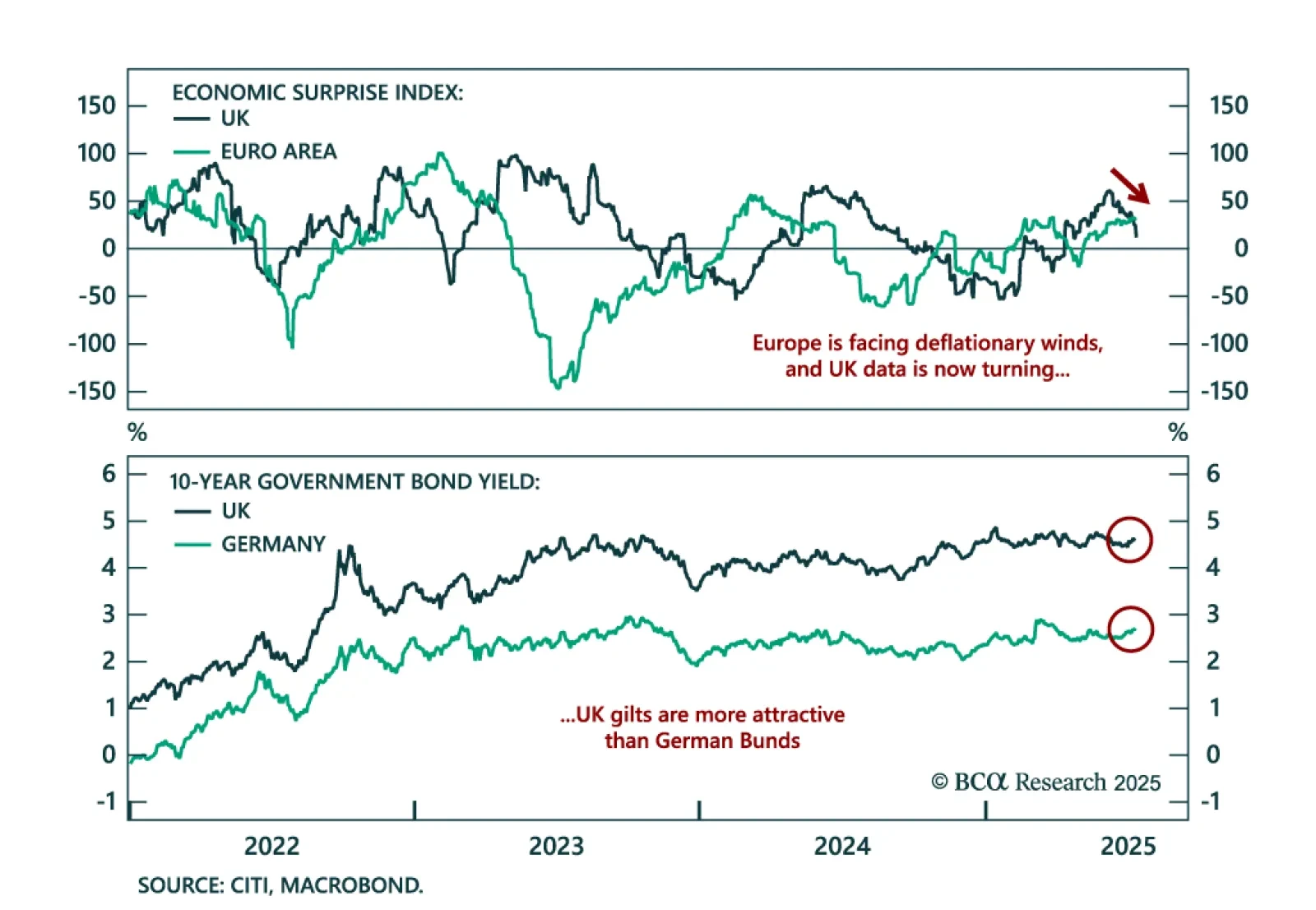

UK growth data continues to disappoint, making the case for a Gilts overweight and a dovish BoE. May GDP fell 0.1% m/m, missing estimates and marking a consecutive monthly contraction after April’s 0.3% decline. Industrial and…

In this chartbook, we look at the balance of payments across DM and EM countries. The US does not fare well, but neither do a few other countries.

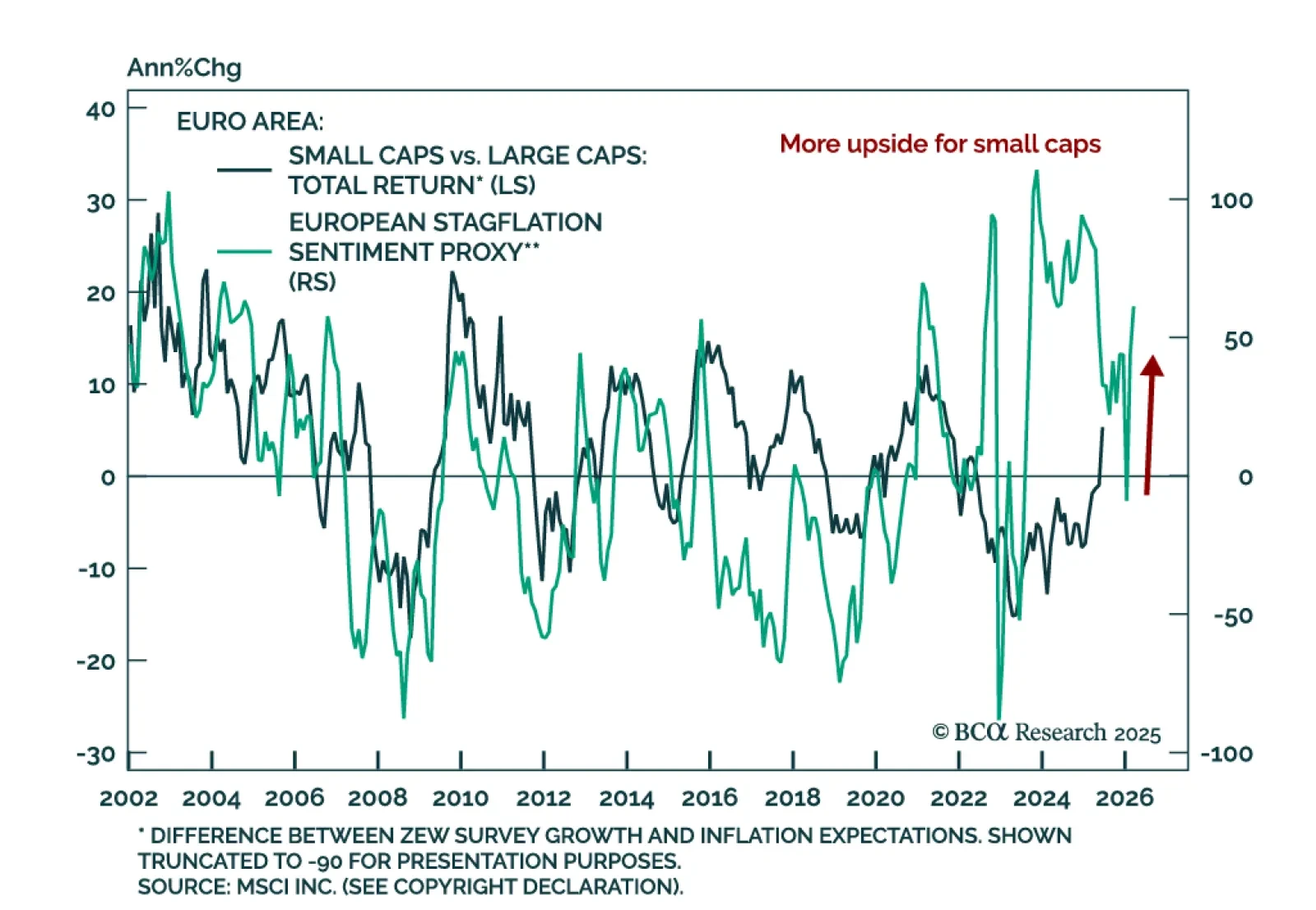

Our European Investment strategists upgrade small caps to maximum overweight, citing improving margins, supportive macro trends, and attractive valuations. They expect small caps to continue outperforming large caps over the next 12…

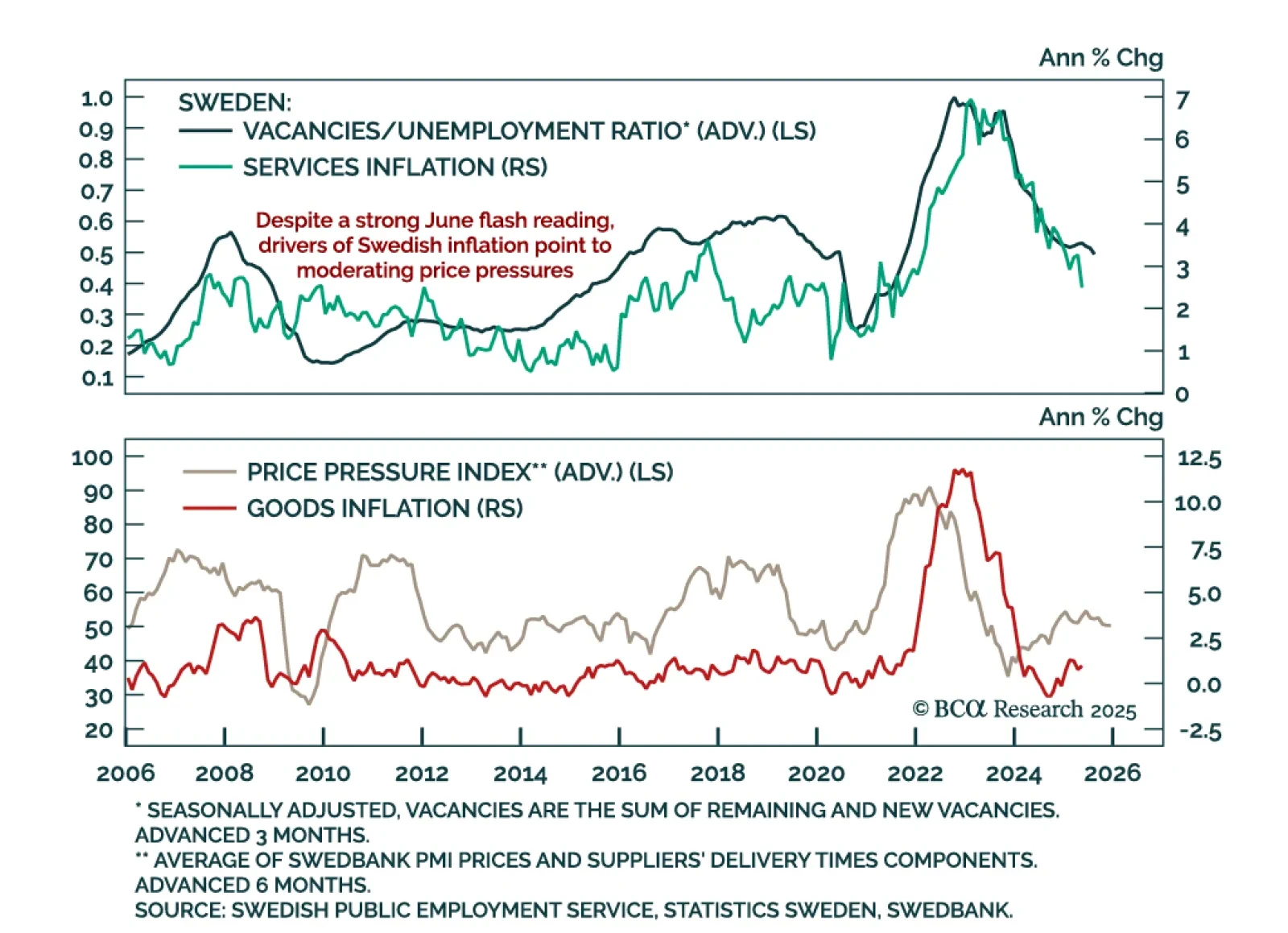

Stronger-than-expected June inflation will likely keep the Riksbank on hold in August, despite soft underlying trends. Headline inflation accelerated more than expected to 0.5% m/m (0.8% y/y), while CPI ex-housing rose to 2.9% y/y…

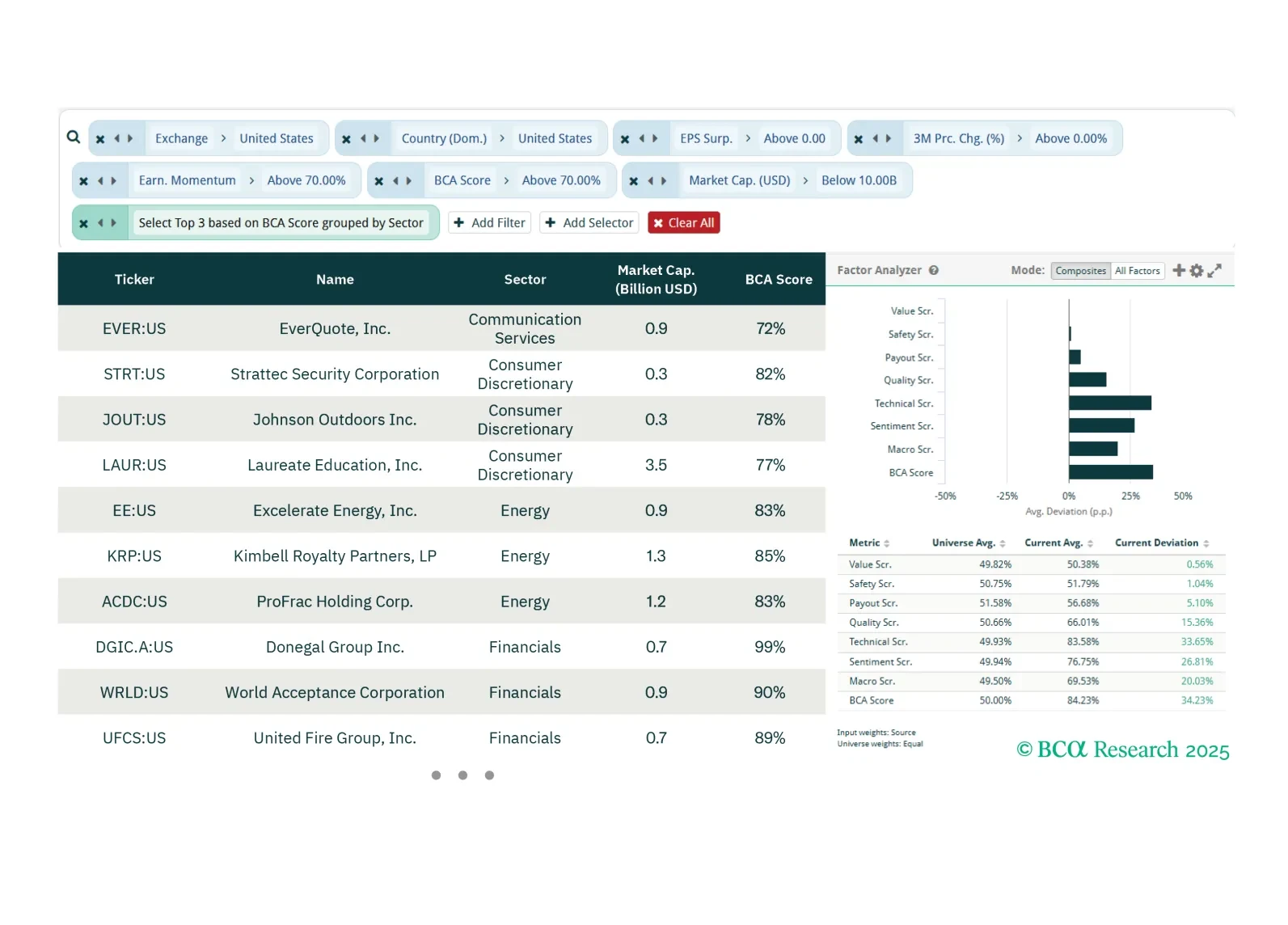

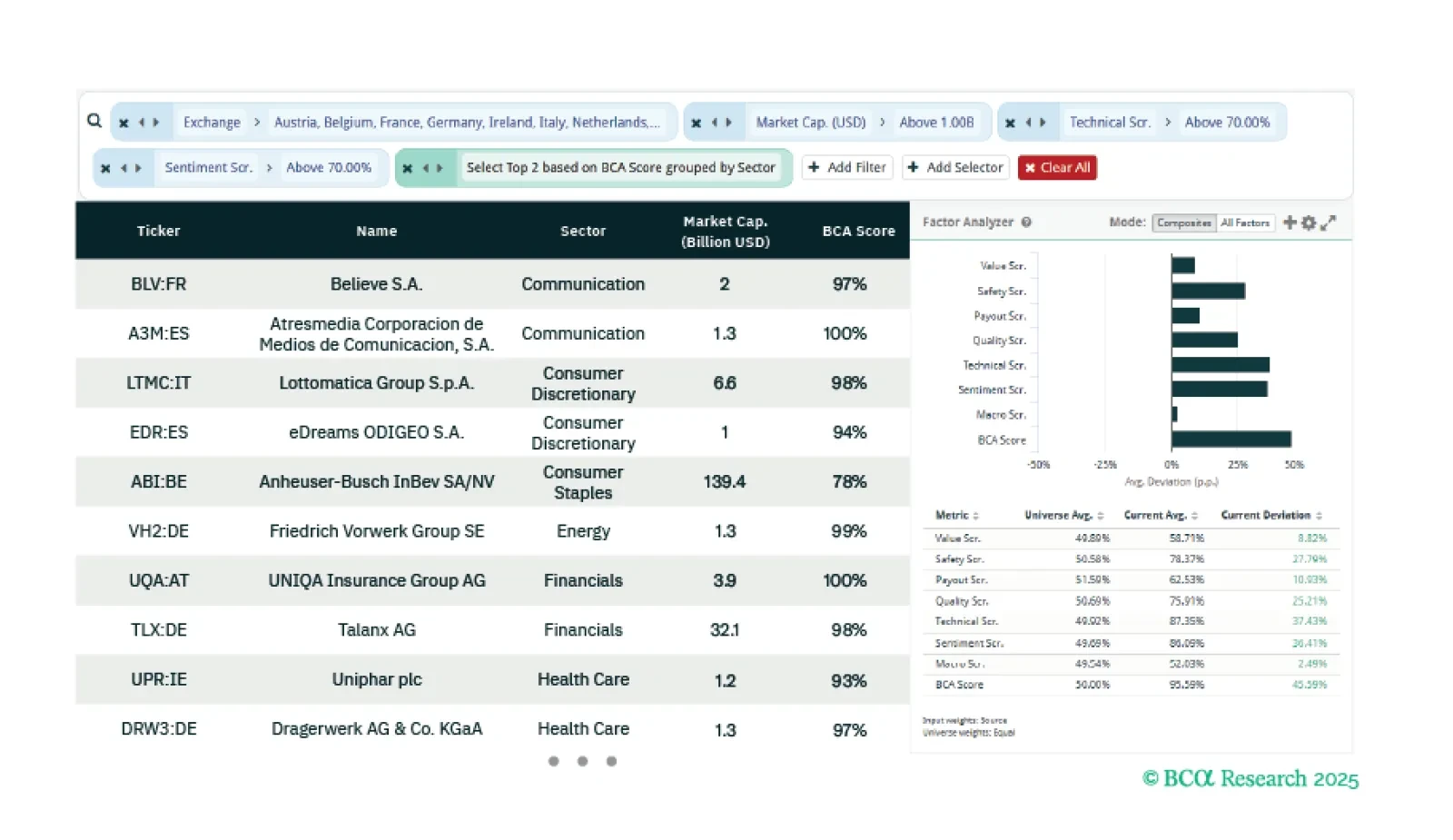

This week our three screeners identify stocks that are likely to keep delivering deliver earnings surprises in the US, European small caps that are high quality and mean reverting, and Japanese large caps picks across GICS 1 sectors…

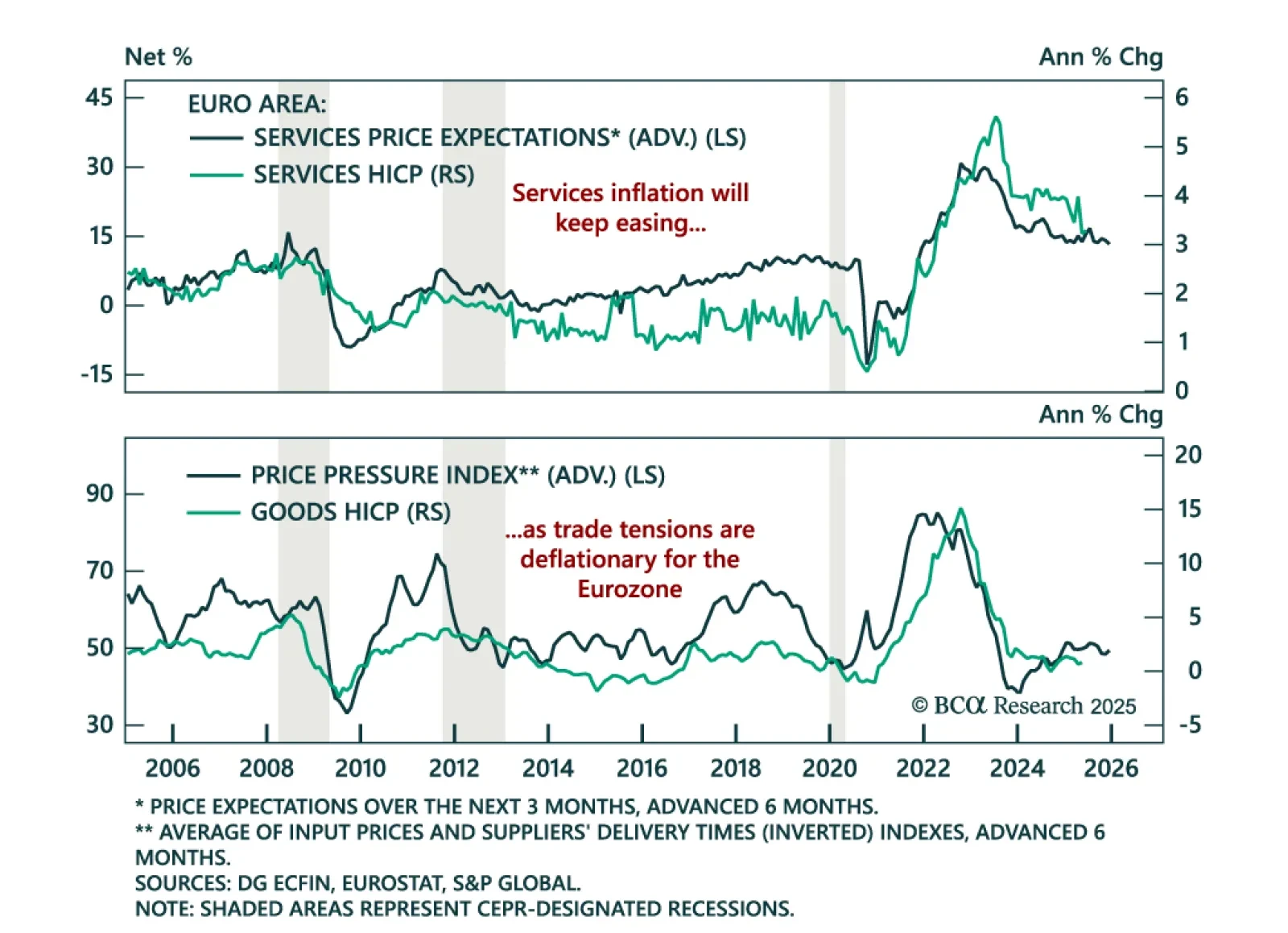

June Eurozone inflation data and soft growth backdrop support further ECB easing and reinforce the case for long European bond exposure. Flash HICP inflation ticked up to 2.0% y/y from 1.9%, while core inflation held steady at 2.3%,…

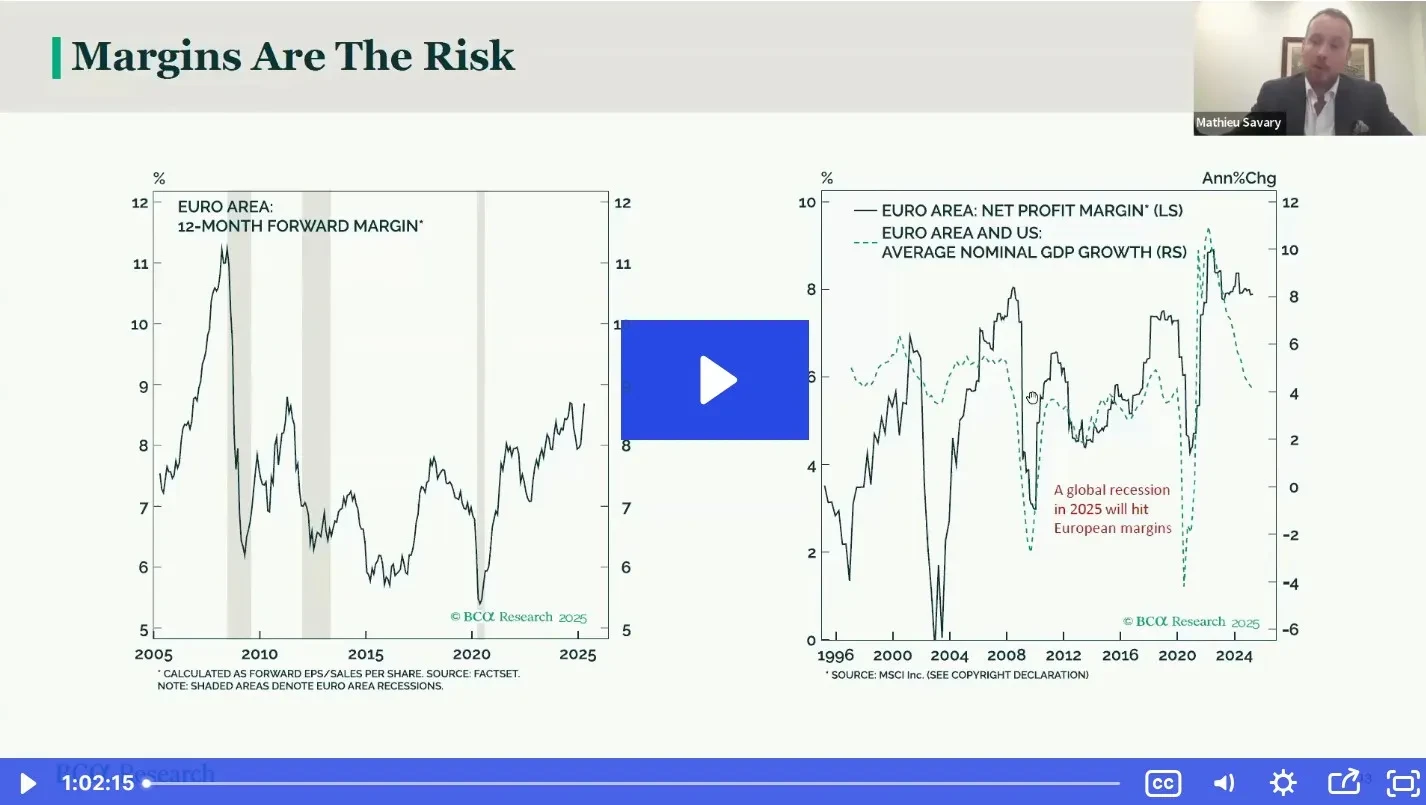

The European economy is losing altitude; and the second half of 2025 could get bumpier.

Join Mathieu Savary and Jérémie Peloso for our European Investment Strategy Webcast as we break down the key drivers shaping the outlook for…

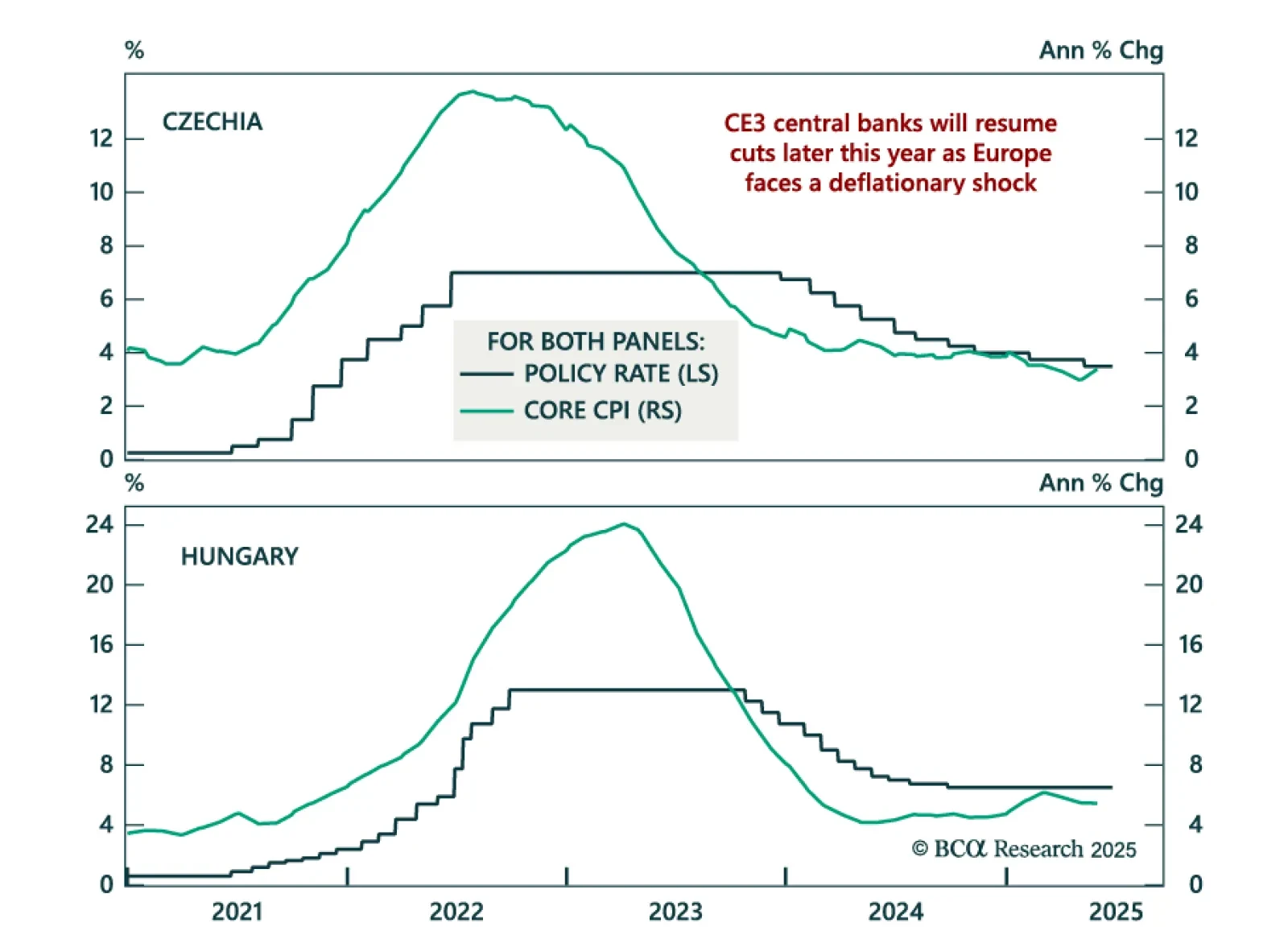

Deflationary pressures and weak core Europe growth support CE3 bond longs as rate cuts loom. The Czech and Hungarian central banks held rates steady at 3.5% and 6.5% this week, following Poland’s earlier decision to keep rates…

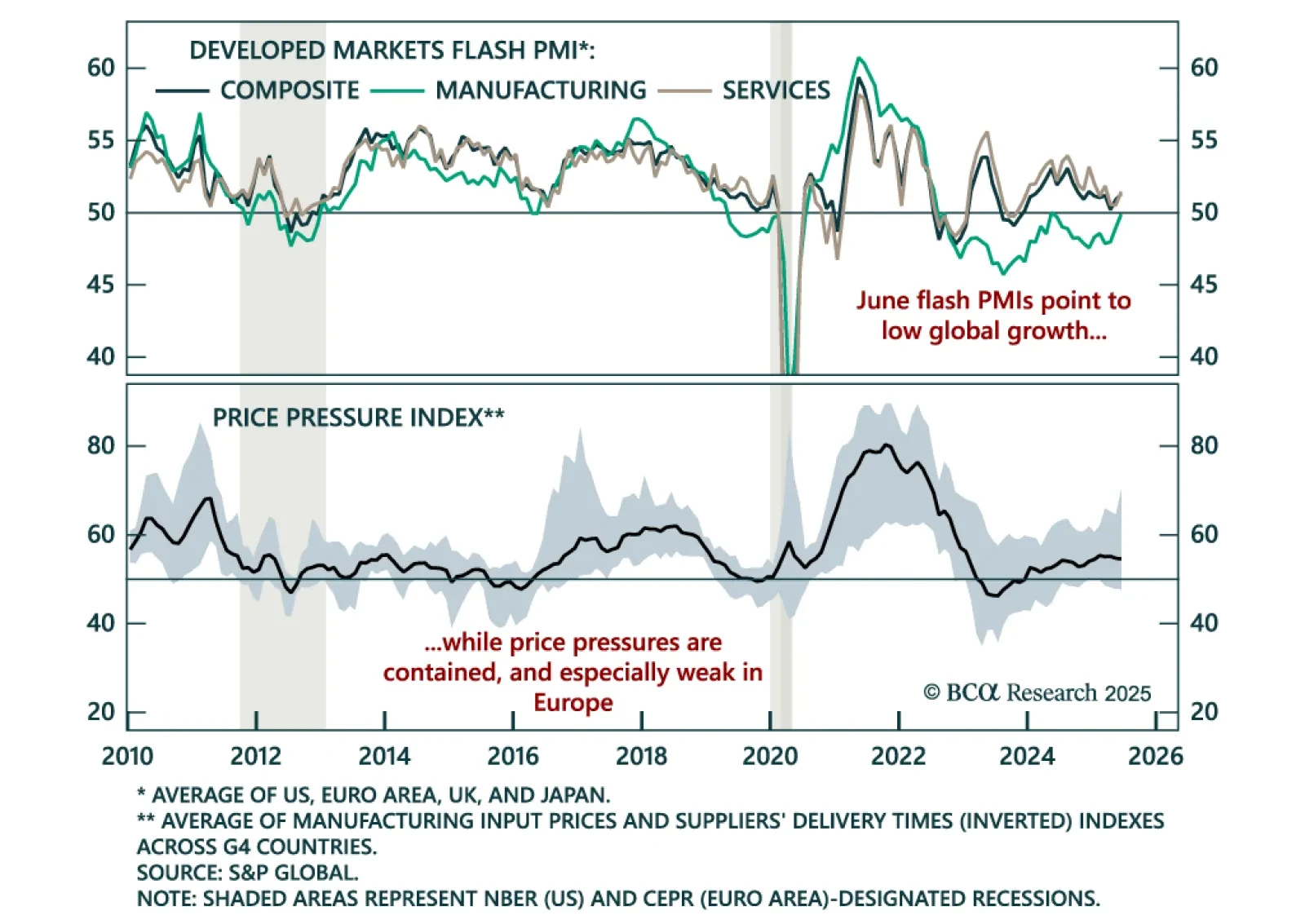

June PMIs confirm low global growth and support a long duration stance as price pressures remain contained. The flash PMIs were mixed across DMs: Sideways in the US and euro area, but firmer in the UK and Japan. Yet the overall…

This week our three screeners explore: Equity trades across the Euro Zone focusing on Technicals and Sentiment; US Oil, Gas and Fuel stocks; and European Small Caps.