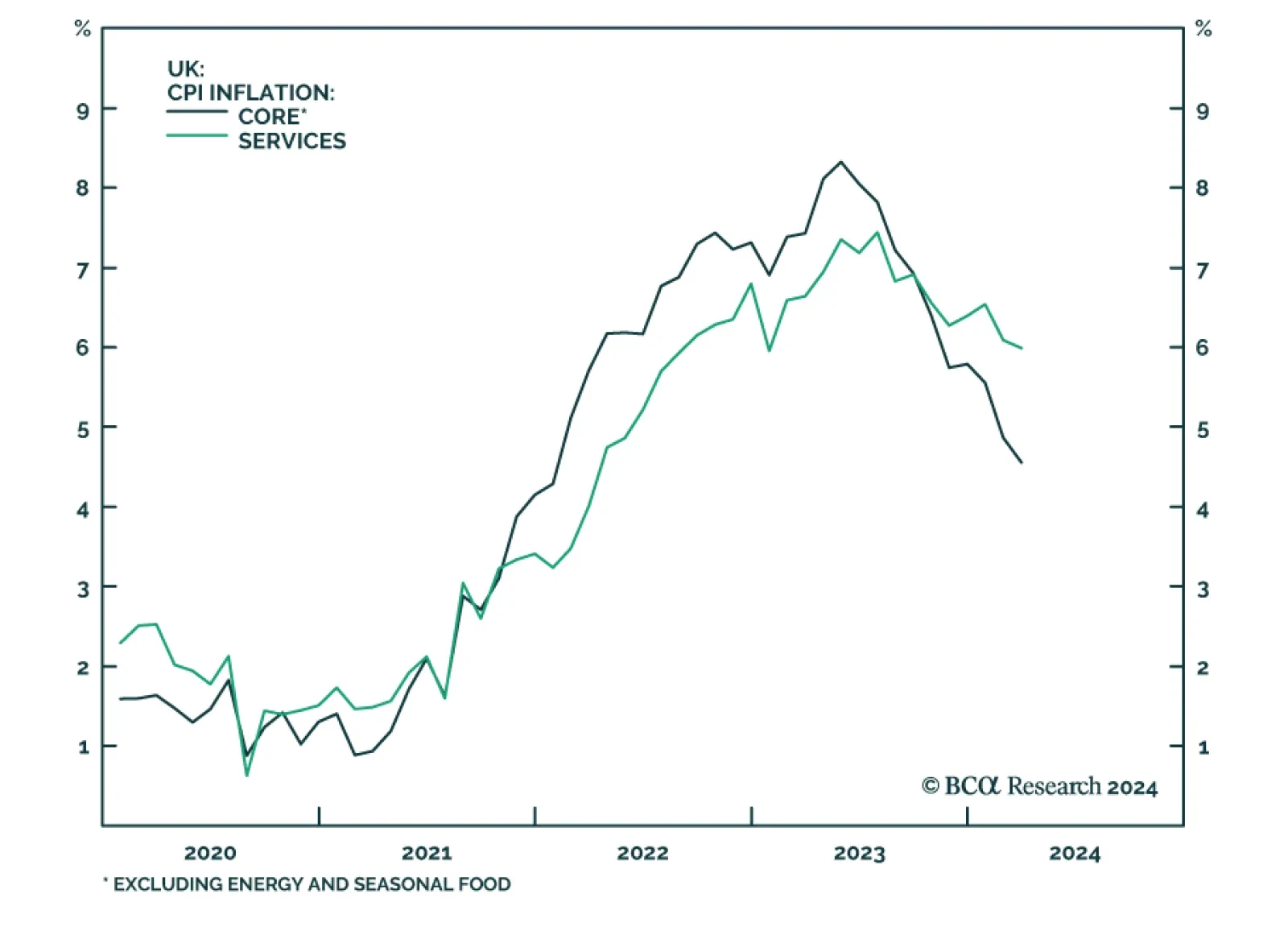

UK inflation came in hotter than expected in March. Headline CPI inflation was unchanged at 0.6% m/m – above expectations of a slowdown to 0.4% m/m. Moreover, while the headline and core measures both decelerated on an…

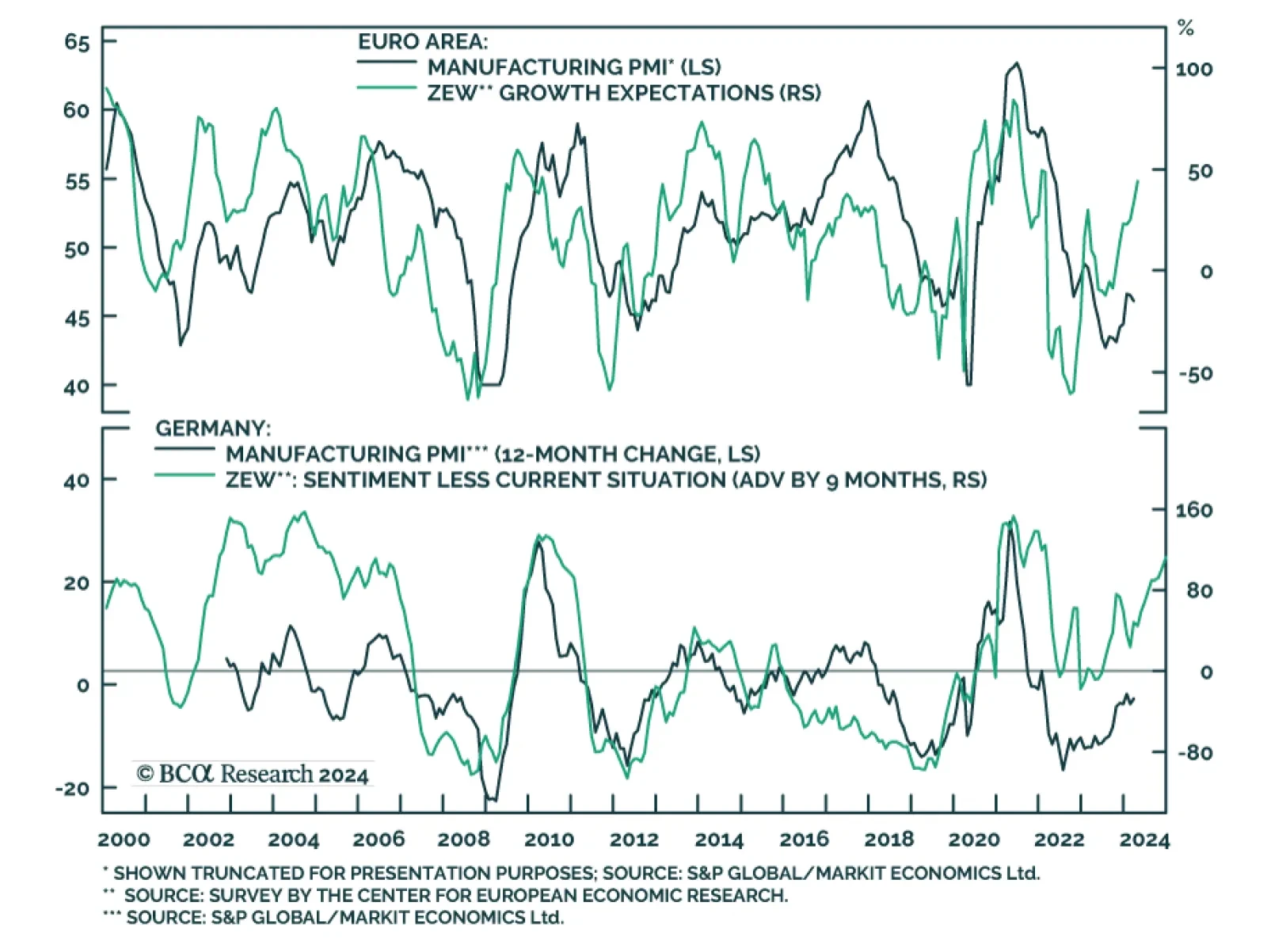

Optimism about the future continues to boost investor confidence in the Euro Area. The ZEW Expectations series for the Eurozone (+10.4 to 43.9) and Germany (+11.2 to 42.9) surged and are now both at their highest in 26…

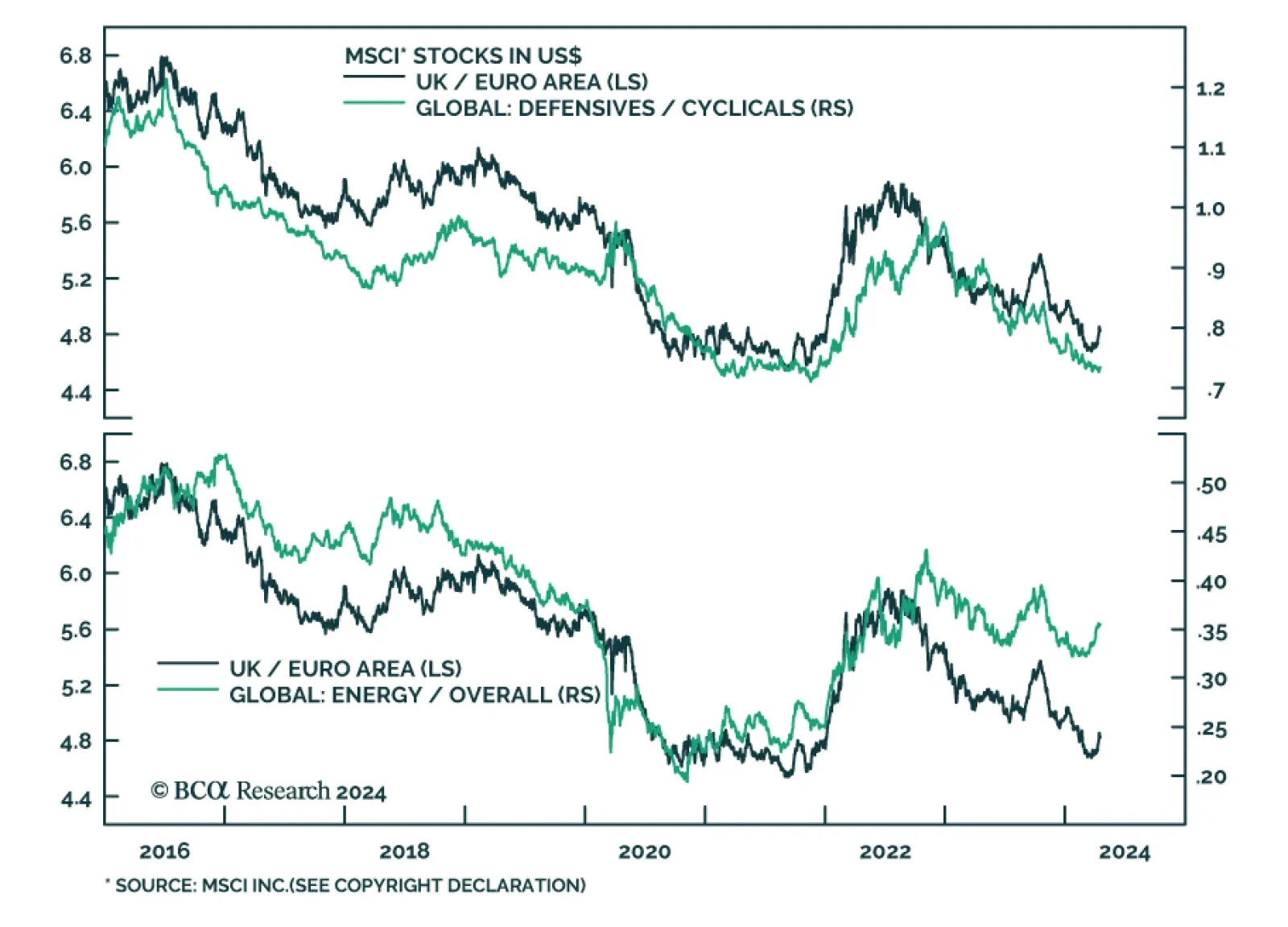

UK stocks posted one of the largest positive abnormal returns (z-score) among the major financial markets we tracked in March. The MSCI UK index has gained 2% relative to Eurozone stocks since late February. However, the…

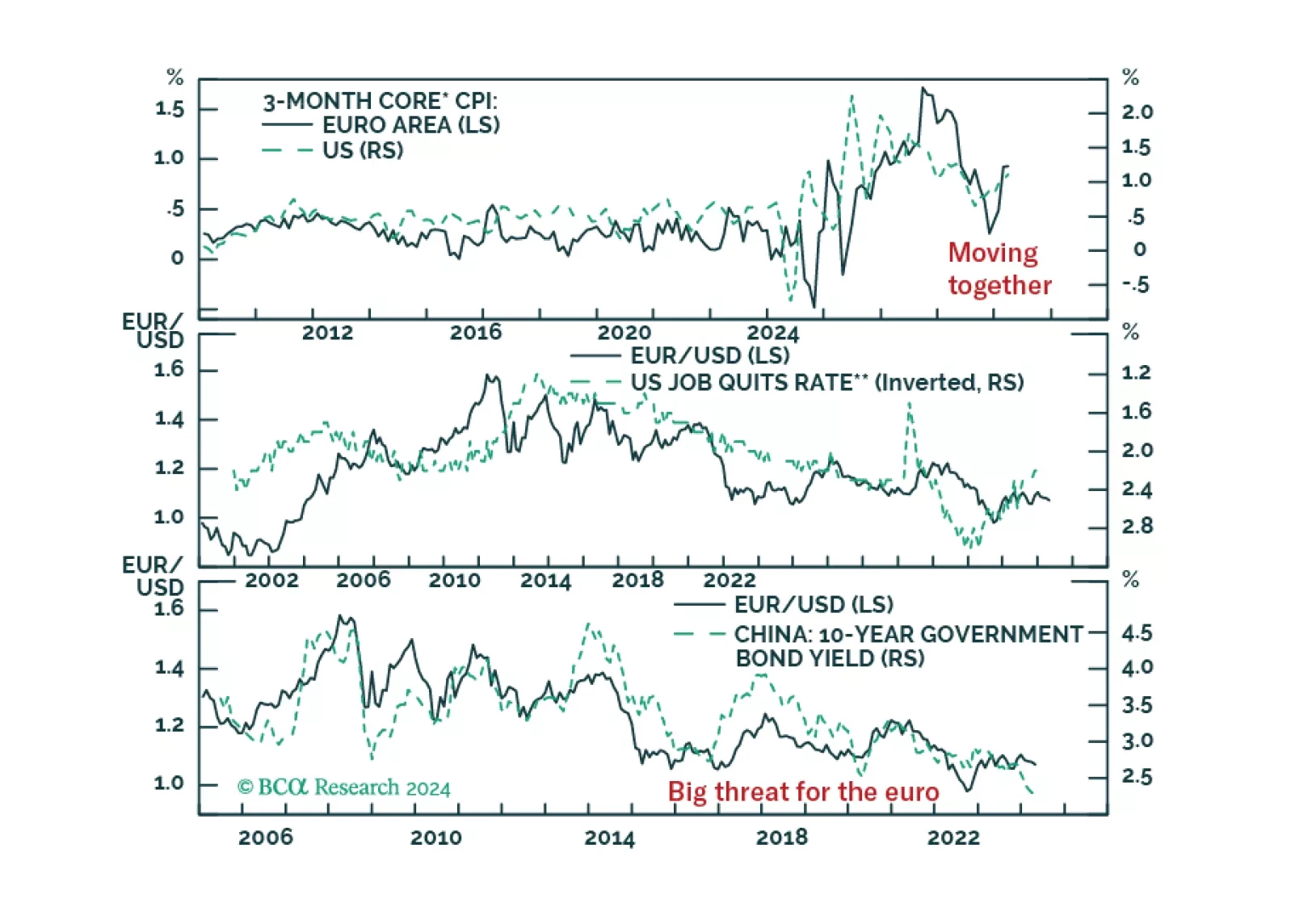

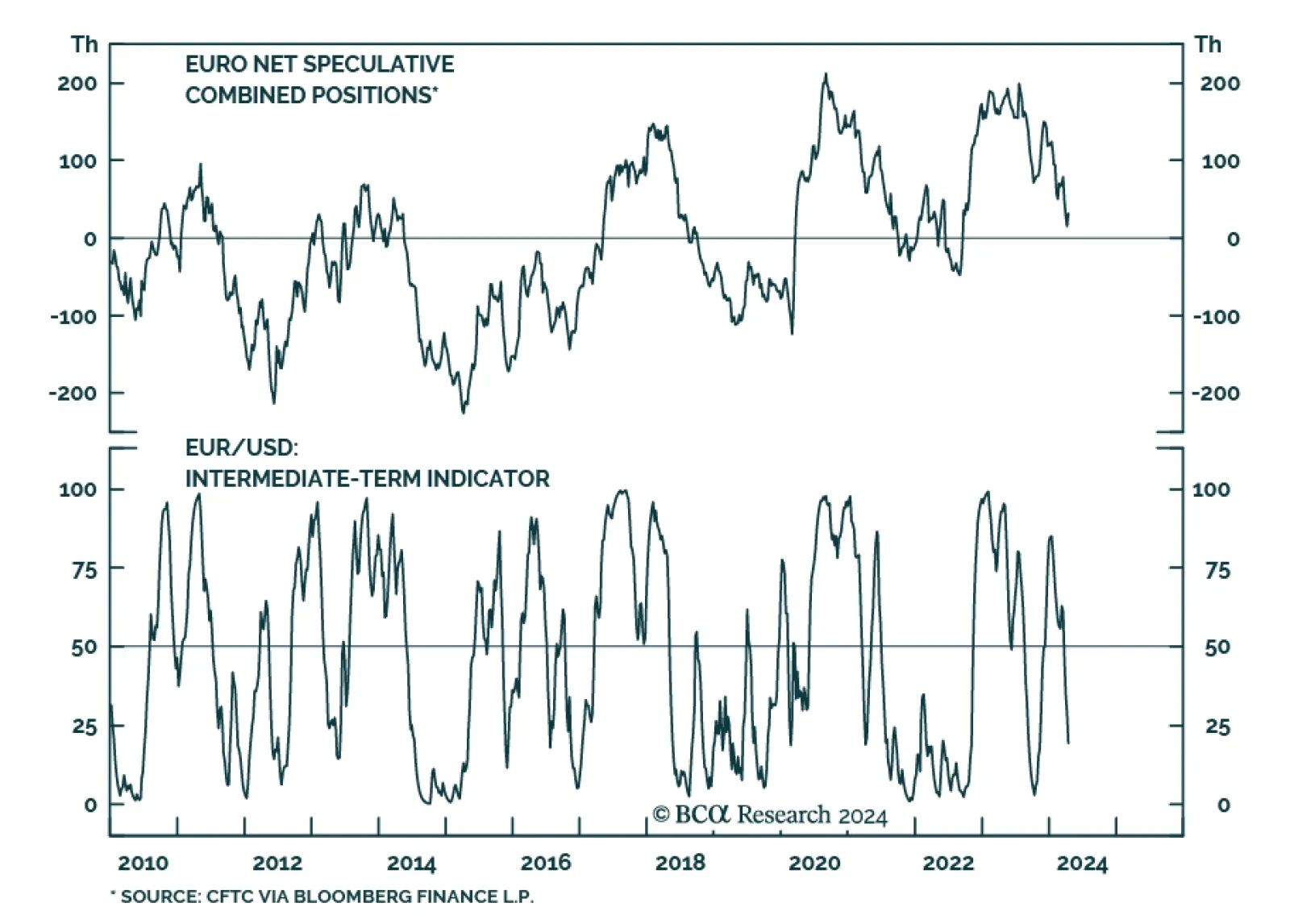

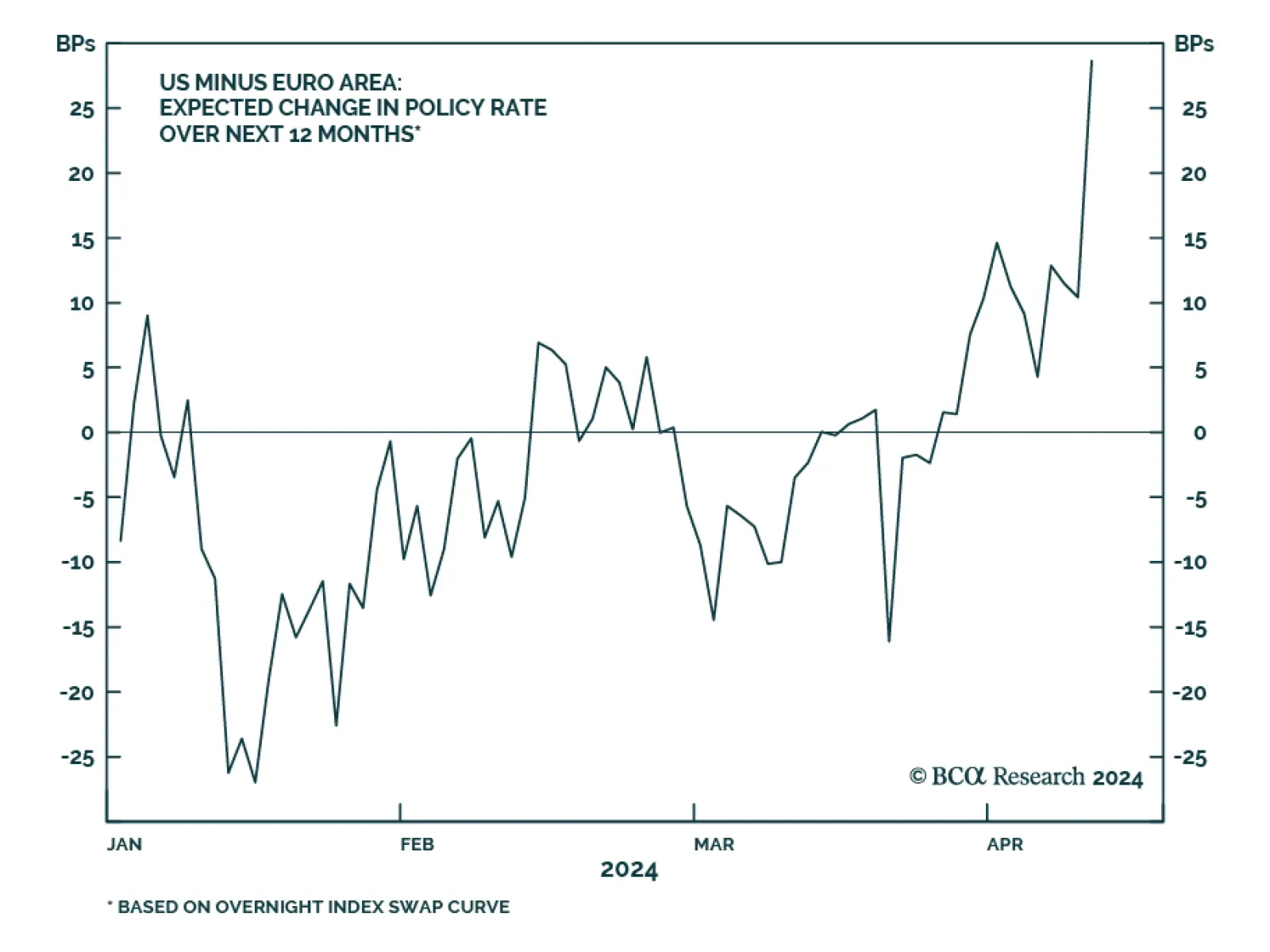

According to BCA Research’s European Investment Strategy service, a tactical buying opportunity for EUR/USD is approaching. However, this will not lead to a renewed bull market, only to a bounce toward 1.10-1.12. …

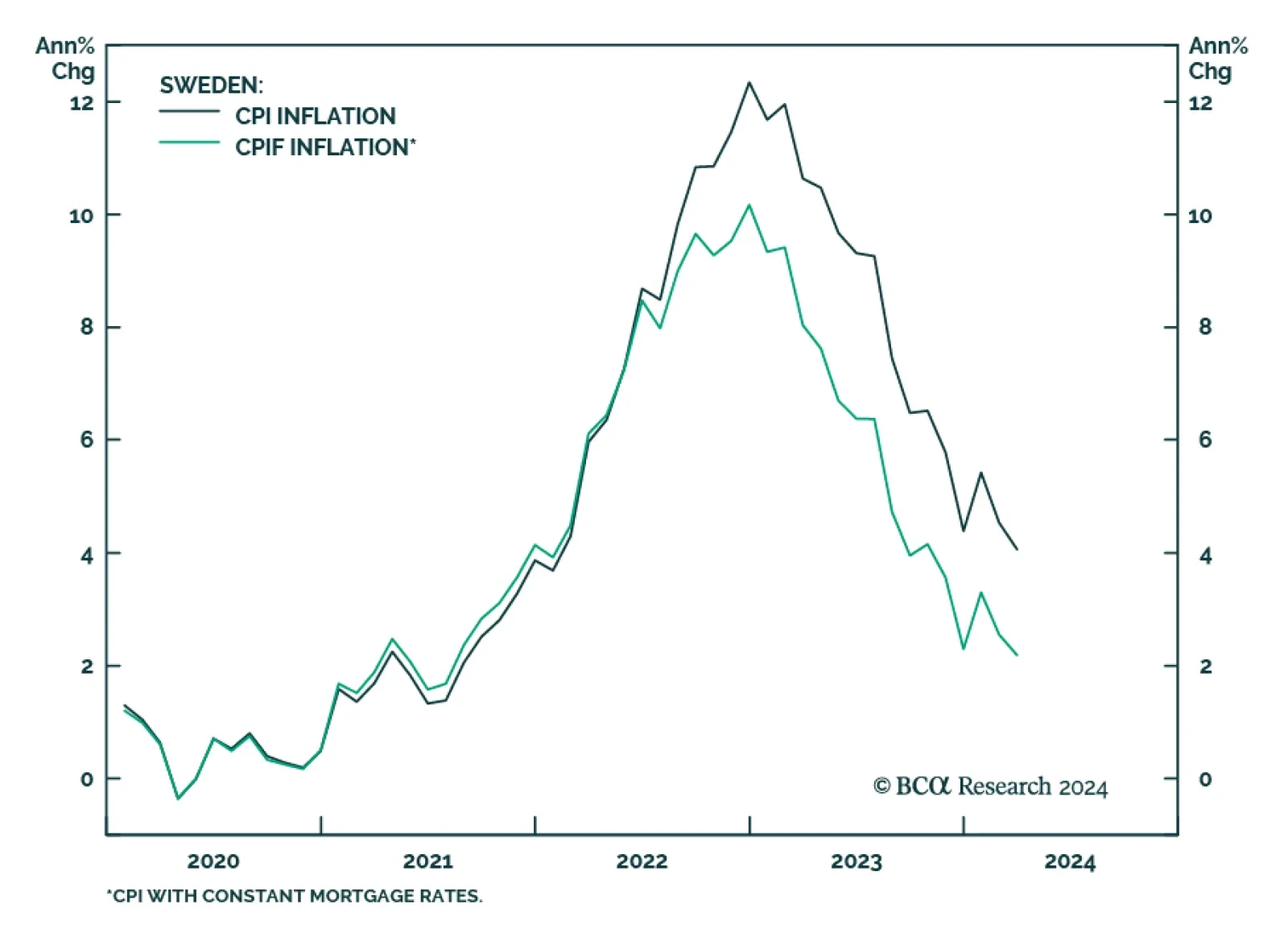

Headline inflation in Sweden came in at 4.1% in March. Lower food prices as well as lower inflation for recreation and culture were the main contributors to the drop. The biggest positive contributor was housing due to higher…

In the short run, global risk assets are vulnerable due to rising oil prices and bond yields. Cyclically, a global economic downturn will weigh on global risk assets.

EUR/USD collapsed in the wake of last week’s hotter-than-expected US CPI report. Is this pessimism warranted and will the euro’s trading range that has prevailed since 2023 breakdown?

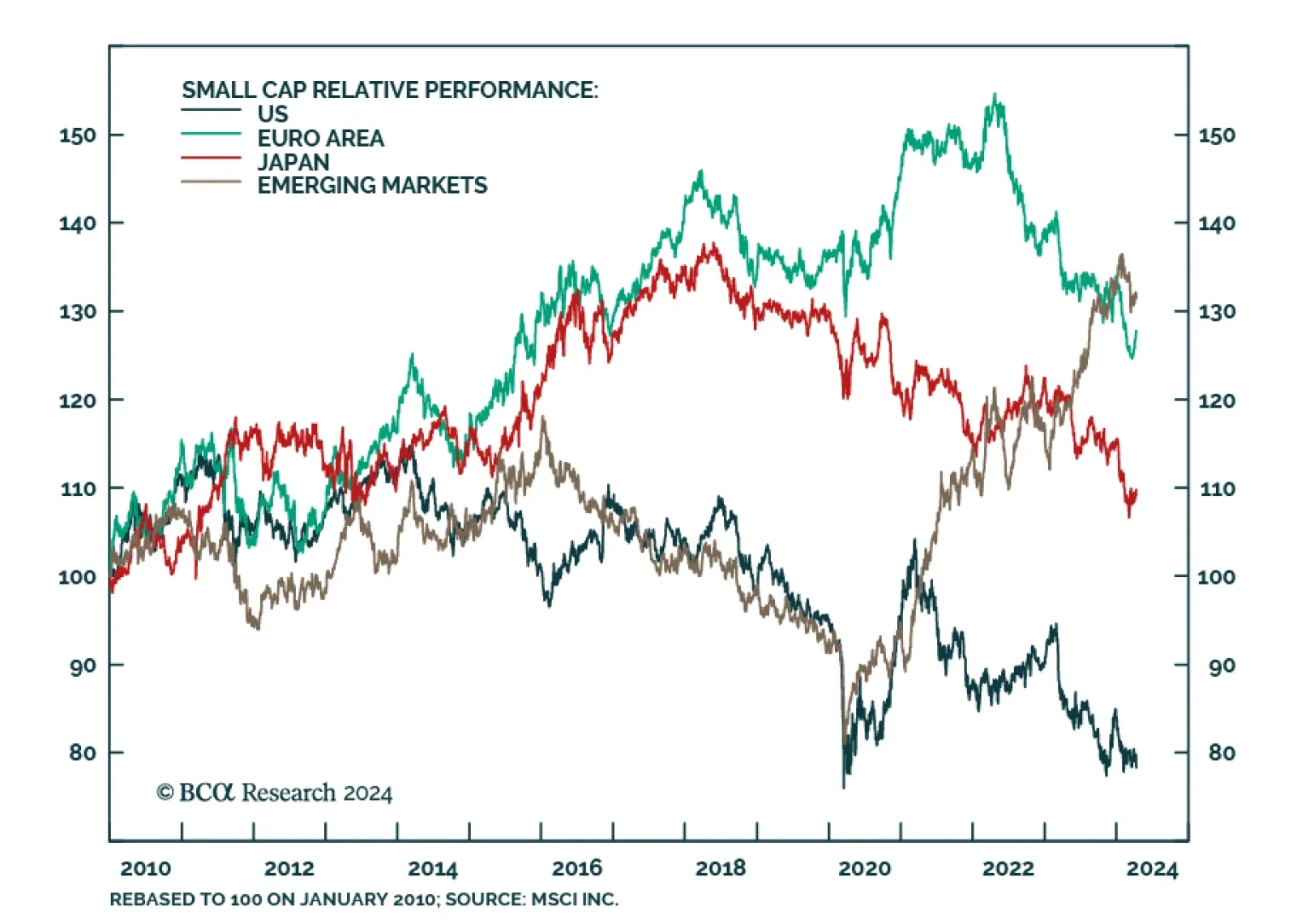

US, European and Japanese small caps have underperformed their large cap counterparts by 22.6%, 15.3% and 10.1% respectively since 2021. They now face conflicting forces. On the one hand, they are extremely beaten down and cheap…

As expected, the Governing Council of the ECB kept interest rates unchanged on Thursday. In its statement, the ECB reiterated that most measures of underlying inflation were easing, wage growth was moderating, and firms were…

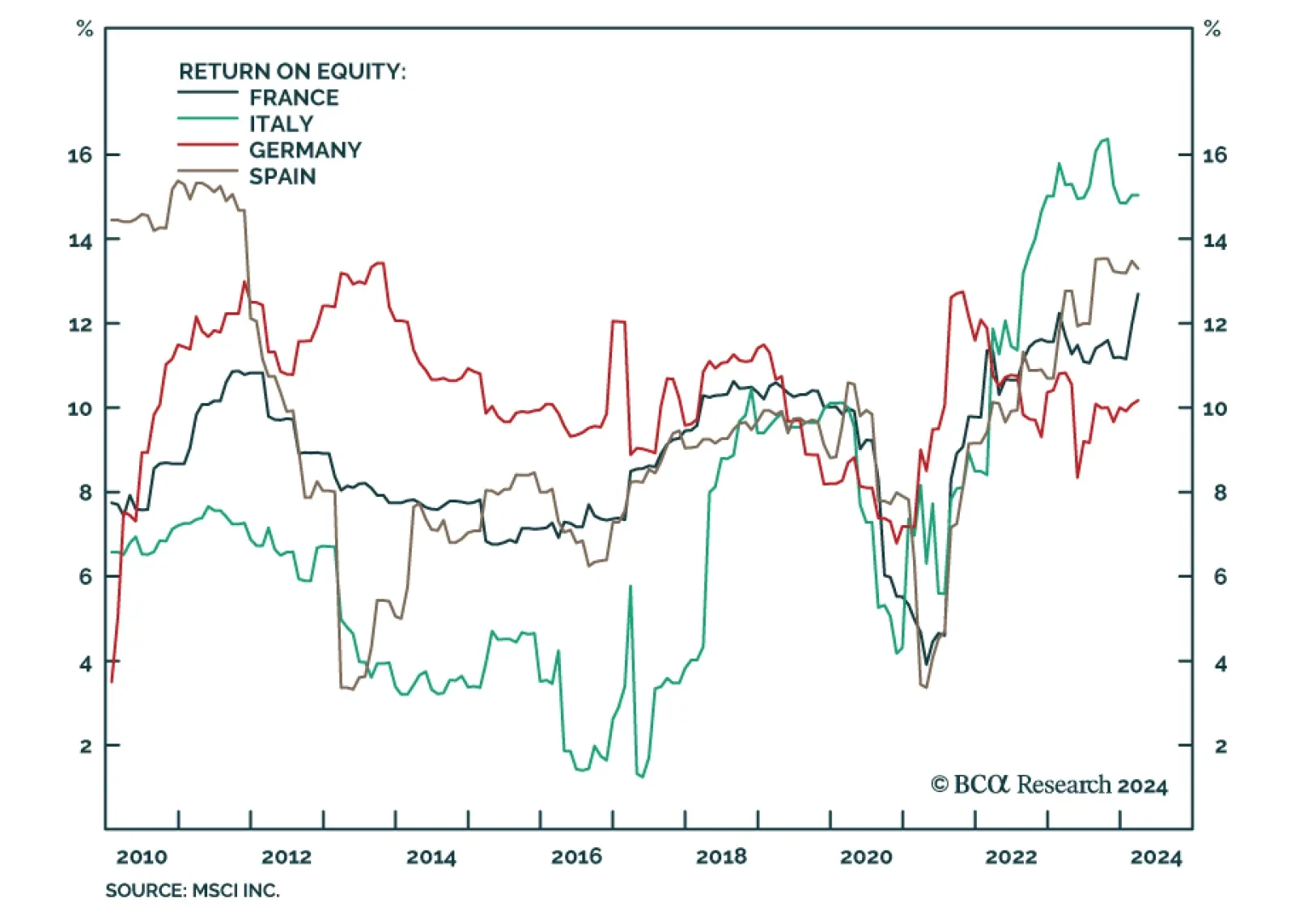

Italy and Spain have a poor reputation when it comes to their economies. The European debt crisis affected them more than other Euro Area countries. Their housing markets collapsed and debt cost soared. France and Germany, while…