Looking at economic activity, global monetary policy seems restrictive, however, the behavior of financial markets tells a different story. What gives?

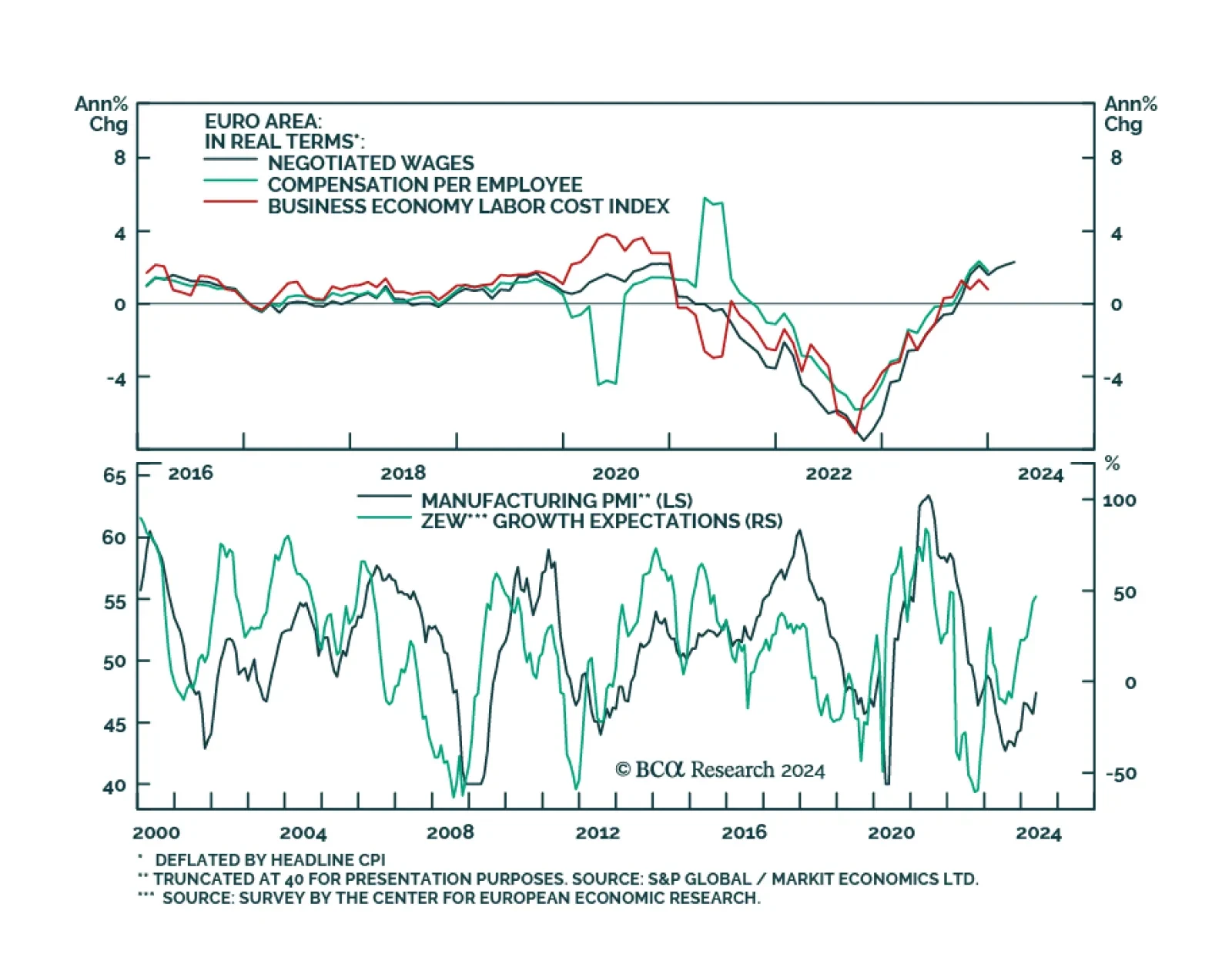

Negotiated wages rose 4.7% y/y in Q1, from 4.5% y/y in Q4 in the Eurozone. Meanwhile, preliminary estimates for the Eurozone Composite PMI surprised to the upside in May. Although wage growth is the main driver of services…

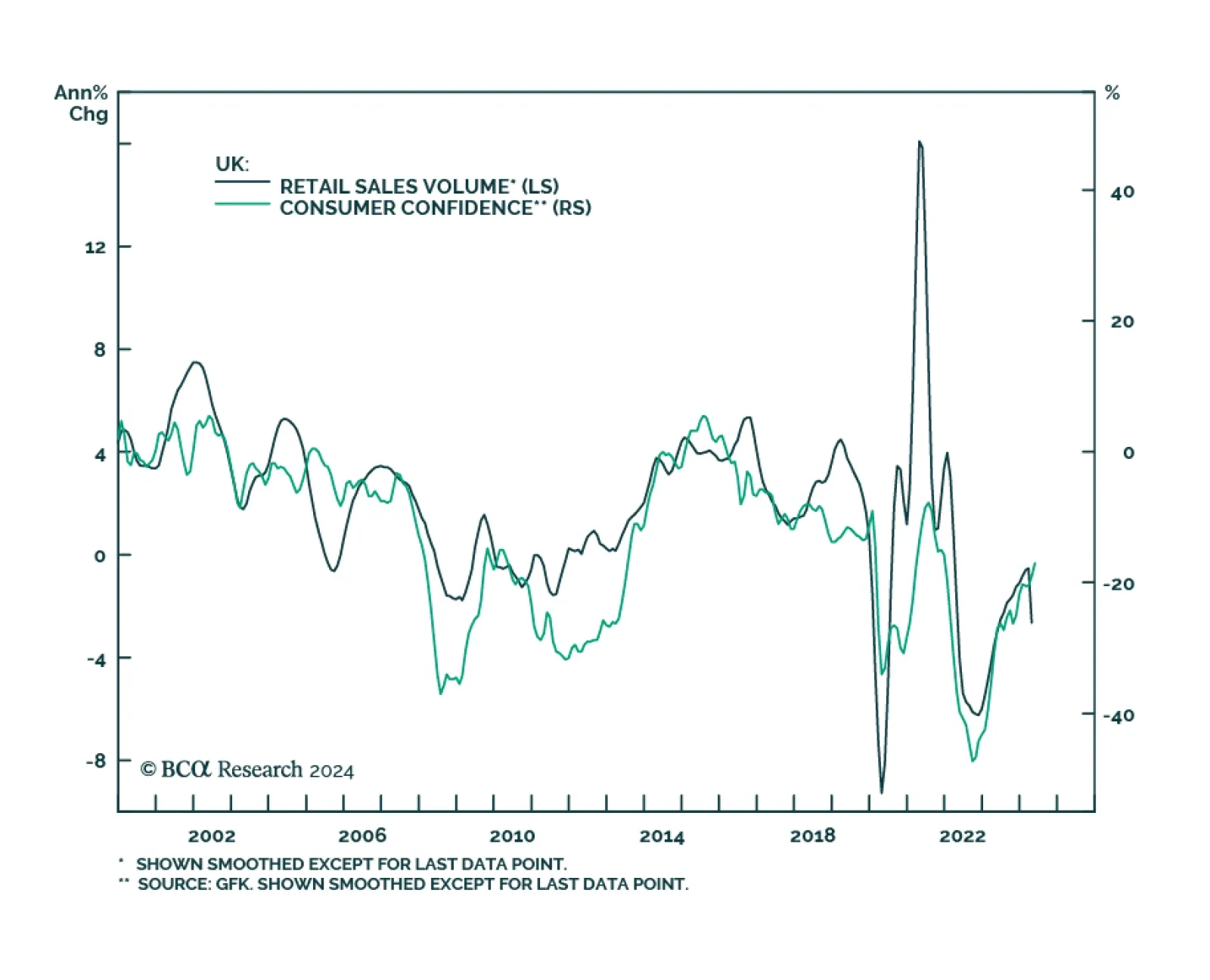

UK retail sales plunged 2.3% m/m in April from a downwardly revised 0.2% m/m contraction in March, significantly undershooting expectations of a 0.5% m/m decline. Household goods as well as clothing and footwear stores led the…

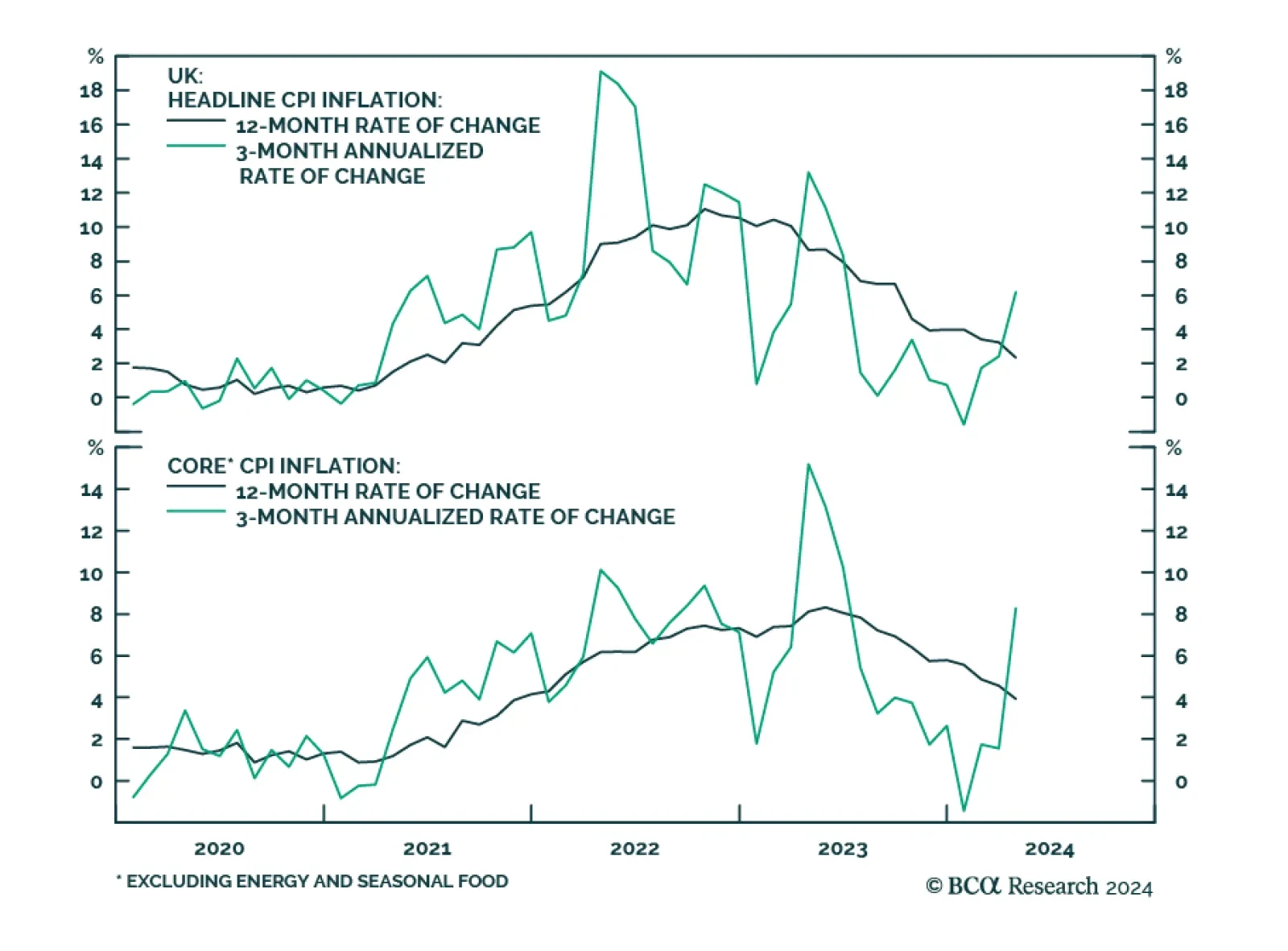

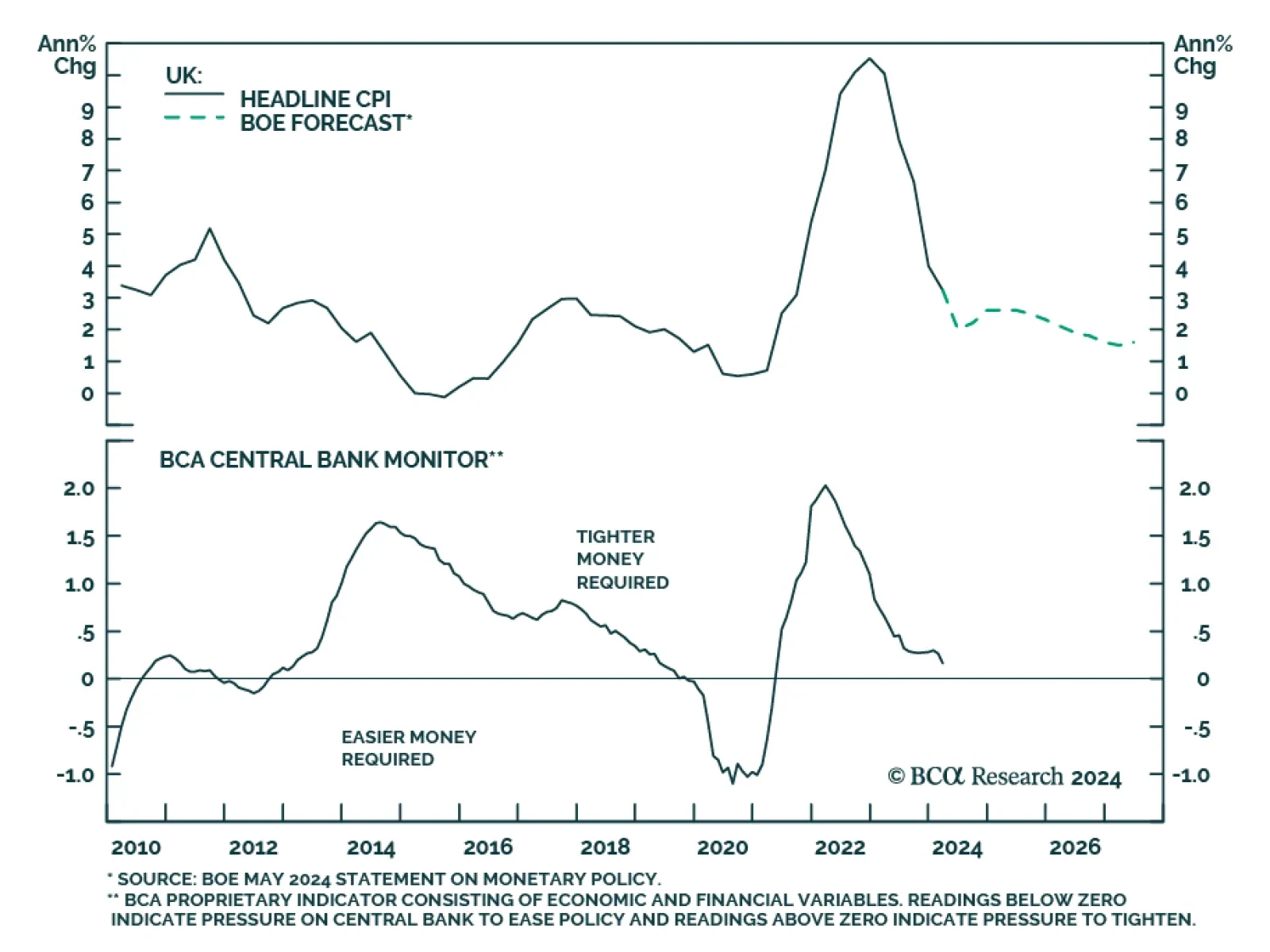

The UK CPI release surprised markets to the upside across the board on Wednesday. Headline CPI increased 2.3% year-on-year, above expectations of 2.1%. Core surprised to the upside as well, moderating from 4.2% to 3.9%y/y, less…

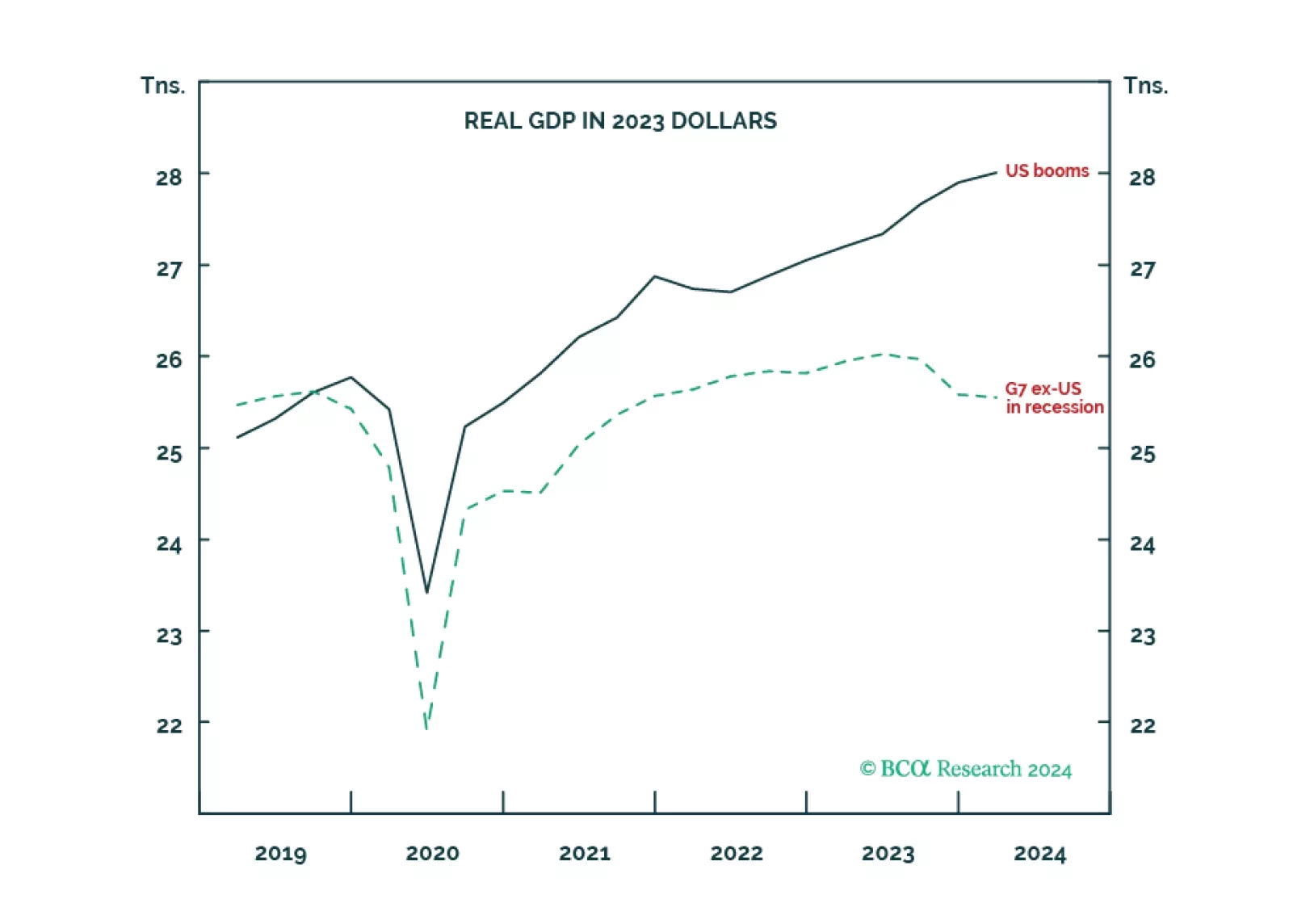

The economic schism in the world economy, between the non-US developed economy in recession and the US in strong growth, is unprecedented during our lifetimes. Now the schism will continue in reverse, as the non-US developed economy…

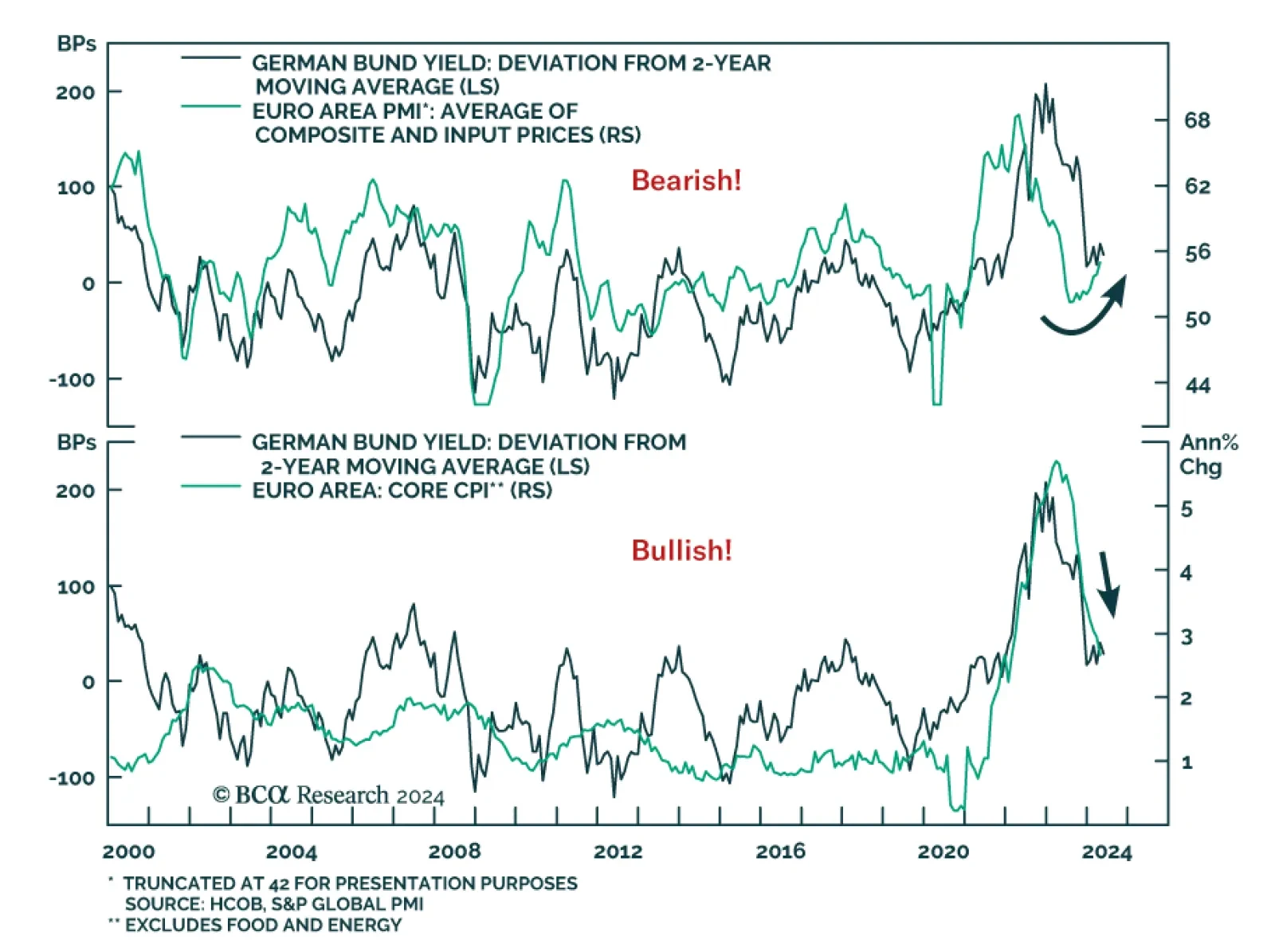

According to BCA Research’s European Investment Strategy service, the domestic picture indicates that Bund yields will stay rangebound over the next few months due to the tug-of-war between bond bullish and bond bearish…

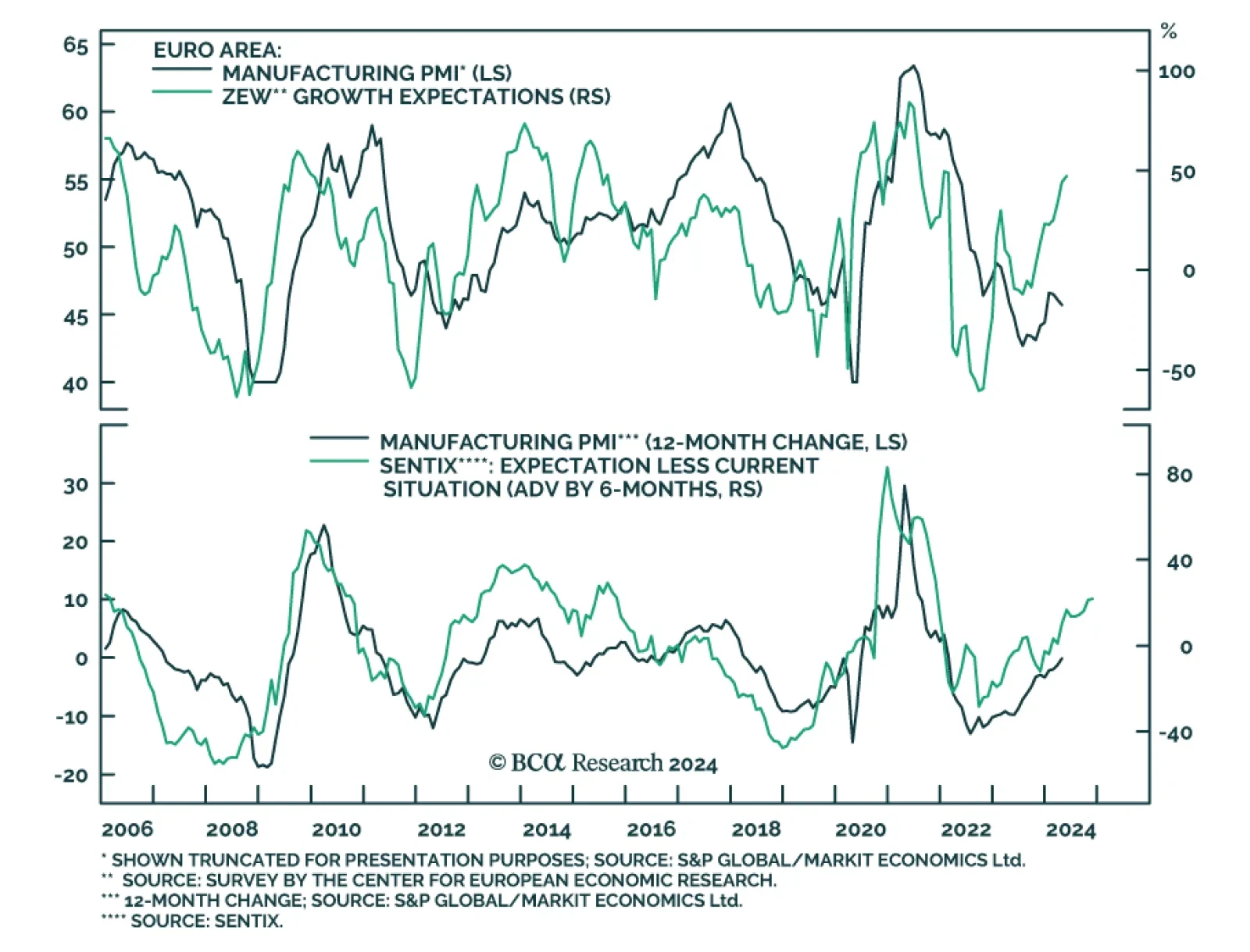

Investor and business sentiment continues to improve in the Eurozone. The ZEW Expectations series for the Eurozone (+3.1 to 47 in May) and Germany (+4.2 to 47.1, above expectations) strengthened to 27-month highs. Moreover, the…

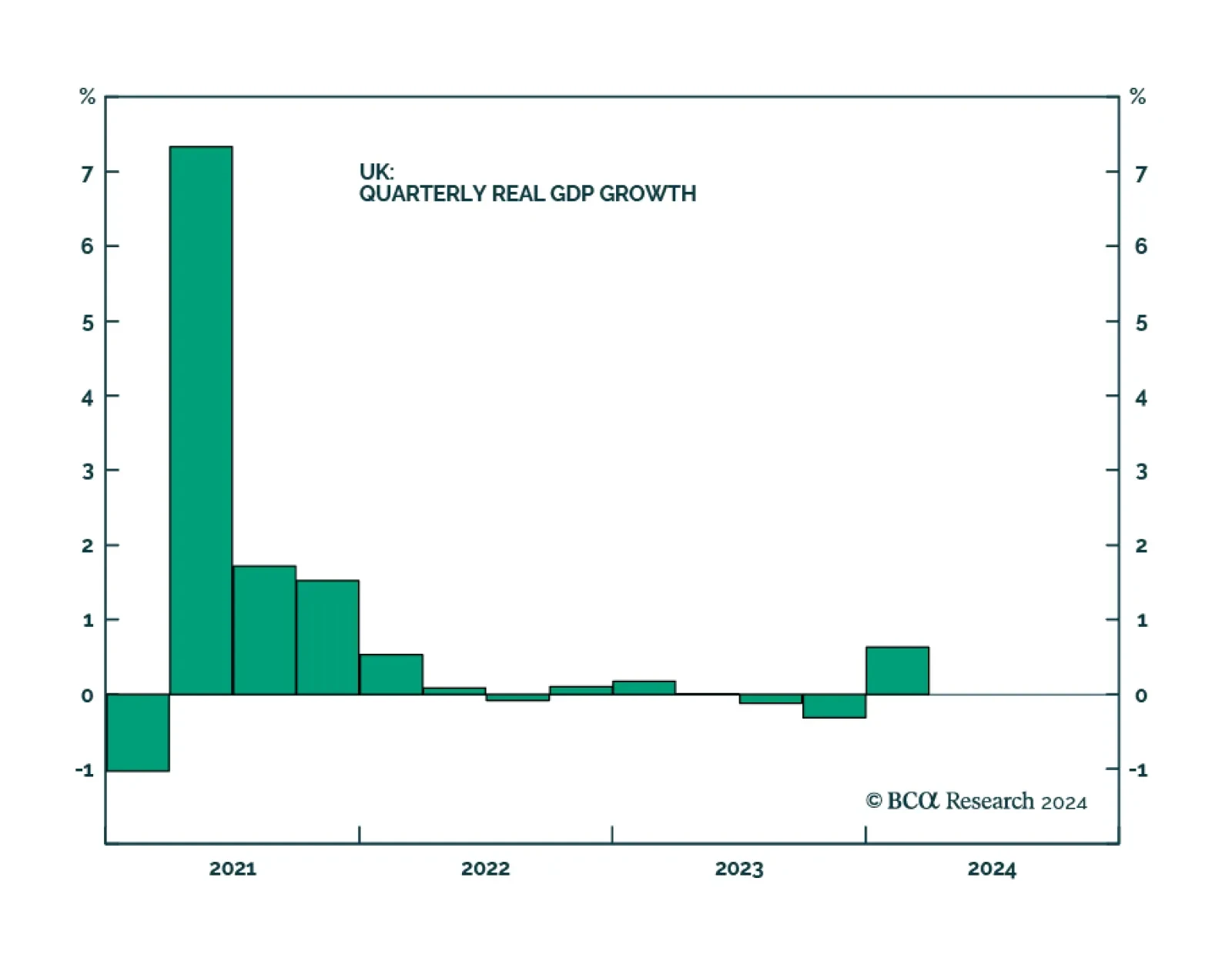

Preliminary GDP estimates suggest that the UK economy started growing again in Q1, thus exiting a technical recession in the past two quarters. Q1 growth came in at 0.6%, improving from a 0.3% contraction last quarter,…

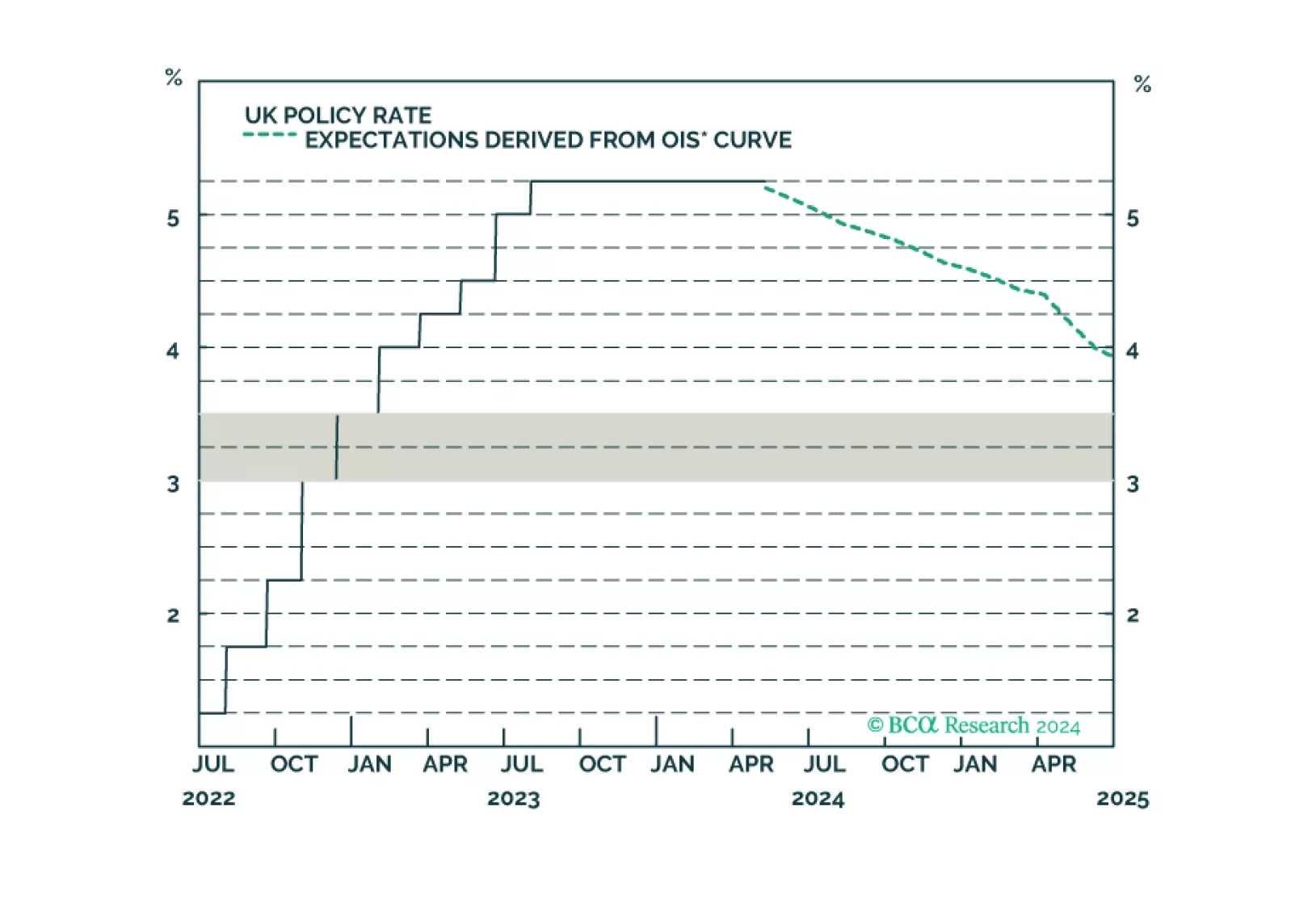

In a widely expected move, the Bank of England (BoE) maintained its policy rate at 5.25% in May. Nevertheless, two Committee Members voted in favor of cutting rates, one more than was anticipated. The tone of the report was…

An update to our views on UK rates and currency following today’s Bank of England meeting.