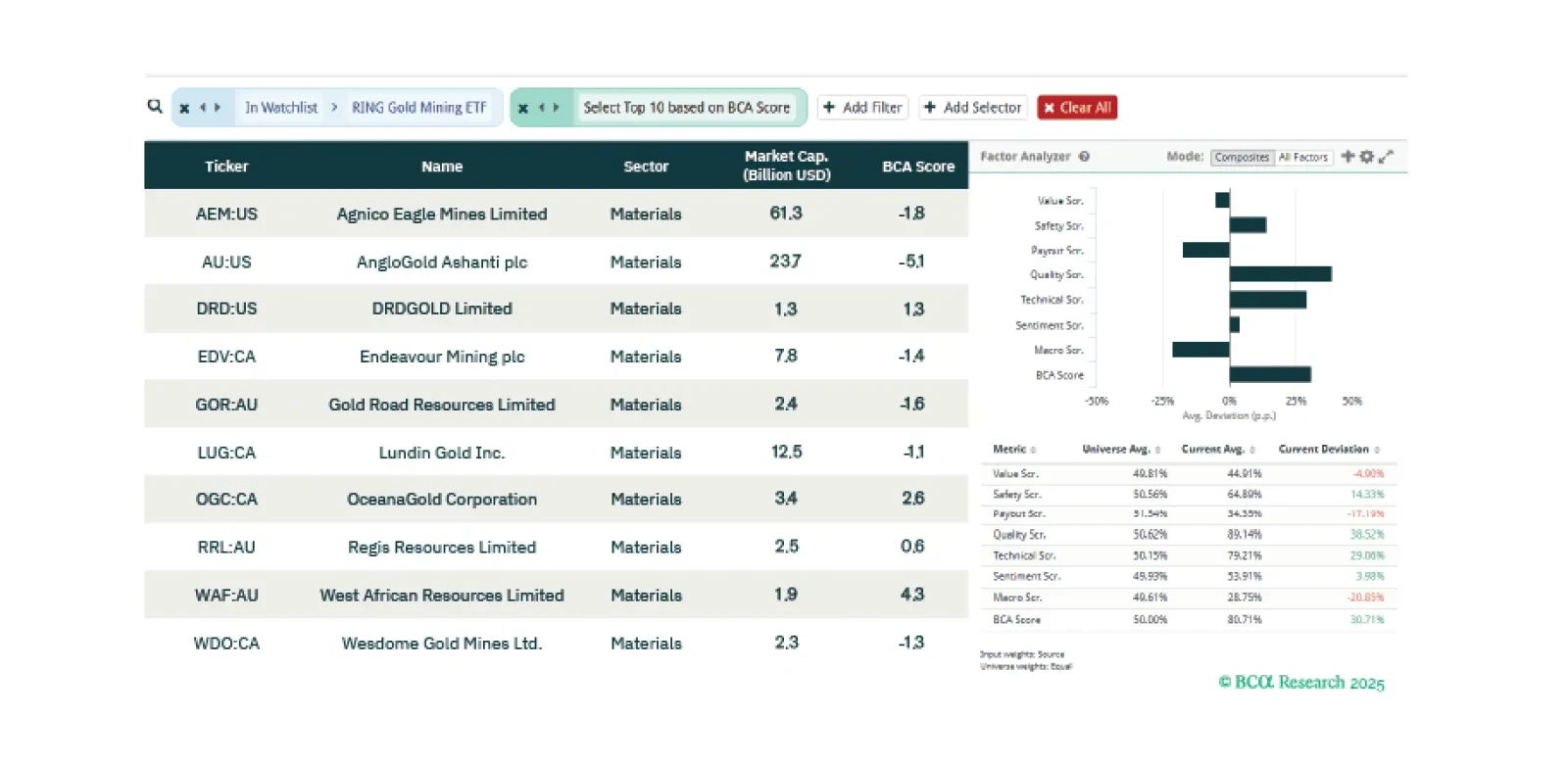

This week our three screeners explore equity trades in gold mining stocks, European banks, and US stocks ex-Tech should a recession not be imminent.

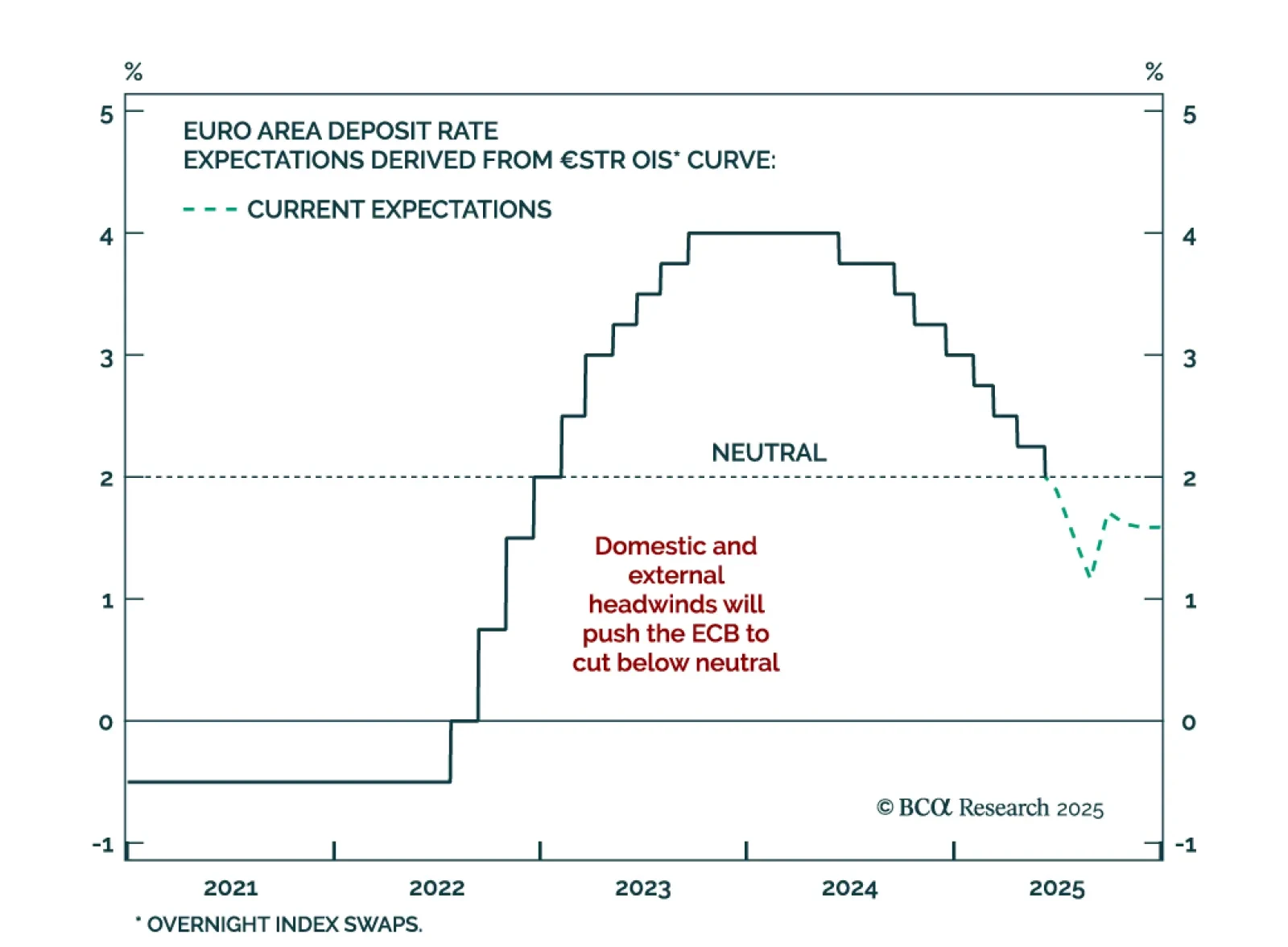

The ECB’s expected rate cut to 2% marks a slower easing phase, capping Bund yields. The shift to a quarterly pace of cuts, barring surprises, confirms a more gradual approach despite ongoing disinflation and weak growth. Staff…