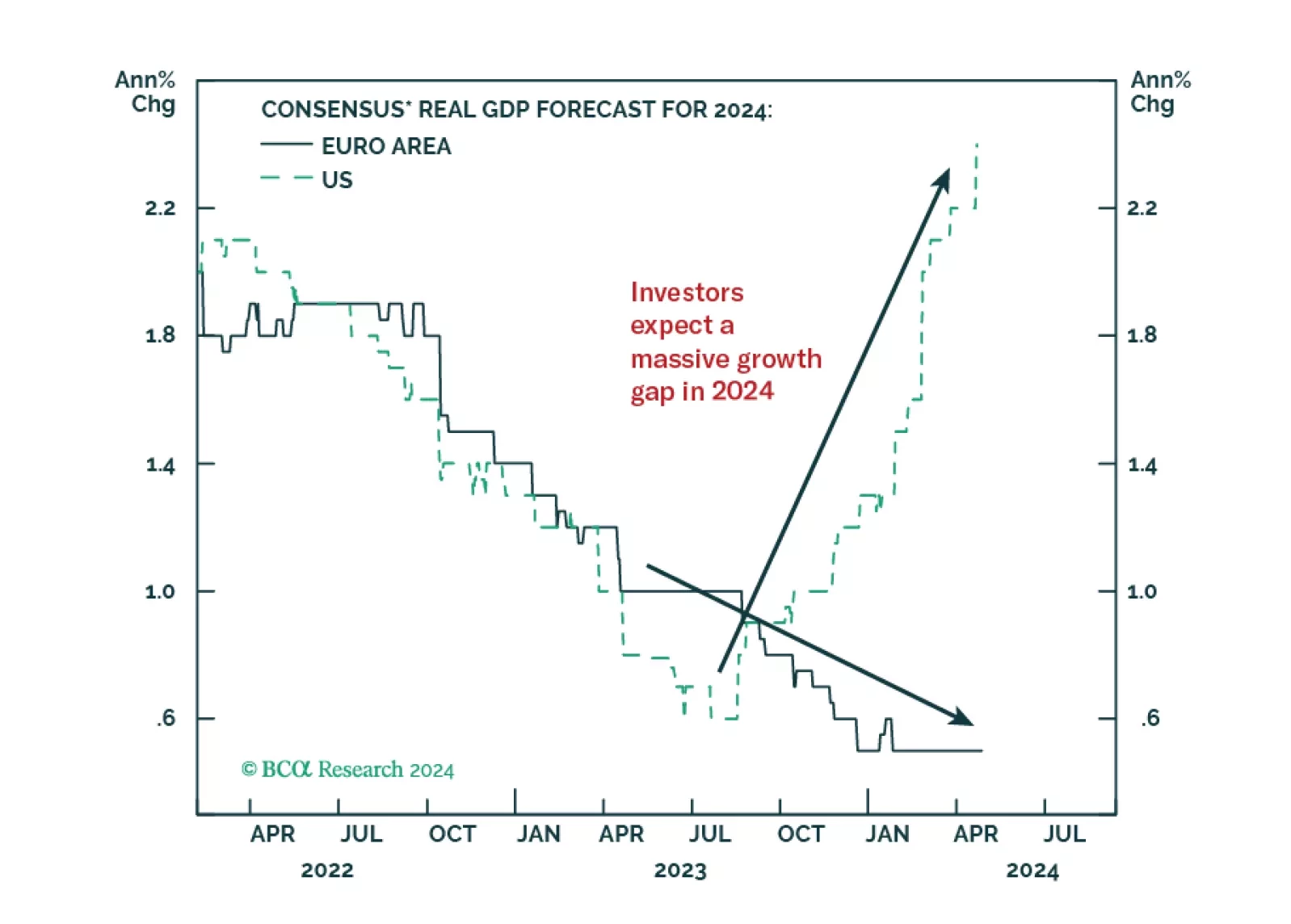

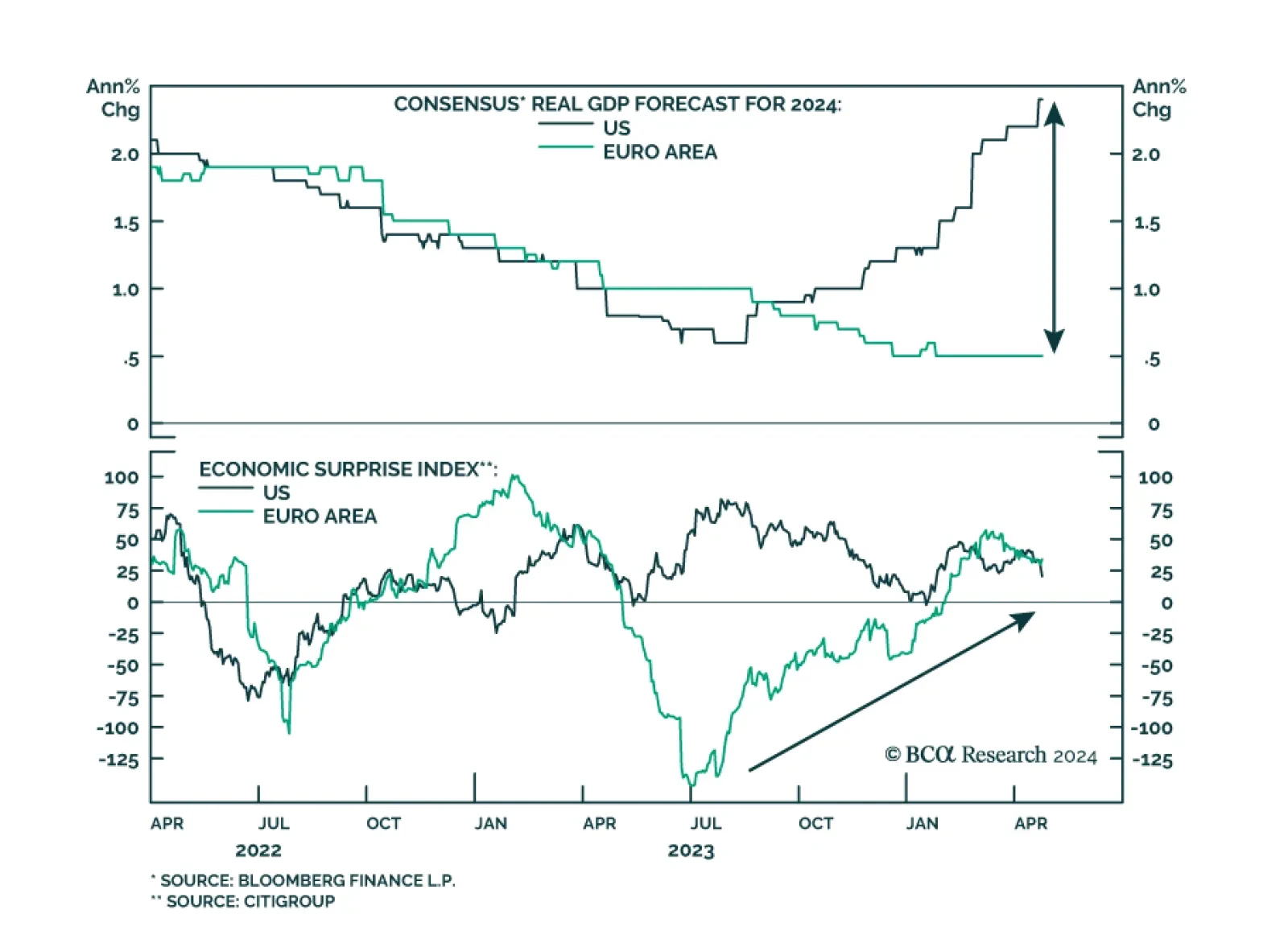

Investors anticipate a record growth gap between the US and the Eurozone in 2024. Does this skewed expectation create market opportunities?

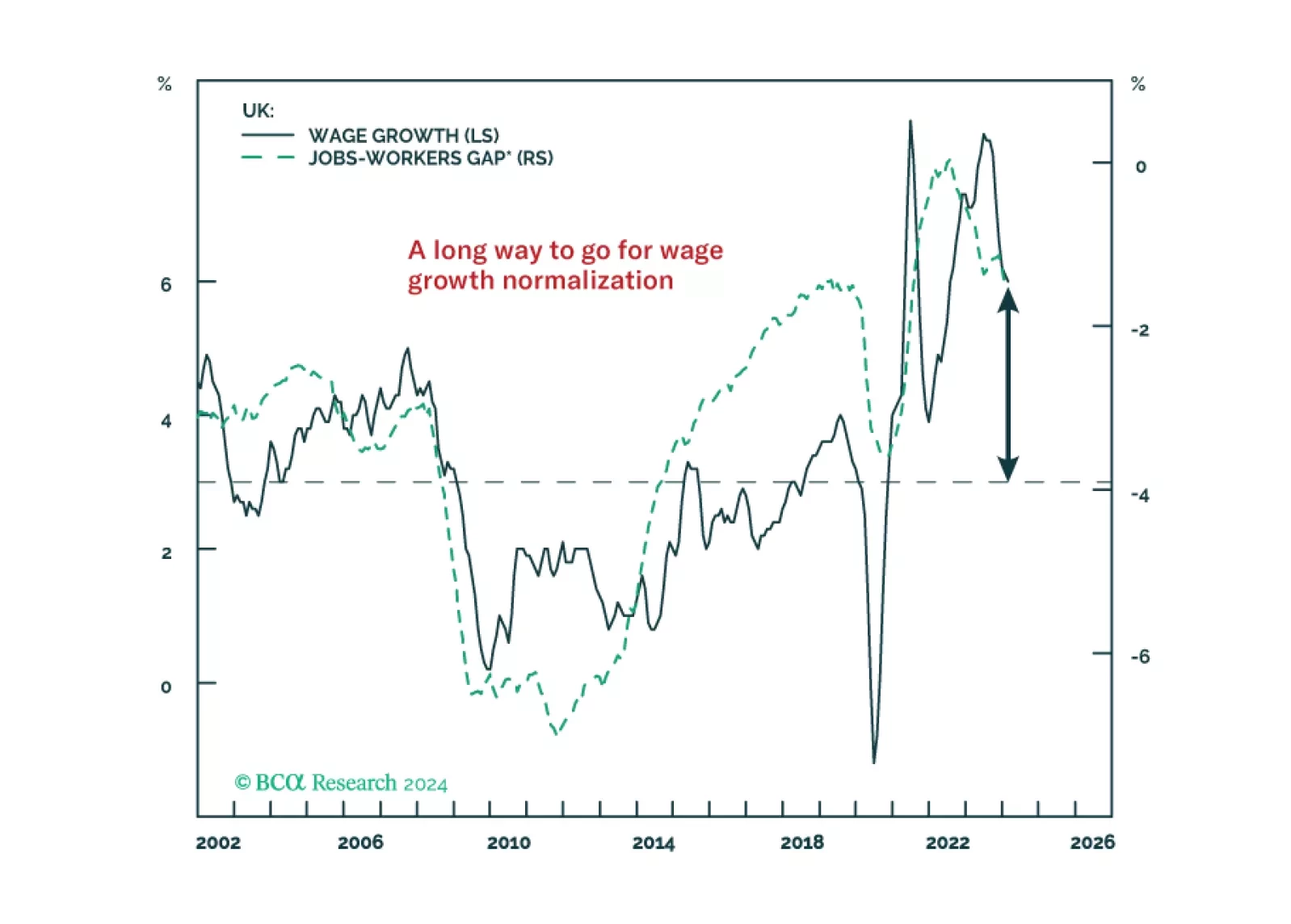

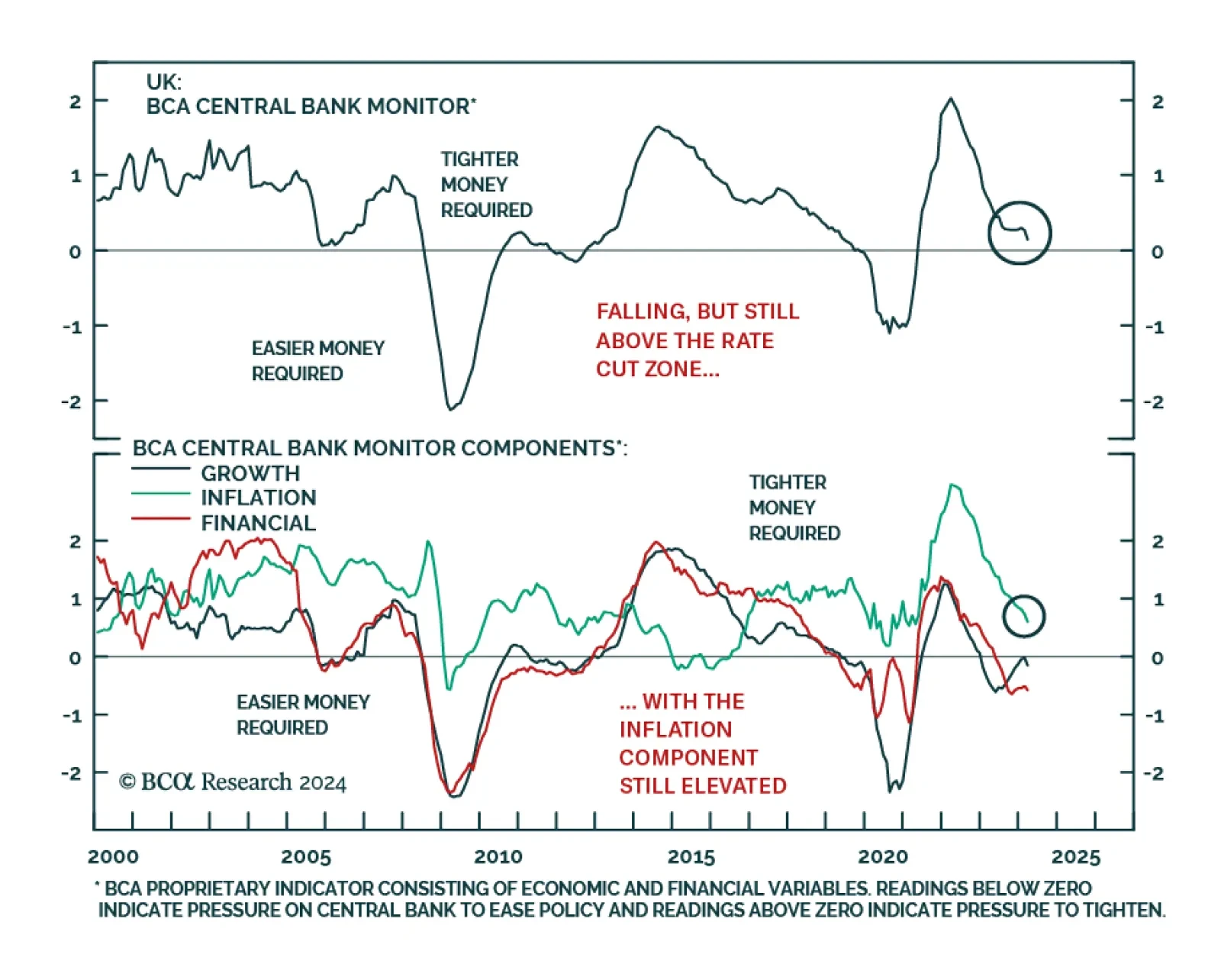

According to BCA Research’s Global Fixed Income Strategy service, a hard landing is the only way to solve the UK inflation problem. Sticky inflation and lingering inflation pressures have made the BoE’s job much…

The resilience of the US economy has led economists to consistently revise up their consensus real GDP growth forecast for 2024, which now stands at 2.4%, up from 0.6% in July 2023. Conversely, the 2024 consensus Eurozone growth…

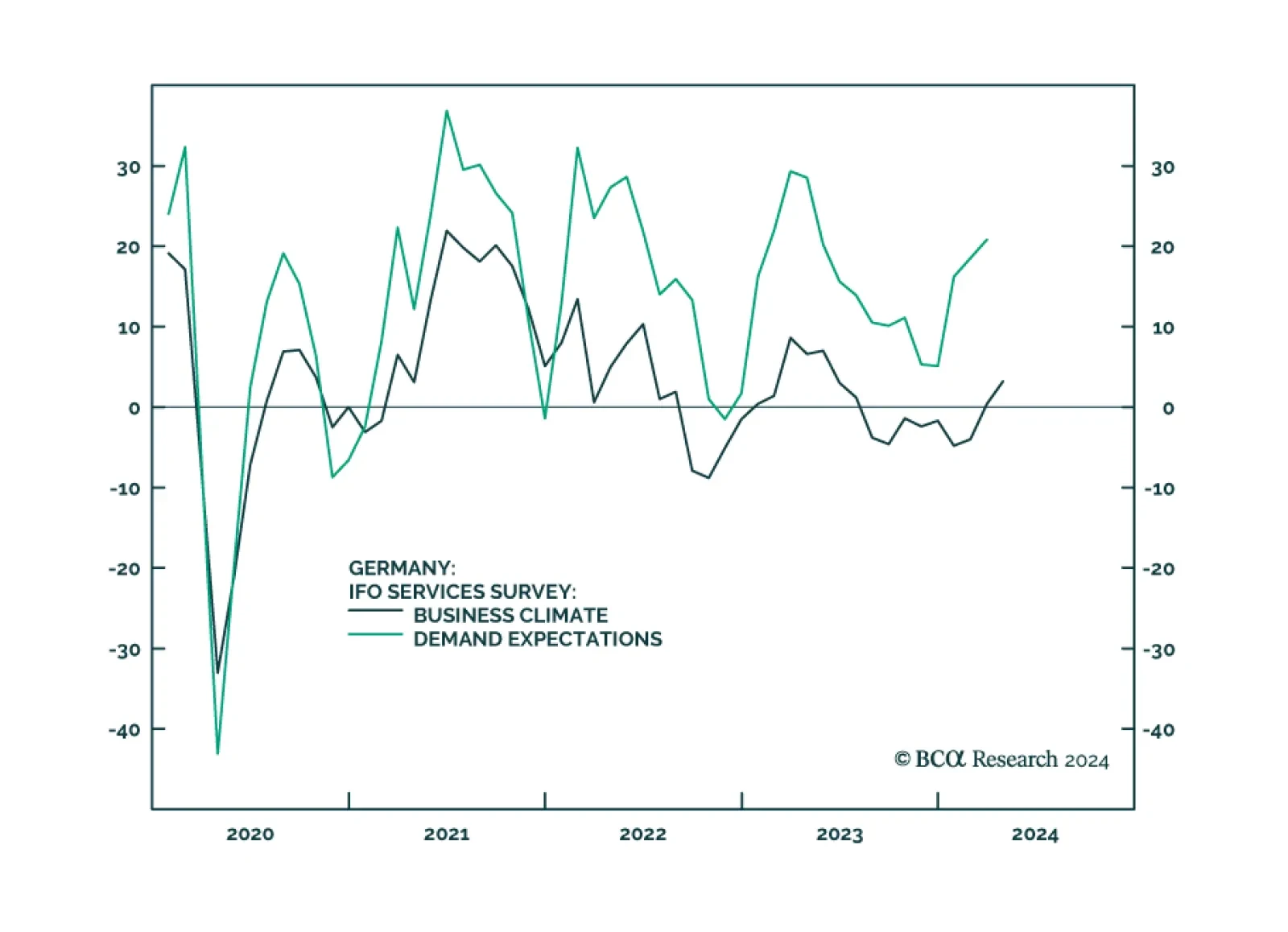

Results of Germany’s IFO business climate survey for April sent a positive message on Tuesday. The overall Business Climate Index increased from 87.9 to 89.4, beating expectations of 88.9. Assessments of both the current…

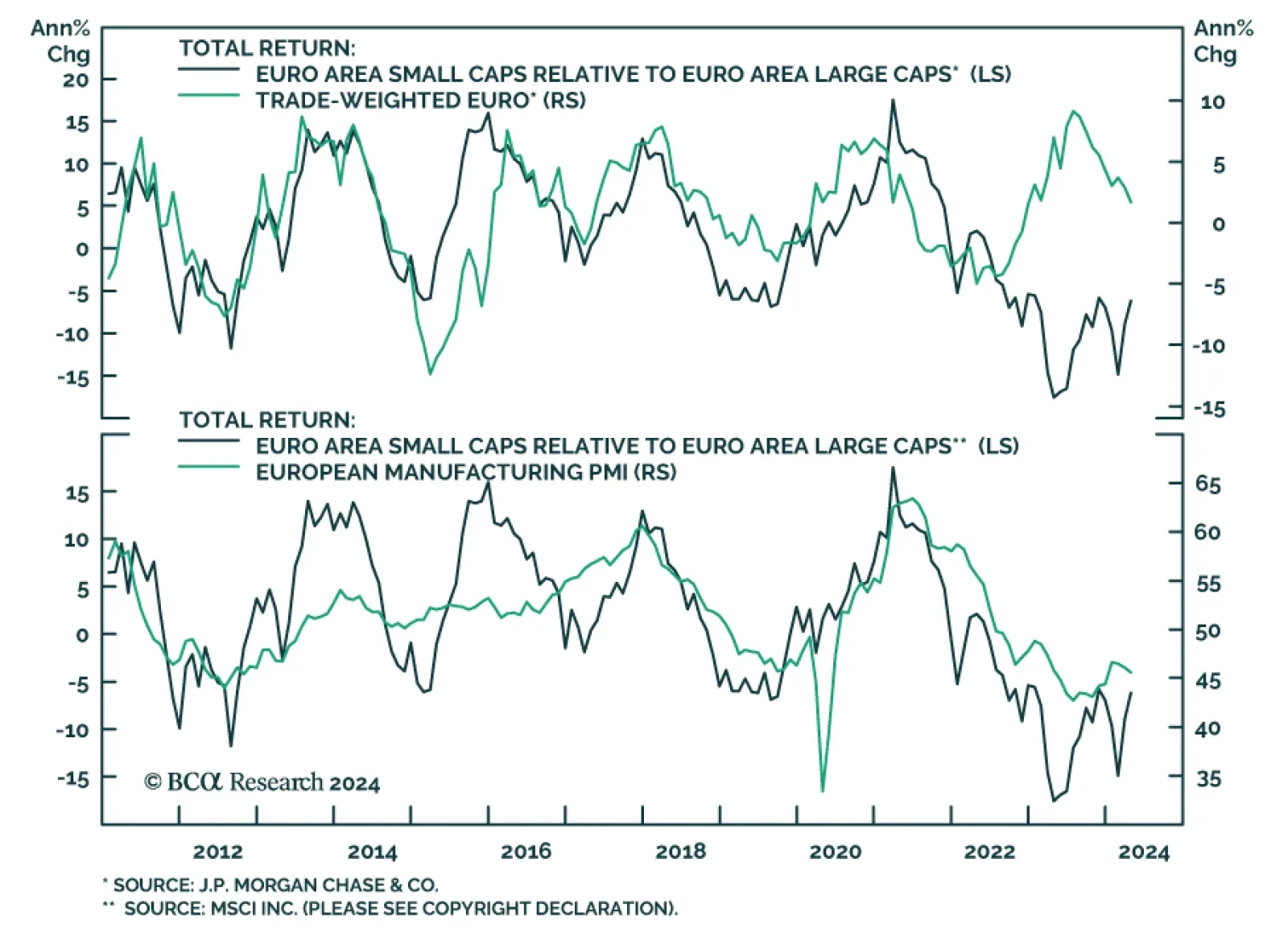

Euro Area small caps typically outperform large caps whenever the trade weighted euro appreciates and underperform whenever it depreciates. The rationale is simple. Most European large cap companies are large multinationals that…

Flash estimates for several European PMIs were released Tuesday. The results for manufacturing activity were somewhat disappointing. The German manufacturing PMI increased from 41.9 to 42.2, but underperformed expectations of…

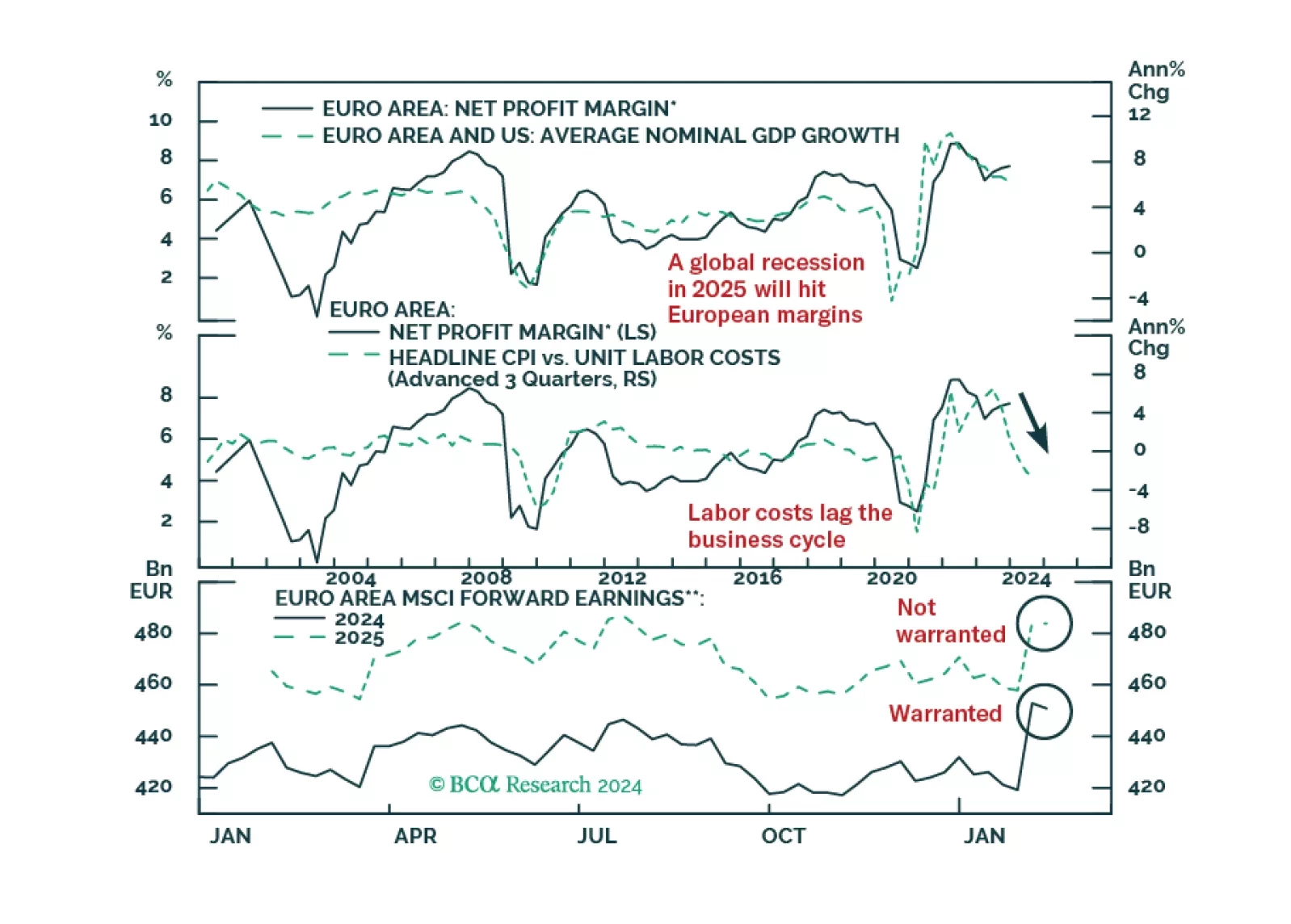

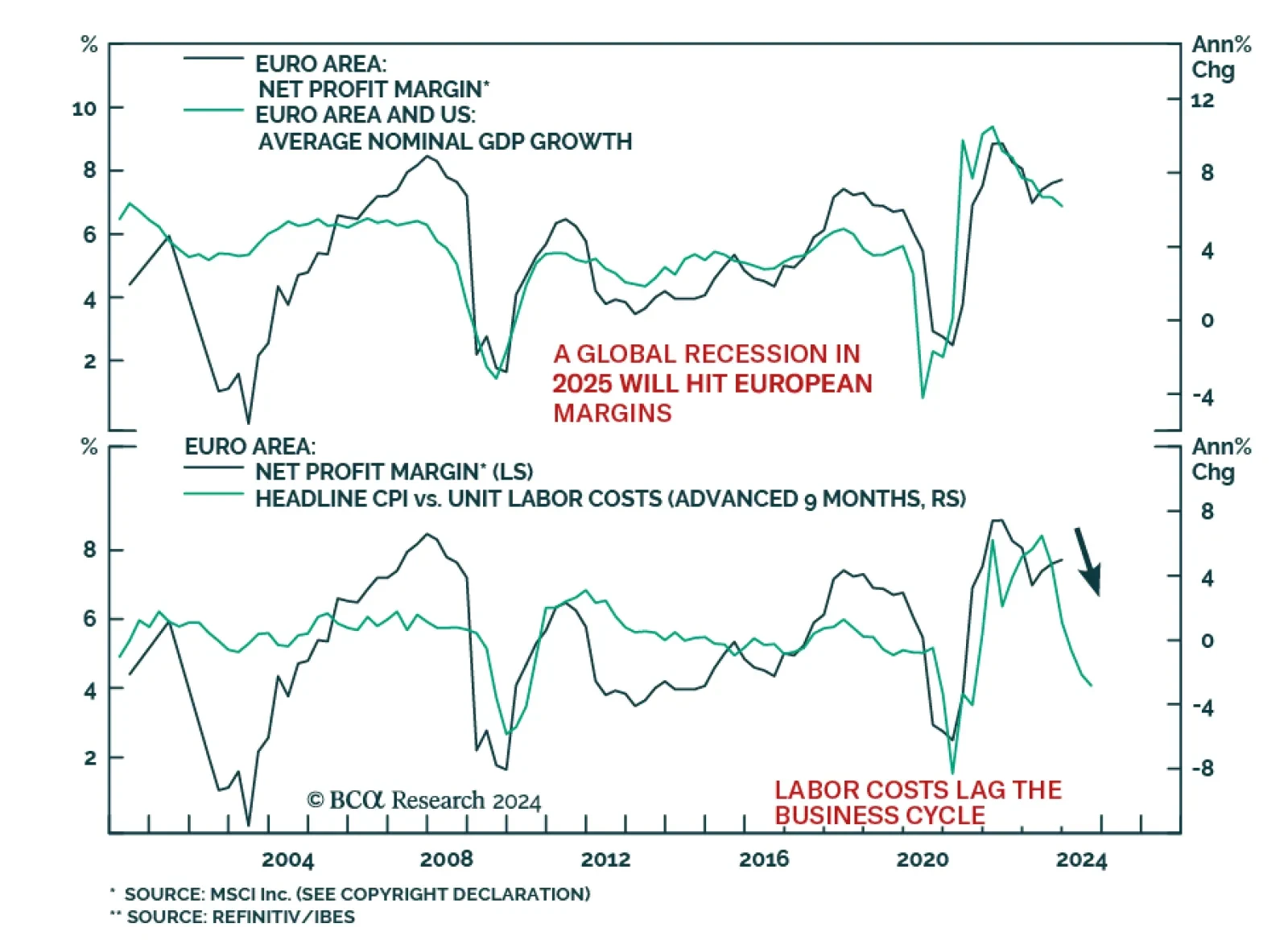

According to BCA Research's European Investment Strategy service, European profit margins have downside because they are both elevated and procyclical. European net margins stand at 7.7% above their long-term average…

European profits margins are elevated. Will a mild recession be enough to bring them down?