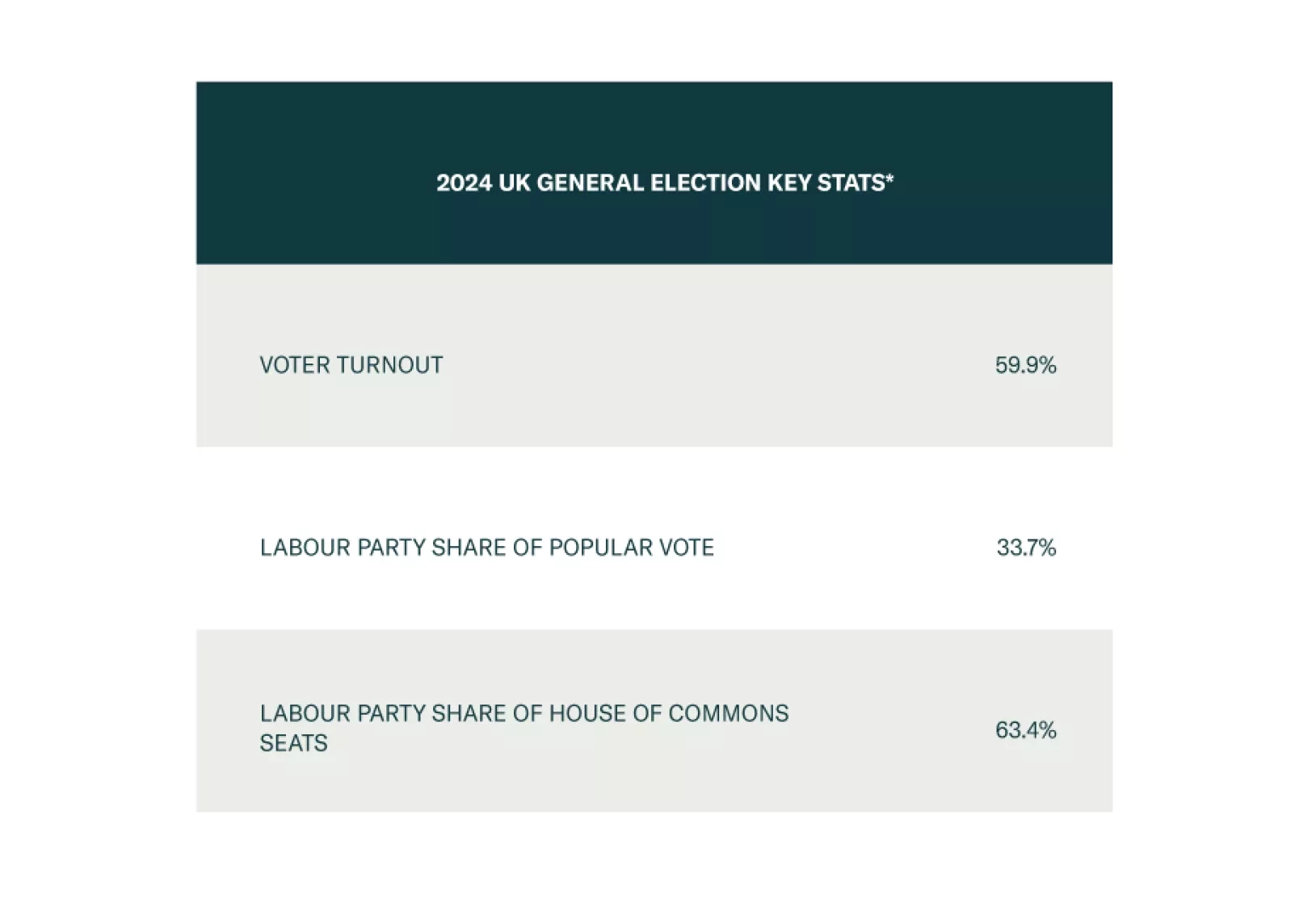

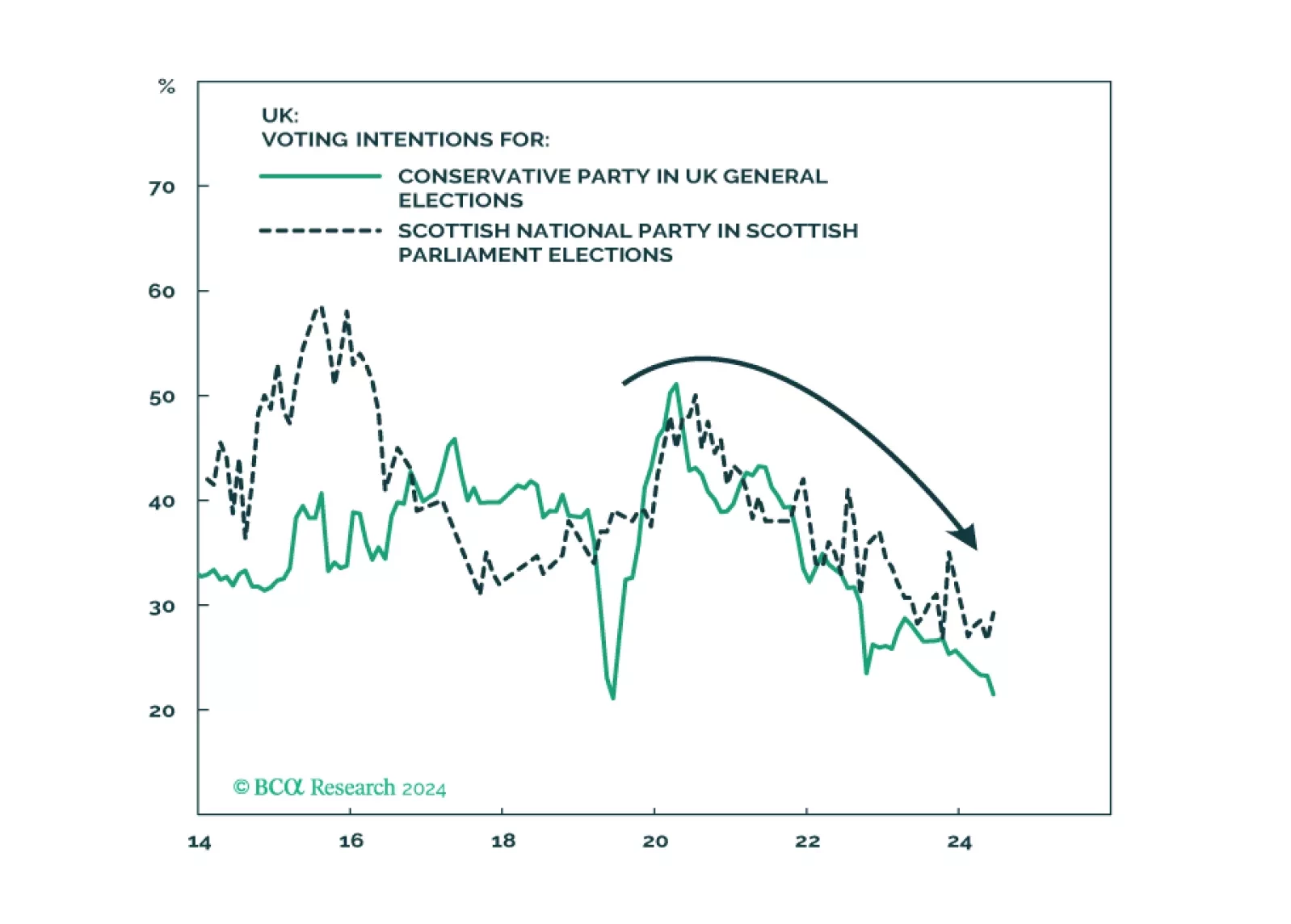

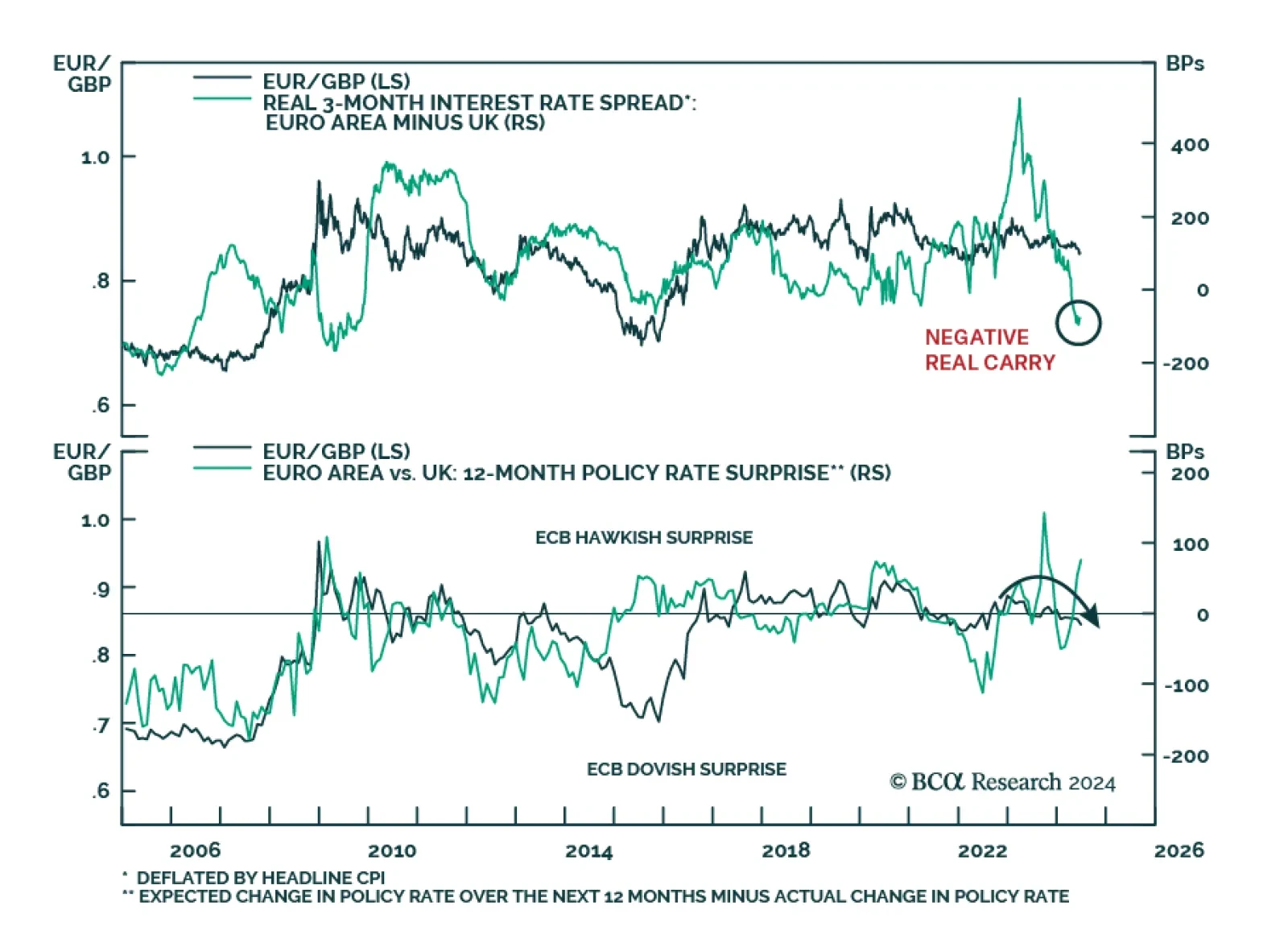

The new Labour government will have flexibility to respond to macro shocks, which is positive for the UK in general, namely GBP-EUR, and also gilts in absolute terms. But over the long run, tax hikes will likely surprise to the…

Does the incipient slowdown in European data herald a soft landing and a goldilocks period for equities? We have our doubts.

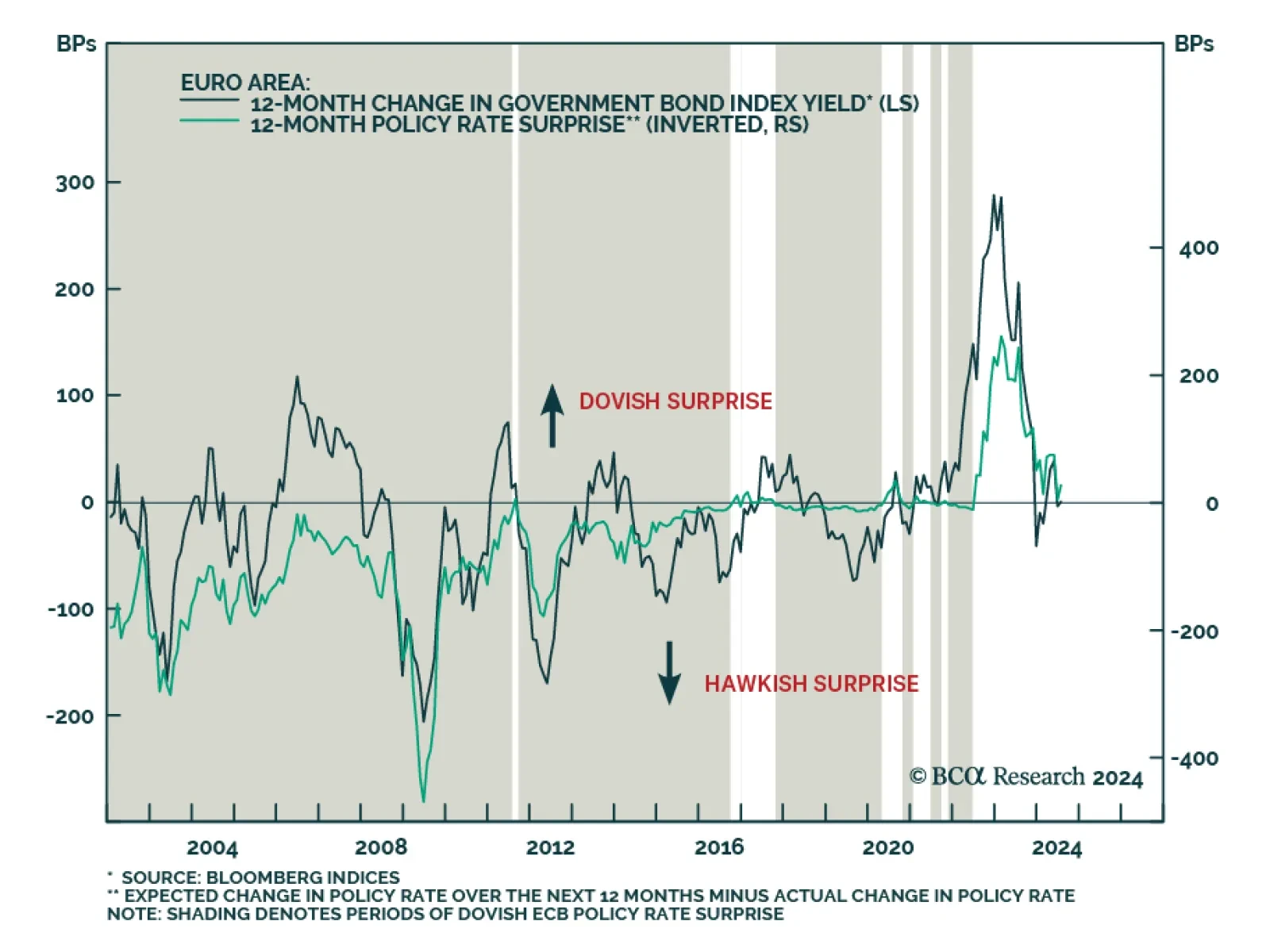

Eurozone headline inflation slowed from 2.6% y/y to 2.5% in June. Germany, its largest economy, saw price pressures ease from 2.4% to 2.2%, below expectations of 2.3% (or from 2.8% to 2.5% on an EU-Harmonized basis). However,…

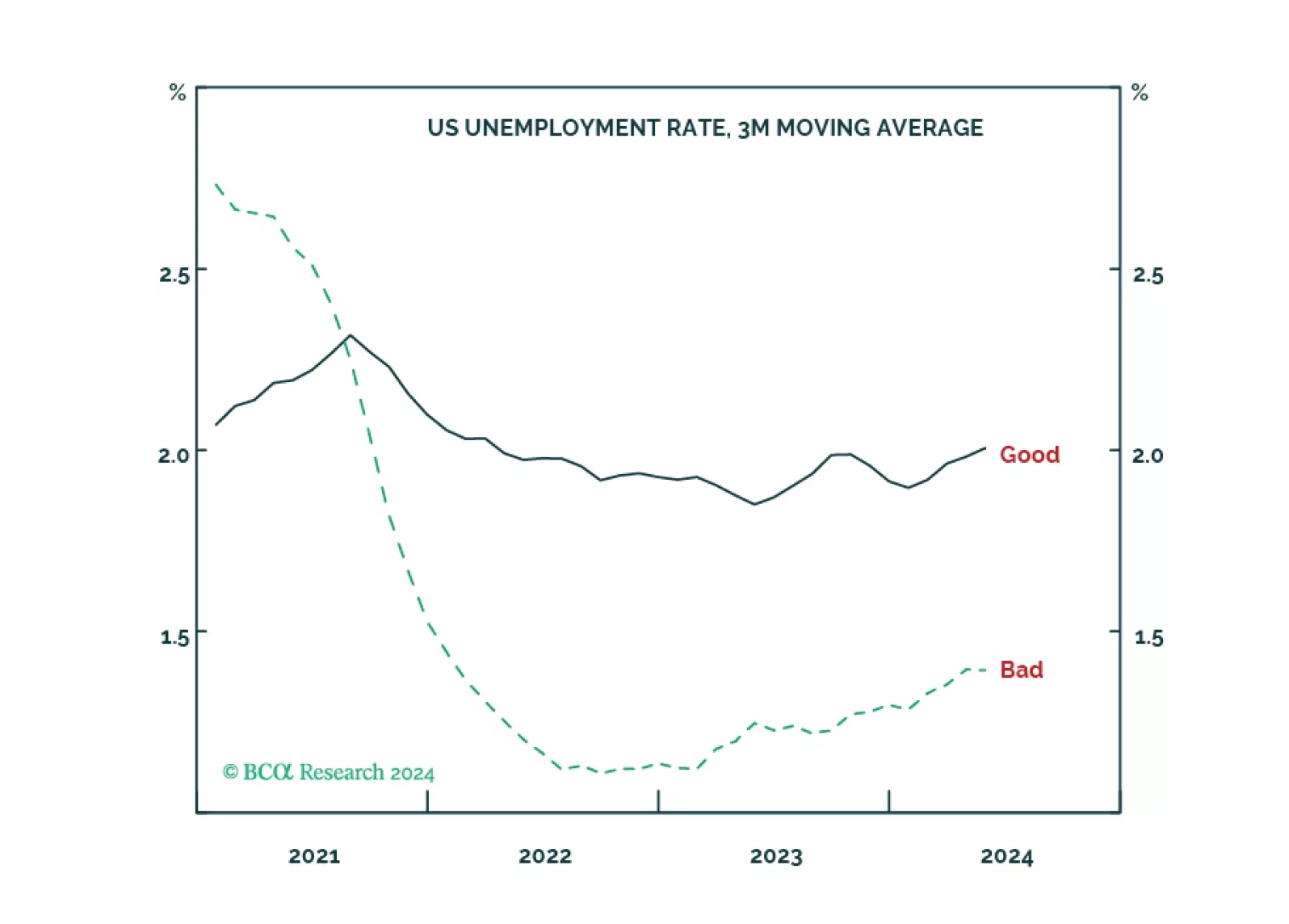

We explain how to distinguish between ‘good’, ‘bad’ and ‘ugly’ unemployment, why bad unemployment is a much better gauge of the jobs market than headline unemployment, and what this means for the tactical positioning in bonds and…

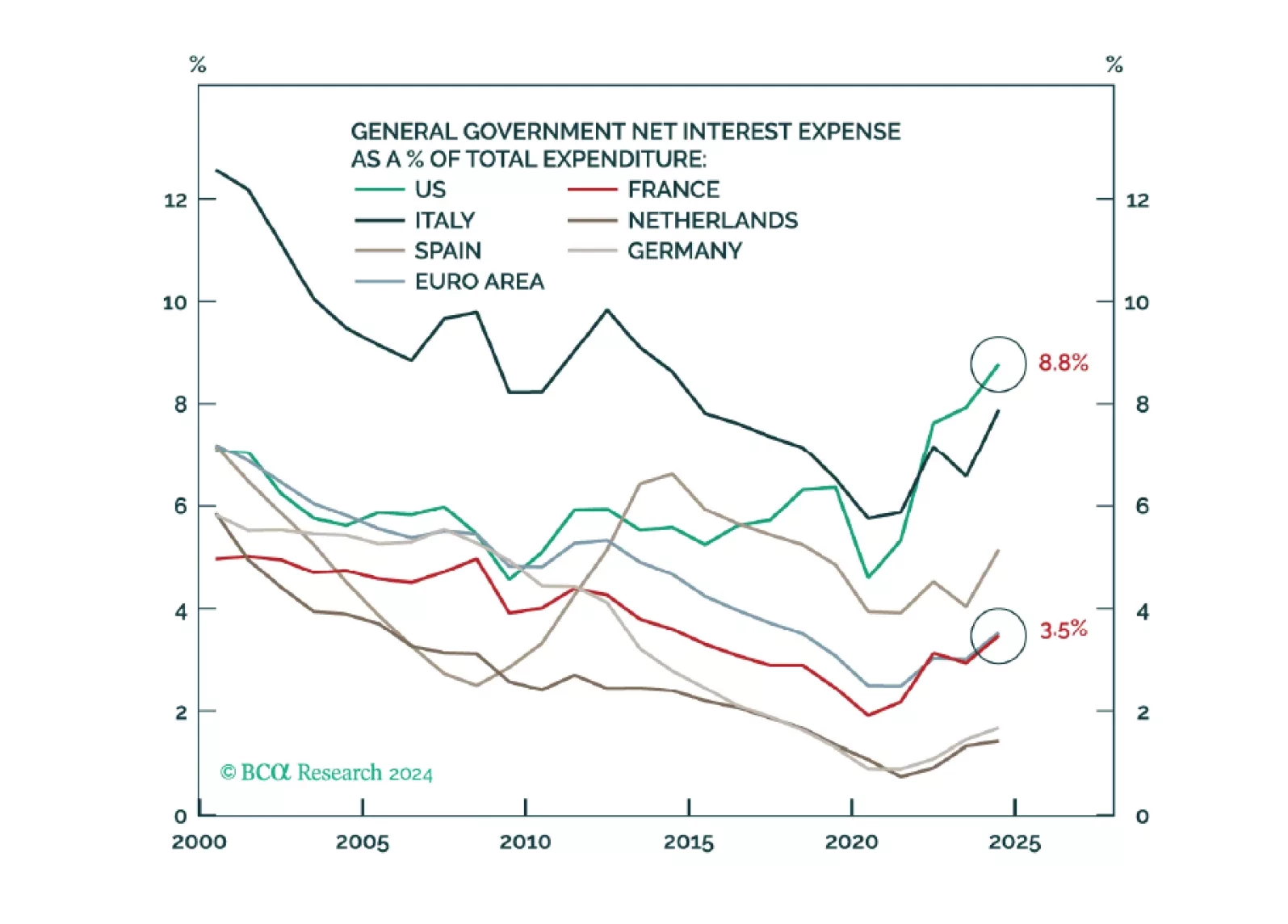

In our Volume I – The Alpha Report – we posit that the French bond market reaction is a mere amuse bouche for what is coming to the US. All year, we have warned investors that US politics could induce a bond market riot. This moment…

Concerns about the global economy have shifted from sticky inflation to faltering growth. Tight monetary policy is finally starting to bite. We suggest increasing portfolio defensiveness.

In Section I, we examine some concerning signs of US economic weakness that emerged in June. We also discuss portfolio positioning in the face of falling interest rates and cross-check our recommended US equity overweight in the face…

The consensus soft-landing narrative is wrong. The US will fall into a recession in late 2024 or early 2025. We were tactically bullish on stocks most of last year, turned neutral earlier this year, and are going underweight today.…

According to BCA Research’s European Investment Strategy service, the BoE will start cutting rates in September, but the pace of subsequent rate cuts will be modest until a recession engulfs Western economies in early 2025…